Harmonic Patterns

FOLLOW THE RAINBOWWhile technical analysis is usually NOT easy, once in a while it can be.

This chart - which shows the TOTAL MARKET CAP minus ETH & BTC - just so happens to be one of those rare cases, and some simple pattern recognition is all it requires to see the obvious similarities that exist between the two fractals/structures. Assuming the pattern holds, expect to see price bounce one more time within the final (purple) circle before...BLAST OFF.

A Story About Simplicity and Moving Average Envelopes CBOT:ZB1!

First, a short story. I like simple stuff. Maybe it's just me (I don't think so) but the more complex my process becomes, the worse the trading results. In 1987, four years into my career, I used a combination of Wyckoff and Elliott to make a series of very profitable bond market calls for my institutional clients. I spent my days and nights obsessed with counts, counter counts, alternate counts, Wyckoff sequences, oscillator nuances…. In other words, all the shiny complex things were in play. Needless to say, I came out of the experience a legend…. in my own mind. In retrospect, I had loads of confidence but very limited real knowledge or experience. It's counter intuitive, but the success of 1987 was detrimental to my growth as a trader/analyst.

After the great results/luck during the tumult of 1987, 1988 proved difficult. My Elliott count became muddied, I often misread the Wyckoff price volume relationships and while not disastrous, my results turned quite ordinary. As the results worsened I responded by adding ever more complexity to what was an already complex routine. To make a long story short, as complexity increased, results worsened. To suggest that I became frustrated would be an extreme understatement. I questioned my future as a technician/trader.

I remember walking into my office one morning after a particularly bad week and deciding that things had to change. I decided to immediately begin simplifying my process. I retreated to basics. Happily for me, as I eliminated complexity I found better results. Over the next few years I continued to simplify and to refine my risk management approach. By simplifying and becoming less risk tolerant I became an effective trader/analyst. Simplicity is robust, it is typically fractal, and reduces difficult decisions to ordinary. Simplicity is also a process. Most only arrive there after a long journey.

Moving average envelopes certainly fall into this "simple is simply better" approach.

• Construction is simple and intuitive.

• Construction is easily adapted for any market or time frame.

○ This is important because every market has a specific character. Some trend for long periods while others chop and mean revert with regularity.

○ Importantly, character changes over time. It had been four years since I last updated my bond moving averages, the changes were significant.

○ Part of this probably has to do with the level of Fed involvement. I don't think I had significantly updated my bond envelopes for nearly thirty years prior to this adjustment.

○ Part of this has to do with the level of interest rates. At lower levels of rates, prices are generally more volatile as durations (a measure of rate sensitivity) become longer.

○ Because the envelope construction is revisited periodically it remains current to changes in market state and condition.

○ Don't assume that envelope settings that work on 30 year futures will work on 10s or 5s. Differences in duration create large differences in volatility

○ Also, the settings that work well on futures won't translate to yields. Using percent change (envelope tops and bottoms are placed at percentages of the moving averages) on a percentage is just wrong. I see supposedly financially literate people do this all the time… what the hell?

Building the Envelopes:

• The average and the width of the band is an eyeball approximation. Nothing fancy.

• Choose one of the available moving average envelope studies available. I used one created by H-potter.

• Set average 1 up so that the upper and lower bands follow the price action closely.

• Set average 2 up so that the upper and lower bands generally tag the next higher perspective swing points.

• Set the third average up so that the upper and lower bands tag the highs and lows of the next more volatile set of swings.

• I often add a fourth set of bands that tag the next higher perspective highs and lows.

• Don't get carried away. Keep it simple and intuitive.

• I am intentionally not providing my settings. I don't think they are important but I think its important for you to go through the process for the particular market and time frame you are working in.

How I use the Envelopes:

• Convergence of the upper or lower bands suggest that the market has become overbought or oversold.

• Odds of correction, even if laterally, expand significantly when the band extremes converge.

• You would never buy or sell based upon the convergence. But you might reduce a long/short position or begin monitoring for reversal behaviors as the bands come together.

• I generally use the warning of an extended trend given by the bands to begin closely monitoring price action, searching for tradable setups with good risk reward characteristics.

Conclusion: Simplicity can provide a real edge while complexity often becomes a headwind to success. This simple moving average envelope system can be modified for nearly any market or time frame and is adaptive over time.

Good Trading:

Stewart Taylor, CMT

Chartered Market Technician

Shared content and posted charts are intended to be used for informational and educational purposes only. The CMT Association does not offer, and this information shall not be understood or construed as, financial advice or investment recommendations. The information provided is not a substitute for advice from an investment professional. The CMT Association does not accept liability for any financial loss or damage our audience may incur.

🔥 Types of Analysis 📉 In trading and investing there are 2 t🔥 Types of Analysis

📉 In trading and investing there are 2 types of analysis a trader can make to have an edge and generate trading ideas.

📉 There is no such thing as technical analysis is better than fundamental or viceversa, personally i use fundamental analysis to understand what to buy or what to sell on a mid-long term perspective and technical analysis basically shows me when to enter the trade at a better price level.

‼️ Fundamental Analysis

• Using of the financial statements, news and events to generate trading ideas

• Mid-Long term approach

• Usually investors/traders use this for investing or position trading that could last for couple months

‼️ Technical Analysis

• Use chart, volume and price action

• Short-mid term approach

• Usually people use this for intra-day or intra-week moves

Which one you like more ?

📍 Trading Styles 📍 Trading Styles

There are a lot of strategies and types of traders and investors in the financial markets, this doesn't mean you have to learn all of them. In my opinion you should try all trading types and then conclude which one suits more to your personality becuase there is no such thing as you HAVE TO trade intraday or swing or position, everything depends strictly on you.

✅ Scalping Traders

Holding positions for several minutes, in my opinion its not recommended for the newbies as you will see a lot of losses and wins during the day and this can hurt your emotions.

✅ Day Traders

Holding positions for couple hour or a day, they basically when to know ar the end of the day If they made money or not. Same recommendation as for scalping

✅ Swing Traders

Holding positions for a several days, intra-week trading. This is the recommendation for the newbies as you dont get the market feedback really fast and you can counter emotions + overtrading, usually they take 4-5 trades during the trading week.

✅ Position Traders

Holding positions for several weeks, usually this type of traders trade on a weekly-monthly basis with a focus on the fundamental analysis more than on the technical side. Recommended for experienced traders as you can get big returns with a iron patience

What type do you like or want to be ?

🎯 Trading Plan Questions I will try to show you in this post how my intra-day trading plan works and what exactly do i use in terms of risk,pairs,timeframes.

✅ What are my trading goals ?

My intraday trading goal is to close the day in GREEN, but if i see no opportunities i dont push the buttons just to get to a profitabile day.

Focus on making 1% a day this means 22% a month that is a lot just do your math and understand the power of consistency

✅ What timeframe do i use ?

My intra-day timeframes that i am using are H1/M30/M15 you need to

know which is your higher timeframe and execution time frame for me its M15, neither higher or lower.

✅ How long to hold trades ?

Usually in 80% of the trades i hit the stop loss or take profit order before the day ends, i can left a open position overnight only if it's secured risk.

✅ Which Currency Pairs to follow ?

As you are trading intra-day you need volatility and low spreads, i trade the most volatilite instruments such as nasdaq, gold, oil, gbpusd, gbpjpy, bitcoin on the session opening as the spread is lower during those hours.

✅ What is the Risk per Trade ?

When you are starting an intra-day account you have to know first of all what will be the risk you take in every trade, the session risk and finally the daily risk.

It's very important to RESPECT the daily risk rule as this keeps you in the game when the market conditions are bad.

What is your Trading Plan ??

Why 90% of Traders Lose ? ❌ Going Full Margin

Risk management is the most important in this game because it keeps you alive, keeps your account fresh during bad market conditions.

Learn risk management first to understand how to protect your capital first of all and then learn a strategy

You have to know your risk numbers in terms of

• Risk per trade

• Daily Drawdown Limit

• Weekly Drawdown Limit

• Monthly Drawdown Limit

✅ Buying SIGNALS

Buying signals and expecting overnight succes could be bad for your trading journey, don't expect anything from anybody and start to be your signal generator

✅ Get Rich Quickly

Trading business its not getting rich overnight, its getting rich for sure on a long term basis. Don't expect succes overnight its not gonna happen i promise you.

• Trading is a marathon, not a sprint. Give it time and simply commit to the process

✅ Not Sticking to the Plan

Your trading plan is your trading bible and principles, you should respect it no matter what. Your trading plan its the only thing you can control in the markets as you can't control the price movement.

Make the plan and trade the plan.

What do you think ?

Trading BottomsA lot of this going on, or attempting to go on as of late, has to do with waiting for a bottom. Three come to mind are FB, SQ, and PYPL, but there are plenty more. I am trying to accustom myself to a new type of market, that does not appear, at this time, to be bullish. For most, it is apparent the reasons why we may be dipping out of a bull market. Either way, one has to adjust.

The market is bearish as of late. Take a look at QQQ, SPY and DIA. All 3 are under their 50 day SMA. This is usually a bearish outlook, even though moving averages are lagging indicator's, The Russell index is also under this average and I see large players shorting these indexes. So knowing bottoms can become valuable so you do not lose, or as much anyway. )o:

How do you Know you are at the bottom? You can not for sure and bottoms can be harder to call than tops. I prefer calling a top over a bottom any day of the week! Bottoms have all kinds of tricky patterns whereas tops only have a few.

You can look at indicators. For instance you can wait until the RSI is pointing up and over 50, or until the MACD does a crossover of the 0 line (MACD is simply moving averages, 13 and the 26). Sometimes simple is best but will not always get you where you want to go. But then nothing always will and accepting this can be paramount.

Higher lows is another strategy. Yet Bear Flags also make higher lows for a short amount of time, so you have to continually be on guard if you plan to hang for any length of time. Sux Rox! Bear Flags trend up against the prevailing trend and then they can burn you. I hate bear flags! They can fool you in a heart beat.

Candle patterns like an engulfing candle, the abandoned baby, the morning star can also be used to call a bottom. Do they always work? Possibly the abandoned baby is the best, but confirmation is a must with candle patterns.

Patterns like an inverse head and shoulders can also be of value but only when they break the neckline.

The yearly low can help, but if price is in the gutter, the 3 year low can come in handy. Still no guarantee. I find the 3 year low to be more helpful when a stock is in a nose dive. Or maybe, in some instances like parabolic arcs, just hold your horses and sit on your hands. It can be absolutely amazing how low price can go )o:

I think looking at volume plus perhaps and another one of the above, is the most helpful to me. But the fact is, price can be at a bottom for a year or more, while new and smart money is buying the whole time. ACAD is an example of a stock that became so low in price, I could not resist.

Most of the folks who are hired to invest for these conglomerates, will not even be alive 20 years from now so they are different from me or you. Something to think about. I like to look at NVI and OBV for volume, but looking at average volume is also a good thing as long as it is not red volume.

Falling below the lower band of Bollinger bands was working when we were in a Bull market. But in reality this is bearish, and in a bear market, this can be a bearish signal. Price used to snap back in when I set the standard deviation of 80. Not lately.

Tell me where there is sanity! It does look like all 3 I named are approaching their bottom, with SQ in the lead. Thinking FB will get closer to 200, or below perhaps/candle does not look so great. PYPL needs to stop missing earnings and I am a PYPL fan, but needing to see something bullish to help this one out. 3 year low is 82.07

Never say never. Anything is possible unfortunately and even dirt can get cheaper )o" I am trying not to fall for rallies up, unless to sell, but especially if you are in for the long term right now.

Maybe sit on your hands if you have to do so, or perhaps trade short term (o:

Patience can be a virtue.

USD/JPY 4H Trading Idea by Harmonic, Classic & Volume Profiles.This is a quick glance of our method in trading by using Harmonic, Classic and Volume Profiles.

Everything is hopefully well explained as i want you to excuse me if I sounded nervous because it is my first time posting a video.

I would appreciate it if you guys could help me out and support me :) let me know your thoughts in the comments section and if you like what you see, I would gladly share with you more of my humble analysis :).

MY FIB SPEED RESISTANCE FAN TRADING STRAT : )

Hi! I'm xtekky and this is my tutorial on how to use the Fibonacci speed retracement tool- I used Apple (AAPL) as an example to display the tutorial.

Steps:

(1) Open the fib retracement section on the left bar and select the " Fib Speed Retracement Fan"

(2) According to your trading style, select the timeframe I indicated in the chart - to begin with - you can then choose the timeframe you are most comfortable with.

(2) Define the begin of an uptrend (after last retracement or reversal) and place your first point

(3) Define the end of the uptrend (after last retracement or reversal) and place your second point - if there isn't any recent retracements / reversals, you can take previous ones or the highest

recent value

(4) Define the most relevant percentage (38.2% on this chart) but it may as well be another level - note that fib levels 38.2% and 61.8% are often the most relevant ones

(5) Let the stock / crypto test the level once or twice to make sure it holds, you can of course jump in directly if you are confident.

(6) Take Longs and Shorts in the "Channel"

Advanced:

(7) Use momentum reversals (Squeeze Momentum from @LazyBear is the best indicator for me) to define more precisely when to jump in - note that the price doesn't always trade in the channel, there are some false breakouts and/or the price sometimes reverses a bit further.

(8) Use volume support / resistance zones

(9) Include Imbalances in the prices (If the Crypto/Stock you trade has a high volatility/manipulation rate)

If you want more complex tutorial, you can see a more detailed vid on the Ytb profile linked to this Tradingview account

Disclaimers:

!! This is not an investment advice and you shouldn't use this technique alone !!

!! Never invest/trade with more money than you can afford to loose !!

------------------------------------------------------------------------------------------------------------------------------------------------------------

That's pretty much it! don't forget to ask or DM if you have any questions!

If you want to follow me on this long journey ahead of us, you can support me by subbing and liking the post !

-Credits to xtekky-

Imbalance Concept ✅✅✅ ⭐️ An imbalance of orders is when a market exchange receives too many of one kind of order—buy, sell, limit—and not enough of the order's counterpoint. For sellers to complete their trades, there must be buyers and vice versa; when the equation is slanted too heavily in one direction, it creates an imbalance.

I use imbalances both bullish and bearish to spot where price made ,,un-natural,, moves that should be filled as a tipical GAP move, i will look at them as MAGNET area where price should be attracted where price should go.

⭐️ You can use them as entry areas when price fills the imbalance area or profit target zones

I attached couple photos where you can see bullish & bearish imbalances both filled and un-fullfiled(price didnt come back)

Hope that was insightfull

FOLLOW / LIKE for more content ✅

The Madness of the Crowds ✅✅✅ ✅ The Madness of Crowds

One way to view the market is as a disorganized crowd of individuals whose sole common purpose is to ascertain the future mood of the economy—or the balance of power between optimists (bulls) and pessimists (bears)—and thereby generate returns from a correct trading decision made today that will pay off in the future.

🎯However, it's important to realize that the crowd is comprised of a variety o individuals, each one prone to competing and conflicting emotions. Optimism and pessimism, hope and fear—all these emotions can exist in one investor at different times or in multiple investors or groups at the same time. In any trading decision, the primary goal is to make sense of this crush of emotion, thereby evaluating the psychology of the market crowd. Understanding Herd Behavior

The key to such widespread phenomena lies in the herding nature of the crowd: the way in which a collection of usually calm, rational individuals can be overwhelmed by such emotion when it appears their peers

🎯 The Risks of Following the Crowd

The key to enduring success in trading is to develop an individual, independent system that exhibits the positive qualities of studious, non-emotional, rational analysis, and highly disciplined implementation. The choice will depend on the individual trader's unique predilection for charting and technical analysis. If market reality jibes with the tenets of the trader's system, a successful and profitable career is born (at least for the moment).

🎯 So the ideal situation for any trader is that beautiful alignment that occurs when the market crowd and one's chosen system of analysis conspire to create profitability. This is when the public seems to confirm your system of analysis and is likely the very situation where your highest profits will be earned in the short term. Yet this is also the most potentially devastating situation in the medium to long term because the individual trader can be lulled into a false sense of security as their analysis is confirmed. The trader is then subtly and irrevocably sucked into joining the crowd, straying from their individual system and giving increasing credence to the decisions of others.

🎯 Inevitably, there will be a time when the crowd's behavior will diverge from the direction suggested by the trader's analytical system, and this is the precise time at which the trader must put on the brakes and exit his position. This is also the most difficult time to exit a winning position, as it is very easy to second guess the signal that one is receiving, and to hold out for just a little more profitability. As is always the case, straying from one's system may be fruitful for a time, but in the long term, it is always the individual, disciplined, analytical approach that will win out over blind adherence to those around you.

Momentum in the Markets ✅✅✅✅ I will look at the momentum to understand if price has power to move towards my take profit area or no, a perfect scenario is when i enter a long or a short order the momentum should increase from candlestick to candlestick not decreasing, increasing momentum meaning that price has fuel and it is not exhausted.

🎯 Increasing momentum - bulls/bears has power, they have fuel to push price

🎯 Decreasing momentum - bulls/bears are losing power, they dont have fuel they are exhausted.

‼️ Take a look at this concept in HTF starting from H4 - MN

Kindly see the photos attached with bullish/bearish decreasing and increasing momentum.

BOS - BREAK OF STRUCUTRE ✅✅✅🎯 WHAT IS BOS ?

BOS - break of strucuture. I will use market strucutre bullish or bearish to understand if the institutions are buying or selling a financial asset.

To spot a bullish/bearish market strucutre we should see a higher highs and higher lows and viceversa, to spot the continuation of the bullish market strucuture we should see bullish price action above the last old high in the strucutre this is the BOS.

🎯 BOS for me is a confirmation that price will go higher after the retracement and we are still in a bullish move

Kindly see attached photos

DXY EXPLAINED 📉📉📉🎯 DXY - USD Index

USDINDEX - The U.S. Dollar Index (USDX, DXY, DX, or, informally, the "Dixie") is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies, this index helps us to understand if USD is bullish or bearish on a short term or long term perspective.

🎯 DXY has two correlations one of them is positive meaning the certain assets moves like DXY and negative corelation meaning certain assets move exactly vice-versa.

✅ DXY Positive Correlations

DXY ⬆️

USDCAD ⬆️

USDJPY ⬆️

USDCHF ⬆️

USDRUB⬆️

USD XXX ⬆️

✅ DXY Negative Corelations

DXY ⬆️

EURUSD ⬇️

GBPUSD ⬇️

AUDUSD ⬇️

NZDUSD ⬇️

From a technical standpoint to have a better probability in your trades try to find entries when both DXY and for example USDCAD are in long poi (point of interest) this will increase your chance of having profits as you use inter-market correlations

HTF intention with LTF execution 📉📉📉🎯 I will try to explain how do i use HTF in order with LTF.

✅ HTF - higher time frame usually those are timeframes that are higher then H4 like D1,MN1.

✅ LTF - lower time frame usually those are timeframes that are lower then H1 like M30,MAT,M5

When i take trades i wait for price to approach a HTF POI and then zoom out on LTF to find a better risk-reward entry like the photo says HTF intent LTF execution helps you to get a better risk-reward ratio and a higher probability trade, this is working on every financial asset from crypto to forex to commodities and stock market

✅ POI - POINT OF INTERES an area in the market where price have a higher probability to go bullish then bearish lets say 70/30 % probability.

Example price come into a ,,support,, area this means we have a BULLISH POI we have a better probability to go higher then lowe

Order Types in the Markets💰💰💰🎯 In the financial market the orders are on two categories.

✅ Market Execution orders LONG - BUY SHORT - SELL meaning that you are ok with the price on the certain asset and you would like to short or long it on the other side there is

✅ Pending Orders - meaning you are not ok with the actual price and you would like to buy/sell it later in time I use pending orders when i am out of my trading office so i dont miss trading opportunities

Was this valuable, drop a comment !

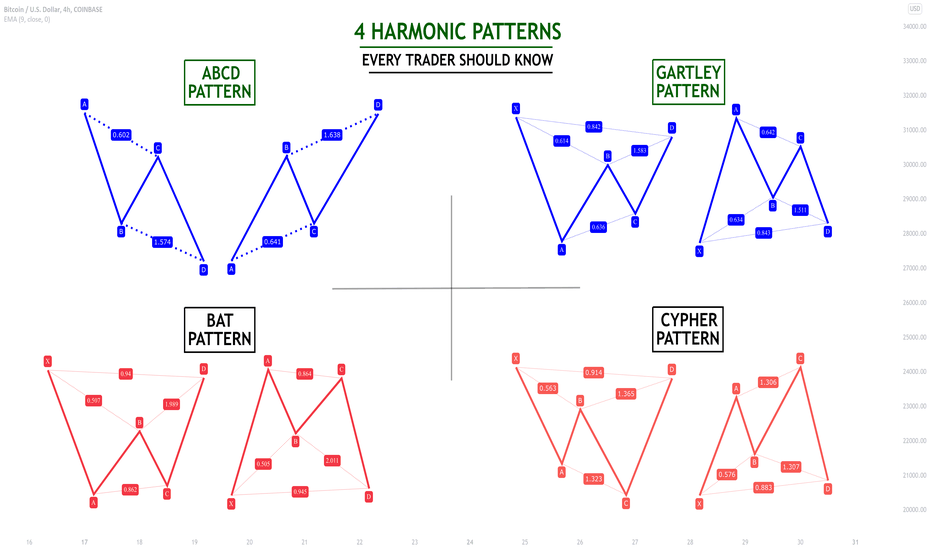

4 Harmonic Patterns Every Trader Should Know 📚

Hey traders,

In this post, we will discuss 4 phenomenally accurate harmonic patterns that you must know.

1️⃣The first and the simplest harmonic pattern is called ABCD pattern.

This pattern is based on 3 legs of a move:

✔️Initial impulse (bullish or bearish). AB leg

✔️Retracement leg with a completion point lying within the range of the initial impulse. BC leg.

✔️Second impulse with a completion point lying beyond the range of the initial impulse (it must have the same direction as the initial impulse). BD leg

Equal AB and CD legs indicate a highly probable retracement from D point of the pattern.

❗️Please, note that the time horizon and the length of the impulses must be equal.

2️⃣The second harmonic pattern is called Gartley Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Gartley Pattern we measure the retracement of B/C points with Fib. Retracement tool and extension of D point of a harmonic pattern with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.618 level and 0.786 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.618 and 0.786

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - D point should lie strictly on 1.272 extension of AB leg (Fib. Extension of AB)

*it should strictly touch 1.272

Such a formation indicates a highly probable retracement from D point of the pattern.

3️⃣The third harmonic pattern is called Bat Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form.

To identify a Harmonic Bat Pattern we measure the retracement of B/C/D points of a harmonic pattern with Fib. Retracement tool:

✔️ - The retracement of B point should lie between 0.5 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch 0.5 but it can’t touch 0.618

✔️ - The retracement of C point should lie between 0.618 level and 1.0 level of AB leg(Fib. Retracement of AB)

*it can touch both 0.618 and 1.0

✔️ - The retracement of D point should lie strictly on 0.886 level of XA leg (Fib.Retracement of XA)

*it should strictly touch 0.886

Such a formation indicates a highly probable retracement from D point of the pattern.

4️⃣The fourth harmonic pattern is called Cypher Pattern.

This pattern is based on 4 legs of a move and has a "W/M" shape form with C point lying beyond the range of XA leg.

To identify a Harmonic Cypher Pattern we measure the retracement of B point with Fib. Retracement tool and extension of C point with Fib. Extension tool:

✔️ - The retracement of B point should lie between 0.382 level and 0.618 level of XA leg (Fib. Retracement of XA)

*it can touch both 0.382 and 0.618

✔️ - The extension of C point should lie between 1.272 level and 1.414 level of XA leg(Fib. Extension of XA)

*it can touch both 1.272 and 1.414

✔️ - D point should lie strictly on 0.786 retracement of XC leg (Fib. Retracement of XC)

*it should strictly touch 0.786

Such a formation indicates a highly probable retracement from D point of the pattern.

🦉What is good about these patterns is the fact that they are objective.

Since each point of the pattern is measured with Fibonacci levels, one can avoid subjectivity.

Try harmonic pattern trading and you will see how efficient this strategy is.

Do you trade harmonic patterns?

❤️Please, support this idea with like and comment!❤️

My Favorite Strategy For The Market Right Now(I have talked about this strategy before very frequently but it works especially well right now since we are seeing big intraday moves. This is a perfect day trade strategy for the market's current situation)

I have found extreme success with this strategy in day trading. I use it every day I trade and is most certainly the best strategy I use. Below are the details, feel free to comment if you have any questions.

Name: Opening Range Breakout

Target Stocks: This strategy is a momentum strategy so stocks with above average volume work very well. Look for stocks with over 20 million volume and above the 10 day average. Volatile stocks are great, we want to catch a big move.

Buy Trigger:

Any break up or down of the range of the first 5 minute bar(as shown above)

Stop Loss:

The opposite end of the first 5 minute bar is the stop loss. (This helps keep losses small in most cases)

Trailing stop loss:

You can use an EMA line. Some I use are: 12, 13 or 14. (Also note I like I like to be out of these trades by 12pm - 2pm EST)

Extra Notes:

Trading Views built in hot list stocks work very well with this strategy

This strategy also works very well with the 15 minute time frame

This strategy is strictly a day trading strategy, do not hold over night

Key Points:

Respect the rules of the strategy, that is what makes it work best. If you have additions to the rules that is fine but make sure when trading this you have a set of rules you follow every single time.

I hope you guys enjoy this strategy and get as much use out of it as I do. Like always, I encourage you to do your own backtesting and try it out to see if this strategy works with your style.

For more details check out Delta Trading youtube linked in Bio. (Full tutorial there)

Hope you guys enjoy!!!

HOW TO TRADE A MARKET SETUP LIKE THISLet's drop down in

LTF ( lower time frame )

& try to find potential entry

SO, Now we are monitoring market in LTF

& trying to find some good potential entry.

CASE 1

CASE 2

CASE 3

CASE 4

There are meny types of wyckoff & other types of entry too..

We will discuss that later

Like this post and share with your trading gang

& let me know in the comment section below if you want more posts like this .