EDUCATION - SUPPORT & RESISTANCE Hello Traders,

Here i am highlighting what support and resistance is, also i go on to show you how i look at support & resistance and how it fits into my trade plan as a pattern trader.

I aim to simplify how a beginner looks at the market, and show them how to identify important areas within the market.

I hope you enjoy my content, if so please like and follow my channel.

Safe Trading.

Harmonic Patterns

📚 Demand zones: How to Identify and trade them? Hello Traders. Welcome to this Post about How to properly Draw and trade demand levels. In this post first post we will talk about how to draw it. if you can memorize the simple methodology, then you can start applying more advanced theories on top of them! Make sure to follow for more content

Frequent Questions :

How to Draw a demand level ?

When to Know when we have a valid demand Level?

When a Demand level is invalidated?

When to execute a trade in a valid demand area?

-----

How to Draw it ?

You just need to start with current price on the chart . Then look left and down until you find the origin of a very strong rally in price. Understand that behind every rally and strong mouvement someone is behind leaving a footprint.

Identify the base and mark it from the messy top of the base to the extreme bottom.

When to Know when we have a valid demand Level?

Rules:

When you have a very strong bullish monthly structure , demand levels tend to be accurate a stronger. In downtrend they are valid but less acurrate. By other side we like to trade the first retest. The more a zone is being tested the less accurate it becomes.

When to execute a trade in a valid demand area?

→ It is possible that price retest the zone. If that happens , from my experience you need to combine multiple factors. One of the most important is the fundamental. when you have a strong fundamental trend confirmed , then a pullback into a demand level in a strong uptrend structure is valid. By other side when you have valid micro signals in a valdi macro buy zone they probably price will be using the demand level to continue to the upside.

When a Demand level is invalidated?

❗The purpose of demand levels are to push the price to the upside. in that way a demand level is invalidated when price cross beyond the base . By other side if price consolidate a lot in a strong demand level and slowly start to break the zone keep in mind that the price can slide down and totally invalidate the demand zone. make sure to only trade the first retest of the zone. Never trade MULTIPLE retests

❗Watch out for the big time frames trend

I hope this Educational Post was helpful . Make sure to follow and let me know in the comment section if you trade supply and demand ? have a nice day!

Ascending Triangle - What's the phycological Truth behind this?We see many trend patterns while trading. One of them is ascending Triangle.You guys may rote that ascending Triangle is always bullish and it will be always bullish. But why it is bullish? Can't it be bearish any time? If not, Why? If yes, when? If you are finding the answers of these questions,this article is for you. Don't escape any line. Please read the full article. You will find your answers and will enjoy this article. Now Let's get into the topic✅✅

1️⃣ You may know Uptrend is always bullish and Downtrend is always bearish. What's uptrend or Down trend? An uptrend is when candlesticks make HH and HL or same High and higher Low. In an ascending Triangle, Candlesticks make same High and Higher Low. So it makes an uptrend into ascending Triangle. As a result it is bullish structure.

2️⃣ You may hear this " The more times candlesticks touches the trend line the weaker it becomes." In aline cending Triangle candlesticks touch the resistance 3 times but touch the support 2 times. As a result the resistance become weaker and get broken.

3️⃣ So a ascending Triangle never becomes bearish? Obviously it does. When the trend touches support line 3 times,it becomes an Head and Shoulder pattern. And it becomes bearish and breaks the support line.

4️⃣ Another bearish form of ascending Triangle is when trend makes a double top pattern into ascending Triangle.

✳️✳️ Now where to take entries?

Long position After the retest of previous resistance as support and short position after the retest of previous support as resistance.

✳️✳️Where to put SL? That's you all know where to put SL. You can put SL according to your bookish knowledge. But I prefer smart SL. I will share How to put smart SL in future.

✳️✳️Now I want your opinion. How's the article? Is it good or bad? I want to know your opinion eagerly. Please comment your opinion below. And A like is always appreciated. Thanks❤️

A-B-C Pattern (Bearish entry 2/5)One of my favorite entry patterns on daily, 4 hour or 1 hr chart pattern (can use on lower time frames too)

Example of a bearish 4 hour A-B-C pattern GBPJPY attached chart:

Rules:

1) Wait for 0 leg to A leg (bearish trend) then

2) Wait for A leg to B leg (bullish pullback back upwards, but not above A price) then

3) Entry once B leg breaks the low of A leg price, with a stop loss comfortably above entry (4 hr chart, so account for that in stop and lot size).

4) B leg to C leg is daily trend and take profit/ set target leg of this pattern.

Example chart had a target of 70 pips on 10 pm to 10 am, three 4 hr candles. *This is highest liquidity and volume 12 hrs per day. 1:3 or 20 pip/60 pip risk reward would have worked great.

The 10.618 Fibonacci Secret by StyxAs promised i have made the video explaining you my little secret.

backtest it on other assets and you will be surprised what you will find..

if my content brings value to your trading please consider following and sharing me here and on twitter and donating some Tradingview Coins would be of course also very welcome.

looking forward seeing you experiment with this and where it gets you.

INSTANTLY IDENTIFY AN UPTREND Hi guys

so today I wanted to show you how are usually how I usually identify an uptrend.

I would like to add that I came up myself with these particular time frames by doing very precise calculation and mathematics by using the Fibonacci sequence order and the laws of the universe in order to determine it.

You will see these time frames will make you bank once you learn how to use them.

And as always I'm not a financial advisor, do your own due diligence and research, happy trading!

Educational: AB=CD pattern w/ BTC exampleOne fairly easy and useful pattern for determining reversals is the AB=CD pattern.

The pattern simply looks for two rising or falling legs up or down respectively. Then one simply measures the retracement level from point B followed by the projection from C (luckily tradingview has a tool to assist with this). If these values equal a 0.618 or 0.786 retracement followed by a 1.272 or 1.618 projection respectively, the pattern is likely to indicate a reversal of the current trend. For example, above we can clearly see the pattern almost perfectly matched the required levels of 0.618 and 1.272.

However, no pattern is guaranteed, so it is always recommended to seek out confirmation. As we can see in the above example, there is bearish reversal divergence that can be seen on both RSI and MACD (dotted green lines), whereby price is rising while oscillators are falling, indicating an even greater likelihood for a reversal.

Upon confirmation of a reversal, one can then target Fibonacci retracement levels as key points of interest as can be seen above.

A nice part about this pattern is how simple it is to spot and draw out particularly with tools available on tradingview.

Hopefully you are able to use this pattern as another useful tool in your arsenal!

Big Alert :- Stay away from PnD Low Volume CoinsHi CryptoPatel Family!

This is a Informational/Educational post on one of Trading strategy PnD( Pump and Dump).

Basically in other words we can correlate it with another word SCAM, we should try to always avoid these kind of strategy.

By following this we can end up with major loss.

Always remember there is NO shortcut to SUCESS.

First LEARN then remove L.

Pump and Dump is nothing just Low volume/Penny/small cap coins in which retails investor have higher participation, operated and execution by very well with very well Plannings.

We are attaching the same example with a recent P&D of IDEX coin.

Hope you guys follow my advice by keeping yourself away from these kind of Pump and Dump Strategy.

Always Remember, THERE IS NO SHORTCUT TO SUCESS.

With Love,

CryptoPatel.

WTW: Worried about BTC and ALTs? Let me help.BITBAY:BTCUSDT sometimes feels like a winding road of volatility and confusion. It is until you understand the meaning behind the madness... In this week's: What The What?1? with @SwayzePunkz.

SwayzePunkz is an educational service, we're, of course, never soliciting any products we're just looking after the average investor, from beginner to advanced with some tips and tricks we learned along the way. Disclaimer, this isn't financial advice, so don't take it that way or we get in trouble.

Somewhere along the way, I came across some pretty useful information on TradingView, I was a beginner, but something caught my eye on the ol' squiggly lines. (this was before I knew what candlesticks were). I was roughly familiar with the FTX:SPYUSD aka the S&P 500, I knew it was a market indicator that showed roughly what was happening, but that was it... But what I noticed was the correlations between this chart and some of the ones I was watching.. Some of them, almost like clockwork, following the chart, or better yet, inversely (like it's opposite day) following the S&P...This staggering realization made me understand that trading wasn't only about the Trade fundamentals but also relied on the market's overall daily performance.

As I've always preached, trading is a mind game... Not some Jedi-voodoo shit, but a rigorous representation of human psychology. And that psychology all boils down to one word... Confidence.

Confidence could be the feeling you get when you're walking tall after getting that dope new fade, or it could be the way you feel about an unknown. As far as the squiggly lines go, unknowns come with the territory. This doesn't mean they need to be scary, and you should never feel worried. Confidence is that feeling after you've looked at the charts, made a plan for action, and are ready to execute. The better you are at trading, means the more confident you will be - before everyone else. I say this because if a chart is screaming at you, it shouldn't be because everyone already bought it and you feel that FOMO (fear of missing out). That confidence needs to come much before that, depending on the trading style as early as 30 minutes before everyone else. This way, once everyone else is throwing in their stake, you're already in, at that low-low, watching your portfolio climb and climb.

Now, the stock market is behind me and I'm a crypto punk these days, not your standard #NFT but I'm all about these crypto plays and I love the volatility... But at the base of it all, it all comes down to one fundamental truth, find your way to become confident in an entry, before everyone else.

Consider this, remember that time you bought into a long position, then it took a sharp turn to the dirt? You were trading FOMO. If you experience this a lot, here's my tip for evading this What The What?! scenario...

When you get that feeling in your tummy when you're scrolling through your "most active" for the HIGHEST* change% over time... That is FOMO**. Try the opposite, look for that entry on a stock that is OVERSOLD** and is on the LOWEST* change % list, and see if that has an entry point. If you're playing the short game take the words with * and ** above, and swap em.

This has been another What The What?! article from @Swayzetrain from @Swayzepunkz.

As always, thank you to TradingView for your amazing service. If you're not already a PRO member, I highly suggest you check that out for some of the best charting money can buy. Go over to SwayzePunkz Promo for $30 off your new membership *terms and conditions apply.

Also, thank you to my homies at MOGO, for hooking me up with my brand new Crypto Back Rewards Visa,

and to Binance for giving me a place to trade without worrying about high trading fees and confusing platforms!

If you want to check either of these things out, swing on by my Linktr.ee at Click Here!

or from mobile just hit up my TradingView Profile (hit follow) and go through my link in bio!

Have an awesome trading week guys! Talk soon!

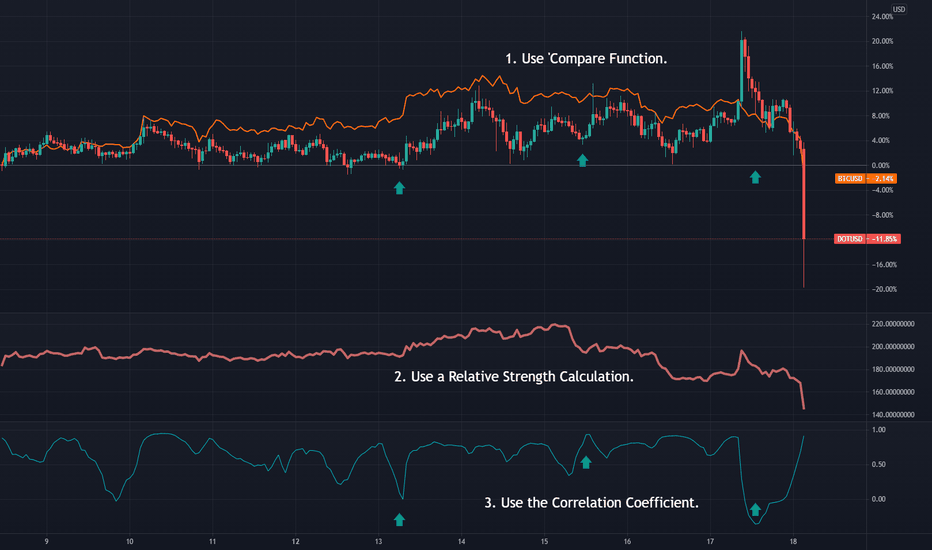

Three ways to follow market relationships on TradingView. All trading requires an understanding of how markets are related. Understanding these relationships will put you ahead of others that don’t get it.

Mean reversion and spread trades require a deeper understanding of how markets move together and how these relationships change. Like the weather, the degree of correlations, lag, convergence/divergence change all the time. It is that change that can bring about opportunity.

On TradingView, there are three really easy ways to measure relationships.

1 Use the ‘Compare’ Function.

Click Compare.

Select Market.

This creates an overlay, showing relative performance in percentage terms. The starting point is the visual start of the chart.

Tip#1: Choose starting points that are significant, like just before a big announcement or at a chart high or low.

Tip#2: Play around with time frames to look for patterns.

-

2 Use Relative Strength (not RSI).

This is not the RSI most of us know. This ‘Relative Strength’ shows the performance of one market versus another based on momentum and change.

Select indicator and search ‘relative strength’. Look for an indicator that compares to a 2nd market. Example: ‘relative strength to SPX’. For this particular one, the default setting is to compare to SPX (obviously). In settings, change this to your chosen market. In the above chart, we use BTC.

A falling index shows market#1 underperforming. This can be used to show overbought/sold conditions, relatively speaking.

-

3 Watch your Correlations.

The Correlation Coefficient measures the degree of statistical relationship between two markets.

Tip: Look for extreme levels/changes in the number. It can tell of a change in trend or breakout.

-

Try all three and see what works for you and your markets. Look for patterns.

-

*11/19/20 BACKTEST* Bearish ButterflyThis is my first backtest. Here we have USDJPY on the 15m chart from 11/19/20. X-A retracement measure in at 0.746 and the X-A projection was spot on at 1.272. SL was calculated just beyond the 1.414 level on X-A projection. TP levels were 0.382 and 0.618 on the A-D retracement. Trade would have been entered at 04:30 UTC-5. First TP achieved at 06:00 UTC-5. Second TP achieved at 10:45 UTC-5. RR was 2.83.

DOGE IIIA close above previous high shows that the buyers are leading the current wave, a move back to test the pivot 1 could be doable but not so easy considered the actual momnetum. Only with a move back and with a close under pivot 1 we will reconsider the long positions opened in the 0.05 ish.

Update of:

Michael Saylor Twitter Strategy DumpPump BitcoinHello People !!!

We have all heard of Michael Saylor and we can say that we are your followers on twitter that every time he posts that he is buying bitcoin then we go too. But the main fact is that how much is the possibility that he is dipping bitcoin at a price we can not predict? Since as far as I understand every time he is buying it becomes a 5% climb and a dump of 14% is this the most powerful purchase and the whale that we should emphasize?

During the month of March he may have made 2 purchases meanwhile already in April on the 4th he made a purchase of 15 million dollars today is the 7th two days back he bought the bitcoin prices for 59k ... The question is did he sell that the price has dropped? Of course not, and I do not even think that he has sold his shares for nothing and that in fact there could be another greater risk if he sold them as we are leaving buyers but the holder of 92k bitcoin is in the game we hope that the next purchases are in a dip of 50k as the return of bitcoin is expected from 50k ...

Twitter is one of his strategies to decide the buyers we are entering, you are getting a chance and you to enter.

How does volume REALLY works?Volume is one of those indicators that remain as part of the standard palette of essential indicators (if there is such a thing), and yet, from intermediaries, brokers and exchanges, they teach you how to use it incorrectly. . Ultimately, as with most misconceptions, it is perpetuated by group mentality and dogma, and makes traders who use them fail. However, it is logical, these entities are not traders, they are programmers and financial agents who sell tools, and therefore their knowledge is limited to a logic that may or may not be the one that the market follows.

So how is volume actually used and how can a trader take advantage of it?

We are told that the more volume, the more likely a price movement is to occur. Some limit themselves to saying that when volume appears in a downtrend, it means that it will change, since the price has fallen to an interesting level for buyers and this new demand will raise the price. Others directly link more volume with more force in the direction of the trend.

From my point of view both are wrong, The only thing that indicates the volume is the probability that there is a change in volatility. Let me explain:

Suppose that in a port they are selling fish in several stalls, and there are 10 sellers and 10 buyers. In this situation, the price will be balanced, since there is one buyer per seller, neither the sellers are motivated to lower the price nor the buyers to offer higher prices. for what? if everyone can already buy their piece and go home.

If the situation were that there would be 8 buyers and 2 sellers, then the price would not stop rising; The 8 people who want fish could only get it from 2 people, and therefore, they would offer to buy it at a higher price so that one of the two sellers can decide and sell it to one of them.

However, here is the first problem: in trading, the volume does not tell us how many buyers and sellers there are, it only tells us the total amount. If I don't know how many of each there are, how am I going to be able to use that information to know where the price is going to go?

If in that scenario where there are 2 sellers and 8 buyers, there are instead 20 sellers and 80 buyers, would the situation change anything? There would still be a ratio of 1 to 4, and therefore the price would continue to rise, since in essence, there would still be 4 people wanting to buy for every person who wants to sell. The same happens if there are 200 or 20,000 sellers, while in return there are respectively 800 and 80,000 buyers.

What marks the variations in the price are not the people, it is the PROPORTION between the type of participation of those people. The only thing that could be used as a price prediction is the knowledge of that proportion, but in volume it does not show it.

That said, one might think that the more volume, the more volatility there is, and, for example, it could be used to buy or sell volatility in options contracts or directly by making a "grid" with other financial products, but from my point of view it is precisely otherwise:

What makes the price move is the breakdown of that harmony between buyers and sellers, regardless of the number of each of them.

Following the previous example, suppose there are two markets in the port. In one of them there are 100 people and in the other 10, and we do not know who buys or who sells in each of them.

It happens that a person enters each of the markets and we do not know if he wants to buy or sell.

In principle, we could not say that these new people will raise or lower the price, but if we look at it from a mathematical point of view, in the first market with 10 people, one person represents an increase of 10% of the participants (1 / 10 * 100) but in the market of 100 people, it is only 1% (1/100 * 100). This means that in the first market the price is more likely to change, since the moment this new person buys or sells, it would generate a 10% disproportion between supply and demand, and yet in the other market , it would only be 1%.

The percentage that represents a supposed new participant in the market tells us if greater volatility can occur.

DEADLY Accurate levels from Monthly log. Spider LinesThis chart's support and resistance was inspired by Crypto Face's spider line drawing method, I took candles from the monthly time frame and toggled 'Log' and drew the lines all the way from the first BTC monthly candles. I took every Monthly candle and drew extended rays, first point coming from the top of the first candle low candle of each cycle, second point on the top of nearest ATH at the time. By rinsing and repeating this process through the whole duration of BTC's lows and few ATH candles, this chart was born. You can clearly see that price action reacts very strongly to these levels. You could solely rely on this chart, but it would be best to pair with other TA in my opinion. I have not tested this with other cryptos just yet but I plan to in the near future.

100 ways to read a chart Especially for beginners it can be very confusing to interpret a chart ... patterns, indicators, oscilators. SDMA, EMAs, Fibonacci.

If you are interested, I would be happy to go into more detail about individual tools and setups, but today I will just give an overview of which tools and types of trade are available.

Timeframe

Trend trading months to years

Swing trading days to weeks

Intraday 1 day

Scalping seconds-minutes

Different markets

Forex

Stocks

raw materials

Indices

Cryptocurrencies

The main technical indicators

Simple moving average (SMA)

Exponential Moving Average (EMA)

Stochastics

Relative Strength Index (RSI)

Commodity Channel Index (CCI)

Moving Average Convergence / Divergence (MACD)

Bollinger Bands (BB)

Chart types

Line chart

Bar chart

Candlestick Chart

Point & Figure Chart

Renko chart

Three line break chart.

Kagi Chart.

Heikin Ashi Chart.

Trade setups basic types

Continuation

Reversal

Sideways

Break out

My personal preferences

EW

Algo's

Pattern

Price action

EMA's MA's

RSI

MACD

KDJ

TAR

Stoch

BB

Pitchfork

Gan

The world of finance is diverse. It is very important to choose a style that suits your psyche, preferences and the amount of time you want to spend.

I would be grateful if you support my post whit likes and comments

Have a nice trading day