Futures on CME and Launch of XpFinance DeFi PlatformOn May 7, 2025, the XRP ecosystem received two major developments that signal a new chapter in its evolution. First, the Chicago Mercantile Exchange (CME) announced the launch of futures contracts for XRP. Shortly thereafter, developers behind the XRP Ledger unveiled XpFinance — the first non-custodial lending platform built on the network. These two events are poised to reshape XRP's market perception and could attract a wave of new investment.

XRP Futures on CME: A Leap Toward Institutional Adoption

Set to go live on May 19, the new CME product will enable investors to trade XRP through regulated futures contracts. This is a major milestone. With similar contracts already in place for Bitcoin and Ethereum, XRP becomes the third digital asset to gain such legitimacy in institutional markets.

The introduction of futures means greater liquidity, risk management tools, and a clear path for hedge funds, pension managers, and banks to engage with XRP — without needing to custody the underlying token directly. Analysts anticipate that this added market structure could drive up demand, especially if the rollout is smooth and met with trading interest.

XpFinance and the XPF Token: DeFi Comes to XRP Ledger

The second big announcement came from XpFinance, a new decentralized lending protocol. What sets it apart is its non-custodial model — users can lend assets and earn interest while retaining full control of their private keys. At a time when centralized platforms are under scrutiny, this approach appeals to security-conscious users.

XpFinance is powered by a new token, XPF, which will be used for staking rewards, fee payments, and governance. The pre-sale of XPF has already begun and is generating buzz, especially among XRP community members eager to participate in the first major DeFi initiative on the ledger.

Market Outlook and Analyst Forecasts

Reactions from analysts have been positive. According to a report from DigitalMetrics, if both the CME futures and XpFinance platforms gain traction, XRP could see a sharp upward move — potentially reaching $10 by summer 2025. That would represent a fourfold increase from its current price.

However, risks remain. Ripple Labs continues to face regulatory pressure in the U.S., and crypto markets overall remain volatile. Still, the general tone has shifted. With increasing institutional interest and expanding utility, XRP appears to be entering a new phase of growth.

Conclusion

The combination of institutional infrastructure and decentralized finance innovation makes May 2025 a pivotal moment for XRP. If these initiatives succeed, XRP could transition from a mid-cap altcoin to a primary digital asset in the eyes of both institutional investors and the broader crypto community. Whether this momentum will translate into long-term market dominance remains to be seen — but the foundation is clearly being laid.

Harmonic Patterns

Mastering Order Blocks: How to Trade Like Smart MoneyIntroduction

Order Blocks (OBs) are one of the most critical concepts in Smart Money trading. They represent areas where institutional traders have entered the market with significant volume, typically leading to strong price movements. Identifying and trading Order Blocks gives traders an edge by aligning with the footprints of Smart Money.

What is an Order Block?

An Order Block is the last bearish candle before a bullish move for bullish OBs, or the last bullish candle before a bearish move for bearish OBs. These candles represent areas where institutions accumulated or distributed large positions, leading to a market shift.

Types of Order Blocks

A Bullish Order Block appears at the end of a downtrend or during a retracement just before the price moves sharply upward. It is typically represented by the last bearish candle prior to an impulsive bullish move. Price will often return to this level to mitigate institutional orders before continuing upward.

A Bearish Order Block, in contrast, forms at the end of an uptrend or retracement where price begins a downward reversal. It is characterized by the last bullish candle before a strong bearish move. Price tends to revisit this level to mitigate before continuing lower.

How to Identify a Valid Order Block

The key to identifying a valid Order Block is first observing a strong impulsive move, also known as displacement, that follows the OB candle. The move must also result in a break of market structure or a significant shift in direction. Order Blocks that produce Fair Value Gaps (FVGs) or Market Structure Shifts (MSS) tend to be more reliable. Another important sign is when price returns to the OB for mitigation, offering a potential entry.

Entry Model Using Order Blocks

After locating a valid OB, the next step is to wait for price to return to this area. The ideal entry happens within the OB body or near its 50% level. For extra confirmation, look for a Market Structure Shift or Break of Structure on a lower timeframe. Entries are more powerful when combined with additional elements like Fair Value Gaps, liquidity grabs, or SMT Divergences. The stop-loss should be placed just beyond the OB’s high or low, depending on the direction of the trade.

Refinement Techniques

To increase precision, higher timeframe OBs can be refined by zooming into lower timeframes like the 1M or 5M chart. Within a broad OB zone, identify internal market structure, displacement candles, or embedded FVGs to determine a more precise entry point. One effective refinement is the Optimal Trade Entry (OTE), which is often found at the 50% level of the Order Block.

Order Blocks vs. Supply and Demand Zones

While they may seem similar, Order Blocks are more narrowly defined and specifically related to institutional order flow. Supply and Demand zones are broader and typically drawn around areas of price reaction, but OBs are derived from the final institutional candle before a large move and are often confirmed by structure shifts or displacement. This makes OBs more precise and actionable in the context of Smart Money concepts.

Target Setting from Order Blocks

Targets after entering from an OB should align with liquidity objectives. Common targets include internal liquidity like equal highs or lows, or consolidation zones just beyond the OB. External liquidity targets such as previous major swing highs or lows are also ideal, especially when they align with imbalances or Fair Value Gaps. It's important to adjust targets based on the current market structure and trading session.

Common Mistakes to Avoid

A frequent mistake is treating any candle before a move as an OB without verifying key signals like displacement or a Break of Structure. Entering without other confirmations, such as an MSS or liquidity sweep, can lead to poor trades. Another common error is placing the stop-loss too tightly within the OB, instead of just beyond it, increasing the chance of premature stop-outs. Traders should also avoid executing OB trades during low-liquidity sessions where price action can be unpredictable and wicky.

Final Thoughts

Order Blocks are foundational to Smart Money trading. They allow you to enter where institutions have placed large positions and offer clear invalidation and entry logic. With practice, you can identify high-quality OBs and combine them with other concepts like FVGs, MSS, and SMT for powerful, precise trades.

Practice on different timeframes and assets, and always look for clean displacement and structure confirmation. Mastering OBs is a big step toward becoming a consistently profitable trader.

Trust the Blocks. Trade with Intention.

Visa-Ripple Partnership Could Spark a Significan from Trenovia GThe financial world is undergoing a period of active transformation, and one of the most talked-about developments is the potential partnership between Visa and Ripple. According to a new analytical report by Trenovia Group, such a strategic collaboration could act as a catalyst for a substantial rise in Visa's stock value in the coming months.

Key Growth Drivers

Trenovia Group analysts emphasize that integrating Ripple’s technologies into Visa’s ecosystem would dramatically enhance the speed and reduce the cost of international transactions. RippleNet, built on blockchain technology, offers unique advantages: near-instant settlements, greater transparency, and lower fees compared to traditional interbank systems.

Partnering with Ripple would provide Visa with a powerful technological upgrade, reinforcing its dominance in the payment solutions market, particularly in cross-border transfers.

Expected Market Reaction

According to Trenovia Group, even the announcement of such a partnership could trigger a strong positive reaction from investors. In an increasingly competitive payments landscape, adopting blockchain innovations would be seen as a forward-looking move, enhancing Visa’s market appeal.

Technical analysis also points to favorable conditions: Visa shares are maintaining solid support around $260, and the formation of a "bullish flag" pattern suggests the potential for a breakout following positive news.

Strategic Importance of the Alliance

Trenovia Group highlights the long-term strategic benefits of this union. As digital currencies and decentralized payment systems gain traction, the integration of blockchain-based solutions would ensure Visa’s adaptability to evolving market and regulatory demands.

Meanwhile, Ripple would gain access to Visa’s vast global client network, boosting its position as a leader in the corporate cross-border payments sector.

Conclusion

According to Trenovia Group’s forecast, the Visa-Ripple partnership could provide a powerful boost to Visa’s stock. Upon successful integration of RippleNet technologies, analysts project a 15–25% rise in Visa's share price within the first six months after the announcement.

For investors, this could represent a rare opportunity to invest in the expansion of the world’s leading payment platform during a crucial phase of digital transformation.

The Hidden Power of the Silver Bullet Strategy - Full GuideIntroduction

The Silver Bullet Strategy is a high-probability intraday trading technique popularized within the Smart Money Concepts community. It focuses on taking precision trades during specific times of the day when liquidity is most active. Mastering this strategy can help traders consistently capture high-quality setups with minimal risk.

In this guide, we will cover:

- What the Silver Bullet Strategy is

- Key Times to Watch

- Entry Models

- Target Setting

- Risk Management

- Real Chart Examples

---

What is the Silver Bullet Strategy?

The Silver Bullet Strategy is based on trading within a "window" of high-probability price action, typically during key liquidity times. It looks to capture moves after liquidity sweeps, order block mitigations, and Fair Value Gap (FVG) plays.

Key Principles:

- Focuses on high-probability windows (New York session especially)

- Waits for a liquidity grab and displacement

- Entries are often on FVGs, OBs, or MSS points

---

Silver Bullet Timing Windows

Timing is crucial to this strategy. The "Silver Bullet" typically occurs in these windows (New York time):

- First Window: 10:00 AM - 11:00 AM (New York)

- Second Window: 2:00 PM - 3:00 PM (New York)

These times capture major moves post-liquidity sweeps or reversals after news/market manipulation.

---

Silver Bullet Entry Model

The classic sequence for a Silver Bullet setup:

1. Identify Liquidity Sweep: Look for price to grab liquidity above a swing high or below a swing low.

2. Look for Displacement: A strong move away from the sweep, creating a Fair Value Gap (FVG) or Breaker Block.

3. Entry in FVG or OB: Enter on a retracement into the FVG or Order Block after displacement.

4. Confirmation: Use lower timeframe MSS or BOS to confirm the reversal.

Liquidity sweep and FVG at the 5m:

MSS + Displacement candle at the 1m:

So all 4 steps completed!

Example Entry Checklist:

- Liquidity sweep

- Strong displacement creating an FVG

- Price retraces into FVG or OB

- MSS/BOS confirmation

- Execute trade with tight stop-loss

---

Where to Set Targets

Targets should be logical based on market structure:

- First Target: Recent internal liquidity (equal highs/lows)

- Second Target: External liquidity zones (major swing highs/lows)

- Optional: Use 1R/2R/3R scaling based on risk-to-reward goals

---

Risk Management for Silver Bullet Trades

Golden Rules:

- Risk less than 1% per Silver Bullet setup

- Set stop-loss beyond the liquidity sweep (not too tight, not too loose) or above FVG

candle

- Stick to one or two trades per window maximum

- Avoid revenge trading outside the windows

---

Common Mistakes to Avoid

- Trading outside the specified time windows

- Entering without a confirmed sweep and displacement

- Overleveraging because the strategy "looks easy"

- Ignoring higher timeframe bias (HTF context is still critical!)

Pro Tip: Combine Silver Bullet entries with SMT Divergences, MSS, and IFVGs for maximum confluence.

---

Final Thoughts

The Silver Bullet Strategy is one of the cleanest ways to approach intraday trading. By mastering liquidity concepts, timing, and precision entries, traders can catch powerful moves with strong risk-to-reward setups.

Be patient, wait for your window, and always trade with discipline.

Happy Sniping!

Gold and Chart Patterns I’m dropping this XAU/USD M30 insight because my system’s a damn executioner, and you need to see how I hunt the market. This chart is a textbook of bearish patterns—first a bearish three drives showing smart money exhausting buyers with three weakening upward pushes, then a head and shoulders with the neckline break confirming the reversal, and now a bearish shark forming to seal the deal, all playing out within my descending trendlines. Smart money’s been in control from the start, distributing at the peaks, grabbing liquidity, and dumping price to hunt stop-losses below key levels. Supply and demand zones are my edge—supply at the right shoulder of the head and shoulders where sellers stacked orders before the break, demand near the lower trendline where buyers might step in, my target for this bearish move. My checklist operations are a predator’s playbook. I start with harmonic patterns, hunting XABCD structures like the bearish shark I’m seeing now, signaling smart money’s reversal zones. I confirm market structure, looking for breaks of structure to show trend shifts—here, the neckline break confirms bearish continuation. I identify order blocks, those consolidation zones where smart money stacks orders, like the bearish order block at the right shoulder where sellers distributed. Volume profile is key—I check for high volume nodes where price stalls, like the neckline where sellers defended, and low volume nodes that act as magnets, like gaps below the neckline. Top-down analysis keeps me sharp—four-hour timeframe sets the bearish trend, one-hour confirms the break, thirty-minute narrows the setup, fifteen-minute is my strike zone, waiting for a neckline retest. I use Heikin Ashi for confirmation—red candles mean sell, waiting for red on the fifteen-minute at the retest. Fibonacci levels mark my targets—I focus on key extensions to set exits, like targeting the lower trendline of the channel. Gann theory adds confluence—I look for angles or retracements to align with my setups, like a Gann angle pointing to the lower trendline. MACD and RSI measure momentum—MACD’s bearish crossover and negative histogram confirm the downtrend, RSI below fifty with bearish divergence at the right shoulder seals it. Risk management is my law—I risk small to win big, stop-loss above the right shoulder, take-profit at the lower trendline, aiming for a high reward ratio. I monitor news and liquidity traps—fake spikes above the neckline are smart money’s tricks, so I stay sharp. I wait for confirmation—every piece aligns, or I walk, then I document to keep my edge razor-sharp. I’m rating this system a ten out of ten—harmonic patterns, Smart Money Concepts, volume profile, top-down analysis, and now MACD and RSI for momentum make it untouchable. I’ve fine-tuned this over six months, backtesting until it’s a weapon. I need two of you to join me at Academia—let’s hunt together.DYOR

Shieldsmine Diaries

Geld Vision Investing with values — how ESG is changing More and more people today not only want to earn money, but also want to know where their money is going and what impact it is having . They want to invest in projects that are not only profitable, but also responsible and sustainable. This is precisely where the ESG investing approach comes into play—a concept in which returns and responsibility go hand in hand.

We explain in a simple and understandable way what ESG means, how it works and why this approach will become increasingly important in 2025.

What does ESG mean?

ESG stands for three central principles:

E — Environmental: Climate protection, CO₂ emissions, resource conservation, waste prevention

S — Social: fair working conditions, human rights, diversity and inclusion

G — Governance: Transparency, anti-corruption, ethical leadership

Companies with high ESG ratings try to act responsibly towards people, the environment and society.

Why invest in ESG?

ESG investing combines ethical values with economic rationality. The benefits are obvious:

Fewer risks. Companies with clear ESG policies are less likely to experience scandals or legal problems.

Long-term stability. Sustainable companies are more resilient to crises and more future-oriented.

Good reputation. Companies with strong values gain trust from customers and partners.

Political support. More and more countries are promoting sustainable economic activity.

The platform allows users to specifically search for ESG-compliant companies and funds and track their development.

ESG and returns – contradiction or win-win?

A common misconception: Companies that operate sustainably earn less. In fact, the opposite is often true.

Numerous studies show that ESG companies perform better in the long term because they:

be managed more efficiently,

respond better to crises,

Attract investors and talent more strongly,

be on the safe side from a regulatory perspective.

Sustainability and profit are not mutually exclusive – they complement each other.

How do I get started with ESG investing?

Clarify your own values. What's important to you? The environment, fair working conditions, equality?

Analyze companies. Many companies publish ESG reports that provide information about their goals and progress.

ESG funds are reviewed. These funds pool audited companies with good ESG ratings.

Review performance regularly. ESG is not a fad, but a long-term approach with measurable results.

GeldVision offers tools that allow you to filter, analyze, and incorporate ESG data into your investment strategy.

In which industries does ESG play a major role?

Renewable energies — solar, wind, hydrogen

Sustainable consumption — environmentally friendly packaging, recycling

Technology and digitalization — inclusive and ethically managed companies

Education and health — socially relevant sectors with great impact

FinTech — Platforms that make investing more transparent and fairer

The ESG approach can be applied across industries—it is not a trend, but a new way of thinking.

Who relies on ESG?

Young investors. Generation Z and Millennials value values.

Large investment funds. ESG is an integral part of their strategy.

Private investors. People who want to make a positive impact with their money.

So ESG is no longer just for idealists — it has become mainstream .

What does Money Vision offer?

The platform helps users invest with a clear conscience. It offers:

Access to ESG rankings and sustainability data

Filters for targeted investment decisions

Market analyses on green and social trends

Support in building a balanced portfolio

Whether you’re a beginner or a professional, Geld Vision makes sustainable investing easier and more transparent.

ESG investing is more than just a trend. It's a new, future-oriented perspective on money, markets, and responsibility.

You can invest today without betraying your values —and still achieve attractive returns. With the right knowledge, the right tools, and platforms like Geld Vision, sustainable investing becomes a true success model.

Because investing responsibly means making profits while contributing to a better world.

Altavics Group: Why Smart Investors Embrace CryptoVolatility Isn't the Enemy — It's the Opportunity

The crypto market is known for its fast and sharp moves. Yes, Bitcoin can drop 10% in a day. But it can also rise 40% in a month.

This is exactly why cryptocurrency remains one of the most profitable asset classes over the past decade.

At Altavics Group, we believe that fearing short-term price swings means missing out on long-term strategic opportunities.

Why Invest in Crypto?

1. Blockchain is not the future — it's already here

Web3, DeFi, and Central Bank Digital Currencies (CBDCs) are shaping a new financial system, where cryptocurrencies are the backbone of innovation.

2. Limited supply = growing value

There will never be more than 21 million Bitcoins. That makes BTC a digital equivalent of gold. In a world of inflation and excessive debt, scarcity is strength.

3. Portfolio diversification

Crypto assets help reduce exposure to traditional markets. Especially in times of geopolitical or economic instability, decentralized currencies offer a non-political, borderless hedge.

What if the market crashes?

Crypto corrections are not the end — they’re accumulation phases. Some of the best opportunities are found when the market is fearful.

Bitcoin dropped to $3,000 in 2018. Today it trades above $90,000.

Ethereum was $80 in 2019. Today it’s over $1,600.

The history of crypto is one of crashes and recoveries. Those who stay in smartly — win big.

What Altavics Group Offers

A secure, advanced platform for buying, storing, and trading cryptocurrencies

Real-time analysis and expert trading signals

Custom investment strategies aligned with your goals and risk appetite

Education for beginners and seasoned investors

Altavics Group’s Final Word

Investing in crypto doesn't mean taking blind risks. It means thinking ahead.

Those afraid of volatility today may regret missing the upside tomorrow.

Strong investors don’t chase comfort — they seek potential. And crypto is exactly that: proven potential.

Market Structure Shift (MSS) & Break of Structure (BOS) - GuideIntroduction

Understanding market structure is fundamental to becoming a consistently profitable trader. Two key concepts that Smart Money traders rely on are the Break of Structure (BOS) and the Market Structure Shift (MSS) . While they may seem similar at first glance, they serve different purposes and signal different market intentions.

In this guide, we will break down:

- The difference between BOS and MSS

- When and why they occur

- How to identify them on your charts

- How to trade based on these structures

- Real chart examples for visual clarity

---

Break of Structure (BOS)

A Break of Structure is a continuation signal. It confirms that the current trend remains intact. BOS typically occurs when price breaks a recent swing high or low in the direction of the existing trend .

Key Characteristics:

- Happens with the trend

- Confirms continuation

- Can be used to trail stops or add to positions

Example:

In an uptrend:

- Higher High (HH) and Higher Low (HL) form

- Price breaks above the last HH → BOS to the upside

---

Market Structure Shift (MSS)

Market Structure Shift signals a potential reversal . It occurs when price breaks a significant swing level against the prevailing trend and is often followed by a shift in the internal structure (e.g., lower highs after higher highs).

Key Characteristics:

- Happens against the trend]

- Signals possible trend reversal

- Often occurs after a liquidity grab or stop hunt

- Optional: is created by a displacement candle

Example:

In an uptrend:

- Price takes out a significant high (liquidity grab)

- Then aggressively breaks the most recent HL → MSS to the downside

---

How to Identify BOS and MSS

For BOS:

1. Determine the current trend.

2. Identify swing highs/lows.

3. Look for price breaking past these levels in the same direction as the trend .

For MSS:

1. Look for signs of exhaustion or liquidity grabs near swing highs/lows.

2. Watch for price to break against the trend structure .

3. Confirm with a shift in internal structure (e.g., lower highs start forming in an uptrend).

---

Using BOS and MSS in Your Trading Strategy

With BOS:

- Use it to confirm trend continuation

- Add to your position after a retracement into an OB or FVG

- Trail your stop-loss below the most recent HL or above LH

With MSS:

- Look for confluence (liquidity sweep + MSS = strong signal)

- Use it to spot early reversal entries

- Wait for a confirmation candle or structure shift on LTF (1m, 5m, 15m)

- If the displacement candle is too big you can wait for the retest

---

Common Mistakes to Avoid

- Confusing BOS with MSS

- Ignoring higher timeframe context

- Trading MSS too early without confirmation

- Chasing BOS without waiting for a proper retracement

Pro Tip: Use BOS/MSS with confluences like SMT Divergence, IFVGs, or key session times for higher probability setups.

---

Final Thoughts

Mastering BOS and MSS will give you an edge in understanding price delivery and anticipating market moves. BOS confirms strength in the current trend, while MSS warns of a possible reversal and new trend forming. Combine these with smart money tools, and you’ll be equipped to enter the market like a pro.

Happy Trading!

RSI-Volume Momentum Signal Score: Trading the Momentum PressureThe indicator used in this chart is an updated version of the RSI-Volume Momentum Score.

The RSI-Volume Momentum Signal Score is a predictive technical indicator designed to identify bullish and bearish momentum shifts by combining volume-based momentum with the Relative Strength Index (RSI). It generates a Signal Score derived from:

• The divergence between short-term and long-term volume (Volume Oscillator), and

• RSI positioning relative to a user-defined threshold. The Signal Score is calculated as follows:

Signal Score = tanh((vo - voThreshold) / scalingFactor) * ((rsiThreshold - rsi) / scalingFactor)

The logic of this formula are as follows:

• If Volume Oscillator >= Volume Threshold and RSI <= RSI Threshold: Bullish Signal (+1 x Scaling Factor)

• If Volume Oscillator >= Volume Threshold and RSI >= (100 – RSI Threshold): Bearish Signal (-1 x Scaling Factor)

• Otherwise: Neutral (0)

The tanh function provides the normalization process. It ensures that the final signal score is bounded between -1 and 1, increases sensitivity to early changes in volume patterns based on RSI conditions, and prevent sudden jumps in signals ensuring smooth and continuous signal line.

This updated version Introduces colored columns (green and red bars) representing momentum pressure directly. These bars:

o Green bars represent bullish pressure when the signal score is +1.

o Red bars represent bearish pressure when the signal score is -1.

o The transition point from one color to another acts as a visual signal of momentum reversal.

LONG SIGNAL: A transition from green bar to red bar indicates that bullish pressure has reached a tipping point—price is likely to rise soon.

SHORT SIGNAL: A transition from red bar to green bar signals bearish pressure is peaking—potential price drop ahead.

These transitions become intuitive signals for bullish or bearish entries, depending on the context.

Inversion Fair Value Gaps (IFVGs) - A Deep Dive Trading GuideIntroduction

Inversion Fair Value Gaps (IFVGs) are an advanced price action concept rooted in Smart Money theory. Unlike standard Fair Value Gaps (FVGs), IFVGs consider the idea of price revisiting inefficiencies from an inverse perspective. When price "respects" a previously violated gap from the opposite side, it creates a powerful confluence for entries or exits.

This guide will cover:

- What an IFVG is

- How it differs from traditional FVGs

- Market context for IFVG setups

- How to trade them effectively

- Real chart examples for clarity

---

What is an IFVG?

An Inversion Fair Value Gap (IFVG) occurs when price trades through a traditional Fair Value Gap and later returns to that area, but instead of continuing in the original direction, it uses the gap as a support or resistance from the other side.

Standard FVG vs. IFVG:

- FVG: Price creates a gap (imbalance), and we expect a return to the gap for mitigation.

- IFVG: Price violates the FVG, but instead of invalidation, it respects it from the other side.

Example Logic: A bullish FVG is formed -> price trades through it -> later, price revisits the FVG from below and uses it as resistance.

---

Structure and Market Context

Understanding structure is key when trading IFVGs. Price must break structure convincingly through a Fair Value Gap. The gap then acts as an inversion zone for future reactions.

Ideal Market Conditions for IFVGs:

1. Market is trending or has recently had a strong impulsive move.

2. A Fair Value Gap is created and violated with displacement .

3. Price retraces back to the FVG from the opposite side .

4. The gap holds as support/resistance, indicating smart money has respected the zone.

---

Types of IFVGs

1. Bullish IFVG: Price trades up through a bearish FVG and later uses it as support.

2. Bearish IFVG: Price trades down through a bullish FVG and later uses it as resistance.

Note: The best IFVGs are often aligned with Order Blocks, liquidity levels, or SMT divergences.

---

How to Trade IFVGs

1. Identify a clear Fair Value Gap in a trending market.

2. Wait for price to break through the FVG with momentum .

3. Mark the original FVG zone on your chart.

4. Monitor for price to revisit the zone from the other side.

5. Look for reaction + market structure shift on lower timeframes.

6. Enter trade with a clear stop loss just beyond the IFVG.

Entry Confluences:

- SMT divergence

- Order Block inside or near the IFVG

- Breaker Blocks

- Time of day (e.g., NY open)

---

Refined Entries & Risk Management

Once the IFVG is identified and price begins to react, refine entries using:

- Lower timeframe market structure shift

- Liquidity sweeps just before tapping the zone

- Candle closures showing rejection

Risk Management Tips:

- Set stop loss just beyond the IFVG opposite wick

- Use partials at 1:2 RR and scale out based on structure

- Don’t chase missed entries—wait for clean setups

---

Common Mistakes to Avoid

- Confusing IFVG with invalidated FVGs

- Trading them in low volume or choppy conditions

- Ignoring market context or structure shifts

- Blindly entering on first touch without confirmation

Tip: Let price prove the level—wait for reaction, not prediction.

---

Final Thoughts

IFVGs are an advanced but powerful tool when used with precision. They highlight how Smart Money uses inefficiencies in both directions, and when combined with other concepts, they can form sniper-like entries.

Practice finding IFVGs on historical charts. Combine them with SMT divergences, OBs, and market structure, and soon you’ll start seeing the market through Smart Money eyes.

Happy Trading!

Futures electronic hoursFutures electronic hours

💡 This idea focuses on trading futures during the electronic trading hours — the periods outside the regular cash session, where unique price behavior often occurs due to lower liquidity and algorithmic dominance.

📊 Core Strategy:

During electronic hours (typically post-market/pre-market), futures like ES, NQ, or CL often show sharp moves driven by global macro news, low-volume liquidity zones, or overnight positioning. These moves can offer high-probability setups when combined with key levels from the regular session.

🧠 How to use it:

1. Mark key support/resistance levels from the previous regular session.

2. During electronic hours (e.g., 6 PM – 9 AM ET), monitor price interaction with these levels.

3. Look for rejection, breakout, or fakeout signals, ideally with volume spikes.

4. Use tight risk management due to increased volatility and spreads.

⏱️ Electronic hours are often overlooked but can offer clean technical setups for experienced traders, especially in quiet news environments or after major macro releases.

📌 Works well with futures contracts like ES, NQ, CL, and GC. Can also be adapted for FX and crypto markets which trade 24/7.

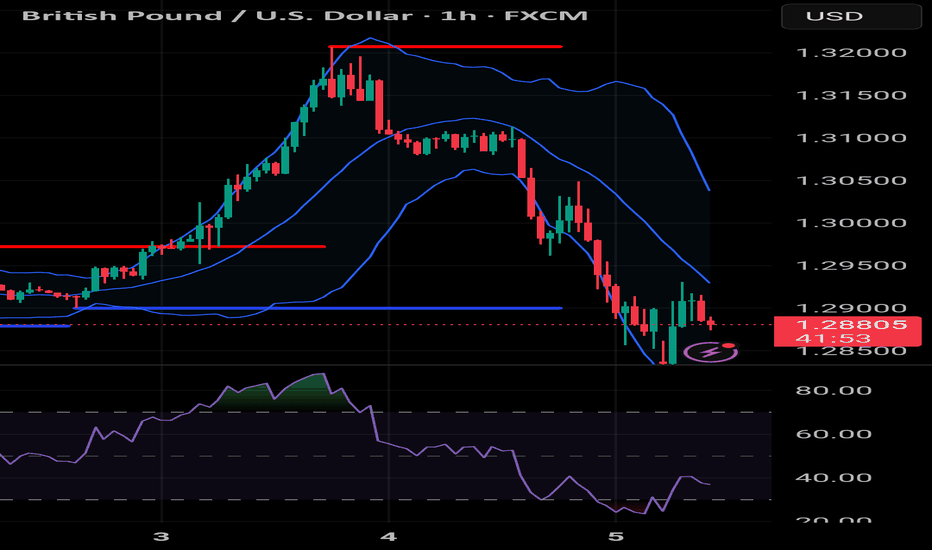

RSI + BB strategy - the strong duo you will ever need to win Hello traders!

This article shares with you a strategy employing two famous indicators that have stood the test of time and used by professionals and amateurs alike. A solid trading plan needs at least one solid strategy which will be your bread and butter. You can always add more strategies or game plans to your repertoire but you need to master one. Trading can be as complicated or simple as you make it. To make sense of it all, you should always try to be realistic and stick to a trading plan which is "simple and stupid" so that you free your mind from overthinking and focus on the market movements instead. A good strategy, along with constant market trend analysis, good risk management, news awareness and emotion control can ultimately transition you to being a consistent profitable trader. Indeed, there are times where the odds will not be in your favour and you will have losing trades. However, the key to success is to think of trading as a game of probability and developing a winning edge that ensures you are profiting more than losing. A 1:2 RRR is the least you have to accept when entering a trade, else sit tight and wait for the next opportunity. As Jesse Livermore quoted, "It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!".

RSI

Developed by J. Welles Wilder Jr. In 1978, the relative strength index is a momentum indicator that measures the speed and magnitude of price changes. At 70+, RSI is considered overbought and a retracement in price may occur. At 30-, RSI is considered oversold and price may go up. The middle line is the mean of recent prices, usually during a 14 days period.

BB

Developed by John Bollinger much later in the 1980s, BB is a volatility indicator which measures the speed and extent of price changes. A wider band signals high volatility and a narrow band signals low volatility. When price reaches the upper band, the asset is considered overbought and price may retract. When price reaches the lower band, the asset is considered oversold, meaning there are less and less sellers in the market and price may go up. The middle line is usually a simple moving average, showing the mean price across a time period.

RSI + BB strategy

The combination relies, and truthfully so, on the fact that the price of an asset usually hovers around its mean. Unless there are significant macroeconomic changes and news are strong (ultimately forming a new trend), price does not deviate much from its mean. It continues and builds its existing trend and moves up and down the moving average. By meauring both the momentum and volatility of the price, while keeping an eye on the direction of the trend, a trader can place small trades with a minimum 1:2 RRR as the asset moves in a range, an uptrend or a downtrend. The indicators give you insight on where to buy and place your SL and TP.

Trading set ups

- RSI 70+, BB touching upper band, no news, BB horizontal (showing a ranging market), price at major resistance zone - sell because price is likely to move through the moving average towards to lower band

- RSI 30-, BB touching lower band, no news, BB horizontal (showing a ranging market), price at major support zone- buy because price is likely to move through the moving average towards to upper band

- RSI 70+, BB touching upper band (price climbing up the BB ladder), BB moving upwards (uptrend), strong good news - buy because price is in uptrend and trend is likely to continue

- RSI 30-, BB touching lower band (price falling off the BB cliff), strong bad news - sell because price is in downtrend and trend is likely to continue

Sitting tight

-Playing on a 1hr timeframe, there won't be many instances when all these stars align. That is when you sit tight and wait.

- When price is hovering in between the RSI grid and BB band - sit tight and wait because the odds are not in your favour and it is impossible to predict which way price will move. Let the market do its thing, protect your capital and wait for the market to show you what to do next.

Note

- When the conditions are met, always enter the trade as soon as you get confirmation. If you are late in entry, skip the trade and wait

- Place your SL just above the upper BB if selling or just below the lower BB if buying

- TP is essential so you can lock in profits, especially in ranging markets where price quickly touches the BB band and bounces back. If you are in a trade and not able to monitor it, a TP ensures you have closed your trade at your desired and predicted price. TP is placed close to the lower band if selling or close to the upper band if buying

-Ensure that all your other criteria such as news, RRR and emotion control are met to enter a trade. If one is not met, this trade is not for you.

- Familiarise yourself using alerts. You have to be able to be present when the opportunity presents itself. Tradingview's lowest paid plan gives you 20 alerts, which is more than sufficient if you are focusing on 4-5 assets only. Alerts add to your winning edge and enable you to be trading the best set ups when they form.

Please do not hesitate to share your thoughts if you do use RSI and/or BB and have had positive outcomes. :)

GL to all!

Blueprint for Becoming a Successful Forex Trader in 2025🚀 Blueprint to Becoming a Successful Forex Trader in 2025: Leveraging ICT, Automation, and Prop Funding

Here’s a detailed, actionable blueprint designed to position you for success by carefully navigating broker selection, adopting advanced trading strategies, obtaining prop funding, and integrating automation and AI technologies into your trading.

🏦 Broker Selection (Actionable Steps)

🔍 Choose brokers with true ECN/STP execution

⚡ Ensure brokers offer low spreads (0.0-0.2 pip average) and fast execution to maximize ICT precision entries.

🛡️ Prioritize brokers regulated by ASIC, FCA, or FSCA with verified Myfxbook execution reports.

📊 Confirm broker compatibility with MetaTrader 4 (MT4) to seamlessly integrate Expert Advisors (EAs).

💳 Check for flexible withdrawal/deposit methods and swift payouts (Crypto, Wise, Revolut).

🎯 Trading Strategy (ICT Concepts & Supply-Demand Zones)

🧠 Master ICT Concepts: Liquidity sweeps, Order Blocks (OB), Fair Value Gaps (FVG), Market Structure Breaks (MSB).

📍 Combine ICT with Supply-Demand: Identify institutional supply-demand zones aligning with ICT Order Blocks & liquidity areas.

📐 Execute High-Probability Setups: Trade only after liquidity grabs at key daily/weekly ICT points, avoiding retail traps.

📈 Time & Price Theory: Trade London Kill Zones and New York Open exclusively, exploiting predictable ICT volatility.

📆 Weekly Preparation: Annotate D1/H4 charts on weekends marking liquidity points, order blocks, and premium/discount zones clearly.

💰 Getting Prop Funding (Actionable Approach)

🥇 Target reputable prop firms (FTMO, MyForexFunds, The Funded Trader, 8cap, etc) with clear and attainable evaluation objectives.

📑 Use ICT trading style for evaluation: lower-frequency, high-probability trades with clearly defined risks.

🎯 Implement strict risk management rules: never exceed 1% risk per trade, aiming for steady account growth (5-10% monthly target).

📊 Monitor performance closely using provided analytics dashboards (e.g., FTMO Metrics App) and adapt accordingly.

📚 Diversify funded accounts across multiple firms, compounding total available trading capital while reducing firm-specific risk.

⚙️ Automating & Executing Trades (MT4 EA & Bots)

🛠️ Hire experienced MQL4 developers to code custom ICT-based MT4 Expert Advisors

🤖 Develop EAs specifically around ICT logic (Order Block detection, liquidity grabs, market structure shifts) and or supply/demand logic

🤖 use advanced algo based breakout EAs for automation

📌 Automate trade management: EAs should handle entry precision, partial exits, break-even stops, and trail stops.

📡 Set EAs on VPS Hosting (NY4, LD4) for optimal latency and consistent execution (ForexVPS, AccuWeb Hosting).

📈 Regularly perform forward-testing and optimization of EAs on demo accounts before live deployment (at least quarterly optimization).

📲 Integrating Advanced Bots and Technology in 2025

📊 Combine your MT4 EAs with third-party analytics platforms for detailed trade performance insights.

🔮 Incorporate AI-based forecasting tools to refine ICT setups and trade signals.

🔔 Use automated bots for real-time alerts on ICT-based setups via Telegram or Discord channels.

🧑💻 Maintain manual oversight for discretionary ICT decisions—use automation for entry efficiency, not blind reliance.

🔄 Continuously retrain and update your bot’s logic monthly using the most recent trade data, ensuring adaptive execution.

🗓️ Daily Routine for Success

🌅 Pre-session (30 mins): Review annotated charts, ICT concepts (liquidity, OB, FVG), and supply-demand levels.

💻 During trading session: Monitor EA execution, manually adjust positions based on real-time ICT setups.

📝 Post-session (15 mins): Journal trades meticulously in detail, noting ICT reasoning behind wins and losses.

📆 Weekly review: Assess overall ICT & EA performance—adjust EA parameters as needed to match evolving market conditions.

📚 Continuous learning: Keep updated on advanced ICT framework,

supply demand zone trading.

📌 Final Actionable Advice for 2025

🔍 Specialize intensely on ICT & supply-demand concepts rather than multiple strategies—depth over breadth.

🚩 Always adapt and evolve your trading algorithms to ICT methodology—market dynamics continually change.

🧘 Maintain emotional discipline and patience, relying on high-probability setups to steadily compound your account.

💡 Stay ahead by embracing technology: automation, AI-driven forecasting, and custom ICT tools will provide a significant edge in 2025.

What Is an ABCD Pattern, and How Can You Use It in Trading?What Is an ABCD Pattern, and How Can You Use It in Trading?

Are you looking to improve your trading strategy and technical analysis skills? The ABCD trading pattern may be just what you need. This tool may help you identify potential market reversals and decide when to enter a trade. Keep reading to learn more about the ABCD pattern and how to apply it to your trading strategy.

What Is an ABCD Pattern?

The ABCD pattern is one of the basic harmonic patterns. It gives traders an idea of where the market might reverse. Therefore, when combined with other forms of technical analysis, it may be a great addition to your trading arsenal.

The ABCD pattern comprises two legs, AB and CD, and one retracement, BC, with D as an entry point. More specifically, an ABCD can be identified by:

- AB Leg: A trend starts at A and makes a high or low at B.

- BC Retracement: The price retraces from B to C.

- CD Leg: The trend continues from C to D.

- D Entry Point: Once another high or low forms and traders enter at D.

These price movements create the “zig-zag” or “lightning bolt” shapes.

In fact, ABCD patterns are present across every market and every timeframe. The up-down movements in financial assets represent opportunities to identify and trade ABCD patterns.

Why Use the ABCD Pattern in Your Trading Strategy?

Before we move on to identifying and trading the ABCD pattern, it’s worth explaining why you might want to consider using it. Here are a few reasons traders favour the ABCD pattern:

- It’s one of the harmonic patterns suitable for traders of all experience levels.

- It’s versatile and works for stocks, commodities, and cryptocurrencies*, not just forex trading.

- Traders use ABCD patterns to make informed decisions about potential turning points in the market.

- It can form the basis of a working trading strategy if used correctly alongside other forms of technical analysis.

- It provides quite an effective risk/reward ratio if reversals are caught.

How Traders Identify an ABCD Trading Pattern

The first step in finding ABCDs is to look for that classic zig-zag shape. Once you’ve found one, it’s time to apply Fibonacci ratios to confirm the pattern. If you’re struggling, you can consider using pre-made ABCD pattern indicators or scanners to help your eyes get used to spotting them.

The ABCD pattern requires that the BC leg is between a 38.2% to 78.6% retracement of AB, ideally between 61.8% and 78.6%. This means that if you put a Fibonacci retracement tool at A and B, C should be between 0.382 and 0.786.

The second CD leg should be a 127.2% to 161.8% extension of the BC retracement. For extra confirmation, consider specifying that AB is equal to the same length as CD.

While it can be tempting to start trading based on these conditions, you’ll find that, in practice, identifying point D can be trickier than it seems. That’s why traders typically use Fibonacci ratios, key levels, candlestick patterns, and higher timeframe convergence to confirm their entries, which we will touch on shortly.

ABCD Pattern Examples

Now that we understand how to identify the ABCD pattern, we can start applying it to real price action.

Note that the ratios won’t always be perfect, so allowing for slight variability above or below the defined ratios is acceptable.

Bullish ABCD Pattern

For a bullish formation, the following must be present:

- The AB leg should be between the high A and low B.

- The BC bullish retracement should be between the low B and high C, which is below the high A.

- The CD leg should be between the high C and low D.

- BC is a 38.2% to 78.6% retracement of AB, preferably between 61.8% and 78.6%.

- CD is a 127.2% to 161.8% extension of BC.

Additionally, you may look for AB to be an identical or similar length to CD.

Entry: Traders set a buy order at D.

Stop Loss: The theory suggests traders place a stop below a nearby support level or use a set number of pips.

Take profit: Traders place take-profit orders at the 38.2%, 50%, or 61.8% retracement of CD or hold for higher prices if they believe there’s the potential for further bullishness.

Bearish ABCD Pattern

The bearish ABCD chart pattern is essentially the same, just with the reversed highs and lows. As such:

- The AB leg should be between the low A and high B.

- The BC bullish retracement should be between the high B and low C.

- The CD leg should be between the low C and high D.

- BC is a 38.2% to 78.6% retracement of AB, preferably between 61.8% and 78.6%.

- CD is a 127.2% to 161.8% extension of BC.

You can choose to apply the same AB = CD rules in a bearish ABCD pattern if desired.

Entry: Traders typically place a sell order at D.

Stop Loss: A stop may be placed above a nearby resistance level or at a set number of pips.

Take profit: Traders often take profits at the 38.2%, 50%, or 61.8% retracement of CD or hold for lower prices if there’s a bearish trend on a higher timeframe.

ABCD Pattern Strategy

A momentum-based ABCD trading strategy can help traders confirm potential reversals by incorporating indicators like the RSI (Relative Strength Index). This approach often adds an extra layer of confluence.

Entry

- Traders may wait for point D to form and for the RSI to indicate overbought or oversold conditions, typically above 80 or below 20.

- Additional confirmation can be sought if there is a divergence between price and RSI, signalling weakening momentum.

- Once the RSI crosses back into normal territory, it can suggest a reversal, providing an opportunity to enter the market.

Stop Loss

- A stop loss is often placed slightly above or below point D, depending on whether the formation is bearish or bullish, respectively. This helps potentially manage risk in case the reversal doesn’t hold.

Take Profit

- Traders can consider taking profits at Fibonacci retracement levels of leg CD, such as 38.2%, 50%, or 61.8%.

- Another common target is point C, but traders may also hold the position for longer if further price movement is anticipated.

Looking for Additional Confluence

Given that trading the ABCDs usually relies on setting orders at specific reversal points, consider looking for extra confirmation to filter potential losing trades. Below, you’ll find three factors of confluence you can use to confirm your entries.

Key Levels

If your analysis shows that D is projected to be in an area of significant support or resistance, there’s a greater chance that the level will hold and the price will reverse in the way you expect.

ABCD Timeframe Convergence

One technique to potentially enhance the reliability of ABCD chart patterns is to check for multiple timeframes. When you identify the formation on a lower timeframe—say, the 5-minute chart—you can then look to a higher timeframe chart, such as the 30-minute or 1-hour chart to see the overall trend.

If the pattern converges with the longer-term trend, it strengthens the analysis and increases the likelihood of an effective trade.

Candlestick Patterns

Some traders look for particular candlestick patterns to appear. The hammer and shooting star patterns are commonly used by ABCD traders for extra confirmation, as are tweezer tops/bottoms and engulfing candles. You could choose to wait for one of these candlesticks to form before entering with a market order.

Common Mistakes to Avoid When Identifying an ABCD Chart Pattern

Of course, ABCD patterns aren’t a silver bullet when it comes to effective trading. There are several common mistakes made by inexperienced traders when trading these types of patterns, such as:

- Confusing the ABCD with other harmonic patterns, like the Gartley or three-drive pattern.

- Trading every potential ABCD formation they see. It’s preferable to be selective with entries and look for confirmation.

- Not being patient. ABCDs on higher timeframes can take days, even weeks, to play out.

Experienced traders wait for the pattern to develop before making a trading decision.

- Ignoring key levels. Instead, you could allow them to guide your trades and look for the ABCD pattern in these areas.

The Bottom Line

The ABCD pattern is a versatile tool that can enhance a trader’s ability to identify potential market reversals and refine their overall strategy. When combined with other forms of technical analysis, such as momentum indicators, an ABCD trading strategy can be an invaluable addition to your trading arsenal.

For traders looking to apply the ABCD pattern in forex, stock, commodity, and crypto* markets, consider opening an FXOpen account and take advantage of low-cost, high-speed trading across more than 600 assets. Good luck!

FAQ

What Is an ABCD Trading Pattern?

The ABCD trading pattern is a simple harmonic pattern used by traders to identify potential market reversals. It consists of three price movements: the AB leg, BC retracement, and CD leg, with point D marking a potential entry for a reversal trade. It helps identify changes in trend direction.

How Can You Use the ABCD Pattern in Trading?

Traders identify the ABCD pattern by finding the characteristic zig-zag shape and using Fibonacci ratios to confirm it. Entry points are typically placed at point D, with stop losses and profit targets based on the formation’s structure. Confluence with other technical analysis tools improves its reliability.

Is the ABCD Pattern Bearish or Bullish?

The ABCD pattern can be either bearish or bullish. A bullish ABCD indicates a potential upward reversal, while a bearish ABCD suggests a downward reversal. The structure remains the same, but the highs and lows are reversed.

What Is the ABCD Strategy?

The ABCD strategy revolves around identifying trend reversals using the formation and confirming entry points through tools like Fibonacci retracements or momentum indicators like the RSI for added accuracy.

*At FXOpen UK, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Precision Trading – How Our Trade Played Out PerfectlyIntroduction

In trading, precision and patience are everything. We don’t chase trades—we wait for the perfect confluence of technical factors to align. This trade idea followed our systematic approach, utilizing ranges, Fibonacci levels, internal & inducement liquidity, break of structure (BOS), entry confirmation patterns, and harmonics. Here’s a breakdown of how it all unfolded.

1. Identifying the Range

Before executing, we mapped out the market structure to establish a clear range. The price action showed a well-defined consolidation zone, which helped us anticipate liquidity grabs and potential reversal points.

2. Fibonacci Confluence – 78.20% Level

Using the Fibonacci retracement tool, we identified the 78.20% level as a strong reaction point. This aligned with other key technicals, increasing our confidence in the trade setup.

3. Internal & Inducement Liquidity

Liquidity is key in trading. We spotted internal liquidity zones where price was likely to manipulate weak hands before the actual move. Inducement liquidity was also present, providing additional confirmation that price would tap into deeper levels before reversing.

4. Break of Structure (BOS) and Entry Confirmation

Once BOS occurred in alignment with our anticipated liquidity grab, we looked for our **entry pattern**. The market printed a textbook confirmation, allowing us to enter with precision and minimal risk.

5. Harmonic Pattern for Additional Confluence

The final piece of confirmation was a harmonic pattern, further validating our entry. These patterns, when combined with our overall strategy, add an extra layer of probability to our trades.

Trade Outcome

The execution was flawless! 🎯 The price respected our levels, moved in our favor, and hit our target zones with precision. This is the power of structured analysis and disciplined execution.

📉 Key Takeaway:Never trade blindly! Always have a solid confluence of technicals before taking a trade.**

🔎 What’s your go-to confirmation before entering a trade? Let’s discuss in the comments! 📩

#ForexTrader #ForexLifestyle #ForexSignals #DayTrading #TradingMindset #ForexMoney #PipsOnPips #ForexSuccess #ForexMotivation #MillionaireMindset #TradingStrategy #FXMarket #ForexWins #TradeSmart #MarketAnalysis #WealthBuilding #Investing #PriceAction #ChartAnalysis #Scalping #SwingTrading #FinancialFreedom #MakingMoneyMoves #HustleHard #NoDaysOff #MoneyMindset

ICT Concepts for FX and GOLD traders: 2025 edition🔍 ICT (Inner Circle Trader) is a trading methodology developed by Michael J. Huddleston. It focuses on market structure, smart money concepts (SMC), and how institutions manipulate liquidity to trap retail traders.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

Ultimate 2025 Forex Prop Trading FAQ + Strategy Guide🧠 Forex Prop Trading: What Is It?

Prop trading (proprietary trading) is when a trader uses a firm’s capital to trade the markets (instead of their own), and keeps a share of the profits – usually 70–90%.

✅ Low startup cost

✅ No personal risk (firm takes the loss)

✅ Big upside potential with scaling plans

📋 Step-by-Step Action Plan to Get Started (2025)

🔍 1. Understand the Prop Firm Model

🏦 Prop firms fund skilled traders with $10K to $500K+

🎯 You pass a challenge or evaluation phase to prove your skills

💵 Once funded, you earn a profit split (70%–90%)

🧪 2. Choose a Top Prop Firm (2025)

Look for reliable and regulated firms with transparent rules:

FTMO 🌍 – Trusted globally, up to $400K scaling

MyFundedFX 📊 – Up to 90% profit split, no time limit

E8 Funding ⚡ – Fast scaling and instant funding

FundedNext 💼 – 15% profit share during challenge phase

The Funded Trader 🏰 – Up to $600K with leaderboard bonuses

🔎 Compare features: fees, drawdown limits, trading style freedom

💻 3. Train & Master Your Strategy

🧠 Pick a clear, rule-based strategy (e.g. trend following, breakout, supply/demand)

📅 Backtest over 6–12 months of data

💡 Use AI tools & trade journals like Edgewonk or MyFXBook

🎯 Focus on:

Win rate (above 50–60%)

Risk-reward ratio (1:2 or better)

Consistency, not wild profits

🧪 4. Pass the Evaluation Phase

🔐 Follow risk rules strictly (daily & max drawdown)

⚖️ Use proper risk management (0.5–1% risk per trade)

🧘♂️ Trade calmly, avoid overtrading or revenge trades

📈 Most challenges:

Hit 8–10% profit target

Stay under 5–10% total drawdown

Trade for at least 5–10 days

🧠 Tip: Pass in a demo environment first before going live!

💵 5. Get Funded & Start Earning

🟢 Once approved, you trade real firm capital

💰 You keep up to 90% of profits, with withdrawals every 2 weeks to 1 month

🚀 Many firms offer scaling plans to grow your account over time

💬 FAQ – Prop Trading in 2025

❓ How much can you make?

🔹 Small accounts ($50K): $2K–$8K/month with 4–8% returns

🔹 Large accounts ($200K+): $10K+/month possible for consistent traders

💡 Many traders start part-time and scale as they build trust with the firm

❓ How much do I need to start?

💳 Challenge fees range from:

$100 for $10K

$250–$350 for $50K

$500–$700 for $100K+

⚠️ No need to deposit trade capital – just the challenge fee

❓ What are the risks?

You can lose the challenge fee if you break rules or over-leverage

You won’t owe money to the firm

The biggest risk is psychological – many fail from overtrading or emotional decisions

🚀 Final Tips to Succeed

✅ Trade like a robot, think like a CEO

✅ Journal every trade – self-awareness is key

✅ Avoid over-leveraging and gambling mindset

✅ Stick to one strategy and master it

✅ Focus on consistency over quick wins

Predicting sell off, 30"++ in advance of a head and shouldersLet's examine how a head and shoulders is usually formed by a wave 4 and 5 and an A & B wave, the C wave is the sell off after the head and shoulders.

I use this pattern to predict a head and shoulders AT THE RIGHT NECKLINE. In this case 90 minutes in advance.. So 6 X 15 minute candles in advance we can predicted a H & S and a selloff, sound valubale?

if you understand this concept please give a thumbs up.

To go over price action again, we are going up on 5 waves. Wave 4 creates the left shoulder. After wave 5 we come down on an A wave, that is the right neckline.

This is where You can predict an B wave UP, and if it doesn't go higher than the previous wave 5, we will get a typical head and shoulder sell off after the wave B up.

Smart Money: Key Zones for Entry and Market RebalancingHello, friends!

Below is my market analysis, where for each key element of the Smart Money concept I use.

1. Premium/Discount zones allow me to quickly identify where capital works most profitably. Using the Fibonacci Correction tool, I find areas that indicate entry opportunities: buying in the discount zone and selling in the premium zone. This helps to form a basic picture of the market balance.

2.OTE helps me find optimal entry points by refining the zones defined by the basic correction. This tool allows me to look at possible entry areas in more detail, making the signals more accurate.

3. When analyzing market movements, I pay attention to FVGs that arise due to a lack of liquidity during impulse movements. Such cavities indicate an imbalance that the market is trying to eliminate, which creates additional opportunities for rebalancing and entering a position.

4.With ImpIMB analysis, I find imbalances where the center candle is significant and its wicks overlap on both sides. This allows me to isolate the zone that signals an aggressive market, giving additional trading clues without revealing all the details.

5.GAP is formed when a cavity appears between the extremes of candles due to a sharp market opening. Using Fibonacci, I outline these areas, because they often become benchmarks for future rebalancing and correction of market dynamics.

Best wishes Mvp_fx_hunter

TOP 5 TRADING SETUPS THAT MAY BE IN THE ARSENAL OF A SKIN TRADERSuccessful trading is not about “guessing the market”, but about clear strategies and discipline. Today I will show you 5 setups that really work and will help you find the entry point with the best risk management.

1️⃣ Breakout & Retest

✅ How I work:

The price breaks through the rhubarb (strong support/support).

Then it turns around, tests this rope and jumps.

🔍 What you need to joke about:

High volume under breakdown (strong impulse).

A clear retest without any deep push back.

Candle pattern confirmation (pin bar, clay, etc.).

📈 De vikoristuvati:

Cryptocurrency

Forex

Stock market

🔸 Example: BTC/USD breaks through $50,000, turns around, tests it as support - and goes up.

🛑 Stop loss: after the breakout (with a small margin).

🎯 Goal: 1:2 or 1:3 for risk management.

2️⃣ False Breakout

✅ How I work:

The price breaks through the rhubarb, but then quickly turns back.

This is a trap for those who “run after the market.”

🔍 What you need to joke about:

Great tail of the candle after breakdown (manipulation).

The volume falls after the breakdown - shows the weakness of the rukh.

Confirming reversal pattern (pin bar, clay).

📈 De vikoristuvati:

Crypt

Forex

NASDAQ, S&P500

🔸 Example: The price of Ethereum breaks through $3,500, but it quickly turns around under this pressure – the witches “took control.”

🛑 Stop loss: beyond the extreme of the fake breakout.

🎯 Purpose: front level of support/support.

3️⃣ Liquidity Grab

✅ How it works:

The price breaks through the level sharply, knocking out stops.

Then returns to the zone and changes direction.

🔍 What to look for:

A strong impulse movement with a sharp pullback.

Knocking out stops (candle tails).

High volume on the return.

📈 Where to use:

Forex

Stock markets

Cryptocurrency

🔸 Example: Before a big drop, BTC makes a sharp jump above $52,000, collects stops of longs - and then falls to $48,000.

🛑 Stop loss: short, following a manipulation move.

🎯 Target: the nearest liquidity zone.

4️⃣ Trendline Bounce

✅ How it works:

Price tests the trendline and bounces.

🔍 What to look for:

Minimum 3 touches of the trendline (it should be strong).

Bounce with confirmation (candlestick patterns, volume).

Previous support or resistance zone.

📈 Where to use:

Any market (crypto, forex, stocks).

🔸 Example: NASDAQ tests the rising trendline, bounces - long entry.

🛑 Stop loss: below the trendline.

🎯 Target: nearest resistance level.

5️⃣ Double Top / Double Bottom

✅ How it works:

The price forms two identical highs (or lows), after which a reversal occurs.

🔍 What to look for:

Symmetrical pattern (two tops/two bottoms).

Reversal signal (bearish or bullish candle).

High volume during the second touch.

📈 Where to use:

Stock market

Forex

Cryptocurrency

🔸 Example: SP500 makes a double peak at 4700 and falls.

🛑 Stop loss: just above the top/bottom.

🎯 Target: 50% or 100% of the figure.

Conclusion:

These setups work in any market if applied correctly! The main thing is not just to see the pattern, but to understand what is behind the price movement.

Subscribe so you don't miss new discussions!

US30 Trading Strategy That’s Been Proven to WorkThis strategy is backtested over trades and works best during the New York session (9:30 AM - 12 PM EST).

Here’s how it works:

Step 1: Identify Key Levels

These are the support & resistance areas where institutions place big orders.

Look for previous highs, lows,

Step 2: Wait for a Liquidity Grab

Banks love to trick retail traders by creating fake breakouts.

We wait for price to break a key level, trap traders, then reverse.

Step 3: Enter on Confirmation

Once we see a liquidity grab, we wait for a strong rejection candle (pin bar, engulfing, etc.).

Entry is placed at the close of the confirmation candle.

Step 4: Set Stop Loss & Take Profit

Stop loss: Just beyond the liquidity grab.

Take profit: At least 2x the stop loss distance for a 1:2 risk-reward ratio.