🔥Why does a bear market make traders rich?🔥 Why does a bear market make traders rich? The answer is very simple. All really rich people can buy any asset at a big discount. In crypto this discount can be up to 80% and sometimes more than 95%.

📊 But why is it a bear market and not a bull market that makes traders rich?

A bull market helps active traders (scalpers, swing traders) a lot, especially to quickly build up their capita l if they are trade follow the trend.

Also, it`s a good time to study trade and when the real bull market return you will be highly prepared to this!

🚩 While the market is out of trend and certainty, the biggest upside potential for cryptocurrency is at the end of a bear market, as it was in: 2017, 2019, 2020 and possibly now in 2022.

Never can crypto give more profit than the one bought at the end of a bull market. For example, Bitcoin at $3200, which rose to $69,000. That's 20x to your deposit. And you just need to buy close to the bottom (green areas).

📊 Which strategy should I use to buy crypto?

The best strategy for that is DCA. This strategy helps to get an average buy price over a certain period. That way you won't make the maximum profit, but you won't incur huge drawdown when buying crypto.

In the following tutorials I will tell you about the DCA and the advanced DCA used by professionals to buy crypto on the spot.

🔥Also you can check the Greendwhich indicator that help to BUY crypto at the bottom and sell close to the HIGHS. The additional module helps to increase the number of crypto during the bull market growth.

✅ My recommendation is not to buy more than 30% of altcoins on spot because 95% of them will disappear forever after a bear market.

✅ I suggest focusing on buying Bitcoin and the biggest altcoin Ethereum. They should be the biggest part of your portfolio if you want to buy cryptocurrency on spot (long term).

🚩 Write the comments, if you have a question about this topic. Do you agree with this idea or have smonething to add about the highest possible profit?

💻Friends, press the "boost"🚀 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

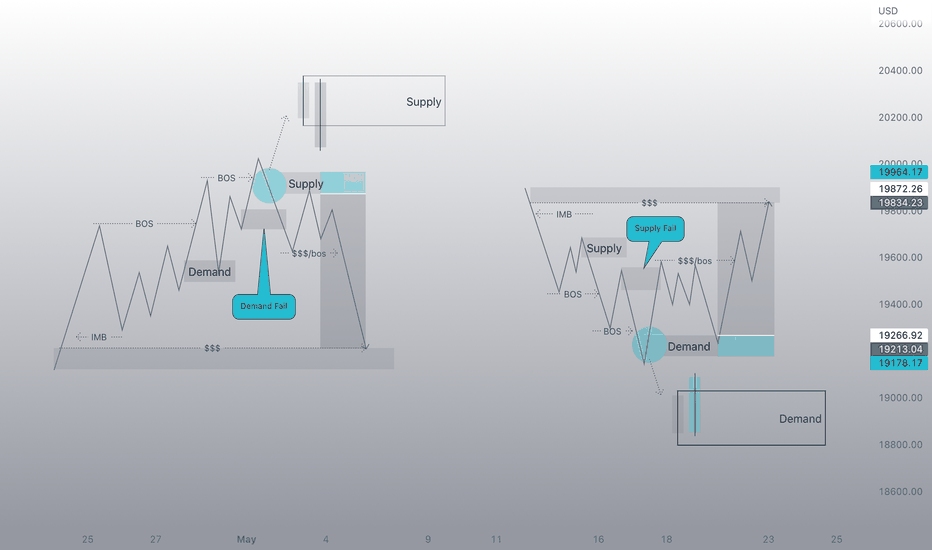

Supply and Demand

THE MOST PROFITABLE PATTERN: how to trade liquidity collection?What is your favourite pattern in trading? Write in the comments below this educational idea. I think one of the best patterns is liquidity collection.

This pattern has become so common in Bitcoin trading that it is no longer considered unique. But if you look at the history of trades over the last year, you can see the profitability and reliability of this pattern. The number of profitable trades using this pattern is close to 100%.

🚩 To understand what liquidity collection is, we need to understand the definition of liquidity.

📊 What is liquidity?

✅ Liquidity is the ability of a cryptocurrency to exchange into fiat or another cryptocurrency. From this came the concept of high liquidity and low liquidity assets. If you can sell or buy 1 Bitcoin in 1 second. It`s a high liquidity, then you can sell unknown coin on small exchange for the whole 2-3 days. It`s a low liquidity.

Also, there are high and low liquidity exchanges. For example, you want to trade 1 Bitcoin for $30 000. On a high liquidity exchange you can do it in 1 second and 1 click, but on a low liquidity exchange, where there are simply no buyers for your Bitcoin, the trade can take more than 1 minute.

📊 What is liquidity collection?

Liquidity collection is an intentional price movement where a big player pushes the price up or down in order to get enough cryptocurrency to oprn his short or long . You can see examples of liquidity collection on the chart.

🚩 After liquidity collections, the price could fall by -50-70% and rise by >+100%. This shows how important this pattern is in trading and what profit it may give.

📊 What types of liquidity collection are possible?

There are 2 types of liquidity collection:

1️⃣ liquidity collection to buy. This happens when a big player wants to open a long trade. He pushes the price below a local low or important level to activate stop losses of long traders and buy back their cryptocurrency (their liquidity). After that, the price starts to rise.

🚩 You can see such an example on the $30,000 chart. There have been 2 liquidity collections to buy.

2️⃣ A liquidity collection to sell occurs when the whale needs to open a short. He intentionally pushes the price above the local level. By doing this he activates stop losses of short traders and he can also sell enough of his cryptocurrency to long traders who are trading a breakout of the highs.

🚩 There are a lot of examples on the chart. My favourite is the liquidity collection at the ATH and new ATH. The price fall so much and you can get good profit from 30 to 70%.

📊 How can you identify liquidity collection?

It can be in the form of a false breakout or an intentional takeout of stops like a shakeout (where a major player intentionally pushes the price to activate traders' stop-losses).

Liquidity collection happens not only on higher timeframes, but also on lower ones. Some scalpers use this pattern to trade on 5-15 min.

🚩 I decided to show you liquidity collection on the daily timeframe because these signals are more noticeable and have better results on 4h-1d timeframes. Also you can use this pattern at any crypto, Forex or stocks.

📊 Why are big players looking for liquidity?

If you're a big player, even on a highly liquid exchange it's hard for you to sell or buy >100 Bitcoins. There are simply no buyers or sellers at the price you need. To do that, the whale is looking for liquidity accumulation areas, which are very often placed below or above important price levels (local lows/highs, all-time highs, even numbers). These are the places where traders place most of their buy or sell orders and big player have enough liquidity to buy or sell crypto.

I like the example with the bread and it`s easy to understand for the beginner. Image that you need to buy bread to yout home. You can buy it at any shop. But what if you are large enterprenuer and want to buy the bread to your 100 shops? You not able to buy it in the closest shop because there is no bread (no liquidity). You have to go to the the large bakery where you can order enough bread for your shops. This large bakery is the liquidity accumulation areas above or below important price levels.

📊 What tools can help you identify liquidity collection?

What can help you understand where the price will go more than the whale's own orders? The whale places his buy/sell orders near important levels in advance, because this is his only chance to open a deal for $100-200 million or more.

That's why I use the DOM and Footprint indicators , where I can clearly see the orders of the big players. With this information I can:

1️⃣ close the trade in profit in time , before the price starts to make a pullback.

2️⃣ open a trade in the same side with a big player : put a short stop loss close to the whale's order and get a best risk reward.

You can see an example of a large whale order on the chart. One whale placed an order to buy 98 Bitcoins at $23,200, after which the price rebounded during the fall and continued rising.

🔥 Traders, how do you use liquidity collection? Write in the comments if you found this educational idea useful and going to use it in your trading strategy.

💻Friends, press the "boost"🚀 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

10 secrets to staying motivated in trading. Part 2

6- Make sure you love trading

It's hard to stay motivated when you don't like what you're doing. So while it may sound like a no-brainer, make sure you actually enjoy trading. Or find a way to do it. It can be from a fundamental, technical, financial point of view... Whatever you aim for, to stay motivated, find your angle and enjoy what you do.

7- Accept to win in steps

The stock market works very differently from the way it is possible to get rich through gambling. For a relatively small initial stake, gambling games, such as the lottery, promise exponential gains and instant wealth. This rarely happens in trading. Instead, you must rely on returns that are at best proportional to the level of your initial investment. As a result, your capital will only appreciate very slowly. Understanding and accepting this is the key to longevity in the financial markets.

8- Find people to talk to

Trading is not easy every day, especially when you are a beginner. A good way to take the pressure off is to surround yourself with people who understand the business and with whom you can talk about the different aspects of your daily life. As in any other field, it is through sharing that you nourish your reasoning and maintain your motivation.

9- Avoid going in circles by learning from your mistakes

One of the most demotivating things about trading is that unpleasant feeling of standing still. This happens when you get caught up in repeating the same mistakes over and over again. After a while, this kind of behavior gets so bad that we stop trying. The solution is 4 words: "Learn from ours mistakes". To finally start moving forward...

10- Be inspired by the journey of a successful trader

There are many stories of successful traders. In general, we discover their journey, often similar to ours. They started at the bottom, struggled for a while, then climbed the ladder one by one. One day, they ended up becoming stars as we know them today. Knowing about such trajectories in the financial markets can be a great source of motivation for all of us who find ourselves dreaming of the same success for ourselves. To stay in the race, consider finding a role model and get inspired.

What is liquidity gap? Why there is always pump?🚀 When the bull market start with a good news? It`s always bad news at the beginning of the uptrend: in 2015, 2019, 2020. Always the same situation. And now we a here in 2022 and bad news at the bottom of the market. Push 🚀 if it looks similar to other cycles.

In this idea i explain you what is liquidity gap and global situation on BTC. You can identify it using the Volume Profile which is default tool at TradingView.

📊Liquidity gap is an area where the price not stay for the long time and don`t create any levels or order flows. So as you understand there are areas without any liquidity where the traders can set a sl or tp. We can compare it with empty space where is no life or it`s really rare thing.

The price break this areas so easy because there are no liquidity and the price:

🔥 have no support if it falls (as it was when BTC fall in a week from $29k to 17k few month ago)

🔥 have no resistance if it growth (as it was at any bull market when the price nreak the ATH and scyrocketing)

Now the price of BTC consolidating below such liquidity gap of $24500-29500 and going to break it up after some accumulation. As a rule, the liquidity gap breaking with a pumps because nothing stop them inside this gaps.

The top of this gap is a bottom of a huge consolidation channel $29500-69000, so the price can make a pullback after $29500 test. In final, price break this level and continue it`s growth to the previous ATH.

Thanks in large part to consolidation at the bottom, where the bulls were able to accumulate enough Bitcoins and are ready to sell them higher and higher. Consolidation is always good for the bulls especially for the biggest one 🐳

📊Why are these white circles marked? It's a bonus for my subscribers. Remember that before the very PUMP you will think everything will fall to zero, and many analysts on the trading view will say that the price has created a bear flag or a wedge etc. At that point, you may be disappointed and afraid to open a trade or sell all your crypto, but that will only be an emotion you should not succumb to. Only if your strategy says so. Keep these words in mind.

🔥 I will open a trade if I will see the large whales orders on DOM and Footprint. These are usually the most profitable trades with a short stop loss and excellent risk to reward.

💻Friends, press the "boost"🚀 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

5 bad attitudes that would ruin even the best traders

1- Directional bias

This is when you have a very clear idea of where the market is going before you have even done any objective analysis. This is detrimental because it removes any form of rationality and your ego could prevent you from avoiding losses that are hanging over your head.

2- The lure of gain

Sometimes for various reasons, as a trader, you can find yourself obsessed with the financial objective. This means that the basic procedures for validating a trade are shattered. And in disregard of all prudence, which we know we must show to protect our capital. In these situations, we come to respect neither money management, nor trading plan in the hope of succeeding in winning big, without delay. But often it's the opposite that we find along the way...

3- Impatience

One of the biggest difficulties in trading is managing the time that passes. This often translates into hours and hours of waiting to enter or exit a position. Impatience often causes traders to deviate from their original plan. It can lead to unwelcome behavior such as opening a position only to close it a second later, only to reopen it in the same breath... In this kind of situation, it is the brokers who rub their hands.

4- Excessive ego

There are those times when you don't really want to be wrong. Even worse, we categorically refuse to be wrong. The problem is that the market loves this kind of trader. Whereas the trader knows that it would be more appropriate to close the position and accept his loss. Caught up in his ego, he freezes and owes the salvation of his capital only to the intervention of his broker, who by means of a painful but liberating margin call puts an end to his torpor.

5- Addiction to the stock market

Trading is an activity that fascinates to the point that one might not want to disconnect from it. However, it is a task that forces the body to a high level of mental and physical involvement. And since the stock market never sleeps, over a long period of time, trading leads to exhaustion. So, it is essential to know how to impose limits on our exposure to the market, in order to fully recover from each of our sessions. And thus avoid all possible and imaginable careless mistakes.

What is an altseason❓What altcoins to BUY❓Altseason is a time when you can increase your deposit by several times in just a couple of weeks. But how to identify why and when the altseason starts, what is domination and what altcoins to buy? We will talk about that in this educational idea.

📊 What is an altseason?

Altseason is a period in the cryptocurrency market when altcoins grow by 50-100% or more in a few weeks.

📊 When does the altseason start?

Typically, the altseason happens when Bitcoin:

🔥 is in consolidation, i.e. trades in the same price range for a long time or 1-1,5 month after it

🔥 renewed it`s ATH ($20k in 2017, $69k in 2021, etc.)

🔥 starts it`s correction close to ATH or when BTC has already reached its new all-time highs before bear market

🚩 In this example I have compared Bitcoin and Ethereum. Ethereum is the largest and most famous altcoin. If you want to understand what will happen with altcoins, look at Ethereum.

On the chart you can see the altseasons and how much more percent Ethereum is growing than Bitcoin:

1️⃣ BTC +32% vs ETH +136%

2️⃣ BTC +40% vs ETH +70%

3️⃣ BTC -15% vs ETH +170% for the same period

🚩 There are the altseasons.

📊 Why should you pay attention to Bitcoin and Ethereum?

99% of altcoins follow Bitcoin. When Bitcoin is in a bear market, all altcoins fall except the popular ones at the time. For example, like GMT in its day.

When Bitcoin is rising, all altcoins are rising. When Ethereum rises in pair with Bitcoin (ETH/BTC), all other altcoins rise. This is especially common when Bitcoin begins its first correction after reaching its all-time highs and a bear market begins.

📊 Why does an altseason happen?

The main reason for an altseason is the outflow of money from Bitcoin and its flow into altcoins.

The second reason is the desire to make as much money as possible. Especially this huge desire has retail traders and newcomers who have just come on the highs of the crypto market. They sell their Bitcoins and use the money to buy altcoins, which grow by 100% or more in a few weeks.

🚩 Of course, Bitcoin has a much larger capitalisation and cannot grow that fast, but altcoins with a capitalisation of up to 1 billion grow very quickly.

✅ As a consequence, Bitcoin's Domination falls. Dominance is a measure that shows the ratio of the worth of all Bitcoins to the total worth of the crypto market (the capitalisation of the entire crypto market). If Bitcoin Dominance is 40%, it means that 60% of the remaining money is in altcoins. A rise in Dominance to 50% means that Bitcoin has equalised in value to all other altcoins combined.

Many people think that Domination helps determine the altcoin season, but this index only shows the fact✅of the flow and predicting that money from Bitcoin will start flowing into altcoins at a certain point using Domination is quite difficult.

📊 What altcoins to buy before the alt season has started?

Friends, how to predict that AXS will grow by 130x or meme lord Elon Musk will start pamping exactly meme coins? It's almost like a lottery, that's why I recommend you to choose altcoins from different categories and buy them in equal parts: DeFi, Game-Fi, Exchange and wallet tokens etc.

Equal capital allocation will ensure that you don't miss out on any kind of altcoin growth. From practice, this is the most correct way. And what ways to buy altcoins do you know? Share in the comments.

🔥 Most likely, the next BIG altseason will start after Bitcoin renews its all-time highs. In the current market situation, that could happen within 6-12 months.

Traders, was this article about the altseason useful to you? Write your opinion in the comments.

💻Friends, press the "like"👍 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

Quiz: Have you mastered the basics of winning trading ?

1. Are you sufficiently trained in trading?

If so, in the different aspects of your trading, you are in your element

2. In your chosen market, has your opportunity-finding methodology already proven itself?

If so, you are satisfied with your current success rate.

3. Does your money management really protect you against capital loss?

If so, your trading is profitable, at worst flat.

4. Do you systematically enter positions with a trading plan?

If so, you know that not having one is not such a good idea.

5. Do you know how to manage your stress when the market turns against you?

If so, you don't stress, at worst you are a little disappointed.

6. Do you know how to manage euphoria when the market easily proves you right?

If yes, you never fall into euphoria. At best you feel a great deal of satisfaction.

7. Do you take into account the spread levels before placing an order?

If yes, when the spread is too high, you postpone your trade.

8. Do you always place a stop loss to protect yourself from a bad analysis?

If yes, you never trade without one, because you consider them an indispensable safety.

9. Do you know how to let go when the market proves you wrong?

If so, you never move your stop and you always exit your position according to your initial trading plan.

10. Do you trade out of passion or just for the money?

If you trade out of passion, in your eyes, trading is more than a living. It is a way of life, a challenge, a quest...

You're ticking off as many of the bases as possible. Congratulations, you're on the road to winning trading.

10 secrets to stay motivated in trading. Part 1...

1- Focus on the process:

Trading is like a boxing match. Unless there is a knockout, 1 round cannot determine the outcome of the fight. In trading it's the same, you must avoid at all costs the margin call, which is the technical knockout of the market. It happens when your capital decreases so much that your broker, the referee on the markets, decides to stop the game. This is one of the worst scenarios that can happen to you in the business. And it doesn't bode well for your capital. To avoid this, make sure you're up to speed before you take on the market. Focus on the process, accept that you have to go through all the necessary steps to become a seasoned trader. This will ensure that you are always the favorite when you enter a position.

2- Set long term goals

Just like in bodybuilding, it can be a long time before you can admire your transformation. And even once you've reached your goal, you still need to be able to maintain it... Think of trading as a bodybuilding exercise, refuse shortcuts that could lead to unsustainable results. Be strong in the face of difficulty and aware that ambitious goals often take a while to achieve. Carve out your success one victory at a time, but set long-term goals that will allow you to view each defeat as a warm-up.

3- Keep a cool head

In this activity, inevitably, one day or another you will find yourself in trouble. The reasons can be numerous: absent-mindedness, flash crash, technical problem... It is in these moments that you must avoid being emotional. To do so, you must be ready to handle the situation, which necessarily implies that you have prepared yourself in advance. Otherwise, the emotional tsunami that will fall on you will probably not leave you any chance to save the situation. Study your psychological limits and then trade consistently to keep a cool head and stay in a position to recover from such a situation.

4- Remember why you started

Trading is not the Mont Blanc, although... Just like in the mountains, when you start an ascent it is to reach the top. Of course it is possible to stop as soon as things start to get tough, but in that case, you can't expect to make it to the top. Because whatever happens, one thing is certain, long before the summit, things are bound to get complicated. So the real question to ask is not whether it will get difficult, but how do you plan to react when it does? And it's precisely at that moment that you need to remember why you decided to start in the first place. This could help you to recover enough energy and motivation not to miss the initial goal.

5 - Be well equipped

It's not even worth considering staying motivated if you are poorly equipped. For example, an inadequate internet connection will probably ruin your day even before the market does. A screen that hurts your eyes may cause you to prefer watching TV to working hard on your charts. A faulty mouse, an uncomfortable chair, a noisy environment... These are all problems that will undermine your motivation at the first sign of trouble. To beat the market no choice! One of the very first steps is to make sure you are always well equipped, in order to preserve your chances to go through with your project.

10 things to know about trend lines10 things to know about trend lines :

1- They connect two candles minimum. But more is always better, because the more candles there are, the stronger the trend.

2- They can be of 3 types: bullish (pointing up), bearish (pointing down), directionless (drawn horizontally).

3- Trend lines can be traced either on the closing price or on the candlestick wicks. It is up to the trader.

4- They can be visually represented as a line or a zone.

5- When two parallel trend lines are drawn on either side of the same candle, you get a channel. It is a 2D representation of the trend.

6- A trend line is invalidated when it is broken by either the wick or the close of a candle.

7- There are many possible trend lines. The objective is to identify the most relevant of them. The ones that will best predict the price movement.

8- Trend lines can form graphic figures. Each of them will have a specific meaning.

9- Trend line analysis is not 100% reliable. Each trend line has its own probability of success or failure.

10 - The effectiveness of a trend line evolves with the passing of time. It is necessary to constantly update them to remain in phase with the market.

Think like a PRO and trade at ANY markets🔥Hi friends! Do you want to know what zones I marked on the chart? Put 🚀 and read to the end.

In this educational idea I will explain a few traders secrets that will help you stay profitable in any market for the long term. Take Bitcoin as an example and you'll be surprised how often the same mistake is repeated by beginners and understand how professional traders take advantage of it.

📊 But first, let's find out why the psychology of the crowd drives the market

Fortunately for professional traders, human psychology has not changed in centuries. Bubbles in financial markets now appear just as they did before the Great Depression🔻in the early 20th century, when stocks rose by hundreds of percent in a month, and just as they did during the Tulip Fever🌷in the 17th century, when the price of tulips really soared to the moon due to the huge demand for the flower.

🚩 This shows the similarity in the thoughts of people in the 17th, 20th, 21st centuries. It is these faults in human psychology that allow the patterns in trading to work and professional traders to be profitable over the long term. Just don't tell anyone about it!)

📊 Why do people tend to panic during a fall and get greedy during a rise? The fact is that our brain tends to paint wishful thinking in our imagination. When a cryptocurrency is rising, the imagination thinks that the price will rise forever, and you get excited just thinking about the possible earning. And the happiness hormones just keep surging.

The opposite is the situation with the fall. When markets fall, our brain tries to protect us from more losses and forces us to sell cryptocurrency.

📊 What help the big players to control the psychology of the crowd? Of course, it's the media. Remember when news of the US recession was at its peak and it seemed like a crisis was imminent. Just at the bottom of the market, when Bitcoin fell to $17k and the SnP500 to $361.

I may surprise you, but in 2018, 2020 people had identical thoughts and all thought Bitcoin would fall to $1000. The crypto market can fall lower to 10-12k of course, but just interesting to know did any of my subscribers buy cryptocurrency back then or at 17-19k❓Write in the comments./b]

📊 What are the areas on the chart? I marked 2 areas:

🔥The 1st area (white) is the areawhere the majority of traders, especially newbies, want to buy cryptocurrency. I call this " Bitcoin will rise to 1 million" zone.

🔥The 2nd area (green) is the area where most traders sell the cryptocurrency they bought at a higher price. Most importantly, it is where most traders believe that the fall will continue even lower and do not buy, expecting a fall. I call this "Bitcoin will fall to zero" zone.

✅How can you use the psychology of the crowd to your advantage? I can tell you from my own example that a clear strategy and working with indicators helps me. For example DOM and Footprint, where I can see huge whale orders and open a trade in the same direction as a big player. A large order is a clear signal✅, not a psychological speculation because of the news.

A few days ago I showed in one of my ideas how Bitcoin rebounded from a large whale order. Bitcoin then grow by 4-5% in just a few hours.

I also use trading systems such as Greenwich or Pump Tracker to identify Bitcoin and altcoins bottoms and ATH. You can see ideas about them on TradingView and their live results✅ It may surprise you!

🏁Summary. This knowledges are usefull for any market: crypto, stocks, ForEx, bonds etc. Human psychology and thinking are the same, but each market has its own specifics. Perhaps I will talk about this in the next educational ideas.

Friends, was the idea useful to you? Have you noticed such psychological zones? Do you agree with this idea or do you think Bitcoin will fall below $17k? Write in the comments.

💻Friends, press the "like"👍 button, write comments and share with your friends - it will be the best THANK YOU.

P.S. Personally, I open an entry if the price shows it according to my strategy.

Always do your analysis before making a trade.

A Dive Into My Swing Trading Approach (+setup) This video was a short synthesis of my swing trading approach. For the amount of information I presented, I'm not expecting to successfully being able to convey my means and ways in one short video, but I'm glad if I could at least show a different perspective.

Some important things I forgot to mention:

- The tolerance for identifying a visual weak liquidity pattern is 2 ticks, 3 ticks during highly volatile days (for the ES). This can change from one market to another. Anything more than 2/3 ticks is considered a move of conviction supported by strong liquidity, a market that has the confidence to see what's beyond a certain point to then either sharply reverse or move forward.

- Using this method I CANNOT know what the market makers are exactly doing, there is no way to know, they will always be a step ahead of any brilliant retail trader. However, we can understand their logic and the weak traders' logic, the latter is the type we want to trade against.

SETUP

As I said, I favour a short trade, but as of today I have to remain on the sidelines. During this times is important to be flexible and change ones bias if that's what the market is suggesting. I will post my set up (if any) in due course.

Volume profile confirmationsWatch this clip to learn how the volume profile can be used as an extra confirmation when looking for optimal entry criteria.

Trigonometric TrendSome follow up to the new Trigonometrical Playtoy :-)

After watching for some time that trend indicator, i have to say the entrys are usually late, but 80-90% of the time with proper riskmanagement this should be easy to trade directly on switch at min´ss and max´s

I added some marks in the chart to see the trading signal, exactly where both get the same color and way in the upper limits.

It seems longs are better than shorts.

play with different lengths at the same timeframe like here in this setup

3 Possible Ways to trade:

* trade with orderbook, orderblocks and hotspots when switching from green to red

* trade with some cloud, Nadaraya, ATRCloud, FIbcloud, Bollinger with final gaussian smoothing,.... whatever all are in some way good,

use it as "safety" before firing a position

* directly the switch of minimas or maximas to the different color

www.tradingview.com

here a already finished setup to copy ^^