Using Candle Wicks to refine your daytrading entriesIn the video I discuss the importance of 'Candle Wicks' in price action and how I use them to refine an entry.

I like to use the 1 minute chart for my entries and have certain criteria to trade with the trend (which I discuss in the video). When trying to trade with the predominant trend up/down, I look to trade retracements. One thing I look for is wicks into the EMAs and then a reversal of the previous candle.

I find these greatly help my timing for entries and can greatly reduce my risk.

I hope that you enjoy the video and are able to use in your own trading.

** If you like the content then take a look at the profile to get more daily ideas and learning material **

** Comments and likes are greatly appreciated **

Supply and Demand

NQ - Volume Profile on Day Chart

Using a composite volume profile and setting the bars to significant lows in the last couple of years, you can see that the VPOCs (Volume Point of Control) are almost perfect.

By using a hollow Composite Volume Profile in conjunction with a Solid Volume Profile, you can spot-check where low and high volume nodes are on different time-scale profiles.

What does all of this mean? Basically, my thesis regarding volume profile, which is shared by some, is that liquidity will be attracted to the low volume profile nodes. Liquidity will find a presence in these depressions, causing prices to gravitate to the local area, filling in the node to build a shelf. This allows for a stronger base or foundation to continue its positive drift upward. However, caution is necessary, as this strategy can work against bulls if the price gets trapped under a substantial shelf, making it harder to climb upward.

Composite Volume Profile indicator below

ES Morning Shorts From Last Nights IdeaGood Afternoon everyone,

I will show in depth order entries in this post, read the updates to see.

This idea was formed last night around 10PM NY Time. I originally was hoping to trade up into the most recent Order Block (green path arrow) during the London session and end at the Terminus -4 around 8:00AM NY time. I then would've liked to see accumulations followed by a Turtle Soup or sweep of that low at the Terminus -4 during market open. I wanted to take countertrend longs in that area into the Order Block resting above the Liquidity Void, this move is denoted by the orange path arrow.

However we ended up going straight to Terminus -4 during London and we rallied above Asia accumulation into the Bearish Order Block sitting right above (green path arrow). We took shorts from this area and we were looking to target the Sellside Liquidity below to complete our MMSM (Market Maker Sell Model) on the 15M chart. We were able able to bank 2.1% off the move just by taking profits at the short term low 4507.5 and holding a few more contracts to a slightly lower price once we noticed price wasn't wanting to break the low at the Terminus -4 just yet. The Sellside Liquidity is still a viable target, we have just been choppy since right after open so taking profits is worth the time spent waiting for price.

Hopefully this was more insightful on how to form an idea for the next trading day. I will commit to making more informational posts like this. Please read the updates for a 5M look at the entries and a reference to the MMSM.

Supply and Demand Zones: Buying Low, Selling High1. What Are Supply and Demand Zones?

In the cryptocurrency trading, supply and demand zones are pivotal concepts that profoundly impact market behavior. These zones act as critical areas where traders engage in buying and selling actions, significantly influencing price movements. To gain a deeper understanding of how these zones work, let's delve into the specifics.

2. What Is A Supply Zone?

A supply zone, within the context of cryptocurrency trading, represents a resistance area where traders are inclined to sell their assets. Supply zones are typically positioned above the current market spot price and often coincide with prominent psychological price thresholds, such as $50,000 or $60,000. This zone often becomes the focal point for take-profit orders, and when the price approaches it, resistance ensues. Unless there's a notable surge in buying pressure to counteract the selling momentum, prices are prone to decline.

3. What Is A Demand Zone?

On the flip side, a demand zone serves as a support area where traders favor purchasing cryptocurrency assets. Demand zones are generally situated below the current market spot price and are frequently aligned with significant psychological price levels, such as $10,000 or $20,000. Traders are inclined to set limit buy orders within these zones, leading to upward price movements as the appeal of the support level draws in buyers.

4. How to Draw Supply and Demand Zones?

Drawing supply and demand zones is a fundamental skill for cryptocurrency traders. To create these zones effectively, traders often employ the "Rectangle" tool available on @TradingView charts. By identifying historical peak levels and bottoms where price reversals have occurred, traders can accurately delineate supply and demand areas.

5. How to Find Supply and Demand Zones?

While there isn't a specific indicator dedicated to supply and demand, we can utilize tools like "Pivot Points" to narrow down these key areas.

Pivot Points are instrumental in highlighting support and resistance levels, making them valuable for identifying potential supply and demand zones.

When Bitcoin or other cryptocurrencies reach these levels marked by Pivot Points, significant price reactions often follow, offering prime opportunities for profitable trades.

6. How to Trade Supply and Demand Zones?

Trading based on supply and demand zones is a versatile strategy that suits both short-term and long-term trading approaches. The fundamental principle remains constant: buy within demand zones and sell within supply zones.

For example, suppose Bitcoin is currently trading at $25,900, and demand zones are situated in the range of $25,300 to $25,600. In this case, we can place buy orders within this demand zone and sell orders in the supply zones. It's essential to adapt this strategy to your specific trading goals and preferences, utilizing support and resistance levels as a foundational framework for drawing trend lines and setting limit orders.

Incorporating the power of supply and demand zones into your cryptocurrency trading strategy can provide invaluable insights and enhance your overall trading success.

Whether you're a day trader or a long-term investor, comprehending and effectively utilizing these zones can enable you to make more informed decisions and potentially amplify your profitability in the cryptocurrency trading.

Wyckoff Accumulation & DistributionThe Wyckoff Method, pioneered by Richard Wyckoff, a prominent figure in the early 1900s stock market, remains a powerful technical analysis-based trading approach. This article delves into the intricacies of the Wyckoff Accumulation and Distribution phases, fundamental to this method.

Who was Richard Wyckoff?

Richard Wyckoff, a highly successful American stock market investor of his time, stands as a pioneer in technical analysis. He transitioned from accumulating personal wealth to addressing what he perceived as market injustices, devising the Wyckoff Method to empower traders against market manipulation. Through various platforms like his own Magazine of Wall Street and Stock Market Technique, Wyckoff disseminated his insights.

The Wyckoff Method:

Wyckoff proposed that markets undergo distinct phases: Accumulation and Distribution. These phases guide traders on when to accumulate or distribute their positions, forming the core of the method.

The Wyckoff Accumulation Phase:

This phase materializes as a sideways, range-bound period subsequent to a prolonged downtrend. During this stage, significant players seek to establish positions without causing dramatic price drops. The accumulation phase comprises six integral components, each serving a vital role:

Preliminary Support (PS): As signs of the downtrend ending emerge, high volume and wider spreads surface. Buyers initiate interest, suggesting the end of selling dominance.

Selling Climax (SC): Characterized by intense selling pressure and panic selling, this phase represents a sharp price decline. Often, price closes well above the lowest point.

Automatic Rally (AR): Late sellers experience a reversal, driven by short sellers covering positions. This phase sets the upper range limit for subsequent consolidation.

Secondary Test (ST): Controlled retesting of lows with minimal volume increase indicates potential reversal.

Spring: A deceptive move resembling a downtrend resumption, designed to deceive and shakeout participants.

Last Point of Support, Back Up, and Sign of Strength (LPS, BU, SOS): Clear shifts in price action mark the transition into the range's start. A rapid, one-sided move signifies buyer control, often following the spring.

Wyckoff Distribution Cycle:

Following Accumulation, the Wyckoff Distribution phase unfolds. This cycle consists of five phases:

Preliminary Supply (PSY): Dominant traders initiate selling after a notable price rise, leading to increased trading volume.

Buying Climax (BC): Retail traders enter positions, driving further price increase. Dominant traders capitalize on premium prices to sell.

Automatic Reaction (AR): The end of the BC phase brings a price drop due to decreased buying. High supply causes a decline to the AR level.

Secondary Test (ST): Price retests the BC range, assessing supply and demand balance.

Sign of Weakness, Last Point of Supply, Upthrust After Distribution (SOW, LPSY, UTAD): SOW signals price weakness, LPSY tests support, and UTAD might occur near cycle's end, pushing the upper boundary.

Wyckoff Reaccumulation and Redistribution Cycles:

Reaccumulation occurs during uptrends, as dominant traders accumulate shares during price pauses. Redistribution, during downtrends, begins with sharp price rallies as short sellers capitalize.

Dominant traders strategically enter positions during these rallies.

Wyckoff's Foundational Concepts:

Law of Supply and Demand:

Prices rise when demand is high and supply is low. Prices fall when supply is high and demand is low. Balanced supply and demand lead to stable prices.

Law of Cause and Effect:

Price changes are driven by specific underlying factors. Price rises result from accumulation phases, while drops arise from distribution phases.

Law of Effort vs. Result:

Trading volume should match price movement. Deviations signal potential shifts in market sentiment or upcoming opportunities.

The Wyckoff Method is relevant to all markets, including cryptocurrencies like Bitcoin, where supply and demand play a crucial role in influencing price movements.

Learning Wykcoff Trading Method. {27/08/2023}Wyckoff Most Popular Trading Method Across Retail Traders and Smart Money.

Practicing on the Market to make myself expertise and Trade efficiently without putting my emotions while executing my trades.

Will be trading on Smart Money like Orderblock, trendline, the break of Structure, Change of Character, and Now Wyckoff trade schematic with the trend to improve my trade risk reward ratio.

Let's See

Thank you for your support.

Happy trading

FX Dollars.

How to identify a trend move using AnchorsIn the video I discuss the concept of Anchors in trading and how I use them in my own trading.

Anchors play a major part in identifying the prime areas to trade and also in risk management when in a trade. I will discuss my prime setups and trading areas using anchors and multi-timeframe analysis.

** If you like the content then take a look at the profile to get more daily ideas and learning material **

** Comments and likes are greatly appreciated **

Day Trading the Hang Seng IndexDay trading the Hang Seng Index...explanation of the two trades for the day and the price action that led to the setups.

I talk through my approach to Day trading and how I use the indicators along with how to Manage the Risk while in a trade.

** If you like the content then take a look at the profile to get more daily ideas and learning material **

** Comments and likes are greatly appreciated **

Guard Your Funds: Only risk what you can afford to lose.🎉 Risk Management tip for Vesties and @TradingView community! 🚀

😲 We all know the saying "only risk what you can afford to lose," but do you know the powerful impact it can have on your trading journey? 🤔

In the ever-evolving world of cryptocurrency and futures trading, one fundamental principle stands as the cornerstone of profitable and sustainable trading journeys: Only risk what you can afford to lose. Embracing this essential concept is crucial for preserving capital, maintaining emotional stability, and cultivating a disciplined approach to risk management. In this article, we will delve into the significance of operating money and risk within the confines of one's financial capacity and explore the key pillars that underpin this approach.

Understanding Risk Tolerance and Capital Allocation:

1. Assessing Individual Risk Tolerance:

To truly understand one's risk tolerance and establish a robust risk management strategy, traders are encouraged to engage in a thought exercise that involves imagining potential losses in tangible terms. Visualize throwing money into the bin or burning it completely, purely to experience the feeling of losing money. This exercise may seem unconventional, but it serves a crucial purpose: it helps traders gauge their emotional response to monetary losses.

During this exercise, consider the two extreme scenarios: the first being the largest amount of money you can lose without causing significant distress, and the second being the maximum amount of loss that would completely devastate you financially and emotionally. These two amounts represent your Fine Risk and Critical Risk , which reflects the sum you are willing and able to lose over a specific period of time without compromising your financial well-being.

👉 The next step involves breaking down the Fine Risk into smaller, manageable parts. 🔑 Divide the Fine Risk into 10 or even 20 equal parts, each representing the risk amount for every individual trade. This approach is designed to create a safety net for traders, especially when they encounter unfavorable market conditions.

For instance, imagine a scenario where you face five consecutive losing trades. With each trade representing only a fraction of your Fine Risk, the cumulative loss remains relatively small compared to your risk capability, providing emotional resilience and the ability to continue trading with confidence.

By splitting the Fine Risk into smaller portions, we can safeguard their capital and ensure that a string of losses does not result in irreversible damage to our trading accounts or emotional well-being. Additionally, this approach promotes a disciplined and structured trading mindset, encouraging us to adhere to their predefined risk management rules and avoid impulsive decisions based on emotions.

Remember, risk management is not solely about avoiding losses but also about preserving the means to participate in the market over the long term.

2. Establishing a Risk-to-Reward Ratio:

The risk-to-reward ratio is a critical metric that every trader must comprehend to develop a successful trading system. It is a representation of the potential risk taken in a trade relative to the potential reward. For a well-balanced and sustainable approach to trading, it is essential to ensure that the risk-to-reward ratio is greater than 1:1.10.

A risk-to-reward ratio of 1:1.10 implies that for every unit of risk taken, the trader expects a potential reward of 1.10 units. This ratio serves as a safety measure, ensuring that over time, the profits generated from winning trades will outweigh the losses incurred from losing trades. While there is a popular notion that the risk-to-reward ratio should ideally be 1:3, what truly matters is that the ratio remains above the 1:1.10 mark.

Maintaining a risk-to-reward ratio of at least 1:1.10 is beneficial for several reasons. Firstly, it allows traders to cover their losses in the long term. Even with a series of losing trades, the accumulated profits from winning trades will offset the losses, allowing traders to continue trading without significant setbacks.

Secondly, a risk-to-reward ratio higher than 1:1.10, combined with proper risk management and a well-executed trading system, enables traders to accumulate profits over time. Consistently achieving a slightly better reward than the risk taken can lead to substantial gains in the long run.

3. Determining Appropriate Position Sizes:

Once you have a clear understanding of your risk amount and risk-to-reward ratio, you can proceed to calculate appropriate position sizes for each trade. To do this, you can use a simple formula:

Position Size = (Risk Amount per Trade / Stop Loss) * 100%

Let's take an example to illustrate this calculation:

Example:

Risk Amount per Trade: $100

Risk-to-Reward Ratio: 1:2

Stop Loss: -4.12%

Take Profit: +8.26%

Using the formula:

Position Size = ($100 / -4.12%) * 100%

Position Size ≈ $2427.18

In this example, your calculated position size is approximately $2427.18. This means that for this particular trade, you would allocate a position size of approximately $2427.18 to ensure that your risk exposure remains at $100.

After executing the trade, let's say the trade turned out to be profitable, and you achieved a profit of $200. This outcome is a result of adhering to a well-calculated position size that aligns with your risk management strategy.

By determining appropriate position sizes based on your risk tolerance and risk-to-reward ratio, you can effectively control your exposure to the market. This approach helps you maintain consistency in risk management and enhances your ability to manage potential losses while allowing your profits to compound over time.

Emotions and Psychology in Risk Management:

A. The Impact of Emotions on Trading Decisions:

Emotions can significantly influence trading decisions, often leading to suboptimal outcomes. Traders must recognize the impact of emotions such as fear, greed, and excitement on their decision-making processes. Emotional biases can cloud judgment and result in impulsive actions, which can be detrimental to overall trading performance.

B. Recognizing and Managing Fear and Greed:

Fear and greed are two dominant emotions that can disrupt a trader's ability to make rational choices. By developing self-awareness and recognizing emotional triggers, traders can gain better control over their reactions. Implementing techniques to manage fear and greed, such as setting predefined entry and exit points, can help traders navigate turbulent market conditions.

C. Developing a Disciplined Trading Mindset:

A disciplined trading mindset is the bedrock of successful risk management. This involves adhering to a well-defined trading plan that outlines risk management rules and strategies. By staying committed to the plan and maintaining a long-term perspective, traders can resist impulsive actions and maintain discipline during times of market volatility.

D. Techniques for Avoiding Impulsive and Emotional Trading:

To avoid impulsive and emotional trading, traders can employ various techniques. Implementing cooling-off periods before making trade decisions allows traders to gain clarity before acting. Seeking support from trading communities or mentors provides valuable insights and helps traders stay grounded. Utilizing automated trading systems can reduce emotional interference and ensure trades are executed based on predefined criteria.

In the world of cryptocurrency and futures trading, the fundamental principle of "only risk what you can afford to lose" remains the cornerstone of successful trading. Embracing this concept is essential for preserving capital, maintaining emotional stability, and cultivating a disciplined approach to risk management.

Understanding individual risk tolerance and breaking down total risk into smaller portions allows traders to navigate unfavorable market conditions with resilience. Maintaining a risk-to-reward ratio above 1:1.10 ensures that profits outweigh losses over time, while determining appropriate position sizes enables effective risk control.

Emotions play a significant role in trading decisions, and managing fear and greed empowers traders to make rational choices. Employing techniques to avoid impulsive trading, like cooling-off periods and seeking support, reinforces a disciplined trading mindset.

In conclusion, adhering to the principle of only risking what you can afford to lose leads to sustainable success in the dynamic trading world. By implementing effective risk management practices, traders enhance their chances of achieving profitability and longevity in their trading journeys.

📝👋 Feedback is super important to us! 😊

We would absolutely love to hear your thoughts and comments about the article. 🧐

Did you find the information helpful and well-explained? 🤔

Your feedback means a lot to us and will help us improve our content to provide better insights in the future. 😇

Thank you so much for taking the time to share your thoughts! 🙏 We're excited to hear from you! 💬

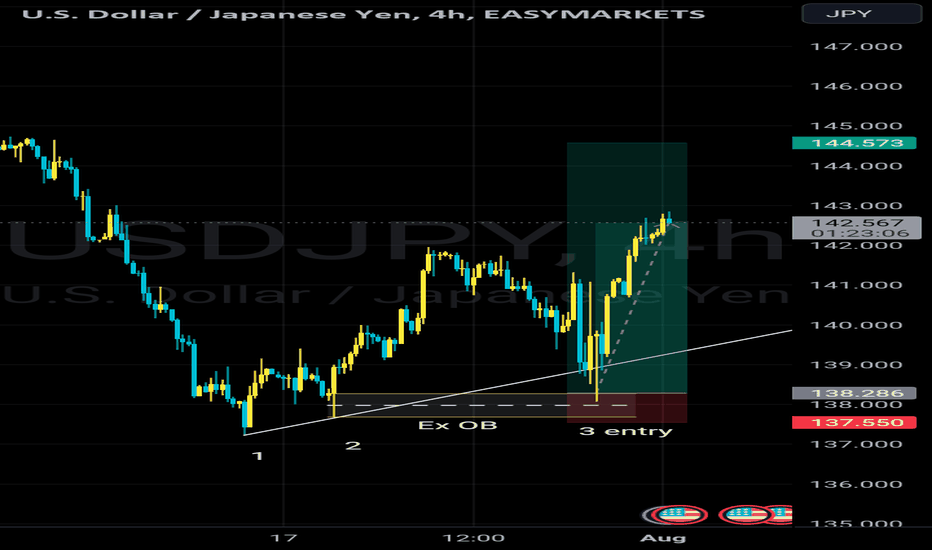

3 Touches Trendline Retracement.This is a very powerful strategy that works 90% of the times all you have to do is wait for a trend reversal and immediately you see a Change Of Character (ChoCh) or any form of Market Structure shift to the opposite direction apply a trendline to the first visible 2 swing and highlight the Oder Block that was left over before the Impulsive movement for you to know the exact point where market is likely to come back and retrace before going to your profit direction. Make sure you manage your risk well.

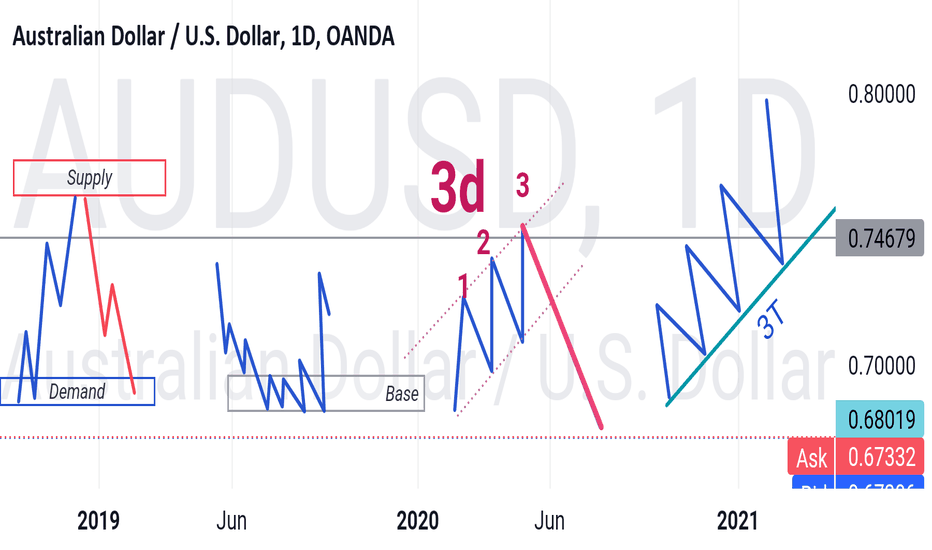

How to read market?three drive and three touch

Good day traders:

Let's start with supply and demand:

Golden Key's that run markets.

What is supply? Sell orders in different layers of the market. In order for the buyers group to drive the price to higher levels, these sales orders must be consumed.

What we see on the chart forming is all about buying and selling of currencies.

What is supply?

Supply, is a amount of currency that someone is wanting to sell at a certain price. A stack of orders or a pallet or more of cash money that has to be moved out of the way before we can move to a higher level.

What is demand?

s supply?

Demand, is a amount of currency that someone is wanting to buy at a certain price.

In order for the sellers group to drive the price to lower levels this buy orders must be consumed.

Balance or imbalance?

And it's the reality that makes currency movements in the market.

Price begins an uptrend and create a series of higher high and higher low.

But how do we know where this uptrend/downtrend movement ends?

One of this patterns that tell us this trend may be at the end is the three-drive pattern.

It is a price following pattern that indicates a potential upcoming reverse in the trend.

A golden trading opportunity.

Three drive indicates if the market is exhausted or not.

It is also a three harmonic chart pattern.

What is the purpose of this pattern?

The main purpose of three drive is to look for similar successive price fluctuations.

It is a reversal pattern that usually we may see at the end of a trend.

How we can benefit to trade two side of pattern?

There is an easy role for trend line when price touch it for third time.

Now a little about 3touch continuation pattern:

We know what the trend line is and how to draw it after three price touch.

There is many point to consider trading a pattern.

We only trade order flow and pattern help us get a better idea where to enter or exit of a trade.

Have a great sunday,

Ninja Talks Ep 35: Mentors, Yay or Nay?In the labyrinth of financial markets, the search for a good trading mentor is akin to finding a guiding light in the darkness. It is a journey that can transform an ordinary trader into an extraordinary one.

As some of you know, I started trading in 2013 and 6 months into my journey I found my mentor - the rest was history, but why is a mentor so important?

Here's my take;

The Call to Adventure: Acknowledging the Need for Guidance

Every hero's journey begins with a call to adventure. For aspiring traders, it's the realization that the road to success is riddled with challenges and uncertainties. The overwhelming landscape of charts, indicators, and strategies can be intimidating, making a mentor's guidance invaluable.

Recognize that seeking a mentor is not a sign of weakness, but a testament to your commitment to excel. A mentor can offer insights, share their experiences, and provide the much-needed emotional support during the roller-coaster ride of trading.

The Wise Elder: Qualities of an Exceptional Mentor

A good trading mentor is like a wise elder, possessing qualities that set them apart from the crowd. Look for someone with a proven track record of success, whose achievements speak volumes about their expertise. Seek out mentors with a genuine passion for teaching and a desire to see their protégés flourish.

An exceptional mentor is also patient and empathetic. They understand the struggles and challenges faced by new traders and are willing to guide them with unwavering support. Additionally, they should be excellent communicators, capable of conveying complex concepts in a clear and understandable manner.

The Mentor's Journey: Learning from Their Experiences

One of the most valuable aspects of having a mentor is the opportunity to learn from their experiences. They have walked the treacherous path you are about to embark on, and their insights can help you avoid common pitfalls.

A mentor can provide you with personalized feedback, helping you identify your strengths and weaknesses. Through their guidance, you can fine-tune your trading strategies and develop the confidence needed to face the ever-changing market.

The Alliance Formed: Building a Strong Mentor-Mentee Relationship

A successful mentorship is built on trust, respect, and open communication. When you find a potential mentor, take the time to get to know them and their trading philosophy. Ensure that your goals and trading styles align, and that you feel comfortable sharing your challenges and questions.

Remember that the mentor-mentee relationship is a two-way street. Show your commitment to learning and improving, and be receptive to feedback and advice. Stay humble and open-minded, as there's always room to grow and evolve as a trader.

The Transformation: Empowered by Knowledge

Under the guidance of a skilled mentor, you'll experience a transformation in your trading journey. As you apply their teachings, you'll gain the confidence to navigate the markets with clarity and purpose.

You'll learn to trust your instincts, make well-informed decisions, and weather the storms of uncertainty with resilience. With each successful trade, you'll realize that you owe a part of your triumph to the wisdom and guidance of your mentor.

The Hero's Return: Paying It Forward

As your skills and confidence soar, you'll reach a pivotal moment in your journey - the opportunity to pay it forward. Just like your mentor believed in you, you can become a guiding light for aspiring traders, sharing your knowledge and experiences to help them carve their paths to success.

To finish up, finding a good trading mentor can be a transformative experience, leading you towards greater heights in the financial markets. Embrace the quest with determination and an open heart, for in the embrace of a seasoned mentor, you may unlock the true hero within - a skilled and successful trader.

Make sense Ninja?

That's all for todays episode my friend.

Keep your blades sharp and I'll see you soon.

Ninja out...

*Drops smoke bomb and disappears*

Ninja Talks EP 34: True StoryTrue story Ninjas, listen to this;

In the early 1980s, a captivating experiment in trading took place, involving a renowned commodities trader named Richard Dennis. He believed that successful trading could be taught and was not solely reliant on innate talent. To prove his theory, he set out to find a group of individuals he could mold into profitable traders.

Dennis, a firm believer in trend-following strategies, developed a simple and straightforward trading system that focused on identifying and riding market trends. The rules were clear-cut and required no complex calculations or indicators.

He gathered a diverse group of individuals, some with little to no trading experience, whom he affectionately called the "Turtle Traders." The name was inspired by an exhibit of turtle farm in Singapore, as Dennis remarked that he could grow traders as quickly and efficiently as the farm grew turtles.

The training began, and Dennis shared his simple trend-following strategy with his protégés. The Turtle Traders learned to identify entry and exit points based on price action and a few straightforward indicators.

Consistency was the key tenet of the training. The Turtle Traders were expected to stick to the rules religiously and follow the strategy even during challenging market conditions. It was not about making impulsive decisions or chasing after every potential profit; it was about maintaining discipline and patience.

As the Turtle Traders ventured into the world of trading, they faced a variety of market environments. There were moments of success and periods of drawdowns. However, what set them apart was their unwavering commitment to the simple strategy they had been taught.

Over time, the Turtle Traders' discipline and consistency paid off. They proved that Richard Dennis was right – successful trading could indeed be taught. Several of the Turtle Traders went on to achieve remarkable success, achieving annual returns of over 100% and earning millions of dollars in profits.

The story of the Turtle Traders serves as a timeless reminder of the power of sticking to a simple strategy and applying it consistently. In a world where complexity often dazzles and confuses, Richard Dennis's experiment showed that mastery lies in simplicity. By resisting the allure of constant strategy-hopping and embracing patience and discipline, the Turtle Traders proved that even novices can thrive in the trading world with a well-defined, straightforward approach.

Too many Bambi traders want to over complicate, it isn't neccesary - I've used the same strategy for years and although I've developed nuances the foundation remains the same.

Consistency comes from repeatability.

Repeatability comes from simplicity.

Simplicity comes from making an observation and REFUSING to chase after more!

Do you understand Ninja?

Good, you're learning ;)

See you in the next episode and always remember to...

...keep your blades sharp.

Ninja Nick

Ninja Talks EP 33: The Boy PlungerIn the early 20th century, there was a legendary stock trader named Jesse Livermore, known as the "Boy Plunger." Jesse's life was a roller-coaster ride of fortunes won and lost, and his story stands as a testament to the importance of managing risk in the financial world.

Jesse Livermore was a natural-born speculator with an uncanny ability to read the market. His journey began as a teenager when he started working as a stock ticker runner in a brokerage firm. He soaked up market knowledge like a sponge, observing the strategies of seasoned traders.

In 1907, at the young age of 24, Jesse made his mark during the Panic of 1907. The financial crisis sent shockwaves through the markets, and seasoned investors were scrambling to secure their fortunes. Amidst the chaos, Jesse displayed a keen sense of risk management. He shorted stocks, betting that their prices would fall, and successfully navigated the treacherous market conditions. By the end of the panic, he had amassed a fortune of around three million dollars - a colossal sum in those days.

However, as success often does, it bred overconfidence. Jesse's risk management skills waned as he let his emotions and ego drive his decisions. With boundless optimism, he engaged in high-risk trades without proper stop-loss measures, believing that his intuition would always lead him to triumph.

In 1929, the markets were engulfed in the Great Crash, and Jesse Livermore's fortunes took a disastrous turn. He failed to manage his risks effectively, and as a result, he suffered devastating losses that wiped out his entire fortune.

But true wisdom comes from learning from one's mistakes. Jesse Livermore did not let his downfall define him. He picked himself up, dusted off the ashes of defeat, and focused on refining his risk management strategies.

He realized that managing risk was not just about making money; it was about preserving capital. He developed a set of strict rules to protect himself from catastrophic losses, including using stop-loss orders to limit potential downsides. He also learned to control his emotions, avoiding impulsive trades driven by greed or fear.

With renewed discipline and risk management prowess, Jesse Livermore once again entered the trading arena. This time, he achieved sustained success and rebuilt his fortune. He went on to make several other notable profitable trades throughout his career.

In the end, Jesse Livermore's story is one of triumph and redemption. He learned the hard way that no trader, no matter how skilled, is immune to the risks inherent in the financial markets. But by embracing the lessons of risk management, he proved that it is possible to rise from the depths of failure and navigate the turbulent waters of trading with wisdom and resilience.

So, the next time you're tempted to take a reckless gamble in the market, remember the story of Jesse Livermore and the importance of managing risk wisely. It's not just a tale from history; it's a valuable lesson that can shape your own journey as a trader.

I've seen many traders in my time end their career short because they refuse to face the beast (Risk) - Don't be afraid, it's a friendly monster once you get to know it :)

See you in the next episode Ninjas!

Keep your blades sharp.

Ninja Talks EP 32: Secret RecipeHey Ninjas!

Today, we're going to dive into a topic that might seem like a detour from the world of numbers and charts, but believe me, it's a vital ingredient to becoming a true trading maestro.

Buckle up as we explore the untold connection between a healthy body and mind and your trading success.

1. The Tale of Two Traders: Meet Larry and Serena

Picture this: Larry, our first trader, spends every waking moment glued to his computer screen. He lives, breathes, and dreams about market movements and financial speculation. His sleep is fitful, and he lives off a diet of energy drinks and snacks as he trades into the wee hours. Now, meet Serena, our second trader. She's sharp, well-informed, and knows her way around the market too. But Serena also knows the value of balance. She makes time for regular exercise, enjoys hobbies, and cherishes quality time with loved ones.

Quote to remember: "Balance is not something you find; it's something you create." - Jana Kingsford

2. The Science Behind It: Boost Your Trading Prowess

Serena might seem like the fun-loving one, but there's actual science behind her approach. Engaging in physical activities pumps oxygen to your brain, promoting better cognitive function. This means you'll be more focused and better equipped to make strategic decisions when those stock prices are being moody. Plus, exercise triggers the release of endorphins, making you happier and less likely to panic when the market takes a nosedive.

3. Meditation: The Mindfulness Superpower

Ever tried meditating? No, it's not just for monks on mountaintops. Meditation can do wonders for your trading game! Taking a few minutes each day to quiet your mind and focus on the present moment will help you stay calm under pressure. When the market resembles a roller coaster, you'll be that Zen trader, not the one tearing out their hair.

Quote to remember: "The mind is like water. When it's turbulent, it's difficult to see. When it's calm, everything becomes clear." - Prasad Mahes

4. Laughter, the Ultimate Trading Elixir

If you haven't heard, laughter is the best medicine. And guess what? It works wonders in the trading world too! When you laugh, you reduce stress hormones, which can lead to better decision-making. So, share a trading joke or two with your trading buddies, or even better, laugh at your own bad trades (we all have those)!

5. Sleep, Your Magical Trading Pill

Sleep is the holy grail of a healthy body and mind. It's not a badge of honor to pull all-nighters staring at your trading screen. A well-rested brain is more alert, focused, and creative. Your trading strategy might even thank you for the power nap.

Quote to remember: "Sleep is the golden chain that ties health and our bodies together." - Thomas Dekker

6. Outside the Box: Diversify Your Life

In trading, diversification is key. The same goes for your life! Having interests outside the financial realm can refresh your perspective and provide valuable insights. Take up a new hobby, explore nature, or learn a new language. Who knows, you might discover hidden patterns that others miss!

So, my fellow traders, remember that success in the financial markets is not solely about crunching numbers. It's about nurturing a healthy body and mind that can weather any storm the markets throw your way. Embrace the fun, laughter, and balance in life, and you'll see the numbers on your trading screen soar! Happy trading, and don't forget to stop and smell the roses along the way.

Keep your blades sharp!

Nick

3 Best Market Trading Opportunities to Maximize Profit Potential

Hey traders,

In the today's article, we will discuss 3 types of incredibly accurate setups that you can apply for trading financial markets.

1. Trend Line Breakout and Retest

The first setup is a classic trend line breakout.

Please, note that such a setup will be accurate if the trend line is based on at least 3 consequent bullish or bearish moves.

If the market bounces from a trend line, it is a vertical support.

If the market drops from a trend line, it is a vertical resistance.

The breakout of the trend line - vertical support is a candle close below that. After a breakout, it turns into a safe point to sell the market from.

The breakout of the trend line - vertical resistance is a candle close above that. After a breakout, it turns into a safe point to buy the market from.

Take a look at the example. On GBPJPY, the market was growing steadily, respecting a rising trend line that was a vertical support.

A candle close below that confirmed its bearish violation.

It turned into a vertical resistance.

Its retest was a perfect point to sell the market from.

2. Horizontal Structure Breakout and Retest

The second setup is a breakout of a horizontal key level.

The breakout of a horizontal support and a candle close below that is a strong bearish signal. After a breakout, a support turns into a resistance.

Its retest is a safe point to sell the market from.

The breakout of a horizontal resistance and a candle close above that is a strong bullish signal. After a breakout, a resistance turns into a support.

Its retest if a safe point to buy the market from.

Here is the example. WTI Crude Oil broke a key daily structure resistance. A candle close above confirmed the violation.

After a breakout, the broken resistance turned into a support.

Its test was a perfect point to buy the market from.

3. Buying / Selling the Market After Pullbacks

The third option is to trade the market after pullbacks.

However, remember that the market should be strictly in a trend.

In a bullish trend, the market corrects itself after it sets new higher highs. The higher lows usually respect the rising trend lines.

Buying the market from such a trend line, you open a safe trend-following trade.

In a bearish trend, after the price sets lower lows, the correctional movements initiate. The lower highs quite often respect the falling trend lines.

Selling the market from such a trend line, you open a safe trend-following trade.

On the chart above, we can see EURAUD pair trading in a bullish trend.

After the price sets new highs, it retraces to a rising trend line.

Once the trend line is reached, trend-following movements initiate.

What I like about these 3 setups is the fact that they work on every market and on every time frame. So no matter what you trade and what is your trading style, you can apply them for making nice profits.

Good luck!

Finding Bottoms Using Monthly Inside Candles: DKNGNow, let's take a look at $DKNG.

One of my highest conviction trades this year in January.

In this case, we traded within its March '20 monthly inside range.

pbs.twimg.com

DKNG

We zoom in to see not only did the monthly inside low hold, but we have a massive bull flag breakout.

Add the fact that Massachusetts had an inevitable sports betting approval coming, this became a no brainer A+ setup.

Given at $13-$14.

pbs.twimg.com

We capitalized on NASDAQ:DKNG , then rolling it up to a 3/17 22.5c with our target of what?

The March '20 monthly inside resistance of $19.50.

We sold near the top of its first wave into $21, now providing a 50%+ move on underlying since adding to WL in January.

pbs.twimg.com

After a pullback, NASDAQ:DKNG reclaimed the breakout of its March '20 inside range $19.50, providing another massive move into $30+ (+50%).

From the time of my WL add in January, this has now provided over 110% upside.

See how breaks of monthly inside ranges provide large moves?

pbs.twimg.com

📊 Navigating The Trading Range📌What Is a Trading Range?

A trading range is a period during which an asset consistently fluctuates between high and low prices. The upper limit of the range acts as a resistance level, meaning it tends to hinder further price increases. The lower limit of the range serves as a support level, providing a barrier against significant price declines. When an asset breaks through or falls below its trading range, it usually means there is momentum (positive or negative) building. A breakout occurs when the price of a security breaks above a trading range, while a breakdown happens when the price falls below a trading range.

Typically, breakouts and breakdowns are more reliable when they are accompanied by a large volume, which suggests widespread participation by traders and investors. Many investors look at the duration of a trading range. Large trending moves often follow extended range-bound periods.

📌Support and Resistance

If an asset is in a well-established trading range, traders can buy when the price approaches its support and sell when it reaches the level of resistance only if there is confluence and signs for it. Using volume is a good indication of spotting continuation or reversals. If the price is approaching a support level with high sell-side volume, its a good indication it might just break down and continue the downtrend to the next support zone. You can define major support/resistance zones where there was clear reaction in the past and use them as major pivots to guarantee safer entries.

Always remember two key things about S/R. The first is, the more times a S/R zone is tested the higher the change a breakout/breakdown will occur. Once a S/R breaks, it will automatically turn into the opposite of what it was, the price break out of the resistance and range above. That previous resistance will act as a support level next time the price action touches it.

👤 @QuantVue

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Finding Bottoms Using Monthly Inside Candles: SNOWThis past year, I shared many bottoms on names on my weekly WLs based on bottoming consolidation structures, mentioning a specific strategy as a reasoning for the trades. Aside from understanding price action, I used a simple method:

Monthly inside candles/bars.

----------------------------------------------

What is an inside candle/bar?

Inside candles trade “inside” its previous candle. The previous candle’s high and low can be used as resistance and support, respectively. Your trade execution comes on a break & hold above/below the range.

Here are a few examples of this:

pbs.twimg.com

----------------------------------------------

NYSE:SNOW

This has traded within it’s May ‘22 inside range for over a year. This has been one of my top watches earlier this year.

The range provides a macro resistance/support of $187.23 and $112.10, respectively. These levels can now be used as targets for your trades.

How do I execute on this?

Zoom into LTFs to find swing opportunities. In my 1/23/23 weekly watchlist, I provided NYSE:SNOW based on a previous bull div + key support/demand being held (red box).

pbs.twimg.com

All swing contracts provided on the WL printed, while NYSE:SNOW saw a massive upside move from $140 into $178.70 within 2 weeks.

You’ll also notice my invalidation for this was $133.10 while the low was $134.34. This invalidation was based on a breakdown of the range low.

Now once again, on 3/31/2023 I mentioned NYSE:SNOW as a potential high R:R trade.

Based on the exact same reasoning as my January WL.

Once again, NYSE:SNOW was able to hold its demand zone with a macro target of the monthly inside candle resistance.

NYSE:SNOW

The same exact entry & same exact analysis now provided a recent move into my $187.23 target. First move providing a 33% move, second providing a 42% move.

This is how you take advantage of macro inside ranges (specifically monthly candles in these examples).

pbs.twimg.com

Learn this price action setup for the BIGGEST DAY TRADESI walk through the pre-market prep and the price action that led to a big move on the Nikkei Index.

Learning price action means understanding 'WHO' may be trapped and where they will start to feel the pain and be forced to act and potentially close positions....that is when we want to initial a position to take advantage of the move.

The Nikkei index was a great example of knowing when and where to trade which could have led to a big payouts.

** If you like the content then take a look at my WEBSITE in the profile to get more daily ideas and learning material **

** Comments and likes are greatly appreciated. **

Learn Why You Should Study Multiple Time Frame Analysis

In my daily posts, I quite frequently use multiple time frame analysis.

If you want to enhance your predictions and make more accurate decisions, this is the technique you need to master.

In the today's post, we will discuss the crucial importance of multiple time frames analysis in trading the financial markets.

1️⃣ Trading on a single time frame, you may miss the important key levels that can be recognized on other time frames.

Take a look at the chart above. Analyzing a daily time frame, we can spot a confirmed bullish breakout of a key daily resistance.

That looks like a perfect buying opportunity.

However, a weekly time frame analysis changes the entire picture, just a little bit above the daily resistance, there is a solid weekly resistance.

From such a perspective, buying GBPUSD looks very risky.

2️⃣ The market trend on higher and lower time frames can be absolutely different.

In the example above, Gold is trading in a bullish trend on a 4h time frame. It may appear for a newbie trader that buyers are dominating on the market. While a daily time frame analysis shows a completely different picture: the trend on a daily is bearish, and a bullish movement on a 4H is simply a local correctional move.

3️⃣ It may appear that the market has a big growth potential on one time frame while being heavily over-extended on other time frames.

Take a look at GBPJPY: on a weekly time frame, the market is trading in a strong bullish trend.

Checking a daily time frame, however, we can see that the bullish momentum is weakening: the double top pattern is formed and the market is consolidating.

The sentiment is even changing to a bearish once we analyze a 4H time frame. We can spot a rising wedge pattern there and its support breakout - very bearish signal.

4️⃣ Higher time frame analysis may help you to set a safe stop loss.

In the picture above, you can see that stop loss placement above a key daily resistance could help you to avoid stop hunting shorting the Dollar Index.

Analyzing the market solely on 1H time frame, stop loss would have been placed lower and the position would have closed in a loss.

Always check multiple time frame when you analyze the market.

It is highly recommendable to apply the combination of at least 2 time frames to make your trading safer and more accurate.

❤️Please, support my work with like, thank you!❤️

Daytrade Review on the Hang Seng IndexI small trade today on the Hang Seng Index that turned out to be quick and simple with little to no pressure from the entry. Could have been a better exit but all up it was a good start to the day.

I will explain the price action for the Entry and the reasoning for the trade coming into the start of the session.

** If you like the content then take a look at my WEBSITE in the profile to get more daily ideas and learning material **

** Comments and likes are greatly appreciated. **