Bitcoin - Bearish Engulfing Pattern Definition and TacticsWhat is a Bearish Engulfing Pattern?

A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

KEY TAKEAWAYS

- A bearish engulfing pattern can occur anywhere, but it is more significant if it occurs after a price advance. This could be an uptrend or a pullback to the upside with a larger downtrend.

- Ideally, both candles are of substantial size relative to the price bars around them. Two very small bars may create an engulfing pattern, but it is far less significant than if both candles are large.

- The real body—the difference between the open and close price—of the candlesticks is what matters. The real body of the down candle must engulf the up candle.

- The pattern has far less significance in choppy markets.

What Does the Bearish Engulfing Pattern Tell You?

A bearish engulfing pattern is seen at the end of some upward price moves. It is marked by the first candle of upward momentum being overtaken, or engulfed, by a larger second candle indicating a shift toward lower prices. The pattern has greater reliability when the open price of the engulfing candle is well above the close of the first candle, and when the close of the engulfing candle is well below the open of the first candle. A much larger down candle shows more strength than if the down candle is only slightly larger than the up candle.

The pattern is also more reliable when it follows a clean move higher. If the price action is choppy or ranging, many engulfing patterns will occur but they are unlikely to result in major price moves since the overall price trend is choppy or ranging.

Before acting on the pattern, traders typically wait for the second candle to close, and then take action on the following candle. Actions include selling a long position once a bearish engulfing pattern occurs, or potentially entering a short position.

If entering a new short position, a stop loss can be placed above the high of the two-bar pattern.

Astute traders consider the overall picture when utilizing bearish engulfing patterns. For example, taking a short trade may not be wise if the uptrend is very strong. Even the formation of a bearish engulfing pattern may not be enough to halt the advance for long. Yet, if the overall trend is down, and the price has just seen a pullback to the upside, a bearish engulfing pattern may provide a good shorting opportunity since the trade aligns with the longer-term downtrend.

Limitations of Using a Bearish Engulfing Pattern

Engulfing patterns are most useful following a clean upward price move as the pattern clearly shows the shift in momentum to the downside. If the price action is choppy, even if the price is rising overall, the significance of the engulfing pattern is diminished since it is a fairly common signal.

The engulfing or second candle may also be huge. This can leave a trader with a very large stop loss if they opt to trade the pattern. The potential reward from the trade may not justify the risk.

Establishing the potential reward can also be difficult with engulfing patterns, as candlesticks don't provide a price target. Instead, traders will need to use other methods, such as indicators or trend analysis, for selecting a price target or determining when to get out of a profitable trade.

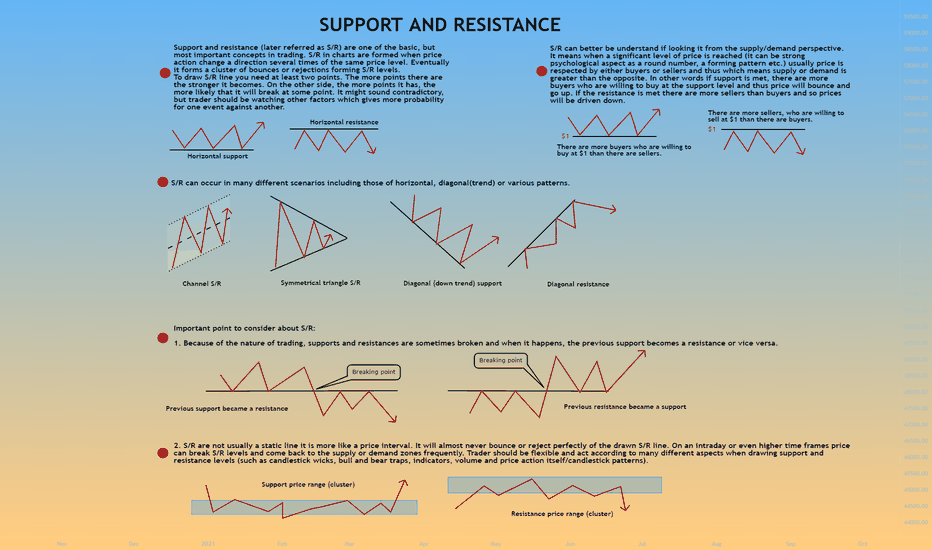

Supply and Demand

The Ultimate Stop Loss GuideHi Traders. Today's topic is requested some of the followers, wondering why they're constantly getting stopped out OR misled by the "stop-hunt" concept. Have you ever questioned what's the purpose of a stop loss (SL) in the first place? Majority is taking SL as a tool to maximize their position sizing rather than an emergency break preventing yourself from a heavy collision. SL is nothing, but the final defense that determines the validity of the setup. Once it is being triggered, admit that you're wrong, close out the position and move on. Either way, if you're constantly moving your SL OR having it too tight, you've clearly misunderstood the purpose of SL all the while. Above illustration is solely for demonstration purposes, not a general indication of all.

Questions before you determine a SL location:

1. Is my SL obvious? Is it sensible?

2. Where's the majority placing their SL?

3. If it is triggered, is the setup still valid?

4. Should I re-enter?

5. Is the Risk-to-Reward reasonable?

6. Re-assessment (Does my strategy fits well into the current market context?)

Solutions:

- Emotional control (Constantly remind yourself the purpose of a SL)

- Use an ATR-based SL (Eg. 1 ATR below the swing low)

- Determine the volume/ volatility of the market (Eg. If the volatility is high, give it more room and expect some spikes)

- Back-test (How to improve your expectancy? Prove it through statistics)

- Ensure the Risk-to-Reward is favorable before you even consider placing a trade

- Forward-testing with smaller sizing to identify the performance in the live market condition

- Wider SL does not mean it is better!

No matter how good you are, there will be times where the markets prove you wrong. Keep learning and practicing! Stop the blame, the only person in charge of your decision and success is you.

"Losses are necessary, as long as they are associated with a technique to help you learn from them" - David Sikhosana

Trade safe as usual.

Do follow my profile for daily fx forecast & educational content.

Auction Market Theory + Supply and Demand ETHUSDI have tried to move away from indicator based trading into more fact based TA and would like to breakdown how to use this form of analysis with just candlesticks and volume. This is a larger time frame breakdown though similar patterns can be identified (though significantly more volatility prone) in smaller time frames and one can find that these principles explain moves across many markets. What's interesting with Ethereum is the similarities to precious metals. The demand has no specified cap while the supply is limited. Using supply as a constant and demand as dependent variable paired with a basic understanding of auction market theory, each move in an asset can be analyzed. I only chose ETHUSD due to the rising buzz around cryptocurrency.

There are 3 main discussion points in this post They are numbered on the chart in order and the numbers will also be used to tie them to their principle.

1. Aggression: Who is currently more aggressive in the market? Buyer or sellers? Aggression in markets simply is the continued buying or selling at higher or lower prices respectively, causing rapid fluctuations. I try to mark the more significant areas of aggression as they often have more importance in the broader scheme of things. For ETHUSD, in 2021, we have seen tons of buyer aggression causing large breakouts, often followed by selling aggression after new highs are created. These types of moves can not be predicted, nor can we establish how long they will carry on, though after the fact they are of upmost importance. For reference, (1), (2), (4), (5), (6) are all areas of aggression I identified on this chart. To identify these I look for volume that is relatively higher than usual as this shows the increase of interaction between buyers and sellers. I then find the bias which is simple on a candle chart- red or green. Typically with larger aggressive moves there is a scenario that occurs referred to as imbalance. An imbalance is formed when buyers raise the bid or sellers lower the ask quickly creating larger fluctuations in prices. These imbalances are often POI's during a retrace.

2. Absorption: Absorption is when there is a large group of resting limit buy or sell orders that temporarily or fully halt selling or buying action. This information can be accessed in real time with level 2 data in the stock market though I'm not to sure how to identify them best real time in the cryptocurrency market as it is decentralized. Though absorption isn't dependent on aggression, it can easily be identified when there is an aggressive party in the market. First, the assumption must be made that prices with downward/upward momentum will continue in the same direction as long as the majority of the money in the market retains bull or bear bias. Theoretically, one must assume that as long as there is no worthy contest, prices will remain moving to infinity or 0. Second, the study of volume. If there is an obvious directional movement, volume is continuing to increase, and prices are unchanged as buy/sell pressure continues, then it is safe to assume that there is larger amount of limit orders than active/aggressive orders, in a nut shell that is all absorption is. Example- . What happens next is a competition of the buyers or sellers for the best possible prices and trends form in that direction until their position is fully formed, example-(COMP). Absorption areas are often referred to as support and resistance and in a consolidating market these areas are easy to identify. They often creating a mix of limit buyers/sellers along with "market" buyers/sellers resulting from the fact that both of these parties have identified these levels and they both are in agreement that it is a buy/sell zone . If these supports and resistances are broken (typically a result of aggression) those on the sidelines may see a chance to enter the market causing aggression/breakouts, for example- (5).

3. Supply and Demand- Supply and demand is essential for understanding any market and is arguably the biggest influence on price. When it comes to understanding demand in the form of Cryptos or any other asset it is not always easy to identify, as it is all relative. However, as stated earlier we know for a fact that the total supply in my example, ETHUSD, is always going to be capped. Demand on the other hand, is constantly going to be changing. One way demand can be inferred is fundamental analysis, technically if enough people were to say "to the moon" and the unspoken HODL agreement is maintained, price could rise forever as people continue to put money into the market. Another way to find demand is looking at historical price relative to historical volume, find areas where volume was low yet price still pushed higher. This occurs when enough are people are actively buying the asset but there is a majority of people intentionally holding the bag. This is a phenomenon known as a supply crunch and is exclusive to assets with capped supply. As these people continuously buy, the asset's price moves higher in search of absorption or where market participants may want to sell their holdings. As mentioned before, these can be found with time/price based volume studies that for simplicity sake I will refer to as "volume wells" (3A and 3B). More often than not these volume wells a result of ranging markets and come in different sizes depending on the longevity of the consolidation/accumulation period.

Tying it Together-

Using these three principles to breakdown markets, one can better establish an understanding of price action and envision the market as whole rather than piece by piece. Furthermore, the understanding of how buyers and seller are interacting minimizes the risk when trading. I hope this was helpful and remember, there is no right or wrong way to trade and I intend for this post to be strictly educational. Feel free to leave your thoughts or questions in the comments.

A Practical Guide to High Risk/Reward Trading in Forex. This will show my methodology and system for getting high risk to reward trading setups using whatever analysis that you choose that doesn't involve indiaotrs. Wyckoff, Smart Money Concepts, Price Action. But primarily this calls for an understanding of market structure.

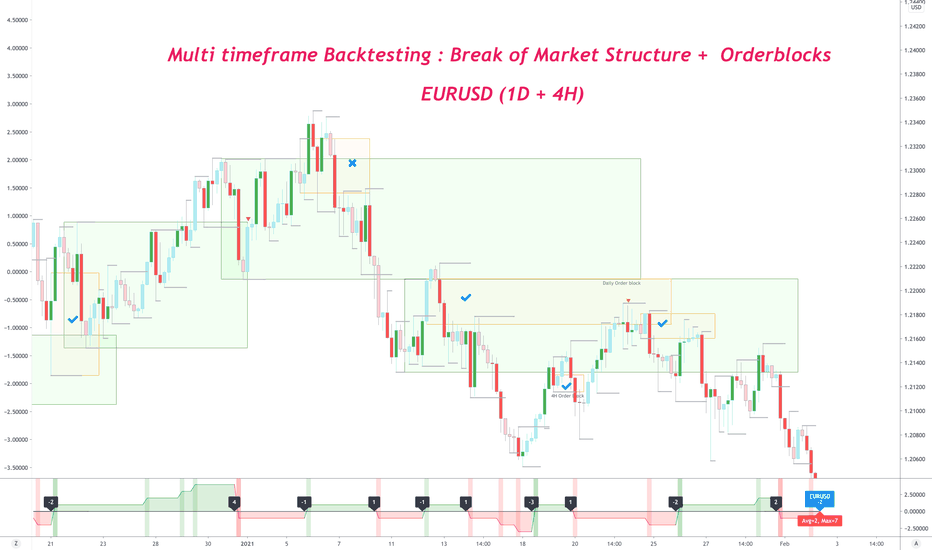

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

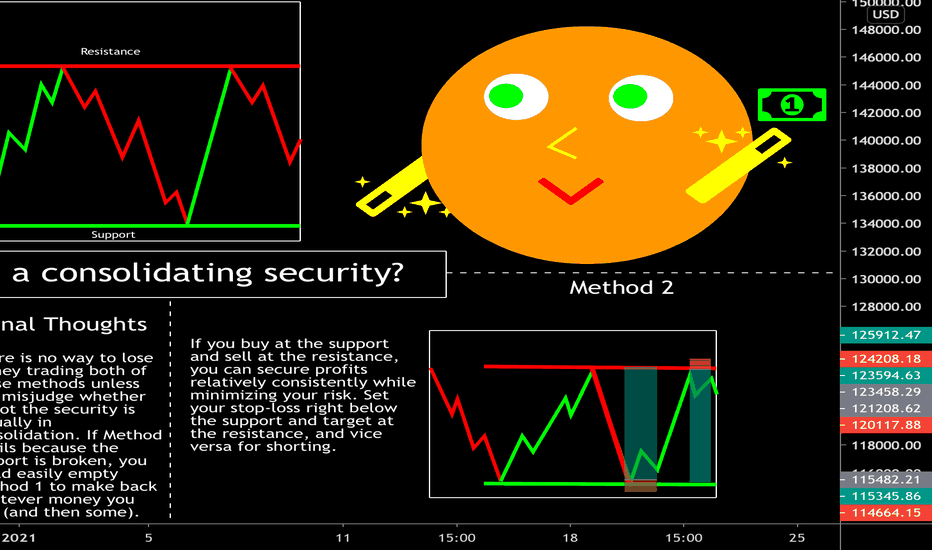

How do you trade a consolidating security? Introduction

Hello trading view! Today I will be doing an educational post about trading consolidation effectively. There are two methods that I've found that are not only simple, but also self explanatory, and can provide decent returns for everyone who uses them.

==============================================================================================================================

Method 1

Long/Short the breakout. Set your target for the nearest resistance and stop-loss below the consolidation resistance. If you have any reason to believe the security will go higher, set your target at the second or third nearest resistance level (or wherever you see fit).

==============================================================================================================================

Method 2

Long a retest of the support, short a retest of the resistance. Set your target for the resistance if longing, support if shorting. Stop-loss below the support if longing, above the resistance if shorting. This strategy can be used in conjunction with method 1 to make up for any losses caused by you getting stopped out.

*if you get stopped out there has been a breakout, which is when you enter using the first strategy. This can cut any losses you incurred when using the second method and then some.

==============================================================================================================================

Final thoughts

When combining the two methods above you can always make money off of consolidation (or at least most of the time). Good luck and great trading everyone! I will be posting again soon.

*this is not financial advice.

How To Know If A Trend Is Ending? - Take Advantage of ReversalsHi Traders. Today I'm going to discuss about a highly requested topic, how could you stay informed and identify an ending trend/ reversal beforehand? It all begin with do you know how to identify a trend in the first place? It may sound simple, higher highs & higher lows sequence. Referring to the illustration above, believe or not, majority of new traders actually short into these simple continuation pattern thinking that the market is going to reverse anytime based on their FOMO, overthinking behaviour, misuse of candlestick pattern, and lack of knowledge. If you are new to trading, I'd recommend you to avoid mean reversion or reversal setups as most likely you are going to catch falling knives. It's relatively easier for new traders to trade with the trend as reversal trading is something require more experience, understanding of the market, and back-tested strategies. Do get me right, reversal is a highly profitable trading style that I am doing most of the time, but catching the tops & bottoms could be devastating if you're not doing it the right way. I'll pinpoint some common characteristics of exhaustion vs reversal below,

Exhaustion/ Continuation pattern

- Short in duration

- Tight range

- Weak pullback compared to the impulse

- Respecting static & dynamic support (Eg. EMAs, trendline, S&R, Fibonacci, etc.)

- Showing signs of a healthy trend

Reversal pattern

- Longer duration (Distribution phase)

- Wide range

- Strong pullback digesting the impulse (Shock the market)

- Disrespecting key levels & dynamic support

- No sign of a healthy trend

One thing to remind yourself, is to avoid finding reversal on the lower timeframe 1m - 15m charts, as there are time where you'd get trapped onto some seemingly healthy pullback on the higher timeframe, but you're treating it like a reversal which the Risk-to-reward ain't going to be great. Constantly practice and train your brain into spotting reversals is the best way to become a better countertrend trader. Keep your chart simple, understand support & resistance first before you jump into any other indicators or complicated strategies. Eg. on an uptrend, simply look for higher highs & lows until the market is not doing so, then you'll be cautious on possible momentum shift.

Knowledge, discipline, mindset.

" The goal of a successful trader is to make the best trades, money is secondary " - Alexander Elder

Trade safe.

Do follow my profile for daily fx forecast & educational content.

How to trade from SUPPLY TO SUPPLY and DEMAND TO DEMAND**THIS IS PURELY MY OPINION AND I AM NOT LIABLE FOR YOUR TRADING DECISIONS**

I've been getting a lot of questions about my trading strategy. I think this AMZN chart is a good example for me to explain. I trade on the theory that price moves from supply to supply or demand to demand , which is a fundamental approach to trading that I definitely did not create.

You can see that AMZN has been trading between the bounds of this wedge (white trendlines) since September 2020. The yellow horizontal line at 3367 is a major supply level.

- " Supply " means a level where a lot of investors sell their holdings and take profit as its reached their price target, which results in a price rejection and drop in stock price. You can see that the market was in consensus about the 3365 price target for AMZN, as it was rejected at this level 5 or 6 times since September (yellow circles). It managed to breakthrough twice, made new supply levels at 3400, 3450, 3500 and 3550, but quickly retraced back into the range each time.

- Supply is created when emotional buyers buy from smart sellers . This is why in my strategy, I only buy a stock when price breaks a major supply level (or short a stock when it breaks a major demand level). When this happens, it means the market is in consensus that this asset is actually worth more than this level, and all of the investors that were previously sellers at this level either hold or buy more, and price tends to explode through the level. This is why I like to trade stocks when they cross major supply levels.

The next level of supply is the first horizontal green line at around 3400. Since price moves from supply to supply and demand to demand, this is technically the next price target, followed by 3450, 3500 and 3550. My trading style is more conservative so I would definitely take partial profit on the way up.

Just a note that AMZN has earnings tomorrow after market close. I personally never hold a stock/option through earnings because it's so unpredictable. If I take this trade tomorrow, it will most definitely be a day trade

Trading demand to demand is the exact same thing - just flipped! Demand is a level where buyers step in and drive price higher. I enter puts when a major demand level is broken, and my price target is the next level of demand.

Hope this helps! Feel free to comment with any questions or opinions.

Bitcoin Traders Beware!, Buyers Will win this War(Short Squeeze)Like And Subscribe(😊 Thanks in advance)

Why do Support and Resistance hold but sometimes break forcefully? you may ask after bitcoin recent price actions.

I am sincerely more than happy😳 to welcome our new subscribers.

My analysis are always multi-timeframes, so please do expect a full week play out of my predictions.

as a result of my busy hectic schedules, I will be making only weekly analysis every weekends on what to expect from the market through out the new week before a new weekend.

I will do my best to try to constantly update the posts during the week, to keep you updated incase we have any sudden incoming changes in price action that could affect our results.

Thanks for your constant supports and understanding.

It is crazy to know that the bull(buyer) and the bear(seller) can be same trader at any point in time in the market, and sometimes even confused of what she/he should be doing, buying or selling.

To answer the above question, first I will start by explaining what Resistance and Support truly is in the most simplest way that I can, for the sake of new born traders reading along.

what then is Support And Resistance?

For Support;

The simplest definition I can gave you is that , a Support is simply an invincible form of form(🛏)made floor area on the chart where price somehow bounces off from, this invincible floor prevents price from going farther down

when falling from a higher price range as a result of coming in contact with an invincible barrier called resistance.

Ones price comes close to the support, here it manages to find a way to bounce back to the upside after being pushed down(sold off) by sellers in the market.

this support are build or formed by unusual huge number of buyers(when you have huge number of traders willing to buy at a particular price range on the chart) .

To better understand how a support works, I will like you to see this support built floor by the buyers as a form 🛌 floor because it is breakable and can be sliced to the worst piece with no remorse when the sellers are huge in numbers.

Here is my lil secret for trading supports (secret source😉):

*See support as an area on the chart and not a line because, it is likely price breaks the line only to find buyers below your line.

* Whenever price gets closer to support, start by focusing more on the candle formations even before it comes in contact with it. If any candlestick pierces the support with a full grown body, this will most likely mean that price could go down lower more if the next two to three candles doesn't give bulls(buyers) a bounce above the support area( the last swing low that was broken). It will likely seek the next support below for assistance of a bounce(price is looking for more buyers)

* If price gets to the support and starts to go side ways, then bounce strongly with strong reversal candle stick pattern, don't jump the gun yet, wait for price to come back to confirm by forming higher low on the support, to prove the buy power on the support, price always retest a support before taking off from it(if it finds large enough strong buyers, it will make a higher stronger bounce before it even touch the support on the retest, this therefore leads to a higher low as a result of too many traders watching that support and are racing each other on the buy zone , when more buyers see this they will also jump in because now they know that the support is likely to HOLD.

*The more a support is hit 🧐,the more lower the strength of the bounce grows, the more likely price will break below it. to trade, start by watching the candle sticks forming on the area of support. This simply means that, hitting the support countlessly times leads to it breaking because it is likely that soon one candle will break the support. too much sideways on support will lead to its break or pierce also.

* Support holds, but the can also sometimes easily break as well. When supports are broken they automatically turn to new resistance.this simply means that the buyers house is now having now owners(sellers), if you understand this particular tip, it easily explains why supports got broken in the first place because the buyers at home were to small in number to defend the house so sellers killed them all🤣(bull hunt) and took over the ownership of the support there by turning it into their now home(resistance),

*Horizontal support areas are the strongest while the slanting trendline buyers are weak and more prone to break easily.

What is Resistance ?

Resistance is simply an invincible Form🛌made barrier area where price comes in contact with then starts to drop, this invincible barrier prevents price from moving upward any further, next this barrier pushes price down(sometimes even after price successfully pushes above these barriers they some how manage to get the bulls tail and drag them back down, this is also know as fake out by price action traders. just like the buyers support, these resisitance areas built by sellers can be sliced to pieces if the buyers are huge in number and out number the sellers, the barrier will be 😱 destroyed 💸 with out remorse!

Here is my lil Resistance secret source😉:

here everything is just the opposite of my tip for support.

* when price starts to gets closer to the resistance, start focusing more on the candlestick formations even before it comes in contact. if any candlestick pierce the resistance with a full grown body(make sure the candle that follows doesn't close below the resistance, it will likely go down below more if the next two to three candles doesn't give bulls(buyers) a follow through, above the that resistance area that was broken. It is most likely, price will seek to retest that resistance if it succeed in breaking through the form barriers. buyers will allow price to comeback to the top of the barrier, here they will take time to reenforce and also make sure the barrier is turned into a new support( new home owners).

The current bitcoin price is in a buy support area. in my last analysis, the vertical support line was broken and price went below it to 28900 zone still within the horizontal support area, we saw price seeking stronger buyers zone on the support . I still remain bullish o! as I believe a short squeeze is coming, and can still see a strong bull bounce before the major retest of the last breakout of 12k resistance as a result of the weekly chart.

this new week coming we are likely seeing a reaction buy from the pullback. if buyers successfully holds the 32k support and get a bounce, their first target will be 37k resistance and if they succeed to break the edge at 39k of that barrier then 46k to 60k range will be their next target before a major big dump of over 40% drop will occur in my opinion.

but what if sellers break the support area as a result of countless touch?

Trading is a game of probability so yes the chances of that happening exist . though the first option has higher chances of playing out, if the second do play out instead, here is what to expect

then we will see this play out.

Bitcoin Traders Beware!, Buyers Will win this War(Short Squeeze)Like And Subscribe(😊 Thanks in advance)

Why do Support and Resistance hold but sometimes break forcefully? you may ask after bitcoin recent price actions.

I am sincerely more than happy😳 to welcome our new subscribers.

My analysis are always multi-timeframes, so please do expect a full week play out of my predictions.

as a result of my busy hectic schedules, I will be making only weekly analysis every weekends on what to expect from the market through out the new week before a new weekend.

I will do my best to try to constantly update the posts during the week, to keep you updated incase we have any sudden incoming changes in price action that could affect our results.

Thanks for your constant supports and understanding.

It is crazy to know that the bull(buyer) and the bear(seller) can be same trader at any point in time in the market, and sometimes even confused of what she/he should be doing, buying or selling.

To answer the above question, first I will start by explaining what Resistance and Support truly is in the most simplest way that I can, for the sake of new born traders reading along.

what then is Support And Resistance?

For Support;

The simplest definition I can gave you is that , a Support is simply an invincible form of form(🛏)made floor area on the chart where price somehow bounces off from, this invincible floor prevents price from going farther down

when falling from a higher price range as a result of coming in contact with an invincible barrier called resistance.

Ones price comes close to the support, here it manages to find a way to bounce back to the upside after being pushed down(sold off) by sellers in the market.

this support are build or formed by unusual huge number of buyers(when you have huge number of traders willing to buy at a particular price range on the chart) .

To better understand how a support works, I will like you to see this support built floor by the buyers as a form 🛌 floor because it is breakable and can be sliced to the worst piece with no remorse when the sellers are huge in numbers.

Here is my lil secret for trading supports (secret source😉):

*See support as an area on the chart and not a line because, it is likely price breaks the line only to find buyers below your line.

* Whenever price gets closer to support, start by focusing more on the candle formations even before it comes in contact with it. If any candlestick pierces the support with a full grown body, this will most likely mean that price could go down lower more if the next two to three candles doesn't give bulls(buyers) a bounce above the support area( the last swing low that was broken). It will likely seek the next support below for assistance of a bounce(price is looking for more buyers)

* If price gets to the support and starts to go side ways, then bounce strongly with strong reversal candle stick pattern, don't jump the gun yet, wait for price to come back to confirm by forming higher low on the support, to prove the buy power on the support, price always retest a support before taking off from it(if it finds large enough strong buyers, it will make a higher stronger bounce before it even touch the support on the retest, this therefore leads to a higher low as a result of too many traders watching that support and are racing each other on the buy zone , when more buyers see this they will also jump in because now they know that the support is likely to HOLD.

*The more a support is hit 🧐,the more lower the strength of the bounce grows, the more likely price will break below it. to trade, start by watching the candle sticks forming on the area of support. This simply means that, hitting the support countlessly times leads to it breaking because it is likely that soon one candle will break the support. too much sideways on support will lead to its break or pierce also.

* Support holds, but the can also sometimes easily break as well. When supports are broken they automatically turn to new resistance.this simply means that the buyers house is now having now owners(sellers), if you understand this particular tip, it easily explains why supports got broken in the first place because the buyers at home were to small in number to defend the house so sellers killed them all🤣(bull hunt) and took over the ownership of the support there by turning it into their now home(resistance),

*Horizontal support areas are the strongest while the slanting trendline buyers are weak and more prone to break easily.

What is Resistance ?

Resistance is simply an invincible Form🛌made barrier area where price comes in contact with then starts to drop, this invincible barrier prevents price from moving upward any further, next this barrier pushes price down(sometimes even after price successfully pushes above these barriers they some how manage to get the bulls tail and drag them back down, this is also know as fake out by price action traders. just like the buyers support, these resisitance areas built by sellers can be sliced to pieces if the buyers are huge in number and out number the sellers, the barrier will be 😱 destroyed 💸 with out remorse!

Here is my lil Resistance secret source😉:

here everything is just the opposite of my tip for support.

* when price starts to gets closer to the resistance, start focusing more on the candlestick formations even before it comes in contact. if any candlestick pierce the resistance with a full grown body(make sure the candle that follows doesn't close below the resistance, it will likely go down below more if the next two to three candles doesn't give bulls(buyers) a follow through, above the that resistance area that was broken. It is most likely, price will seek to retest that resistance if it succeed in breaking through the form barriers. buyers will allow price to comeback to the top of the barrier, here they will take time to reenforce and also make sure the barrier is turned into a new support( new home owners).

The current bitcoin price is in a buy support area. in my last analysis, the vertical support line was broken and price went below it to 28900 zone still within the horizontal support area, we saw price seeking stronger buyers zone on the support . I still remain bullish o! as I believe a short squeeze is coming, and can still see a strong bull bounce before the major retest of the last breakout of 12k resistance as a result of the weekly chart.

this new week coming we are likely seeing a reaction buy from the pullback. if buyers successfully holds the 32k support and get a bounce, their first target will be 37k resistance and if they succeed to break the edge at 39k of that barrier then 46k to 60k range will be their next target before a major big dump of over 40% drop will occur in my opinion.

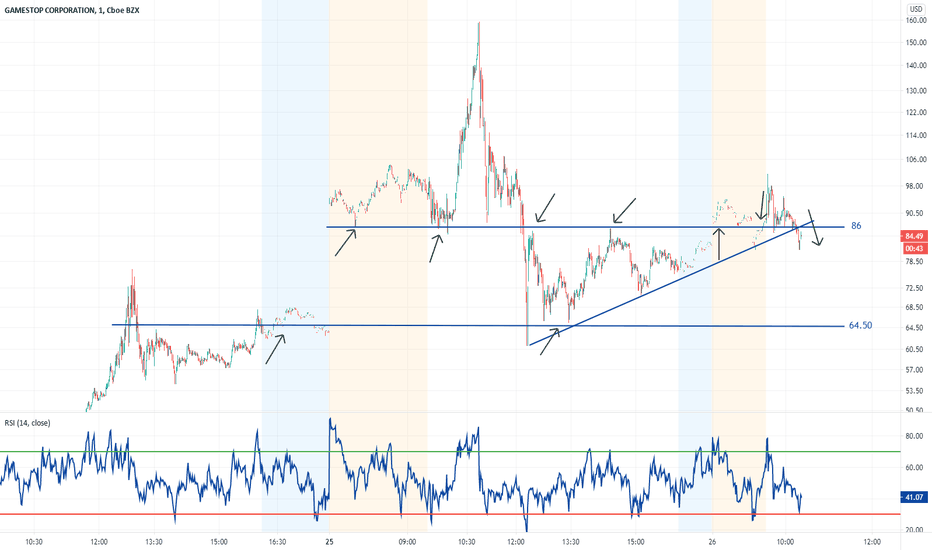

Are You Still Making These Range Trading Mistakes?Are you still making these range trading mistakes? Majority of traders always have the sense of urgency to get involved into a position, which is a trait you need to avoid at all cost. Successful traders spend 90% of their time thinking, 10% of the time taking action. Trading in a range bound condition sounds easy, especially if you are referring to the textbook stuff. But range trading in live market condition varies every time. Believe or not, majority of new traders tend to give back all of their hard earned profit by over-trading/ revenge trading during a ranging market condition, it's never just about making money but to preserve your profit. These are some of the mistakes and solutions, hopefully to give you some clarity and to master range trading, making the most out of it.

Mistakes:

1. Sense of urgency - Refer to the chart above, before the dotted black line no one has any idea the market is going to range across, this is when you must take a step back and re-assess the market condition. Let the market do whatever it wants until you have a clue about it.

2. Trading the continuation pattern - One of the biggest mistakes I realize new traders constantly make is trading the continuation pattern during a range bound condition (Eg. flag, pennant, etc.). Yes, indeed sometimes it might works, but think deeply about the concept & purpose of an exhaustion pattern, it is to catch the fresh momentum after a temporary pause in the market. Why would you take momentum patterns within a range, when buyers & sellers are clearly agreed upon certain price range? It simply doesn't fulfill the risk-to-reward in your expectation.

3. Misuse the candlestick patterns - Candlestick patterns only work when you use in the right context. Imagine you taking a short just because there's a bearish doji in a parabolic uptrend, does it make sense? Avoid overthinking about candlestick patterns, it simply tells you what happened within the time period. Always utilize it correctly.

4. Fail to identify the area of value - The most important thing about range trading is identifying the area of value (support & resistance zone). Identify where you think you could safely lean your SL against, and have a realistic target.

5. Chase the breakouts - In the live market, there'd be tons of spikes near the support & resistance zone, avoid chasing them to prevent unnecessary losses.

Solutions:

1. Trade the higher timeframe - During a range bound condition, personally I would avoid trading the lower timeframe (1min - 15min charts). Simply because a breakout on the lower timeframe could be a regular wick rejection on the 1h chart, avoid going down to lower timeframe especially if you are an aggressive trader like myself.

2. Pending order - Identify area of value where you'd like to get involved in the market, place a pending order, allow the market to come to you instead of you chasing it.

3. Widen your SL & realistic target - During a range bound condition, it is always safer to have your SL at a sensible place and have realistic target. You cannot expect to have a 1:5RR trade in a range bound condition, avoid being greedy.

Trading is never easy, but being patient allows you to have a calm mind to read the market. Trade safe.

Do follow my profile for daily fx forecast & educational content.

Swedish sterling - darvas box trade patternDarvas box trade explained with Swedish sterling as example.

Where to put on the trade, where to put the stop loss and context.

Context, swedish sterling is a stock with increasing trade volume, in a rising market and in a bullish sector

with news of a recent patent filing to the european patent office.

Swedish sterling

A clean tech company, filing a new patent of Sterling engine which is more efficient in converting to electricity .

The company's latest product - the PWR BLOK 400-F - is a propriatery solution for recycling energy from industrial residual and flare gases and converting these into 100% carbon-neutral electricity at high efficiency.

According to an independent certification, the PWR BLOK is the cheapest way to generate electricity that exists today, yielding greater CO\2\ savings per krona invested than any other type of energy.

BALUSDT - wrong / correct break outBiko membership understand me

Push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

make your analysis before a trade

Double Top Variations- Flexibility Is ImportantHi Traders. Today's topic is about one of my favourite reversal setups of all time. If you are constantly searching for the perfect double top pattern or you are looking to add a reversal strategy into your trading plan, this post is dedicated for you. Let's get into the story behind a double top pattern. Imagine yourself trying to get through a concrete wall by banging it with a hammer, banged once, you took a bit of break. Banged twice still failed, you are frustrated and eventually give up because it consumes too much energy or you're planning to come back another day, giving yourself enough time to recharge so you could return with more energy and power. Eg. In an uptrend, buyers attempt to breach a key resistance level but there are too much selling pressure against them OR buyers are simply taking their profit off. Price then pulled back and have the second attempt, still do not find enough bullish momentum enough to get through the barrier, buyers eventually give up and sellers then step in with increased selling pressure taking control of the market. There are some of the double top variations that I've traded from time to time.

1. Regular (Equal high) - This is the typical textbook double top, where the market creates an equal high double rejection, followed by a strong reversal.

2. Distribution top - This variation is something occurs very often, where most traders find it misleading and get hooked into the opposite direction. The second top looks like a 'buildup', breakout sort of situation. Usually the distribution (consolidation) phase will take some time, It is the gradual exhaustion of buyers attempting to breach the resistance zone but fail multiple times. Eventually It results in some rollover/ rotation, reversing downwards as buyers are slowly quitting and big sellers are accumulating their sell orders in a discrete manner. In this specific variation I'd often use the 18 ema & 50ema to identify the gradual shift in momentum, ideally ema crosses to help me with finding the sweet spot for entries.

3. Probe variation - One of the biggest mistakes majority of new traders make is the false concept of 'stop hunting'. As an advice, support or resistance are zones where the majority expects the market to respect, It is NOT a level or specific price point. If you are constantly putting your SL overly tight, you will get stopped out very often simply because you do not understand the purpose of a SL. SL is nothing but a trigger that invalidates your initial thesis, never treat it as a tool to maximize your position size, allow the market to breathe. The concept of fake out/ probe is straightforward, price attempt to violate certain key levels, but there's an immediate force (disagreement) pushing the price back into the range, this is what creates a wick rejection. There are times where sellers do not find enough liquidity to reverse the market, so they simply identify a level where the majority place their stops, hitting that zones before it goes into the opposite direction.

4. Lower high - This happen because the market do not have enough 'steam' to get back to the previous high, It then eventually rejects the previous minor support turns resistance, followed by a complete reversal.

Avoid looking for the perfect setup, flexibility is important.

Trade safe.

Do follow my profile for daily fx forecast & educational content