Trading Smarter, Not Harder: Decoding Institutional MovesThere’s an old saying in trading: “Follow the smart money.” But how do you know where the smart money is going? The answer lies not in guesswork but in data—specifically, the kind of institutional-grade data that most retail traders overlook. If you’re serious about understanding market dynamics, it’s time to dive into the world of **COT (Commitment of Traders) reports** and **options flow data** from the **CME (Chicago Mercantile Exchange)**. These tools are like your personal radar, cutting through the noise to reveal what the big players are doing.

Step 1: Understanding the Big Picture – Why Market Sentiment Matters

Before we zoom into the specifics, let’s start with the basics. Markets are driven by sentiment—the collective mood of participants. When fear dominates, prices fall; when greed takes over, they rise. But here’s the catch: Retail traders often react to sentiment after it’s already priced in. By the time you see a headline screaming “Market Crashes!” or “Record Highs!”, the opportunity has likely passed.

This is where systematic analysis comes in. Instead of relying on emotions or lagging indicators, smart traders use raw data to anticipate shifts in sentiment. And two of the most powerful sources of this data are **COT reports** and **CME options flow**.

Step 2: The Commitment of Traders (COT) Report – Peering Into the Mind of Institutions

The **COT report**, published weekly by the Commodity Futures Trading Commission (CFTC), provides a breakdown of positions held by different types of traders: commercial hedgers, non-commercial speculators (like hedge funds), and small retail traders. Here’s why it’s invaluable:

- **Commercial Hedgers**: These are the “smart money” players—producers and consumers who use futures markets to hedge their risk. For example, a sugar producer might sell futures contracts to lock in prices. Their actions often signal future supply and demand trends.

- **Non-Commercial Speculators**: These are the momentum-driven players who bet on price movements. Tracking their positioning helps identify potential reversals.

- **Small Traders**: Often considered the “dumb money,” their positions frequently coincide with market tops or bottoms.

By systematically analyzing the COT report, you will discover your ability to identify patterns and positioning levels of participants that signal trend reversals or the onset of corrections. Seriously, this will blow your mind! The insights you gain will be so groundbreaking that they will change your trading game forever.

Step 3: Options Flow – Real-Time Insights Into Institutional Activity

While the COT report offers a macro view, **options flow** gives you real-time insights into institutional activity. Directly through CME data feeds, you can track large block trades in options markets. Here’s why this matters:

It will take some time, observation, and comparison with price charts to learn how to uncover insights that lead to trades with a risk-reward ratio of 1:10 or even higher. This isn’t about needing to make options trades; that’s not a requirement. It’s about being able to trade the Forex market much more effectively by using entry points highlighted by options and futures market reports.

For example, over the past few weeks, the USD/JPY pair has been in a downtrend. Long before this happened, major players were accumulating positions in call options on the futures for the yen (which is equivalent to a decline in the yen). We discussed this before the drop occurred (you can easily find those analyses on our page ).

What’s remarkable is that there are many such insights available. For certain instruments (like precious metals and currency pairs), these insights appear with a certain regularity and provide excellent sentiment for opening positions or reversing positions in the opposite direction.

Step 4: Connecting the Dots – From General Trends to Specific Trades

Now that we’ve covered the tools, let’s talk about how to apply them systematically. Imagine you’re analyzing the sugar futures market (a favorite among commodity traders):

1. **Check the COT Report**: In the precious metals market, commercials are often positioned short, hedging against the risk of a decline in the underlying asset's value. When their net position hovers around zero , it typically signals a bullish trend for gold prices in the vast majority of cases.

2. **Analyze Options Flow**: when filtering options by sentiment, there are several key factors to consider:

- Size and value of the option portfolio

- Distance from the central strike (Delta)

- Time to expiration

- Appearance on the rise/fall of the underlying asset

Option portfolios with names such as vertical spread, butterfly, and condor (iVERTICAL SPREAD, IRON FLY/FLY, CONDOR/IRON CONDOR) have predictive sentiment regarding the direction of the asset's price movement. While "naked" options (PUT or CALL options) with above-average volume can signal that the price is encountering a significant obstacle at that level, leading to a potential bounce off that level (support or resistance).

3 **Combine with Retail Positions Analysis**: Look for opportunities to trade against the crowd. If retail sentiment is overwhelmingly bullish, consider a bearish position, and vice versa.

This layered approach ensures you’re not just reacting to headlines but making informed decisions based on valuable data.

Step 5: Why Systematic Analysis Sets You Apart

Here’s the truth: Most traders fail because they rely on intuition rather than evidence. They chase tips, follow social media hype, or get swayed by emotional biases. But markets reward discipline and preparation. By mastering tools like COT reports and options flow, you gain a competitive edge—a deeper understanding market breath! The path of least resistance!

Remember, even seasoned professionals don’t predict every move correctly.However, having a reliable structure allows you to maximize profits from transactions, eliminate noise and unnecessary (questionable) transactions.

Final Thoughts: Your Path to Mastery

If there’s one takeaway from this article, let it be this: The best traders aren’t fortune-tellers; they’re detectives. They piece together clues from multiple sources to form a coherent picture of the market. Start with the big picture (COT reports), zoom into real-time activity (options flow), and then refine your strategy with technical analysis.

So next time you open chart, don’t just look at price. Dive into the reports/data before. Ask questions. Connect the dots. Because in the world of trading, knowledge truly is power.

What’s your experience with COT reports or options flow? Share your thoughts in the comments below—I’d love to hear how you incorporate these tools into your trading routine!

**P.S.** If you found this article helpful, consider bookmarking it for future reference.

Trend Analysis

What Is a Balanced Price Range, and How Can You Use ItWhat Is a Balanced Price Range, and How Can You Use It in Trading?

Balanced Price Ranges (BPRs) offer traders insight into areas where market forces temporarily balance. Understanding how BPRs form and how to use them can help traders identify key zones of interest on the chart. This article explores the details of BPRs, their applications in trading, and how combining them with other tools can refine your market analysis.

What Is a Balanced Price Range (BPR)?

A Balanced Price Range (BPR) is an Inner Circle Trader (ICT) concept used to pinpoint areas on a price chart where market activity reflects a temporary equilibrium between buyers and sellers. These zones, often identified through overlapping Fair Value Gaps (FVGs), highlight price levels where buying and selling pressures have offset each other, creating a balance.

Here’s how it works in a bullish scenario: a rapid price move downward leaves a bearish Fair Value Gap—a price range the market skips over due to strong selling momentum. If the price rises with equal intensity shortly, creating a bullish Fair Value Gap in the opposite direction, the overlapping region between these gaps becomes the BPR. This overlap represents a zone of temporary balance, where the market has effectively “corrected” the earlier imbalance.

BPR zones are not random. They often form in areas of high market interest—perhaps near key support or resistance levels, or after significant news events that cause sharp price movements. Traders look at these ranges because they frequently act as reference points for future price reactions.

The boundaries of an ICT BPR—its high and low—serve as critical levels. These edges often function as dynamic support and resistance, helping traders gauge potential turning points. Furthermore, BPRs can appear across various timeframes, from minute-by-minute to weekly charts.

How Does a Balanced Price Range Form?

Now that we know the idea of the ICT Balanced Price Range, let’s look at how it forms step by step.

1. An Initial Price Imbalance

A BPR begins with a strong price movement in one direction—either up or down. For example, in an overall bearish scenario, buyers initially drive the price up rapidly and leave behind a bullish FVG. This gap reflects an area where the market didn’t fully engage, often skipping over price levels due to overwhelming demand.

2. A Counter-Move Creates an Opposing Gap

After the initial move, the market can shift in the opposite direction with equal momentum. In our example, sellers step in, pushing the price downward. This creates a bearish FVG that partially overlaps with the earlier bullish FVG. These rapid shifts often occur around key events, such as news releases or liquidity grabs, which ignite temporary market imbalances.

3. Overlapping Fair Value Gaps Define the Range

The overlapping portion of the bullish and bearish FVGs is what forms the BPR. This zone represents the price levels where buying and selling forces are temporarily balanced, neutralising the earlier imbalances.

4. Market Consolidation and Testing

Once the BPR is established, the price often consolidates near this range. This zone acts as a magnet for future price action because it’s seen as an area of high market interest, where traders may take note of previous balance. In the example given, a test may precede a bearish reaction.

Combining BPRs With Other ICT Concepts

Balanced Price Ranges in the ICT methodology become even more powerful when combined with other related concepts. By layering multiple tools, traders can refine their analysis and pinpoint high-probability areas for market activity. Here’s how BPRs work with key ICT concepts:

Fair Value Gaps

Since BPRs are defined by overlapping fair value gaps, understanding how to read these gaps adds depth to BPR analysis. FVGs outside the BPR can act as supplementary zones of interest.

Order Blocks

Traders often spot BPRs forming near significant order blocks. When these zones overlap, they highlight areas where institutional activity may have left a footprint, increasing their importance for analysis.

Liquidity Pools

BPRs often align with liquidity zones where stop orders are clustered. Price may gravitate toward these areas before reacting, offering traders insight into potential price reversals or continuations.

Market Structure Shifts

BPRs can reinforce insights gained from market structure shifts. For example, a BPR forming after a break in structure might signal consolidation before the next major move.

Higher Timeframe Confluence

When a BPR aligns with key levels on higher timeframes, it can provide added confidence in the zone’s relevance for price reactions.

How to Use a Balanced Price Range

The Balanced Price Range can provide traders with valuable insights into price behaviour, acting as a reference point for analysing potential market movements. By understanding how these zones function, traders often use them to refine their strategies and enhance their market analysis.

Identifying High-Interest Zones

As BPRs highlight areas where the market found an equilibrium between buyers and sellers, traders typically monitor how the price reacts when revisiting a BPR. For example, if the price approaches the upper or lower boundary of a BPR, it may indicate a potential turning point or a continuation, depending on the market context.

Support and Resistance Dynamics

One common approach is to view BPRs as dynamic support or resistance zones. When the price tests the range, traders often anticipate a reaction. For instance, a rejection from a BPR in a bearish trend may suggest continued downward momentum, while a breach might signal weakening selling pressure.

Contextualising Larger Market Structures

BPRs don’t exist in isolation; they often align with broader market structures. Traders may use them in combination with tools like liquidity zones or order blocks to build a more complete market picture. For instance, if a BPR forms near a major resistance level on a higher timeframe, this confluence could strengthen its importance as a reference point.

Adjusting for Timeframe and Strategy

The relevance of a BPR often depends on the timeframe being analysed. Day traders might focus on intraday BPRs to find potential trading opportunities, while swing traders could look for these zones on higher timeframes, considering them significant levels for long-term moves. Either trader can use lower and higher timeframe BPRs to inform their analysis and entries.

Managing Risk Around BPRs

Traders may incorporate BPRs into their risk management plans, such as by using the boundaries of the range to set stop-loss or take-profit levels. A breach of these levels can indicate a shift in market sentiment, helping traders refine their analysis.

Risks and Considerations When Using BPRs

While BPRs can be a useful tool for analysing price behaviour, they aren’t without limitations. Traders need to approach BPRs with a clear understanding of their potential pitfalls. Here are some key considerations:

- Not Predictive: BPRs don’t guarantee future price movement. While they highlight zones of interest, traders must combine them with broader market analysis to avoid over-reliance.

- Subjectivity: Identifying BPRs can sometimes be subjective. What one trader sees as a balanced range might not align with another’s interpretation, especially on different timeframes.

- Timeframe Sensitivity: A BPR on a lower timeframe may lose significance in the broader market context. Conversely, higher timeframe BPRs may lag behind fast-moving markets.

- False Breakouts: Price can move beyond a BPR briefly before reversing, creating potential traps for traders relying solely on breakout strategies.

- Market Context Matters: BPRs are analysed alongside market conditions like volatility, news events, or broader trends. Ignoring these factors can reduce their reliability.

The Bottom Line

Understanding Balanced Price Ranges can help traders interpret key market zones and improve their analysis. By combining BPRs with other tools and strategies, traders gain deeper insights into price movements.

FAQ

What Is the ICT Price Range?

The ICT price range refers to specific price levels or zones highlighted in the Inner Circle Trader (ICT) methodology. These ranges often represent areas of interest in the market, such as liquidity pools, fair value gaps, or balanced price ranges. Traders use ICT price ranges to analyse price movement, identify potential reaction points, and refine their trading strategies.

What Is the Meaning of a Balanced Price?

Balanced price describes a market state where buying and selling pressures are in equilibrium. It typically forms in areas where overlapping fair value gaps exist, reflecting zones where previous imbalances have corrected. These areas can act as key levels for future price reactions.

What Is an Optimal Trade Entry in a Balanced Price Range?

Optimal trade entry in a balanced price range refers to identifying high-probability entry points within or near a BPR. Traders often look for price reactions at the range’s boundaries, combining BPR analysis with other ICT tools, such as order blocks or liquidity zones, to refine their approach.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Elliott Wave Analysis of DLF: A Technical PerspectiveHello friends, let's analyze the DLF chart on a daily time frame. Currently, we're observing a corrective phase, where the stock has completed a flat correction pattern (A-B-C) with a 3-3-5 structure. Following this correction, we've seen a significant drop, accompanied by a strong double divergence in the RSI indicator. Where Fibonacci Retracement of last long Rally on Weekly is near 50% - 55% which is less than 61.8% should consider as a Healthy Retracement

As the price is currently moving upwards, completing wave counts, a breakout above the downward trend line would increase our conviction in the analysis.

This analysis is for educational purposes only and not a tip or advisory. If the price breaks out and stays above the trend line while maintaining the low of 601, we can expect further upside momentum. However, 601 would remain a crucial invalidation level, and a breakdown below it would require us to reassess our wave counts.

Key points:

1. DLF chart analysis on daily time frame

2. Flat correction pattern (A-B-C) with 3-3-5 structure

3. Healthy Retracement

4. Strong double divergence in RSI indicator

5. Breakout above trend line increases conviction (Which is pending yet)

6. 601 as invalidation level

Please note that this is a Educational technical analysis post and not a recommendation to buy or sell.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

What to consider when trading...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost".

Have a nice day today.

-------------------------------------

This is my personal opinion, so it may differ from yours.

Please keep this in mind.

-

So, how should I proceed with day trading?

When trading day trading, the first thing to consider is the trading volume.

Coins (tokens) with low trading volume should be avoided because volatility can occur in an instant, making it difficult to respond quickly and likely to result in losses.

Therefore, if possible, it is recommended to choose coins (tokens) with high trading volume.

The next thing to consider is the price of the coin (token).

If the price of the coin (token) becomes too high or too low, even if you sell it for profit, you may incur a loss.

Therefore, when trading a coin (token) with a very high price, you should trade with a longer time frame.

In other words, the increase should be high.

When trading a coin (token) with a very low price, you need to be persistent.

This is because the amount you want to trade is large, so the rise or fall may be slow.

The next thing to consider is the size of your trading funds.

If your trading funds are too small, you may not be able to enjoy trading because you will earn too little profit compared to the stress of trading.

If you lose the fun of trading like this, you will have difficulty continuing to trade or you will likely leave the investment market, so you need to be careful.

If you set the trading fund size too high, you can suffer a big loss with one mistake, so you must set a stop loss point and keep it.

You can find out how much trading fund size is right for you by looking at your psychological state when you trade.

If you think you are trading too boldly, it is better to think that the trading fund size is small and increase it little by little.

If you feel extremely anxious when you trade and incur a loss, it is better to reduce the trading fund size little by little.

-

(BTCUSDT 30m chart)

Considering the above considerations (trading volume, price, trading fund size), you should continuously observe the selected coin (token) chart to check the movement at the support and resistance points.

To do this, you need to check whether there is support at the support and resistance points drawn on the 1M, 1W, and 1D charts when you meet the HA-Low and HA-High indicators, which can be the basis for starting a transaction, or when you have a trading strategy.

Usually, when the Trend Cloud indicator shows an upward trend while receiving support near the HA-Low indicator and rising, there is a high possibility of rising.

Therefore, you should consider whether to buy when the HA-Low indicator shows support.

And, when the HA-High indicator touches and falls, there is a high possibility of falling when the Trend Cloud indicator shows a downward trend.

Therefore, the area near the HA-High indicator corresponds to the first selling section.

In this way, you can conduct transactions within the sideways section trading within the HA-Low ~ HA-High section.

Then, when there is a movement that falls below the HA-Low indicator or rises above the HA-High indicator, you can conduct a transaction according to the trend.

Therefore, split trading is essential.

The basics of split trading are to sell half when you make a profit and set the stop loss at the principal price for the remaining half.

-

This is something everyone knows, but it is not easy to follow.

Also, there are times when it is difficult to decide what to use as the standard for trading.

In such cases, as I mentioned, I recommend that you choose a coin (token) considering the trading volume, price, and trading fund size and continuously check the movement of the chart.

Even if you are not familiar with chart analysis, if you continuously look at the chart, there is a possibility that you will see movement.

However, you need prior knowledge on how to set the stop loss point.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Understanding Our Approach: High-Probability Reversals Understanding Our Approach: High-Probability Reversals with Price & Time Analysis

Hello Fellow Traders!

We often get asked about the core principles behind our analysis here on TradingView. Today, we want to share a key part of our methodology: how we combine Price Analysis and Time Analysis to pinpoint potentially high-probability reversal signals in the market.

Our goal isn't just about finding any setup, but finding setups where the odds seem stacked more favorably for a potential trend change. We do this by looking for confluence – where different factors align.

1. Price Analysis: Finding Where the Market Might Turn

What it is: This is about identifying significant price levels on the chart. Think of these as important zones, not just single lines.

How we use it:

Support & Resistance: We look for historical areas where price has repeatedly bounced off (support) or struggled to break through (resistance). The stronger and more tested the level, the more significant it becomes.

Price Action Clues: We watch how price behaves when it reaches these key levels. Are there strong rejection candles (like pin bars or engulfing patterns)? Is momentum slowing down? These clues tell us if buyers or sellers are stepping in or losing control.

2. Time Analysis: Finding When the Market Might Turn

What it is: This adds the dimension of time to our price analysis. Markets often move in cycles or react around specific time points.

How we use it:

Timing Cycles: We look for potential cycles or rhythmic patterns in price swings. Sometimes, trends tend to exhaust themselves after a certain duration.

Time Convergence: We pay close attention when price approaches a key Price Level (from step

1) around a potentially significant Time point (e.g., end of a known cycle, specific session timing, alignment with time-based indicators if used).

The Synergy: Combining Price & Time for High-Probability Signals

The real power in our approach comes when Price and Time align.

Imagine price reaching a major historical resistance level (Price Analysis).

Now, imagine this happens exactly when a known time cycle is expected to complete (Time Analysis).

This convergence signals a potentially higher probability reversal point than if only one factor was present. It tells us that where the market is and when it got there are both significant.

How You Can Apply This Concept:

Identify Key Levels: Mark major support and resistance zones on your charts.

Observe Time: Become aware of market timing – session opens/closes, news events, or potential cyclical patterns you observe.

Look for Confluence: Wait for price to test a strong level around a potentially significant time point.

Seek Confirmation: Always look for confirmation signals (like candlestick patterns or divergence) at these points of confluence before considering any action.

Important Note: Trading involves significant risk. This methodology aims to identify higher probability setups, but no method guarantees success. Always use proper risk management and conduct your own analysis before making any trading decisions. This is shared for educational purposes.

We hope this gives you a clearer insight into our analysis process! Follow us here on TradingView to see how we apply these concepts in our regular updates. Feel free to ask questions in the comments – we're all here to learn together.

Want to Level Up?

Join Shunya Trade’s Mentoring Program to master these strategies and sharpen your technical analysis skills.

Trade safely!

-----------------------------------------------------------------------------------------------

Here few Historical chart study's

-----------------------------------------------------------------------------------------------

PriceAnalysis, TimeAnalysis, PriceAction, TechnicalAnalysis, SupportResistance, CandlestickPatterns, ChartPatterns, MarketStructure, TimeCycles, MarketTiming, TradingSignals, ReversalTrading, TradingStrategy, MarketAnalysis, TradingView, Forex, Stocks, Crypto, Trading, Investing, DayTrading, SwingTrading, MarketCycles, FibonacciTime, Gann, TradingLevels, PricePatterns

EUR/USD- Elliott Wave + Smart Money Concepts (SMC)SMC Insight

Supply Zone Marked: Between 1.1500 – 1.2000.

Price is heading toward the supply zone.

On the right visual, schematic shows:

Liquidity build-up below equal highs.

Possible liquidity grab just above the supply zone.

Expect reaction or reversal around that supply.

---

Trade Bias

Short-term: Bullish (momentum and structure are up).

Long-term: Watch for reaction at the 1.1500–1.2000 zone. This could be a major sell zone if price shows rejection/mitigation signs

The Ultimate Guide to Smart Money ReversalsLet’s cut to it. Most retail traders get caught chasing moves that were never meant for them. They’re entering late, reacting to structure breaks without context, or fading moves without understanding what’s really happening behind the price.

If you're trying to trade like smart money on the reversal, at the turn then you need to know when the game is flipping. That’s where the Market Structure Shift (MSS) comes in. But not just any MSS. I'm talking about MSS that follow a liquidity sweep and are driven by real displacementnot weak candles, not in consolidation. Real intent. Real shift.

Here’s how I approach it.

What Actually Counts as a Market Structure Shift?

Everyone talks about market structure higher highs, lower lows, etc. But structure breaks alone don’t mean anything. A valid MSS isn’t just about breaking a swing point. It’s why it broke and how it broke that matters.

I only consider a shift valid when three things are in place:

Liquidity has been taken (above a high or below a low).

The shift is caused by a displacement candle that clearly shows urgency.

The move happens with strength, not during chop or consolidation.

If you don’t have all three, it’s just noise.

Liquidity Comes First

Everything starts with a liquidity sweep. That’s the trap.

Price has to reach into a pool of liquidity usually above equal highs, clean swing highs, or below clean lows to grab those orders, and reject. That rejection is key. It shows smart money is offloading positions into retail breakouts or stop hunts.

Without a sweep, I don’t care what breaks. No liquidity = no reversal setup.

So the first thing I do is mark out obvious liquidity levels. Equal highs, equal lows, trendline touches anywhere retail is likely to have their stops sitting. That’s where the fuel is.

Then Comes Displacement

After the sweep, I want to see displacement a sharp, aggressive move in the opposite direction.

Not a weak pullback. Not a slow grind. A real candle that shows intent.

Displacement is always obvious. You’ll get a clean candle, often engulfing multiple others, that breaks structure and leaves behind an imbalance what we call a Fair Value Gap (FVG). That imbalance is the signature of smart money hitting the market hard enough to leave a gap in the order flow.

If the candle’s weak, or if it happens during consolidation, I skip it. Displacement is what separates real reversals from fakeouts.

Here is a clean example of what it should look like.

Confirming the Shift

Once displacement confirms intent, I check if it actually broke structure.

That means:

In an uptrend, I want to see price break a previous higher low after sweeping a high.

In a downtrend, I want price to break a lower high after sweeping a low.

When that happens, that’s your MSS. Price has grabbed liquidity, shown displacement, and broken a key point in the structure. At that point, we’ve got a confirmed shift in control.

Entries, Stops, and Targets

Here’s how I trade it.

After the MSS, I wait for price to pull back into the origin of the move. Usually, that’s going to be one of two things:

The Fair Value Gap (imbalance left by the displacement candle)

Or the MSS line itself (Shown on the example)

Once price comes back into that zone, that’s where I’m interested in getting in.

Stop loss always goes just above the high (for shorts) or below the low (for longs) of the displacement candle that caused the MSS. You’re giving it room to breathe, but keeping it tight enough to protect capital.

Targets are straightforward: go for the next pool of liquidity. That means swing lows (sell-side) if you’re short, or swing highs (buy-side) if you’re long. That’s where price is most likely to be drawn next.

A Clean Bearish Example

Let’s say price is trending up, putting in higher highs and higher lows. Then it takes out a recent swing high liquidity swept.

Immediately after that, a strong bearish candle drops and breaks the most recent higher low. That candle leaves an imbalance behind—perfect.

Now I’ve got:

✅ Liquidity sweep

✅ Displacement

✅ Break of structure

I mark out the FVG / MSS line, wait for price to retrace back into it, and enter the short. My stop goes above the displacement candle high. My target? The next clean swing low. That's the next spot where stops are resting where the market is drawn.

A Few Things to Watch Out For

This method works, but only if you’re strict about the rules.

Don’t take MSS setups in consolidation. Wait for clean, impulsive breaks.

If the shift happens without displacement or imbalance, skip it. It’s not clean.

Be realistic with stops. Tight is good, but don’t choke the trade. Give it the structure it needs.

The biggest mistake I see? Traders jump in too early trying to front-run the shift before displacement confirms it. Let the story unfold. Wait for the sweep. Wait for the candle that slaps the market and breaks structure. That’s your edge.

As shown here, the first "MSS" is invalid and not the A+ setup you're looking for.

Final Thoughts

Trading smart money reversals is about reading intent. You’re not just looking at price, you’re understanding why it moved the way it did.

When you combine a liquidity grab, displacement, and a break in structure, you're aligning with institutional activity. You're trading at the turn when smart money flips the script and leaves everyone else chasing.

This isn’t about trading every break. It’s about knowing which breaks matter.

Keep it clean. Stay patient. Follow the flow.

__________________________________________

Thanks for your support!

If you found this guide helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Supply and Demand by Thapelo Consolidation and Expansion

The markets either do one of two things: Price either consolidates or expands.

Consolidation: a period in the market where price is moving calm which moves in a range known as the dealing range. We will be able to identify a clear high and low to this range.

You have probably heard of the term range bound, ranging, or consolidating. This means that price is typically staying in one area, and just moving sideways, rather than up or down.

The range can be tight (meaning a spread of only a few pounds), or the range can be loose (meaning a spread of hundreds of thousands of pounds from range high to low. This partly will come down to the timeframe implemented.

Expansion: a period in the market where price is moving aggressively in one direction or the other. We will see an impulsive move to the upside, or an impulsive move to the downside, where price will give us large candle bodies or wicks. This is known as expansion.

Do You Know the Difference Between an Indicator and a Strategy?A lot of traders jump into Pine Script or apply a script on TradingView without understanding one key difference:

Indicators and Strategies are not the same — especially when it comes to real-time performance and backtesting.

---

What’s the Key Difference?

Indicators

Indicators are visual tools designed to help you analyze price action in real time . They do not track trade performance or simulate trades automatically.

You can use them to:

- Generate signals

- Stack confluences

- Set custom alerts

- Overlay custom visuals on charts

Best for: Chart analysis, signal confirmation, and manual or semi-automated alerts.

---

Strategies

Strategies are built for backtesting . They simulate how your trade logic would have performed historically, using `strategy.entry`, `strategy.exit`, and related functions.

They automatically calculate:

- Hypothetical P&L

- Win/loss ratio

- Drawdowns

Best for: Validating trade logic, optimizing entries and exits, performance tracking.

---

But Here’s the Catch

Many traders assume that once a strategy backtest looks good, it will behave exactly the same in live trading. This assumption can lead to poor decision-making.

❌ Why Forward Testing Isn't Perfect

When you set alerts based on a strategy, you're asking a backtest engine to behave like a live trading engine — and that’s not what it was designed for.

TradingView strategies:

- Only execute on candle close

- Do not simulate intrabar price action

- Do not account for slippage

- Do not reflect real-time market volatility

So:

- Your strategy alert may fire late compared to actual price movement

- Your SL/TP may be hit within a candle, but the strategy won’t know until close

- You may see better backtest results than what happens live

---

Takeaway

If you're using strategies with alerts, it’s critical to understand these constraints:

TradingView’s strategy engine is optimized for historical testing, not for real-time execution. It provides insight into the validity of your logic — but it’s not a replacement for a live execution engine.

Best Practice Recommendations:

- Always forward-test on a demo or paper account first

- Monitor how alerts perform in real-time

- Be ready to adjust parameters based on your asset and timeframe

If you need better responsiveness or real-time adaptability, consider using indicators to generate your alerts. Indicators react to price in real time and are often more suitable for live market conditions.

---

Final Note

Some strategies are built with these limitations in mind. They can still be useful in real-time trading as long as you're aware of how they work.

Transparency is key. Backtesting is a guide, not a guarantee.

Trade smart, stay informed.

Feel free to reach out if you have questions or insights to share!

Bitcoin, Gold, S&P 500 and InflationBitcoin, Gold, S&P 500 and Inflation

This is a 3 year view (2022 - 2025 to date), 1 week comparison chart of Bitcoin, Gold, S&P 500 and US cumulative rate of inflation. The most interesting part of this analysis to me is that the S&P 500 bounced off the cumulative rate of inflation slope. I did not know that until after I set up the comparison.

Gold = +80%

BTCUSD = +50%

S&P 500 = +19%

US cumulative rate of inflation:

2022 = +6.5%

2023 = +3.4%

2024 = +2.9%

3 yr = +10.8%

2025 = +2.4% forecast

Best Technical Indicator to Identify Order Block & Imbalance

Your ability to correctly identify Order Blocks on a price chart is essential for profitable trading Smart Money Concept.

In this article, I will show you a great technical indicator that will help you to spot Order Blocks on any financial market.

First, in brief, let me give you my definition of Order Block.

The problem is that in SMC trading there is no one single definition of that and many traders interpret it differently.

To me, an Order Block is a specific zone on a chart from where a strong price movement initiates and where a significant imbalance between supply and demand occurs .

This imbalance should strictly originate from a liquidity zone.

That definition implies that in order to identify an Order Block zone, one should learn to properly identify the imbalance and liquidity zones.

And again, there is no precise definition of an imbalance on a price chart. To me, a bullish imbalance is a formation of a bullish engulfing candle - the one that engulfs a range of previous bearish candle with its body.

Above is the example of a valid Order Block on GBPUSD.

A bearish imbalance is a formation of a bearish engulfing candle - the one that engulfs a range of a previous bullish candle with its body.

Above, you can see the example of an Order Block on USDCAD, based on a bearish imbalance.

There is one technical indicator that will help you to recognize such Order Blocks. It is called " All Candlestick Patterns" on TradingView.

Open settings of the indicator and make it show ONLY Engulfing Candles and choose "No Detection" in "Detect Trends Based on".

After that, hide the indicator and first, Identify the liquidity zones on a chart and wait for a test of one of these zones.

Here is a test of a liquidity zone on NZDUSD on an hourly time frame.

After that, turn on the indicator, and wait for its signal.

You can see that after some time, the price formed a bullish imbalance with a bullish engulfing candle. The indicator highlight that candle.

The Order Block zone will be based on the lowest low of 2 candles and the high of a bearish candle preceding the imbalance.

One more example. We see a test of a significant liquidity zone on EURAUD on a 4H time frame.

We turn on the indicator and look for a signal.

A bearish imbalance is formed and the indicator immediately notifies us.

An Order Block Zone in that case will be the area based on the highest high of 2 candles and the low of a bullish candle preceding the imbalance .

Of course, there will be the rare cases when the indicator will miss the imbalances. But while you are learning to recognize Order Blocks, this indicator will definitely help you a lot!

Thank you for reading!

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trendlines and broken trendlines resultsTrendlines are one of the major supports or resistances and on this Bitcoin chart we can see few examples which price react well to them and start to pump from green trendlines and sometimes dump from red trendlines and it is easy to draw one trendline ----> simple like drawing support line this time try to find support line which is Diagonal and one or two touch with this trendline you can find next support which is third touch and you can set your buy there like below example:

also sometimes trendline broke and their support turn to resistance and after retest of breakout you can enter sell like example:

there are so many rules about trendline like when it can break or after how many touches trendline lose it's power and ... we can discuss in comments more about them so ask any questions there and lets discuss.

Also currently if we have a valid breakout of red trendline to the upside for Bitcoin price can easily pump to 90K$ at least.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

The Charts Wall Street Watches – And Why Crypto Should Too📉 Crisis or Rotation? Understanding Bonds Before the Bitcoin Reveal 🔍

Hi everyone 👋

Before we dive into the next major Bitcoin post (the 'Bitcoin Reveal' is coming up, yes!), let's take a moment to unpack something critical most crypto traders overlook — the world of bonds .

Why does this matter? Because the bond market often signals risk... before crypto even reacts.

We're going to walk through 4 charts I've posted recently — not the usual BTC or altcoin setups, but key pieces of the credit puzzle . So here’s a simple breakdown:

1️⃣ BKLN – Leveraged Loans = Floating Risk 🟠

These are loans to risky companies with floating interest rates.

When rates go up and liquidity is flowing, these do well.

But when the economy weakens? They’re often the first to fall.

📌 Key level: $20.31

This level held in COVID (2020), the 2022 bank scare... and now again in 2025.

⚠️ Watch for a breakdown here = real credit stress.

Right now? Concerned, but no panic.

2️⃣ HYG – Junk Bonds = Risk Appetite Tracker 🔴

Junk bonds are fixed-rate debt from companies with poor credit.

They pay high interest — if they survive.

When HYG bounces, it means investors still want risk.

📌 Fear line: 75.72

Held in 2008, 2020 (COVID), and again now.

Price rebounded — suggesting risk appetite is trying to return .

3️⃣ LQD – Investment Grade = Quality Credit 💼

LQD holds bonds from blue-chip companies like Apple, Microsoft, Johnson & Johnson.

These are lower-risk and seen as safer during stress.

📊 Chart still shows an ascending structure since 2003, with recent pressure on support.

📌 Support: 103.81

Holding well. Rebound looks solid.

Unless we break 100, this says: "No panic here."

4️⃣ TLT – U.S. Treasuries = Trust in the Government 🇺🇸

This is the BIG one.

TLT = Long-term U.S. bonds (20+ yrs) = safe haven assets .

But since 2022, that trust has been visibly broken .

A key trendline going back to 2004 was lost — and is now resistance.

📉 Price is in a clear descending channel .

📌 My expectation: One final flush to $76 or even $71–68

…before a potential macro reversal toward $112–115

🔍 The Big Picture – What Are Bonds Telling Us?

| Chart | Risk Level | Signal |

|--------|------------|--------|

| BKLN | High | Credit stress rising, but support holding |

| HYG | High | Risk appetite bouncing at a key level |

| LQD | Medium | Rotation into quality, no panic |

| TLT | Low | Trust in Treasuries fading, support being tested |

If BKLN breaks $20...

If HYG fails to hold 75.72...

If LQD dips under 100...

If TLT falls to all-time lows...

That’s your crisis signal .

Until then — the system is still rotating, not collapsing.

So, Should We Panic? 🧠

Not yet.

But we’re watching closely.

Next: We add Bitcoin to the chart.

Because if the traditional system starts breaking... 🟧 Bitcoin is the alternative.

One Love,

The FXPROFESSOR 💙

📌 Next Post:

BTC vs Treasuries – The Inversion Nobody Saw Coming

Because if the system is shaking… Bitcoin is Plan B.

Stay ready.

The Art of Doing Nothing: Why Tape Watchers Beat Impulse TradersLess is more. In this Idea we dig into the trading philosophy where less action means more traction. It’s the dispute between the chart readers and the button clickers.

Some swear by this: the smartest trading strategy sometimes involves sitting on your hands and embracing the sweet, underrated beauty of doing absolutely nothing. The Italians figured this out ages ago—they call it Dolce Far Niente , the sweetness of doing nothing.

But can a trader really get away with just kicking back and waiting while sipping espresso (or the mezcal martini type if you got your Patagonia vest)? Actually, yes—and it often pays better than impulsive clicks.

Let’s talk about why chart-watching and tape-reading often outsmart trigger-happy trading.

🤷♂️ Doing Nothing Is Harder Than It Looks

First off, let’s acknowledge something painfully true: not trading is tough. Seriously tough. Trading never sleeps, notifications flash at you like slot machines. Headlines constantly scream about massive opportunities you're missing — Tesla's NASDAQ:TSLA latest rally or gold’s OANDA:XAUUSD record-breaking surge powered by tariff jitters.

The pressure to click, buy, sell, or do something—anything!—can be overwhelming. It’s why there’s something called a heatmap — because it’s hot, hot, hot!

But here’s the secret: successful traders know that impulse trading isn't a strategy; it's just financial caffeine. Instead, chart watchers—the cool-headed crowd who sit back, patiently observing price movements, market structure, and volume flow—tend to win the marathon, while impulse traders burn out in the sprint.

🌸 The Dolce Far Niente Method

Ever watched an old Italian movie? There's usually a scene featuring someone lounging effortlessly, soaking in life’s beauty without lifting a finger—this is Dolce Far Niente.

In trading terms, it’s the act of patiently waiting, savoring the calm between trades, watching your charts like an old-school tape reader that would make Jesse Livermore proud. (“A prudent speculator never argues with the tape. Markets are never wrong, opinions often are.”)

A good setup is worth the wait. Instead of diving into trades, relax, observe, and let opportunities come to you. Because the reality is, not every candlestick needs your immediate response. Markets don’t reward hyperactivity; they reward patience and calculated action.

🤩 Tape Reading vs. Trading: The Difference Between Winning and Clicking

The lost art of tape reading, as hedge fund guru Paul Tudor Jones calls it, is about carefully tracking price action, volume, and market sentiment. It’s far less exciting than rapid-fire day trading but potentially more rewarding.

“When it comes to trading macro,” Tudor Jones says, “you cannot rely solely on fundamentals; you have to be a tape reader, which is something of a lost art form.

Learning when to sit quietly (doing nothing) and when to strike decisively is the hallmark of trading mastery.

✋ Real Traders Don’t Chase—They Anticipate

Waiting isn’t passive. It’s actually active restraint—a calculated choice to do nothing until the odds tip decidedly in your favor. Let’s be clear: chart watchers aren’t asleep at the wheel; they're carefully steering clear of trouble until clear setups emerge.

The result? Better entry points, clearer risk-reward ratios, and fewer sleepless nights worrying about impulsive mistakes.

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!,’ ignore them.” Bonus points if you know who said that!

So, next time your finger hovers over that "buy" or "sell" button, ask yourself if you’re trading strategically or just for the dopamine hit. Remember the Italian saying, take a breath, embrace the tranquility, and let patience become your trading superpower.

Let us know in the comments: Are you team “click less, wait more,” or do you find yourself riding the impulse wave fairly frequently?

Breakout trading

(Title)

Breakout trading starts with finding support and resistance points

-------------------------------

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I will take the time to talk about breakout trading.

This is my opinion, so the content may be lacking.

The reason I did not explain what other people say with examples is because trading is a psychological battle.

Most of the content in books or on the Internet is explained with patterns.

However, it is not easy to find patterns when checking the movement of a real-time chart.

Therefore, I think it is more important to understand why such movements occur than to explain them with patterns.

Therefore, I think it is better to create a trading strategy by finding support and resistance points and checking whether or not they are supported by the support and resistance points rather than memorizing patterns.

Breakout trading refers to starting a transaction after checking whether there is support at a point or section when the price rises above a certain point or section, and there is a possibility of a larger rise.

If you do a breakout trade incorrectly, you may end up buying at a high point, which could result in a large loss, so it is recommended to always keep a stop loss point when trading.

In order to reduce the stop loss, you need to make an effort to lower the average purchase price by selling in installments when the price rises after purchasing and buying in installments when the price falls again.

Therefore, the stop loss point is when it is beyond the range you can handle.

-

Let's take the BTCUSDT 1D chart as an example.

It has fallen after renewing the ATH.

Looking at the current price position, it feels like it will fall further.

However, if the price rises to around the HA-Low indicator on the 1D chart, that is, around 89294.25, you will feel like it will turn into an uptrend.

Even if you think that you won't feel that way now, you will feel that way after it rises.

Therefore, the most important thing in breakout trading is to find important support and resistance points.

To find support and resistance points, you need to basically understand candles.

Any book or video about candles will do.

I recommend that you don't try to memorize the content in it, but read or watch it repeatedly several times.

In my case, after watching the video about candles about 3 times, my understanding of the chart became easier.

The reason for finding support and resistance points is to select a trading point.

What you need to find support and resistance is a horizontal line.

It is not easy to start trading with chart tools that are not horizontal lines but diagonal lines or curves.

The reason is that when you try to start a trade, you are more likely to miss the timing because your psychological state is added.

-

You can see that the uptrend started when it broke through the 73072.41 point.

Therefore, you can see that it is possible that the uptrend will start when it breaks through the 106133.74 point this time as well.

However, in this case, since it is rising while renewing the ATH, it is a point where it is thought to be difficult to actually start trading.

In other words, it is likely that you will be reluctant to trade because it is thought to be a high point.

Therefore, as I mentioned earlier, the actual breakout trade will be conducted when it breaks through the 89294.25 point.

Then, even if it rises to around the 106133.74 point, you will be more likely to respond stably without feeling much psychological anxiety.

-

However, there is one problem.

That is, the StochRSI indicator is currently in the overbought zone.

Therefore, when it rises near the 89294.25 point and confirms support, the StochRSI indicator should show a downward trend from the overbought zone.

Otherwise, the 89294.25 point is likely to act as a resistance point.

Even if the market is messy and difficult to predict, you should not be too busy finding support and resistance points.

After all, you need to have a standard for creating a trading strategy to start trading.

It is better to create a trading strategy and respond at the support and resistance points you have selected if possible.

Even if you suffer a loss, if you continue to trade, you will be able to better organize the support and resistance points.

For reference, the indicators that can create a trading strategy on my chart are the HA-Low and HA-High indicators.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Inversion Fair Value Gaps (IFVGs) - A Deep Dive Trading GuideIntroduction

Inversion Fair Value Gaps (IFVGs) are an advanced price action concept rooted in Smart Money theory. Unlike standard Fair Value Gaps (FVGs), IFVGs consider the idea of price revisiting inefficiencies from an inverse perspective. When price "respects" a previously violated gap from the opposite side, it creates a powerful confluence for entries or exits.

This guide will cover:

- What an IFVG is

- How it differs from traditional FVGs

- Market context for IFVG setups

- How to trade them effectively

- Real chart examples for clarity

---

What is an IFVG?

An Inversion Fair Value Gap (IFVG) occurs when price trades through a traditional Fair Value Gap and later returns to that area, but instead of continuing in the original direction, it uses the gap as a support or resistance from the other side.

Standard FVG vs. IFVG:

- FVG: Price creates a gap (imbalance), and we expect a return to the gap for mitigation.

- IFVG: Price violates the FVG, but instead of invalidation, it respects it from the other side.

Example Logic: A bullish FVG is formed -> price trades through it -> later, price revisits the FVG from below and uses it as resistance.

---

Structure and Market Context

Understanding structure is key when trading IFVGs. Price must break structure convincingly through a Fair Value Gap. The gap then acts as an inversion zone for future reactions.

Ideal Market Conditions for IFVGs:

1. Market is trending or has recently had a strong impulsive move.

2. A Fair Value Gap is created and violated with displacement .

3. Price retraces back to the FVG from the opposite side .

4. The gap holds as support/resistance, indicating smart money has respected the zone.

---

Types of IFVGs

1. Bullish IFVG: Price trades up through a bearish FVG and later uses it as support.

2. Bearish IFVG: Price trades down through a bullish FVG and later uses it as resistance.

Note: The best IFVGs are often aligned with Order Blocks, liquidity levels, or SMT divergences.

---

How to Trade IFVGs

1. Identify a clear Fair Value Gap in a trending market.

2. Wait for price to break through the FVG with momentum .

3. Mark the original FVG zone on your chart.

4. Monitor for price to revisit the zone from the other side.

5. Look for reaction + market structure shift on lower timeframes.

6. Enter trade with a clear stop loss just beyond the IFVG.

Entry Confluences:

- SMT divergence

- Order Block inside or near the IFVG

- Breaker Blocks

- Time of day (e.g., NY open)

---

Refined Entries & Risk Management

Once the IFVG is identified and price begins to react, refine entries using:

- Lower timeframe market structure shift

- Liquidity sweeps just before tapping the zone

- Candle closures showing rejection

Risk Management Tips:

- Set stop loss just beyond the IFVG opposite wick

- Use partials at 1:2 RR and scale out based on structure

- Don’t chase missed entries—wait for clean setups

---

Common Mistakes to Avoid

- Confusing IFVG with invalidated FVGs

- Trading them in low volume or choppy conditions

- Ignoring market context or structure shifts

- Blindly entering on first touch without confirmation

Tip: Let price prove the level—wait for reaction, not prediction.

---

Final Thoughts

IFVGs are an advanced but powerful tool when used with precision. They highlight how Smart Money uses inefficiencies in both directions, and when combined with other concepts, they can form sniper-like entries.

Practice finding IFVGs on historical charts. Combine them with SMT divergences, OBs, and market structure, and soon you’ll start seeing the market through Smart Money eyes.

Happy Trading!

How Momentum Divergence Reveals Hidden Market Strength and WeaknMost traders watch price action closely: candlesticks, moving averages, trendlines. But there’s a deeper, less obvious layer of information that often signals shifts in direction before price confirms it: momentum.

📌 Quick overview – what you'll learn:

What momentum divergence is (clearly explained)

How it helps predict potential trend shifts

Practical ways to spot and trade divergences

📈 Price vs Momentum: They're Not the Same!

Momentum doesn't simply track price direction. Instead, it measures the strength behind price movements.

Rising prices, falling momentum often signals upcoming bearish reversals.

Falling prices, rising momentum often hints at bullish reversals building beneath the surface.

These subtle divergences are powerful because they reveal hidden market shifts before everyone else notices them.

⚠️ How to Spot Momentum Divergence (Simple Steps):

Step-by-step:

- Find clear price swings:

Clearly defined highs/lows on your chart.

- Check momentum indicators (RSI, MACD, CCI, etc.):

Does the indicator agree or disagree with the price action?

- Spot divergence:

Bullish divergence: Price makes lower lows, indicator shows higher lows.

Bearish divergence: Price makes higher highs, indicator shows lower highs.

- Confirmation:

Always wait for price confirmation like a reversal candle or break of a trendline.

🔥 Why Momentum Divergence Works:

Divergence highlights hidden accumulation or distribution by smart money.

Helps you anticipate reversals before price confirms.

Filters out weak moves and helps you avoid fake breakouts.

📊 Real Example (XAUUSD – April 2025):

Recently in Gold:

Price was dropping steadily, reaching new lows.

Meanwhile, RSI showed clear higher lows – classic bullish divergence.

Result: Price exploded significantly shortly after momentum divergence appeared clearly.

🧠 Trading Tips to Remember:

Divergence signals are stronger near key support/resistance zones.

Use momentum divergence with your existing strategy for confirmation, not isolation.

Always define your risk clearly (set stops above/below recent highs/lows).

🚩 Common Pitfalls to Avoid:

Trading divergence without confirmation: always wait for the market to show its hand.

Ignoring the bigger picture: check higher timeframes for stronger signals.

Overtrading: not every divergence leads to a reversal; quality beats quantity.

🚀 Your Action Plan for Next Week:

Pick one momentum indicator and identify at least 3 divergences on your favorite assets.

Monitor how they play out.

Note down what works best in your trading journal.

💬 Question for you:

What’s your go-to momentum indicator when spotting divergence? RSI, MACD, CCI, or something else? Drop a comment below!

Happy trading!

TrendGo Team

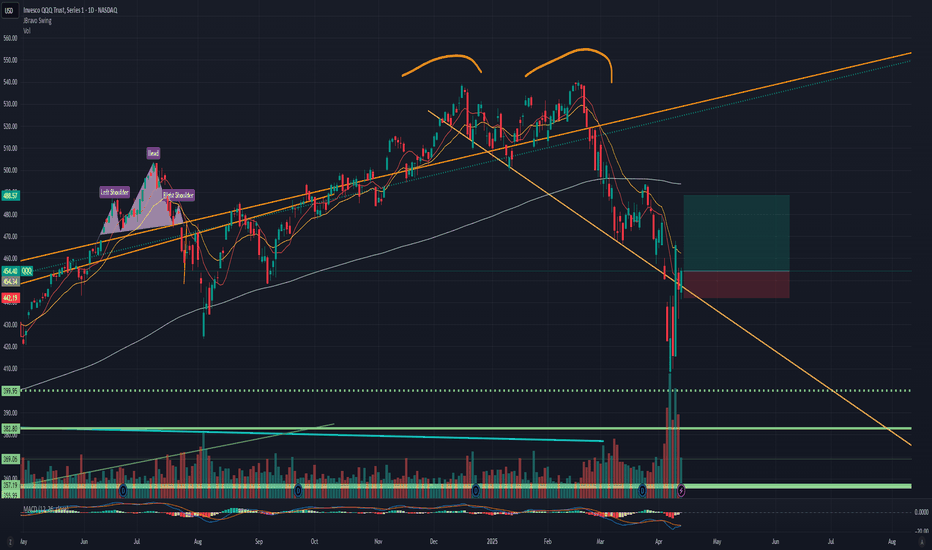

Instructional for my brother. IThis is a bad swing trade, it is under the 180 day moving average. You wouldn't enter this using a swing trading system alone, its more advanced to identify. But you can see the yellow line I drew, that is strong resistance. That means the price don't want to go below that line.

I put what a trade would look like on it. You see how in this trade there is much more green than red? That is a good risk to reward ration.

Now here is CBOE. See how the green and red of this projected trade are nearly equal? Yeah, that is a bad risk to reward ration. At a 1:1 (that is for each dollar you can gain, you are risking) you are at a coin toss odds. Which is better than gambling but isn't trading.

You pretty much have the gist of Bravo simple trading, these are more advanced things. IF you are trading, you want to know where you will set your stop loss and where you will set your take profit BEFORE you buy anything. And then set those with the trade. That way you know beforehand what a worse case scenario looks like. If you do this, you will very likely succeed in the long run.

LiteCoin (LTC) - Chart reading with Weis Wave with Speed Index

Lesson 15 Methodology:

1. Largest up volume wave at the bottom after while (probable buyers but let's confirm using AVWAP and Weis Wave with Speed Index and it's Plutus Signals.

2. Placed AVWAP at the beginning of the previous down wave and wait for price to pullback to it.

3. Price Respects AVWAP.

4. Abnormal Speed Index 40.8 is a sign that price has a hard time to move down.

5. Enter Long on PL signal.

... and up we go!!!!

Target Fib area which was reached!

No entries now - Fib could risky!

Learning The Excess Phase Peak Pattern : How To Identify/Use ItThis new tutorial video is for all the new followers I have on TradingView who don't understand the Excess Phase Peak pattern (EPP) yet.

I received a question from a new follower yesterday about the EPP patterns. He/She could not understand what they were or how to use/identify them.

This video should help you understand what the EPP patterns are, how to identify them, how to trade with them, and how to identify/use proper expectations with them.

I hope this video is informative and clear. Remember, price only does two things...

FLAG or TREND - NOTHING ELSE

And the EPP pattern is the CORE STRUCTURE of price that happens on all charts, all intervals, and all the time.

The second pattern, the Cradle pattern, is part of the EPP pattern, but it acts as another price construct related to how to identify opportunities in price action.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trading A Divergence Trade (Breakdown) with Pivots and LiquidityTrading divergences was always a problem for me in the past. I did the same thing you did and got it wrong every time. I was trading divergences when i saw them instead of realizing a divergence is a flip of support and resistance levels. I just needed to know where they are.

In this video:

Internal vs External Pivot divergence confirmation:

You can have two types of pivots on your chart. One for long term and one for short term.

Using them to confirm short and long term price action is intuitive as youll be able to see the market squeezing on the short term while knowing where your long term price structure exists.

Price action to Divergence Confirmation:

A divergence on a short term pivot is an indication of short term loss of trend or reversal.

If the short term has no divergence but the long term does, you are about to end up with some pretty large price moves.

Youll be confirming the divergence by looking for highs, lows, and closes moving the wrong way from current price action.

This video will give you a method you can use to draw out your support zone / resistance zone / divergence zone and use them to your advantage.

The "Divergence Zone" that you draw out is the very reason why so many people fail at divergences.

Bare in mind that when you have a divergence, support and resistance are on the WRONG sides as their normally are so you'll learn here how to find those zones as well.

Then in the end of the video ill show you how to use lower timeframes to confirm the new move of the market.

Thanks, everyone. For coming through to the CoffeeShop.