Velocity Market Conditions Explained.There are 6 primary upside Market Conditions. Currently the stock market is in a Velocity Market Condition where price and runs are controlled by retail investors, retail swing traders, retail day traders and the huge group of Small Funds Managers using VWAP ORDERS to buy shares of stock with an automated systematic buy order trigger when the volume in that stock starts to rise. The more volume in a stock the faster the VWAP order will trigger.

You task is to study Dark Pool hidden and quiet accumulation bottoming formations to be ready for the Velocity Market Condition that always follows.

Price is a primary indicator.

Volume is a primary Indicator.

These are the most important indicators in your trading charting software tools.

The next most important indicator is Large lot versus Small lot indicators which are NOT based on volume but more complex formulations.

HFTs use algorithms, AI, social media discussions etc.

To ride the Velocity wave upward, you must enter the stock before the run upward.

Learning to read charts as easily takes practice and experience.

The benefit is the ability to forecast with a very high degree of accuracy what that stock will due in terms of rising profits, over the next few days or longer.

Candlesticks have many new candle patterns that have just developed in the past couple of years. The stock market is evolving at a fast pace and the internal market structure that you can't see is only visible in the candlesticks, large lot vs small lot indicators, and other semi professional to professional level tools for analyzing stocks.

The stock market is changing and becoming far more tiered with more off exchange transactions. Learn to read charts so that you can trade with higher confidence and higher revenues.

Trend Analysis

Internal and external liquidity Here's another mechanical lesson for you.

In my last post I covered a mechanical technique to identify swing ranges. Rule-based, simple and repeatable.

In this post, I want to share another little technique, again part of the mechanical series. But this time I want to talk about liquidity.

Most traders talk about liquidity, they might even have a grasp of what it is. But most do not know how liquidity forms the sentiment and how that creates a type of algo for the market.

You might have heard of Elliott wave theory. There is a saying along the lines of "you ask 10 Elliott traders for their count and you get 11 answers".

But the point is here, when you simplify the concept, it's clear to see that sentiment caused by liquidity swings is what causes a repeatable pattern in the market.

Let's take the idea of the ranges from my last post.

Now after a fair amount of accumulation, this level becomes "defended" - the price will gradually move up until old short stop losses are tagged and new long entries are entered into.

This allows the institutional players to open up their orders without setting off the alarm bells.

Price then comes back from external liquidity to find internal liquidity (more on this in a later post).

But then it looks for the next fresh highs.

As the highs are put in, we can use the range technique to move our range to the new area as seen in the image above.

Next we will be looking for an internal move, not just internal to the range, but a fractal move on the smaller timeframe that drives the pullback down. See this in blue.

The logic here is simple; on the smaller timeframes we have witnessed an accumulation at the 2 region and as we spike up for 3; we will witness a distribution on the smaller timeframes.

Wyckoff called this the accumulation, followed by a mark-up and then the distribution and a mark-down.

It is this pattern, over and over again that leads to this type of structure.

This will then be re-branded by various analysts who will call it things like a head and shoulders, smart money will see a change of character and a retest before breaking the structure.

This is all the same thing - just a different naming convention.

Again, I hope this helps some of you out there!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Embracing Uncertainty

In trading, the illusion of certainty is often our biggest enemy.

Even the cleanest setups—like a MTR (Major Trend Reversal)—can fail.

Mark Douglas said it best:

“Anything can happen.”

This simple truth is what keeps professional traders humble and disciplined.

Respect the market, manage your risk, and never assume you know what comes next.

Stay sharp.

#MJTrading

#GoldTrading #XAUUSD #TradingPsychology #AnythingCanHappen #MarkDouglas #ForexMindset #TradingQuotes #PriceAction #RiskManagement #MindOverMarkets #ChartOfTheDay #MJTrading

Skeptic| Cycle Mastery Part 1: HWC, MWC, LWC for Smarter TradingUnderstanding Higher Wave Cycle ( HWC ), Minor Wave Cycle ( MWC ), and Low Wave Cycle ( LWC ) is the key to making informed trading decisions, simplifying when to go long , short , or stay out . This Part 1 masterclass introduces these cycles, their relative nature, and how to align them with your strategy for precise entries and effective risk management . Let’s break it down. 📊

The Three Cycles: HWC, MWC, LWC

We trade across three market cycles:

HWC (Higher Wave Cycle) : The big-picture trend, like Bitcoin’s yearly uptrend.

MWC (Minor Wave Cycle): A medium-term trend, often an uptrend or corrective phase within the HWC.

LWC (Low Wave Cycle): The short-term daily trend, which can be range-bound, uptrend, or downtrend.

Knowing these cycles helps you decide when to e nter long, short, or avoid trading altogether, ensuring you align with the market’s rhythm.

Defining Your Cycles: It’s Relative

The main question before diving in: What timeframes are HWC, MWC, and LWC? The answer is relative—it depends on your strategy. Think of it like a temperature scale: 0°C isn’t “no heat” but a reference point (water’s freezing point). Similarly, your cycles are defined by the largest timeframe you analyze:

HWC: Your highest timeframe (e.g., Weekly for long-term traders).

MWC: The next level down (e.g., Daily).

LWC: Your shortest timeframe (e.g., 4-Hour or 1-Hour).

Ask yourself: What’s the largest timeframe I check? Set your HWC there, then scale down for MWC and LWC based on your trading style. This relativity ensures your cycles fit your unique approach.

While shorter cycles (LWC, MWC) form the HWC, the HWC’s power dominates, influencing smaller cycles. Let’s explore how to trade based on these relationships.

Trading Scenarios: When to Act

Scenario 1: HWC Uptrend, MWC Range

When the HWC is in an uptrend and the MWC is range-bound:

Action: Enter a long position on the first MWC wave when the LWC breaks the ceiling of the MWC range (e.g., a box breakout).

Why? The HWC’s bullish power supports the move, likely triggering an MWC uptrend. This makes the first wave a strong, low-risk entry.

Example: If the LWC (e.g., 4-hour) breaks the MWC range ceiling with a strong candle, you can confidently go long, backed by the HWC uptrend.

Scenario 2: HWC Downtrend, MWC Range

When the HWC is in a downtrend and the MWC is range-bound:

Action: Skip the first MWC wave. If the LWC breaks the MWC range ceiling, avoid going long—the bearish HWC could reject the move, resuming its downtrend.

Wait for the Second Wave: Let the MWC return to a range after the first wave. If the LWC breaks the range ceiling again, go long with confidence—the HWC’s influence is less likely to disrupt this second wave.

Risk Management Tips (if you trade the first wave against the HWC):

Reduce Risk: Lower your position size to minimize exposure.

Take Profits Early: Close the position or secure most profits (e.g., scale out) once you hit your R/R target, as volatility is high.

Wider Stop-Loss: Set a larger stop-loss to account for potential HWC-driven reversals, as stop-loss hunts are common in this scenario.

Adjusting Stop-Loss Size Based on Cycles

Aligned Cycles (HWC, MWC, LWC in Same Direction): When all three cycles align (e.g., all uptrend), set a tighter stop-loss relative to market conditions. Gradually scale out profits instead of closing the position, as the trend’s strength supports higher R/R (e.g., 5 or 10).

HWC Against MWC/LWC: If the HWC opposes the other cycles (e.g., HWC downtrend, MWC/LWC uptrend), use a wider stop-loss. The HWC’s power could reverse the LWC, lowering your win rate if stops are too tight. Expect volatility and plan accordingly.

Final Vibe Check

This Cycle Mastery Part 1 equips you to time MWC waves with precision, aligning HWC, MWC, and LWC for smarter entries. By mastering when to trade the first or second wave, you’ll avoid traps and maximize your edge. Part 2 will dive deeper with examples—stay tuned! At Skeptic Lab, we trade with no FOMO, no hype, just reason. Protect your capital—stick to 1%–2% risk per trade. Want Part 2 or another topic? Drop it in the comments! If this guide sharpened your game, hit that boost—it fuels my mission! 😊 Stay disciplined, fam! ✌️

💬 Let’s Talk!

How will you time your MWC waves? Share your thoughts in the comments, and let’s crush it together!

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Have a nice day today.

-------------------------------------

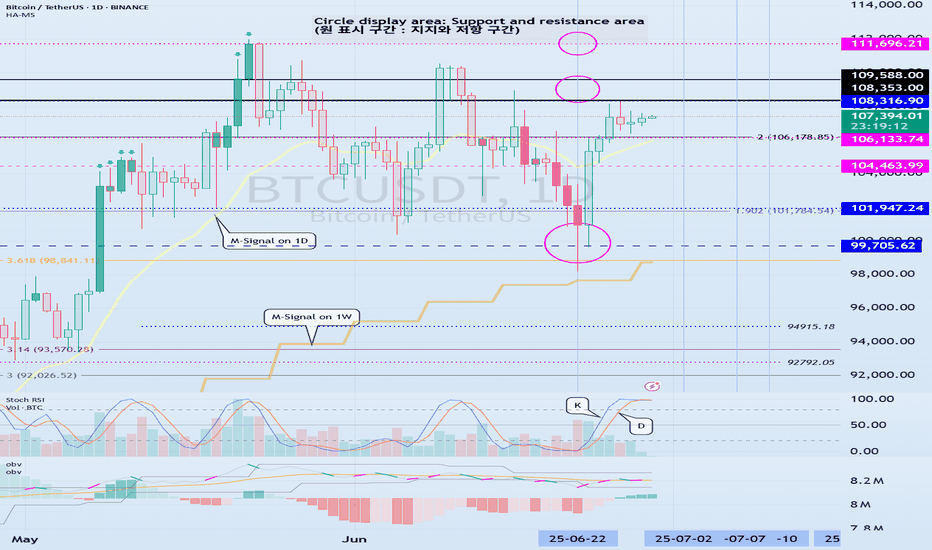

We use the StochRSI indicator to draw a trend line.

We draw a trend line by connecting the peaks of the StochRSI indicator, i.e. the K line, when they are created in the overbought area or when they are created in the overbought area.

That is, when the K line of the StochRSI indicator forms a peak in the overbought area, the trend line is drawn by connecting the Open values of the falling candles.

If the candle corresponding to the peak of the StochRSI indicator is a rising candle, move to the right and use the Open value of the first falling candle.

When drawing the first trend line, draw it from the latest candle.

Since the third trend line indicates a new trend, do not draw anything after the third trend line.

The currently drawn trend line corresponds to the high-point trend line.

-

Therefore, you should also draw the low-point trend line.

The low-point trend line is drawn by connecting the K line of the StochRSI indicator when the top is formed in the oversold zone.

The low-point trend line uses the low value of the candle when the K line of the StochRSI indicator forms the top in the oversold zone.

That is, it doesn't matter whether the candle is a bearish candle or a bullish candle.

The drawing method is the same as when drawing the high-point trend line, drawing from the latest candle.

The top of the best K line of the StochRSI indicator was not formed within the oversold zone.

(The top is indicated by the section marked with a circle.)

Since the trend line was not formed, the principle is not to draw it.

If you want to draw it and see it, it is better to display it differently from the existing trend line so that it is intuitively different from the existing trend line.

-

The chart below is a chart that displays the trend line drawn separately above as a whole.

It is also good to distinguish which trend line it is by changing the color of the high-point trend line and the low-point trend line.

The chart below is a chart that distinguishes the high-point trend line in blue (#5b9cf6) and the low-point trend line in light green (#00ff00).

The low-point trend line is a line drawn when the trend has changed, so it does not have much meaning, but it still provides good information for calculating the volatility period.

-

To calculate the volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

However, since I am currently explaining how to draw a trend line, it is only drawn on the 1M chart.

-

I use the indicators used in my chart to indicate support and resistance points.

That is, I use the DOM(60), DOM(-60), HA-Low, HA-High, and OBV indicators to indicate support and resistance points.

Since the DOM(-60) and HA-Low indicators are not displayed on the 1M chart, I have shown the 1W chart as an example.

The indicators displayed up to the current candle correspond to the main support and resistance points.

Although it is not displayed up to the current candle, the point where the horizontal line is long is drawn as the sub-support and resistance point.

It is recommended to mark them separately to distinguish the main support and resistance point and the sub-support and resistance point.

The trend line drawn in this way and the support and resistance points are correlated on the 1D chart and the volatility period is calculated.

(For example, it was drawn on the 1M chart.)

The sections marked as circles are the points that serve as the basis for calculating the volatility period.

That is,

- The point where multiple trend lines intersect

- The point where the trend line and the support and resistance points intersect

Select the point that satisfies the above cases at the same time to display the volatility period.

When the point of calculating the volatility period is ambiguous, move to the left and select the first candle.

This is because it is meaningless to display it after the volatility period has passed.

If possible, the more points that are satisfied at the same time, the stronger the volatility period.

If the K-line peak of the StochRSI indicator is formed outside the overbought or oversold zone, it is better to exclude it when calculating the volatility period.

-

The chart below is a chart drawn on a 1D chart by summarizing the above contents.

The reason why there are so many lines is because of this reason.

For those who are not familiar with my charts, I have been simplifying the charts as much as possible these days.

However, when explaining, I have shown all the indicators to help you understand the explanation.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

StochRSI indicator and support and resistance levels

Hello, traders.

If you "follow" me, you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

The StochRSI indicator on the left chart is slightly different from the StochRSI indicator on the right.

The StochRSI indicator on the left chart is the StochRSI indicator provided by default in TradingView, and the StochRSI indicator on the right chart is an indicator with a modified formula.

The StochRSI indicator is a leading indicator that is reflected almost in real time.

Therefore, it reacts sensitively to price changes.

Although it is advantageous because it reacts sensitively, it also increases the possibility of being caught in a fake, so I thought that a slight delay(?) was necessary, and so I created the StochRSI indicator on the left chart.

If you look at the relationship between the K and D of the StochRSI indicators on the two charts, you can see that there is a big difference.

In the end, you can predict the movement by checking whether the movement of the K line has escaped the overbought or oversold section.

However, I think that you will receive information that can determine the sustainability of the trend depending on the positional relationship between K and D.

Therefore, it is important to distinguish the inflection points that occur in the StochRSI indicator.

This is because these inflection points provide important information for drawing trend lines.

Therefore, the StochRSI indicator on the left chart, which better expresses the inflection point, is being used to draw the trend line.

(Unfortunately, this indicator was not registered on TradingView because I did not explain it well.)

-

As a new candle was created, the StochRSI indicator on the left chart is showing an inflection point on the K line.

The StochRSI indicator on the right chart is showing a transition to a state where K < D.

We will have to check whether the inflection point was created only when today's candle closes, but I think that the fact that it is showing this pattern means that there is a high possibility of a change in the future trend.

Since the next volatility period is expected to start around July 2nd (July 1st-3rd), I think it has started to show meaningful movements.

-

It is true that you want to buy at the lowest price possible and sell at the highest price.

However, because of this greed, one mistake can lead to a loss that can overturn nine victories, so you should always be careful.

Therefore, if possible, it is better to check for support and respond.

In that sense, I think it is worth referring to the relationship between K and D of the StochRSI indicator on the left chart.

This is because the actual downtrend is likely to start when K < D.

-

In order to check for support, you definitely need support and resistance points drawn on the 1M, 1W, and 1D charts.

Ignoring this and checking for support at the drawn support and resistance points can result in not being able to apply the chart you drew to actual trading.

Therefore, you should draw support and resistance points first before starting a trade.

Otherwise, if you draw support and resistance points after starting a trade, you are more likely to set support and resistance points that reflect your subjective thoughts, so as I mentioned earlier, you are more likely to lose faith in the chart you drew.

If this phenomenon continues, it will eventually lead to leaving the investment market.

-

It is important to determine whether there is support by checking the correlation between the StochRSI indicator and other indicators at the support and resistance points drawn on the 1M, 1W, and 1D charts.

Even if the inflection point of the StochRSI indicator or other indicators occurs at a point other than the support and resistance points you drew, you should consider it as something that occurred beyond your ability to handle.

In other words, you should observe the price movement but not actually trade.

As I mentioned earlier, if you start to violate this, you will become less and less able to trust the chart you drew.

-

Accordingly, the basic trading strategy I suggest is to buy near the HA-Low indicator and sell near the HA-High indicator.

However, since the HA-Low and HA-High indicators are expressed as average values, they may move in the opposite direction to the basic trading strategy.

In other words, if the HA-Low indicator is resisted and falls, there is a possibility of a stepwise downward trend, and if the HA-High indicator is supported and rises, there is a possibility of a stepwise upward trend.

Therefore, the basic trading strategy mentioned above can be considered a trading strategy in the box section.

In the case of deviating from this box section, it is highly likely to occur before and after the volatility period indicated by the relationship between the trend line using the StochRSI indicator mentioned above and the support and resistance points drawn on the 1M, 1W, and 1D charts.

Therefore, special care is required when conducting new transactions during the volatility period.

This is because there is a high possibility of being caught in a fake when trading during the volatility period.

-

The DOM(60) and DOM(-60) indicators are good indicators to look at together with the HA-Low and HA-High indicators.

The DOM indicator is an indicator that comprehensively evaluates the DMI, OBV, and MOMENTUM indicators.

Therefore, the DOM(60) indicator is likely to be at the end of the high point range, and the DOM(060) indicator is likely to be at the end of the low point range.

In the explanation of the HA-Low and HA-High indicators,

- I said that if the HA-Low indicator receives resistance and falls, there is a possibility that a stepwise downtrend will begin,

- and if the HA-High indicator receives support and rises, there is a possibility that a stepwise uptrend will begin.

In order for an actual stepwise downtrend to begin, the price must fall below DOM(-60), and in order for a stepwise uptrend to begin, it must rise above DOM(60).

In other words, the DOM(-60) ~ HA-Low section and the HA-High ~ DOM(60) section can be seen as support and resistance sections.

-

If these correlations start to appear, I think you will be able to create a trading strategy that fits your investment style without being swayed by price volatility and proceed with trading.

The reason for analyzing charts is to trade.

Therefore, the shorter the time for chart analysis, the better, and you should increase the start of creating a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

SMC Trading Basics. Change of Character - CHoCH (GOLD FOREX)

In the today's post, we will discuss one of the most crucial concepts in SMC - Change of Character.

Change of Character relates to market trend analysis.

In order to understand its meaning properly, first, we will discuss how Smart Money traders execute trend analysis.

🔘Smart Money Traders apply price action for the identification of the direction of the market.

They believe that the trend is bullish ,

if the price forms at least 2 bullish impulse with 2 consequent higher highs and a higher low between them.

The market trend is considered to be bearish ,

if the market forms at least 2 bearish impulses with 2 consequent lower lows and a lower high between them.

Here is how the trend analysis looks in practice.

One perceives the price action as the set of impulse and retracement legs.

According to the rules described above, USDCAD is trading in a bullish trend because the pair set 2 higher lows and 2 higher highs.

🔘Of course, trends do not last forever.

A skill of the identification of the market reversal is a key to substantial profits in trading.

Change of Character will help you quite accurately identify a bullish and bearish trend violation.

📉In a bearish trend, the main focus is the level of the last lower high.

While the market is trading below or on that, the trend remains bearish .

However, its bullish violation is a very important bullish signal,

it is called a Change of Character, and it signifies a confirmed violation of a bearish trend.

In a bearish trend, CHoCH is a very powerful bullish pattern.

Take a look, how accurate CHoCH indicated the trend reversal on Gold.

After a massive selloff, a bullish breakout of the level of the last lower high confirmed the initiation of a strong bullish wave.

📈In a bullish trend, the main point of interest is the level of the last higher low. While the price is trading above that or on that, the trend remains bullish.

A bearish violation of the last higher low level signifies the violation of a current bullish trend. It is called a Change of Character, and it is a very accurate bearish pattern.

Take a look at the example on Dollar Index below.

In a bullish trend, bearish violation of the last higher low level

quite accurately predicted a coming bearish reversal.

Change of Character is one of the simplest , yet accurate SMC patterns that you should know.

First, learn to properly execute the price action analysis and identify HH, HL, LL, LH and then CHoCH will be your main tool for the identification of the trend reversal.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

How to Trade When Buy/Sell Alerts Conflict with Market StructureQuestion:

If we have a buy/sell alert and an opposing Market Structure, how can we tell which will prevail or is heavier?

Answer (VX Algo System perspective):

In the VX Algo system, both the alert signals (buy/sell) and the market structure are crucial, but they serve different roles:

Alerts are dynamic triggers based on price action, momentum, or specific algorithmic conditions. They indicate potential entry or exit points.

Market Structure reflects the broader trend and underlying order flow, indicating the prevailing direction of the market (e.g., higher highs and higher lows for bullish structure, or lower highs and lower lows for bearish structure).

When an alert contradicts the prevailing market structure, the heavier factor is usually the Market Structure because it represents the dominant order flow and sentiment. In other words, alerts give you tactical timing, but market structure provides strategic context.

How to tell which prevails:

Confirm with Market Structure: If the market structure is bullish (uptrend), a buy alert aligns with it and is more likely to succeed. A sell alert against that structure is a warning sign that the alert may be weaker or a potential false signal.

Volume and Momentum: Use volume or momentum indicators (built into VX Algo or complementary tools) to see if the alert has strength behind it. A strong sell alert with high volume during an uptrend may indicate an imminent structure shift.

Multiple Timeframe Analysis: Check if the opposing alert is supported or rejected on higher timeframes. A buy alert on a lower timeframe against a bearish higher timeframe structure is less likely to prevail.

Risk Management: If you trade against structure alerts, reduce position size and tighten stops until the structure confirms the shift.

Summary: Market structure is heavier and more reliable for directional bias. Alerts provide tactical entry timing. When they conflict, lean on structure for bias but watch for alert strength as early signals of possible structure changes.

Sharing the advanced Bollinger Bands strategyHere are the Bollinger Band trading tips: *

📌 If you break above the upper band and then drop back down through it, confirm a short signal!

📌 If you drop below the lower band and then move back up through it, confirm a long signal!

📌 If you continue to drop below the middle band, add to your short position; if you break above the middle band, add to your long position!

Pretty straightforward, right? This means you won’t be waiting for the middle band to signal before acting; you’ll be ahead of the game, capturing market turning points!

Let’s break it down with some examples:

1. When Bitcoin breaks above the upper Bollinger Band, it looks strong, but quickly drops back below:

➡️ That’s a “bull trap”—time to go short!

2. If Bitcoin crashes below the lower band and then pops back up:

➡️ Bears are running out of steam—time to go long and grab that rebound!

3. If the price keeps moving above the middle band:

➡️ Add to your long or short positions to ride the trend without being greedy or hesitant.

Why is this method powerful?

It combines “edge recognition + trend confirmation” for double protection:

1. Edge Recognition—spot the turning point and act early.

2. Trend Confirmation—wait for the middle band breakout and then confidently add positions!

You won’t be reacting after the fact; you’ll be ahead of the curve, increasing your positions in the trend’s middle and locking in profits at the end. This is the rhythm of professional traders and the core logic of systematic profits!

Who is this method for?

- You want precise entry and exit points.

- You’re tired of “chasing highs and cutting losses.”

- You want a clear, executable trading system.

- You want to go from “I see the chart but don’t act” to “I see the signal and take action.”

Follow for more. Make sure to like this if you found it useful.

Skeptic | RSI Masterclass: Unlock Pro-Level Trading Secrets!Hey traders, it’s Skeptic ! 😎 Ready to transform your trading? 95% of you are using the Relative Strength Index wrong , and I’m here to fix that with a game-changing strategy I’ve backtested across 200+ trades. This isn’t a generic RSI tutorial—it’s packed with real-world setups, myth-busting insights, and precise rules to trade with confidence. Join me to master the art of RSI and trade with clarity, discipline, and reason. Big shoutout to TradingView for this epic free tool! 🙌 Let’s dive in! 🚖

What Is RSI? The Core Breakdown

The Relative Strength Index (RSI) , crafted by Welles Wilder, is a momentum oscillator that measures a market’s strength by comparing average gains to average losses over a set period. Here’s the formula:

G = average gains over n periods, L = average losses.

Relative Strength (RS) = | G / L |.

RSI = 100 - (100 / (1 + RS)).

Wilder used a 14-period lookback , and I stick with it—it’s smooth, filters noise, and gives a crystal-clear read on buyer or seller momentum. Let’s get to the good stuff—how I use RSI to stack profits! 📊

My RSI Strategy: Flipping the Script

Forget what you’ve read in books like The Handbook of Technical Analysis by Mark Andrew Lim— overbought (70) and oversold (30) aren’t just for shorting or buying. I go long when RSI hits overbought, and it’s been a goldmine. I’ve backtested over 200 trades with this approach, and it’s my go-to confirmation for daily setups. Why does it work? When RSI hits overbought on my 15-minute entry chart, it signals explosive buyer momentum. Here’s what you get:

Lightning-Fast R/R: I hit risk/reward targets in 30 minutes to 2 hours on 15-minute entries (longer for 1-hour entries, depending on your timeframe).

Massive R/R Potential: An overbought RSI on 15-minute can push 1-hour and 4-hour RSI into overbought, driving bigger moves. I hold for R/Rs of 5 or even 10, not bailing early. 🚀

Rock-Solid Confirmation: RSI confirms my entry trigger. Take BTC/USD:

BTC bounces off a key support at 76,000, sparking an uptrend.

It forms a 4-hour box range, but price tests the ceiling more than the floor, hinting at a breakout.

Trigger: Break above the box ceiling at 85,853.57.

On 15-minute, a powerful candle breaks the ceiling, and RSI hits overbought—that’s my green light. I open a long.

Soon, 1-hour and 4-hour RSI go overbought, signaling stronger momentum. I hold, and BTC pumps hard, hitting high R/R in a short window.

This keeps trades fast and efficient—quick wins or quick stops mean better capital management and less stress. Slow trades? They’re a mental grind, pushing you to close early for tiny R/Rs. 😴

Pro Rules for RSI Success

Here’s how to wield RSI like a trading weapon:

Stick to the Trend : Use RSI in the direction of the main trend (e.g., uptrend = focus on longs).

Confirmation Only: Never use RSI solo for buy/sell signals. Pair it with breakouts or support/resistance triggers.

Fresh Momentum: RSI is strongest when it just hits overbought/oversold. If the move’s already rolling, skip it—no FOMO, walk away!

Customize Zones: Overbought (70) and oversold (30) can shift—it might show reactions at 65 or 75. Adjust to your market’s behavior.

Backtesting RSI: Your Path to Mastery

To make RSI yours, backtest it across at least 30 trades in every market cycle— uptrend, downtrend, and range. Test in volatile markets for extra edge. 😏 Key takeaways:

Range Markets Kill RSI: Momentum oscillators like RSI (or SMA) are useless in ranges—no momentum, no signal. Switch to ROC (Rate of Change) for ranges—I use it, and it’s a beast. Want an ROC guide? Hit the comments!

Overextended RSI Zones: On your entry timeframe (e.g., 15-minute), check higher timeframes (e.g., 4-hour) for past RSI highs/lows. These are overextended zones—price often rejects or triggers a range. Use them to take profits.

Final Vibe Check

This RSI masterclass is your key to trading like a pro—fast R/Rs, big wins, and unshakable confidence . At Skeptic Lab, we live by No FOMO, no hype, just reason. Guard your capital— max 1% risk per trade, no excuses. Want an ROC masterclass or more tools? Drop a comment! If this fired you up, smash that boost—it means everything! 😊 Got a setup or question? Hit me in the comments. Stay sharp, fam! ✌️

Anatomy of a Breakout: How to Spot It Before It Fakes You OutFew things in trading are as appealing as a breakout. The chart tightens, volume starts to stir, headlines align, your alerts start going off , and suddenly — boom! Price explodes above resistance. Your adrenaline spikes and you pop open that long.

But just as often, that breakout turns out to be nothing more than an expensive head fake. Price stalls. Sellers swoop in. Your stop gets clipped. And now you’re sitting there, blinking at your screen, “Welp… that was quick.”

Welcome to the bittersweet world of breakouts — where opportunity and deception dance like partners at a high-stakes poker table.

📢 What Is a Breakout, Really?

Let’s get the basics out of the way: A breakout happens when price pushes beyond a key support or resistance level that’s been holding for a while.

That level could be a previous high, a consolidation range, a trendline, or a psychological number that traders obsess over because humans love round numbers (did someone say Bitcoin BITSTAMP:BTCUSD at $120,000 ?).

The logic is simple: Once price clears a well-watched level, trapped shorts have to cover, new longs pile in, and momentum feeds on itself. That’s the dream scenario.

But markets aren’t always that generous. For every clean breakout, there are a few fakeouts lurking — luring in overeager traders with the promise of easy money before slamming the door shut.

⚠️ Why Breakouts May Fail

If breakouts were easy, we’d all be rich. The problem is that breakouts attract a special kind of crowd: late-to-the-party momentum chasers, breakout algorithm bots, and retail traders who read one blog post about technical analysis.

The moment price nudges above resistance, FOMO kicks in. Volume surges. But if the move isn’t backed by genuine institutional buying (you need lots of billions to move the needle nowadays), it quickly becomes what seasoned traders call a “liquidity vacuum” — thin air where the only participants are you, a few equally optimistic Reddit threads, and market makers more than happy to take the other side.

Sometimes breakouts fail because:

The move lacked volume confirmation.

Macro headlines shifted mid-breakout.

A key level was front-run, and the real buyers have already taken profit.

It was a deliberate trap set by larger players to hunt stops before reversing.

Or — more often — the market just needed an excuse to shake out weak hands before resuming the actual move later.

🍸 Volume: The Truth Serum

Let’s be very clear: Breakouts without volume are like dating profiles without photos — you should be suspicious.

When real breakouts occur, you’ll usually see strong accompanying volume. That’s your proof that big players — funds, institutions, serious money — are committing to the move. No volume? Maybe the summer vibes are already here .

Smart traders wait for confirmation:

Is volume above average relative to recent sessions?

Is price holding above the breakout level after the initial pop?

Are follow-through candles printing convincingly?

Are we seeing continuation across related sectors or instruments?

Without these signs, that breakout candle may just be a cruel joke.

🤯 Breakout Psychology

Breakouts prey on two of the most dangerous emotions in trading: greed and urgency. The market whispers, “If you don’t get in now, you’ll miss it.”

This is where breakout psychology becomes more dangerous than the chart itself. Once a breakout happens, most traders are no longer analyzing — they’re reacting. They buy late, set tight stops below the breakout level, and become easy prey for stop-hunting algorithms.

✨ Types of Breakouts

Not all breakouts are created equal. Here’s the lineup you should be watching for:

Clean Breakouts:

The rarest and most beautiful. Strong move, high volume, sustained momentum. You’ll know it when you see it — or after you’ve hesitated and missed it.

Fakeouts (a.k.a. False Breakouts):

Price nudges just past resistance, triggers breakout orders, then swiftly reverses. Designed to shake out breakout traders before resuming the original trend.

Break-and-Retest Setups:

Often the highest-probability trades. Price breaks out, then pulls back to retest the former resistance (now support). If buyers defend this retest, you’ve got confirmation.

News-Driven Breakouts:

Triggered by earnings, economic data, or political events. Volatile, fast, and often unsustainable unless backed by real fundamental shifts.

📈 The “Pre-Breakout Tell”: Reading the Tape

Good breakout traders aren’t just watching levels — they’re watching how price behaves near those levels in advance.

Tight consolidation? Lower volatility into resistance? Declining volume as price grinds higher? That often signals an impending breakout as supply dries up.

Conversely, choppy action with large wicks and erratic volume often signals indecision — ripe conditions for failed breakouts and fakeouts.

Tape-reading matters. The cleaner the structure before the breakout, the better your odds.

💰 Breakout Traders Need Thick Skin

Even with perfect analysis, breakout trading requires accepting that many will fail. That’s the game. Your job isn’t to nail every breakout — it’s to size your positions properly , keep losses small when faked out, and let the clean breakouts run when you catch one.

Stop-loss discipline is everything. Breakouts are binary events: you’re either right quickly, or you’re cutting the trade quickly. There’s no room for “maybe it’ll come back.”

The most painful breakouts are the ones that fake out, stop you, then continue in your original direction. Every breakout trader has lived that nightmare. Accept it. Build it into your risk plan.

👉 Takeaway: Prepare the Setup, Anticipate the Fakeout

Breakouts will always be part of every trader’s playbook. But they require discipline, experience, and an iron stomach. The market loves to tempt you with early signals — your job is to separate signal from noise.

Pro tip: Start your day by checking the Economic calendar and browsing the latest news — staying informed (and witty) helps you build better context for smarter decisions.

So before you chase that next breakout candle, ask yourself:

Is volume there?

Is the broader market supportive?

Have I managed my risk before clicking buy?

Because in trading, the only thing worse than missing a breakout… is getting faked out and blowing up your account chasing it.

Now over to you : Are you a breakout trader or a fakeout victim? Share your best (or worst) breakout stories — we’ve all been there.

What Is a Change of Character (CHoCH) and How Can You Trade It?What Is a Change of Character (CHoCH) and How Can You Trade It?

Navigating the nuances of Smart Money Concept (SMC) trading requires a keen understanding of market signals like the Change of Character (CHoCH). This concept can help traders detect and react to potential trend reversals. Today, we’ll delve into the mechanics of CHoCHs, explaining how they manifest in different market conditions and how they can be strategically leveraged for trading decisions.

Understanding Breaks of Structure

Understanding Breaks of Structure (BOS) is essential for traders before delving into concepts like Change of Character (CHoCH). A BOS in trading signifies a continuation within the current trend and is marked by a clear deviation from established swing points that indicate previous highs and lows.

In the context of an uptrend, a BOS is identified when the price exceeds a previous high without moving below the most recent higher low. This action confirms that the upward momentum is still strong and likely to continue as buyers push the market to new heights.

Similarly, in a downtrend, a BOS occurs when prices drop below a previous low without breaking the prior lower high, suggesting that sellers remain in control and the downward trend is set to persist.

By recognising these points where the market extends beyond its former bounds, traders can confirm that the current trend is robust and act accordingly. This foundational concept of BOS not only helps in assessing trend strength but also sets the stage for understanding more complex patterns like CHoCH, where the focus shifts from trend continuation to potential trend reversals.

CHoCH Trading Meaning

In trading, a Change of Character (CHoCH) signals a potential shift in market dynamics, often indicating a reversal from the prevailing trend. This concept is particularly valuable as it helps traders discern when the momentum is shifting, offering a strategic point to consider adjusting their positions.

A CHoCH occurs when there's a noticeable deviation in the market's price trend. For example, in a bullish trend characterised by a series of higher highs and higher lows, a CHoCH is indicated by the price failing to set a new high and subsequently falling below a recent higher low. This suggests that buyers are losing control, and a bearish trend could be emerging.

Similarly, during a bearish trend marked by lower highs and lower lows, a bullish CHoCH would occur if the price unexpectedly breaks above a recent lower high. This break indicates that sellers are losing their grip, and a bullish trend may be starting.

The Significance of CHoCHs Across Timeframes

The fractal nature of financial markets means that patterns and behaviours recur across various timeframes, each providing unique insights and implications for trading. Understanding CHoCHs in different timeframes is crucial for traders to effectively align their strategies with both short-term opportunities and long-term trend shifts.

In intraday trading, where decisions are made on lower timeframes (like minutes or hours), a CHoCH can signal a possible short-term trend reversal. For example, if a currency pair in a downtrend on a 15-minute chart suddenly posts a higher high, this could indicate a weakening of the bearish momentum, suggesting a potential bullish reversal.

Traders might use this information to close short positions or to consider a long position, capitalising on the emerging upward trend. These short-term CHoCHs allow traders to respond quickly to market changes, potentially securing returns before larger market shifts occur.

Conversely, CHoCHs observed on higher timeframes, such as daily or weekly charts, are particularly significant because they can indicate a shift in the broader market trend that might last days, weeks, or even months. Such changes can then be used by both long and short-term traders to adjust their positioning and directional bias.

How to Identify a CHoCH

The initial step to identify a CHoCH in trading involves clearly defining the existing trend on a specific timeframe. This is done by marking the significant swing highs and lows that delineate the trend's progress. These points should represent somewhat meaningful retracements in the price, providing clear markers of trend continuity or potential reversal points.

According to the Smart Money Concept (SMC) theory, the integrity of an uptrend is maintained as long as the price does not trade through the most recent significant higher low. Conversely, a downtrend is considered intact if the price does not surpass the most recent significant lower high. Therefore, traders focus their attention on these critical points.

To identify a CHoCH, traders watch for a break in these crucial high or low points. For instance, in an uptrend, a bearish CHoCH is indicated when the price achieves a higher high but then reverses to descend below the previous significant higher low.

Similarly, in a downtrend, a bullish CHoCH occurs when the price drops to a lower low before reversing to break above the previous significant lower high, setting a new high. Both types of breaks signal a potential reversal in the trend direction.

How to Trade a CHoCH

When trading a CHoCH, it’s essential to recognise that it should be integrated with other aspects of the SMC framework to get the best results. This includes the use of order blocks and imbalances, which are key components in identifying potential reversals.

Order Blocks and Imbalances

An order block is essentially a substantial consolidation area where significant buying or selling has occurred, and prices often revisit these zones before reversing. These blocks can be seen as levels where institutional orders were previously concentrated.

An imbalance, also known as a fair value gap, occurs when the price moves sharply up or down, leaving a zone that has not been traded extensively. Price often returns to these gaps to 'fill' them, establishing equilibrium before a potential reversal happens.

In practice, traders can look for a sequence where the price first approaches an order block and begins to fill any existing imbalances. This setup increases confidence in a potential reversal. As the price meets these criteria and a CHoCH occurs, this indicates that the influence of the order block is likely to initiate a price reversal.

Practical Example on GBP/USD

Consider the 4-hour chart of the GBP/USD pair above. We see the pair encounter an order block on the left, one that’s visible on the daily chart. As the price interacts with this block, it begins to retrace, attempting to fill the imbalance but moves away. Eventually, the price completes the fill of the imbalance and meets the previously established order block.

Switching to a 1-hour timeframe, this scenario unfolds similarly. After reaching the order block on the 4-hour chart, another CHoCH occurs, signalling the start of a new uptrend. This lower timeframe CHoCH, following the meeting of the order block, corroborates the potential for a reversal initiated by the higher timeframe dynamics.

This example illustrates how CHoCHs can be effectively utilised across different timeframes, tying back to the fractal nature of markets discussed earlier. By recognising these patterns and understanding their interaction with order blocks and imbalances, traders can strategically position themselves to capitalise on potential market reversals, aligning their trades with deeper market forces at play.

CHoCH vs Market Structure Shift

A Market Structure Shift (MSS) is a specific type of Change of Character that includes additional signals suggesting a potential trend reversal. Unlike a straightforward CHoCH that typically indicates a trend is shifting but may also be a false break, an MSS can be seen as a higher confluence CHoCH. An MSS occurs after the market first makes a key movement contrary to the established trend—forming a lower high in an uptrend or a higher low in a downtrend—without plotting a higher high or lower low.

Following these preliminary signals, an MSS is confirmed when there is a decisive break through a significant swing point accompanied by a strong displacement (i.e. impulse) move, creating a CHoCH in the process. This sequence not only reflects that the prevailing trend has paused but also that a new trend in the opposite direction is establishing itself.

Due to these additional confirmations, an MSS can offer added confirmation for traders, indicating a stronger likelihood that a new, sustainable trend has begun. This makes the MSS particularly valuable for traders looking for more substantiated signals in their trading strategy.

The Bottom Line

The concept of a CHoCH is instrumental in navigating the complexities of SMC trading. By identifying these crucial market signals, traders may align their strategies to capitalise on market movements efficiently.

FAQs

What Is CHoCH in Trading?

In trading, CHoCH is a technical observation that signifies a change in the trend's character, where the price movement breaks from its established pattern of highs and lows, suggesting a potential reversal or substantial shift in the market's direction.

What Is CHoCH in SMC Trading?

In Smart Money Concept (SMC) trading, a Change of Character (CHoCH) refers to a clear shift in market behaviour that indicates a potential reversal of the prevailing trend. This concept is used by traders to detect early signs of a momentum shift that might lead to significant changes in price direction, enabling strategic adjustments to their trading positions.

What Is a CHoCH in the Market Structure?

A CHoCH in market structure is identified when there is an observable deviation from established price patterns — specifically when new highs or lows contradict the current trend. It signifies that the previous market sentiment is weakening, and a new opposite trend may be starting, prompting traders to reassess their strategies.

How Do You Identify a CHoCH?

Identifying a CHoCH involves monitoring significant swing highs and lows for breaks that are contrary to the existing trend. For instance, in an uptrend, a CHoCH would be indicated by a failure to reach a new high followed by a drop below the recent higher low, suggesting a shift to a bearish outlook.

What Is ChoCH vs BOS in Trading?

While both CHoCH and Break of Structure (BOS) are critical in assessing market dynamics, they serve different purposes. CHoCH indicates a potential trend reversal by highlighting a significant change in the price pattern. In contrast, a BOS indicates a continuation of the current trend by showing the price surpassing previous significant highs or lows, reinforcing the ongoing direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

FED, rate cut possible on July 30? With the US Federal Reserve (FED) meeting on July 30 fast approaching, the markets are scrutinizing the slightest signals likely to indicate an inflexion in monetary policy. While a rate cut seems unlikely in the short term, it cannot be ruled out altogether. Despite Chairman Jerome Powell's firm stance, some influential members of the Monetary Policy Committee (FOMC) are actively pushing for monetary easing this summer.

1) Jerome Powell is not the only decision-maker on the FOMC, and there is pressure for a rate cut in July

Jerome Powell adopts a very cautious stance, making any monetary easing conditional on clear convergence towards the 2% inflation target. His main concern is the potentially inflationary impact of the tariffs currently under negotiation. However, Powell does not have absolute power. The FOMC has 12 voting members, including 7 permanent governors, the president of the New York Fed and 4 rotating regional bank presidents.

Although each vote is worth as much, the Chairman largely shapes the agenda and guides the discussions. Some members, such as Michelle Bowman and Christopher Waller, appointed under the Trump presidency, are pushing for a cut as early as July. Donald Trump's implicit support for this option adds political pressure, even if his direct influence is limited.

Below is a table showing the current balance of power between the voting members of the FOMC.

2) There will be a rate cut on July 30 if and only if the unemployment rate becomes worrying

On the fundamentals side, inflation measured by the PCE index, the FED's benchmark, remains slightly above target, but several key components are showing signs of normalization. Oil, which accounts for around 11% of the basket, is not showing any alarming technical signals with the geopolitical calm in the Middle East. The real estate sector and healthcare spending, also heavily weighted, are showing positive indications in favor of further disinflation. Moreover, tariffs are only marginally affecting services, which account for 67% of the PCE.

Despite this, Powell remains concerned about the risk of exogenous inflationary resurgence, especially if the universal 10% tariff were to apply to all US trading partners, with an expected impact on core PCE of +0.2% to +0.3%.

Markets are anticipating a first decline in September, but a July changeover cannot be ruled out if employment data, notably the NFP report of July 3, show a marked weakening of the labor market.

3) The S&P 500 index will need the FED's pivot to go higher, as it has returned to its all-time high

On the financial markets, a FED pivot would be a decisive bullish catalyst, especially for US equities, Bitcoin and other high-beta assets. Technical analysis of the S&P 500 shows a favourable technical configuration since the beginning of April, with a V-shaped recovery. But with the market now in contact with its all-time high, very positive fundamentals will be needed to consider going higher.

In short, the decision on July 30 will depend on a subtle trade-off between political pressures, inflation dynamics and the health of the job market. A status quo remains the central scenario, but a reversal is conceivable in the event of a sharp deterioration in macroeconomic data, good inflation figures or positive surprises on trade diplomacy.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Four Ways to Improve Focus When Trading“Execution is everything.” It’s a phrase you’ll hear time and again in trading circles, and for good reason. Having a solid strategy is important, but it means very little if you can’t stay focused enough to follow through. One moment of hesitation, one distracted click, and the edge you worked so hard to find can vanish in an instant.

Focus is the gateway to execution. Without it, even the best setups fall apart. Yet in a world of constant noise with live charts, endless alerts, social media and background distractions it’s never been harder to stay present and in control. Here are four ways to improve your focus while trading. Two are grounded and practical. Two are a bit more unconventional. All of them can help you sharpen your focus where it really counts in the moment of decision.

1. Start with a Written Game Plan

This is the foundation. Before you even open your trading platform, write down your trade ideas, key levels, and any news or events that could impact your market. It doesn’t have to be elaborate. A simple list of “if this, then that” scenarios is enough.

By putting your plan on paper, you free up mental space and reduce emotional interference. You’re no longer reacting to every tick or candle. You’re tracking a few clear ideas and waiting for price to confirm your bias. That alone can dramatically improve focus. When your brain knows the plan, it doesn’t need to make it up on the fly.

More importantly, a written plan acts as an anchor when the session heats up. If you get shaken by a false breakout or tempted by something that wasn’t in your prep, it’s easy to refer back and reset. The best traders are those who execute simple ideas with discipline, not those who chase every signal that flashes across the screen.

2. Silence the Noise Around You

Multitasking is the enemy of trading. One browser tab for news, another for Twitter, five charts open, notifications popping up on your phone it all adds up to mental chaos.

Clean up your digital workspace before you start trading. Close all tabs that aren’t directly relevant to your session. Mute group chats. Set your phone to silent and put it face down, or better yet, in a drawer. Keep your trading screen as clean as possible. Use one or two key charts. Turn off indicators you don’t need.

If you trade in a noisy household or shared office space, noise-cancelling headphones can be a game changer. Some traders even use ambient sound apps like brain.fm or simple white noise to drown out distractions and stay locked in. A quiet mind is a focused mind.

3. Stand Up Before You Enter a Trade

Here’s something a little unorthodox, but surprisingly effective. Before you click the buy or sell button, physically stand up.

This small physical action creates a moment of separation between your thinking and your doing. It forces you to pause, breathe, and check in with yourself. Am I acting on plan or emotion? Is this trade aligned with my prep, or am I forcing it out of boredom?

We’ve all taken impulsive trades, only to regret them seconds later. Standing up adds a layer of intentionality. It breaks the rhythm of screen-staring and puts your brain back in the driver’s seat.

Think of it as your personal circuit breaker. It gives you a chance to double-check your logic and stops you from slipping into autopilot mode. Some traders even take it a step further and stretch or roll their shoulders before re-engaging with the screen. It might sound silly, but the effect on your mindset is real.

4. Use a ‘Focus Trigger’ to Prime Your Brain

Our brains love routines. You can use that to your advantage by building a simple ritual that tells your mind, “It’s time to trade.”

This doesn’t have to be anything elaborate. It might be playing a song you only use when trading or doing a brief breathing exercise. Some traders even use the act of cleaning their desk or making a fresh cup of coffee as a cue to shift into a focused state.

Over time, these small rituals become associated with mental readiness. They condition your brain to transition from passive scrolling or chatting into active concentration. That’s powerful, especially on days when you’re feeling a bit foggy or distracted.

The goal isn’t to create a superstition. It’s to build a reliable on-ramp into a focused headspace something that centres you and sets the tone for your session.

Disclaimer: This is for information and learning purposes only. The information provided does not constitute investment advice nor take into account the individual financial circumstances or objectives of any investor. Any information that may be provided relating to past performance is not a reliable indicator of future results or performance. Social media channels are not relevant for UK residents.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 85.24% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Learn Best Change of Character CHoCH Model in Trading with SMC

Most of the SMC traders get Change of Character CHoCH WRONG!

In this article, I will share with you Change of Character models that have a low accuracy and better to be avoided.

I will teach you the best CHoCH model for Forex Gold trading and show you how to identify it easily.

Let's start with the basic theory first and discuss what Change of Character signifies.

Change of Character in Bearish Trend

In a downtrend, Change of Character CHoCH is an important event that signifies a violation of a bearish trend.

CHoCH is confirmed when the price breaks and closes above the level of the last lower high.

Above, is a text book Change of Character model in a bearish trend.

For the newbie traders, such a price action provides a strong signal to buy while it fact it is NOT .

One crucial thing is missing in this model to confirm a bullish reversal.

According to basic trend analysis rules, we say that the market trend is bullish if the price forms a bullish impulse, retraces and sets a Higher Low HH , forms a new bullish impulse with a new Higher High HH.

Only then, we can say that the market is trading in up trend.

CHoCH model above confirms a bearish trend violation BUT it does not confirm a trend change.

Such a model may easily signify a deeper correction.

Look what happened with GBPNZD.

Though the price formed a confirmed bearish CHoCH, it was a false signal and just an extended correction.

That's a perfect bullish reversal model.

It combines CHoCH and conditions for a bullish trend.

Such a union is extremely accurate in predicting up movements.

Examine a price action on USDJPY.

Not only the price formed a confirmed CHoCH but also we see a start of a new bullish trend.

Change of Character in Bullish Trend

In an uptrend, Change of Character CHoCH is a significant event that signifies a violation of a bullish trend.

CHoCH is confirmed when the price breaks and closes below the level of the last higher low.

Above is a typical model of a bearish CHoCH.

For many traders, that is the signal to open short.

However, it is not that accurate and one important component is missing there.

According to basic price action rules, the market trend is bearish

if the price forms at least 2 bearish impulses with Lower Lows LL and a pullback between them with a Lower High LH.

Only when these 3 conditions are met, a bearish trend is confirmed .

Perfect bearish Change of Character model should include both CHoCH and a bearish trend price action. That will confirm a violation of a bullish trend and start of a new bearish trend.

EURCAD has a very strong potential to continue falling:

not only we see a valid bearish Change of Character but also

a start of a new bearish trend based on a price action.

Next time when you identify CHoCH on forex market, make sure that you check the preceding price action. It will help you to more accurate assess reversal probabilities and make a wiser trading decision.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Learn how to trade EOD / FOD Professional StrategyEOD /FOD is an acronym for End of Day buy or sell short entry that holds overnight and the First of Day sell the ETF or stock at Market Open. This is a strategy for experienced to Elite aka Semi-Professional Traders. Beginners need to hone skills and practice in a simulator.

Professional Traders use this strategy all the time. They rarely intraday trade aka "day trading" unless they are Sell Side Institution floor traders who do intraday trading all daylong.

EOD /FOD is a very simple, easy to learn strategy for when Buy Side Giant Dark Pools have accumulated OR have Supported the Market and the Dark Pools foot print of a rectangle that is narrow with consistent highs and lows.

TWAP Dark Pool orders trigger at a low price or lower and usually move price minimally. When in Support the Market mode. The run up is a long white candle.

TWAPs are automated Time Weighted At Average Price. These orders ping at a specific time and buy in accumulation mode. If the stock price suddenly moves up beyond the high range of the TWAP, then the orders pause or halt.

Then pro traders do nudges and runs are instigated by either Gap Ups by HFTs, OR smaller funds VWAP ORDERS, or MEME's or other large groups of retail traders all trading and entering orders in sync or as close to sync as possible to create a flood of small lots that do move price upward OR downward rapidly.

Using the EOD /FOD requires understanding of how the Dark Pools, Pro Traders and other groups react to price and what, where and when orders are automated.

When ever you see a platform trend pattern such as we have on the QQQ yesterday at close and early this morning, then the entry would have been in the last 5 minutes of yesterday's market.

A Step-by-step Guide to One of the Chart Analysis MethodHello Friends,

Welcome to RK_Chaarts,

Today we're going to learn step-by-step guide to one of the chart analysis Method by analyzing a chart of " Varun Beverages Ltd. (VBL) " to identify a trend change opportunity.(Educational Post).

Let's get started!

Applying Elliott Wave Theory

First, we can see that the bottom formed in March 2025 is likely a Wave ((4)) in Black as a bottom, marked as such on the chart. From there, Wave 5 should move upwards. Looking at the daily timeframe, we can see that price gone up in five sub-divisions of Wave (1) in Blue of Wave ((5)) in Black have completed, marked as Red 1-2-3-4-5, that means blue intermediate Wave (1) has ended, and Wave (2) has begun, which is unfolded in corrective nature marked as WXY in Red of Wave (2) in Blue.

According to the wave principle, Wave (2) should not retrace more than 100% of Wave (1), which started from the 419.65 bottom. Therefore, 419.65 becomes our invalidation level. If the price moves below this level, it would invalidate our Wave (2) principle.

Assuming our wave counts are correct, the upward movement is in the five sub-divisions, and the downward movement is in the three sub-divisions. Definitely, the conviction is increasing that we have correctly identified Waves (1) and (2). Shown in chart image below

Tweezers at Bottom

Now, we can see that Wave 2 has retraced more than 70% and has formed a Tweezer candlestick pattern at the bottom. A bearish candle was followed by a bullish candle, both with a Tweezer-like shape, with the second candle being green. This could indicate a potential reversal. Moreover, the latest candle has also taken out the high of the previous two candles, showing follow-through. The price has also shown follow-through on the upside after that. So, this can be considered as the first sign that Wave 2 might be ending, marked by a significant Tweezer pattern at the bottom with a follow-through candle. Shown in chart image below

Significant Breakout Pending Yet

Secondly, from the top where Wave 1 ended, we've been considering the decline from around 560.50 as a resistance. We drew a resistance trend line, and if the price breaks out above it, we can say that the resistance trend line has been broken, indicating a breakout above the last fall's trend line, Which is not Broken yet. Shown in chart image below

Dow Theory

The Dow Theory states that when the price moves up, it forms a Higher High, Higher Low pattern, and when it moves down, it forms a Lower High, Lower Low pattern. Somehow, the Dow Theory also needs to change, as the last swing was forming a Lower High, Lower Low pattern. The last swing high was at 479, which we marked with a green arrow. If the price crosses above it, we can say that the price is now forming a Higher High pattern. This indicates that the Dow Theory is changing from a falling trend to a rising trend. Shown in chart image below

Stop Loss

Once the Dow Theory also changes, we can use the last swing low at 446.15 as our stop loss. However, this stop loss will only be valid after the Dow Theory changes; otherwise, the invalidation level will remain at 419. Shown in chart image below

Projected Target of Wave (3)

So, friends, we've applied the Elliott Wave principle, and there's been a significant retracement, all within the valid range, without violating any rules or triggering invalidation. There's limited room left on the downside, and then we have the Tweezer candlestick pattern, which is a significant sign. We're expecting a reversal from there, and the price has followed up with an upward move.

What's left now is the breakout above the resistance trend line and a change in the Dow Theory. Once these two conditions are confirmed, all parameters will match, and we can add a position to our portfolio using the last swing low as our stop loss, instead of the invalidation level.

This is how chart analysis is done for investment purposes. We've seen many signs in our favor, and yet we still use a stop loss to prevent significant losses in case the stock or market moves unexpectedly. This is what stop loss is all about - minimizing potential losses.

We've also discussed the target projection based on Wave theory, 161.8% level, which we explained through an image. So, friends, I hope you've understood the entire conclusion and learned how to analyze charts using different methods, one of which we shared with you today.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Impact on the Dollar and Forex — Artavion AnalyticsThe development of central bank digital currencies (CBDCs) — especially the digital yuan (e-CNY) — is becoming a key factor in transforming global currency flows. While the US dollar still dominates, the architecture of global liquidity is beginning to shift.

At Artavion, we see the e-CNY not just as a technological experiment but as a tool of China’s currency policy. Its goal is to strengthen the yuan’s role in international settlements and reduce dependence on the dollar, particularly in developing regions.

Why the Digital Yuan Matters

The e-CNY is already being used in China for retail payments and is being tested in cross-border transactions (e.g., in the mBridge project with the UAE and Thailand). This enables the creation of alternative payment systems not tied to SWIFT.

If the digital yuan gains broader acceptance, especially for commodity and energy settlements, its role in forex will grow, potentially weakening the dollar’s monopoly in certain regions.

CBDCs and Forex Structure

CBDCs won’t displace the dollar in the near term, but they are already influencing the structure of currency trading:

New currency pairs are emerging, especially in Asia;

Transactions are becoming faster and cheaper, particularly in the B2B segment;

Market participants are adjusting strategies to real-time settlements and the potential programmability of currencies.

Risks and Limitations

Privacy: CBDCs are under full state control;

Fragmentation: There is no unified technical standard across different countries’ CBDCs;

Geopolitics: The rise of the e-CNY could intensify currency competition with the dollar.

Artavion’s Conclusion

The digital yuan will not replace the dollar, but it is creating an alternative — especially in regions seeking autonomy from Western financial infrastructure. For traders and investors, this means reassessing currency risks and exploring new opportunities in decentralized settlement channels.

3 Line Strike Pattern: What It Means and How to Use It3 Line Strike Pattern: What It Means and How to Use It in Trading

Candlestick patterns are crucial tools for traders, offering valuable insights into market sentiment and potential price movements. Among these patterns, the Three Line Strike setup is particularly sought after by traders in forex, stock, commodity, and index markets. This article explores the intricacies of the Three Line Strike, explaining how to identify it on charts, highlighting its unique characteristics, and discussing how to incorporate it into trading strategies.

Three Line Strike Pattern: An Overview

The Three Line Strike is a candlestick pattern used in technical analysis to trade trend continuations. However, it often appears ahead of trend reversals. The pattern consists of four candlesticks and can be found in up- and downtrends.

Bearish Three Line Strike

The bearish 3 Line Strike candlestick pattern suggests a continuation of a downtrend. It starts with three consecutive bearish candles, each opening and closing lower than the previous one. This is followed by a large bullish candle, which opens lower and closes above the open price of the first bearish candle. This pattern reflects the strength of the downtrend. Still, it may appear at the bottom of the downtrend and signal a trend reversal.

Bullish Three Line Strike

The bullish 3 Line Strike candlestick pattern suggests the potential continuation of a solid uptrend. It starts with three consecutive bullish candles, each opening and closing higher than the last. This is followed by a large bearish candle, which opens higher and closes below the close of the first bullish candle. This pattern indicates that the solid uptrend may continue, but it may signal the market will turn down if it’s formed at the peak of the uptrend.

Analysing Three Line Strike Patterns

As the Three Line Strike pattern can provide both reversal and continuation signals, it’s vital to combine it with other analytical tools, including trend indicators like moving averages and oscillators like the Relative Strength Index. Also, traders consider the overall trend on higher timeframes.