crypto downtrend exhaustion indicatorsA couple facts:

1) usdt.d is above 5.60% for ~two days. This is a major fact. We have an early bull market end confirmation, or at least the end of an impulse structure of intermediate degree. There is a probability that the structure of the current bull market will be either extended or will end with the final diagonal.

2) usdt.d below 5.60% is confirmation of current dump exhaustion.

3) Crossing down one of the trend lines at BTC dominance chart will mean start of alt season. The target for the mini alt season is ~53% at BTC.D;

4) The terminal target for upcoming Dogecoin rally is range between 0.5 - 1.37 USD. Beware pullback, i look at whole crypto market structure and anticipate one.

Wave Analysis

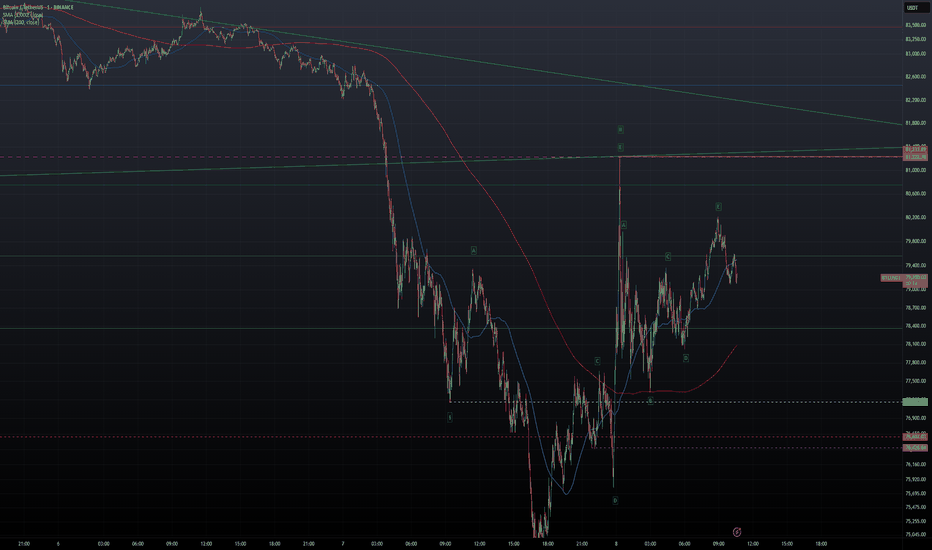

BITCOIN - Short Trade Idea Update - Wave ii Looks Complete...In this video, I break down what I woke up to this morning regarding the wave structure.

With wave ii appearing to be complete, I’m looking to add to my short position and adjust my stop level down to 81,223—creating another potential entry point for the short trade.

Recognizing and understanding these developing patterns is essential if you want to stay in the game.

SOL Trade Plan: Daily Support, Liquidity Grab & Trade Idea.Solana (SOL) is currently navigating a challenging market environment, with broader sell-offs across the crypto space weighing heavily on its price action. On the daily and 4-hour timeframes, SOL has traded into a significant support zone, marked by previous swing lows. This area has historically acted as a magnet for buyers, but the recent dip below these levels suggests a liquidity grab is underway. This move has likely triggered sell stops sitting below the lows, creating the potential for a reversal as smart money steps in. ⚡

Zooming into the 15-minute timeframe, SOL is consolidating within a tight range, reflecting a period of indecision. This range-bound behavior often precedes a breakout, and a bullish break above the range could signal the start of a recovery. A shift in market structure—marked by higher highs and higher lows—would provide further confirmation of bullish intent.

Key Insights:

Daily Timeframe: SOL has dipped below key support levels, sweeping liquidity.

4-Hour Timeframe: Price is overextended, trading into a critical demand zone.

15-Minute Timeframe: Consolidation within a range, awaiting a breakout for directional clarity.

Trading Plan:

Patience is Key: Wait for SOL to break out of the 15-minute range to the upside. 🚀

Market Structure Confirmation: Look for a clear shift to bullish market structure (higher highs and higher lows). 📊

Entry Strategy: Enter long positions after confirmation, with a stop-loss placed below the range low. 🛡️

Profit Targets: Focus on resistance levels on the 4-hour and daily timeframes for potential take-profit zones. 🎯

Levels to Watch:

Support Zone: Previous daily swing lows, now acting as a liquidity zone.

Resistance Zone: The upper boundary of the 15-minute range and key levels on the 4-hour chart.

This setup highlights the importance of waiting for confirmation before entering a trade. While the liquidity grab below support is a promising signal, a breakout and bullish structure are essential to avoid false moves. As always, this is not financial advice—traders should conduct their own analysis and manage risk appropriately. ⚠️

Markets Technical Analysis 6th April 2025Summary:

- Expects Equities (NK225, HSI, SPX, NDX) to bounce on Monday trading session (7th April 2025).

- Big US tech stocks (AAPL, MSFT, NVDA, AMZN, TSLA, META, GOOG, NFLX) are at support levels.

- Expects commodities (Oil, Copper, Gold, Silver, Cocoa) to be down in the longer term.

I will post this idea as neutral even though it is long for equities in the very short term and short for commodities in the longer term.

BRIEFING Week #14 : What a Mess !Here's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BITCOIN - Price Could Be Heading Towards 60K...After multiple rejections at higher price levels, the most recent major rejection—followed by a break of the lows—suggests that the corrective move we've seen since the end of February may have concluded.

In this video, I outline the key reasons why a larger upside move no longer appears likely.

With the potential end of the corrective wave combinations now in sight, I'm shifting to a bearish outlook, targeting a potential move down to $61K. To validate this view, we need to see a break below $81,222, confirming the start of a deeper breakdown.

As it stands, I can no longer support a short-term bullish scenario unless we see a strong break above $84,715. However, given the recent sharp move to the downside, this seems unlikely and may, in fact, mark the beginning of a larger downward trend.

Bitcoin Elliott Waves Analysis: Short opportunityIn this lengthy video, I discussed the details of labelling and counting of waves for Bitcoin from daily to the 5 mins timeframes. I drilled down to the minuette waves (in orange) on the 5 mins timeframe. Take note that I made a mistake in the actual config of one of the orange waves (setting it as minute instead of minuette). The mistake happened on the 9:15 where I changed the color of the corrective wave A-B-C but did not change the degree.

In this video, I also discussed the alternate counts (in blue) in details.

But while both the primary and alternate counts are both short bias, the target entries (and thus risks) are different. if you are an aggressive trader, and want to trade on the alternate count, your stop will be set above the blue line where the alternate count is invalidated. If you are trading on my primary count, you will want to see reversal pattern (e.g. candlestick reversal) or see rejection at the red line.

In any case, good luck in your trading and remember to keep your risk tight!

NAS100 Turn of the Month Strategy Meets Market Volatility!In this video, we dive into the Turn of the Month Strategy and explore how it could play out in the current market environment. Historically, mutual funds rebalance their portfolios at the end of the month, creating buying pressure that often leads to higher stock prices into the new month. Additionally, recurring financial inflows, such as monthly salary payments and pension contributions, tend to boost market demand during this period.

However, this month presents a unique challenge. The NASDAQ 100 has capitulated into the end of the month, driven by heightened volatility and uncertainty fueled by Donald Trump's rhetoric. With the market currently trading into a significant support zone and liquidity pool, we analyze whether the Turn of the Month effect can counteract the recent bearish momentum.

📊 Key Highlights in the Video:

Price Action Analysis: The NASDAQ 100 is deeply overextended, trading into a critical liquidity pool.

Trade Idea: A potential counter-trend rally could emerge as the market seeks to correct and rebalance.

Strategy: Look for a short-term rally into resistance, followed by a possible shorting opportunity as the market resumes its downward trend.

This video is perfect for traders looking to combine price action trading with seasonal strategies like the Turn of the Month effect. Will the market rally into the new month, or will bearish momentum prevail? Watch now to find out! 🚀

Nasdaq Elliott Wave Update on Short Position ManagementIn this video, I go through exactly how I plotted the wave counts that I published on 3rd April (linked to this idea). I also show how to estimate price target using support and Fibonacci extensions. Lastly, I talk about trading productivity again and why I recommend to take out some of your short position.

There are 3 main reasons:

1. We have completed wave 3 of 3 and is now going into wave 4 (and wave 4 are notorious for being unpredictable and may even have triple combinations).

2. We are what? 80% in the money and it happens very fast. So productivity wise, it is good to take some money off the table.

3. Weekend risk.

I am putting this idea as "Neutral" even though I am still expecting a wave 5 down. Reason is because we are in wave 4, and also because I pray that I can find time to update again when wave 4 ends and wave 5 of 3 starts.

Good luck!

Using Fibonacci/Measured Moves To Understand Price TargetThis video is really an answer to a question from a subscriber.

Can the SPY/QQQ move downward to touch COVID levels (pre-COVID High or COVID Low).

The answer is YES, it could move down far enough to touch the pre-COVID highs or COVID lows, but that would represent a very big BREAKDOWN of Fibonacci/ElliotWave price structure.

In other words, a breakdown of that magnitude would mean the markets have moved into a decidedly BEARISH trend and have broken the opportunity to potentially move substantially higher in 2025-2026 and beyond (at least for a while).

Price structure if very important to understand.

Measured moves happen all the time. They are part of Fibonacci Price Theory, Elliot Wave, and many of my proprietary price patterns.

Think of Measured Moves like waves on a beach. There are bigger waves, middle waves, smaller waves, and minute waves. They are all waves. But their size, magnitude, strength vary.

That is kind of what we are trying to measure using Fibonacci and Measured Move structures.

Watch this video. Tell me if you can see how these Measured Moves work and how to apply Fibonacci structure to them.

This is really the BASICS of price structure.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver