Wave Analysis

Ethereum - Watch This Massive Support!Ethereum ( CRYPTO:ETHUSD ) is weak but testing strong support:

Click chart above to see the detailed analysis👆🏻

The entire crypto market is currently not able to stop the bleeding and also Ethereum just dropped another -20% over the past three days. It might seem like a horrible scenario but overall Ethereum is still in a bullish market. Just watch the final confluence of support now.

Levels to watch: $2.000, $4.000

Keep your long term vision,

Philip (BasicTrading)

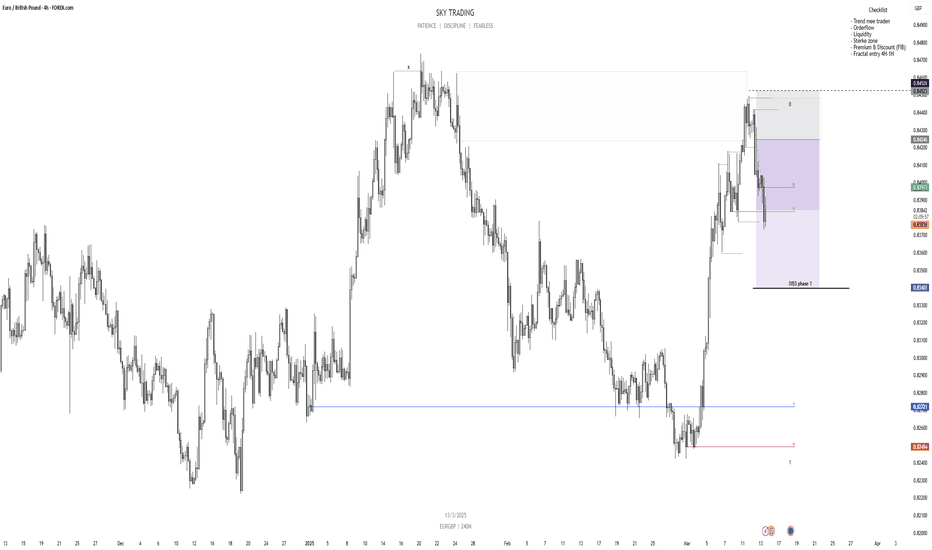

GOLD: In-Depth AnalysisGOLD: In-Depth Analysis

Today, I present to you an in-depth analysis of GOLD.

In this analysis, I delve into the factors influencing GOLD's price movements, examining both the potential reasons for upward and downward trends, as well as various trading scenarios.

You May Watch The Analysis For Further Details!

Thank you:)

CADCHF; Heikin Ashi Trade IdeaOANDA:CADCHF

In this video, I’ll be sharing my analysis of CADCHF, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

HK50; Heikin Ashi Trade IdeaPEPPERSTONE:HK50

In this video, I’ll be sharing my analysis of HK50, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏