Wave Analysis

Elliott Waves Breakdown of $BCH Bearish ModeAnalyzing Bitcoin Cash ( BINANCE:BCHUSD.P BCH) on the 1D timeframe using Elliott Wave theory, we observe a potential bearish continuation forming.

🔹 Wave Count & Structure

The primary structure suggests a Wave 4 correction has completed, leading to a possible Wave 5 decline.

A descending triangle formation has been broken, with an (A)-(B)-(C)-(D)-(E) wave structure confirming the pattern.

A sub-wave 1-2-3-4-5 impulse appears to be developing for the next downward move.

🔹 Key Levels

Entry Zone: The price has rejected from resistance around $350.

Target Zone: Bears could push price toward the $286 - $281 demand zone, with an extended target near $260 if selling pressure persists.

Invalidation Level: A break above $350+ would negate this bearish setup.

🔹 Market Context

Bitcoin's movement could influence BCH direction.

Confirmation needed with volume & candlestick structure before a strong move.

🚨 Bearish Bias – Watching for a potential breakdown continuation with proper risk management. Let me know your thoughts in the comments! 🔥💬

#Crypto #BCH #ElliottWave #Trading #BitcoinCash #Bearish #ChartAnalysis

Gold Short: Completion of 5 waves of Wave 5 (or sub-wave 3)As mentioned in this video, I have a primary count that states that Gold has completed the entire wave 3 (see link video for cycle wave counts), and my alternate count is that the 5th wave is not completed BUT sub-wave3 is completed and we are going into wave 4. Both primary and alternate points to a short opportunity.

The stop loss will be recent high (around 3058).

BITCOIN - Long Trade Idea - Possible Move Higher Incoming...This video follows up on the chart I posted last night, where I suggested that Bitcoin could break past its all-time highs and potentially double in value from its current levels.

This analysis is based on the AriasWave methodology, which offers a clearer perspective compared to the often-confusing Elliott Wave approach.

Check out the related idea below for the original chart, and in this video, I update that analysis with key levels to watch and potential risks to consider.

Micron Technology - Fully Resisting The Stock Market Crash!Micron Technology ( NASDAQ:MU ) is one of the few bullish stocks:

Click chart above to see the detailed analysis👆🏻

Despite the stock market kind of "crashing" lately, Micron Technology is one of the few stocks which remains in a rather bullish environment. Following the uptrend, the bullish break and retest and the beautiful cycles on Micron Technology, this strength will soon become reality.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

INJ | ALTCOINS | Bottom Likely CLOSEIn the previous cycle, INJ made a near full retracement after the bullish cycle.

This would put us round here, to which we are already fairly close:

To make it a little easier to reference, I'll use the Elliot wave tool (although these are not Elliot waves).

In short, the bottom is likely very close for INJ - but accumulation / sideways phase may take another while.

_______________________

BINANCE:INJUSDT

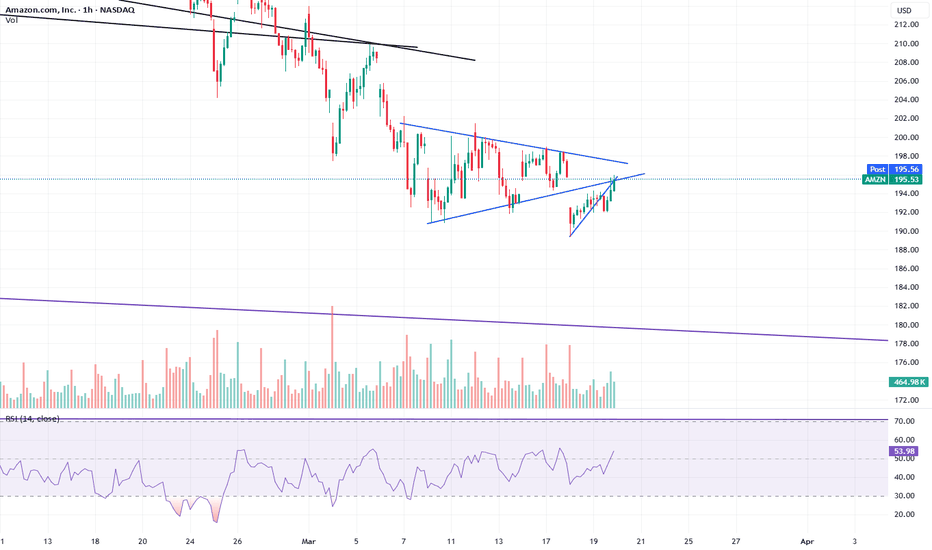

the market is in chop modeToday's price action wasn't as bearish as it should have been if we were to keep moving down. 5600 held, and that is significant. Chances are, we will triangle into Powell and then rally briefly to 5750 area to fill the futures gap and test the 200 and 18ma area. if that's the case, we may be in a larger correction period (ABC)

Gold Bullish to $3,030 (VIDEO UPDATE)As you remember from Saturday’s update I did say that Gold has surpassed $3,000, which opens up potential upside towards $3,030 - $3,060.

2 Scenario’s On How It’ll Play Out👇🏻

Scenario 1: Gold has a 3 Sub-Wave correction towards $2,964 - $2,940 (Wave 4), before buyers come in.

Scenario 2: Impulse move towards $3,030 carries on from CMP.

GBPJPY: Both Moves Are Possible But It Has Higher Odds To RiseGBPJPY: Both Moves Are Possible But It Has Higher Odds To Rise

19 March - Bank of Japan (BOJ) Rate Decision The BOJ is expected to maintain its interest rate at 0.5%, with no hike anticipated. While the rate decision itself seems predictable, the real market mover will likely be the press conference. If the BOJ avoids providing clear guidance on its monetary policy and leaves room for interpretation, the Japanese yen (JPY) may weaken further.

20 March - Bank of England (BOE) Rate Decision The BOE is also expected to hold its interest rate steady at 4.5%, with no cuts or hikes on the horizon. This aligns with market expectations.

You may watch the analysis for further details!

Thank you:)

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD Under Pressure - TA and Trade IdeaAUDNZD is facing selling pressure, as evident on the daily timeframe 📉. In this video, we analyze key support and resistance levels 📊 and explore a potential trade setup based on technical analysis, market structure, price action, and other critical factors. As always, this is not financial advice.