GOLD TOP IS NEARGold appears to be distributing on all timeframes excepting daily , this added to the extensive media coverage recently makes me think that a significant all time top is near , gold still maintains support on all timeframes but that is probably the only thing holding it from a big crash.

Wave Analysis

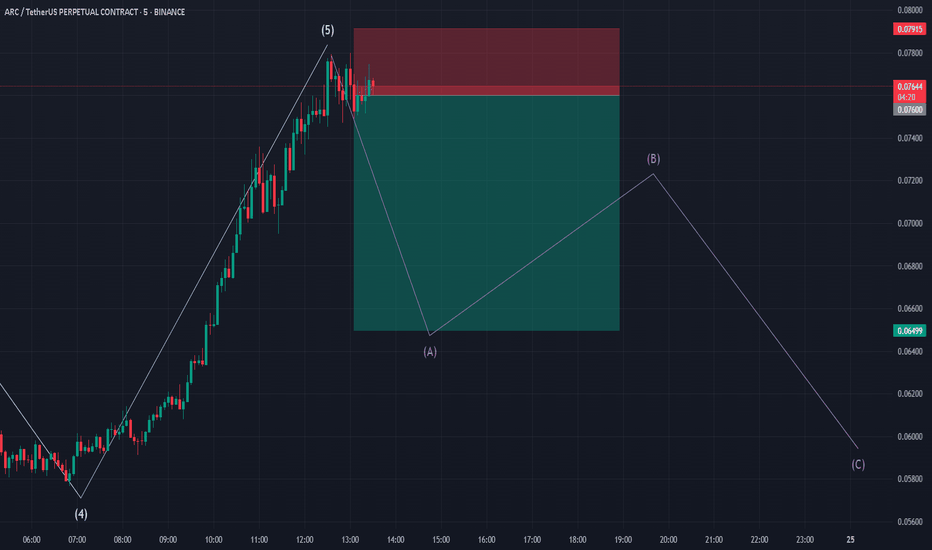

ARC/USDT - Elliott Wave Completion and ABC Correction ExpectedThe ARC/USDT perpetual contract on Binance has completed a classic 5-wave Elliott impulse pattern, peaking at wave (5). Based on Elliott Wave Theory, a corrective ABC pattern is expected, with wave A initiating a decline.

Entry: Short position near wave (5) peak

Target: Wave C completion zone around 0.056

Stop Loss: Above recent high near 0.0817

The retracement aligns with Fibonacci levels and prior support zones, suggesting a potential pullback before further trend continuation. Manage risk accordingly.

Nasdaq short: Hit Previous High and 2 Fib Ext TargetsAs explained in the video, I have 3 hits that suggests that we have hit the peak for Nasdaq:

1. Hit previous high made on 20th March 2025.

2. Fibonacci Extension where wave 5 = 1.618x Wave 1.

3. Entire wave e = 2.618x Wave 1.

Important here is the stop loss of around 19978. This is a positional play, meaning to ride this position if it goes in our favor.

Good luck!

Bitcoin at a Critical Juncture – Breakout or Breakdown? 📉 BTC is at a key decision point! After pulling back from recent highs, it's now consolidating within a range, sitting right in the middle of the previous price swing. I'm keeping a close eye on this zone—if price breaks out, a high-probability trade opportunity could emerge.

🎯 In this video, we dive deep into price action and market structure, breaking down a potential trade setup—if the market aligns with our strategy.

🚨 Trade smart, manage risk—this isn’t financial advice! 🚀🔥

Cardano Rangebound – Is a Breakout or Breakdown Imminent?📉 ADA is Rangebound! I’m watching closely—if price breaks out of this consolidation, it could set up a strong trading opportunity.

🎯 In this video, we analyze the market structure and price action, breaking down a possible trade setup—if the right conditions align.

🚨 Stay sharp, manage risk—this is not financial advice! 🚀🔥

Is Gold Ready to Drop? Key Levels & Strategy for the Next Move!📉🔥 Right now, XAUUSD (Gold) is pulling back from the highs and consolidating in a range. I'm watching for a buy opportunity if price breaks below the current range low and retraces into the previous swing equilibrium.

🎯 In the video, we dive into imbalances as key pullback targets, analyze price action and market structure, and discuss a potential trade setup—if the market presents the right conditions.

🚨 Not financial advice—trade smart! 🚀

The New week can give us a Pullback on Gold!Waiting for the bigger move and for that bigger move to happen we need a solid pill back to fill in some gaps. Focused on the patience for this in order to maximize the reward. Allow Monday and Tues to show if they will reach for the lows and set up. Logically the best entry should come after Tuesday. But you never know. Just wait for it cause price will show when it is ready.

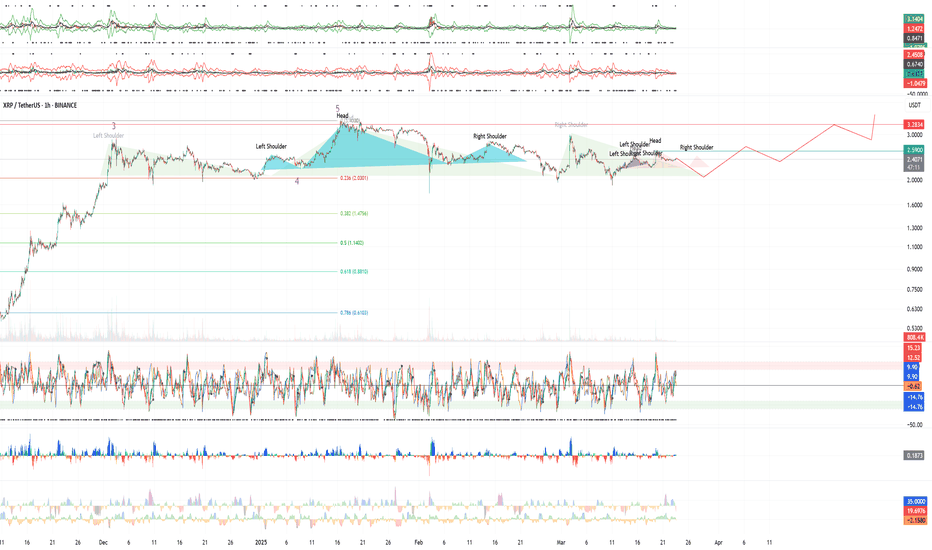

XRPUSDT Consolidating at ATHi see the consolidation as very young and it may need both : time and volume to gather serious weight in order to register new all time highs . I see a rare fractalized repetition of H&S patters on the lower timeframes which is up to end a toping pattern in the following days thus granting short term opportunities for shorting with significant R/R ratios

BRIEFING Week #12 : Alt-Season might be coming soonHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

bear market confirmationIf the chart will consolidates above 5.81%, i.e. above the sloping downtrend line, this would be an early indicator of the start of a bear market, because this line is global for the current bull market.

The second confirmation will be if dominance will bumped at 3.94 - 4.30% range as wave B and will update the end of wave A.