Wave Analysis

Nasdaq Elliott Wave Update on Short Position ManagementIn this video, I go through exactly how I plotted the wave counts that I published on 3rd April (linked to this idea). I also show how to estimate price target using support and Fibonacci extensions. Lastly, I talk about trading productivity again and why I recommend to take out some of your short position.

There are 3 main reasons:

1. We have completed wave 3 of 3 and is now going into wave 4 (and wave 4 are notorious for being unpredictable and may even have triple combinations).

2. We are what? 80% in the money and it happens very fast. So productivity wise, it is good to take some money off the table.

3. Weekend risk.

I am putting this idea as "Neutral" even though I am still expecting a wave 5 down. Reason is because we are in wave 4, and also because I pray that I can find time to update again when wave 4 ends and wave 5 of 3 starts.

Good luck!

Using Fibonacci/Measured Moves To Understand Price TargetThis video is really an answer to a question from a subscriber.

Can the SPY/QQQ move downward to touch COVID levels (pre-COVID High or COVID Low).

The answer is YES, it could move down far enough to touch the pre-COVID highs or COVID lows, but that would represent a very big BREAKDOWN of Fibonacci/ElliotWave price structure.

In other words, a breakdown of that magnitude would mean the markets have moved into a decidedly BEARISH trend and have broken the opportunity to potentially move substantially higher in 2025-2026 and beyond (at least for a while).

Price structure if very important to understand.

Measured moves happen all the time. They are part of Fibonacci Price Theory, Elliot Wave, and many of my proprietary price patterns.

Think of Measured Moves like waves on a beach. There are bigger waves, middle waves, smaller waves, and minute waves. They are all waves. But their size, magnitude, strength vary.

That is kind of what we are trying to measure using Fibonacci and Measured Move structures.

Watch this video. Tell me if you can see how these Measured Moves work and how to apply Fibonacci structure to them.

This is really the BASICS of price structure.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$AMD position trade idea LONG TERM weekly/monthlyNASDAQ:AMD has been weak for awhile on the weekly chart, but nothing lasts forever. This is a long position trade idea I have for myself, with the thesis that, long term, NASDAQ:AMD is reaching for $360ish over the next couple of years, based on fib projections from back when the bull market started years ago.

NASDAQ:AMD briefly touched a premium zone months ago (red shaded area), and with the current weakness NASDAQ:AMD has been pulling back and just reached a short term discount zone around $109 (green shaded area). My expectation is that NASDAQ:AMD might drop a bit more into this zone, perhaps sweep under the lows at $93.12, reach a couple of projected targets for the short interest (that I have marked in red and orange lines), and then find support and bounce aggressively from there.

This is all based on a pattern I frequently see where when a chart reaches the premium zone near the end of a move, it often pauses just shy of the target and feigns a reversal, falling back into the short term discount zone, often sweeping a low, and then aggressively pushing for the target that was intended all along. This serves to wash out any short term holders and deny them the full target, while offering good prices to the long term holders to reaccumulate before reaching their target.

Seek professional investment advice elsewhere, this is not trading or investment advice, this is my own observations and how I intend to approach NASDAQ:AMD in this current price area. I will not be blindly buying anything and I always manage my risk in case I'm wrong.

Flow State StrategyPrice behaves like a single organism that moves in cyclical, parabolic patterns: from Higher Highs (HH) to Higher Lows (HL) to Higher Highs again, and from Lower Highs (LH) to Lower Lows (LL) to Lower Highs. Each Higher Low creates new buy orders that are fulfilled, leading to the formation of a new High. Likewise, each Lower High creates resting sell orders that are executed, resulting in a new Low. Once you understand, monitor, and act upon this principle, along with your chosen strategy, you can truly flow with the market's movements rather than against them.

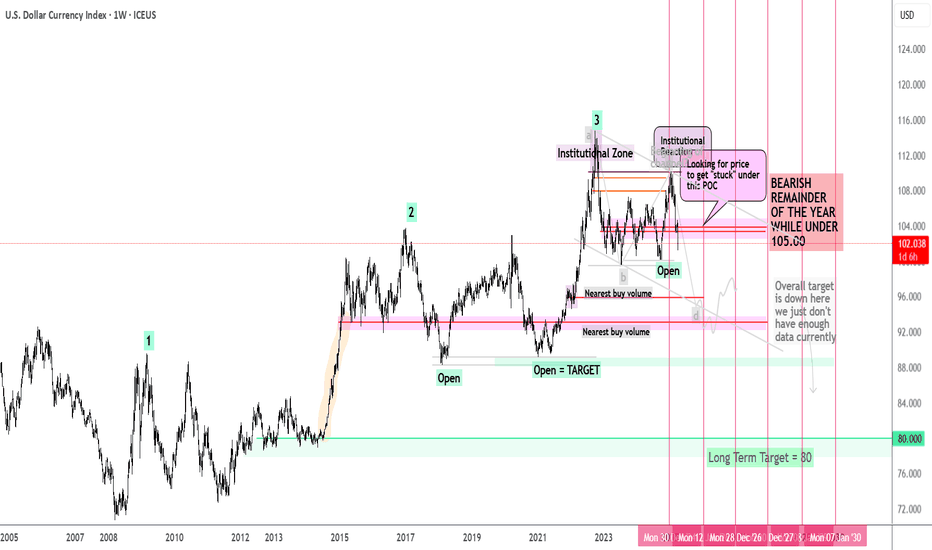

DXY to 80? ...Tariffs the First Domino in a Multi-Year Collapse?This is a pure technical walkthrough of the U.S. Dollar Index—no fluff, no indicators, no fundamentals. Just market structure, smart money, and liquidity concepts.

Back on January 14th , I posted about a potential 20%+ drop in the DXY — you can view it here . This video builds on that thesis and walks you through the full technical story from 1986 to today , including accumulation cycles, yearly trap zones, and my long-term target of 80. Am I crazy? Maybe. Let's see if I can convince you to be crazy too 😜

There is a video breakdown above, and a written breakdown below.

Here are timestamps if you want to jump around the video:

00:00 – The Case for $80: Not as Crazy as It Sounds

02:30 – The 0.786 Curse: Why the Dollar Keeps Faking Out

06:15 – How Smart Money Really Moves: The 4-Phase Playbook

12:30 – The Trap Is Set: Yearly Highs as Liquidity Bait

20:00 – Inside the Mind of the Market: 2010–2025 Unpacked

25:00 – The Bear Channel No One’s Talking About

36:00 – The First Domino: Is the Dollar’s Slide Just Beginning?

👇 If you're a visual learner, scroll down—each chart tells part of the story.

Chart: Monthly View – Three Highs, .786 Retraces, and Trendline Breaks

History doesn’t repeat, but it sure rhymes.

Each major DXY rally has formed a sequence of three swing highs right after a break of trendline structure. In both instances, price retraced to the .786 level on the yearly closes—an often overlooked fib level that institutional players respect.

We’re now sitting at a high again. You’ll notice price has already reversed from that zone. That doesn’t guarantee a collapse, but when we line it up with other confluences (next charts), the probability of a deeper markdown becomes hard to ignore.

I'd also like to note that all of the highlighted moves, are 2-3 year trend runs. Which means if we are bearish, this could be the exact start of a 2-3 bear market.

Market Phases Since 1986

This chart illustrates how DXY has moved through repeating cycles of:

🟡 Accumulation: Smart money building positions quietly.

🔵 Markup: Price accelerates with buy orders + media hype.

🟣 Distribution: Smart money sells to latecomers.

🔴 Markdown: Public panic → smart money reloads.

If we are indeed entering another markdown phase, this would align perfectly with the pattern seen over the past 40 years.

You’ll also notice the "Point of Control" (POC) zones—volume-based magnets that price often returns to. These spots often act as the origin of the move, and as such, they make for strong targets and areas of interest.

Liquidity Zones and Stop Loss Traps

This is where it gets juicy.

The majority of breakout traders placed long entries at the blue lines—above swing highs, thinking resistance was broken. But what’s under those highs? Stop loss clusters.

Institutions use these areas as liquidity harvests.

Several key levels are marked as “OPEN” in this chart, meaning price has yet to return to sweep those orders. That’s why I’m expecting price to begin seeking out that liquidity over the coming months.

There's also an imbalance gap (thin price action) around the 85–86 zone. If price falls into that trap door, there’s nothing to stop it until the 80s.

The 2025 Outlook

Here’s how I’m approaching this year:

✅ Bearish bias under 105

🎯 Targets at 100, 95, and 90

🚪 Trap door under 86 if volume is thin

Price is currently stuck under the recent point of control and showing signs of distribution. If that level continues to hold as resistance, we could see a multi-leg push downward, with the 100 and 95 zones acting as check-in points.

If we break under the 90s and enter the imbalance zone, 80 becomes more than just possible—it becomes probable.

🗣️ Let’s Sharpen Together

Do you see this unfolding the same way?

Do you disagree with the 80 target?

Drop a comment with your view or share your own markup—this is why we trade!

Stay safe,

⚠️ Risk Disclaimer

This post is for educational purposes only and reflects my personal analysis and opinions. It is not financial advice. Trading involves significant risk and may not be suitable for all investors. Always do your own research, manage your risk appropriately, and never trade money you can’t afford to lose.

BITCOIN - Long Trade Price Action Update...In this video, I break down the latest price action while incorporating some AriasWave analysis along the way.

There's nothing unusual happening—just psychological reactions testing your patience.

Welcome to the world of trading lol, where you can be riding high one moment and facing losses the next, shifting between excitement and frustration.

Today, I dive into the psychology of trading—what drives a trader’s mindset, the balance between logic and mental discipline, and how mastering both can help grow your bank account. Everything begins in the mind, whether it’s knowledge or habit.

I remain bullish, and while the external picture hasn’t changed much, what about your internal one?

NASDAQ Trade Plan: From 4-Hour Trend to 15-Minute Execution!NAS100 Strategy: Using Fibonacci and Market Structure for Precision!

📊 In this NASDAQ (NAS100) trade idea, I focus on a top-down approach starting with the 4-hour chart. If the 4-hour trend is bullish, I look for higher highs and higher lows. If bearish, I focus on lower highs and lower lows. 🔄 My key strategy is identifying pullbacks into equilibrium—around the 50% Fibonacci retracement level—within any price swing. This is my point of interest.

Once price moves into this area, I shift to the 15-minute chart to refine my entry. 🔍 Here, I wait for a break of structure during the pullback, aligning with the overall trend direction. This approach allows for precise execution while staying in sync with the larger trend. 🚀

⚠️ This is not financial advice. Always trade responsibly and manage your risk.

XAUUSD Analysis: Why I’m Not Buying Gold at the Highs!Gold’s Rally: A Strategic Plan for the Next Buy Setup!

✨ Gold (XAUUSD) has experienced a strong rally recently, fueled by the stock market sell-off. However, I’m waiting for a better entry point rather than buying at the current highs, as price is trading at a premium. 📉 My focus is on a potential retracement on the daily and 4-hour timeframes, targeting a pullback into the swing low-to-high range. Specifically, I’m watching for price to return to the equilibrium zone around the 50% Fibonacci retracement level. 🔄 If price pulls back and we see a bullish break of market structure in this area, it could present a solid buying opportunity. Until then, patience is key! 🛠️

⚠️ This is not financial advice. Always trade responsibly and conduct your own analysis.

Trend Changing Pattern (TCP) in Action: Live ExampleHey traders,

Following up on yesterday’s lesson about the Trend Changing Pattern (TCP), I wanted to share a real-time example using the CADJPY pair in an intraday downtrend.

Today, we spotted a TCP setup where price action gave us a classic reversal signal:

The market manipulated the low of the TCP zone with a single break.

This was followed by a W pattern and a second attempt that failed to make a lower low.

That failure to create a new low acted as our entry confirmation for a long position.

🔹 Entry: 103.71 (Long)

🔹 Stop Loss: 103.28 (Just below the break low for protection)

This trade setup perfectly illustrates how price structure and momentum shifts can help you catch early entries during trend reversals.

Stay sharp, manage your risk — and have a blessed trading day!

Dogecoin - You Should Not Be Afraid!Dogecoin ( CRYPTO:DOGEUSD ) could reverse right now:

Click chart above to see the detailed analysis👆🏻

Four months ago Dogecoin perfectly retested the previous all time high and is now creating the anticipated bearish rejection. However during every bullish cycle we saw a correction of at least -60%, which was followed by a parabolic rally, so there is no reason to be worried at all.

Levels to watch: $0.2, $0.5

Keep your long term vision!

Philip (BasicTrading)