EUR/USD- Elliott Wave + Smart Money Concepts (SMC)SMC Insight

Supply Zone Marked: Between 1.1500 – 1.2000.

Price is heading toward the supply zone.

On the right visual, schematic shows:

Liquidity build-up below equal highs.

Possible liquidity grab just above the supply zone.

Expect reaction or reversal around that supply.

---

Trade Bias

Short-term: Bullish (momentum and structure are up).

Long-term: Watch for reaction at the 1.1500–1.2000 zone. This could be a major sell zone if price shows rejection/mitigation signs

Community ideas

The Ultimate Guide to Smart Money ReversalsLet’s cut to it. Most retail traders get caught chasing moves that were never meant for them. They’re entering late, reacting to structure breaks without context, or fading moves without understanding what’s really happening behind the price.

If you're trying to trade like smart money on the reversal, at the turn then you need to know when the game is flipping. That’s where the Market Structure Shift (MSS) comes in. But not just any MSS. I'm talking about MSS that follow a liquidity sweep and are driven by real displacementnot weak candles, not in consolidation. Real intent. Real shift.

Here’s how I approach it.

What Actually Counts as a Market Structure Shift?

Everyone talks about market structure higher highs, lower lows, etc. But structure breaks alone don’t mean anything. A valid MSS isn’t just about breaking a swing point. It’s why it broke and how it broke that matters.

I only consider a shift valid when three things are in place:

Liquidity has been taken (above a high or below a low).

The shift is caused by a displacement candle that clearly shows urgency.

The move happens with strength, not during chop or consolidation.

If you don’t have all three, it’s just noise.

Liquidity Comes First

Everything starts with a liquidity sweep. That’s the trap.

Price has to reach into a pool of liquidity usually above equal highs, clean swing highs, or below clean lows to grab those orders, and reject. That rejection is key. It shows smart money is offloading positions into retail breakouts or stop hunts.

Without a sweep, I don’t care what breaks. No liquidity = no reversal setup.

So the first thing I do is mark out obvious liquidity levels. Equal highs, equal lows, trendline touches anywhere retail is likely to have their stops sitting. That’s where the fuel is.

Then Comes Displacement

After the sweep, I want to see displacement a sharp, aggressive move in the opposite direction.

Not a weak pullback. Not a slow grind. A real candle that shows intent.

Displacement is always obvious. You’ll get a clean candle, often engulfing multiple others, that breaks structure and leaves behind an imbalance what we call a Fair Value Gap (FVG). That imbalance is the signature of smart money hitting the market hard enough to leave a gap in the order flow.

If the candle’s weak, or if it happens during consolidation, I skip it. Displacement is what separates real reversals from fakeouts.

Here is a clean example of what it should look like.

Confirming the Shift

Once displacement confirms intent, I check if it actually broke structure.

That means:

In an uptrend, I want to see price break a previous higher low after sweeping a high.

In a downtrend, I want price to break a lower high after sweeping a low.

When that happens, that’s your MSS. Price has grabbed liquidity, shown displacement, and broken a key point in the structure. At that point, we’ve got a confirmed shift in control.

Entries, Stops, and Targets

Here’s how I trade it.

After the MSS, I wait for price to pull back into the origin of the move. Usually, that’s going to be one of two things:

The Fair Value Gap (imbalance left by the displacement candle)

Or the MSS line itself (Shown on the example)

Once price comes back into that zone, that’s where I’m interested in getting in.

Stop loss always goes just above the high (for shorts) or below the low (for longs) of the displacement candle that caused the MSS. You’re giving it room to breathe, but keeping it tight enough to protect capital.

Targets are straightforward: go for the next pool of liquidity. That means swing lows (sell-side) if you’re short, or swing highs (buy-side) if you’re long. That’s where price is most likely to be drawn next.

A Clean Bearish Example

Let’s say price is trending up, putting in higher highs and higher lows. Then it takes out a recent swing high liquidity swept.

Immediately after that, a strong bearish candle drops and breaks the most recent higher low. That candle leaves an imbalance behind—perfect.

Now I’ve got:

✅ Liquidity sweep

✅ Displacement

✅ Break of structure

I mark out the FVG / MSS line, wait for price to retrace back into it, and enter the short. My stop goes above the displacement candle high. My target? The next clean swing low. That's the next spot where stops are resting where the market is drawn.

A Few Things to Watch Out For

This method works, but only if you’re strict about the rules.

Don’t take MSS setups in consolidation. Wait for clean, impulsive breaks.

If the shift happens without displacement or imbalance, skip it. It’s not clean.

Be realistic with stops. Tight is good, but don’t choke the trade. Give it the structure it needs.

The biggest mistake I see? Traders jump in too early trying to front-run the shift before displacement confirms it. Let the story unfold. Wait for the sweep. Wait for the candle that slaps the market and breaks structure. That’s your edge.

As shown here, the first "MSS" is invalid and not the A+ setup you're looking for.

Final Thoughts

Trading smart money reversals is about reading intent. You’re not just looking at price, you’re understanding why it moved the way it did.

When you combine a liquidity grab, displacement, and a break in structure, you're aligning with institutional activity. You're trading at the turn when smart money flips the script and leaves everyone else chasing.

This isn’t about trading every break. It’s about knowing which breaks matter.

Keep it clean. Stay patient. Follow the flow.

__________________________________________

Thanks for your support!

If you found this guide helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

Make sure to follow me for more price action insights, free indicators, and trading strategies. Let’s grow and trade smarter together! 📈

Supply and Demand by Thapelo Consolidation and Expansion

The markets either do one of two things: Price either consolidates or expands.

Consolidation: a period in the market where price is moving calm which moves in a range known as the dealing range. We will be able to identify a clear high and low to this range.

You have probably heard of the term range bound, ranging, or consolidating. This means that price is typically staying in one area, and just moving sideways, rather than up or down.

The range can be tight (meaning a spread of only a few pounds), or the range can be loose (meaning a spread of hundreds of thousands of pounds from range high to low. This partly will come down to the timeframe implemented.

Expansion: a period in the market where price is moving aggressively in one direction or the other. We will see an impulsive move to the upside, or an impulsive move to the downside, where price will give us large candle bodies or wicks. This is known as expansion.

How to Apply Modern Portfolio Theory (MPT) to Trading?How to Apply Modern Portfolio Theory (MPT) to Trading?

Harry Markowitz’s Modern Portfolio Theory revolutionised investing by providing a structured way to balance potential risk and returns. By focusing on diversification and understanding how assets interact, MPT helps traders and investors build efficient portfolios tailored to their goals. This article explores “What is MPT,” the core principles of MPT, its practical applications, and its limitations, offering insights into why it remains a foundational concept in modern finance.

What Is Modern Portfolio Theory?

Modern Portfolio Theory (MPT) is a financial framework designed to help investors build a portfolio that balances potential risk and returns in the most efficient way possible. Introduced by economist Harry Markowitz in 1952, MPT is grounded in the idea that diversification—spreading investments across different assets—can reduce overall risk without necessarily sacrificing returns.

At its core, MPT focuses on how assets within a portfolio interact with each other, not just their individual performance. Each asset has two key attributes: expected return, which represents the potential gains based on historical performance, and risk, often measured as the volatility of those returns.

The theory emphasises that it’s not enough to look at assets in isolation. Instead, their relationships—measured by correlation—are critical. For instance, combining assets that move in opposite directions during market shifts can stabilise overall portfolio performance.

A central concept of Markowitz’s model is the efficient frontier. This is a graphical representation of portfolios that deliver the highest possible return for a given level of risk. Portfolios below the efficient frontier are considered suboptimal, as they expose investors to unnecessary risk without sufficient returns.

MPT also categorises risk into two types: systematic risk, which affects the entire market (like economic recessions), and unsystematic risk, which is specific to an individual company or sector. Diversification can only address unsystematic risk, making asset selection a key part of portfolio construction.

To illustrate, imagine a portfolio that mixes equities, bonds, and commodities. Equities may offer high potential returns but come with volatility. Bonds and commodities, often less correlated with stocks, can act as stabilisers, potentially reducing overall risk while maintaining growth potential.

The Core Principles of MPT

Markowitz’s Portfolio Theory is built on a few foundational principles that guide how investors can construct portfolios to balance potential risk and returns.

1. Diversification Reduces Risk

Diversification is the cornerstone of MPT. By spreading investments across different asset classes, industries, and geographic regions, traders can reduce unsystematic risk. For example, holding shares in both a tech company and an energy firm limits the impact of a downturn in either industry. The idea is simple: assets that behave differently in various market conditions create a portfolio that’s less volatile overall.

2. The Risk-Return Trade-Off

Investors face a constant balancing act between potential risk and returns. Higher potential returns often come with higher risk, while so-called safer investments tend to deliver lower potential returns. MPT quantifies this relationship, allowing investors to choose a risk level they’re comfortable with while maximising their potential returns. For instance, a trader with a low risk tolerance might lean towards a portfolio with bonds and dividend-paying stocks, whereas someone with a higher tolerance may include more volatile emerging market equities.

3. Correlation Matters

One of MPT’s key insights is that not all assets move in the same direction at the same time. The correlation between assets is crucial. Low or negative correlation—where one asset tends to rise as the other falls—helps stabilise portfolios. For example, government bonds often perform well when stock markets drop, making them a popular addition to equity-heavy portfolios.

How the MPT Works in Practice

Modern Portfolio Theory takes theoretical concepts and applies them to real-world investment decisions, helping traders and investors design portfolios that align with their goals and risk tolerance. Here’s how it works step by step.

The Efficient Frontier in Action

The efficient frontier is a visual representation of optimal portfolios. Imagine plotting potential portfolios on a graph, with risk on the x-axis and expected return on the y-axis. Portfolios on the efficient frontier offer the highest possible return for each level of risk. For example, if two portfolios have the same level of risk but one offers higher returns, MPT identifies it as the better choice. Investors aim to build portfolios that lie on or near this frontier.

Portfolio Optimisation

The goal of Markowitz’s portfolio optimisation is to combine assets in a way that balances potential risk and returns. This involves analysing the expected returns, standard deviations (volatility), and correlations of potential investments. For instance, a mix of stocks, government bonds, and commodities might be optimised to maximise possible returns while minimising overall portfolio volatility. Technology, like portfolio management software, often assists in running complex Modern Portfolio Theory formulas, like expected portfolio returns, portfolio variance, and risk-adjusted returns.

Risk-Adjusted Metrics

Investors also evaluate portfolios using metrics like the Sharpe ratio, which measures returns relative to risk. A higher Sharpe ratio typically indicates a more efficient portfolio. For example, a portfolio with diverse holdings might deliver similar returns to one concentrated in equities but with less volatility.

Adaptability to Changing Markets

While the theory relies on historical data, Markowitz’s Portfolio Theory is adaptable. Investors frequently rebalance their portfolios, adjusting asset allocations as markets shift. For example, if equities outperform and dominate the portfolio, a trader may sell some and reinvest in bonds to maintain the desired risk level.

Limitations and Criticisms of MPT

Modern Portfolio Theory has reshaped how we think about investing, but it’s not without its flaws. While it offers a structured framework for balancing possible risk and returns, its assumptions and practical limitations can present challenges.

Assumption of Rational Behaviour

MPT assumes that investors always act rationally, basing decisions on logic and complete information. In reality, emotions, biases, and unpredictable behaviour play significant roles in markets. For example, during a financial crisis, fear can lead to widespread selling, regardless of an asset’s theoretical value.

Ignoring Tail Risks

The model underestimates the impact of extreme, rare events, known as tail risks. These events, including economic collapses or geopolitical crises, can significantly disrupt even well-diversified portfolios.

Dependence on Historical Data

The theory relies on historical data to estimate risk, returns, and correlations. However, past performance doesn’t always reflect future outcomes. During major market disruptions, correlations between assets—normally stable—can spike, reducing the effectiveness of diversification. For instance, in the 2008 financial crisis, many traditionally uncorrelated assets fell simultaneously.

Simplified Risk Measures

MPT equates risk with volatility, which doesn’t always capture the full picture. Sharp price swings don’t necessarily mean an asset is risky, and relatively stable prices don’t guarantee reliability. This narrow definition can lead to overlooking other important factors, like liquidity or credit risk.

How Investors and Traders Use MPT Today

Modern Portfolio Theory remains a cornerstone of investment strategy, and its principles are widely applied in portfolio construction, asset allocation, and diversification.

Portfolio Construction and Asset Allocation

Central to Modern Portfolio Theory is asset allocation: determining the optimal mix of assets based on an investor’s risk tolerance and goals. A classic example is the 60/40 portfolio, which allocates 60% to equities for growth and 40% to bonds for so-called stability. This balance aims to provide steady possible returns with reduced volatility over time.

Another well-known approach is Ray Dalio’s All-Weather Portfolio, designed to perform across various economic conditions. It includes:

- 30% stocks

- 40% long-term bonds

- 15% intermediate bonds

- 7.5% gold

- 7.5% commodities

This portfolio reflects MPT's emphasis on diversification and risk management, spreading investments across asset classes that respond differently to market shifts.

Alternative Investments and Diversification

MPT has evolved to include alternative investments like real estate, private equity, crypto*, hedge funds, and even carbon credits. These assets often have lower correlations with traditional markets, enhancing diversification. For example, real estate might perform well during inflationary periods, offsetting potential declines in equities.

Investors also consider geographic diversification, combining domestic and international assets to balance regional risks.

Implications for Traders

While MPT is often associated with long-term investing, its principles can inform trading strategies. For instance, traders might diversify their positions across uncorrelated markets, such as equities and commodities, to reduce overall portfolio volatility. Dynamic position sizing—adjusting exposure based on market conditions—also aligns with MPT’s risk-return framework.

The Bottom Line

The Modern Portfolio Theory offers valuable insights into balancing possible risk and returns, helping traders and investors create diversified, resilient portfolios. While it has its limitations, MPT’s principles remain widely used in portfolio construction and trading strategies.

FAQ

What Is the Modern Portfolio Theory?

The Modern Portfolio Theory (MPT) is a framework that helps investors construct portfolios to balance possible risk and returns. It emphasises diversification, using statistical analysis to combine assets with varying risk and return profiles to reduce volatility and optimise potential income.

What Are the Two Key Ideas of Modern Portfolio Theory?

MPT focuses on two main concepts: diversification and the risk-return trade-off. Diversification spreads investments across assets to potentially reduce risk, while the risk-return trade-off seeks to maximise possible returns for a given level of risk.

What Are the Most Important Factors in Modern Portfolio Theory?

Key factors include expected returns, risk (measured by volatility), and correlation between assets. These elements determine how assets interact within a portfolio, enabling investors to build an efficient mix that aligns with their risk tolerance and goals.

What Are the Disadvantages of Modern Portfolio Theory?

MPT assumes rational behaviour and relies on historical data, which does not predict future market behaviour. It also underestimates extreme events and simplifies risk by equating it solely with volatility.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Do You Know the Difference Between an Indicator and a Strategy?A lot of traders jump into Pine Script or apply a script on TradingView without understanding one key difference:

Indicators and Strategies are not the same — especially when it comes to real-time performance and backtesting.

---

What’s the Key Difference?

Indicators

Indicators are visual tools designed to help you analyze price action in real time . They do not track trade performance or simulate trades automatically.

You can use them to:

- Generate signals

- Stack confluences

- Set custom alerts

- Overlay custom visuals on charts

Best for: Chart analysis, signal confirmation, and manual or semi-automated alerts.

---

Strategies

Strategies are built for backtesting . They simulate how your trade logic would have performed historically, using `strategy.entry`, `strategy.exit`, and related functions.

They automatically calculate:

- Hypothetical P&L

- Win/loss ratio

- Drawdowns

Best for: Validating trade logic, optimizing entries and exits, performance tracking.

---

But Here’s the Catch

Many traders assume that once a strategy backtest looks good, it will behave exactly the same in live trading. This assumption can lead to poor decision-making.

❌ Why Forward Testing Isn't Perfect

When you set alerts based on a strategy, you're asking a backtest engine to behave like a live trading engine — and that’s not what it was designed for.

TradingView strategies:

- Only execute on candle close

- Do not simulate intrabar price action

- Do not account for slippage

- Do not reflect real-time market volatility

So:

- Your strategy alert may fire late compared to actual price movement

- Your SL/TP may be hit within a candle, but the strategy won’t know until close

- You may see better backtest results than what happens live

---

Takeaway

If you're using strategies with alerts, it’s critical to understand these constraints:

TradingView’s strategy engine is optimized for historical testing, not for real-time execution. It provides insight into the validity of your logic — but it’s not a replacement for a live execution engine.

Best Practice Recommendations:

- Always forward-test on a demo or paper account first

- Monitor how alerts perform in real-time

- Be ready to adjust parameters based on your asset and timeframe

If you need better responsiveness or real-time adaptability, consider using indicators to generate your alerts. Indicators react to price in real time and are often more suitable for live market conditions.

---

Final Note

Some strategies are built with these limitations in mind. They can still be useful in real-time trading as long as you're aware of how they work.

Transparency is key. Backtesting is a guide, not a guarantee.

Trade smart, stay informed.

Feel free to reach out if you have questions or insights to share!

3 Tips to Make Trading EasierTrading is such a strange beast—both extremely difficult and unparalleled in its simplicity.

Sometimes, we find ourselves floating in effortless flow. Other times, we’re stuck in a storm of confusion, frustration, or overconfidence.

And it’s in these oscillations—the swing between extremes—where the true difficulty lies.

On one end, we show the market less respect than it demands.

On the other, we freeze in fear or get swept away in frustration and rage.

Managing these extremes is part of the trader’s job.

Managing them well… is an art form.

Here are 3 foundational tools that have helped me:

⸻

1. Find. Your. Rhythm.

Each of us is wired differently. Our biochemistry, personality traits, and preferences are all unique—and they absolutely affect how we trade.

Some traders thrive on high-frequency scalping.

Others wait patiently for a single swing setup.

Some feel energized after 6 hours of screen time.

Others burn out after one intense hour.

If you don’t understand your personal rhythm, you’ll constantly be misaligned—not just with your strategy, but with your life.

Workaholics may get bored and start forcing trades.

Laid-back traders may overcommit and burn out fast.

Rhythm isn’t just about preference—it’s about sustainability.

⸻

2. Practice Tolerating Discomfort.

Trading is uncomfortable.

Let’s be real—90% of it ranges from mildly uneasy to outright agonizing.

Practicing discomfort outside of trading has made a huge difference for me:

Cold plunges.

Sadhu boards.

Early morning wake-ups.

Cardio.

Even practicing restraint during family arguments.

These things teach you to sit with that gnawing feeling and not act impulsively.

They train your nervous system to stay stable under pressure.

Trading may not get “easier,” but your capacity for difficulty increases—so it starts to feel easier.

⸻

3. Plan Is Everything.

Trading becomes way simpler when you just show up to execute a plan.

If your plan says there are no trades today—then walk away.

If your plan says take two trades—then take them.

Win or lose, outsource the result to the plan, not to your self-worth.

Then, at the end of a set period (ideally written into the plan), review your execution.

Were you compliant?

What can be adjusted?

A good plan + rhythm alignment + discomfort tolerance = consistency.

⸻

Trading is obviously more complex than three bullet points can capture—but the foundation you can build from these is immense.

Thanks for reading.

Happy trading.

—Lightwork_

Major Life Update: I Left the United Nation to Trade Full TimeAfter 11+ years of working in some of the toughest crisis zones — Jordan, Turkey, Syria, Iraq, HQ Geneva, and Ukraine — I’ve officially stepped down from my role as Head of the Information Management Team for the Health Cluster – World Health Organization – Ukraine Office.

It wasn’t easy.

But it was time.

The pressure, the politics, the burnout… it all started to weigh too heavy. And somewhere along the way, I realized I wasn’t living — I was just surviving.

And with the recent UN funding cuts — especially following the decision by Trump to halt contributions — it became clear that working in the humanitarian system is no longer something I can rely on for long-term stability or financial security for my family.

Trading changed that for me.

It gave me space to think, to breathe, and to build something that’s mine. It taught me discipline, patience, and how to trust myself again.

So now, I’m stepping into a new chapter — full-time day trader.

Not chasing the noise. Just sticking to my setups, showing up every day, and trusting the process.

I’m sharing this here because honestly, everyone following me feels like my new big family — and to the good friends I’ve made in this community, thank you for being part of this journey.

This isn’t the end of the road. It’s a new one.

And I’m walking it fully awake this time.

Wish me luck, see you in the minds section :)

Moe,

#TradingLife #Mindset #DayTrader #Resignation #LifeShift #NewChapter #FinancialFreedom #SeeYouInTheMindsSection

Bitcoin, Gold, S&P 500 and InflationBitcoin, Gold, S&P 500 and Inflation

This is a 3 year view (2022 - 2025 to date), 1 week comparison chart of Bitcoin, Gold, S&P 500 and US cumulative rate of inflation. The most interesting part of this analysis to me is that the S&P 500 bounced off the cumulative rate of inflation slope. I did not know that until after I set up the comparison.

Gold = +80%

BTCUSD = +50%

S&P 500 = +19%

US cumulative rate of inflation:

2022 = +6.5%

2023 = +3.4%

2024 = +2.9%

3 yr = +10.8%

2025 = +2.4% forecast

Best Technical Indicator to Identify Order Block & Imbalance

Your ability to correctly identify Order Blocks on a price chart is essential for profitable trading Smart Money Concept.

In this article, I will show you a great technical indicator that will help you to spot Order Blocks on any financial market.

First, in brief, let me give you my definition of Order Block.

The problem is that in SMC trading there is no one single definition of that and many traders interpret it differently.

To me, an Order Block is a specific zone on a chart from where a strong price movement initiates and where a significant imbalance between supply and demand occurs .

This imbalance should strictly originate from a liquidity zone.

That definition implies that in order to identify an Order Block zone, one should learn to properly identify the imbalance and liquidity zones.

And again, there is no precise definition of an imbalance on a price chart. To me, a bullish imbalance is a formation of a bullish engulfing candle - the one that engulfs a range of previous bearish candle with its body.

Above is the example of a valid Order Block on GBPUSD.

A bearish imbalance is a formation of a bearish engulfing candle - the one that engulfs a range of a previous bullish candle with its body.

Above, you can see the example of an Order Block on USDCAD, based on a bearish imbalance.

There is one technical indicator that will help you to recognize such Order Blocks. It is called " All Candlestick Patterns" on TradingView.

Open settings of the indicator and make it show ONLY Engulfing Candles and choose "No Detection" in "Detect Trends Based on".

After that, hide the indicator and first, Identify the liquidity zones on a chart and wait for a test of one of these zones.

Here is a test of a liquidity zone on NZDUSD on an hourly time frame.

After that, turn on the indicator, and wait for its signal.

You can see that after some time, the price formed a bullish imbalance with a bullish engulfing candle. The indicator highlight that candle.

The Order Block zone will be based on the lowest low of 2 candles and the high of a bearish candle preceding the imbalance.

One more example. We see a test of a significant liquidity zone on EURAUD on a 4H time frame.

We turn on the indicator and look for a signal.

A bearish imbalance is formed and the indicator immediately notifies us.

An Order Block Zone in that case will be the area based on the highest high of 2 candles and the low of a bullish candle preceding the imbalance .

Of course, there will be the rare cases when the indicator will miss the imbalances. But while you are learning to recognize Order Blocks, this indicator will definitely help you a lot!

Thank you for reading!

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trendlines and broken trendlines resultsTrendlines are one of the major supports or resistances and on this Bitcoin chart we can see few examples which price react well to them and start to pump from green trendlines and sometimes dump from red trendlines and it is easy to draw one trendline ----> simple like drawing support line this time try to find support line which is Diagonal and one or two touch with this trendline you can find next support which is third touch and you can set your buy there like below example:

also sometimes trendline broke and their support turn to resistance and after retest of breakout you can enter sell like example:

there are so many rules about trendline like when it can break or after how many touches trendline lose it's power and ... we can discuss in comments more about them so ask any questions there and lets discuss.

Also currently if we have a valid breakout of red trendline to the upside for Bitcoin price can easily pump to 90K$ at least.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

How Can You Use the Ascending Triangle in Trading?How Can You Use the Ascending Triangle in Trading?

An ascending triangle is a chart pattern traders rely on to identify potential breakouts and further price movements. Recognised for its versatility, this pattern can signal trend continuations across all types of markets, including stocks, forex, commodities, and cryptocurrencies*. In this article, we’ll break down how to spot and trade this formation.

What Is an Ascending Triangle?

An ascending or rising triangle is a bullish chart pattern that usually signals a trend continuation. It is framed by two trendlines. The upper line connects highs placed at almost the same level, while the lower line is angled and connects higher lows.

The triangle’s appearance is explained as follows: buyers try to push the price up, but they meet a strong resistance level, so the price rebounds. Still, buyers have strength, which is reflected in higher lows. Therefore, they continue pushing the price until it breaks above the resistance level. The period during which the price bounces back and forth between the two lines depends on the timeframe. On daily charts, the triangle can be in place for over a week.

Note: The ascending triangle is a continuation chart pattern but sometimes it can be used as a reversal signal. It happens when the ascending triangle occurs in a downtrend. It’s the biggest challenge of all the triangles.

The rising triangle is one of the setups in the triangle group. There are also descending and symmetrical formations.

Ascending, Descending, and Symmetrical Triangles: The Differences

The triangle group of patterns comprises ascending, descending, and symmetrical formations.

The ascending triangle is a bullish formation and the descending triangle is bearish. At the same time, the symmetrical triangle is a bilateral setup that signals a rise and a fall in the price.

To distinguish between them, traders draw trendlines. In a rising triangle pattern, an upper trendline is horizontal and connects equal or almost equal highs, while the lower trendline is rising as it connects higher lows. In a descending or falling triangle pattern, the lower trendline is horizontal and connects equal or almost equal lows, while the upper trendline declines, going through lower highs. A symmetrical triangle has a falling upper line that connects lower highs and a rising lower line that connects upper lows.

How Traders Spot the Ascending Triangle

It’s quite easy to identify the formation on a chart. Still, there are a few rules that may help a trader determine its strength.

- The trend strength. Although the setup may appear on any timeframe, traders look for strong long-term trends as risks of a fakeout on low charts are higher.

- Consolidation. Triangles appear when the market consolidates within an overall trend.

- Trendlines. Trendlines must be drawn through at least two points. Still, the larger the number of points, the higher the possibility the setup works.

- Breakout. Can the ascending triangle pattern be bearish? No. It is a bullish formation that appears in a bullish and a bearish trend but always signals a potential price rise.

How Can You Trade Ascending Triangles?

The rising triangle pattern is usually considered a continuation setup formed in an uptrend. Still, if the ascending triangle is in a downtrend, it may signal a trend reversal. The trading rules will be the same in both cases.

As with most chart patterns, triangles have specific rules that help traders place entry and exit points.

Entry

The theory suggests trades go long when the price breaks above the setup's upper boundary. In a conservative approach, traders wait for the price to form at least several candles before entering the market. In a risky strategy, traders open a position as soon as the breakout occurs, and the breakout candlestick closes.

It's worth considering trading volumes as breakouts often turn into fakeouts, meaning the market returns to its previous trend. The chance of a strong breakout is higher if the volumes are high.

However, increased volumes aren't the only tool used to confirm a breakout. Many traders consider trend indicators and oscillators to potentially limit the risks of bad trading decisions.

- If the triangle serves as a continuation setup, it may be helpful to look at the signals of trend-strength indicators, including the average directional index.

- If traders use the ascending triangle as a reversal setup, they usually implement indicators that may signal a trend reversal, including the moving average, the relative strength index, the moving average convergence divergence, and the stochastic oscillator.

Take Profit

A standard take-profit target equals the size of the largest part of the setup and is measured just from the breakout trendline.

Stop Loss

Traders consider several options when placing stop-loss levels. In a conservative approach, they implement the risk/reward ratio, which is usually 1:2 or 1:3 but depends on the trader's willingness to take risks. Also, traders utilise the upper trendline as a threshold and place the stop-loss order just under it.

Note: These are general rules. However, traders can develop their own trading strategies and adjust the pattern's parameters and rules according to their trading approach.

Ascending Triangle: Strategy

In this strategy, traders observe an existing bullish trend and the formation of an ascending triangle, which suggests the potential for a continuation pattern. Incorporating a short-term moving average, such as a 9-period EMA, provides dynamic support, aligning with the trendline to strengthen the setup.

Entries

- Traders typically wait for the price to break through the top trendline of the ascending triangle.

- A strong candle breaking the resistance level adds confidence, though any move above the top trendline can serve as an entry signal.

- The price should also trade above the moving average, offering additional confirmation.

- An order is often placed at the top trendline, anticipating a retracement to this level, which now acts as support.

Stop Loss

- Traders place a stop-loss below the most recent swing low within the triangle.

- For more conservative traders, the stop may be set at any prior swing low, depending on risk tolerance.

Take Profit

- Many traders aim for a risk-reward ratio of 1:2 or 1:3.

- Profits might also be taken at the next strong resistance level, aligning with the market structure.

Rising Triangle: Benefits and Drawbacks

This formation has advantages and pitfalls that traders consider when developing their strategies.

Benefits

- It can be used on any timeframe. Triangles are formed on charts of any period. Still, they might be more effective if the setup appears in a solid trend on a high timeframe.

- It can be used for any asset. Another advantage is that the ascending triangle pattern is used for stock, commodity, cryptocurrency*, and Forex trading.

- Easy to spot. A trader only needs to draw two trendlines to define this setup on the chart.

- Exact entry and exit points. Although traders can develop their entry and exit points, the setup assumes there are specific rules traders with any experience utilise.

Drawbacks

- It can confuse traders. As the rising triangle is used as a reversal and continuation formation, traders with less experience may be confused with its signals.

- False breakouts. The setup works when a price breakout occurs. However, there is a high risk the breakout will appear to be a fakeout, and the price will return.

- The pattern may fail. Aside from a fakeout, there is another risk when trading with triangles. The price may break another side of the formation, and the formation will fail.

- The trading rules may not work. Although specific rules indicate where a trader should place entry and exit points, buyers may be too weak to push the price to the take-profit target.

Final Thoughts

The ascending triangle is one of the more common chart patterns traders use when trading various assets. Still, there is no 100% guarantee that it will work every time you spot it on a price chart. It's vital to remember that every signal must be confirmed with other indicators, chart patterns, and candlesticks. Also, it's a well-known fact that any trade involves risks that should be considered every time a trader enters the market. Improve your skills by practising on different assets and timeframes.

FAQ

How Do You Form an Ascending Triangle?

An ascending triangle is formed when the price action creates a series of higher lows while facing a resistance level, resulting in a horizontal upper trendline and a rising lower trendline. The price consolidates between these two lines before potentially breaking out above the resistance, signalling a bullish continuation.

Is an Ascending Triangle Bullish or Bearish?

The ascending triangle is a bullish pattern. It suggests that buyers are gaining strength as higher lows form, increasing the likelihood of a breakout above the resistance level. There is a descending triangle pattern that usually appears in a downtrend, signalling a downward movement.

How to Enter an Ascending Triangle?

According to the theory, in triangle pattern trading, it’s common to enter the market when the price breaks above the upper trendline of the triangle. In a conservative approach, traders wait for confirmation through several closing candles after the breakout. The increased volume also adds confidence to the trade.

What Is the Ascending Triangle Pattern Retest?

A retest occurs when the price breaks out of the triangle but then briefly falls back to test the former resistance level. A successful retest confirms the breakout and can provide an additional entry point.

How Long Does an Ascending Triangle Pattern Take to Form?

The formation of a bullish triangle pattern can vary based on the timeframe. On daily charts, it can take several days to weeks, while on shorter timeframes, it might form within hours.

What Is the Difference Between an Ascending Triangle and a Rising Wedge?

In comparing the ascending triangle vs. the rising wedge, it’s key to recognise that the rising wedge has converging trendlines, signalling a possible weakening trend, often leading to a bearish reversal. In contrast, an ascending triangle trading pattern typically signals a continuation of the uptrend.

*At FXOpen UK, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Monitor Price action with Trendlines / Gan Fan*And over here, Sir/Madam, we have the 3.5L six-cylinder, 800-horsepower, 95-cubic feet

truck with a diesel engine. It goes 0 to 60 in 0.5 seconds and comes fully equipped with an 18-foot lift kit and did I mention the 80 inch strobe lights.”*

Some days, wave counting feels exactly like that—like you’ve been dragged to a dealership and hit with a barrage of numbers you didn’t ask for.

Information you have to painstakingly puzzle through.

All you really want to know is: Does it drive? *Where will it take me?*

That’s the heart of my wave counts. I don’t care about the extra fluff. I want clarity, direction, and purpose.

But doing the two-step between multiple asset classes—forex, indices, FANG stocks—feels like a dangerous tango. One where my precious money is on the line.

* *

There’s a Chinese proverb that sums it all up:

**“Life is really simple, but we insist on making it complicated.” — Confucius**

In this quick article, I’ll show you a dead-simple concept that can clear up your charts and your thinking. A quick read. Quick to understand. So for one night, you don’t have to do a dirty tango with crazy numbers.

**Cue: Gann Fans and Trend Lines.**

You’ve seen trend lines.

But have you seen *three*?

When you use three trend lines, you’re not just capturing the obvious. You’re measuring *acceleration*, *deceleration*, and *breakout momentum*. One line to show the base trend. One to catch the slowdown. And one to anticipate the breakout.

Pair that with s&r levels and suddenly you’re seeing *speed* and *time* like never before. A break of a key level or a sharp lift off your trend line isn’t random—it’s often the market shifting gears.

You didn’t think I’d drop all this without sprinkling in some wave counts, did you?

Welcome to the fiesta.

- Tango intensities*

Here’s where it ties in:

A **double bottom** formation near the end of a trend often isn’t just a reversal—it’s a *setup*.

What you’re likely seeing is a **Wave 3-4-5** squeeze into completion. That double bottom is the market catching its breath.

And when it breaks the trend line on the upside? That’s often the beginning of a brand new wave structure in the opposite direction.

If this breakout fails it is just as easy to exit the position with easy to identify stop out points.

It doesn’t have to be complicated.

Just structured.

Best,

Coi

Mastering Volatile Markets: Why the Trend is Your Best Friend█ Mastering Volatile Markets Part 4: Why the Trend is Your Best Friend

In Part 1 , we covered reducing position size.

In Part 2 , we explored liquidity and execution strategies.

In Part 3 , we discussed the power of patience over FOMO.

Now,we're diving into one of the most important principles of all — especially in volatile, fast-moving markets: Follow the Trend. Trust the Trend. Trade With the Trend.

In wild markets like these, everything changes quickly. Indicators print overbought or oversold conditions well before the market even thinks about reversing.

Divergences can keep stacking up while the price continues trending for another 300, 500, or even 1000 points. Why? Volatility + Liquidity conditions = Extended trending behavior.

When liquidity is thin, and volatility is high, strong trends tend to last longer than usual:

Breakouts run further.

Breakdowns fall deeper.

And counter-trend trades? They're often a fast ticket to losses.

█ What Pro Traders Know Better Than Anyone:

In volatile markets, trend-following isn't optional — it's survival.

But wait, it is obvious that trends aren't perfect straight lines. So how can one even realistically “follow” a trend, especially in volatile markets.

Well, the key is to expect the unexpected. Experienced traders trade logically, we expect pullbacks, fakeouts, stop hunts, snapbacks and/or channel breaks. In fact, we prepare for them.

It is detrimental to assume the trend is over just because of these moves. Most of these are liquidity traps, not real reversals.

█ Here's What Pro Traders Do Differently:

⚪ They Identify the Core Trend Direction

Pro traders use price structure, trendlines, moving averages, VWAP , or higher timeframe levels to identify the trend direction. Once identified, every trade respects the trend.

Let me explain with an example.

→ Uptrend Identification:

Say you notice that the price of Gold (XAUUSD) has been consistently making higher highs and higher lows. What should you do?

You use the 100-period moving average (MA) and see that price is staying above it, indicating an uptrend. You wait for price to pull back to the MA, giving you a low-risk entry to join the uptrend rather than chasing the trend.

→ Downtrend Identification:

In a downtrend, USD/JPY keeps making lower highs and lower lows. You observe the 100-period moving average pointing down. This is your cue to look for short entries , avoiding countertrend buys that could trap you.

⚪ They ONLY Look for Entries at Key Trend Channel Levels

Professional traders don’t chase the price or try to catch every move. Instead, they patiently wait for price to return to key areas within a well-defined trend channel , either the upper boundary (in a downtrend) or the lower boundary (in an uptrend).

→ In an uptrend:

Pro traders draw a trend channel based on the price move. When price pulls back to the lower boundary of the channel (often aligning with demand zones), they start looking for long entries, aiming to trade with the trend and target a new high.

→ In a downtrend:

The same logic applies, but in reverse. Price pulls back to the upper boundary of the channel (supply area), offering a clean short opportunity to continue with the trend and target a new low.

But here’s what separates pros from amateurs:

→ They expect fakeouts, spikes , and temporary breaks beyond the trend channel — especially in volatile conditions.

→ They don’t panic when the price briefly moves outside the channel. Instead, they wait for confirmation signals (like a rejection candle, break of structure, or momentum shift) before entering.

→ This gives them both a logical entry point and a favorable risk-reward setup — aligning with the larger trend direction while staying protected if the trend fails.

⚪ They Treat Countertrend Moves as Opportunities to Enter WITH the Trend

When a countertrend move happens, pro traders see it as an opportunity to enter with the prevailing trend, rather than trying to catch a reversal.

→ Counter-Trend Move in an Uptrend:

Let's say S&P 500 is in a strong uptrend, and it experiences a sharp pullback of 5%.

While many retail traders panic and try to short the market, pro traders see this as a buying opportunity at a lower price, anticipating the trend will continue after the correction.

→ Counter-Trend Move in a Downtrend:

For Gold (XAU/USD) , if the price falls sharply from $1,900 to $1,850 and then retraces back to $1,875 (a previous support-turned-resistance level), pros see this as an opportunity to sell into the trend rather than buying into what could be a false recovery.

⚪ They Accept That Trends Can Look "Overbought" or "Oversold" for a Long Time

In volatile, trending conditions, RSI can stay above 70 for hours or even days, and divergences can build for a long time without price reacting.

→ RSI Above 70 in an Uptrend:

Bitcoin (BTC/USD) rallies from $40,000 to $60,000. Despite RSI being above 70 for a few days, pro traders don't fight the trend because momentum is strong. Instead, they look for a pullback to the 100-period MA for a safer entry.

→ Divergence in Downtrend:

The EUR/USD shows a bearish trend , but the RSI starts to build a divergence as the price keeps making lower lows. Pro traders ignore the divergence because the trend is still strong. They wait for a clear break of the trendline or confirmation that price has reversed before considering a long trade.

█ Summary of Part 4 — Trend is Your Best Friend

You can't control how far a trend will run…but you can control whether you're with or fighting against it.

And trust me, fighting a strong trend in a volatile market is a battle retail traders rarely win.

Here’s what you should take away from this article:

Volatile markets = Extended trends

Indicators can lie — trend structure tells the truth

Fakeouts & pullbacks are normal

Don't fight the trend — trade with it

Use counter-moves to enter the trend

Patience & trend-following = Survival + Profit

█ What We Covered:

Part 1: Reduce Position Size

Part 2: Liquidity Makes or Breaks Your Trades

Part 3: Patience Over FOMO

Part 4: Trend is Your Best Friend

That's it! You've now completed the Mastering Volatile Markets series.

Stay calm, adapt quickly, and trade smarter — that's how you survive (and thrive) in volatile markets.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

The Charts Wall Street Watches – And Why Crypto Should Too📉 Crisis or Rotation? Understanding Bonds Before the Bitcoin Reveal 🔍

Hi everyone 👋

Before we dive into the next major Bitcoin post (the 'Bitcoin Reveal' is coming up, yes!), let's take a moment to unpack something critical most crypto traders overlook — the world of bonds .

Why does this matter? Because the bond market often signals risk... before crypto even reacts.

We're going to walk through 4 charts I've posted recently — not the usual BTC or altcoin setups, but key pieces of the credit puzzle . So here’s a simple breakdown:

1️⃣ BKLN – Leveraged Loans = Floating Risk 🟠

These are loans to risky companies with floating interest rates.

When rates go up and liquidity is flowing, these do well.

But when the economy weakens? They’re often the first to fall.

📌 Key level: $20.31

This level held in COVID (2020), the 2022 bank scare... and now again in 2025.

⚠️ Watch for a breakdown here = real credit stress.

Right now? Concerned, but no panic.

2️⃣ HYG – Junk Bonds = Risk Appetite Tracker 🔴

Junk bonds are fixed-rate debt from companies with poor credit.

They pay high interest — if they survive.

When HYG bounces, it means investors still want risk.

📌 Fear line: 75.72

Held in 2008, 2020 (COVID), and again now.

Price rebounded — suggesting risk appetite is trying to return .

3️⃣ LQD – Investment Grade = Quality Credit 💼

LQD holds bonds from blue-chip companies like Apple, Microsoft, Johnson & Johnson.

These are lower-risk and seen as safer during stress.

📊 Chart still shows an ascending structure since 2003, with recent pressure on support.

📌 Support: 103.81

Holding well. Rebound looks solid.

Unless we break 100, this says: "No panic here."

4️⃣ TLT – U.S. Treasuries = Trust in the Government 🇺🇸

This is the BIG one.

TLT = Long-term U.S. bonds (20+ yrs) = safe haven assets .

But since 2022, that trust has been visibly broken .

A key trendline going back to 2004 was lost — and is now resistance.

📉 Price is in a clear descending channel .

📌 My expectation: One final flush to $76 or even $71–68

…before a potential macro reversal toward $112–115

🔍 The Big Picture – What Are Bonds Telling Us?

| Chart | Risk Level | Signal |

|--------|------------|--------|

| BKLN | High | Credit stress rising, but support holding |

| HYG | High | Risk appetite bouncing at a key level |

| LQD | Medium | Rotation into quality, no panic |

| TLT | Low | Trust in Treasuries fading, support being tested |

If BKLN breaks $20...

If HYG fails to hold 75.72...

If LQD dips under 100...

If TLT falls to all-time lows...

That’s your crisis signal .

Until then — the system is still rotating, not collapsing.

So, Should We Panic? 🧠

Not yet.

But we’re watching closely.

Next: We add Bitcoin to the chart.

Because if the traditional system starts breaking... 🟧 Bitcoin is the alternative.

One Love,

The FXPROFESSOR 💙

📌 Next Post:

BTC vs Treasuries – The Inversion Nobody Saw Coming

Because if the system is shaking… Bitcoin is Plan B.

Stay ready.

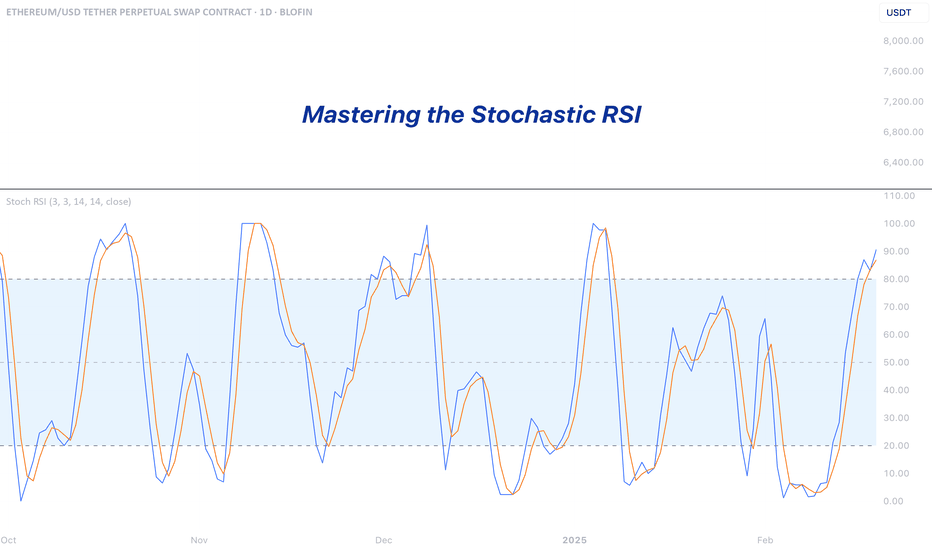

Mastering the Stochastic RSI - Guide to Spotting Momentum ShiftsIntroduction

In the world of technical analysis, momentum indicators are essential tools for understanding market sentiment and potential price movements. One such tool is the Stochastic RSI (Stoch RSI), a unique and highly sensitive variation of the traditional Relative Strength Index (RSI). While the standard RSI focuses on price, the Stoch RSI takes it a step further by measuring the momentum of the RSI itself. This makes it a faster-reacting and more dynamic indicator that many traders use to anticipate trend shifts and spot overbought or oversold conditions earlier.

What is the Stochastic RSI?

The Stochastic RSI (Stoch RSI) is a momentum oscillator that operates similarly to the RSI but with a twist — instead of measuring the price of an asset, it measures the movement of the RSI. Because of this, the Stoch RSI is typically more sensitive and quicker to respond to changes in market momentum.

It consists of two lines:

* The blue line: The primary line that reacts quickly and shows when the RSI is gaining or losing momentum.

* The orange line: A moving average of the blue line, which acts as a smoother version to help filter out noise and highlight potential turning points.

How to Read the Stoch RSI

The Stoch RSI moves between 0 and 100, and traders often focus on the 20 and 80 levels as key thresholds:

Above 80 (Overbought): Indicates that the RSI has been running hot compared to recent values. This suggests strong upward momentum that could be due for a slowdown or minor correction. However, it doesn’t necessarily mean the price will drop immediately, just that conditions are extended.

Below 20 (Oversold): Suggests the RSI has been suppressed, signaling weakening bearish momentum and a possible reversal upward. Again, this isn’t a guaranteed bounce but rather a situation where a shift may be more likely.

How to Trade with the Stoch RSI

While entering overbought or oversold zones can offer insight, trading solely based on those levels is risky. Instead, look for crossovers between the blue and orange lines:

Bearish signal: When the Stoch RSI is above 80 and the blue line crosses below the orange line, it can indicate that bullish momentum is fading — a potential short entry.

Bullish signal: When the Stoch RSI is below 20 and the blue line crosses above the orange line, it may suggest that bearish momentum is weakening — a potential long entry.

These crossover points provide more reliable signals than the levels alone, especially when confirmed by price action or other indicators.

What Timeframes to Use

The Stoch RSI can be applied to any timeframe, but its effectiveness varies. On lower timeframes (like 1-minute or 5-minute charts), it generates many signals, including plenty of false or weak ones. For stronger and more reliable signals, it’s best used on higher timeframes such as the 4-hour, daily, weekly, or monthly charts. Generally, the higher the timeframe, the more significant the signal becomes.

Conclusion

The Stochastic RSI is a powerful indicator that combines the strengths of the RSI and Stochastic Oscillator to deliver sharper, more responsive momentum signals. While it’s tempting to act on overbought or oversold readings alone, true effectiveness comes from understanding the behavior of the two lines and using it in conjunction with other analysis tools. Whether you're a short-term trader or a long-term investor, mastering the Stoch RSI can add depth to your strategy and help you make more informed decisions.

The Art of Doing Nothing: Why Tape Watchers Beat Impulse TradersLess is more. In this Idea we dig into the trading philosophy where less action means more traction. It’s the dispute between the chart readers and the button clickers.

Some swear by this: the smartest trading strategy sometimes involves sitting on your hands and embracing the sweet, underrated beauty of doing absolutely nothing. The Italians figured this out ages ago—they call it Dolce Far Niente , the sweetness of doing nothing.

But can a trader really get away with just kicking back and waiting while sipping espresso (or the mezcal martini type if you got your Patagonia vest)? Actually, yes—and it often pays better than impulsive clicks.

Let’s talk about why chart-watching and tape-reading often outsmart trigger-happy trading.

🤷♂️ Doing Nothing Is Harder Than It Looks

First off, let’s acknowledge something painfully true: not trading is tough. Seriously tough. Trading never sleeps, notifications flash at you like slot machines. Headlines constantly scream about massive opportunities you're missing — Tesla's NASDAQ:TSLA latest rally or gold’s OANDA:XAUUSD record-breaking surge powered by tariff jitters.

The pressure to click, buy, sell, or do something—anything!—can be overwhelming. It’s why there’s something called a heatmap — because it’s hot, hot, hot!

But here’s the secret: successful traders know that impulse trading isn't a strategy; it's just financial caffeine. Instead, chart watchers—the cool-headed crowd who sit back, patiently observing price movements, market structure, and volume flow—tend to win the marathon, while impulse traders burn out in the sprint.

🌸 The Dolce Far Niente Method

Ever watched an old Italian movie? There's usually a scene featuring someone lounging effortlessly, soaking in life’s beauty without lifting a finger—this is Dolce Far Niente.

In trading terms, it’s the act of patiently waiting, savoring the calm between trades, watching your charts like an old-school tape reader that would make Jesse Livermore proud. (“A prudent speculator never argues with the tape. Markets are never wrong, opinions often are.”)

A good setup is worth the wait. Instead of diving into trades, relax, observe, and let opportunities come to you. Because the reality is, not every candlestick needs your immediate response. Markets don’t reward hyperactivity; they reward patience and calculated action.

🤩 Tape Reading vs. Trading: The Difference Between Winning and Clicking

The lost art of tape reading, as hedge fund guru Paul Tudor Jones calls it, is about carefully tracking price action, volume, and market sentiment. It’s far less exciting than rapid-fire day trading but potentially more rewarding.

“When it comes to trading macro,” Tudor Jones says, “you cannot rely solely on fundamentals; you have to be a tape reader, which is something of a lost art form.

Learning when to sit quietly (doing nothing) and when to strike decisively is the hallmark of trading mastery.

✋ Real Traders Don’t Chase—They Anticipate

Waiting isn’t passive. It’s actually active restraint—a calculated choice to do nothing until the odds tip decidedly in your favor. Let’s be clear: chart watchers aren’t asleep at the wheel; they're carefully steering clear of trouble until clear setups emerge.

The result? Better entry points, clearer risk-reward ratios, and fewer sleepless nights worrying about impulsive mistakes.

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!,’ ignore them.” Bonus points if you know who said that!

So, next time your finger hovers over that "buy" or "sell" button, ask yourself if you’re trading strategically or just for the dopamine hit. Remember the Italian saying, take a breath, embrace the tranquility, and let patience become your trading superpower.

Let us know in the comments: Are you team “click less, wait more,” or do you find yourself riding the impulse wave fairly frequently?

The End of Meme Coin Scams: A New UpdateWith the latest update, we are witnessing a shift in how meme coins operate in the crypto world, effectively putting an end to scams that have plagued the meme coin space.

Hello✌

Spend 3 minutes ⏰ reading this educational material. The main points are summarized in 3 clear lines at the end 📋 This will help you level up your understanding of the market 📊 and Bitcoin💰.

🎯 Analytical Insight on Bitcoin: A Personal Perspective:

Bitcoin is currently near a strong trendline and a solid daily support level. I’m expecting it to break the $90,000 mark, a key psychological level, within the next few days. My main target is at least a 7% increase, reaching $90,500.

📈

Now , let's dive into the educational section, which builds upon last week's lesson (linked in the tags of this analysis). Many of you have been eagerly waiting for this, as I have received multiple messages about it on Telegram.

A Recap of Meme Coin Creation and Scams

In a previous educational analysis, I walked you through the step-by-step process of how meme coins are created and, most importantly, how scammers often exploit these coins for personal gain. I explained the mechanics behind the manipulation of meme coins, where bad actors would create a coin, pump its price, and then abandon it once they made a profit, leaving countless investors in financial ruin.

The Hidden Aspect: How Creators Profited from Commissions

However, there was one critical aspect I did not discuss—how meme coin creators were profiting through transaction fees, also known as commissions. Prior to this update, many small-scale creators were incentivized to sell portions of their holdings at high prices, ensuring they made a profit, often at the cost of the coin's long-term stability. This led to price crashes, the collapse of the coin's market, and devastating losses for thousands of investors. 🚨

The Previous Model: 2 important platform one for creating the mem coin and second for transactions and fees

Under the previous system, meme coins were typically launched on platforms like P p .F n, which helped boost the coin’s liquidity through in-app promotions and social media outreach. This initial momentum would attract many investors, and then the coin would be listed on various exchanges for wider visibility.

To ensure that creators could continue to profit, the transactions would eventually shift to a new platform, which took all of the transaction fees, further enriching the platform but leaving creators with limited sustainable profits.

The New Update: Introducing new version for enring fees directly

With the latest update, the creator introduces a revolutionary feature. This addition fundamentally changes how meme coin creators can profit. Instead of relying on external platforms that take all the transaction fees, allows creators to receive a significant percentage of trading fees directly. This ensures that creators who are genuinely committed to the long-term success of their coin can continue to benefit from it without destroying the project once the coin gains traction.

A Sustainable Future for Meme Coins

This update paves the way for a new era where meme coins are not just tools for short-term profit but are sustainable and beneficial in the long run for both creators and investors. Creators who have the genuine intention to build and maintain their projects will now have the opportunity to continuously profit from them as the coin grows stronger and attracts more users. 🌱

Why This Matters for Investors

For investors, this is a game-changer. As meme coins become more reliable and profitable for creators, they also become safer and more promising for long-term investment. The more successful these meme coins become, the more lucrative it will be for investors in both the short and long term. 📈

By fostering a system that rewards creators based on the coin's success and longevity, this update helps eliminate the risk of sudden crashes. As a result, meme coins have the potential to evolve into solid, dependable projects rather than speculative assets that leave many in financial distress.

However , this analysis should be seen as a personal viewpoint, not as financial advice ⚠️. The crypto market carries high risks 📉, so always conduct your own research before making investment decisions. That being said, please take note of the disclaimer section at the bottom of each post for further details 📜✅.

🧨 Our team's main opinion is: 🧨

With the latest update, meme coin scams are effectively ending. creator website of meme coin now introduces new direct update for fees, which allows creators to earn a fair share of trading fees, ensuring they benefit long-term without abandoning the project. This makes meme coins more sustainable, rewarding both creators and investors. It’s a major shift towards stability and profitability in the meme coin space. 🚀

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

Breakout trading

(Title)

Breakout trading starts with finding support and resistance points

-------------------------------

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I will take the time to talk about breakout trading.

This is my opinion, so the content may be lacking.

The reason I did not explain what other people say with examples is because trading is a psychological battle.

Most of the content in books or on the Internet is explained with patterns.

However, it is not easy to find patterns when checking the movement of a real-time chart.

Therefore, I think it is more important to understand why such movements occur than to explain them with patterns.

Therefore, I think it is better to create a trading strategy by finding support and resistance points and checking whether or not they are supported by the support and resistance points rather than memorizing patterns.

Breakout trading refers to starting a transaction after checking whether there is support at a point or section when the price rises above a certain point or section, and there is a possibility of a larger rise.

If you do a breakout trade incorrectly, you may end up buying at a high point, which could result in a large loss, so it is recommended to always keep a stop loss point when trading.

In order to reduce the stop loss, you need to make an effort to lower the average purchase price by selling in installments when the price rises after purchasing and buying in installments when the price falls again.

Therefore, the stop loss point is when it is beyond the range you can handle.

-

Let's take the BTCUSDT 1D chart as an example.

It has fallen after renewing the ATH.

Looking at the current price position, it feels like it will fall further.

However, if the price rises to around the HA-Low indicator on the 1D chart, that is, around 89294.25, you will feel like it will turn into an uptrend.

Even if you think that you won't feel that way now, you will feel that way after it rises.

Therefore, the most important thing in breakout trading is to find important support and resistance points.

To find support and resistance points, you need to basically understand candles.

Any book or video about candles will do.

I recommend that you don't try to memorize the content in it, but read or watch it repeatedly several times.

In my case, after watching the video about candles about 3 times, my understanding of the chart became easier.

The reason for finding support and resistance points is to select a trading point.

What you need to find support and resistance is a horizontal line.

It is not easy to start trading with chart tools that are not horizontal lines but diagonal lines or curves.

The reason is that when you try to start a trade, you are more likely to miss the timing because your psychological state is added.

-

You can see that the uptrend started when it broke through the 73072.41 point.

Therefore, you can see that it is possible that the uptrend will start when it breaks through the 106133.74 point this time as well.

However, in this case, since it is rising while renewing the ATH, it is a point where it is thought to be difficult to actually start trading.

In other words, it is likely that you will be reluctant to trade because it is thought to be a high point.

Therefore, as I mentioned earlier, the actual breakout trade will be conducted when it breaks through the 89294.25 point.

Then, even if it rises to around the 106133.74 point, you will be more likely to respond stably without feeling much psychological anxiety.

-

However, there is one problem.

That is, the StochRSI indicator is currently in the overbought zone.

Therefore, when it rises near the 89294.25 point and confirms support, the StochRSI indicator should show a downward trend from the overbought zone.

Otherwise, the 89294.25 point is likely to act as a resistance point.

Even if the market is messy and difficult to predict, you should not be too busy finding support and resistance points.

After all, you need to have a standard for creating a trading strategy to start trading.

It is better to create a trading strategy and respond at the support and resistance points you have selected if possible.

Even if you suffer a loss, if you continue to trade, you will be able to better organize the support and resistance points.

For reference, the indicators that can create a trading strategy on my chart are the HA-Low and HA-High indicators.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

Trading is a business

The masses have the wrong ideas about Trading. It is a business and just like others it involves risk. We grow, we learn, earn and scale up. Crafting a plan is essential to success and character also play a key role here.

In this business, risk is an inherent part of the equation. Just like any other enterprise, trading exposes you to challenges and setbacks, but it's how you manage these risks that can differentiate a thriving business from one that falters. Careful risk management—whether through proper position sizing, stop-loss strategies, or diversification—is the foundation that helps protect your capital while you grow your business over time.

Crafting a trading plan is essential. This plan should not only outline your entry and exit strategies based on rigorous analysis but also incorporate a framework to evaluate your performance critically. A well-crafted plan serves as a roadmap, guiding your decisions in both favorable and challenging market conditions. Moreover, it creates a discipline that protects you from emotional reactions that can often lead to impulsive decisions—a common pitfall in trading.

Character plays a crucial role as well. In trading, psychological fortitude, resilience in the face of losses, and the humility to learn from mistakes are qualities that separate the successful from the rest. Many people mistakenly believe that a few big wins can offset a series of missteps; however, it is the consistent, calculated, and disciplined approach that leads to sustainable growth. This business mindset—acknowledging that each trade is a learning opportunity and a step in scaling up your efforts—is what ultimately propels traders to long-term success.

In essence, re-framing trading as a business fosters a mindset where every decision is taken seriously, every mistake is analyzed for improvement, and every trade is seen as a building block for growth. This approach not only minimizes unnecessary risks but also enables you to scale up with confidence.

I'm curious—what elements of your trading plan do you find most effective at keeping your business mindset in check, and are there aspects you'd like to refine further?

QE vs QT: The Invisible Force Behind Every Pump and Dump !Hello Traders 🐺

In this idea, I want to talk about macroeconomics and how QE and QT actually impact the economy and financial markets — and more importantly, how both pro traders and even non-professionals can benefit from understanding these basic concepts in their trading journey and even their everyday life.

So make sure to stick with me until the very end, because if you still don't know about these key metrics, this is going to be extremely helpful — and I promise I’ll keep it simple.

🔄 First... What Are QE and QT Anyway?

It’s simple:

QE (Quantitative Easing) = Pumping money into the system 💸

QT (Quantitative Tightening) = Sucking money out of the system 💀

That’s it.

The Fed either injects liquidity — or pulls it back.

And that liquidity is the real fuel of the market —

Not your RSI, not your fib levels, not your favorite influencer's altcoin pick.

🟩 What Is QE?

When the Fed wants to support the economy (like during a crash or recession), it prints money and buys government bonds, mortgage-backed securities, and more.

This increases liquidity → makes borrowing easier → and drives people toward risky assets like stocks and crypto.

✅ Benefits of QE:

Boosts markets (stocks, crypto, real estate — all of it)

Supports employment and economic growth

Weakens the dollar → makes exports stronger

❌ Downsides of QE:

Can lead to inflation or even hyperinflation if overused

Creates asset bubbles (aka pumps with no real fundamentals)

Weakens long-term purchasing power

In short:

QE = Bullish AF for markets — but dangerous if left unchecked.

🟥 What Is QT?

QT is the opposite.

When the economy overheats or inflation gets out of control, the Fed stops printing — and even starts removing liquidity from the system.

They let bonds expire or sell them off, reducing the amount of money circulating.

✅ Benefits of QT:

Helps bring inflation down

Cools off overheated markets

Restores balance after aggressive QE periods

❌ Downsides of QT:

Slows down the economy

Crashes risk assets (like BTC, tech stocks, etc.)

Can trigger a recession if done too fast or too long

QT = Bearish pressure for almost every chart you trade.