What’s the Most Valuable Token in the Crypto World?Hello and greetings to all the crypto enthusiasts,✌

Spend 3 minutes ⏰ reading this educational material. The main points are summarized in 3 clear lines at the end 📋 This will help you level up your understanding of the market 📊 and Bitcoin💰.

🎯 Analytical Insight on Bitcoin: A Personal Perspective:

Regarding the movement of the Bitcoin market, I'll briefly mention that the price is currently near a very strong monthly support, which I’ve marked on the chart for you. I believe now is not the time to break this support, and the price will likely retest it. I foresee at least a 10% increase from here, with a short-term target of $83,000. 📈

Now, let's dive into the educational section, which builds upon last week's lesson (linked in the tags of this analysis). Many of you have been eagerly waiting for this, as I have received multiple messages about it on Telegram.

What’s the Most Valuable Token in the Crypto World?

If we were to simplify things, one could argue that the most important token in the world of crypto is... the Gold Token.

Yes — a digital representation of gold itself. 🪙✨

Why Gold, and Why Now?

With the return of Donald Trump to the presidency of the United States, global markets are likely to face renewed uncertainty and directional shifts. Historically, political shake-ups like this have had a profound effect on financial systems, commodity prices, and investor sentiment.

In times of unpredictability, gold has always been a safe haven. It's trusted, time-tested, and globally valued. That’s why it makes sense for investors to allocate a portion of their capital to gold — especially now.

But what if you didn’t have to deal with storing physical gold? What if you could hold it digitally, within the same crypto ecosystem you’re already familiar with? That’s where gold-backed tokens come into play.

What Are Gold Tokens? 🌐

Gold tokens are digital assets built on blockchain networks (typically Ethereum) and backed by real, physical gold held in secure vaults. These tokens offer a modern bridge between traditional wealth preservation and decentralized finance.

They’re designed to let users enjoy the benefits of gold investment — without the inconvenience of owning, storing, or securing physical bars.

Key Features of Gold-Backed Tokens:

🔹 Real Asset Backing: Each token typically represents a fixed amount of gold (like 1 gram or 1 troy ounce).

🔹 Transparency & Security: Since they're built on blockchain, transactions are traceable, secure, and publicly verifiable.

🔹 Redeemability: Some platforms allow users to exchange their tokens for physical gold if identity verification conditions are met.

🔹 Liquidity: Unlike physical gold, these tokens can be traded instantly on major crypto exchanges.

🔹 Divisibility: You can own fractions of an ounce — making gold more accessible than ever.

Leading Gold Tokens to Know About:

Here are three of the most recognized gold-backed tokens in the crypto market:

PAX Gold (PAXG) : 1 token = 1 ounce of London Good Delivery gold

Tether Gold (XAUT) : Issued by the same company behind USDT, backed by Swiss vault gold

AurusGOLD (AWG) : A decentralized token fully backed by gold, built on Ethereum

Let’s focus on the two most dominant players: PAXG and XAUT.

1. PAX Gold (PAXG) 🏛

Issuer: Paxos Trust Company, regulated by the New York Department of Financial Services

Backing: Each token equals 1 troy ounce (≈31.1g) of high-purity gold stored in secure London vaults

✅ Users can redeem for physical gold

✅ Supports micro-investments — ideal for beginners

✅ Full transparency: Regular audits and proof of reserves

✅ Traded on top-tier exchanges like Binance, Kraken, and Coinbase

Why people trust PAXG:

Its regulatory status and institutional backing make it one of the most secure ways to gain gold exposure in the crypto world.

2. Tether Gold (XAUT) 🇨🇭

Issuer: Tether, the company behind the widely used USDT stablecoin

Backing: 1 token equals 1 ounce of physical gold held in Swiss vaults

🔐 Focuses heavily on privacy and robust asset protection

🔁 Tokens are redeemable for physical gold by verified users

📉 Less transparent than PAXG in terms of regulation and audit trails

💹 Listed on popular platforms like Bitfinex

Worth noting:

Despite Tether’s past controversies around asset disclosures, XAUT remains popular due to its ease of use and the strong brand behind it.

Which One Should You Choose?

If regulation and transparency matter most to you, PAXG may be the better fit. It’s trusted by institutions, backed by U.S. regulators, and offers detailed audits of gold reserves.

If you value brand recognition and a more flexible approach, XAUT offers a credible alternative — just be aware of the differences in oversight.

Final Thoughts 💼🪙

Gold-backed tokens combine the timeless value of gold with the flexibility and innovation of blockchain. They're an excellent way to hedge against economic uncertainty without stepping outside the crypto ecosystem.

If you’re building a diversified portfolio, allocating a portion of your investment to digital gold could be a smart move — both for stability and long-term value.

Let your crypto holdings shine with a touch of gold. 🌟

However , this analysis should be seen as a personal viewpoint, not as financial advice ⚠️. The crypto market carries high risks 📉, so always conduct your own research before making investment decisions. That being said, please take note of the disclaimer section at the bottom of each post for further details 📜✅.

🧨 Our team's main opinion is: 🧨

Gold-backed tokens, like PAXG and XAUT, let you invest in gold digitally without the hassle of storing physical gold. They’re built on blockchain, offering transparency, security, and easy trading. PAXG is more regulated, making it ideal for cautious investors, while XAUT offers privacy and is backed by Tether, a big name in crypto. These tokens represent real gold and can be redeemed for it. If you're looking to diversify and hedge against economic uncertainty, they’re a solid option in your portfolio.

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

Community ideas

Candlestick Pattern Trading: Reading the Market in ColorHello, traders!

Let’s face it — price charts can feel overwhelming at first. Red. Green. Wicks. Shadows. Bodies. It’s like abstract art for traders. But once you understand candlestick pattern trading, you’ll start to see structure in the chaos—and maybe even profit from it.

Candlestick patterns are one of the most popular tools in technical analysis. They don’t just show price data; they tell a story about market sentiment. Whether you’re a beginner or an experienced trader, knowing your candlestick pattern chart basics is essential. So, grab your coffee (or matcha, we don't judge), and let’s break this down.

What Is a Candlestick Pattern?

A candlestick pattern is a visual formation that appears on a price chart and helps traders predict future market movement based on past price behavior. Each candle represents the open, high, low, and close price for a specific time frame.

When grouped, candlestick chart patterns help traders spot potential reversals, continuations, and areas of indecision. These formations work across all time frames and are used in stocks, crypto, and forex – you name it.

Candles don’t just represent price; they reflect emotion. Greed. Fear. FOMO. Panic selling. It’s all there in the pattern candlestick formations. Learning to read them is like learning a new language—except this one helps you protect your capital.

Whether you're a scalper or a swing trader, the best part of candlestick pattern trading is that it gives you context. It shows who’s in control — buyers or sellers— and offers clues on what might come next.

Candlestick Patterns Cheat Sheet for Cryptomarkets

To help you better navigate, here's a handy visual reference that breaks down key candlestick chart patterns by category: bullish, bearish, and neutral. Whether you're spotting a potential reversal or riding a continuation, this cheat sheet covers some of the most reliable formations used in candlestick pattern trading.

🔵 Bullish Patterns (Reversal & Continuation)

These patterns typically appear at the bottom of a downtrend and signal potential upside momentum.

Key Bullish Patterns Shown Include:

Hammer and Inverted Hammer – Reversal patterns that signal buyer strength.

Bullish Engulfing, Morning Star, and Tweezer Bottom – These are Strong indications of a trend reversal.

Rising Three Methods, Bullish Three Line Strike, and Bullish Mat Hold – Continuation patterns that suggest a bullish trend is likely to resume.

🔴 Bearish Patterns (Reversal & Continuation)

Found at the top of uptrends, these patterns often warn of downward pressure:

Hanging Man and Shooting Star – Classic bearish reversals.

Bearish Engulfing, Evening Star, and Tweezer Top – Indicate a shift from bullish to bearish control.

Falling Three Methods, Bearish Three Line Strike, and Bearish Mat Hold – Patterns that imply the downtrend is resuming after a pause.

🟠 Neutral Patterns

These patterns signal indecision in the market and require confirmation:

Doji – A candle where the open and close are nearly the same, reflecting balance.

Gravestone Doji and Dragonfly – Unique forms of the Doji that lean toward reversals depending on their position.

This cheat sheet is a great visual companion for understanding candlestick pattern charts at a glance — especially useful in fast-moving markets like crypto.

Final Thoughts: Learn the Language of the Market

Candlestick pattern trading is like learning to read between the lines—but in chart form. Once you recognize the key candlestick chart patterns, you’ll stop guessing and start interpreting what the market is really trying to say.

So, next time you open a chart, don’t just stare at it. Ask questions:

❓ Is that a bullish candlestick pattern forming?

❓ Is this a breakout or a trap?

❓ Is the candlestick flag pattern just pausing, or is momentum dying?

When you start seeing candles not as just red and green bars but as signals of crowd behavior… well, that’s when the magic begins.

Have a favorite candlestick pattern chart setup you swear by? Drop it in the comments, and let’s compare notes. 🔥

Easy tricks to master you mind during correctionsHello,

The markets have been correcting, and fear seems to be creeping in. What most investors fail to understand is that big corrections such as this are the best opportunities handed to them. This is the best time to buy since markets are trading at the bottom. Additionally, for this time earnings season is about to kick in while this time the market is trading at the bottom. We compiled a few things that can help you remain composed in the current market environment.

A transformative book I would recommend is Trading in the Zone by Mark Douglas. Douglas brilliantly compares elite traders to world-class athletes, revealing that both achieve greatness not through luck, but through rigorous mental discipline and robust, repeatable systems. To guide you toward this coveted "zone" of peak performance, here are four indispensable strategies:

Craft a Rock-Solid Trading Plan

A well-defined trading plan is your compass in the chaotic wilderness of the markets. It spells out precise conditions for entering trades, selecting opportunities, and exiting positions. By faithfully following this blueprint, you anchor yourself in accountability, sidestepping the pitfalls of reckless, emotion-driven moves.

Maintain a Detailed Trading Journal

Think of your trading journal as a mirror reflecting your journey. Record every trade, emotion, and market insight. This disciplined habit empowers you to evaluate your performance, pinpoint weaknesses, and sharpen your approach—unlocking a deeper understanding of your own psychological triggers.

Cultivate Confidence Through Realistic Goals

Confidence isn’t bravado—it’s the quiet strength to take calculated risks and embrace the results. Build it by practicing on a demo account with the seriousness of real stakes, setting attainable targets, and celebrating small wins. This foundation turns uncertainty into opportunity.

Master the Art of Risk Management

In trading, protecting your capital is paramount. Embrace proven techniques like setting risk/reward ratios, deploying stop losses, and sizing positions sensibly. These habits don’t just shield you from ruin—they pave the way for consistent, long-term gains.

With the above rules we believe you should be able to invest or remain invested during these volatile moments. Again, remember the tariffs that have been set are the ceiling and we expect concessions to come once negotiations between countries begin.

Good luck and stay invested. As shown in the chart, this is not the first time the market is undergoing a significant correction. What's clear is that markets always recover from corrections and continue pushing higher. This further reinforces our conviction that this are the best times to begin buying.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

There's a Time to Trade and a Time to Watch Lately, the market has been in chaos – indices are dropping like there’s no tomorrow, and when it comes to Gold, what used to be a normal fluctuation of 100 pips has now turned into a 500-pip swing. In such a volatile environment, many traders feel compelled to be constantly active, believing that more trades mean more profit. But the truth is, there’s a time to trade and a time to watch.

Conservation of Capital is Essential 💰

The best traders understand that their capital is their lifeline. It’s not about making trades; it’s about making the right trades.

The market doesn’t reward effort; it rewards patience and precision.

Instead of jumping into mediocre setups, learn to appreciate the value of patience .

Every time you enter a trade that doesn’t meet your criteria, you risk your capital unnecessarily. And every loss chips away at your ability to capitalize on the real opportunities when they come. Capital preservation should be your priority.

Focus Only on A+ Signals 📌

Not every setup is worth your time and money. The goal should be to only enter positions that offer a clear edge – signals that you’ve identified as high-probability opportunities through your experience and strategy.

A + setups are those that offer:

• A clear technical pattern or setup you've mastered.

• A favorable risk-to-reward ratio, ideally 3:1 or better.

• Alignment with your overall strategy and market context.

If these criteria aren't met, it’s often better to do nothing. Waiting for the right setup and market conditions is part of the game.

The Power of Doing Nothing 🤫

Inaction is a skill. It requires discipline to avoid the urge to "force" trades. But the market will always be there tomorrow , and so will the opportunities.

By learning to watch rather than trade during uncertain or suboptimal conditions, you avoid unnecessary losses and conserve your capital for when the market truly presents an edge.

Conclusion 🚀

Trading is about quality, not quantity. Respect your capital and recognize that sometimes, the smartest move is to wait. Let the market be clear.

Remember, there’s a time to trade and a time to watch. Master this balance, and you’ll be miles ahead of most traders.

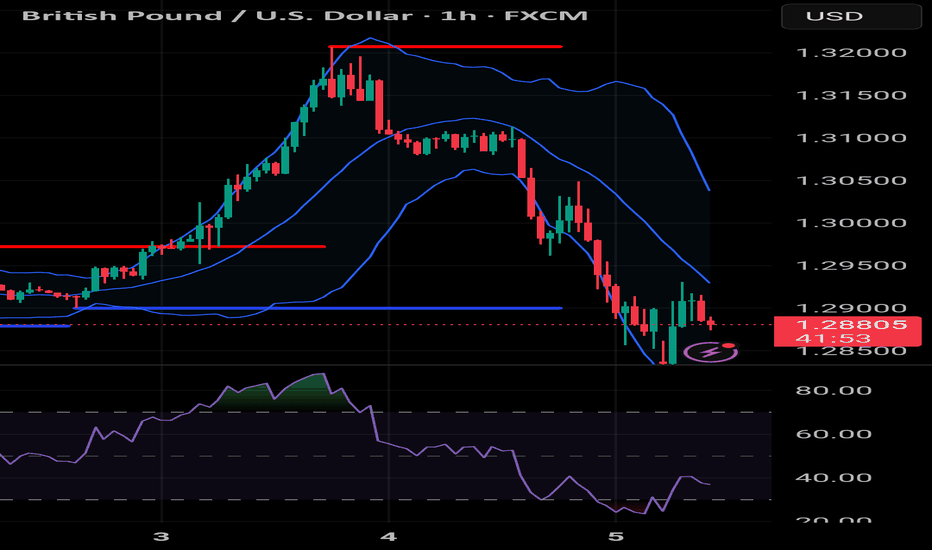

RSI + BB strategy - the strong duo you will ever need to win Hello traders!

This article shares with you a strategy employing two famous indicators that have stood the test of time and used by professionals and amateurs alike. A solid trading plan needs at least one solid strategy which will be your bread and butter. You can always add more strategies or game plans to your repertoire but you need to master one. Trading can be as complicated or simple as you make it. To make sense of it all, you should always try to be realistic and stick to a trading plan which is "simple and stupid" so that you free your mind from overthinking and focus on the market movements instead. A good strategy, along with constant market trend analysis, good risk management, news awareness and emotion control can ultimately transition you to being a consistent profitable trader. Indeed, there are times where the odds will not be in your favour and you will have losing trades. However, the key to success is to think of trading as a game of probability and developing a winning edge that ensures you are profiting more than losing. A 1:2 RRR is the least you have to accept when entering a trade, else sit tight and wait for the next opportunity. As Jesse Livermore quoted, "It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!".

RSI

Developed by J. Welles Wilder Jr. In 1978, the relative strength index is a momentum indicator that measures the speed and magnitude of price changes. At 70+, RSI is considered overbought and a retracement in price may occur. At 30-, RSI is considered oversold and price may go up. The middle line is the mean of recent prices, usually during a 14 days period.

BB

Developed by John Bollinger much later in the 1980s, BB is a volatility indicator which measures the speed and extent of price changes. A wider band signals high volatility and a narrow band signals low volatility. When price reaches the upper band, the asset is considered overbought and price may retract. When price reaches the lower band, the asset is considered oversold, meaning there are less and less sellers in the market and price may go up. The middle line is usually a simple moving average, showing the mean price across a time period.

RSI + BB strategy

The combination relies, and truthfully so, on the fact that the price of an asset usually hovers around its mean. Unless there are significant macroeconomic changes and news are strong (ultimately forming a new trend), price does not deviate much from its mean. It continues and builds its existing trend and moves up and down the moving average. By meauring both the momentum and volatility of the price, while keeping an eye on the direction of the trend, a trader can place small trades with a minimum 1:2 RRR as the asset moves in a range, an uptrend or a downtrend. The indicators give you insight on where to buy and place your SL and TP.

Trading set ups

- RSI 70+, BB touching upper band, no news, BB horizontal (showing a ranging market), price at major resistance zone - sell because price is likely to move through the moving average towards to lower band

- RSI 30-, BB touching lower band, no news, BB horizontal (showing a ranging market), price at major support zone- buy because price is likely to move through the moving average towards to upper band

- RSI 70+, BB touching upper band (price climbing up the BB ladder), BB moving upwards (uptrend), strong good news - buy because price is in uptrend and trend is likely to continue

- RSI 30-, BB touching lower band (price falling off the BB cliff), strong bad news - sell because price is in downtrend and trend is likely to continue

Sitting tight

-Playing on a 1hr timeframe, there won't be many instances when all these stars align. That is when you sit tight and wait.

- When price is hovering in between the RSI grid and BB band - sit tight and wait because the odds are not in your favour and it is impossible to predict which way price will move. Let the market do its thing, protect your capital and wait for the market to show you what to do next.

Note

- When the conditions are met, always enter the trade as soon as you get confirmation. If you are late in entry, skip the trade and wait

- Place your SL just above the upper BB if selling or just below the lower BB if buying

- TP is essential so you can lock in profits, especially in ranging markets where price quickly touches the BB band and bounces back. If you are in a trade and not able to monitor it, a TP ensures you have closed your trade at your desired and predicted price. TP is placed close to the lower band if selling or close to the upper band if buying

-Ensure that all your other criteria such as news, RRR and emotion control are met to enter a trade. If one is not met, this trade is not for you.

- Familiarise yourself using alerts. You have to be able to be present when the opportunity presents itself. Tradingview's lowest paid plan gives you 20 alerts, which is more than sufficient if you are focusing on 4-5 assets only. Alerts add to your winning edge and enable you to be trading the best set ups when they form.

Please do not hesitate to share your thoughts if you do use RSI and/or BB and have had positive outcomes. :)

GL to all!

Position Sizing StrategiesPosition sizing is one of the most important aspects in risk management for traders. Proper position sizing helps manage the risk effectively by maximizing profits and limiting the losses. In this publication, we will explore popular position sizing strategies and how to implement them in pinescript strategies

🎲 Importance of Position Sizing in Trading

Let's take an example to demonstrate the importance of position sizing. You have a very good strategy that gives you win on 70% of the times with risk reward of 1:1. If you start trading with this strategy with all your funds tied into a single trade, you have the risk of losing most of your fund in the first few trades and even with 70% win rate at later point of time, you may not be able to recoup the losses. In such scenarios, intelligent position sizing based on the events will help minimize the loss. In this tutorial, let us discuss some of those methods along with appropriate scenarios where that can be used.

🎲 Position Sizing Strategies Available in Tradingview Strategy Implementation

🎯 Fixed dollar amount position sizing In this method, trader allocate a fixed value of X per trade. Though this method is simple, there are few drawbacks

Does not account for varying equity based on the trade outcomes

Does not account for varying risk based on the volatility of the instrument

🎯 Fixed Percentage of Equity In this method, percent of equity is used as position size for every trade. This method is also simple and slightly better than the Fixed dollar amount position sizing. However, there is still a risk of not accounting for volatility of the instrument for position sizing.

In tradingview strategies, you can find the position sizing settings in the properties section.

In both cases, Pinescript code for the entry does not need to specify quantity explicitly, as they will be taken care by the framework.

if(longEntry)

strategy.entry('long', strategy.long)

if(shortEntry)

strategy.entry('short', strategy.short)

🎲 Advanced Position Sizing Strategies

There are not directly supported in Tradingview/Pinescript - however, they can be programmed.

🎯 Fixed Fractional Method

The Fixed Fractional Method is similar to the fixed percentage of equity method/fixed dollar amount positioning method, but it takes into account the amount of risk on each trade and calculate the position size on that basis. This method calculates position size based on the trader’s risk tolerance, factoring in stop-loss levels and account equity. Due to this, the trader can use any instrument and any timeframe with any volatility with fixed risk position. This means, the quantity of overall trade may vary, but the risk will remain constant.

Example.

Let's say you have 1000 USD with you and you want to trade BTCUSD with entry price of 100000 and stop price of 80000 and target of 120000. You want to risk only 5% of your capital for this trade.

Calculation will be done as follows.

Risk per trade = 5% of 1000 = 50 USD

Risk per quantity = (entry price - stop price) = 20000

So, the quantity to be used for this trade is calculated by

RiskQty = Risk Amount / Risk Per Quantity = 50 / 20000 = 0.0025 BTC

To implement the similar logic in Pinescript strategy by using the strategy order quantity as risk, we can use the following code

riskAmount = strategy.default_entry_qty(entryPrice)*entryPrice

riskPerQty = math.abs(entryPrice-stopPrice)

riskQty = riskAmount/riskPerQty

With this, entry and exit conditions can be updated to as follows

if(longEntry)

strategy.entry('long', strategy.long, riskQty, stop=entryPrice)

strategy.exit('ExitLong', 'long', stop=stopPrice, limit=targetPrice)

if(shortEntry)

strategy.entry('short', strategy.short, riskQty, stop=entryPrice)

strategy.exit('ExitShort', 'short', stop=stopPrice, limit=targetPrice)

🎯 Kelly Criterion Method

The Kelly Criterion is a mathematical formula used to determine the optimal position size that maximizes the long-term growth of capital, considering both the probability of winning and the payoff ratio (risk-reward). It’s a more sophisticated method that balances risk and reward in an optimal way.

Kelly Criterion method needs a consistent data on the expected win ratio. As and when the win ratio changes, the position sizing will adjust automatically.

Formula is as follows

f = W - L/R

f: Fraction of your capital to bet.

W : Win Ratio

L : Loss Ratio (1-W)

R : Risk Reward for the trade

Let's say, you have a strategy that provides 60% win ratio with risk reward of 1.5, then the calculation of position size in terms of percent will be as follows

f = 0.6 - 0.4/1.5 = 0.33

Pinescript equivalent of this calculation will be

riskReward = 2

factor = 0.1

winPercent = strategy.wintrades/(strategy.wintrades+strategy.losstrades)

kkPercent = winPercent - (1-winPercent)/riskReward

tradeAmount = strategy.equity * kkPercent * factor

tradeQty = tradeAmount/entryPrice

🎲 High Risk Position Sizing Strategies

These strategies are considered very high risk and high reward. These are also the strategies that need higher win ratio in order to work effectively.

🎯Martingale Strategy

The Martingale method is a progressive betting strategy where the position size is doubled after every loss. The goal is to recover all previous losses with a single win. The basic idea is that after a loss, you double the size of the next trade to make back the lost money (and make a profit equal to the original bet size).

How it Works:

If you lose a trade, you increase your position size on the next trade.

You keep doubling the position size until you win.

Once you win, you return to the original position size and start the process again.

To implement martingale in Pine strategy, we would need to calculate the last consecutive losses before placing the trade. It can be done via following code.

var consecutiveLosses = 0

if(ta.change(strategy.closedtrades) > 0)

lastProfit = strategy.closedtrades.profit(strategy.closedtrades-1)

consecutiveLosses := lastProfit > 0? 0 : consecutiveLosses + 1

Quantity can be calculated using the number of consecutive losses

qtyMultiplier = math.pow(2, consecutiveLosses)

baseQty = 1

tradeQty = baseQty * qtyMultiplier

🎯Paroli System (also known as the Reverse Martingale)

The Paroli System is similar to the Anti-Martingale strategy but with more defined limits on how much you increase your position after each win. It's a progressive betting system where you increase your position after a win, but once you've won a set number of times, you reset to the original bet size.

How it Works:

Start with an initial bet.

After each win, increase your bet by a predetermined amount (often doubling it).

After a set number of wins (e.g., 3 wins in a row), reset to the original position size.

To implement inverse martingale or Paroli system through pinescript, we need to first calculate consecutive wins.

var consecutiveWins = 0

var maxLimit = 3

if(ta.change(strategy.closedtrades) > 0)

lastProfit = strategy.closedtrades.profit(strategy.closedtrades-1)

consecutiveWins := lastProfit > 0? consecutiveWins + 1 : 0

if(consecutiveWins >= maxLimit)

consecutiveWins := 0

The quantity is then calculated using a similar formula as that of Martingale, but using consecutiveWins

qtyMultiplier = math.pow(2, consecutiveWins)

baseQty = 1

tradeQty = baseQty * qtyMultiplier

🎯D'Alembert Strategy

The D'Alembert strategy is a more conservative progression method than Martingale. You increase your bet by one unit after a loss and decrease it by one unit after a win. This is a slow, incremental approach compared to the rapid growth of the Martingale system.

How it Works:

Start with a base bet (e.g., $1).

After each loss, increase your bet by 1 unit.

After each win, decrease your bet by 1 unit (but never go below the base bet).

In order to find the position size on pinescript strategy, we can use following code

// Initial position

initialposition = 1.0

var position = initialposition

// Step to increase or decrease position

step = 2

if(ta.change(strategy.closedtrades) > 0)

lastProfit = strategy.closedtrades.profit(strategy.closedtrades-1)

position := lastProfit > 0 ? math.max(initialposition, position-step) : position+step

Conclusion

Position sizing is a crucial part of trading strategy that directly impacts your ability to manage risk and achieve long-term profitability. By selecting the appropriate position sizing method, traders can ensure they are taking on an acceptable level of risk while maximizing their potential rewards. The key to success lies in understanding each strategy, testing it, and applying it consistently to align with your risk tolerance and trading objectives.

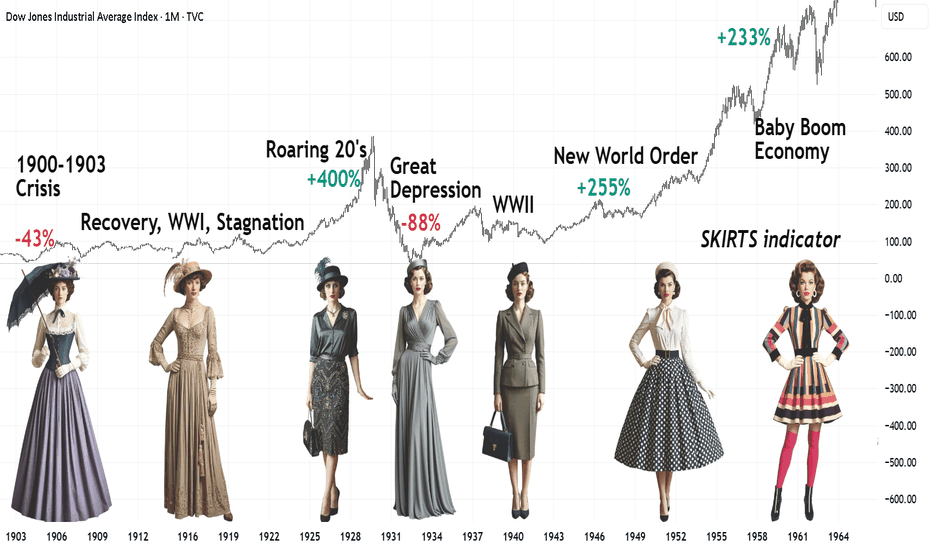

Skirt Lengths as Market Indicators: A Socionomics PerspectivePart of the #Socionomics series.

How fashion and societal moods shifted in the first half of the 20th century.

1900–1910

Economy: The rise of industrialization in the U.S. — Ford’s assembly line (1908), booming cities, and a growing wealth gap between the elite and the working class. In Europe, colonial powers raced for survival, fueling military spending (sound familiar?).

Mood: Faith in technological progress clashed with protests against exploitation. Suffragettes smashed London storefronts (1908), while New York’s Triangle Shirtwaist Factory fire (1911) galvanized labor rights movements.

Fashion: Rigid corsets and floor-length skirts symbolized Victorian morality. Yet rebels like designer Paul Poiret introduced hobble skirts — a tentative step toward freedom of movement.

1910–1920

Economy: World War I (1914–1918) reshaped the globe: Europe lay in ruins, while the U.S. profited from arms sales. Postwar hyperinflation crippled Germany, and the Spanish Flu (1918–1920) claimed millions.

Mood: Women replaced men in factories, only to be pushed back into domestic roles after the war. A feminist explosion: American women won voting rights in 1920.

Fashion: Skirts rose to ankle-length for practicality. By the decade’s end, the flapper emerged — straight-cut dresses, beaded necklaces, and cigarettes in hand, defying tradition. A sign of the stock market’s brewing boom.

1920–1929

Economy: The "Roaring Twenties" — jazz, speculation, and Prohibition. The stock market quadrupled; ordinary Americans borrowed heavily to invest, then borrowed again against rising shares.

Mood: Hedonism reigned. Speakeasies and Gatsby-esque parties masked pre-crash euphoria.

Fashion: Knees on display! Fringed dresses, bobbed haircuts, and gartered stockings. By 1929, subdued silhouettes crept in — an omen of crisis.

1930–1940

Economy: The 1929 bubble burst: Wall Street crashed, triggering the Great Depression (1929–1939). U.S. unemployment hit 25%. Europe veered toward fascism and war.

Mood: Despair from Dust Bowl migrations and hunger marches. Yet Hollywood’s Golden Age offered escapism.

Fashion: Skirts lengthened — modesty returned. Long dresses dominated, while cheap fabrics and turbans (to hide unwashed hair) became staples.

1940–1950

Economy: World War II (1939–1945). Postwar Europe rebuilt via the Marshall Plan; the U.S. embraced consumerism.

Mood: Patriotism ("Rosie the Riveter") and postwar hope. The baby boom idealized domesticity.

Fashion: War mandated minimalism: knee-length skirts and padded shoulders. In 1947, Christian Dior’s New Look rebelled — voluminous ankle-length skirts symbolized postwar opulence.

1950–1960

Economy: America’s "Golden Fifties" — middle-class expansion, cars, and TV. Europe recovered, but colonial wars (Algeria, Vietnam) exposed crises.

Mood: Conformity (suburban perfection) vs. teenage rebellion (James Dean, Elvis’s rock ‘n’ roll).

Fashion: Sheath dresses and midi skirts emphasized femininity. By the late 1950s, Mary Quant experimented with mini-skirts — a harbinger of the sexual revolution.

1960s: Peak of Postwar Prosperity

Economy: U.S. GDP grew 4-5% annually; unemployment dipped below 4%. Baby boomers (1946–1964) fueled suburban housing and education demand.

Fashion: The mini-skirt became an era-defining manifesto of freedom, paired with bold go-go boots. Economic optimism bred experimentation: neon synthetics (nylon, Lycra) and psychedelic hues.

Conclusion

Women’s fashion mirrors its era. Crises (1930s) hide knees; liberating times (1920s, 1960s) bare them. Even war skirts (1940s’ knee-length pragmatism) carried hope.

💡 Like and subscribe for insights your economics textbook won’t reveal!

#beginners #learning_in_pulse #interesting

#socionomics #history #fashiontrends

How to Set Stop LossesViolating stop losses is like alcoholism.

There are 3 basic ways to set stop losses in trading:

1. Price-Based Stop

This can be a fixed monetary or percentage loss.

This is the most common and comfortable method — trading becomes a game with predictable outcomes. Knowing your maximum risk keeps emotions in check.

How to choose the price level?

Set a loss limit you're comfortable with — for example, 1% for a short-term trade or up to 12% for an investment position.

I don’t recommend anything over 15% — that usually signals a bad position that starts draining your energy and dominates your thoughts: “When will this finally recover?!”

Alternatively, use a support/resistance level, previous high/low — but don’t place the stop exactly on the level. Put it slightly above/below (e.g. 0.5%) and make sure the potential loss is still acceptable.

Or base it on volatility — for example, the Volatility Stop indicator on TradingView. Again, place your stop slightly beyond the indicated level.

Avoid setting stops based on moving averages — they’re trend indicators, not stop-loss tools.

2. Indicator-Based Stop

Used when a price breaks a key technical level or indicator signal — useful in trend or pattern-based strategies.

3. Time-Based Stop

Often used around news events or major announcements. The market needs time to digest the info, so a time stop lets you exit if the move doesn’t happen within a set timeframe.

❗️Match your stop-loss to the timeframe of your entry❗️

If you entered based on the daily chart — use daily levels, volatility, and context for your stop. Don’t mix timeframes.

RSI 101: Scalping Strategy with RSI DivergenceFX:XAUUSD

I'm an intraday trader, so I use the H1 timeframe to identify the main trend and the M5 timeframe for entry confirmation.

How to Determine the Trend

To determine the trend on a specific timeframe, I rely on one or more of the following factors:

1. Market Structure

We can determine the trend by analyzing price structure:

Uptrend: Identified when the market consistently forms higher highs and higher lows. This means price reaches new highs in successive cycles.

Downtrend: Identified when the market consistently forms lower highs and lower lows. Price gradually declines over time.

2. Moving Average

I typically use the EMA200 as the moving average to determine the trend. If price stays above the EMA200 and the EMA200 is sloping upwards, it's considered an uptrend. Conversely, if price is below the EMA200 and it’s sloping downwards, it signals a downtrend.

3. RSI

I'm almost use RSI in my trading system. RSI can also indicate the phase of the market:

If RSI in the 40–80 range, it's considered an uptrend.

If RSI in 20 -60 range, it's considered a downtrend.

In addition, the WMA45 of the RSI gives us additional trend confirmation:

Uptrend: WMA45 slopes upward or remains above the 50 level.

Downtrend: WMA45 slopes downward or stays below the 50 level.

Trading Strategy

With this RSI divergence trading strategy, we first identify the trend on the H1 timeframe:

Here, we can see that the H1 timeframe shows clear signs of a new uptrend:

Price is above the EMA200.

RSI is above 50.

WMA45 of RSI is sloping upward.

To confirm entries, move to the M5 timeframe and look for bullish RSI divergence, which aligns with the higher timeframe (H1) trend.

RSI Divergence, in case you're unfamiliar, happens when:

Price forms a higher high while RSI forms a lower high, or

Price forms a lower low while RSI forms a higher low.

RSI divergence is more reliable when the higher timeframe trend remains intact (as per the methods above), indicating that it’s only a pullback in the bigger trend, and we’re expecting the smaller timeframe to reverse back in line with the main trend.

Stop-loss:

Set your stop-loss 20–30 pips beyond the M5 swing high/low.

Or if H1 ends its uptrend and reverses.

Take-profit:

At a minimum 1R (risk:reward).

Or when M5 ends its trend.

You can take partial profits to optimize your gains:

Take partial profit at 1R.

Another part when M5 ends its trend.

The final part when H1 ends its trend.

My trading system is entirely based on RSI, feel free to follow me for technical analysis and discussions using RSI.

How to Use the TradingView Search Bar Efficiently 01. Introduction to the TradingView Search Bar

The TradingView Search Bar is one of the most essential tools in your charting journey. Located at the top-left corner of the interface, this feature allows you to instantly switch between stocks, indices, crypto assets, forex pairs, futures, and more — without leaving your current chart tab.

Whether you're a day trader looking for high-volume movers or an investor monitoring global indices, the search bar makes it effortless to pull up symbols with lightning speed.

One of the best parts? You don’t even need to click anything — just start typing on your keyboard while a chart is open, and the search bar automatically activates.

Pro Tip: The TradingView Search Bar supports symbol auto-suggestions with exchange suffixes (like .NS for NSE stocks), making it ultra-fast for Indian markets too.

02. How to Open the Symbol Search Bar

Opening the symbol search bar in TradingView is incredibly intuitive — and can be done in multiple ways depending on how fast you want to move.

Here are the top 3 ways to launch the search bar:

• 🔘 Click the Symbol: Go to the top-left corner of your chart and click the current symbol (e.g., NIFTY or BTCUSD) to open the search panel.

• ⌨️ Start Typing: When your chart is focused, just begin typing any symbol directly — the search window pops up instantly.

• 📚 Use the Watchlist: Open a saved symbol from your Watchlist using a simple click, and it automatically replaces the current chart.

Shortcut Key:

Just press your keyboard and type RELIANCE or NIFTY without clicking anywhere — TradingView immediately opens the search popup.

Works on both Windows and Mac.

03. Extended: Exploring the Search Interface (Tab-by-Tab Breakdown)

The TradingView Symbol Search Interface is more than just a place to look up stock names. It’s a powerful filtering system designed to help traders and investors access any instrument—globally and across asset classes—in just a few clicks. Let’s break down each tab and filter in detail:

🔍 1. Asset Type Tabs

Located at the top of the search panel, these tabs let you narrow down by instrument type:

• All – View all available instruments.

• Stocks – Equity shares from global exchanges (e.g., NSE, NASDAQ, BSE, etc.).

• Funds – Includes ETFs, mutual funds, and index funds.

• Futures – Derivative contracts across commodities, indices, etc.

• Forex – Currency pairs like USDINR, EURUSD, GBPJPY, etc.

• Crypto – Popular cryptocurrencies like BTC, ETH, and exchange pairs.

• Indices – Market indices like NIFTY50, S&P 500, NASDAQ100.

• Bonds – Government and corporate bond listings.

• Economy – Macro-economic indicators like GDP, unemployment, CPI.

• Options – Derivative instruments based on options chain availability.

💡 Pro Tip: Use these tabs before typing a symbol to narrow down your focus instantly.

🌍 2. All Countries Filter

You can choose to see instruments only from specific countries. Selecting this opens a country-wise list showing all supported exchanges under each country.

• USA: NASDAQ, NYSE, CBOE, OTC

• India: NSE, BSE

• UK: LSE

• Germany: XETRA, FWB

🔎 Use Case: If you only want Indian stocks, choose India to limit the results to NSE/BSE only.

🧾 3. All Types Filter (Only under Stocks Tab)

This filter lets you refine your equity instrument type, such as:

• Common Stock

• Preferred Stock

• Depository Receipt (like ADR/GDR)

• Warrant

🔍 Use Case: Great for global investors looking specifically for ADRs or warrants.

🧭 4. All Sectors Filter (Only under Stocks Tab)

This is one of the most powerful tools for equity screening. You can filter stocks based on their sector like:

• Finance

• Technology Services

• Health Technology

• Consumer Durables

• Electronic Technology

• ... and 20+ more industry segments

💼 Use Case: Perfect for sector-based trading or thematic investing.

⚙️ Power Feature: All filters can be used in combination. Example: You can search only Technology sector stocks from India, of Common Stock type — all in seconds.

05: Using the Flag to Add Symbols to Watchlist

The 🚩 flag icon in TradingView allows you to tag symbols with color-coded labels for easy watchlist management. You can organize your stocks by strategy, sector, volatility, or timeframe using these flags.

🎯 What Does the Flag Icon Do?

• Click the 🚩 icon next to any symbol in the search panel.

• Choose from 7 different colors to group stocks by theme.

• Flagged stocks immediately appear under that color in your Watchlist.

You can create multiple groups — like F&O, Crypto, Sectors, Swing Picks — all visually organized.

🔍 06: Smart Search Tricks (Symbol Syntax, Exchanges, Shortcuts)

The TradingView Symbol Search bar supports intelligent filters, shortcuts, and exchange-based syntax to save time and improve accuracy. Mastering these tricks will allow you to switch charts and find instruments faster than ever.

🧠 1. Use Exchange Prefixes

You can directly use exchange prefixes to narrow your search:

NSE: – National Stock Exchange of India

BSE: – Bombay Stock Exchange

NASDAQ: – U.S. Nasdaq-listed stocks

NYSE: – New York Stock Exchange

👉 Example: NSE:RELIANCE shows Reliance on NSE instantly.

💡 2. Partial Name Works Too

You can type partial symbols after the exchange code and TradingView will auto-suggest:

🔎 Example: Typing NSE:REL shows Reliance Industries and others.

⚡ 3. Avoid Full Company Names

Typing full company names like “Reliance Industries Ltd” might not show accurate results quickly. Instead, use ticker codes or shortcuts with exchange prefixes for better precision.

🎯 4. Type Directly to Open Search

No need to click the 🔍 icon! Just start typing on the chart:

Windows/Mac: Type any symbol (e.g. INFY)

Use Arrows: ⬆️ ⬇️ to move between results

Press Enter: to select symbol instantly

🌐 5. Use Filter Tabs Above Search

TradingView lets you filter across:

Markets: All / India / US / Global

Types: Stocks / Crypto / Forex / Futures

Sectors: Banks / Tech / Pharma / Energy

💡 Pro Tip: Combine NSE: + partial ticker + filters to drill down fast without leaving the chart screen

Blueprint for Becoming a Successful Forex Trader in 2025🚀 Blueprint to Becoming a Successful Forex Trader in 2025: Leveraging ICT, Automation, and Prop Funding

Here’s a detailed, actionable blueprint designed to position you for success by carefully navigating broker selection, adopting advanced trading strategies, obtaining prop funding, and integrating automation and AI technologies into your trading.

🏦 Broker Selection (Actionable Steps)

🔍 Choose brokers with true ECN/STP execution

⚡ Ensure brokers offer low spreads (0.0-0.2 pip average) and fast execution to maximize ICT precision entries.

🛡️ Prioritize brokers regulated by ASIC, FCA, or FSCA with verified Myfxbook execution reports.

📊 Confirm broker compatibility with MetaTrader 4 (MT4) to seamlessly integrate Expert Advisors (EAs).

💳 Check for flexible withdrawal/deposit methods and swift payouts (Crypto, Wise, Revolut).

🎯 Trading Strategy (ICT Concepts & Supply-Demand Zones)

🧠 Master ICT Concepts: Liquidity sweeps, Order Blocks (OB), Fair Value Gaps (FVG), Market Structure Breaks (MSB).

📍 Combine ICT with Supply-Demand: Identify institutional supply-demand zones aligning with ICT Order Blocks & liquidity areas.

📐 Execute High-Probability Setups: Trade only after liquidity grabs at key daily/weekly ICT points, avoiding retail traps.

📈 Time & Price Theory: Trade London Kill Zones and New York Open exclusively, exploiting predictable ICT volatility.

📆 Weekly Preparation: Annotate D1/H4 charts on weekends marking liquidity points, order blocks, and premium/discount zones clearly.

💰 Getting Prop Funding (Actionable Approach)

🥇 Target reputable prop firms (FTMO, MyForexFunds, The Funded Trader, 8cap, etc) with clear and attainable evaluation objectives.

📑 Use ICT trading style for evaluation: lower-frequency, high-probability trades with clearly defined risks.

🎯 Implement strict risk management rules: never exceed 1% risk per trade, aiming for steady account growth (5-10% monthly target).

📊 Monitor performance closely using provided analytics dashboards (e.g., FTMO Metrics App) and adapt accordingly.

📚 Diversify funded accounts across multiple firms, compounding total available trading capital while reducing firm-specific risk.

⚙️ Automating & Executing Trades (MT4 EA & Bots)

🛠️ Hire experienced MQL4 developers to code custom ICT-based MT4 Expert Advisors

🤖 Develop EAs specifically around ICT logic (Order Block detection, liquidity grabs, market structure shifts) and or supply/demand logic

🤖 use advanced algo based breakout EAs for automation

📌 Automate trade management: EAs should handle entry precision, partial exits, break-even stops, and trail stops.

📡 Set EAs on VPS Hosting (NY4, LD4) for optimal latency and consistent execution (ForexVPS, AccuWeb Hosting).

📈 Regularly perform forward-testing and optimization of EAs on demo accounts before live deployment (at least quarterly optimization).

📲 Integrating Advanced Bots and Technology in 2025

📊 Combine your MT4 EAs with third-party analytics platforms for detailed trade performance insights.

🔮 Incorporate AI-based forecasting tools to refine ICT setups and trade signals.

🔔 Use automated bots for real-time alerts on ICT-based setups via Telegram or Discord channels.

🧑💻 Maintain manual oversight for discretionary ICT decisions—use automation for entry efficiency, not blind reliance.

🔄 Continuously retrain and update your bot’s logic monthly using the most recent trade data, ensuring adaptive execution.

🗓️ Daily Routine for Success

🌅 Pre-session (30 mins): Review annotated charts, ICT concepts (liquidity, OB, FVG), and supply-demand levels.

💻 During trading session: Monitor EA execution, manually adjust positions based on real-time ICT setups.

📝 Post-session (15 mins): Journal trades meticulously in detail, noting ICT reasoning behind wins and losses.

📆 Weekly review: Assess overall ICT & EA performance—adjust EA parameters as needed to match evolving market conditions.

📚 Continuous learning: Keep updated on advanced ICT framework,

supply demand zone trading.

📌 Final Actionable Advice for 2025

🔍 Specialize intensely on ICT & supply-demand concepts rather than multiple strategies—depth over breadth.

🚩 Always adapt and evolve your trading algorithms to ICT methodology—market dynamics continually change.

🧘 Maintain emotional discipline and patience, relying on high-probability setups to steadily compound your account.

💡 Stay ahead by embracing technology: automation, AI-driven forecasting, and custom ICT tools will provide a significant edge in 2025.

Could Bitcoin Crash 60%—But Only 20% of Traders Lose?Analyzing the current BTC/USDT chart, we see that Bitcoin is hanging just above a critical support zone—what many traders recognize as “the most important support level” from a volume perspective on Binance. The chart illustrates a potential 60.37% drop, which would pull BTC down nearly $49,000, back toward the high-volume range near $30K.

This sounds catastrophic, right? But here’s the twist...

🔍 Why Only 20% of Traders Might Actually Lose

According to Binance's volume profile data:

The majority of buying activity and position accumulation happened below $35,000.

Most long-term holders and smart money entered during the 2022-2023 accumulation range.

The Volume Profile Visible Range (VPVR) shows significant support below the current price, with minimal trading volume at higher levels.

💡 That means only a minority (approx. 20%) of traders bought BTC during its late-stage bull run above $70K. These are the traders most at risk if a drop occurs.

In contrast, the majority are still sitting in profit—or near break-even—even if Bitcoin retraces back to its base.

📊 So while the price could drop 60%, 80% of holders might remain safe, having entered at lower levels.

🧠 What This Means for You:

If you're a late bull, it’s time to assess risk.

If you're a smart accumulator, the pullback could offer another golden entry.

If you're a bear, this chart supports your thesis—but don't forget the whales are watching this zone closely.

Stay sharp. Stay informed.

Example of how to draw a trend line using the StochRSI indicator

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

I have explained how to draw a trend line before, but I will take the time to explain it again so that it is easier to understand.

-

When drawing a trend line, it must be drawn on the 1M, 1W, and 1D charts.

However, since I focused on understanding the concept of drawing a trend line and the volatility period that can be seen with a trend line, I will explain it only with a trend line drawn on the 1D chart.

Please note that in order to calculate a somewhat accurate volatility period, support and resistance points drawn on the 1M, 1W, and 1D charts are required.

I hope this was helpful for understanding my thoughts on the concept of drawing trend lines and how to interpret them.

The main reason for drawing trend lines like this is so that anyone who sees it can immediately understand why such a trend line was drawn.

Then, there will be no unnecessary disagreements about the drawing, and each person will be able to share their opinions on the interpretation.

--------------------------

When drawing trend lines, the StochRSI indicator is used.

The reason is to secure objectivity.

When the StochRSI indicator touches the oversold zone and rises, the low corresponding to the peak is connected to draw a trend line between low points.

And, when the StochRSI indicator touches the overbought zone and falls, the Open of the downward candle corresponding to the peak is connected to draw a trend line between high points.

If the peak is not a downward candle, it moves to the right and is drawn with the Open of the first downward candle.

If you refer to the candlesticks of the arrows in the chart above, you will understand.

The trend line drawn as a dot is a high-point trend line, but it is a proper trend line because it does not touch the overbought zone between highs.

Therefore, you can draw a trend line corresponding to trend line 1.

Accordingly, around March 25-29, around April 8, and around April 14 correspond to the volatility period.

-

You can see how important the low-point trend line (2) is.

If the high-point trend line is properly created this time and the low-point trend line and the high-point trend line are displayed in the same direction, the trend is likely to continue along that channel.

If the StochRSI indicator rises and a peak is created in the overbought zone, you will draw a high-point trend line that connects to point A.

-

Thank you for reading to the end. I hope your transaction will be successful.

--------------------------------------------------

How to Trade After Major News Events – The 15-Min Trap SetupHello Traders!

We all get excited when major news hits the market — whether it’s budget day, RBI policy, US inflation data, or company results . But jumping in too early can be a trap. Smart money often creates fake moves in the first few minutes. That’s where the 15-Min Trap Setup becomes a powerful tool for intraday traders.

Let me show you how to avoid traps and catch real moves after news events.

Why the First 15 Minutes Matter

Emotions are high: Retail traders often react instantly without confirmation. This creates liquidity for big players.

Fake breakouts happen often: Price breaks key levels in the first candle — then reverses and traps traders.

Volume is misleading: The biggest volume often comes early, but the real direction is seen later.

The 15-Min Trap Setup – How It Works

Step 1: Wait for the first 15-minute candle to close after a big news event — don’t trade before that.

Step 2: Mark the high and low of this 15-minute candle.

Step 3: Wait for a fake breakout above or below that range — if price breaks out but quickly comes back inside, it’s a trap.

Step 4: Enter in the opposite direction of the breakout after confirmation — ride the real move.

When to Use This Strategy

Major economic events – like Fed decisions, budget day, inflation data, RBI policies.

Company results – high-impact earnings or news releases.

Gap up/gap down openings after big global cues.

Rahul’s Tip

Don’t react — observe. Let the market show its trap. Big players love early overconfidence. Use their game to your advantage by planning around the 15-min candle.

Conclusion

The 15-Min Trap Setup helps you avoid emotional trades and catch the real move after major news. Be patient, mark your zones, and strike when the trap is confirmed. This simple rule can completely change your intraday game.

Have you ever been trapped in the first candle after news? Let’s share experiences below and grow together!

Mastering Market Trends: Your Guide to Clearer Trading DecisionsTrends shape every decision you make in the markets, even if you’re unaware of it. Understanding how to identify and adapt to these market phases is your foundational skill - one that separates successful traders from the rest.

Today, let’s simplify and clarify the three essential types of market trends. By mastering this, you’ll approach trading decisions with more confidence and clarity.

⸻

📈 1. Uptrend – Riding the Bull

• What is it?

An uptrend is like climbing stairs upward. Each step (low) is higher than the previous one, and every leap (high) sets a new peak.

• What drives it?

Buyers dominate, optimism rules, and demand pushes prices upward.

• Trading tip:

Identify support levels and look for retracements as potential entry points. Be cautious about chasing prices that have moved too far without a pullback.

⸻

📉 2. Downtrend – Navigating the Bearish Territory

• What is it?

Visualize going down a staircase. Each step down (low) surpasses the previous one, and every upward bounce (high) falls short of the prior peak.

• What drives it?

Sellers control the market, bearish sentiment takes over, and supply outweighs demand.

• Trading tip:

Look for resistance areas to identify potential short entries or wait patiently for signs of a reversal if you’re bullish.

⸻

➡️ 3. Sideways Market – The Calm Before the Storm

• What is it?

Imagine a tug-of-war with evenly matched teams. The price moves back and forth in a narrow range without breaking decisively higher or lower.

• What drives it?

Uncertainty, indecision, or equilibrium between buyers and sellers.

• Trading tip:

Stay patient! Either look to trade range extremes (buying support and selling resistance) or wait for clear breakout signals to catch the next big move.

⸻

🔍 Pro Tip for Trend Analysis:

• Multi-timeframe analysis is key: Always check higher timeframes (weekly, daily, or hourly) to confirm the primary trend. Don’t let short-term noise mislead your trading decisions.

⸻

🚀 Why It Matters:

Aligning your strategies with the correct market trend significantly improves your odds. It’s like sailing with the wind at your back instead of battling against it.

Now, tell us in the comments: Which trend type do you find most challenging to trade?

Trade smarter. Trade clearer.

Clear DayTrading strategy video. The "Inside Bar"🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

DCA Buy Alert Script for Long-Term InvestorsHello, TradingView traders!

I'm sharing a simple Pine Script for cautious DCA (Dollar-Cost Averaging) entries.

This script helps accumulate only on weakness — no buying blindly. (Use only on high volatility altcoins!)

🔍 Strategy logic:

• RSI < 40 → market is oversold

• Price below EMA 21 → short-term trend is down

• Price below SMA 200 → long-term trend is weak

Only when ALL three conditions are met, the script triggers a BUY alert.

✅ How to use:

1. Add the script to your chart

2. Create an alert: choose “Cautious DCA Buy Signal”

3. You’ll get notified when the market dips into a DCA zone

//@version=6

indicator("Cautious DCA on Dips", overlay=true)

rsi = ta.rsi(close, 14)

sma = ta.sma(close, 200)

ema = ta.ema(close, 21)

buySignal = rsi < 40 and close < sma and close < ema

plotshape(buySignal, title="Buy Signal", location=location.belowbar, style=shape.labelup, size=size.normal, color=color.green, text="Buy", textcolor=color.white)

plot(sma, title="SMA 200", color=color.orange)

plot(ema, title="EMA 21", color=color.blue)

alertcondition(buySignal, title="Buy Alert", message="DCA Buy Signal: RSI is low and price is below EMA and SMA")

🔔 This script reduces noise and waits patiently for real dips.

Useful for long-term investors who want to buy with discipline.

Let me know how it works for your strategy!

#DCA #LongTerm

China: 34% Tariffs Against US, Impact on Forex Market

Hello, I am Forex Trader Andrea Russo and today I want to talk to you about China's response to US Tariffs. China's recent decision to impose 34% counter-tariffs on US products represents a significant development in trade tensions between the world's two largest economies. This move, which will take effect on April 10, is a direct response to the 10% tariffs imposed by the United States. The announcement has already had repercussions on global markets, with stocks recording sharp declines. In this article, we will analyze the motivations behind this decision, its economic implications and the impact on the Forex market.

Motivations Behind the Counter-Tariffs

China's decision to impose counter-tariffs is a strategic response to the aggressive trade policies of the United States. The 10% tariffs imposed by the US are aimed at correcting what is perceived as an unfair trade deficit and protecting domestic industries. However, China sees these tariffs as a threat to its economic growth and the stability of its exports. The 34% counter-tariffs are therefore an attempt to rebalance the trade balance and put pressure on the United States to review its policies.

Global Economic Implications

The imposition of counter-tariffs has economic implications that go far beyond the two nations involved. Trade tensions can trigger a series of chain reactions that affect the global economy in various ways:

Increased Production Costs: Companies that rely on imports of raw materials and components from the United States will see an increase in production costs, which could be passed on to consumers in the form of higher prices.

Slower Economic Growth: Trade tensions can lead to a slowdown in global economic growth, as companies may reduce investment due to economic uncertainty.

Inflation: Rising prices of imported goods can contribute to inflation, reducing the purchasing power of consumers and increasing costs for businesses.

Forex Market Impact

The Forex market, known for its sensitivity to geopolitical and economic events, is not immune to the effects of the trade tensions between China and the United States. Here are some of the main impacts:

US Dollar Volatility: The increase in tariffs could weaken the US dollar, as trade tensions tend to reduce investor confidence. Demand for US goods could decrease, negatively impacting the value of the dollar.

Strengthening of the Chinese Yuan: China could see a strengthening of the yuan, as its economy could be perceived as more stable than that of the United States in this context of trade tensions.

Federal Reserve Monetary Policy: The Federal Reserve could be forced to review its monetary policy, with possible interest rate cuts to mitigate the economic impact of the tariffs. This could further impact the Forex market, increasing volatility.

Conclusion

China's decision to impose counter-tariffs of 34% on US products represents a significant development in the trade tensions between the world's two largest economies. The economic implications of this move are vast and complex, affecting not only national economies but also the global Forex market. Investors and analysts will need to monitor these developments closely to fully understand their implications and adjust their strategies accordingly.

Your Best Trading Signal Formula Revealed (Forex, Gold)

If you are looking for a way to increase the accuracy of your trades, I prepared for you a simple yet powerful checklist that you can apply to validate your trades.

✔️ - The trades fit my trading plan

When you are planning to open a trade, make sure that it is strictly based on your rules and your entry reasons match your trading plan.

For example, imagine you found some good reasons to buy USDJPY pair, and you decide to open a long trade. However, checking your trading plan, you have an important rule there - the market should strictly lie on a key level.

The current market conditions do not fit your trading plan, so you skip that trade.

✔️ - The trade is in the direction with the trend

That condition is mainly addressed to the newbie traders.

Trading against the trend is much more complicated and riskier than trend-following trading, for that reason, I always recommend my students sticking with the trend.

Even though USDCHF formed a cute double bottom pattern after a strong bearish trend, and it is appealing to buy the oversold market, it is better to skip that trade because it is the position against the current trend.

✔️ - The trade has stop loss and target level

Know in advance where will be your goal for the trade and where you will close the position in a loss.

If you think that it is a good idea to buy gold now, but you have no clue how far it will go and where can be the target, do not take such a trade.

You should know your tp/sl before you open the trade.

✔️ - The trade has a good risk to reward ratio

Planning the trade, your potential reward should outweigh the potential risks. And of course, there are always the speculations about the optimal risk to reward ratio, however, try to have at least 1.3 R/R ratio.

Planning a long trade on EURNZD with a safe stop loss being below the current support and target - the local high, you can see that you get a negative r/r ratio, meaning that the potential risk is bigger than the potential reward. Such a trade is better to skip.

✔️ - I am ok with losing this trade if the market goes against me

Remember that even the best trading setups may occasionally fail. You should always be prepared for losses, and always keep in mind that 100% winning setups do not exist.

If you are not ready to lose, do not even open the position then.

✔️ - There are no important news events ahead

That rule is again primarily addressed to newbies because ahead and during the important news releases we have sudden volatility spikes.

Planning the trade, check the economic calendar, filtering top important news.

If important fundamentals are expected in the coming hours, it's better to wait until the news release first.

Taking a long trade on Gold, you should check the fundamentals first. Only after you confirm, that there are no fundamentals coming soon, you can open the position.

What I like about that checklist is that it is very simple, but you can use it whether you are a complete newbie or an experienced trader.

Try it and let me know if it helps you to improve your trading performance.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

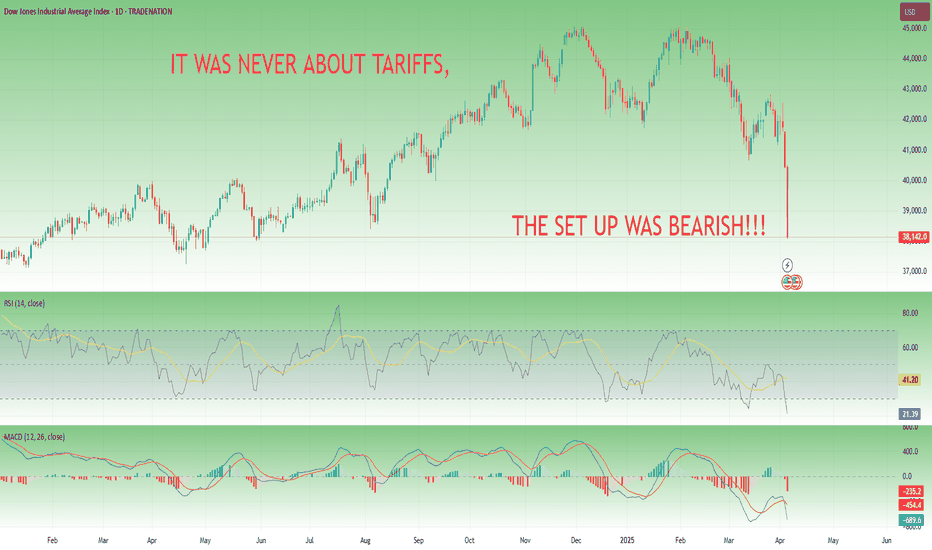

Tariffs Didn’t Cause the Correction — It Was Coming Anyway🚩 Intro: Markets Correct — They Don’t Need Permission

Every time the market drops hard, the headlines rush in to explain it. This time, it was President Trump’s dramatic tariff announcement on April 2nd. The media called it a shock.

I didn’t.

I’ve been calling for S&P 500 to drop to 5,200, and NASDAQ-100 to 17,500, since early January.

Not because I predicted tariffs. But because the charts told the story.

The market didn’t fall because of politics — it fell because it had to.

________________________________________

🔥 The Spark: Trump’s “Liberation Day” Tariffs

On April 2, 2025, Trump rolled out an aggressive trade agenda:

• 10% blanket tariff on all imports

• Up to 54% tariffs on Chinese goods

• 25% tariffs on imported cars and parts

• With limited exemptions for USMCA-aligned countries

Markets reacted instantly:

• S&P 500 dropped 4.8% — worst day since 2020

• NASDAQ-100 plunged over 6%

• Tech mega caps lost 5–14% in a day

Sounds like cause and effect, right?

Wrong.

________________________________________

🧠 The Real Cause: A Market That Was Ready to Fall

Let’s talk technicals:

• S&P 500 had printed a textbook double top at the 6100–6150 zone

• NASDAQ-100 had formed a rising wedge, with volume divergence and momentum fading

• RSI divergence was in place since February

• MACD had crossed bearish and also deverging

• Breadth was weakening while indices were still pushing highs

• Sentiment was euphoric, volatility crushed — a classic setup

You didn’t need to guess the news. The structure was screaming reversal.

SP500 CHART:

NASDAQ CHART:

________________________________________

🧩 Why Tariffs Made a Convenient Narrative

Markets love clean stories. And Trump’s tariffs offered everything:

• Emotional trigger

• Economic fear factor

• Political drama

• Global implications

But smart traders know better: markets correct based on positioning, not politics.

As soon as the wedge broke on NAS100 and SPX broke the double top's neck line the path was clear — risk off.

________________________________________

📉 I Was Calling This Since Q1

The targets were public:

SPX = 5,200. NAS100 = 17,500.

And the logic was simple:

• Overextension in AI-led tech

• Complacent VIX environment

• Crowded long positioning

• Bearish divergences and fading momentum

Double Top and Rising Wedge on SPX and Nas100

We didn’t need a reason to drop. The market had been levitating without support. All we needed was a trigger — and we got one.

________________________________________

🧭 Lesson: Trade the Structure, Not the Story

Here’s what I hope you take away:

✅ Setups come first. News comes later.

✅ If it wasn’t tariffs, it would’ve been CPI, earnings, Fed minutes, or a bird on a wire

✅ Don’t chase headlines. Anticipate setups.

The best trades aren’t reactive. They’re built on structure, sentiment, and timing — not waiting for CNBC to tell them what’s happening.

________________________________________

🔚 Conclusion: It Was Never About Tariffs

Tariffs were the match.

But the market was already soaked in gasoline.

This correction was technical, predictable, and clean.

📝 Post Scriptum — The Setup Shapes the Narrative

Let me be clear:

I’m not a Trump fan. Hoho — not by far.

But I’ll swear this on any chart:

If the setup had been the opposite — double bottom, falling wedge, positive divergences, and improving momentum — these exact same tariffs would’ve been interpreted as “bold leadership,” “pro-growth protectionism,” or “markets pricing in a stronger America.”

That’s how it works.

Price action leads. Narrative follows.

When structure is bullish, traders celebrate even bad news.

When structure is bearish, even good news becomes a reason to sell.

So no — it wasn’t about Trump. It never is. It’s about where the market wants to go. The rest is storytelling.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Understanding the ICT Venom ModelIn this video I break down the ICT Venom Model as recently described by the man himself on his YouTube channel. I am sure he has more details on the model he has not released, but I basically attempt to give my two cents on NQ and the model itself.

I hope you find the video useful in your endeavours regarding learning ICT concepts as well as trading in general.

- R2F Trading

Real Reason Most Strategies Fail–“Overfitting” Explained Simply!Hello Traders!

Have you ever seen a strategy work amazingly on historical charts, but fail badly in live markets? You’re not alone. One of the biggest reasons this happens is due to something called Overfitting . Today, let’s understand this concept in the simplest way — so you can avoid falling into this trap and build smarter strategies.

What is Overfitting in Trading?

Overfitting means your strategy is too perfect for past data:

It works great on old charts, but only because it was made to match that exact data.

It fails in real-time because the market changes:

The strategy doesn’t adapt well to new price behavior — it’s not flexible.

Example:

A strategy with 10 indicators giving perfect backtest results may be too specific and only fits that period — not future ones.

Signs Your Strategy Might Be Overfitted

Too many rules or filters:

If your strategy has too many conditions just to improve past results, that’s a red flag.

Works only on one stock or timeframe:

A good strategy should work on different stocks and market conditions.

Great backtest, bad live performance:

If your real trades don’t match the backtest, it might be too customized to the past.

How to Avoid Overfitting in Trading

Keep it simple:

Use fewer indicators and rules. Focus on clean price action and proven setups.

Test on different stocks/timeframes:

See if your setup works across Nifty, Bank Nifty, stocks, or different timeframes.

Use forward testing:

Try the strategy on live charts (paper trade) before putting real money into it.

Rahul’s Tip

A perfect backtest doesn’t mean a perfect future. Build your strategy to be reliable — not just impressive on history.

Conclusion

Overfitting is like memorizing old exam answers and failing the new paper. Don’t build strategies that only look good on past data. Make them strong, simple, and adaptable to real market conditions.

Have you faced this issue before? Let’s discuss in the comments and help each other improve!