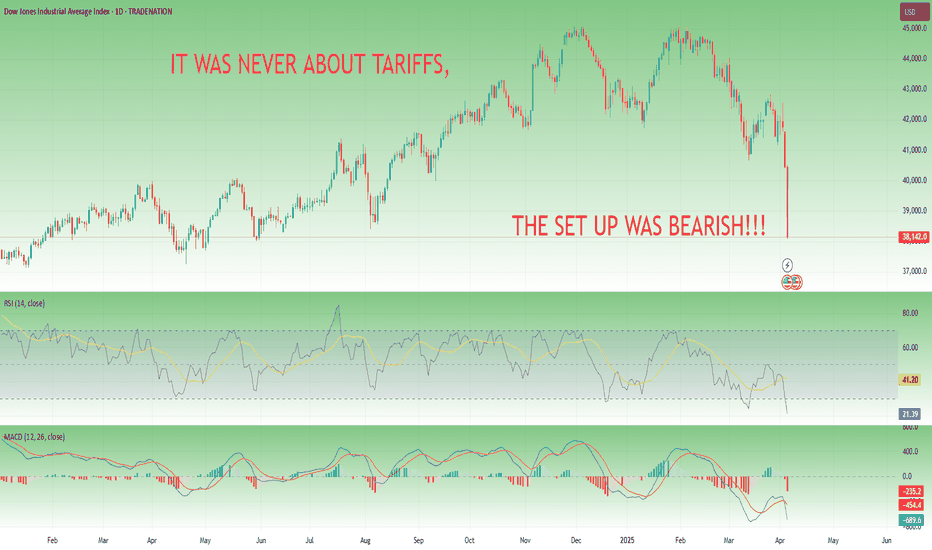

Navigating Trump Tariffs on the Dow JonesNavigating the movements of the **US30 (Dow Jones Industrial Average)** can be challenging, especially amid shifting economic policies. The Dow, which tracks 30 major U.S. companies, is highly sensitive to trade policies, corporate earnings, and geopolitical risks. Trump’s plan to impose **10% across-the-board tariffs** and **60%+ tariffs on Chinese goods** has sparked concerns about inflation, supply chain disruptions, and retaliatory trade measures. Investors are closely watching how these policies could impact multinational companies within the index, particularly those reliant on global trade, such as **Boeing, Apple, and Caterpillar**.

For everyday Americans, higher tariffs could mean **rising prices on imported goods**, from electronics to household items, worsening inflation. While tariffs aim to protect domestic industries, they often lead to **higher production costs** for businesses that rely on foreign materials, potentially triggering job cuts or reduced consumer spending. The stock market’s reaction—volatility in the US30—reflects these uncertainties, as investors weigh the risks of slower growth against potential benefits for U.S. manufacturers.

Traders navigating the US30 must monitor **Fed policy, corporate earnings, and trade war developments**. If tariffs escalate, defensive stocks (utilities, healthcare) may outperform, while industrials and tech could face pressure. Long-term investors might see dips as buying opportunities, but short-term traders should prepare for turbulence. Ultimately, Trump’s tariff policies could reshape market dynamics, making adaptability key for those trading the Dow.

Fundamental Analysis

9 Simple Ratios Every Great Investor Uses - Buffett Included!Forget the hype, headlines, or hope. These 9 financial ratios are what real investors actually use to pick winners, but...

P/E? ROE? EPS? 🧐

- What are they, or better yet, WHO are they? 🤯

- How high is “too high”?

- Is a low number always good, or just a trap?

- Do all industries follow the same rules… or is that another myth?

Buffett. Greenblatt. Graham. Lynch.

They didn’t rely on vibes — they trusted fundamentals

After years of relying on charts, I built a 9-point fundamentals checklist to filter stocks faster and smarter. Now I’m sharing it with real-life examples and key insights to help you spot what really makes a stock worth owning:

Easy enough for new investors diving into fundamentals

Sharp enough to level up seasoned pros

Real enough to avoid hype

…but the truth is: these numbers did flag companies like Amazon, Apple, and Nvidia before the market gave them credit.

-----------------------------------------------------

✅ Quick Reference Table

Scan the table, then dive into the stories…

First Pro Tip: Bookmark this. You’ll check these before every stock pick.

-----------------------------------------------------

📊 1. P/E Ratio | Price-to-Earnings

What it tells you: How much you pay for each dollar of a company’s profit.

Short Example: A P/E of 20 means you pay $20 for $1 of profit. High P/E? Expect big growth or risk overpaying.

Strong: Between 15 and 25

Caution: Above 30 (unless fast growth)

Industry Averages:

- Tech: 25–40

- Utilities: 10–15

- Consumer Staples: 15–20

- Energy: 10–20

- Healthcare: 20–30

Story: In early 2023, NVIDIA’s P/E ratio hovered around 25, near the low end for tech stocks. Investors who saw this as a steal amid the AI boom were rewarded—NVIDIA’s stock made 4x by the end of 2024 as AI chip demand soared.

Contrast that with Tesla in Q1 2025, when its P/E spiked above 40 with slowing sales and Tesla’s stock dropped 50% in weeks.

Pro tip: A low P/E is not always good. If growth is weak or falling, it's often a trap.

Example: A utility company with a P/E of 30 is probably overpriced. A tech stock with 35 might still be fair — if growth justifies it.

-----------------------------------------------------

🧠 2. PEG Ratio | Price-to-Earnings-to-Growth

What it tells you: If a high P/E is worth it based on future profit growth. Whether the earnings growth justifies the price.

Short Example: A PEG below 1 means you’re getting growth at a fair price. High PEG? You’re overpaying.

Strong: Below 1

Caution: Above 2

Industry Averages:

- Software: below 1.5 is solid

- Consumer Goods: Below 2 is more realistic

- Tech: Below 1

- Consumer Staples: Below 1.5

- Healthcare: Below 1.2

- Financials: Below 1.5

- Energy: Below 1.3

Story: In mid-2022, Salesforce’s PEG was 0.8 (P/E 35, forward EPS growth 45%) as cloud demand surged. Investors who spotted this steal saw the stock climb 130% by the end of 2024. Meanwhile, Peloton in 2023 had a P/E of 20 but near-zero growth (PEG above 3). Its stock cratered -50% as fitness trends faded.

Story: NVIDIA’s PEG hit 0.9 in Q3 2023 (P/E 30, growth 35%) during AI hype, a steal for tech (average PEG below 1.2).

PEG filters hype. A stock can look expensive until you factor in growth.

-----------------------------------------------------

🧱 3. P/B Ratio | Price-to-Book

What it tells you: How much you pay compared to what the company owns (like buildings or cash).

Short Example: A P/B below 1.5 means you’re paying close to the company’s asset value. High P/B? Expect strong profits or risk.

Strong: Below 1.5

Caution: Below 1 + poor earnings = value trap

Industry Averages:

- Banks: Below 1.5

- Insurance: Below 1.3

- REITs: Use NAV (aim below 1.2)

- Tech: Often ignored

- Energy: Below 2

Story: In 2024, JPMorgan Chase’s P/B was 1.4, solid for banks (average below 1.5). Investors who bought enjoyed 100% gains.

n 2023, Bed Bath & Beyond’s P/B fell below 1 with collapsing earnings. It looked cheap but filed for bankruptcy that year.

Tip: Only use this in asset-heavy sectors like banking or real estate.

-----------------------------------------------------

⚙️ 4. ROE | Return on Equity

What it tells you: How well a company turns investor money into profits.

Short Example: An ROE above 15% means the company makes good money from your investment. Low ROE? Weak returns.

Strong: Above 15%

Caution: Below 10% unless in slow-growth industries

Industry Averages:

- Tech: 20–30%

- Consumer Staples: 15–25%

- Utilities: 8–12%

- Financials: 10–15%

- Healthcare: 15–20%

Story: Coca-Cola (KO) has kept ROE above 35% for years, a sign of brand power and pricing strength.

Eli Lilly’s (LLY) ROE stayed above 25% from 2022–2024, a healthcare leader (average 15–20%). Its weight-loss drug Mounjaro drove consistent profits, lifting the stock 150%+ in two years. Checking ROE trends helped investors spot this winner.

Tip: If ROE is high but D/E is also high, be careful, it might just be leverage.

-----------------------------------------------------

💰 5. Net Margin | Profitability

What it tells you: How much profit a company keeps from its sales or what % of revenue ends up as pure profit.

Short Example: A 10% margin means $10 profit per $100 in sales. Low margin? Tough business or high costs.

Strong: Above 10-15%+

Caution: Below 5%

Industry Averages:

- Software: 20–30%

- Retail: 2–5%

- Manufacturing: 8–12%

- Consumer Staples: 10–15%

- Energy: 5–10%

- Healthcare: 8–15%

Story: Walmart’s (WMT) 2% net margin looks tiny — but it’s expected in retail.

A software firm with 5%? That’s a warning — high costs or weak pricing.

In 2023, Zoom’s (ZM) net margin fell to 5% (down from 25% in 2021), well below software’s 20–30% average. Pricing pressure and competition crushed its stock quite a lot. Meanwhile, Apple’s 25% margin in 2024 (tech average 20%) remained a cash cow.

Tip: Margins show whether the company owns its pricing or competes on price.

-----------------------------------------------------

💣 6. D/E Ratio | Debt-to-Equity

What it tells you: How much debt a company uses compared to investor money.

Short Example: A D/E below 1 means more investor cash than debt. High D/E? Risky if profits dip.

Strong: Below 1

Caution: Above 2 (except REITs or utilities)

Industry Averages:

- Tech: 0–0.5

- Industrials: 0.5–1.5

- REITs: 1.5–2.5 (manageable due to structure)

- Utilities: 1–2

- Energy: 0.5–1.5

Story: In 2024, Tesla’s D/E dropped below 0.3 (tech average 0–0.5) as it paid down debt, signaling strength despite sales dips - a massive rally afterward.

Tip: Rising debt + falling profits = a storm coming. Always check both.

-----------------------------------------------------

💵 7. Free Cash Flow (FCF)

What it tells you: Cash left after paying for operations and growth investments.

Short Example: Apple’s $100 billion cash pile in 2024 funded stock buybacks, boosting shares. Low cash? Trouble looms.

Strong: Positive and growing

Caution: Negative for multiple years

Sector notes:

- Tech: Lots of cash (think billions)

- Industrials: Up and down, check trends

- REITs: Look at FFO (cash from properties), aim high

- Energy: Has cash, but swings with oil prices

- Healthcare: Steady cash, not too high

Story: Netflix had negative FCF while scaling content. Once costs stabilized, FCF turned positive and stock re-rated sharply.

Pro tip: Profits don’t mean much without real cash. FCF is often more honest.

Cash is king: Companies need cash to pay bills, reduce debt, or fund growth. If FCF is falling, they might be burning through cash reserves or borrowing, which isn’t sustainable.

Potential issues : This mismatch could signal problems like poor cash collection, heavy spending, or even accounting tricks to inflate profits.

-----------------------------------------------------

🚀 8. EPS Growth | Earnings Power

What it tells you: How fast a company’s profits per share are growing.

Short Example: EPS up 10% yearly means more profit per share, lifting stock prices. Flat EPS? No growth, no gains.

Strong: Above 10%

Caution: Below 5%, flat/negative for 3+ years

Industry Averages:

- Tech: 15–30%

- Staples: 5–10%

- REITs: 3–6% (via FFO growth)

- Healthcare: 10–15%

- Financials: 5–10%

- Energy: 5–15% (cyclical)

Story: In Q1 2024, NVIDIA’s forward EPS growth of 30% (tech average 20%+) fueled a rally as AI chips dominated. Checking forward estimates helped investors avoid traps like Intel, with flat EPS and a drop.

Pro tip: A stock with flat EPS and no dividend? There’s no reason to own it.

-----------------------------------------------------

💵 9. Dividend Yield | Passive Income

What it tells you: How much cash you get yearly from dividends per dollar invested.

Short Example: A 3% yield means $3 per $100 invested. High yield? Check if it’s sustainable.

Good: ~3–4%

Red Flag: Above 6% with a payout ratio above 80-90%

Industry Averages:

- Utilities: 3–5%

- REITs: 3–6%

- Consumer Staples: 2–4%

- Tech: 0–2%

- Energy: 2–5%

-----------------------------------------------------

💡 Final Thought: How to Use All of This

Top investors don’t use just one metric. They look at the whole picture:

Good growth? Check PEG.

Good profits? Confirm with ROE and margin.

Safe balance sheet? Look at D/E and cash flow.

Fair valuation? P/E + FCF Yield + P/B.

Real power = Combining metrics.

A company with P/E 15, PEG 0.8, ROE 20%, low debt, and positive FCF? That’s your winner.

A stock with P/E 8, but no growth, high debt, and negative cash flow? That’s a trap.

-----------------------------------------------------

Real-World Combos

🎯Winners:

Tech Gem: P/E 20, PEG 0.8, ROE 25%, D/E 0.4, growing FCF, EPS 20%+ (e.g., NVIDIA 2023: AI-driven growth, stock soared).

Energy Steal: P/E 15, P/B 1.5, FCF positive, Dividend Yield 3.5% (e.g., Chevron 2023: Cash flow king).

⚠️Traps:

Value Trap: P/E 8, flat EPS, D/E 2.5, negative FCF (e.g., Peloton 2023).

Overhyped Tech: P/E 50, PEG 3, Net Margin 5%, D/E 1.5 (e.g., Rivian 2024).

-----------------------------------------------------

🚀 Share your own combos!

What do you personally look for when picking a stock?

If you spotted something off in the numbers, or have a valuable insight to add — please, drop it in the comments.👇

💡 Let’s turn this into a thread that’s not just good but superb and genuinely helpful for everyone.

-----------------------------------------------------

Final Thought

“Buy great companies at fair prices, not fair companies at great prices.” – Warren Buffett

This guide gives you the map.

Charts, tell you when.

These numbers tell you what, and why.

And this post?

It’s just the beginning!

These 9 metrics are part one of a bigger series I’m building — where we’ll go even deeper, with more advanced ratios, smarter combos, and real case studies.

If this guide helped you see financial numbers a little clearer, there’s a good chance it’ll help your investor friend too, especially if they’re just starting their journey...🤝Share it with them!

I built this as much for myself as for anyone else who wants to get better.👊

If you made it this far — thank you! 🙏

...and super thankful if you hit "The Boost" on this post 🚀

Cheers,

Vaido

Real Success Rates of the Falling Wedge in TradingReal Success Rates of the Falling Wedge in Trading

The falling wedge is a chart pattern highly valued by traders for its potential for bullish reversals after a bearish or consolidation phase. Its effectiveness has been extensively studied and documented by various technical analysts and leading authors.

Key Statistics

Bullish Exit: In 82% of cases, the exit from the falling wedge is upward, making it one of the most reliable patterns for anticipating a positive reversal.

Price Target Achieved: The pattern's theoretical target (calculated by plotting the height of the wedge at the breakout point) is achieved in approximately 63% to 88% of cases, depending on the source, demonstrating a high success rate for profit-taking.

Trend Reversal: In 55% to 68% of cases, the falling wedge acts as a reversal pattern, signaling the end of a downtrend and the beginning of a new bullish phase.

Pullback: After the breakout, a pullback (return to the resistance line) occurs in approximately 53% to 56% of cases, which can provide a second entry opportunity but tends to reduce the pattern's overall performance.

False Breakouts: False exits represent between 10% and 27% of cases. However, a false bullish breakout only results in a true bearish breakout in 3% of cases, making the bullish signal particularly robust.

Performance and Context

Bull Market: The pattern performs particularly well when it appears during a corrective phase of an uptrend, with a profit target reached in 70% of cases within three months.

Gain Potential: The maximum gain potential can reach 32% in half of cases during a bullish breakout, according to statistical studies on equity markets.

Formation Time: The wider the wedge and the steeper the trend lines, the faster and more violent the post-breakout upward movement will be.

Comparative Summary of Success Rates:

Criteria Rate Observed Frequency

Bullish Exit 82%

Price Target Achieved 63% to 88%

Reversal Pattern 55% to 68%

Pullback After Breakout 53% to 56%

False Breakouts (False Exits) 10% to 27%

Bullish False Breakouts Leading to a Downside 3%

Points of Attention

The falling wedge is a rare and difficult pattern to correctly identify, requiring at least five contact points to be valid.

Performance is best when the breakout occurs around 60% of the pattern's length and when volume increases at the time of the breakout.

Pullbacks, although frequent, tend to weaken the initial bullish momentum.

Conclusion

The falling wedge has a remarkable success rate, with more than 8 out of 10 cases resulting in a bullish exit and a price target being reached in the majority of cases. However, it remains essential to validate the pattern with other technical signals (volume, momentum) and to remain vigilant against false breakouts, even if their rate is relatively low. When mastered, this pattern proves to be a valuable tool for traders looking for optimized entry points on bullish reversals.

QUARTERLY RESULTS - HOW TO TRADE!This is an educational video explaining the set-ups to trade the quartely results.

Feedback and queries are welcome!

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Discipline in Trading: The Indicator That Works 100% of the TimeEvery trader has that one folder — “Winning Indicators,” “Secret Scripts,” or the iconic “Final Strategy v12_REAL_THIS_ONE_WORKS.” It's where we hoard indicators like Pokémon, convinced the next RSI+MACD+SMA combo tweak will finally reveal the holy grail of trading.

Spoiler: it won’t. Because the real indicator that works — actually works — isn’t on your chart. It’s not in a TradingView script. It’s not even on your screen.

But it’s there — etched into your trade history, tattooed into your losses, and reflected in your ability (or inability) to stop yourself from clicking “buy” because Elon Musk tweeted a goat emoji.

It’s called discipline . And it’s the only thing in trading that has a 100% hit rate… if you let it.

Let’s talk about why discipline isn’t just a virtue — it’s the foundation of every successful trader you admire. And why, ironically, it’s forged in the moments you want to throw your monitor out the window.

👋 Everyone’s a Genius — Until the Market Slaps You

When things are going well, discipline feels unnecessary. You enter a trade on a hunch, it flies. You skip the stop loss, and price reverses right where you “felt” it would. You’re up three trades in a row, so clearly you’ve transcended markets and deserve your own hedge fund. Right?

Until you don’t. And the one time you triple down on a loser “because it always bounces”… it doesn’t. And suddenly you're not a genius — you’re Googling how to recover a blown account and wondering if that crypto bro who offered signals still has his DMs open.

The reality is that everyone trades well in good times — bulls make money in rising markets and bears make money in falling markets. But real traders are made in the bad times. That’s where discipline is forged.

🧐 No Pain, No Gain

Here’s the deal: discipline is not something you're born with. It’s built, brick by painful brick, on the smoldering ruins of your worst trades.

The overleveraged EUR/USD short you held through an ECB rate hike? Discipline.

The meme stock you bought at the top because your barista mentioned it? Discipline.

The four back-to-back trades you entered on revenge mode after getting stopped out? Discipline — with a side of therapy.

These moments suck. But they’re also where the learning happens. You don’t develop discipline from your wins. You develop it from losses that leave a mark. The kind of mark you think about while brushing your teeth. The kind that whispers: “maybe follow the plan next time.”

🤝 Success Leaves Clues

You’ve probably heard the phrase “plan your trade and trade your plan” so many times it’s lost all meaning. But it’s the foundation of discipline. Not because rules are fun, but because rules are the only thing that can protect you from… well, yourself.

Let’s be honest — if left to your own devices, you run the risk of:

Entering too early because “it looks like it’s going to move.”

Exiting too late because “it might come back.”

Increasing the leverage because “I’m due for a win.”

Successful traders are those who follow a disciplined, rule-based approach to trading. Discipline says no. It says “this is the plan” and makes you stick to it — even when your ego is telling you to wing it. Discipline doesn’t care about your feelings. It cares about consistency. And that’s what makes it powerful.

🎯 Hedge Fund Bros Who Didn’t Win by Binge-Clicking

Let’s talk about those who actually did launch a fund — and didn’t blow it up in three months. Stanley Druckenmiller, former lead portfolio manager for George Soros’s Quantum Fund who later went on to launch his own Duquesne family office, famously said:

“The key to making money in markets is to have an opinion and to bet it big. But only when the odds are heavily in your favor.”

Notice what he didn’t say: “Click as many buttons as possible and hope it works out.”

Druckenmiller didn’t trade because he was bored. He waited. He watched. And when his setup came, he struck with discipline. Not with fear. Not with greed. With process.

If one of the greatest macro traders of all time had the patience to wait for his edge, maybe you don’t need to scalp every green candle on the 1-minute chart.

Ray Dalio — the one who built Bridgewater into a hedge fund juggernaut — doesn’t sugarcoat it: trading is hard. And mistakes are inevitable. Discipline, Dalio says, is what turns mistakes into evolution. His famous mantra?

“Pain + Reflection = Progress.”

He built a company culture (and a personal philosophy) around radical transparency — writing down every mistake, analyzing every trade, and building systems that override ego.

Most traders experience pain. Very few pause to reflect. Fewer still build processes to avoid making the same mistake twice. So next time you get stopped out for the third time in a row, don’t curse the chart. Open your journal. Write it down. Check what you missed. That’s what turns amateurs into professionals.

👀 Discipline in Trading: How It Actually Looks

Discipline isn’t glamorous. You won’t post it on Instagram (maybe it's good for LinkedIn, though). But here’s what it looks like in the wild:

Passing on a trade that doesn’t check all the boxes — even though you’re “pretty sure it’ll work.”

Taking a small win and moving on, even when your gut says to hold and “let it ride.”

Staying flat on FOMC day because you know news candles have a personal vendetta against your stop-losses.

Journaling a bad trade and owning the mistake. No excuses. Just honesty.

💪 How to Build Discipline

Building discipline isn’t about becoming a robot. It’s about creating a process that works even when your emotions don’t.

Here’s how to start:

Journal everything : Not just your trades, but your thoughts before and after. Discipline grows in awareness.

Have a checklist: Make it stupidly simple. If a trade doesn’t check every box, don’t take it.

Pre-set your risk: Before the trade. Not after. You’re not negotiating with yourself mid-trade.

Set trade limits: Three trades per day. One setup per session. Whatever keeps you from spiraling.

Take breaks: If you’re chasing losses, walk away. The markets will be there tomorrow. Will you?

📌 Final Thought: Why Discipline Works

You can have the best tools, the slickest chart setup, and the strongest trade ideas. But if you can’t follow your own rules, you won’t go far.

Discipline isn’t flashy. It doesn’t promise 1,000% returns or viral content. It just works. Quietly. Relentlessly. Predictably.

And when the market turns — because it always does — discipline is what will keep you standing.

Because it’s not the indicator that matters. It’s the trader using it.

So, be honest—where has discipline made (or broken) your trading? And what’s your best tip for sticking to the plan when your brain wants to do anything but?

Behind the Curtain: Bitcoin’s Surprising Macro Triggers1. Introduction

Bitcoin Futures (BTC), once viewed as a niche or speculative product, have now entered the macroeconomic spotlight. Traded on the CME and embraced by institutions through ETF exposure, BTC Futures reflect not only digital asset sentiment—but also evolving reactions to traditional economic forces.

While many traders still associate Bitcoin with crypto-native catalysts, machine learning reveals a different story. Today, BTC responds dynamically to macro indicators like Treasury yields, labor data, and liquidity trends.

In this article, we apply a Random Forest Regressor to historical data to uncover the top economic signals impacting Bitcoin Futures returns across daily, weekly, and monthly timeframes—some of which may surprise even seasoned macro traders.

2. Understanding Bitcoin Futures Contracts

Bitcoin Futures provide institutional-grade access to BTC price movements—with efficient clearing and capital flexibility.

o Standard BTC Futures (BTC):

Tick Size: $5 per tick = $25 per tick per contract

Initial Margin: ≈ $102,000 (subject to volatility)

o Micro Bitcoin Futures (MBT):

Contract Size: 1/50th the BTC size

Tick Size: $5 = $0.50 per tick per contract

Initial Margin: ≈ $2,000

BTC and MBT trade nearly 24 hours per day, five days a week, offering deep liquidity and expanding participation across hedge funds, asset managers, and active retail traders.

3. Daily Timeframe: Short-Term Macro Sensitivity

Bitcoin’s volatility makes it highly reactive to daily data surprises, especially those affecting liquidity and rates.

Velocity of Money (M2): This lesser-watched indicator captures how quickly money circulates. Rising velocity can signal renewed risk-taking, often leading to short-term BTC movements. A declining M2 velocity implies tightening conditions, potentially pressuring BTC as risk appetite contracts.

10-Year Treasury Yield: One of the most sensitive intraday indicators for BTC. Yield spikes make holding non-yielding assets like Bitcoin potentially less attractive. Declining yields could signal easing financial conditions, inviting capital back into crypto.

Labor Force Participation Rate: While not a headline number, sudden shifts in labor force data can affect consumer confidence and policy tone—especially if they suggest a weakening economy. Bitcoin could react positively when data implies future easing.

4. Weekly Timeframe: Labor-Driven Market Reactions

As BTC increasingly correlates with traditional markets, weekly economic data—especially related to labor—has become a mid-term directional driver.

Initial Jobless Claims: Spikes in this metric can indicate rising economic stress. BTC could react defensively to rising claims, but may rally on drops, especially when seen as signs of stability returning.

ISM Manufacturing Employment: This metric reflects hiring strength in the manufacturing sector. Slowing employment growth here could correlate with broader economic softening—something BTC traders can track as part of their risk sentiment gauge.

Continuing Jobless Claims: Tracks the persistence of unemployment. Sustained increases can shake risk markets and pull BTC lower, while ongoing declines suggest an improving outlook, which could help BTC resume upward movement.

5. Monthly Timeframe: Macro Structural Themes

Institutional positioning in Bitcoin increasingly aligns with high-impact monthly data. These indicators help shape longer-term views on liquidity, rate policy, and capital allocation:

Unemployment Rate: A rising unemployment rate could shift market expectations toward a more accommodative monetary policy. Bitcoin, often viewed as a hedge against fiat debasement and monetary easing, can benefit from this shift. In contrast, a low and steady unemployment rate may pressure BTC as it reinforces the case for higher interest rates.

10-Year Treasury Yield (again): On a monthly basis, this repeats and become a cornerstone macro theme.

Initial Jobless Claims (again): Rather than individual weekly prints, the broader trend reveals structural shifts in the labor market.

6. Style-Based Strategy Insights

Bitcoin traders often span a wide range of styles—from short-term volatility hunters to long-duration macro allocators. Aligning indicator focus by style is essential:

o Day Traders

Zero in on M2 velocity and 10-Year Yield to time intraday reversals or continuation setups.

Quick pivots in bond yields or liquidity metrics could coincide with BTC spikes.

o Swing Traders

Use Initial Jobless Claims and ISM Employment trends to track momentum for 3–10 day moves.

Weekly data may help catch directional shifts before they appear in price charts.

o Position Traders

Monitor macro structure via Unemployment Rate, 10Y Yield, and Initial Claims.

These traders align portfolios based on broader economic trends, often holding exposure through cycles.

7. Risk Management Commentary

Bitcoin Futures demand tactical risk management:

Use Micro BTC Contracts (MBT) to scale in or out of trades precisely.

Expect volatility around macro data releases—set wider stops with volatility-adjusted sizing.

Avoid over-positioning near major Fed meetings, CPI prints, or labor reports.

Unlike legacy markets, BTC can make multi-percent intraday moves. A robust risk plan isn’t optional—it’s survival.

8. Conclusion

Bitcoin has matured into a macro-responsive asset. What once moved on hype now responds to the pulse of the global economy. From M2 liquidity flows and interest rate expectations, to labor market stability, BTC Futures reflect institutional sentiment shaped by data.

BTC’s role in the modern portfolio is still evolving. But one thing is clear: macro matters. And those who understand which indicators truly move Bitcoin can trade with more confidence and precision.

Stay tuned for the next edition of the "Behind the Curtain" series as we decode the economic machinery behind another CME futures product.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Which altcoins hold the potential to conquer the crypto market?Have you ever heard of ISO 20022?

Do you know what this standard is all about?

Which tokens have adopted or are compliant with this standard?

ISO 20022 is an international standard for the exchange of financial data between financial institutions, banks, corporations, and other entities. Developed by the International Organization for Standardization (ISO), its purpose is to provide a universal language for financial messaging on a global scale.

Hello✌

Spend 3 minutes ⏰ reading this educational material. The main points are summarized in 3 clear lines at the end 📋 This will help you level up your understanding of the market 📊 and Bitcoin💰.

🎯 Analytical Insight on Bitcoin: A Personal Perspective:

Bitcoin is currently near a strong trendline and a solid daily support level. I’m expecting it to break the $90,000 mark, a key psychological level, within the next few days. My main target is at least a 7% increase, reaching $90,500.

📈

Now , let's dive into the educational section, which builds upon last week's lesson (linked in the tags of this analysis). Many of you have been eagerly waiting for this, as I have received multiple messages about it on Telegram.

🔍 What Is ISO 20022 and Why Should Traders Care?

Have you come across ISO 20022 and wondered what it really means in the world of finance and crypto? It’s not just a technical standard—it could be a major bridge between traditional finance and blockchain-based assets.

🌐 A Global Standard for Financial Messaging

ISO 20022 is an international protocol developed by the International Organization for Standardization. It defines a universal language for exchanging financial data between institutions—banks, governments, payment networks, and corporations.

💡 Key Features of ISO 20022

• Uses XML-based message formatting—both machine and human-readable

• Covers multiple financial areas: payments, securities, trade, treasury, and cards

• Highly flexible and extendable to future innovations

• Designed to reduce processing errors and boost interoperability worldwide

📈 Why It’s Becoming a Big Deal

With increasing digitization, the global financial system is shifting toward unified communication standards. Major infrastructures like SWIFT are already migrating to ISO 20022 to future-proof their operations.

🪙 The Crypto Connection

Some cryptocurrencies have been developed to align with ISO 20022 standards. This means they have the potential to integrate directly into regulated financial systems—making them more likely to be adopted by banks and governments.

✅ ISO 20022-Compliant Cryptocurrencies (As of 2024)

• XRP (Ripple)

• XLM (Stellar)

• XDC (XinFin)

• IOTA

• ALGO (Algorand)

• QNT (Quant)

• HBAR (Hedera Hashgraph)

🤝 Why Compliance Matters

If traditional finance fully adopts ISO 20022, only tokens that meet its criteria will likely be considered for official integration. This could have huge implications for utility, regulation, and long-term value.

🧠 Strategic Insight for Investors

Incorporating ISO 20022-compliant assets into your portfolio isn’t just about trends—it’s about positioning yourself for future financial system evolution. These tokens may play a key role in bridging the gap between DeFi and TradFi.

However , this analysis should be seen as a personal viewpoint, not as financial advice ⚠️. The crypto market carries high risks 📉, so always conduct your own research before making investment decisions. That being said, please take note of the disclaimer section at the bottom of each post for further details 📜✅.

🧨 Our team's main opinion is: 🧨

ISO 20022 is a global financial messaging standard designed to streamline data exchange between banks and institutions. It's becoming crucial as traditional systems like SWIFT adopt it for greater efficiency. Several cryptocurrencies, including XRP, XLM, and ALGO, are ISO 20022-compliant, positioning them for future integration with mainstream financial systems. This compliance could lead to wider adoption by banks and governments, making them more valuable long-term. 🚀

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

Smart Traders Watch the Fed — Smarter Ones Watch the DollarHello Traders 🐺

In this idea, I decided to talk about the U.S. Dollar Index (DXY) — because so many people have been asking me:

“How do you predict the Fed’s moves, and how do they affect deflationary assets like BTC?”

My last idea was about BTC, where I explained why I believe a major bull run is coming — and part of that is because the Fed might soon shift back to QE.

But if you're trying to predict QE...

The first thing you need to watch is the U.S. Dollar Index, which reflects the strength of the U.S. Dollar.

So let’s break it all down:

🔍 Part 1: What Does the Fed Actually Do?

The Fed isn’t just a printer — it’s the U.S. central bank, and it has a dual mandate:

✅ Keep prices stable (control inflation)

✅ Promote maximum employment

That means the Fed doesn’t just want growth — it wants sustainable growth. No crazy inflation, no deep recession. Balance is key.

🧰 How Does the Fed Do It?

Through Monetary Policy, which is basically the toolkit used to control liquidity, interest rates, and economic behavior (like how much people borrow, spend, or save).

Let’s break down the main tools:

1️⃣ Federal Funds Rate

This is the most powerful tool the Fed has.

It’s the rate banks use to lend to each other overnight.

If the Fed raises the rate:

→ Loans get expensive

→ Spending slows

→ Inflation drops

→ But markets can crash

If the Fed cuts the rate:

→ Loans get cheaper

→ Demand rises

→ Growth accelerates

→ But inflation can surge

2️⃣ Open Market Operations (OMO)

This is how the Fed injects or removes liquidity using bonds.

Buys bonds → Injects money → 🟩 QE (Quantitative Easing)

Sells bonds / lets them expire → Removes money → 🟥 QT (Quantitative Tightening)

3️⃣ Reserve Requirements

This used to be a big deal — the % banks had to hold in reserves.

But since 2020, it's set to 0%.

4️⃣ Discount Rate

The interest rate the Fed charges banks directly.

A change here sends a strong signal to the markets.

Sometimes the Fed also works in sync with the U.S. government — using fiscal support like:

💸 Stimulus checks

🏢 Corporate bailouts

🧾 Tax relief packages

📈 So... Why Does the Dollar Index (DXY) Matter?

There’s a very clear inverse correlation between the DXY and BTC.

When the dollar gets stronger (DXY pumps), BTC usually dumps.

Why? Because rising DXY often means:

🔺 The Fed is raising rates

🔺 Liquidity is being pulled out

🔺 QT is in play

Let me show you some real chart examples:

📉 July 2014 — DXY pumped → BTC dumped hard

DXY Chart:

BTC Chart:

➡️ Just a 28% DXY pump → 80% BTC crash. Ouch.

📈 2017 — DXY dropped → BTC entered full bull market

DXY Chart:

BTC Chart:

➡️ A 15% DXY drop → Bitcoin bull run of a lifetime.

Now here’s the good news 👇

DXY is starting to look very bearish on the chart:

Combine that with the Fed shifting to QE, and guess what?

We're likely entering the early stages of another bull market.

If you read my last BTC idea, you already know what I’m expecting...

🚀 A massive run is just around the corner.

I hope you found this idea useful, and as always —

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

Crypto Risk Management: The Most Overlooked EdgeIn the thrilling yet unforgiving world of crypto, profit potential is massive—but so is the risk. Every trader or investor enters the space with dreams of 10x gains, but without a solid risk management strategy, many exit just as fast—with a trail of losses.

Risk management is the art of protecting your capital while giving yourself the best shot at long-term profitability. It’s not just a skill; it’s a survival strategy.

What Are the Risks in Crypto?

Crypto markets are unique—24/7, global, and driven by emotion, hype, and tech disruption. With that come several risk categories:

Market Risk – Volatile price swings can wipe out unprepared traders.

Liquidity Risk – Low-volume coins can be hard to exit during dumps.

Regulatory Risk – Government crackdowns or bans (e.g., Binance or XRP cases).

Security Risk – Hacks, rug pulls, phishing scams, and smart contract bugs.

Operational Risk – Mistakes like sending funds to the wrong address or using faulty bots.

These risks aren’t just theoretical—think of the LUNA/UST collapse or the FTX debacle. Billions were lost due to poor risk management at multiple levels.

🧠 Core Principles of Risk Management

To stay in the game long-term, you need to adopt some fundamental principles:

Preserve capital first, profit later.

Risk small, aim big.

Never risk more than you can afford to lose.

Think in probabilities, not certainties.

Be consistent, not lucky.

Even the best traders lose—but they survive because they manage their downside better than the rest.

🛠️ Tools & Techniques That Can Save Your Portfolio

1. ✅ Position Sizing

Don’t bet your whole stack on one trade. A common approach is to risk 1–2% of your portfolio per trade. That way, even a streak of bad trades won’t destroy your capital.

2. 🛑 Stop-Loss & Take-Profit

Always have predefined stop-loss levels to cut losses, and take-profit targets to lock in gains. Trading without a stop-loss is like driving without brakes.

3. 📊 Diversification

Spread your investments across different sectors (DeFi, AI, Layer 1s, etc.). Don’t rely on one narrative or one coin.

4. ⚖️ Leverage Control

Leverage can amplify gains—and losses. Avoid high leverage unless you’re an experienced trader with a tight plan.

5. 🔁 Portfolio Rebalancing

Adjust your allocations periodically. If one asset balloons in value, rebalance to lock in gains and manage exposure.

6. 💵 Using Stablecoins

Stablecoins like USDT, USDC, or DAI are great for hedging during volatility. Park profits or prepare dry powder for dips.

🧠 Psychological Risk: The Silent Killer

Many traders don’t lose due to bad analysis—they lose to emotions.

FOMO leads to buying tops.

Fear leads to panic selling bottoms.

Revenge trading after losses leads to bigger losses.

Greed blinds you from taking profits.

The key is discipline. Create a plan, follow it, and review your mistakes objectively.

🚫 Common Mistakes to Avoid

Going all-in on one trade or coin

Holding through massive drawdowns hoping for a recovery

Ignoring stop-losses

Overleveraging small positions to “win it all back”

Risk management is about avoiding unnecessary pain, not killing your gains.

🧭 Final Thoughts

The best traders in crypto aren't those who win big once—they're the ones who survive long enough to win over and over. Risk management is your edge in a market that respects no one.

Whether you’re a scalper, swing trader, or long-term HODLer, never forget: capital is your lifeline. Guard it with your strategy, protect it with your plan, and grow it with patience.

✍️ By Green Crypto

Empowering traders with analysis, tools, and education. Stay sharp. Stay profitable.

Supply and Demand by Thapelo Consolidation and Expansion

The markets either do one of two things: Price either consolidates or expands.

Consolidation: a period in the market where price is moving calm which moves in a range known as the dealing range. We will be able to identify a clear high and low to this range.

You have probably heard of the term range bound, ranging, or consolidating. This means that price is typically staying in one area, and just moving sideways, rather than up or down.

The range can be tight (meaning a spread of only a few pounds), or the range can be loose (meaning a spread of hundreds of thousands of pounds from range high to low. This partly will come down to the timeframe implemented.

Expansion: a period in the market where price is moving aggressively in one direction or the other. We will see an impulsive move to the upside, or an impulsive move to the downside, where price will give us large candle bodies or wicks. This is known as expansion.

How to Apply Modern Portfolio Theory (MPT) to Trading?How to Apply Modern Portfolio Theory (MPT) to Trading?

Harry Markowitz’s Modern Portfolio Theory revolutionised investing by providing a structured way to balance potential risk and returns. By focusing on diversification and understanding how assets interact, MPT helps traders and investors build efficient portfolios tailored to their goals. This article explores “What is MPT,” the core principles of MPT, its practical applications, and its limitations, offering insights into why it remains a foundational concept in modern finance.

What Is Modern Portfolio Theory?

Modern Portfolio Theory (MPT) is a financial framework designed to help investors build a portfolio that balances potential risk and returns in the most efficient way possible. Introduced by economist Harry Markowitz in 1952, MPT is grounded in the idea that diversification—spreading investments across different assets—can reduce overall risk without necessarily sacrificing returns.

At its core, MPT focuses on how assets within a portfolio interact with each other, not just their individual performance. Each asset has two key attributes: expected return, which represents the potential gains based on historical performance, and risk, often measured as the volatility of those returns.

The theory emphasises that it’s not enough to look at assets in isolation. Instead, their relationships—measured by correlation—are critical. For instance, combining assets that move in opposite directions during market shifts can stabilise overall portfolio performance.

A central concept of Markowitz’s model is the efficient frontier. This is a graphical representation of portfolios that deliver the highest possible return for a given level of risk. Portfolios below the efficient frontier are considered suboptimal, as they expose investors to unnecessary risk without sufficient returns.

MPT also categorises risk into two types: systematic risk, which affects the entire market (like economic recessions), and unsystematic risk, which is specific to an individual company or sector. Diversification can only address unsystematic risk, making asset selection a key part of portfolio construction.

To illustrate, imagine a portfolio that mixes equities, bonds, and commodities. Equities may offer high potential returns but come with volatility. Bonds and commodities, often less correlated with stocks, can act as stabilisers, potentially reducing overall risk while maintaining growth potential.

The Core Principles of MPT

Markowitz’s Portfolio Theory is built on a few foundational principles that guide how investors can construct portfolios to balance potential risk and returns.

1. Diversification Reduces Risk

Diversification is the cornerstone of MPT. By spreading investments across different asset classes, industries, and geographic regions, traders can reduce unsystematic risk. For example, holding shares in both a tech company and an energy firm limits the impact of a downturn in either industry. The idea is simple: assets that behave differently in various market conditions create a portfolio that’s less volatile overall.

2. The Risk-Return Trade-Off

Investors face a constant balancing act between potential risk and returns. Higher potential returns often come with higher risk, while so-called safer investments tend to deliver lower potential returns. MPT quantifies this relationship, allowing investors to choose a risk level they’re comfortable with while maximising their potential returns. For instance, a trader with a low risk tolerance might lean towards a portfolio with bonds and dividend-paying stocks, whereas someone with a higher tolerance may include more volatile emerging market equities.

3. Correlation Matters

One of MPT’s key insights is that not all assets move in the same direction at the same time. The correlation between assets is crucial. Low or negative correlation—where one asset tends to rise as the other falls—helps stabilise portfolios. For example, government bonds often perform well when stock markets drop, making them a popular addition to equity-heavy portfolios.

How the MPT Works in Practice

Modern Portfolio Theory takes theoretical concepts and applies them to real-world investment decisions, helping traders and investors design portfolios that align with their goals and risk tolerance. Here’s how it works step by step.

The Efficient Frontier in Action

The efficient frontier is a visual representation of optimal portfolios. Imagine plotting potential portfolios on a graph, with risk on the x-axis and expected return on the y-axis. Portfolios on the efficient frontier offer the highest possible return for each level of risk. For example, if two portfolios have the same level of risk but one offers higher returns, MPT identifies it as the better choice. Investors aim to build portfolios that lie on or near this frontier.

Portfolio Optimisation

The goal of Markowitz’s portfolio optimisation is to combine assets in a way that balances potential risk and returns. This involves analysing the expected returns, standard deviations (volatility), and correlations of potential investments. For instance, a mix of stocks, government bonds, and commodities might be optimised to maximise possible returns while minimising overall portfolio volatility. Technology, like portfolio management software, often assists in running complex Modern Portfolio Theory formulas, like expected portfolio returns, portfolio variance, and risk-adjusted returns.

Risk-Adjusted Metrics

Investors also evaluate portfolios using metrics like the Sharpe ratio, which measures returns relative to risk. A higher Sharpe ratio typically indicates a more efficient portfolio. For example, a portfolio with diverse holdings might deliver similar returns to one concentrated in equities but with less volatility.

Adaptability to Changing Markets

While the theory relies on historical data, Markowitz’s Portfolio Theory is adaptable. Investors frequently rebalance their portfolios, adjusting asset allocations as markets shift. For example, if equities outperform and dominate the portfolio, a trader may sell some and reinvest in bonds to maintain the desired risk level.

Limitations and Criticisms of MPT

Modern Portfolio Theory has reshaped how we think about investing, but it’s not without its flaws. While it offers a structured framework for balancing possible risk and returns, its assumptions and practical limitations can present challenges.

Assumption of Rational Behaviour

MPT assumes that investors always act rationally, basing decisions on logic and complete information. In reality, emotions, biases, and unpredictable behaviour play significant roles in markets. For example, during a financial crisis, fear can lead to widespread selling, regardless of an asset’s theoretical value.

Ignoring Tail Risks

The model underestimates the impact of extreme, rare events, known as tail risks. These events, including economic collapses or geopolitical crises, can significantly disrupt even well-diversified portfolios.

Dependence on Historical Data

The theory relies on historical data to estimate risk, returns, and correlations. However, past performance doesn’t always reflect future outcomes. During major market disruptions, correlations between assets—normally stable—can spike, reducing the effectiveness of diversification. For instance, in the 2008 financial crisis, many traditionally uncorrelated assets fell simultaneously.

Simplified Risk Measures

MPT equates risk with volatility, which doesn’t always capture the full picture. Sharp price swings don’t necessarily mean an asset is risky, and relatively stable prices don’t guarantee reliability. This narrow definition can lead to overlooking other important factors, like liquidity or credit risk.

How Investors and Traders Use MPT Today

Modern Portfolio Theory remains a cornerstone of investment strategy, and its principles are widely applied in portfolio construction, asset allocation, and diversification.

Portfolio Construction and Asset Allocation

Central to Modern Portfolio Theory is asset allocation: determining the optimal mix of assets based on an investor’s risk tolerance and goals. A classic example is the 60/40 portfolio, which allocates 60% to equities for growth and 40% to bonds for so-called stability. This balance aims to provide steady possible returns with reduced volatility over time.

Another well-known approach is Ray Dalio’s All-Weather Portfolio, designed to perform across various economic conditions. It includes:

- 30% stocks

- 40% long-term bonds

- 15% intermediate bonds

- 7.5% gold

- 7.5% commodities

This portfolio reflects MPT's emphasis on diversification and risk management, spreading investments across asset classes that respond differently to market shifts.

Alternative Investments and Diversification

MPT has evolved to include alternative investments like real estate, private equity, crypto*, hedge funds, and even carbon credits. These assets often have lower correlations with traditional markets, enhancing diversification. For example, real estate might perform well during inflationary periods, offsetting potential declines in equities.

Investors also consider geographic diversification, combining domestic and international assets to balance regional risks.

Implications for Traders

While MPT is often associated with long-term investing, its principles can inform trading strategies. For instance, traders might diversify their positions across uncorrelated markets, such as equities and commodities, to reduce overall portfolio volatility. Dynamic position sizing—adjusting exposure based on market conditions—also aligns with MPT’s risk-return framework.

The Bottom Line

The Modern Portfolio Theory offers valuable insights into balancing possible risk and returns, helping traders and investors create diversified, resilient portfolios. While it has its limitations, MPT’s principles remain widely used in portfolio construction and trading strategies.

FAQ

What Is the Modern Portfolio Theory?

The Modern Portfolio Theory (MPT) is a framework that helps investors construct portfolios to balance possible risk and returns. It emphasises diversification, using statistical analysis to combine assets with varying risk and return profiles to reduce volatility and optimise potential income.

What Are the Two Key Ideas of Modern Portfolio Theory?

MPT focuses on two main concepts: diversification and the risk-return trade-off. Diversification spreads investments across assets to potentially reduce risk, while the risk-return trade-off seeks to maximise possible returns for a given level of risk.

What Are the Most Important Factors in Modern Portfolio Theory?

Key factors include expected returns, risk (measured by volatility), and correlation between assets. These elements determine how assets interact within a portfolio, enabling investors to build an efficient mix that aligns with their risk tolerance and goals.

What Are the Disadvantages of Modern Portfolio Theory?

MPT assumes rational behaviour and relies on historical data, which does not predict future market behaviour. It also underestimates extreme events and simplifies risk by equating it solely with volatility.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bitcoin, Gold, S&P 500 and InflationBitcoin, Gold, S&P 500 and Inflation

This is a 3 year view (2022 - 2025 to date), 1 week comparison chart of Bitcoin, Gold, S&P 500 and US cumulative rate of inflation. The most interesting part of this analysis to me is that the S&P 500 bounced off the cumulative rate of inflation slope. I did not know that until after I set up the comparison.

Gold = +80%

BTCUSD = +50%

S&P 500 = +19%

US cumulative rate of inflation:

2022 = +6.5%

2023 = +3.4%

2024 = +2.9%

3 yr = +10.8%

2025 = +2.4% forecast

The Charts Wall Street Watches – And Why Crypto Should Too📉 Crisis or Rotation? Understanding Bonds Before the Bitcoin Reveal 🔍

Hi everyone 👋

Before we dive into the next major Bitcoin post (the 'Bitcoin Reveal' is coming up, yes!), let's take a moment to unpack something critical most crypto traders overlook — the world of bonds .

Why does this matter? Because the bond market often signals risk... before crypto even reacts.

We're going to walk through 4 charts I've posted recently — not the usual BTC or altcoin setups, but key pieces of the credit puzzle . So here’s a simple breakdown:

1️⃣ BKLN – Leveraged Loans = Floating Risk 🟠

These are loans to risky companies with floating interest rates.

When rates go up and liquidity is flowing, these do well.

But when the economy weakens? They’re often the first to fall.

📌 Key level: $20.31

This level held in COVID (2020), the 2022 bank scare... and now again in 2025.

⚠️ Watch for a breakdown here = real credit stress.

Right now? Concerned, but no panic.

2️⃣ HYG – Junk Bonds = Risk Appetite Tracker 🔴

Junk bonds are fixed-rate debt from companies with poor credit.

They pay high interest — if they survive.

When HYG bounces, it means investors still want risk.

📌 Fear line: 75.72

Held in 2008, 2020 (COVID), and again now.

Price rebounded — suggesting risk appetite is trying to return .

3️⃣ LQD – Investment Grade = Quality Credit 💼

LQD holds bonds from blue-chip companies like Apple, Microsoft, Johnson & Johnson.

These are lower-risk and seen as safer during stress.

📊 Chart still shows an ascending structure since 2003, with recent pressure on support.

📌 Support: 103.81

Holding well. Rebound looks solid.

Unless we break 100, this says: "No panic here."

4️⃣ TLT – U.S. Treasuries = Trust in the Government 🇺🇸

This is the BIG one.

TLT = Long-term U.S. bonds (20+ yrs) = safe haven assets .

But since 2022, that trust has been visibly broken .

A key trendline going back to 2004 was lost — and is now resistance.

📉 Price is in a clear descending channel .

📌 My expectation: One final flush to $76 or even $71–68

…before a potential macro reversal toward $112–115

🔍 The Big Picture – What Are Bonds Telling Us?

| Chart | Risk Level | Signal |

|--------|------------|--------|

| BKLN | High | Credit stress rising, but support holding |

| HYG | High | Risk appetite bouncing at a key level |

| LQD | Medium | Rotation into quality, no panic |

| TLT | Low | Trust in Treasuries fading, support being tested |

If BKLN breaks $20...

If HYG fails to hold 75.72...

If LQD dips under 100...

If TLT falls to all-time lows...

That’s your crisis signal .

Until then — the system is still rotating, not collapsing.

So, Should We Panic? 🧠

Not yet.

But we’re watching closely.

Next: We add Bitcoin to the chart.

Because if the traditional system starts breaking... 🟧 Bitcoin is the alternative.

One Love,

The FXPROFESSOR 💙

📌 Next Post:

BTC vs Treasuries – The Inversion Nobody Saw Coming

Because if the system is shaking… Bitcoin is Plan B.

Stay ready.

The Art of Doing Nothing: Why Tape Watchers Beat Impulse TradersLess is more. In this Idea we dig into the trading philosophy where less action means more traction. It’s the dispute between the chart readers and the button clickers.

Some swear by this: the smartest trading strategy sometimes involves sitting on your hands and embracing the sweet, underrated beauty of doing absolutely nothing. The Italians figured this out ages ago—they call it Dolce Far Niente , the sweetness of doing nothing.

But can a trader really get away with just kicking back and waiting while sipping espresso (or the mezcal martini type if you got your Patagonia vest)? Actually, yes—and it often pays better than impulsive clicks.

Let’s talk about why chart-watching and tape-reading often outsmart trigger-happy trading.

🤷♂️ Doing Nothing Is Harder Than It Looks

First off, let’s acknowledge something painfully true: not trading is tough. Seriously tough. Trading never sleeps, notifications flash at you like slot machines. Headlines constantly scream about massive opportunities you're missing — Tesla's NASDAQ:TSLA latest rally or gold’s OANDA:XAUUSD record-breaking surge powered by tariff jitters.

The pressure to click, buy, sell, or do something—anything!—can be overwhelming. It’s why there’s something called a heatmap — because it’s hot, hot, hot!

But here’s the secret: successful traders know that impulse trading isn't a strategy; it's just financial caffeine. Instead, chart watchers—the cool-headed crowd who sit back, patiently observing price movements, market structure, and volume flow—tend to win the marathon, while impulse traders burn out in the sprint.

🌸 The Dolce Far Niente Method

Ever watched an old Italian movie? There's usually a scene featuring someone lounging effortlessly, soaking in life’s beauty without lifting a finger—this is Dolce Far Niente.

In trading terms, it’s the act of patiently waiting, savoring the calm between trades, watching your charts like an old-school tape reader that would make Jesse Livermore proud. (“A prudent speculator never argues with the tape. Markets are never wrong, opinions often are.”)

A good setup is worth the wait. Instead of diving into trades, relax, observe, and let opportunities come to you. Because the reality is, not every candlestick needs your immediate response. Markets don’t reward hyperactivity; they reward patience and calculated action.

🤩 Tape Reading vs. Trading: The Difference Between Winning and Clicking

The lost art of tape reading, as hedge fund guru Paul Tudor Jones calls it, is about carefully tracking price action, volume, and market sentiment. It’s far less exciting than rapid-fire day trading but potentially more rewarding.

“When it comes to trading macro,” Tudor Jones says, “you cannot rely solely on fundamentals; you have to be a tape reader, which is something of a lost art form.

Learning when to sit quietly (doing nothing) and when to strike decisively is the hallmark of trading mastery.

✋ Real Traders Don’t Chase—They Anticipate

Waiting isn’t passive. It’s actually active restraint—a calculated choice to do nothing until the odds tip decidedly in your favor. Let’s be clear: chart watchers aren’t asleep at the wheel; they're carefully steering clear of trouble until clear setups emerge.

The result? Better entry points, clearer risk-reward ratios, and fewer sleepless nights worrying about impulsive mistakes.

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!,’ ignore them.” Bonus points if you know who said that!

So, next time your finger hovers over that "buy" or "sell" button, ask yourself if you’re trading strategically or just for the dopamine hit. Remember the Italian saying, take a breath, embrace the tranquility, and let patience become your trading superpower.

Let us know in the comments: Are you team “click less, wait more,” or do you find yourself riding the impulse wave fairly frequently?

The End of Meme Coin Scams: A New UpdateWith the latest update, we are witnessing a shift in how meme coins operate in the crypto world, effectively putting an end to scams that have plagued the meme coin space.

Hello✌

Spend 3 minutes ⏰ reading this educational material. The main points are summarized in 3 clear lines at the end 📋 This will help you level up your understanding of the market 📊 and Bitcoin💰.

🎯 Analytical Insight on Bitcoin: A Personal Perspective:

Bitcoin is currently near a strong trendline and a solid daily support level. I’m expecting it to break the $90,000 mark, a key psychological level, within the next few days. My main target is at least a 7% increase, reaching $90,500.

📈

Now , let's dive into the educational section, which builds upon last week's lesson (linked in the tags of this analysis). Many of you have been eagerly waiting for this, as I have received multiple messages about it on Telegram.

A Recap of Meme Coin Creation and Scams

In a previous educational analysis, I walked you through the step-by-step process of how meme coins are created and, most importantly, how scammers often exploit these coins for personal gain. I explained the mechanics behind the manipulation of meme coins, where bad actors would create a coin, pump its price, and then abandon it once they made a profit, leaving countless investors in financial ruin.

The Hidden Aspect: How Creators Profited from Commissions

However, there was one critical aspect I did not discuss—how meme coin creators were profiting through transaction fees, also known as commissions. Prior to this update, many small-scale creators were incentivized to sell portions of their holdings at high prices, ensuring they made a profit, often at the cost of the coin's long-term stability. This led to price crashes, the collapse of the coin's market, and devastating losses for thousands of investors. 🚨

The Previous Model: 2 important platform one for creating the mem coin and second for transactions and fees

Under the previous system, meme coins were typically launched on platforms like P p .F n, which helped boost the coin’s liquidity through in-app promotions and social media outreach. This initial momentum would attract many investors, and then the coin would be listed on various exchanges for wider visibility.

To ensure that creators could continue to profit, the transactions would eventually shift to a new platform, which took all of the transaction fees, further enriching the platform but leaving creators with limited sustainable profits.

The New Update: Introducing new version for enring fees directly

With the latest update, the creator introduces a revolutionary feature. This addition fundamentally changes how meme coin creators can profit. Instead of relying on external platforms that take all the transaction fees, allows creators to receive a significant percentage of trading fees directly. This ensures that creators who are genuinely committed to the long-term success of their coin can continue to benefit from it without destroying the project once the coin gains traction.

A Sustainable Future for Meme Coins

This update paves the way for a new era where meme coins are not just tools for short-term profit but are sustainable and beneficial in the long run for both creators and investors. Creators who have the genuine intention to build and maintain their projects will now have the opportunity to continuously profit from them as the coin grows stronger and attracts more users. 🌱

Why This Matters for Investors

For investors, this is a game-changer. As meme coins become more reliable and profitable for creators, they also become safer and more promising for long-term investment. The more successful these meme coins become, the more lucrative it will be for investors in both the short and long term. 📈

By fostering a system that rewards creators based on the coin's success and longevity, this update helps eliminate the risk of sudden crashes. As a result, meme coins have the potential to evolve into solid, dependable projects rather than speculative assets that leave many in financial distress.

However , this analysis should be seen as a personal viewpoint, not as financial advice ⚠️. The crypto market carries high risks 📉, so always conduct your own research before making investment decisions. That being said, please take note of the disclaimer section at the bottom of each post for further details 📜✅.

🧨 Our team's main opinion is: 🧨

With the latest update, meme coin scams are effectively ending. creator website of meme coin now introduces new direct update for fees, which allows creators to earn a fair share of trading fees, ensuring they benefit long-term without abandoning the project. This makes meme coins more sustainable, rewarding both creators and investors. It’s a major shift towards stability and profitability in the meme coin space. 🚀

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

QE vs QT: The Invisible Force Behind Every Pump and Dump !Hello Traders 🐺

In this idea, I want to talk about macroeconomics and how QE and QT actually impact the economy and financial markets — and more importantly, how both pro traders and even non-professionals can benefit from understanding these basic concepts in their trading journey and even their everyday life.

So make sure to stick with me until the very end, because if you still don't know about these key metrics, this is going to be extremely helpful — and I promise I’ll keep it simple.

🔄 First... What Are QE and QT Anyway?

It’s simple:

QE (Quantitative Easing) = Pumping money into the system 💸

QT (Quantitative Tightening) = Sucking money out of the system 💀

That’s it.

The Fed either injects liquidity — or pulls it back.

And that liquidity is the real fuel of the market —

Not your RSI, not your fib levels, not your favorite influencer's altcoin pick.

🟩 What Is QE?

When the Fed wants to support the economy (like during a crash or recession), it prints money and buys government bonds, mortgage-backed securities, and more.

This increases liquidity → makes borrowing easier → and drives people toward risky assets like stocks and crypto.

✅ Benefits of QE:

Boosts markets (stocks, crypto, real estate — all of it)

Supports employment and economic growth

Weakens the dollar → makes exports stronger

❌ Downsides of QE:

Can lead to inflation or even hyperinflation if overused

Creates asset bubbles (aka pumps with no real fundamentals)

Weakens long-term purchasing power

In short:

QE = Bullish AF for markets — but dangerous if left unchecked.

🟥 What Is QT?

QT is the opposite.

When the economy overheats or inflation gets out of control, the Fed stops printing — and even starts removing liquidity from the system.

They let bonds expire or sell them off, reducing the amount of money circulating.

✅ Benefits of QT:

Helps bring inflation down

Cools off overheated markets

Restores balance after aggressive QE periods

❌ Downsides of QT:

Slows down the economy

Crashes risk assets (like BTC, tech stocks, etc.)

Can trigger a recession if done too fast or too long

QT = Bearish pressure for almost every chart you trade.

💡 Now that you understand QT and QE, let's talk about how we can use this in our trading.

To help you visualize it better, I’ve marked the QT and QE periods on the chart.

And as you’ll see, there’s a perfect correlation between Fed policy decisions and the BTC chart.

It almost looks like their policies decide exactly where and even when the tops and bottoms happen!

Let me explain it step by step — because while it might sound complicated, it’s actually very easy to understand:

📉 Example: The QT Period from 2017 to 2019

From October 2017 to September 2019, the Fed was in full QT mode — and we had three major phases in the market.

Phase 1:

When the Fed first announced QT, BTC was around a red monthly resistance line after a huge parabolic run-up.

Right after the announcement, BTC entered a sharp correction — all the way down to the monthly support.

(Shown with a red ellipse on the chart)

Phase 2:

BTC started to prepare for its next move — it accumulated below a bullish structure and slowly positioned itself for the next wave.

📉📈 Phase 3: The Big Corona Dump + QE Restart

Then came the third and most important phase of QT in the BTC chart:

The COVID crash — a sudden, brutal dump across all markets.

Sound familiar? Yeh, same pattern…

Immediately after the crash, the Fed announced QE and started pumping liquidity again → and we saw that huge parabolic run everyone remembers.

🔁 Now Here’s the Plot Twist... We’re Repeating the Same Pattern

Let’s break it down:

A huge crash after QT announcement (phase 1)

Market accumulation below a bullish structure (phase 2)

One final shakeout — just like the COVID dump — which I personally call Black Monday 2025 👀

And now… the Fed has hinted that they're ready to step in to stabilize the markets if needed ( phase three )

Guess what? Another round of QE could be coming...

In this idea, I tried to explain how QE and QT work — and show you the hidden forces behind every bull and bear cycle.

If you enjoyed this, make sure to follow and stay tuned for more.

And as always, never forget our rule:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

Fear and Greed: How Extreme Emotions Can Wreck Your TradesThere’s an old saying on Wall Street: Markets are driven by just two emotions — fear and greed. It’s been quoted so many times it’s practically cliché, but like most clichés, it’s got a thick slice of truth baked in.

Fear makes you sell the bottom. Greed makes you buy the top. Together, they’re the dysfunctional couple that wrecks your portfolio, sets your confidence on fire, and leaves you staring at your trading screen, wallowing in disappointment.

But here’s the good news: you’re not alone. Everyone — from the newbie scalper with a $500 account to the fund manager with a Bloomberg terminal and a caffeine drip — fights these exact same emotional demons.

Let’s break down how fear and greed mess with your trades, and more importantly, what to do about it.

The Greed Trap: From Champagne Dreams to Margin Calls

Add some more to this one… this one’s going to the moon . Suddenly, you’re maxing out leverage on a hot altcoin because your cousin’s barber said it's “the next Solana.”

This is how traders end up buying tops. Not because they lack information — we’ve got more charts, market data , and indicators than ever before — but because they chase the feeling. The high. The fantasy of catching a once-in-a-lifetime move. Safe to say that’s not investing, that’s fantasy trading.

Greed doesn’t show up in your P&L right away. At first, it may reward you. You get a few wins. Maybe you double your account in a week. You start browsing the million-dollar houses. You post a couple of wins on X. You’re unstoppable… until you’re not.

Then comes the inevitable slap. The market reverses. You didn’t take profits because “it’s just a pullback.” Your unrealized gains evaporate. You panic. You sell the bottom. And just like that, you’re back where you started — only now with a bruised ego and fewer chips on the table.

The Fear Spiral: Paralysis, Panic, and the Art of Missing Every Rally

Fear doesn’t need a market crash to show up. Sometimes all it takes is a bad night’s sleep and a red candle.

Fear tells you to cut winners early — just in case. Fear reminds you of every losing trade you’ve ever taken, every blown stop loss, every time you told yourself, “I knew I should’ve stayed out.”

It’s what makes you exit a long position at break-even, only to watch it rip 20% after you’re out. It’s what keeps you on the sidelines during the best days of the year. It’s what turns potential gains into chronic hesitation.

And the worst part? Fear disguises itself as “discipline.” You think you’re being cautious, but you’re really just self-sabotaging under the banner of risk management. Yes, there's a difference between being prudent and being petrified. One saves your capital. The other strangles it.

The Greed-Fear Cycle: The Emotional Roundabout That Never Ends

Here’s how the emotional hamster wheel usually goes:

You start with greed. You chase something because it looks like easy money.

You get smacked by the market. Now you’re afraid.

You hesitate. You miss the recovery.

You get FOMO. You jump back in… late.

The cycle repeats. Only now your account is lighter, and your confidence is shot.

Wash. Rinse. Regret. Repeat.

This cycle is what turns many promising traders into burnt-out bagholders. It’s not a lack of intelligence or strategy — it’s the inability to manage emotions in a game where emotions are everything.

The Emotional Gym

You can’t eliminate fear and greed — they’re wired into our monkey brain. But you can train your emotional responses the same way you train a muscle.

How? Structure, repetition, and brutal honesty.

Start with a trading journal . Not a Dear Diary, but a cold, clinical log of what you did and why. Include your emotional state. Were you excited? Anxious? Overconfident? Bored? (Yes, boredom is a silent killer. It’s how people end up revenge trading gold futures at 2AM.)

Review it weekly. Look for patterns. Did you always overtrade after three green trades in a row? Did your losses happen when you broke your own rules? Bingo. Now you have something to fix.

The Rules Are the Ritual