What Is an Inverse Fair Value Gap (IFVG) Concept in Trading?What Is an Inverse Fair Value Gap (IFVG) Concept in Trading?

Inverse Fair Value Gaps (IFVGs) are a fascinating concept for traders seeking to refine their understanding of price behaviour. By identifying areas where market sentiment shifts, IFVGs provide unique insights into potential reversals and key price levels. In this article, we’ll explore what IFVGs are, how they differ from Fair Value Gaps, and how traders can integrate them into their strategies for more comprehensive market analysis.

What Is a Fair Value Gap (FVG)?

A Fair Value Gap (FVG) occurs when the market moves so rapidly in one direction that it leaves an imbalance in price action. This imbalance shows up on a chart as a gap between three consecutive candles: the wick of the first candle and the wick of the third candle fail to overlap, leaving a “gap” created by the second candle. It essentially highlights an area where buying or selling pressure was so dominant that the market didn’t trade efficiently.

Traders view these gaps as areas of potential interest because markets often revisit these levels to "fill" the imbalance. For example, in a bullish FVG, the gap reflects aggressive buying that outpaced selling, potentially creating a future support zone. On the other hand, bearish FVGs indicate overwhelming selling pressure, which might act as resistance later.

FVGs are closely tied to the concept of fair value. The gap suggests the market may have deviated from a balanced state, making it an area traders watch for signs of price rebalancing. Recognising and understanding these gaps can provide insights into where the price might gravitate in the future, helping traders assess key zones of interest for analysis.

Understanding Inverse Fair Value Gaps (IFVGs)

An Inverse Fair Value Gap (IFVG), or Inversion Fair Value Gap, is an Inner Circle Trader (ICT) concept that builds on the idea of an FVG. While an FVG represents a price imbalance caused by strong directional movement, an IFVG emerges when an existing FVG is invalidated. This invalidation shifts the role of the gap, turning a bearish FVG into a bullish IFVG, or vice versa.

Here’s how it works: a bearish FVG, for instance, forms when selling pressure dominates, leaving a gap that might act as resistance. However, if the market breaks through this gap—either with a wick or a candle close—it signals that the sellers in that zone have been overwhelmed. The bearish FVG is now invalidated and becomes a bullish IFVG, marking a potential area of support instead. The same applies in reverse for bullish FVGs becoming bearish IFVGs.

Traders use inverted Fair Value Gaps to identify zones where market sentiment has shifted significantly. For example, when the price revisits a bullish IFVG, it may serve as a zone of interest for traders analysing potential buying opportunities. However, if the price moves past the bottom of the IFVG zone, it’s no longer valid and is typically disregarded.

What makes these reverse FVGs particularly useful is their ability to highlight moments of structural change in the market. They can act as indicators of strength, revealing areas where price has transitioned from weakness to strength (or vice versa). By integrating IFVG analysis into their broader trading framework, traders can gain deeper insights into the evolving dynamics of supply and demand.

Want to test your IFVG identification skills? Get started on FXOpen and TradingView.

How Traders Use IFVGs in Trading

By integrating IFVGs into their strategy, traders can refine their decision-making process and uncover potential setups aligned with their broader market outlook. Here’s how IFVGs are commonly used:

Identifying Key Zones of Interest

Traders begin by spotting FVGs on price charts—areas where rapid movements create imbalances. An inversion FVG forms when such a gap is invalidated; for instance, a bearish FVG becomes bullish if the price breaks above it. These zones are then marked as potential areas of interest, indicating where the market may experience significant activity.

Contextualising Market Sentiment

The formation of an IFVG signals a shift in market sentiment. When a bearish FVG is invalidated and turns into a bullish IFVG, it suggests that selling pressure has diminished and buying interest is gaining momentum. Traders interpret this as a potential reversal point, providing context for the current market dynamics.

Analysing Price Reactions

Once an IFVG is identified, traders monitor how the price interacts with this zone. If the price revisits a bullish IFVG and shows signs of support—such as slowing down its decline or forming bullish candlestick patterns—it may indicate a strengthening upward movement. Conversely, if the price breaches the IFVG without hesitation, the anticipated reversal might not materialise.

How Can You Trade IFVGs?

IFVGs provide traders with a structured way to identify and analyse price levels where sentiment has shifted. The process typically looks like this:

1. Establishing Market Bias

Traders typically start by analysing the broader market direction. This often involves looking at higher timeframes, such as the daily or 4-hour charts, to identify trends or reversals. Tools like Breaks of Structure (BOS) or Changes of Character (CHoCH) within the ICT framework help clarify whether the market is leaning bullish or bearish.

Indicators, such as moving averages or momentum oscillators, can also provide additional context for confirming directional bias. A strong bias ensures the trader is aligning setups with the dominant market flow.

2. Identifying and Using IFVGs

Once a Fair Value Gap (FVG) is invalidated—indicating a significant shift in sentiment—it transforms into an Inverse Fair Value Gap (IFVG). Traders mark the IFVG zone as a key area of interest. If it aligns with their broader market bias, this zone can serve as a potential entry point. For instance, in a bearish bias, traders may focus on bearish IFVGs that act as potential resistance zones.

3. Placing Orders and Risk Management

Traders often set a limit order at the IFVG boundary, anticipating a retracement and for the area to hold. A stop loss is typically placed just beyond the IFVG or a nearby swing high/low to manage risk. For exits, targets might include a predefined risk/reward ratio, such as 1:3, or a significant technical level like an order block or support/resistance area. This approach ensures trades remain structured and grounded in analysis.

Advantages and Disadvantages of IFVGs

IFVGs offer traders a unique lens through which to analyse price movements, but like any tool, they come with both strengths and limitations. Understanding these can help traders incorporate IFVGs into their strategies.

Advantages

- Highlight market sentiment shifts: IFVGs pinpoint areas where sentiment has reversed, helping traders identify key turning points.

- Refined entry zones: They provide precise areas for potential analysis, reducing guesswork and offering clear levels to watch.

- Flexibility across markets: IFVGs can be applied to any market, including forex, commodities, or indices, making them versatile.

- Complementary to other tools: They pair well with other ICT tools like BOS, CHoCH, and order blocks for enhanced analysis.

Disadvantages

- Subject to interpretation: Identifying and confirming IFVGs can vary between traders, leading to inconsistencies.

- Limited standalone reliability: IFVGs need to be used alongside broader market analysis; relying solely on them increases risk.

- Higher timeframe dependence: Their effectiveness can diminish on lower timeframes, where noise often obscures true sentiment shifts.

- Potential for invalidation: While IFVGs signal potential opportunities, they aren’t guarantees; price can break through, rendering them ineffective.

The Bottom Line

Inverse Fair Value Gaps provide traders with a structured approach to identifying market shifts and analysing key price levels. By integrating IFVGs into a broader strategy, traders can uncover valuable insights and potentially refine their decision-making. Ready to apply IFVG trading in real markets? Open an FXOpen account today and explore potential trading opportunities across more than 700 markets, alongside four advanced trading platforms and competitive conditions.

FAQ

What Is an Inverse Fair Value Gap (IFVG)?

The IFVG meaning refers to a formation that occurs when a Fair Value Gap (FVG) is invalidated. For example, a bearish FVG becomes bullish after the price breaks above it, creating a potential support zone. Similarly, a bullish FVG can transform into a bearish IFVG if the price breaks below it, creating a potential resistance zone. IFVGs highlight shifts in market sentiment, providing traders with areas of interest for analysing possible reversals or continuation zones.

What Is the Difference Between a Fair Value Gap and an Inverse Fair Value Gap?

A Fair Value Gap (FVG) is an imbalance caused by aggressive buying or selling, creating a price gap that may act as support or resistance. An Inverse Fair Value Gap (IFVG) occurs when the original FVG is invalidated—indicating a shift in sentiment—and its role flips. For instance, a bearish FVG invalidated by a price breakout becomes a bullish IFVG.

What Is the Difference Between BPR and Inverse FVG?

A Balanced Price Range (BPR) represents the overlap of two opposing Fair Value Gaps (FVGs), creating a sensitive zone for potential price reactions. In contrast, an Inverse Fair Value Gap (IFVG) is a concept based on a single FVG that has been invalidated, flipping its role. While both are useful, BPR reflects the equilibrium between buyers and sellers, whereas IFVG highlights sentiment reversal.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Fundamental Analysis

Behind the Curtain: Macro Indicators That Move the Yen1. Introduction

Japanese Yen Futures (6J), traded on the CME, offer traders a window into one of the world’s most strategically important currencies. The yen is not just Japan’s currency—it’s also a barometer for global risk appetite, a funding vehicle for the carry trade, and a defensive asset when markets turn volatile.

But what truly moves Yen Futures?

While many traders fixate on central bank statements and geopolitical news, machine learning tells us that economic indicators quietly—but consistently—steer price action. In this article, we apply a Random Forest Regressor to reveal the top macroeconomic indicators driving 6J Futures across daily, weekly, and monthly timeframes, helping traders of all styles align their strategies with the deeper economic current.

2. Understanding Yen Futures Contracts

Whether you’re trading institutional size or operating with a retail account, CME Group offers flexible exposure to the Japanese yen through two contracts:

o Standard Japanese Yen Futures (6J):

Contract Size: ¥12,500,000

Tick Size: 0.0000005 = $6.25 per tick

Use Case: Institutional hedging, macro speculation, rate differential trading

o Micro JPY/USD Futures (MJY):

Contract Size: ¥1,250,000

Tick Size: 0.000001 = $1.25 per tick

Use Case: Retail-sized access, position scaling, strategy testing

o Margin Requirements:

6J: Approx. $3,300 per contract

MJY: Approx. $330 per contract

Both products offer deep liquidity and near 24-hour access. Traders use them to express views on interest rate divergence, U.S.-Japan trade dynamics, and global macro shifts—all while adjusting risk through contract size.

3. Daily Timeframe: Top Macro Catalysts

Short-term movements in Yen Futures are heavily influenced by U.S. economic data and its impact on yield spreads and capital flow. Machine learning analysis ranks the following three as the most influential for daily returns:

10-Year Treasury Yield: The most sensitive indicator for the yen. Rising U.S. yields widen the U.S.-Japan rate gap, strengthening the dollar and weakening the yen. Drops in yields could create sharp yen rallies.

U.S. Trade Balance: A narrowing trade deficit can support the USD via improved capital flow outlook, pressuring the yen. A wider deficit may signal weakening demand for USD, providing potential support for yen futures.

Durable Goods Orders: A proxy for economic confidence and future investment. Strong orders suggest economic resilience, which tends to benefit the dollar. Weak numbers may point to a slowdown, prompting defensive yen buying.

4. Weekly Timeframe: Intermediate-Term Indicators

Swing traders and macro tacticians often ride trends formed by mid-cycle economic shifts. On a weekly basis, these indicators matter most:

Fed Funds Rate: As the foundation of U.S. interest rates, this policy tool steers the entire FX complex. Hawkish surprises can pressure yen futures; dovish turns could strengthen the yen as yield differentials narrow.

10-Year Treasury Yield (again): While impactful daily, the weekly trend gives traders a clearer view of long-term investor positioning and bond market sentiment. Sustained moves signal deeper macro shifts.

ISM Manufacturing Employment: This labor-market-linked metric reflects production demand. A drop often precedes softening economic growth, which may boost the yen as traders reduce exposure to riskier assets.

5. Monthly Timeframe: Structural Macro Forces

For position traders and macro investors, longer-term flows into the Japanese yen are shaped by broader inflationary trends, liquidity shifts, and housing demand. Machine learning surfaced the following as top monthly influences on Yen Futures:

PPI: Processed Foods and Feeds: A unique upstream inflation gauge. Rising producer prices—especially in essentials like food—can increase expectations for tightening, influencing global yield differentials. For the yen, which thrives when inflation is low, surging PPI may drive USD demand and weaken the yen.

M2 Money Supply: Reflects monetary liquidity. A sharp increase in M2 may spark inflation fears, sending interest rates—and the dollar—higher, pressuring the yen. Conversely, slower M2 growth can support the yen as global liquidity tightens.

Housing Starts: Serves as a growth thermometer. Robust housing data suggests strong domestic demand in the U.S., favoring the dollar over the yen. Weakness in this sector may support yen strength as traders rotate defensively.

6. Trade Style Alignment with Macro Data

Each indicator resonates differently depending on the trading style and timeframe:

Day Traders: React to real-time changes in 10-Year Yields, Durable Goods Orders, and Trade Balance. These traders seek to capitalize on intraday volatility around economic releases that impact yield spreads and risk appetite.

Swing Traders: Position around Fed Funds Rate changes, weekly shifts in Treasury yields, or deteriorating labor signals such as ISM Employment. Weekly data can establish trends that last multiple sessions, making it ideal for this style.

Position Traders: Monitor PPI, M2, and Housing Starts for broader macro shifts. These traders align their exposure with long-term shifts in capital flow and inflation expectations, often holding positions for weeks or more.

Whatever the style, syncing your trading plan with the data release calendar and macro backdrop can improve timing and conviction.

7. Risk Management

The Japanese yen is a globally respected safe-haven currency, and its volatility often spikes during geopolitical stress or liquidity events. Risk must be managed proactively, especially in leveraged futures products.

8. Conclusion

Japanese Yen Futures are a favorite among global macro traders because they reflect interest rate divergence, risk sentiment, and global liquidity flows. While headlines grab attention, data tells the real story.

Stay tuned for the next installment of the "Behind the Curtain" series, where we continue uncovering what really moves the futures markets.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Will Your Tether Holdings Be Frozen Overnight?Hello and greetings to all the crypto enthusiasts ,✌

Spend 2 minutes ⏰ reading this educational material. The main points are summarized in 3 clear lines at the end 📋 This will help you level up your understanding of the market 📊 and Bitcoin💰.

🎯 Analytical Insight on Bitcoin: A Personal Perspective:

Since this is an educational analysis, I’ve kept the chart as simple as possible and provided the most concise Bitcoin analysis. 📉

The price is currently in a descending channel and approaching a key daily resistance level. I expect at least an 8% decline, with $75,000 acting as a major support zone. 📈

Now, let's dive into the educational section, which builds upon last week's lesson (linked in the tags of this analysis). Many of you have been eagerly waiting for this, as I have received multiple messages about it on Telegram.

🧐 Educational Segment: Will Your Tether Holdings Be Frozen Overnight?

Understanding the EU’s New Crypto Regulations 🇪🇺 🔍

In 2023, the European Union (EU) introduced the Markets in Crypto-Assets Regulation (MiCA), a comprehensive legal framework aimed at increasing oversight of the cryptocurrency market. The primary objective of this regulation is to bring stability, transparency, and security to a sector that has historically operated with minimal supervision. One of the core focuses of MiCA is stablecoins, particularly their issuance, reserves, and compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) laws.

The EU prefers highly regulated and trackable stablecoins, such as PayPal’s PYUSD, as these provide greater oversight of financial transactions. Under the new regulatory landscape, if Tether (USDT) fails to meet the EU’s compliance standards, authorities may restrict its usage within the European financial system and exchanges operating in the region. However, it is important to note that such restrictions would be a gradual process, not an abrupt overnight decision. ⏳⚖️

Who Will Be Affected? 🤔📉

These potential regulations primarily impact crypto traders, businesses, and exchanges operating within the EU. If Tether does not secure regulatory approval, platforms serving European customers may be required to delist or limit USDT transactions, similar to past instances where regulatory scrutiny led to the delisting of certain assets in specific jurisdictions.

For individuals and businesses outside of the EU, particularly those using offshore or decentralized platforms, the immediate effects of these regulations would likely be minimal. However, broader market shifts and liquidity changes may still indirectly influence USDT trading volume and availability. 🌍📊

Will Tethers in High-Tension Middle Eastern Countries Be Frozen? 🚨🏦

Geopolitical Risks and US Sanctions 🇺🇸⚠️

Beyond EU regulations, concerns have arisen about whether Tether could be frozen in certain politically sensitive regions, particularly in conflict-prone areas of the Middle East. Given the U.S. government’s control over the global financial system and its increasing scrutiny of crypto transactions, there is speculation that Tether Holdings Ltd. could be pressured to comply with U.S. foreign policy directives, including asset freezes linked to sanctioned individuals, entities, or countries.

Historically, the Office of Foreign Assets Control (OFAC) has taken a firm stance against financial transactions that could be linked to terrorism financing, money laundering, or sanctions violations. While Tether itself is not a U.S.-based company, it does interact with U.S. financial institutions and has previously cooperated with law enforcement agencies to freeze assets tied to criminal activities. 🏛️🔎

If geopolitical tensions worsen, there is a possibility that Tether’s compliance team may receive direct or indirect pressure to restrict access to its stablecoin in certain jurisdictions, mirroring actions previously taken against other crypto wallets and sanctioned entities. 🔥💰

How Can Users Protect Themselves? 🛡️💡

For individuals and businesses operating in high-risk regions, it is crucial to stay informed about potential regulatory and geopolitical shifts. Strategies to mitigate risks include:

Diversifying stablecoin holdings by using multiple assets (e.g., DAI, USDC, or algorithmic stablecoins). 🔄💱

Utilizing decentralized finance (DeFi) solutions that reduce reliance on centralized stablecoin issuers. 🏗️🔐

Exploring on-chain privacy solutions to protect financial autonomy within legal and ethical boundaries. 🕵️♂️📲

Keeping funds in non-custodial wallets rather than centralized exchanges, which are more susceptible to regulatory enforcement. 🔑📜

In an upcoming guide , I will provide a comprehensive tutorial on how to protect your identity and crypto holdings while navigating regulatory challenges and geopolitical risks. Stay tuned for a detailed breakdown of secure storage, alternative stablecoins, and advanced privacy measures. 🚀🔮

However , this analysis should be seen as a personal viewpoint, not as financial advice ⚠️. The crypto market carries high risks 📉, so always conduct your own research before making investment decisions. That being said, please take note of the disclaimer section at the bottom of each post for further details 📜✅.

🧨 Our team's main opinion is: 🧨

The EU’s MiCA regulations may restrict Tether (USDT) in European exchanges, but it won’t happen overnight. 🌍 Meanwhile, rising geopolitical tensions spark fears that the U.S. could freeze USDT in certain regions. If you’re outside these areas, the impact is minimal, but diversifying assets** is a smart move. Stay tuned for my next guide on protecting your identity, wallets, and crypto holdings!

Give me some energy !!

✨We invest countless hours researching opportunities and crafting valuable ideas. Your support means the world to us! If you have any questions, feel free to drop them in the comment box.

Cheers, Mad Whale. 🐋

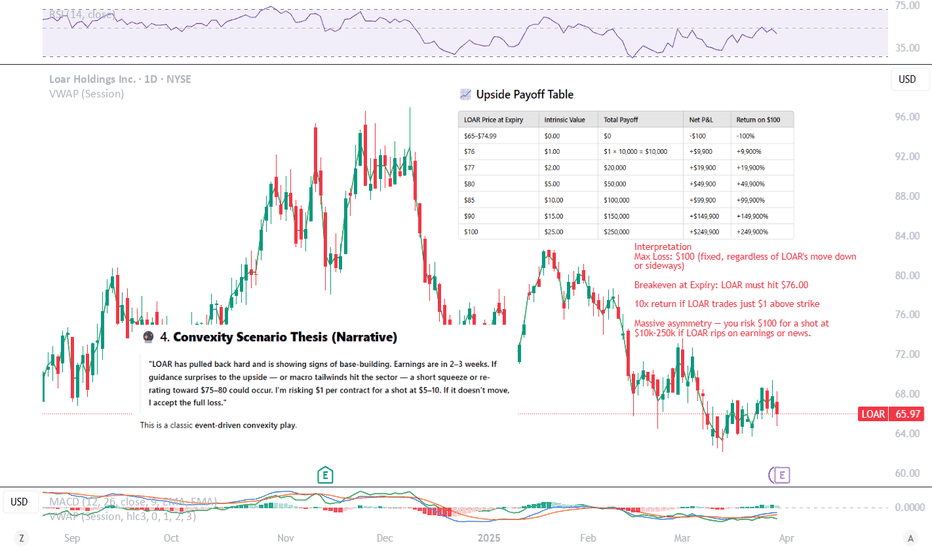

Convexity-based trade scenario using LOAR stock and the April 17Yo traders -

Let’s map out a convexity-based trade scenario using LOAR stock and the April 17, 2025 $75 Call option — currently trading at $1.00, with the stock at $65.97 and only 18 days to expiry.

🔍 Step-by-Step Breakdown:

🧠 1. Basic Structure

You’re buying the LOAR Apr17 $75 call at $1.00.

This is a deep OTM bet (~13.7% above current price).

You’re betting on a short-term move to $75+, meaning volatility spike or news catalyst.

⚙️ 2. Convexity Setup

Convexity means:

Small risk, asymmetric reward

If LOAR stays flat or dips → you lose $1 per contract

If LOAR rips to $80+ → this option could return 5x to 10x+

LOAR Price at Expiry Option Intrinsic Value Profit/Loss

$66 (flat) $0 -$1.00

$70 $0 -$1.00

$75 (strike) $0 -$1.00

$77 $2.00 +$1.00

$80 $5.00 +$4.00 (5x)

$85 $10.00 +$9.00 (9x)

🧾 3. Chart + Sentiment Setup

Looking at the TradingView chart:

Price Action:

LOAR is basing around $66 after a steep downtrend — potential reversal pattern

Volume is light, but some buy pressure is visible

MACD:

Appears to be flattening and potentially crossing bullish

RSI:

~40s: Oversold-to-neutral zone. Could support upward bounce.

Earnings coming up (E icon):

Strong potential for a catalyst move

This setup enhances convexity, because earnings can produce gap moves that DOTM options profit from disproportionately.

🔮 4. Convexity Scenario Thesis (Narrative)

"LOAR has pulled back hard and is showing signs of base-building. Earnings are in 2–3 weeks. If guidance surprises to the upside — or macro tailwinds hit the sector — a short squeeze or re-rating toward $75–80 could occur. I’m risking $1 per contract for a shot at $5–10. If it doesn’t move, I accept the full loss."

This is a classic event-driven convexity play.

⚠️ 5. Risks & Considerations

Time decay is brutal: With only 18 days left, theta decay accelerates daily

IV Crush post-earnings could hurt even if the stock moves

You need a fast, strong move, ideally before or at earnings

Position sizing is critical: This is a "lottery ticket" — don’t over-allocate

✅ 6. Ideal for Your Strategy If:

You're making many small bets like this across tickers/catalysts

You’re not trying to be “right” often, but “big” occasionally

You have capital discipline and uncorrelated base assets

🧮 Position Size:

Option price = $1.00 per contract

You buy 100 contracts of the $75 call

Total risk = $100

Each $1.00 move above $75 = $100 profit per $1, since 100 contracts × 100 shares/contract = 10,000 shares exposure

📈 Upside Payoff Table

LOAR Price at Expiry Intrinsic Value Total Payoff Net P&L Return on $100

$65–$74.99 $0.00 $0 -$100 -100%

$76 $1.00 $1 × 10,000 = $10,000 +$9,900 +9,900%

$77 $2.00 $20,000 +$19,900 +19,900%

$80 $5.00 $50,000 +$49,900 +49,900%

$85 $10.00 $100,000 +$99,900 +99,900%

$90 $15.00 $150,000 +$149,900 +149,900%

$100 $25.00 $250,000 +$249,900 +249,900%

🧠 Interpretation

Max Loss: $100 (fixed, regardless of LOAR's move down or sideways)

Breakeven at Expiry: LOAR must hit $76.00

10x return if LOAR trades just $1 above strike

Massive asymmetry — you risk $100 for a shot at $10k–250k if LOAR rips on earnings or news.

📌 Real-World Considerations:

You might exit early if the option spikes in value before expiry (e.g., stock runs to $72 with 5 days left).

Liquidity may limit large size fills.

Volatility matters: IV spike pre-earnings or a big gap post-earnings increases your chance of profit.

📊 Convex Payoff Table for LOAR Apr17 $75 Call (100 Contracts, $100 Risk)

LOAR Price at Expiry % Move from $65.97 Intrinsic Value Total Payoff Net P&L Return on $100

$65–$74.99 0% to +13.6% $0.00 $0 -$100 -100%

$76 +15.2% $1.00 $10,000 +$9,900 +9,900%

$77 +17.0% $2.00 $20,000 +$19,900 +19,900%

$80 +21.3% $5.00 $50,000 +$49,900 +49,900%

$85 +28.9% $10.00 $100,000 +$99,900 +99,900%

$90 +36.4% $15.00 $150,000 +$149,900 +149,900%

$100 +51.6% $25.00 $250,000 +$249,900 +249,900%

🧠 Takeaway:

Even a 15% move turns your $100 into $10,000 — this is why convex trades are so powerful.

But the trade-off is probability: the odds of a 15–50%+ move in 18 days are low, which is why risk is capped and position sizing matters.

Mastering Risk Management in Trading: The Ultimate GuideMastering Risk Management in Trading: The Ultimate Guide

In the world of trading, success isn’t measured only by big wins but by how well you protect your capital from unnecessary losses. Risk management isn’t just a safety net—it’s the backbone of sustainable trading. In this comprehensive guide, we’ll break down the principles and strategies you need to safeguard your account while still maximizing your profit potential.

---

1. Risk-Reward Ratio: The Foundation of Every Trade

- What it is:

The risk-reward ratio is the cornerstone of every trade. It tells you how much potential reward you’re targeting compared to the risk you’re willing to take. For instance, if you risk $100 and aim to make $200, your risk-reward ratio is 1:2—a commonly accepted standard in trading.

- How to use it:

- Always predefine your risk-reward ratio before entering a trade.

- For swing traders, aim for a minimum of 1:2 or 1:3 to justify holding overnight.

---

2. Position Sizing: The Key to Survival

- Why position sizing matters:

Position sizing ensures you don’t over-leverage your account or lose too much in a single trade. Many traders fail because they bet too big and get wiped out after just a few losing trades.

- How to calculate position size:

- Use this formula:

Position Size = (Account Risk $ ÷ (Entry Price - Stop-Loss Price)).

- For example, if you’re risking $100 per trade and the difference between your entry and stop-loss is $5, your position size should be 20 units (100 ÷ 5).

---

3. Stop-Loss Orders: Your Safety Net

- What is a stop-loss?

A stop-loss is your emergency brake. It’s an order you set in advance to sell your position if the price moves against you by a specified amount.

- How to set stop-losses:

- Use technical analysis to place your stop-loss below support levels for long trades or above resistance levels for short trades.

- Avoid placing stop-losses too close to your entry point, as small fluctuations might trigger them unnecessarily.

Here you can see my ratio is on the low side so i can place a tactical TP and SL in relation to liquidity lines.

---

4. The Art of Diversification: Spreading Risk

- Why diversification works:

Putting all your capital into a single trade or instrument increases your risk. Diversification spreads that risk across multiple trades or markets, reducing the impact of any single loss.

- How to diversify effectively:

- Trade across multiple sectors or currency pairs.

- Avoid overexposure to correlated assets (e.g., don’t trade EUR/USD and GBP/USD simultaneously).

---

5. Emotional Discipline: Winning the Mental Game

- Why it matters:

Even the best trading strategy can fail if emotions like fear or greed take over. Emotional trading leads to impulsive decisions, revenge trading, and overtrading.

- How to maintain discipline:

- Stick to your trading plan, no matter what.

- Use tools like meditation, journaling, or physical exercise to manage stress.

---

6. Dynamic Risk Management: Adapting to Changing Markets

- Adjusting your strategy:

Markets are dynamic, and your risk management should adapt. Volatility can change quickly, requiring you to adjust your stop-loss distance or position size.

- Use ATR (Average True Range):

The ATR is a great tool to measure market volatility and decide how much room to give your stop-loss.

---

7. Tracking and Reviewing Your Trades

- The power of a trading journal:

Every trade is a learning opportunity. Keep detailed records of your trades, including your reasoning, execution, and results.

- What to include in your journal:

- Entry and exit points.

- Risk-reward ratio.

- Mistakes or deviations from the plan.

- Lessons learned.

---

Conclusion: Plan the Trade, Trade the Plan

Risk management isn’t just a skill—it’s a habit. By understanding your risk-reward ratio, managing position sizes, using stop-losses effectively, and staying emotionally disciplined, you can protect your capital and increase your chances of long-term success.

Take a moment to reflect: How do you manage risk in your trading? Are there areas you could improve? Start implementing these strategies today, and watch how they transform your trading results.

Eternal Sunshine of the Spotless MindHere you have Charles Thomas Munger, the permanent vice president of one of the most successful companies in the world, Berkshire Hathaway. He was not at the origins of this business, but it was Charles, together with Warren Buffett, who turned a dying enterprise into a star of the world stock market. It didn't take a Master's degree in Business Administration or incredible luck. As Mr. Munger said, to succeed you don't necessarily have to strive to be the smartest, you just have to be not stupid and avoid the standard ways of failure. He worked as a meteorologist, then a lawyer, and finally as someone we know well - an investor who inspired many to take a smart approach to business and their own lives.

“I don’t think you should become president or a billionaire because the odds are too great against you. It is much better to set achievable goals. I didn't set out to become rich, I set out to be independent. I just went a little overboard”, Charles joked. Wake up every morning, work hard, be disciplined and surprisingly, everything will work out very well. This commandment sounds a little archaic in times of rapid rise and easy money. However, for anyone who thinks years and decades ahead, it is difficult to come up with something better.

Speaking to students at his hometown University of Michigan, Mr. Munger said the most important decision you make in life is not your business career, but your marriage. It will do more good or bad for you than anything else. He attached such great importance to human relationships. This correlates strongly with a study of human happiness that has been ongoing for over 85 years under the auspices of Harvard University. The scientists' main conclusion was that everything we build (portfolios, businesses, strategies) is worthless if there is no person in our lives to whom we can say a simple “I'm here”. Or “Thank you”. Or “I love you”.

The healthiest and happiest in old age were not those subjects who earned the most. And those who have maintained good, trusting relationships. Marital. Friendly. Related. And in this light, Charles Munger's words about caution, moderation and common-sense sound quite different. It's not about money. It's about a life that can be lived with the feeling that you have enough. That you don't have to be a hero. That you can just be a reasonable person. Loving. Healthy. Calm.

Perhaps this is the main secret of Mr. Munger's success in the stock market? In the long run, the one who has already won achieves a positive result.

November 28th, 2023, was the last day of the cheerful Charlie's life. There were 34 days left until his 100th birthday.

Is There the Best Time to Trade Forex in the UK?Is There the Best Time to Trade Forex in the UK?

Grasping the nuances of forex market hours is essential for traders aiming to optimise their strategies. Operating continuously from Sunday evening to Friday night, the currency market accommodates participants across various time zones without being anchored to a singular physical location.

For those in the UK, recognising when to engage can dramatically influence outcomes. This FXOpen article discusses the pivotal currency trading sessions that may be optimal for UK-based traders.

Understanding Forex Market Hours

Understanding currency exchange market hours is crucial for anyone involved in the global foreign exchange market. Although you may already know this, let us remind you.

The forex market operates on a 24/5 basis, opening during weekdays and closing at weekends. This round-the-clock trading is possible because it’s not tied to a physical location; instead, it relies on a decentralised network of banks, businesses, and individuals exchanging currencies across different time zones.

For traders in the UK, knowing the best forex trading hours can be key to effective trading. The currency market is broadly divided into four main 9-hour-long windows, each starting at different times to cater to traders across the globe. The forex session times UK traders need to be aware of are:

- Sydney Session: 9:00 PM GMT - 6:00 AM GMT

- Tokyo Session: 11:00 PM GMT - 8:00 AM GMT

- London Session: 8:00 AM GMT - 5:00 PM GMT

- New York Session: 1:00 PM GMT - 10:00 PM GMT

Note that during British Summer Time (BST), some of these times are shifted forward by one hour.

These forex market trading times are essential to know, as they indicate when liquidity and volatility are likely to increase, potentially offering favourable market conditions.

The Optimal Times to Trade Forex in the UK

In navigating currency trading, UK-based traders should be aware of two key sessions: London and New York. These periods are optimal forex market hours in the UK, offering greater volumes, volatility, and liquidity. They’re also the periods that see the most releases for three of the major economies: the UK, Eurozone, and the US.

The core forex trading times in the UK are anchored around the London session, which is central to global forex market operations due to London's key position in the financial world. The London trading session time in the UK commences at 8:00 AM GMT (winter time).

This period, ending at 5:00 PM GMT (winter time), is pivotal as it accounts for roughly half of the forex transactions globally, making it a prime trading time due to the high liquidity and the potential for more pronounced price movements.

Likewise, the London-New York trading session time in the UK can be especially advantageous. It’s a crucial overlapping window occurring from 1:00 PM to 5:00 PM GMT (winter time), offering an avenue for traders seeking to maximise their potential returns due to the surge in activity and high-profile economic releases from the US.

During this window, the US stock market opens at 2:30 PM GMT. This secondary opening can also have a notable effect on US dollar-based pairs.

Economic Releases and the Impact on Trading Times for UK Traders

Economic releases and central bank announcements significantly influence UK forex trading times, often driving prices higher or lower. Many UK economic releases—affecting GBP currency pairs—are scheduled around 7:00 AM GMT. This timing offers traders opportunities to engage in trends post-release during the early hours of the London open.

However, some UK data and plenty of Eurozone data are released between 8:00 AM GMT and 10:00 AM GMT, periods typically characterised by increased liquidity and volatility, providing fertile ground for traders.

Likewise, many high-profile US economic announcements—non-farm payrolls, inflation statistics and employment data— are made between 1:00 PM GMT and 3:00 PM GMT. Given the US dollar's dominance on the world stage, these releases can present significant trading opportunities.

Although activity tends to quiet down after London closes, the late hours of the New York session still offer potential entries, albeit with generally lower volatility and volume.

Notably, Federal Reserve interest rate decisions are announced at 7:00 PM GMT with a press conference held after that can cause outsized price movements. The same can be said for the Bank of England and European Central Bank’s interest rate decisions at 12:00 PM GMT and 1:15 PM GMT, respectively, and their subsequent press conferences.

The Worst Time to Trade Forex in the UK

The worst times to trade forex in the UK often occur after 8:00 PM GMT, during the tail end of New York’s hours, when liquidity and volume significantly decrease. This reduction in activity can lead to less favourable trading conditions, including wider spreads and slower execution times.

Additionally, while the Asian session forex time in the UK, partially overlapping with the Sydney session, runs from 11:00 PM to 8:00 AM GMT, it presents challenges for UK traders.

Despite offering trading opportunities, especially in Japanese yen, Australian dollar, and New Zealand dollar-based pairs, the volumes during this period are substantially lower compared to the London and New York sessions. The Tokyo session forex time in the UK accounts for particularly unsociable hours anyway, so many UK traders are unlikely to engage in currency trading during this period.

Trading the London Session: A Strategy

The Asian-London Breakout Strategy leverages the unique dynamics between the calmer Asian session and the volatile London session. It involves setting buy/sell stop orders at the high and low points of the Asian period’s range, aiming to capture movements as London opens at 8:00 AM GMT.

With stop-loss orders placed above or below the range and a strategic approach to take profit – either at the end of the London session or by trailing a stop loss during the day – traders can potentially capitalise on the surge in activity. To delve deeper into this strategy and other session-based setups, consider exploring FXOpen’s 3-session trading system article.

The Bottom Line

Understanding forex trading hours and leveraging optimal times are pivotal for achieving favourable outcomes in currency trading. Luckily, UK-based traders are well placed to take advantage of the many opportunities the currency market presents, given their ability to trade both the London and New York sessions.

For UK traders seeking to navigate the complexities of markets with a trusted broker, opening an FXOpen account can provide all of the tools and insights necessary for effective trading.

FAQs

When Do the Forex Markets Open in the UK?

Forex opening times in the UK start at 8:00 AM GMT (winter time) and at 7:00 AM GMT (summer time) when the London session begins, marking the start of significant trading activity due to London's central role in the global currency arena.

What Time Does the Forex Market Open on Sunday in the UK?

The forex market opens on Sunday at 9:00 PM GMT (winter time) and at 10:00 PM GMT (summer time) in the UK, coinciding with Sydney’s opening and marking the beginning of the trading week.

What Time Does the Forex Market Close on Friday in the UK?

The forex market closes at 10:00 PM GMT (winter time) and at 9:00 PM GMT (summer time) on Friday in the UK, concluding with the end of the New York session and wrapping up the trading week.

Can You Trade Forex on Weekends?

Currency trading on weekends is not possible as the market is closed. Trading resumes with the opening of the Sydney session on Sunday at 9:00 PM GMT (winter time) and at 10:00 PM GMT (summer time).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

US Cash Market Goes 'Flippant'. Understanding Revenge in TradingFirst of all, revenge trading is a destructive pattern of behavior in trading where individuals make impulsive and emotionally-driven decisions in an attempt to recoup previous losses. This practice is not limited to novice traders; even experienced traders can fall prey to it. The primary emotions driving revenge trading include anger, frustration, greed, fear, and shame, which cloud judgment and lead to irrational decision-making.

Causes of Revenge Trading

Emotional Response: Traders often react emotionally to significant losses, feeling compelled to immediately recover their losses without adequate analysis or strategy.

Lack of Discipline: Deviating from established trading plans and risk management principles is common in revenge trading.

Psychological Triggers: Feelings of injustice, anger, or a desire for vengeance against the market can trigger revenge trading.

Consequences of Revenge Trading

Financial Losses: Revenge trading often results in larger losses due to riskier trades and poor timing.

Emotional Burnout: The stress and frustration from repeated losses can lead to emotional exhaustion and decreased trading performance.

Career Impact: Persistent revenge trading can erode confidence and lead to a trader questioning their abilities.

Real-Life Examples of Revenge Trading

Increasing Position Size: A trader experiences a significant loss and decides to double or triple their position size in the next trade, hoping to quickly recover their losses. This action disregards risk management principles and often leads to even greater losses.

Ignoring Stop-Loss Orders: After a loss, a trader might hold onto a losing position longer than planned, hoping it will turn around. This behavior ignores established stop-loss orders and can result in further financial damage.

Chasing Trades: A trader feels compelled to enter trades without proper analysis, driven by the urge to recoup losses quickly. This impulsive behavior can lead to a series of poor trading decisions.

Market Reversal Scenario: A trader suffers a loss due to a sudden market reversal. In an attempt to recover, they enter a trade in the opposite direction without thorough analysis, which can exacerbate their losses.

Wish more examples? Watch recent one below 👇👇

How to Avoid Revenge Trading

To avoid revenge trading, traders should focus on maintaining discipline and adhering to their trading strategies. This includes:

Taking Breaks: After a loss, taking time to reassess the market and calm emotions can help prevent impulsive decisions.

Sticking to Plans: Adhering to established trading plans and risk management principles is crucial.

Emotional Awareness: Recognizing emotional triggers and taking steps to manage them can help prevent revenge trading.

In conclusion, revenge trading is a HARMFUL AND DANGEROUS practice that can lead to significant financial and emotional consequences. Understanding its causes and recognizing its signs are essential steps in avoiding this behavior and maintaining a successful trading career.

--

Best wishes,

@PandorraResearch Team 😎

Think Like a Pro: Trade with Discipline, Not Emotion **Taming Greed: The Secret to Long-Term Trading Success**

Trading is a battlefield of emotions—**excitement, fear, hope, and greed**. Among them, **greed is the silent killer**, pushing traders to overtrade, overleverage, and chase the market, ultimately leading to disaster.

As the saying goes:

📉 **“Bulls make money, bears make money, but pigs get slaughtered.”**

**Why Greed is Your Worst Enemy**

Fear may hold you back, but **greed pushes you into reckless decisions**. It makes you **ignore your trading plan, risk too much, and hold losing trades for too long**—all in pursuit of bigger gains.

But here’s the truth: **The market rewards patience, not desperation.**

**How to Keep Greed in Check & Trade Like a Pro**

🔥 **Follow a Strict Trading Plan**

A well-defined **plan is your shield against impulsive decisions**. Know your entry, exit, and risk before placing a trade. **Discipline beats greed—every time.**

📊 **Master Risk Management**

Avoid the temptation to **bet big for quick gains**. A strong **risk strategy protects your capital** and ensures survival in the long run. The goal isn’t just to win—it’s to stay in the game.

⏳ **Say No to Overtrading**

More trades don’t mean more profits—**it usually means more losses**. Trade **with precision, not emotion**. If you’re trading just for the thrill, **you’re gambling, not investing**.

**Success = Patience + Discipline**

Greed is an illusion—it promises wealth but delivers ruin. The real path to trading mastery lies in **consistency, control, and calculated risks**.

💡 **Trade smart. Stay disciplined. Build wealth the right way.**

High Volatility Trade Management & Risk Management Strategies

With a current geopolitical uncertainty and the election of Trump, forex market and gold experience wild price fluctuations. These unpredictable swings can result in substantial losses, particularly for the beginners in trading.

In this article, I will share with you the essential trade management and risk management tips for dealing with extreme volatility in trading.

I will reveal proven strategies and techniques for avoiding losses and unexpected risks.

1. First and foremost, pay attention to the news.

The main driver of high volatility on the markets are the news , especially the bad ones.

In normal times, high impact news events are relatively rare, while in times of uncertainty their frequency increases dramatically.

Such news may easily invalidate the best technical analysis setup: any powerful support or resistance level, strong price action or candle stick pattern can be easily overturned by the fundamentals.

Trump tariffs threats against Canada made USDCAD rise by 400 pips rapidly, while the change of rhetoric quickly returned the prices to previous levels.

One you hold an active trade, monitor the news. If you see the impactful news that may affect the pair or instrument that you trade, immediately protect your position, moving stop loss to entry.

It will help you avoid losses if the market starts going against you.

2. Even constantly monitoring the news, you will not be able to protect yourself from all the surprising movements.

Sometimes your trades will quickly be closed in a loss.

Therefore, I strictly recommend measure a lot size for every trade that you take. Make sure that you risk no more than 1% of your trading account per trade. That will help you to minimize losses cased by the impactful, uncertain events.

3. The impactful events may also occur on weekend, while Forex market is closed. Such incidents can be the cause of huge gap openings.

If you hold an active trading position over the weekend, remember that your entire account can be easily blown with such gaps.

Imagine that you decided to buy EURUSD on Friday during the NY session and keep holding the position over the weekend.

A huge gap down opening would make you face huge losses, opening the market 125 pips below the entry level.

By the way, this day I received a dozen of messages from my followers that their accounts were blown with the opening gaps.

4. If you see a significant price movement caused by some events, and you did not manage to catch it, let it go.

Jumping in such movements is very risky because quite ofter correctional movements will follow quickly.

It will be much safer and better to try to be involved in a trend continuation after a pullback.

Look what happened with Gold when Trump began a new trade war.

The price started to grow rapidly. However, even during such a sentiment, 500 pips pullback occurred, giving patient traders a safe entry point for the trade.

5. In the midst of geopolitical tensions and trade wars, the markets tend to rally or fall for the extended time periods.

The best trading strategies to use to get maximum from such movements are trend-following strategies.

While reversal, counter-trend trading might be extremely risky, providing a lot of false signals.

Trend trading may bring extraordinary profits.

These trading tips, risk management and trade management strategies and secrets are tailored for cutting and avoiding losses during dark times. Empower your strategy with this useful knowledge and good luck to you in trading high volatility on Gold and Forex.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

What Is a Liquidity Sweep and How Can You Use It in Trading?What Is a Liquidity Sweep and How Can You Use It in Trading?

Mastering key concepts such as liquidity is crucial for optimising trading strategies. This article explores the concept of a liquidity sweep, a pivotal phenomenon within trading that involves large-scale players impacting price movements by triggering clustered pending orders, and how traders can leverage them for deeper trading insights.

Understanding Liquidity in Trading

In trading, liquidity refers to the ability to buy or sell assets quickly without causing significant price changes. This concept is essential as it determines the ease with which transactions can be completed. High liquidity means that there are sufficient buyers and sellers at any given time, which results in tighter spreads between the bid and ask prices and more efficient trading.

Liquidity is often visualised as the market's bloodstream, vital for its smooth and efficient operation. Financial assets rely on this seamless flow to ensure that trades can be executed rapidly and at particular prices. Various participants, including retail investors, institutions, and market makers, contribute to this ecosystem by providing the necessary volume of trades.

Liquidity is also dynamic and influenced by factors such as notable news and economic events, which can all affect how quickly assets can be bought or sold. For traders, understanding liquidity is crucial because it affects trading strategies, particularly in terms of entry and exit points in the markets.

What Is a Liquidity Sweep?

A liquidity sweep in trading is a phenomenon within the Smart Money Concept (SMC) framework that occurs when significant market players execute large-volume trades to trigger the activation of a cluster of pending buy or sell orders at certain price levels, enabling them to enter a large position with minimal slippage. This action typically results in rapid price movements and targets what are known as liquidity zones.

Understanding Liquidity Zones

Liquidity zones are specific areas on a trading chart where there is a high concentration of orders, including stop losses and pending orders. These zones are pivotal because they represent the levels at which substantial buying or selling interest is anticipated once activated. When the price reaches these zones, the accumulated orders are executed, which can cause sudden and sharp price movements.

How Liquidity Sweeps Function

The process begins when market participants, especially institutional traders or large-scale speculators, identify these zones. By pushing the market to these levels, they trigger other orders clustered in the zone. The activation of these orders adds to the initial momentum, often causing the price to move even more sharply in the intended direction. This strategy can be utilised to enter a position favourably or to exit one by pushing the price to a level where a reversal is likely.

Liquidity Sweep vs Liquidity Grab

Within the liquidity sweep process, it's crucial to distinguish between a sweep and a grab:

- Liquidity Sweep: This is typically a broader movement where the price action moves through a liquidity zone, activating a large volume of orders and thereby affecting a significant range of prices.

- Liquidity Grab: Often a more targeted and shorter-duration manoeuvre, this involves the price quickly hitting a specific level to trigger orders before reversing direction. This is typically used to 'grab' liquidity by activating stops or pending positions before the price continues to move in the same direction.

In short, a grab may just move slightly beyond a peak or low before reversing, while a sweep can see a sustained movement beyond these points prior to a reversal. There is a subtle difference, but the outcome—a reversal—is usually the same.

Spotting a Liquidity Sweep in the Market

Identifying a sweep involves recognising where liquidity builds up and monitoring how the price interacts with these zones. It typically accumulates at key levels where traders have placed significant numbers of stop-loss orders or pending buy and sell positions.

These areas include:

- Swing Highs and Swing Lows: These are peaks and troughs in the market where traders expect resistance or support, leading to the accumulation of orders.

- Support and Resistance Levels: Historical areas that have repeatedly influenced price movements are watched closely for potential liquidity buildup.

- Fibonacci Levels: Common tools in technical analysis; these levels often see a concentration of orders due to their popularity among traders.

The strategy for spotting a sweep involves observing when the price approaches and breaks through these levels. Traders look for a decisive move that extends beyond the identified zones and watch how the asset behaves as it enters adjacent points of interest, such as order blocks. The key is to monitor for a subsequent reversal or deceleration in price movement, which can signal that the sweep has occurred and the market is absorbing the liquidity.

This approach helps traders discern whether a significant movement is likely a result of a sweep, allowing them to make more informed decisions about entering or exiting positions based on the anticipated reversal or continuation of the price movement.

How to Use Liquidity Sweeps in Trading

Traders often leverage liquidity sweeps in forex as strategic indicators within a broader Smart Money Concept framework, particularly in conjunction with order blocks and fair value gaps. Understanding how these elements interact provides traders with a robust method for anticipating and reacting to potential price movements.

Understanding Order Blocks and Fair Value Gaps

Order blocks are essentially levels or areas where historical buying or selling was significant enough to impact an asset’s direction. These blocks can act as future points of interest where the price might react due to leftover or renewed interest from market participants.

Fair value gaps are areas on a chart that were quickly overlooked in previous movements. These gaps often attract price back to them, as the market seeks to 'fill' these areas by finding the fair value that was previously skipped.

Practical Application in Trading Strategies

Learn how liquidity sweeps can be applied to trading strategies.

Identifying the Trend Direction

The application of liquidity sweeps starts with understanding the current trend, which can be discerned through the market structure—the series of highs and lows that dictate the direction of the market movement.

Locating Liquidity Zones

Within the identified trend, traders pinpoint liquidity zones, which could be significant recent swing highs or lows or areas marked by repeated equal highs/lows or strong support/resistance levels.

Observing Order Blocks and Fair Value Gaps

After identifying a liquidity zone, traders then look for an order block beyond this zone. The presence of a fair value gap near the block enhances the likelihood of the block being reached, as these gaps are frequently filled.

Trade Execution

When the price moves into the order block, effectively sweeping liquidity, traders may place limit orders at the block with a stop loss just beyond it. This action is often based on the expectation that the order block will trigger a reversal.

Utilising Liquidity Sweeps for Entry Confidence

The occurrence of a sweep into an order block not only triggers the potential reversal but also provides traders with greater confidence in their position. This confidence stems from the understanding that the market's momentum needed to reach and react at the block has been supported by the liquidity sweep.

By combining these elements—trend analysis, liquidity zone identification, and strategic use of order blocks and fair-value gaps—traders can create a cohesive strategy that utilises sweeps to enhance decision-making and potentially improve trading results.

The Bottom Line

Understanding liquidity sweeps offers traders a critical lens through which to view market dynamics, revealing deeper insights into potential price movements. For those looking to apply these insights practically, opening an FXOpen account could be a valuable step towards engaging with the markets more effectively and leveraging professional-grade tools to navigate liquidity phenomena.

FAQs

What Is a Liquidity Sweep?

A liquidity sweep occurs when large market participants activate significant orders within liquidity zones, causing rapid price movements. It's a strategic manoeuvre to capitalise on accumulated buy or sell orders at specific price levels.

What Is a Sweep Trade?

A sweep trade is a large order executed through multiple different areas on a chart and venues to optimise execution. This is common in both equities and derivatives trading to minimise market impact.

How to Spot a Liquidity Sweep?

Liquidity sweeps can be identified by sudden, sharp movements towards areas dense with orders, such as previous swing highs or lows or known support and resistance levels, followed often by a rapid reversal.

What Is the Difference Between a Liquidity Sweep and a Liquidity Grab?

A liquidity sweep is a broader market move activating a large volume of orders across a range of prices. In contrast, a grab is a quick, targeted action to hit specific order levels before the price reverses direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

ETFs vs Mutual Funds: Differences and Advantages ETFs vs Mutual Funds: Differences and Advantages

Exchange-traded funds (ETFs) and mutual funds are two of the most popular investment options, each offering unique features and advantages. While both provide access to diversified portfolios, their differences in structure, management, and trading make them suitable for different strategies. This article breaks down the key distinctions between exchange-traded funds vs mutual funds and how to choose between them.

What Are ETFs?

Exchange-traded funds, or ETFs, are investment vehicles that allow traders to access a diverse range of assets through a single product. An ETF is essentially a basket of investments—such as stocks, bonds, or commodities—that typically tracks the performance of an index, sector, or specific theme. For example, SPDR S&P 500 ETF Trust (SPY) follows the S&P 500 index, providing exposure to the largest companies listed on US stock exchanges.

What sets ETFs apart is how they’re traded. Unlike mutual funds, which are only bought or sold at the end of the trading day, ETFs trade on stock exchanges throughout the day, just like individual shares. This means their prices fluctuate as demand and supply change, giving traders the flexibility to enter or exit positions at market prices.

ETFs are known for their cost-effectiveness, as most are passively managed to mirror the performance of an index rather than exceed it. This passive structure usually leads to lower management fees compared to actively managed funds. Additionally, ETFs are often transparent, with their holdings disclosed daily, so investors know exactly what they’re buying.

ETFs come in various types, from those focused on specific sectors, like technology or healthcare, to broader options covering entire economies or bond markets. This variety makes them a popular choice for traders and investors looking to diversify or target specific market opportunities.

What Are Mutual Funds?

Mutual funds are investment products that pool money from multiple investors to create a diversified portfolio, typically managed by a professional fund manager. These funds invest in a wide range of assets, including stocks, bonds, and other securities, depending on the fund’s objective. For instance, an equity mutual fund focuses on stocks, while a bond fund invests primarily in fixed-income securities.

One defining feature of mutual funds is their pricing. Unlike ETFs, mutual funds aren’t traded on stock exchanges. Instead, they are bought and sold at the fund’s net asset value (NAV), which is calculated at the end of each trading day. This makes them more suited to long-term investment strategies.

Mutual funds often appeal to investors looking for a hands-off approach. The fund manager handles the selection and management of assets, aiming to achieve the fund’s stated goals—whether that’s generating income, preserving capital, or achieving long-term growth.

However, this active management comes with higher fees compared to ETFs. These costs include management fees and sometimes additional charges like entry or exit loads, which can eat into returns over time.

Mutual funds also often require a minimum investment, making them less accessible for some investors. That said, they offer a wide variety of options, from sector-specific funds to diversified portfolios, providing flexibility for different investment goals and risk preferences.

Are There Differences Between an ETF and a Mutual Fund?

ETFs and mutual funds share similarities—they both allow investors to pool money into diversified portfolios. However, the differences between ETFs and mutual funds can significantly impact which one is better suited to an investor’s goals.

Trading and Pricing

ETFs are traded on stock exchanges continuously during market hours, similar to individual shares. Price fluctuations are based on market demand and supply. In contrast, mutual funds are priced only once per day after the market closes, based on the fund’s net asset value (NAV). This makes ETFs more appealing for those seeking flexibility and the ability to react to market movements, while mutual funds cater to long-term investors less concerned with intraday price changes.

Management Style

ETFs are mostly passively managed, designed to track the performance of a specific index, sector, or asset class. Mutual funds, on the other hand, often feature active management. This involves fund managers selecting assets to outperform the market, which can offer potential opportunities for higher returns but also comes with increased costs.

Fees and Costs

ETFs typically come with a lower expense ratio compared to mutual funds, making them more cost-efficient. This is due to their passive management approach and lower operational costs. Mutual funds may charge higher fees to cover active management and administrative expenses. Additionally, mutual funds may have extra costs like sales charges or redemption fees, whereas ETFs incur standard brokerage commissions.

Liquidity

When considering mutual funds versus ETFs, liquidity becomes a critical factor, as ETF prices change intraday, while mutual funds are limited to end-of-day pricing. This difference can influence how quickly you can access your funds.

Tax Efficiency

ETFs tend to be more tax-efficient because of their structure. When investors sell ETF shares, transactions occur directly between buyers and sellers on the exchange, limiting taxable events. In mutual funds, redemptions often require the fund manager to sell securities, which can result in capital gains distributed to all investors in the fund.

Minimum Investment

Mutual funds often require a minimum initial investment, which can range from a few hundred to thousands of dollars. ETFs, however, don’t have such requirements—traders can purchase as little as a single share, making them more accessible for those with smaller starting capital.

ETF CFD Trading

ETF CFD trading offers a flexible way for traders to speculate on the price movements of exchange-traded funds without the need to buy them on stock exchanges. CFDs, or Contracts for Difference, are derivative products that track the price of an ETF, allowing traders to take positions on whether the price will rise or fall. This approach is particularly appealing for short-term speculation, making it a useful complement to traditional long-term ETF or mutual fund investing.

Flexibility

One of the standout features of ETF CFDs is their flexibility. Unlike investing directly in ETFs, CFD trading enables you to capitalise on price fluctuations without owning ETF shares. Traders can go long if they anticipate a rise in the ETF’s value or short if they expect a decline. This ability to trade in both directions can potentially create opportunities in both bullish and bearish markets. Moreover, CFDs allow for trading over shorter timeframes like 1-minute or 5-minute charts, providing potential opportunities for scalpers and day traders.

Leverage

Leverage is another significant feature of ETF CFDs. With leverage, traders can gain larger exposure to an ETF’s price movements with smaller initial capital. For example, using 5:1 leverage, a $1,000 position would control $5,000 worth of ETF exposure. However, you should remember that while this magnifies potential returns, losses are also amplified, making risk management a critical component of trading CFD products.

Costs

Actively managed ETFs can charge expense ratios to cover management and operational costs. CFDs eliminate these fees, as traders don’t directly invest in the ETF’s assets. However, both ETF investing and ETF CFD trading include brokerage fees or spreads.

Wider Range of Markets

With CFDs, traders can access a variety of global ETF markets through a single platform. This reduces the need to open accounts in different jurisdictions, saving on administrative and currency conversion costs.

CFD trading is popular among traders who want to take advantage of short-term price movements, diversify their strategies, or access ETF markets straightforwardly. While traditional ETFs are often favoured for long-term growth, ETF CFDs provide an active, fast-paced alternative for traders looking to react quickly to market changes.

Use Cases for ETFs and Mutual Funds

In comparing ETFs vs mutual funds, it’s important to recognise their use cases based on an investor’s goals, strategies, and time horizons.

ETFs

ETFs are used by investors seeking flexibility and real-time market engagement. They are attractive for those who want to take advantage of price movements or actively manage their portfolios. For example, an investor might focus on sector-specific ETFs, like technology or energy, to capitalise on industry trends. ETFs also offer a lower-cost option for diversification, making them useful for those building broad exposure across markets without significant capital.

Additionally, ETFs may be effective for hedging. An investor with exposure to a specific market segment can use an ETF to potentially offset risks, especially in volatile markets. For instance, during an anticipated downturn in equities, an inverse ETF could be used to possibly mitigate losses.

Mutual Funds

Mutual funds are popular among long-term investors prioritising professional management. Their hands-off approach makes them appealing to individuals who prefer not to monitor markets daily. For instance, someone saving for retirement might opt for a diversified mutual fund that balances risk and growth over time.

Mutual funds are also advantageous for accessing specialised strategies, such as actively managed funds focusing on niche markets or themes. While they typically involve higher fees, the tailored management can align with specific financial objectives.

Factors for Choosing Between ETFs and Mutual Funds

Selecting between mutual funds vs ETF options depends on an investor’s financial goals, trading style, and the level of involvement they are comfortable with in managing their investments.

- Time Horizon: ETFs are popular among short- to medium-term investors and traders who prefer flexibility and the ability to follow intraday price movement. Mutual funds, on the other hand, are mostly used by long-term investors focused on gradual growth or income over time.

- Cost Sensitivity: ETFs generally have lower expense ratios and no minimum investment requirements, making them cost-efficient. Mutual funds often involve higher management fees and, in some cases, additional charges like entry or exit fees, which can add up over time.

- Active vs Passive Management: If you’re looking for a hands-off approach with professional oversight, actively managed mutual funds might be more appealing. However, if you prefer to track indices or specific sectors at a lower cost, ETFs might be more suitable.

- Liquidity Needs: Investors who need quick access to their capital often prefer ETFs because they can be traded throughout the day. Mutual funds lack this intraday liquidity, as transactions are only processed at the trading day’s end.

The Bottom Line

Understanding the differences between mutual funds vs exchange-traded funds is crucial for selecting the right investment approach. ETFs offer flexibility and cost-efficiency, while mutual funds are popular among long-term investors seeking professional management. For those interested in ETF CFD trading, which allows traders trade in rising and falling markets, opening an FXOpen account provides access to a diverse range of ETF markets alongside competitive trading conditions.

FAQ

What Is an ETF vs Mutual Fund?

An ETF is a fund traded on stock exchanges, offering intraday liquidity and lower fees, typically tracking an index or sector. A mutual fund pools investor money for professional management, priced once at the end of a trading day at its net asset value per share.

Mutual Funds and ETFs: Differences

ETFs trade like stocks, are generally more cost-efficient, and offer intraday liquidity. Mutual funds are actively managed, have higher fees, and are designed for long-term investing with end-of-day pricing.

Is the S&P 500 an ETF or a Mutual Fund?

The S&P 500 itself is an index, not a fund. However, it can be tracked by both ETFs (like SPDR S&P 500 ETF) and mutual funds, offering similar exposure but with differing management styles and fee structures.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Behind the Curtain The Economic Pulse Behind Euro FX1. Introduction

Euro FX Futures (6E), traded on the CME, offer traders exposure to the euro-dollar exchange rate with precision, liquidity, and leverage. Whether hedging European currency risk or speculating on macro shifts, Euro FX contracts remain a vital component of global currency markets.

But what truly moves the euro? Beyond central bank meetings and headlines, the euro reacts sharply to macroeconomic data that signals growth, inflation, or risk appetite. Using a Random Forest Regressor, we explored how economic indicators correlate with Euro FX Futures returns across different timeframes.

In this article, we uncover which metrics drive the euro daily, weekly, and monthly, offering traders a structured, data-backed approach to navigating the Euro FX landscape.

2. Understanding Euro FX Futures Contracts

The CME offers two primary Euro FX Futures products:

o Standard Euro FX Futures (6E):

Contract Size: 125,000 €

Tick Size: 0.000050 per euro = $6.25 per tick per contract

Trading Hours: Nearly 24 hours, Sunday to Friday (US)

o Micro Euro FX Futures (M6E):

Contract Size: 12,500 € (1/10th the size of 6E)

Tick Size: 0.0001 per euro = $1.25 per tick per contract

Accessible to: Smaller accounts, strategy testers, and traders managing precise exposure

o Margins:

6E Initial Margin: ≈ $2,600 per contract (subject to volatility)

M6E Initial Margin: ≈ $260 per contract

Whether trading full-size or micro contracts, Euro FX Futures offer capital-efficient access to one of the most liquid currency pairs globally. Traders benefit from leverage, scalability, and transparent pricing, with the ability to hedge or speculate on Euro FX trends across timeframes.

3. Daily Timeframe: Key Economic Indicators

For day traders, short-term price action in the euro often hinges on rapidly released data that affects market sentiment and intraday flow. According to machine learning results, the top 3 daily drivers are:

Housing Starts: Surging housing starts in the U.S. can signal economic strength and pressure the euro via stronger USD flows. Conversely, weaker construction activity may weaken the dollar and support the euro.

Consumer Sentiment Index: A sentiment-driven metric that reflects household confidence. Optimistic consumers suggest robust consumption and a firm dollar, while pessimism may favor EUR strength on defensive rotation.

Housing Price Index (HPI): Rising home prices can stoke inflation fears and central bank hawkishness, affecting yield differentials between the euro and the dollar. HPI moves often spark short-term FX volatility.

4. Weekly Timeframe: Key Economic Indicators

Swing traders looking for trends spanning several sessions often lean on energy prices and labor data. Weekly insights from our Random Forest model show these three indicators as top drivers:

WTI Crude Oil Prices: Oil prices affect global inflation and trade dynamics. Rising WTI can fuel EUR strength if it leads to USD weakness via inflation concerns or reduced real yields.

Continuing Jobless Claims: An uptick in claims may suggest softening labor conditions in the U.S., potentially bullish for EUR as it implies slower Fed tightening or economic strain.

Brent Crude Oil Prices: As the global benchmark, Brent’s influence on inflation and trade flows is significant. Sustained Brent rallies could create euro tailwinds through weakening dollar momentum.