Beyond Technical Analysis

How do I know if a day will be bullish?"Daily Bias" is one of the most asked questions by traders!

You’ve probably heard someone say:

“If only I knew where the candle would expand, I’d be rich!”

Well, today I’m sharing a framework that can help you start answering that exact question.

🚶🏽♂️Walk with me as we break down the ES Futures Daily Candle for April 24, 2024.

By the end of this video, you'll have a solid starting point to study and apply this method—

#OneCandlestickAtATime

I am Slightly bullish BUT waiting for more dataFollowing the ideas from earlier in the week, I’m currently waiting on price action to give me more clarity. The market has been pushing higher for the past two days, and while there’s potential for a retracement, it could also be setting up for a continuation to the upside.

I’ll wait until the market opens before making any decisions, but if I had to choose right now, I’d lean slightly bullish.

Is the USD strength back or just a pullback??All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

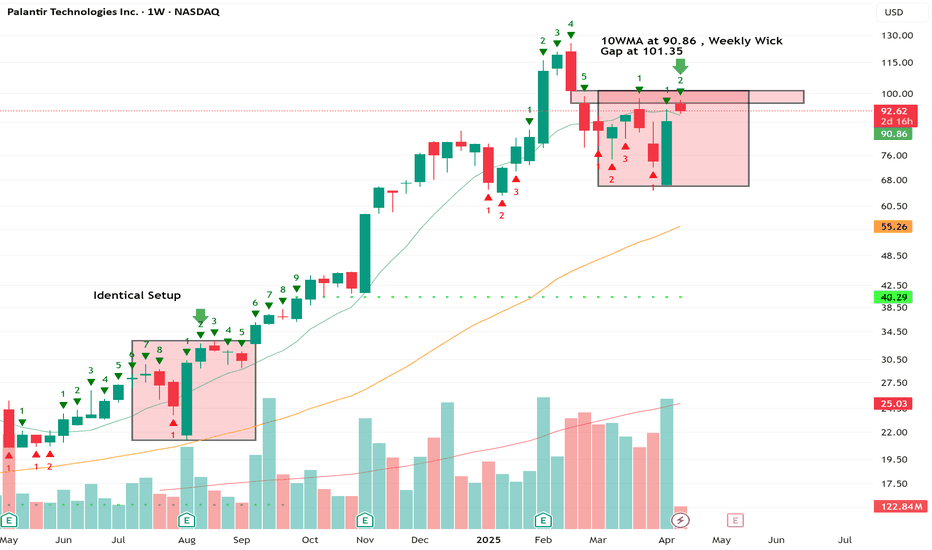

$PLTR Trade: Buy $90.86 , Target $101.35Beep Beep. Hope everyone is taking care of their trading accounts during this volatile phase in the markets. I noticed an identical setup on the weekly from back in August 24' and I'm looking to take advantage. We have a trend reversal on the Tom Demark sequential that helps identify trend exhaustion through a 9 Count. Currently on a 2 Count, we're testing the gap while simultaneously testing the 10WMA at 90.86.There is also a weekly gap at 101.35 ... Entry would be the 10WMA. Target the weekly Gap. Trade is as follows:

Trade Idea - Swing NASDAQ:PLTR $95 Calls 4/25

Entry - 10 WMA @ $90.86

Target - Gap on Weekly at $101.35

EURUSD - Understanding PriceIn this video I go through what has been happening with EURUSD in the past week, where price has reached, where it is likely going, what has happened yesterday and where we are possibly going to go to today. Pretty straight forward stuff using good ol' ICT concepts.

I hope you find this video insightful, because it's the truth of the markets.

Good luck and happy trading!

- R2F Trading

GBPJPY TRADE UPDATE: Is the Bull Run Still On? | Reading CandlesGBPJPY TRADE UPDATE: Is the Bull Run Still On? | Reading Candles

In our latest video, we’re revisiting the GBPJPY trade setup shared earlier this week. With an entry at 188.813, a protective stop loss at 186.814, and a target at 195.170, this swing trade was built on a solid confluence of structure, price action, and momentum bias.

So far, price has respected the entry zone and is making a slow but steady climb. In the video, we break down what’s happening now, how the market reacted to recent news events, and whether the move still has enough steam to reach our target.

We also touch on:

The importance of letting your trade breathe

How to manage open profits without micromanaging

Why patience is one of your most profitable skills

This isn’t just about GBPJPY—it’s about trading with a plan and letting the probabilities play out.

Have you ever exited a trade too early, only to watch it hit your original target later? Let’s talk about that in the comments.

📺 Watch the full update on and stay locked in.

The Market Wins... For now... Let's talk CryptoIt seems that when I said in my previous videos "no matter what we want, Bitcoin can technically shoot up to a million tomorrow because that's just crypto", Crypto heard and said, "yeah, we'll do that". Kidding, we're not at a million nor will we be today or tomorrow. And at some point it will reverse because we need more demand for a sustainable push to new ATH's (peep 2021-2023 as I mention in this video). But at what point? Not for us to say until we start to see signs of tapering.

Once we broke out and consolidated out of our strong selling channel, we were given the heads up to be careful with our shorts - and with a certain amount of levels broken (i.e. FWB:88K ) I closed most of my short positions. But I do still have a HTF target at lower levels.

most importantly, we don't dictate to the market when it goes where. It decides on it's own and we wait for signals utilizing the algorithms and volume to guide us.

This is a long video because I don't have the "answers" as to why BTC is up 10%! But I still urge everyone to stay patient and cautious, either long or short, because in all markets there is clearly something being prepared for.

Happy Trading :)

The Importance of Framing a NarrativeIn this video I go through a trade setup and the importance of framing a narrative in your trading. This allows you to wait for trades to come to you, rather than making up trades out of thin air, which we all know does not usually end well.

I hope you find this video insightful.

- R2F Trading

Collective Confluence among USD majors = USD strengthAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

VWAP Order Types: How Small Funds Use them.VWAP orders are used by Independent Small Funds Managers. IF a Small Fund or Small Asset company has 3 billion or less assets under management, the SEC classifies them as NOT a professional side entity.

This is because most independent Small Funds Managers have no Financial Degree, no professional certification aka CMT, CFA etc.

These managers often know less about the inner workings of the stock market than the average retail trader. It is wise to check to see the dollar value of a small fund and make sure it has more than 3 billion in assets as these managers have minimal experience, education, and usually no certification.

The small funds managers became enamored with the VWAP order as an order that could be placed several days to weeks ahead and then trigger when volume surges.

Unfortunately, that can often cause major sudden whipsaw action. especially intraday and pose much higher risk of sudden huge run downs when buyers evaporate.

The 2010 FLASH CRASH that stunned the financial world was an error on the part of a Fundamental trader who accidentally hit the VWAP order type rather than the TWAP order type for selling futures he had decided to sell. The VWAP order quickly caused a major stock futures sell off especially for the SP500 futures. Then the VWAP caused a systemic spreading of selling into the stock market and options market.

During highly stressed market conditions VWAPs triggering can drive prices down as panic among the less informed retail groups spreads rapidly. The goal is to enter a sell short with pro traders, rather than chasing a VWAP order that is spiraling out of control. When the VWAPs cease, then the market whipsaws or rebounds suddenly upward again.

This is just a snippet of what you need to learn about VWAPS but it is a good start for all of you. Trade Wisely

Why Is the T Bond Heading Down?The downward pressure did not start with the Liberation Day tariffs on 2nd April.

Based on the 30-year long-term bond price chart, the market peaked in 2020, then broke below a major support line—established since the 1980s—in 2022.

Since that break, US bonds have been on a downward trajectory.

So, what happened in 2020 and 2022 that set the bond market on shaky ground?

Why is the recent tariff shock just a continuation of developments that began back then?

And where are bond prices heading next?

This goes beyond investors offloading its US Treasury holdings after 2nd April.

U.S. Treasury Futures & Options

Ticker: ZB

Minimum fluctuation:

1/32 of one point (0.03125) = $31.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

BTCUSD 4/22/2025Come Tap into the mind of SnipeGoat, as he gives you an update of current Price Action based on his previous analysis & call outs. You've NEVER seen transparency like this. You've NEVER seen Precision like this.

_SnipeGoat_

_TheeCandleReadingGURU_

#PriceAction #MarketStructure #TechnicalAnalysis #Bearish #Bullish #Bitcoin #Crypto #BTCUSD #Forex #NakedChartReader #ZEROindicators #PreciseLevels #ProperTiming #PerfectDirection #ScalpingTrader #IntradayTrader #DayTrader #SwingTrader #PositionalTrader #HighLevelTrader #MambaMentality #GodMode #UltraInstinct #TheeBibleStrategy

COLLECTING CONFLUENCE across multiple timeframes is your job!!!!All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com