Beyond Technical Analysis

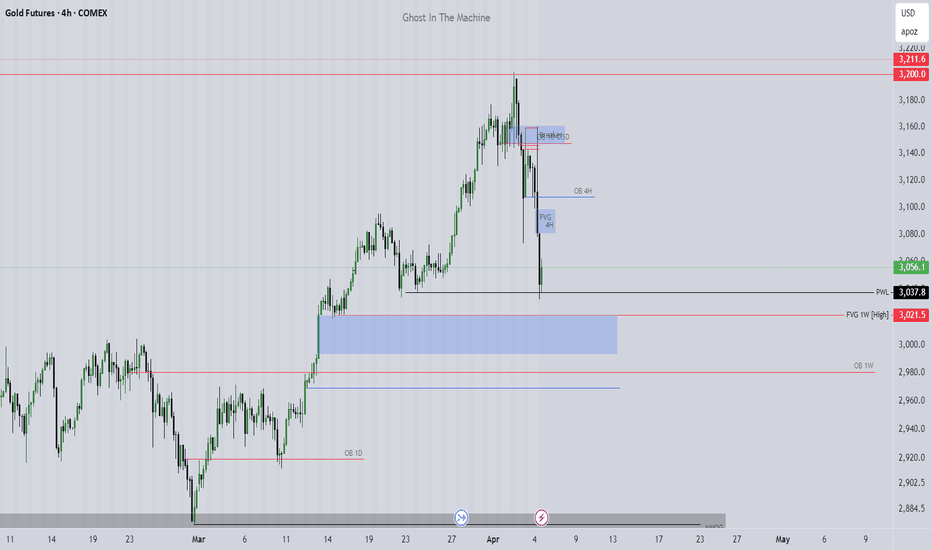

Fundamental V Technical Analysis, who will win? SELL GOLD?All the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

This is Wyckoff Volume Spread Analysis Gotcha Bar with No DemandIn this short video, Author and Trader, Gavin Holmes explains a Wyckoff Volume Spread Analysis Gotcha Bar followed by No Demand on the four hour chart of the E-Mini S&P Futures contract.

This set up appeared last week and again today and is a clear indication of market weakness.

As I type this the headline on BBC News is "Global Markets Plummet as US Tariffs Take Effect.

Panic selling is often an opportunity for the chart readers who can identify a Shakeout, not here yet but watch, I will keep You all posted. Best wishes, Gavin Holmes

RBLX - Why am I not shorting this when everything is dumping?The algorithms built into this chart tell me everything I need to know. Bullish trajectory, bullish movement - and if you remember my RBLX videos from 1 year ago+, this is a great company and all that liquidity that was built in the $20's/$30's/$40's was not for nothing!

This chart, in my opinion, is poised for a continuous breakout once we grab further liquidity from these demand zones, fill the necessary gaps, and proceed to build bullish liquidity.

Outside of the all-important algorithms, obviously we need to be investing in companies with strong fundamentals - and this, to me, is one of them.

To reiterate, I am looking for an entry here in the low $40's at our daily gap fill and strong HTF demand zone.

Happy Trading :)

Aren't you glad you were PATIENT!! Opportunities incoming!I know I got on the nerve of some Crypto bulls over the past few months, stating over and over again that now was not the time to buy! Feel free to watch those linked below - they are absurdly accurate to what has happened since...

Well, I now present to you, Crypto Discount.

Stay patient and smart - but we're definitely approaching levels that could be excellent to start building a long term position in some of these names.

Happy Trading :)

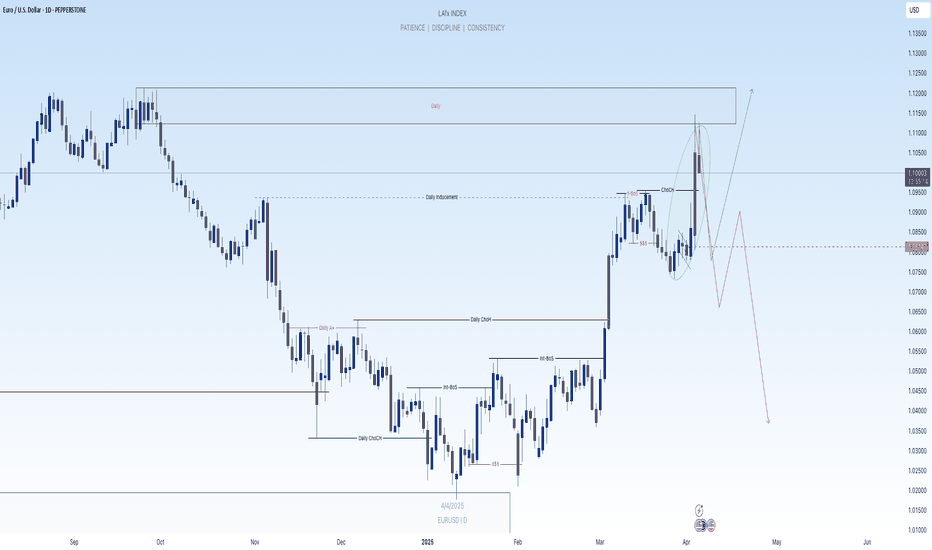

Markets in Turmoil and Correlations breaking - SELL GBPUSDAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

The Perfect Trade. How I've been preparing you for this S&P DUMPThis has been the basis of my 5 recent videos on SPY - walking you through what the market was doing, what algorithms were in play and important to keep an eye out for - and ultimately, how to catch this most recent dump on a rejection (and proof) of teal strong selling.

My best trade ever in terms of profit and preparation, patience, etc.

Happy Trading :)

Market review week ending Friday 4th April- Part oneVideo review of the state of the market and part one of trading plan for next week. Covers macroanalysis of current currency indexes along with VIX and starts reviewing our chosen watchlist verifying assets we are interested in creating trading plans for the week on.

How to Identify Double Top Formation - A Long-Haul Bear?How to identify double top formation?

Is the US market still forming this double top formation, or has the pattern already completed, signaling a deeper correction to come?

In this discussion, we will focus on the latter question: whether this bear is going to be a long-haul bear.

3 parts of today tutorial:

1. How to Identify Double Top Formation is completed technically?

2. How to cross reference to its related markets?

3. How do the fundamental developments confirm these technical studies?

E-mini Dow Jones Index Futures & Options

Ticker: YM

Minimum fluctuation:

1.00 index point = $5.00

Micro E-mini Dow Jones Index Futures

Ticker: MYM

Minimum fluctuation:

1.0 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

Understanding the ICT Venom ModelIn this video I break down the ICT Venom Model as recently described by the man himself on his YouTube channel. I am sure he has more details on the model he has not released, but I basically attempt to give my two cents on NQ and the model itself.

I hope you find the video useful in your endeavours regarding learning ICT concepts as well as trading in general.

- R2F Trading

Solana - The Bullrun Is Not Over Yet!Solana ( CRYPTO:SOLUSD ) might create another move higher:

Click chart above to see the detailed analysis👆🏻

As we are speaking Solana is sitting at the exact same level as it was about 3.5 years ago in the end of 2021. In the meantime we saw a lot of volatility and Solana is now once again retesting a major previous support level. Despite the harsh recent drop, the bullrun remains valid to this day.

Levels to watch: $120, $250

Keep your long term vision,

Philip (BasicTrading)

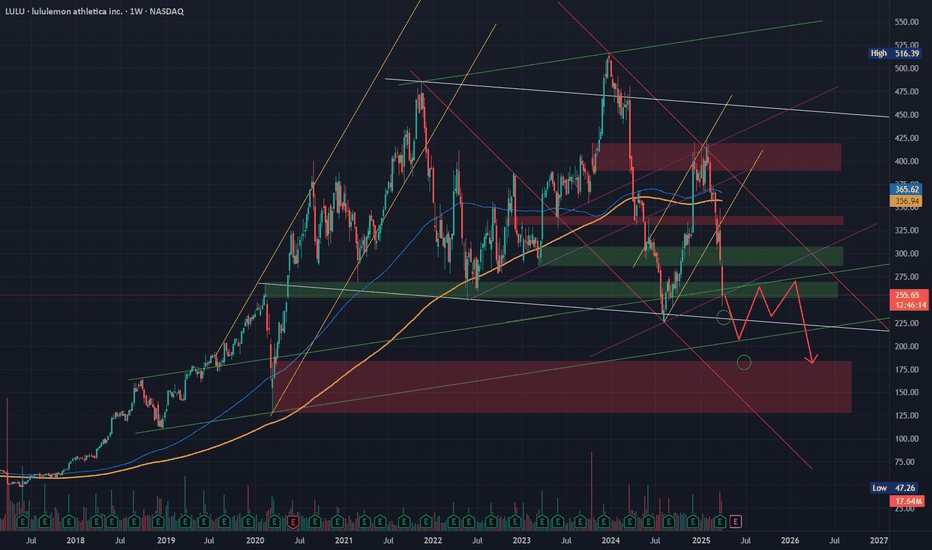

LULU - Tough Road Ahead - What to look out forTough month and outlook for LULU after recent earnings and macro-economic outlook. I'm looking to see a few things play out prior to re-entering a position here - For now, looking for clear bearish liquidity builds to short toward green buying and looking for a subsequent drop from there toward HTF demand at $185

Keep in mind the white tapered selling algorithm at $131 which could be an important hold if HTF price wants to prove a bullish story

Happy Trading :)