Beyond Technical Analysis

TRADE THE FACTS!!!!...NOT...what you think will happenAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade then this is how you will gain consistency in you trading and build confidence

www.tradingview.com

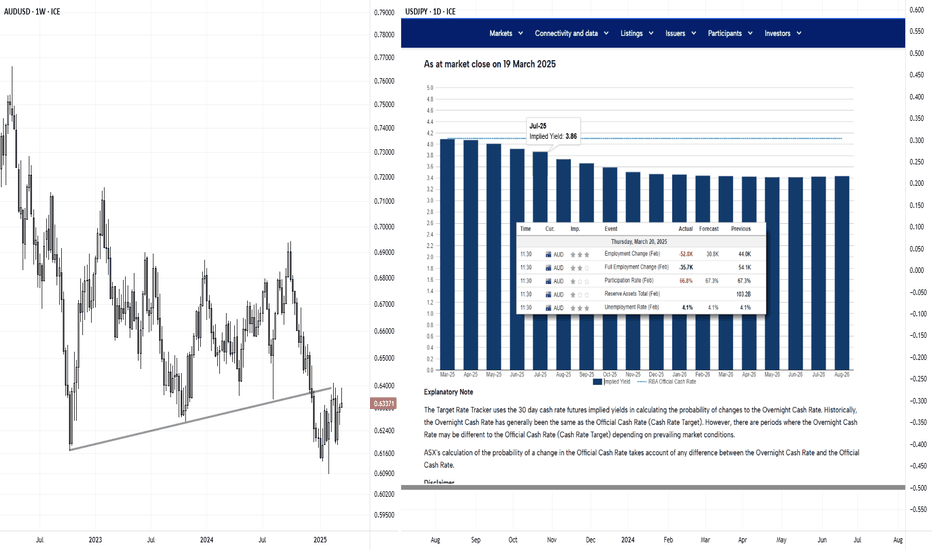

Why the Weak AU Jobs Report Might Not Force the RBA's HandAustralia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given.

Matt Simpson, Market Analyst at City Index and Forex.com

Gold Above $3,000 and MoreAccording to the World Gold Council, more than 600 tons of gold — valued at around $60 billion — have been transported into vaults in New York. Why are they doing that?

Since Donald Trump election in November, there is around $60 billion worth of gold that has flowed into a giant stockpile in New York.

The reason why physical gold is flowing into the US is because traders are afraid Trump might put tariffs on gold.

Gold Futures & Options

Ticker: GC

Minimum fluctuation:

0.10 per troy ounce = $10.00

Micro Gold Futures & Options

Ticker: MGC

Minimum fluctuation:

0.10 er troy ounce = $1.00

1Ounce Gold Futures

Ticker: 1OZ

Minimum fluctuation:

0.25 per troy ounce = $0.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

RISK ON or RISK OFF?? Correlations between JPY and the IndicesAs a trader it is imperative that you understand the correlation between the indices and 'flight to safety' currencies and how this determines whether you are in a risk on or risk off environment and how quickly that can change. You can use this information to help you make informed trading decisions in the market

Sentiment Extreme on the Yen Could Bode Well for Commodity FXI take a closer look at the Japanese yen futures market to highlight why I think the Japanese yen has reached an important inflection point. And that could further support the bounce of yen pairs such as AUD/JPY, CAD/JPY and NZD/JPY - alongside USD/JPY should the Fed not be as dovish as many hope.

Matt Simpson, Market Analyst at City index and Forex.com

AMD- Bullish, Earnings power is there now. Im bullish AMD around these levels.

High growth rates year over year potential.

its trading below the 1000 day moving averages (200 week moving average).

Stock may rise or bounce around for a few months, but historically should do well over the next few years.

Its priced at 20 forward PE, which is cheaper than the Sp500 and most of the large cap stocks.

However, it has a higher growth rate potential expected by analysts, in the 20-30% annual year over year growth range. Each quarter could bring higher valuation as it performs (potentially).

Peter lynch math says we should be willing to pay up to twice the growth rate in PE terms for a good grower. Amd is only trading at 1 x the growth rate.

Do your homework and trade small.

Cheers.

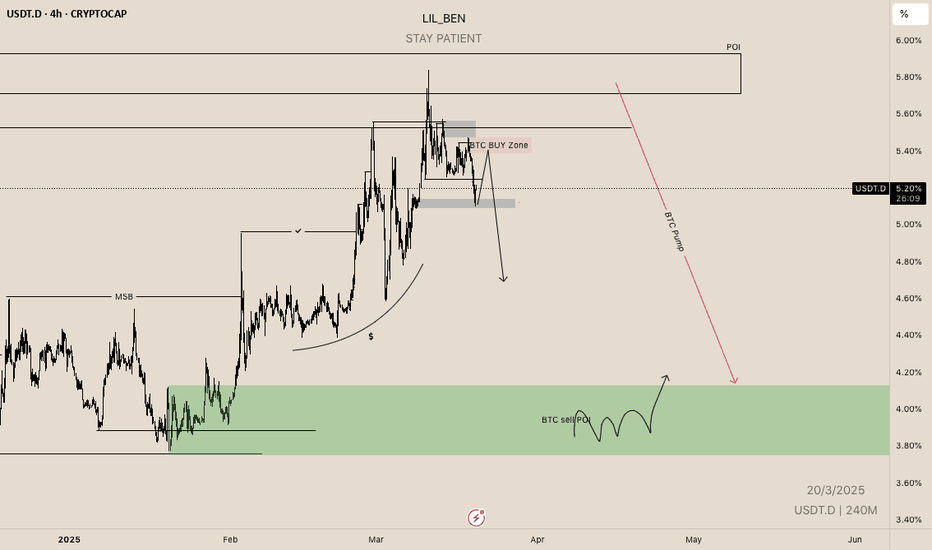

Weekly Market Analysis - 16th March 2025 (DXY, NZD, ES, BTC)This is weekly market analysis of a few pairs (DXY, NZD, ES, BTC).

I haven't done one of these in a while, but here it is!

I would have done more pairs but the video was already 30 minutes long and I went into more teaching rather than pure analysis.

I hope you found it insightful to your own trading, because what I teach is the truth of the market regardless of whatever specific strategy you use for trading.

Anything can make money in the markets, but of course, risk management and discipline rule all.

- R2F Trading

SPY: Update for Week of March 17Hey everyone,

A bit of a longer idea, but I had lots to talk about about, I guess.

Here is the summary information for next week:

Summary

Most likely high target 568.21 (probability assigned 18%)

Most likely bear target 552.74 (probability assigned 64%)

Retracement target 557 (probability 71%)

Expected return -0.11% (very conservative this week interestingly enough).

EMA 200 average target 533 range

Weekly Levels

Weekly Forecast

Thanks for watching and reading and as always safe trades! 🚀And not advice!🚫