GBPJPY - MASSIVE Swing Potential Buy - Happening Now (March)This is a longer term swing idea.

Top down analysis from HTF indicates that:

- Push lower on JPYX Yen index

- Retrace higher on XXXJPY pairs

- Divergence in the Yen pairs, confirming a low

- Price Action has created a lot of liquidity on the downside, which has been taken, signifying upside.

Comment below if you have questions. Happy to help.

Peaceful Trading to you all.

Beyond Technical Analysis

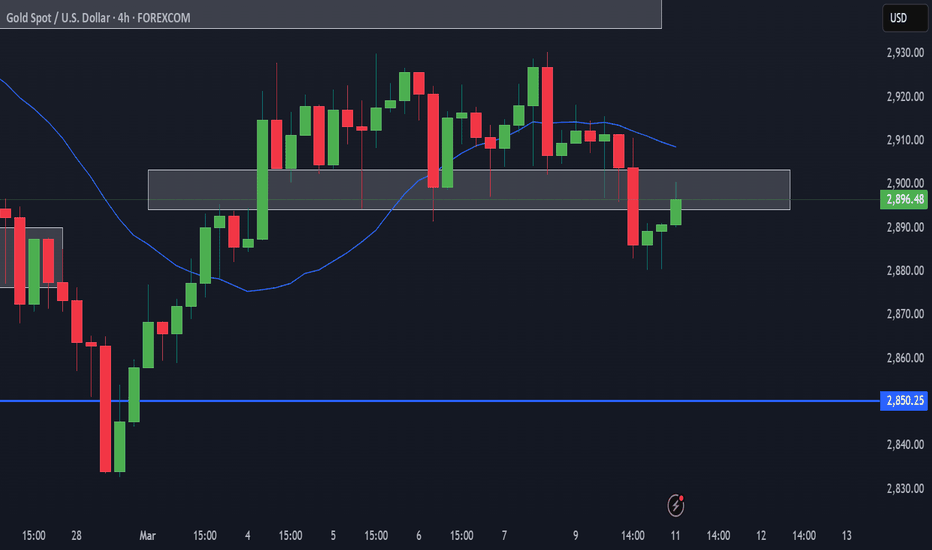

XAUUSD - What Happens When You Get It Wrong? Business as usual.

Watch this video for a brief view of what happens when you get it wrong.

Risk stays managed – no revenge, no overleveraging.

Edge stays the same – every trade is part of a bigger picture.

Execution stays disciplined – no hesitation, no fear, no negotiations.

That’s trading.

What’s your view on the market today? Drop your thoughts below.

Inflation Leading Indicator Data with Agricultural Commodities Inflation leading indicator data is not derived solely from CPI numbers; more importantly, we must consider what drives these CPI numbers. By understanding this, we can stay ahead of the mass market.

Looking at past trends, we can observe that CPI numbers and agricultural commodities tend to move in tandem.

In this discussion, we will explore why agricultural commodities are an effective tool for projecting inflation direction and examine where these commodities may be heading.

Micro Agriculture Futures:

. Corn: MZC

. Wheat: MZW

. Soybean: MZS

. Soybean Oil: MZL

. Soybean Meal: MZM

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

2025 ICT Mentorship: Premium & Discount Price Delivery Intro2025 ICT Mentorship: Lecture 4_Premium & Discount Price Delivery Intro

Greetings Traders!

In this video, we dive into the fundamental concept of Premium and Discount Price Delivery—a crucial aspect of smart money trading that helps us understand how institutions approach the market with precision and efficiency.

Understanding Currency Pairs

Before we explore premium and discount dynamics, it's essential to grasp the basics of currency pairs. A currency pair, like EUR/USD or GBP/USD, represents the value of one currency against another. For example, EUR/USD shows how many U.S. dollars (the quote currency) are needed to purchase one euro (the base currency). Just like any other tradable asset, currency pairs fluctuate in value due to various economic and market factors.

Trading Is Part of Everyday Life

Believe it or not, everyone in the world is a trader. Whether you're buying groceries at a store or negotiating for goods and services, you're participating in trading activities daily. Some people aim to purchase items at a discount, while others can afford to pay a premium—it’s simply part of life.

However, banks and financial institutions take trading to another level. They don’t just trade haphazardly—they operate with extreme precision, aiming to make high-quality investments by executing trades at premium prices and targeting discount levels. This strategic approach allows them to capitalize on market inefficiencies and ensure profitable outcomes.

Why Premium and Discount Matter?

The concept of premium and discount price delivery is foundational for understanding how the market moves. By recognizing where the market is trading at a premium (overvalued) versus a discount (undervalued), traders can make more informed decisions and align their strategies with institutional order flow.

Stay tuned as we break down how to identify these zones on a chart and how to incorporate them into your trading strategy. Make sure to like, subscribe, and turn on notifications so you never miss an update!

Happy Trading,

The_Architect

BUY EURJPY - JPY and CHF weakness in the marketTrader Tom, a technical analyst with over 16 years’ experience, explains his trade idea using price action and a top down approach. This is one of many trades so if you would like to see more then please follow us and hit the boost button.

We are proud to be an OFFICIAL Trading View partner so please support the channel by using the link below and unleash the power of trading view today!

www.tradingview.com

What happens if you give a TikTok trader a billion dollars?In this video, I covered the topic of accumulation and distribution of large positions.

I explained why big market players prefer using limit orders when building and offloading their positions.

I also talked about how retail traders — who I often call TikTok traders — tend to rely on market orders, and why the price is more likely to move against the masses of TikTok traders.

Understanding this is crucial when analyzing what’s really going on "under the hood" of the market. I’ll dive deeper into this in my upcoming posts.

So don’t miss out! Subscribe!

Different Ways to Manage Your TradesFinding the perfect trade setup is just one part of the equation. How you manage that trade can be the difference between consistent profits and missed opportunities. In this video, I’ll break down the different ways you can manage your trades and how each method impacts your results.

We’ll cover essential trade management techniques, including setting fixed take-profits and stop-loss levels, using trailing stops to lock in gains, scaling out of positions with partial profits, and actively monitoring trades for dynamic adjustments. Each method has its own strengths and weaknesses, and the key is finding what aligns with your trading style, risk tolerance, and market conditions.

I’ll also share insights on how I utilize trade management to maximize returns while keeping risk under control. Whether you prefer a hands-off approach or actively managing your trades in real time, this video will help you refine your execution and make smarter decisions.

Watch the full breakdown now, and let me know in the comments, how do you manage your trades?

- R2F Trading

Relax guys! Technical Analysis predicted this a month ago. It's okay traders, markets are allowed to go Down too. In fact it's responsible of them to, as that is what makes a healthy market cycle

I called this downtrend a month ago, using a step by step process I use for all markets.

Give it another week or two, and the uptrend will return

SELL XAUUSD (GOLD) - Is it time to SELL GOLD????Trader Tom, a technical analyst with over 16 years’ experience, explains his trade idea using price action and a top down approach. This is one of many trades so if you would like to see more then please follow us and hit the boost button.

We are proud to be an OFFICIAL Trading View partner so please support the channel by using the link below and unleash the power of trading view today!

www.tradingview.com

No Demand and Wyckoff VSA Upthrust in Downtrend ExplainedIn this short educational video, Author and Fund Manager, Gavin Holmes, explains the key Wyckoff Volume Spread Analysis trade set ups called "No Demand After Selling" and "Upthrust after selling confirmed" using Trade To Win for TradingView Pro.

The example is the NQ Nasdaq futures but this set up works in all markets and multiple timeframes.

Market Crash? No: Sector Rotation!The news is catching up (two weeks late) to the stock market heading into bear territory but that is NOT the whole picture! Investors need to know that there are winners out there in quality stocks as the risky YOLO plays (tech, crypto) are losing. This specific rotation perfectly fits the model of the stock market rolling over into bearish territory.

Follow the money!

Once Upon a Bitcoin CrashBitcoin’s recent price action has traders excited, but is the rally sustainable? In this analysis, I break down key technical indicators, trend patterns, and historical price behavior to explain why Bitcoin is likely heading lower before any major recovery.

🔹 Key Highlights:

✔ Price Prediction: Expecting a pullback to $67,000–$73,000 before a bounce.

✔ Technical Breakdown: Analyzing support, resistance, and inflection points to identify future price action.

✔ Trading Strategy: Why shorting Bitcoin could be the right move in the current setup.

✔ Brief technical analysis instructional: higher highs and lower lows.

Don’t get caught in the trap—stay ahead of the trend!

This isn't investment advice, what are you crazy? You would have to be to take investment advice from a stranger on the Internet. So don't do it.

Addendum: when I draw that lower trend line in the first part of the video I should attach that to the red bodies not the green ones