What is Higher High, Higher Low, Lower Low, Lower High

In this educational article, we will discuss the foundation of price action analysis: the concepts of highs and lows.

In order to grasp that concept, you should learn to perceive the price chart as the sequence of zigzags.

Depending on the direction of the market and the shape of these zigzags, its peaks will be called differently. There are 6 types of them that you should learn to recognize.

1️⃣ Equal Highs (EH).

The peaks of bullish moves will be called equal highs, if they perfectly respect the same level (resistance), retracing from that and not managing to break above.

2️⃣ Equal Lows (EL).

The peaks of bearish moves will be called equal lows, if they perfectly respect the same level (support), bouncing from that and not managing to break below.

3️⃣ Higher High (HH).

The peak of a bullish move will be called Higher High, if the price manages to violate the previous high after a retracement.

4️⃣ Lower Low (LL).

The peak of a bearish move will be called Lower Low, if the price manages to violate the previous low after a pullback.

5️⃣ Higher Low (HL).

The peak of a bearish move will be called Higher Low if, after a retracement from the high, the price manages to set a low that is higher than the previous low.

6️⃣ Lower High (LH).

The peak of a bullish movement will be called Lower High if, after a pullback from the low, the price sets a high that is lower than the previous high.

Why these terms are so important?

Because, firstly, you can apply them to objectively identify the market trend.

Secondly, all the price action patterns are based on a combination of these highs and lows.

You should learn these terms by heart, and you should learn to perceive the price chart as the sequence of zigzags, with a strict designation of each peak.

❤️Please, support my work with like, thank you!❤️

Wave Analysis

Strategy 4: 0.618 fib confirmation swing 0.618 fib confirmation swing

• This strategy provides opportunity for multiple trades

• First swing to 0.618 occurs after breaking a trendline.

• Once price is able to swing to 0.618, certainly confirms a higher probability that price will retrace to the entry for a much higher swing.

* • This can be used on inverted charts as well.

HOW TO USE FIBONACCI LIKE A PRO #part1Hi there! Bolu here

The Fibonacci tool is one of the most popular tools on trading view and many traders use Fibonacci on their charts.

FIBS are a major part of my trading system as you can see on this chart, i use it all the time, as I have to know what structure is saying on major and minor structure to aid my analysis and entry/exit confirmations.

I will be sharing how I use my FIBONACCI tool in this post and you can take some notes and add to your trading plan if you want.

BASICS OF FIBONACCI

In mathematics, the Fibonacci sequence is a sequence in which each number is the sum of the two preceding ones. Numbers that are part of the Fibonacci sequence are known as Fibonacci numbers, commonly denoted Fn . The sequence commonly starts from 0 and 1, although some authors start the sequence from 1 and 1 or sometimes (as did Fibonacci) from 1 and 2. Starting from 0 and 1, the first few values in the sequence are:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144.

The history of Fibonacci is all over the internet. My Job here is to show you how it can be used to your trading advantage.

I majorly use the FIB retracement & FIB extension tool. Trading-view provides a whole lot of other types of FIBs, but they are not a part of my trading system, so i only focus on what is relevant to my Trading plan by keeping it simple.

HOW TO USE THE FIBS

It is imperative to understand that Fibonacci retracement is a tool used to measure the retrace of a counter trend based on the current trend.e.g, After a downtrend formation, how far the correction would go would be measured with the FIBs.

while the Fibonacci extension tool is used to measure the 'length' of the continuation of that trend and is mostly used as Take profit levels

IT CAN ONLY BE USED IN A TRENDING MARKET. You need a valid Uptrend point or Downtrend point to draw out your FIBd]

Drawing out FIBs on the chart is a 3step process

STEPS TO DRAW FIBS

STEP 1 : SPOT A VALID BOS.

STEP 2 : IDENTIFY POINT A – POINT B OF THE IMPULSE MOVE .

STEP 3: DRAG FIB FROM THE HIGH TO THE LOW / LOW TO THE HIGH .

I changed the default settings that the FIBS came with on Trading-view and replace the numbers and colors.

Each FIB Percentage level means something unique on the charts and that helps with understanding what the trend is doing.

The retracement levels are used to see how strong the pullback phase is. Understanding the strength of the pullback is one of the most important things to know in the trend . I will probably make another post on 'Trend strength Analysis'..., You can put it in the comments if you would like to study it with me. Now, back to our FIBs.

Every FIB level is uniquely important and useful. The FIB Level that aligns with a key level of structure is High Probability.

In the Part 2 of this post, i would share the 'secret sauce' of the FIB retracement levels and how they can be used in both Major and Minor Structure.

THE BEST PATTERN TO TRADE AT THE END OF CORRECTIONS IN AN UPTREN1)The price touches a point with a gap

2)Pulling back and making a lower low pivot while breaking last low pivot.

3)Price attempts again and succeeds in breaking the range.

4)Failure to fight a dynamic resistance.

5)Price dump to activate the SL of Longers that is under lows A&B

6)A fake move to get in hasty Longers

8)Scaring and hesitating these hasty buyers

9)Breaking the channel and pulling back and moving away from it

A Guide to Defining 4 Key Elements for Consistent SuccessAre you tired of inconsistent trading results? It's time to master the art of profitable trading by defining four key elements that will ensure your success. In this post, I'll guide you through each step of the process - from your entry strategy to take profit - so that you can create a consistent and effective trading plan.

First, I'll dive into entry strategy and why it's important to have a set of rules for every trade you open. I'll outline how to enter a trade and why you should follow the same rules for each trade.

Next, I'll discuss stop loss and how to define where to put it. I'll help you calculate how much risk you're willing to take and how to set a stop loss that protects your capital.

I'll then explain the importance of exit strategies and what charts you need to see before exiting a trade. You'll learn when and why to exit a trade and how to make informed decisions based on chart patterns.

Take profit is another key element of successful trading that we'll cover. You'll learn when to take profits and what charts to look for to make those decisions. We'll help you set realistic goals for your trades and stick to them.

Time frame selection is critical for consistency in trading, and we'll show you how to select the right time frame for your trading style. We'll explain why sticking to one time frame is essential for success.

Finally, we'll teach you how to manage risk and calculate the amount of capital you're willing to risk on each trade. You'll learn how to accept the possibility of losing trades and see how it affects your overall profitability.

With this guide, you'll be well on your way to mastering profitable trading by defining the four key elements of success. Start taking control of your trading today!

Video Description about this Topic : www.tradingview.com

A CASE FOR TECHNICAL ANALYSISHello,

Over time, we have been challenged to prove wetherit is possible to make money through technical trading. Here is a short strory about Paul who was able to exactly demonstrate that.

One example of a technical stock trader who rose from rags to riches is Paul Tudor Jones. He started his career in the 1970s as a clerk on the trading floor, but he quickly learned technical analysis and began trading futures contracts. Through his use of technical indicators and chart patterns, he was able to make successful trades and eventually started his own hedge fund, Tudor Investment Corporation. Jones' success as a technical trader allowed him to amass a fortune, and he is now considered one of the most successful traders in history.

LIFE JOURNEY

Paul Tudor Jones was born in Memphis, Tennessee, in 1954. His father was a cotton broker, and Jones was exposed to the world of trading from a young age. He went to the University of Virginia and studied economics, but he was more interested in the markets than in academia. After graduation, he got a job as a clerk on the trading floor of the New York Cotton Exchange.

Jones quickly realized that he wanted to become a trader, but he had no capital to invest. So he borrowed money from friends and family and began trading futures contracts. He was a quick learner and started using technical analysis to identify trading opportunities. Technical analysis involves analysing market data such as price and volume to identify trends and patterns, and Jones became a master of this approach.

In 1980, Jones started his own hedge fund, Tudor Investment Corporation, with just HKEX:30 ,000. He continued to use technical analysis to make successful trades, and his fund grew rapidly. In 1987, he made a fortune by correctly predicting the stock market crash and profiting from it. By the end of the year, his fund was up 200%, and he had become a legend in the trading world.

Jones continued to refine his trading strategies over the years, and he was one of the early adopters of computerized trading systems. He also became a prominent philanthropist, donating millions of dollars to charitable causes. Today, Jones is worth an estimated $6.4 billion, and his hedge fund is one of the largest and most successful in the world.

Technical analysis works but you must become good at it to make money.

Good luck & all the best in your journey

Tradingview Volume toolsI've been using Tradingview for just over 8 years now. When I initially started using it I was transitioning from using Footprint tools. I would use techniques that in essence allowed you to see inside a candle. Coupled with techniques such as "DOM" Depth of Market and Cumulative Delta. After a while you get to see some of this stuff without the need of indicators.

Tradingview have steadily added various tools to the platform and with a little help from being able to code your own tools it's made it an interesting space to play.

So here's a quick overview on the abilities, encase you have yet to explore. This is not a lesson on volume as such, just educating you as to what the possibilities can be.

Most would have seen or at least know about the volume on the X axis.

This simply gives an idea of the happening of that particular candle, of course things can alter or yield different results based on settings and time frames.

we've taken the time to incorporate this simple volume in one of our own indicators. Which is coupled with a Stochastic and a few other bits.

It can also be used standalone for spotting divergence for example. You can see how the volume up and price up yet in the third price move up, volume has lowered.

There are also various styles of showing this volume data - one such tool is Weiss waves.

These are great in conjunction with techniques such as Elliott Waves and Wyckoff. I've shown this over the last two years here on TradingView and both of these techniques have been very useful on Bitcoin during this time.

I mentioned CVD the cumulative Volume Delta, here you can see this under the Weiss Wave indicator. Like I said, have a play around with these on your own charts. You will spot some interesting things once you get to know them. Try various instruments as well as timeframes.

More recently I posted a video on using Chat GPT to build a pinescript indicator. Here's the link to that post.

Well, I've taken that a few steps further.

What started as an idea in terms of using Footprint, X axis volume and then what's called periodic volume profile. I personally like to turn the bars/candles off when I got this on.

Here's another view - this is the session volume profile and periodic volume combined without the candles being visible.

This new indicator extracts various pieces of data and paints key levels based on my old trading style. As you can see today, this is showing like a magnet where the key levels in Bitcoin are likely to be. There's a bit more to it than that but in essence, its what I am showing here.

To finish with you have two other tools here on Tradingview - one which is fixed range volume, just as it says on the tin. You can see volume inside a range you determine.

I have used a low and a high here to find the PoC - Point of Control.

Then finally, you have visible range; this I tend to use less personally, but I know many people like it. This allows you to view the volume profile based on what you have visible on the chart. As you can imagine, as you zoom in n out, it can change.

Like I said, this is not a lesson on each tool - it's an intro to, for you to spend the time to play around with these tools. Feel free to ask questions below.

Enjoy the rest of the week!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

Important to Understand About Leverage and Your Own EquityHi Everyone! This is simply a brief summary of WHY it's important to understand how to use leverage. We should always start (begin) with how much of our own equity we should allow to be at risk of liquidation. I personally allow myself to use up to 3 percent of my TOTAL equity in a position; while also allowing the price action to move up to 15 percent against my SWING position. This tutorial is referring to SWING trading and NOT scalping.

I'm not going to take the time to write down everything here in the description. The content in the video should be sufficient to help one understand how to determine your position size. Your position size must rely on the following:

How much of my TOTAL equity should I risk in a leverage position?

What percent will I allow price action to move AGAINST my position before liquidating my position?

Knowing those two (2) things (above) helps you determine the proper size of your position and how much leverage you should use in that position to avoid losing more than I intended.

IMPORTANT: MAKE SURE YOU ARE USING ISOLATED LEVERAGE RATHER THAN CROSS LEVERAGE. Why? To avoid losing more of your total equity. Especially, if you did not setup a stop loss. It's best to simply use "isolated" leverage where at all possible.

Remember... This is NOT a detailed tutorial on margin (leverage) trading. The main purpose of this tutorial was simply to point out how to manage the amount of your TOTAL equity you are willing to risk in any given trade... Why? Because doing this also helps you determine what should be the proper size of your position. However, you cannot know the proper size of that position if you do not also factor in how much of a move you will allow AGAINST your position before being liquidated.

I'm not sure if this is confusing or not. It may be quite confusing to many and not so confusing to others. This is why it's best for you to watch the video.

Thank you for your valuable time!

Happy Trading and Stay Aweosme!

David

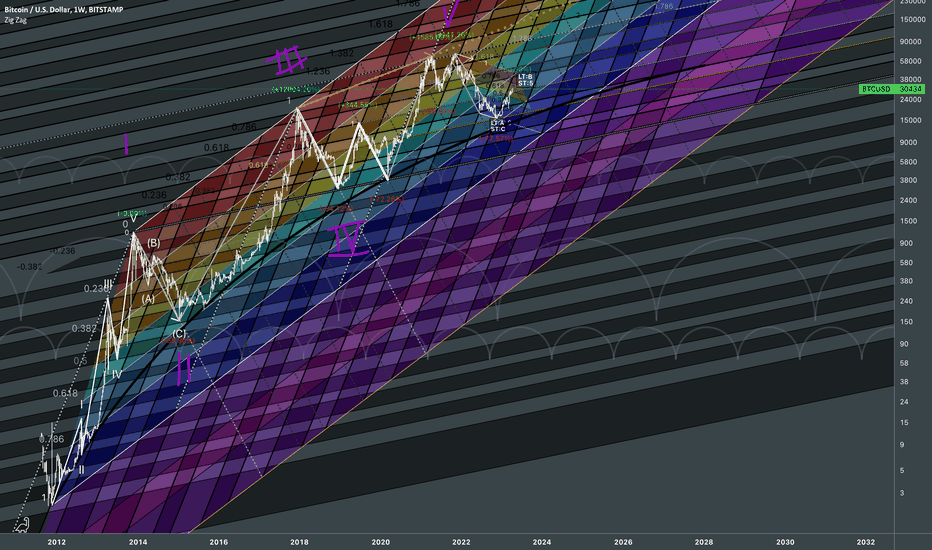

Bitcoin Fractal Dimensions II% 🕘 Fibonacci Reversal Zones give awareness about interconnectedness of historic patterns all the way to current candle. Projecting how one wave can be relative to the other using various Golden Ratios derived from waves of notable cycles.

Application of chaos theory behind the nature of the market in Fractal Geometry.

Long-term alertness for Violet Area:

Why? Because Bitstamp doesn't show candles before 2012. those crucial fluctuations when price was encountering levels.

BLX shows data before 2012 and covered with violet fib area from 1 to 1.618

Fractal Spit Up (Timing):

General Fibonacci Channel responsible for LT Reversals (Price+Time related fib line)

Vertical axis of Critical points of the Wavelength = Price related line

Since market has its own way despite of our perception on price formation, this way we keep neutrality for Long-term strategic aspect.

FREMA Levels:

Curve mimicking lows of price expansion against time scale. Mind 2024 bitcoin halving period.

If it really falls after reaching those hot short-term angled levels, that would be pre "assumed bullrun" period fueled by 2024 halving narrative. That's why relevant to our case fib levels are shown short length. Just like in quantum world particles arrear and disappear or be both, here the levels have their own limited time for the price to be reaching them. The sooner the price reaches them the more crucial reason for presence they have. Since wave frequency right there is high, it applies also to corrective waves. And Since corrective waves would have relatively same momentum measured as angles forming quantum world of possibilities - multi-universe fractal's critical points scaled in unfolding the market. Pretty much all opinions people do classical TA are summarized in terms of the market itself without without actually caring about the news background. Market has its own way and we know that external variable such as news, reports have positive or negative fundamentals already priced in as unfolding pattern to current candles. Odd chaotic movements of the market can be explained through this system of Fibonacci Channels. That's why subjective opinion is way too overrated since market as fractal system of unfolding patterns is more objective than opinions backed by classic TA at specific point of time. After all we care about reversal targets which can be justified by golden ratio rule governing the limits of waves and cycles.

Angles are important because they have time cycle properties within it because market is nothing but a curvature in PriceTime blocks covering variable rates of change of fluctuations.

The 5-Indicator Technical FusionThe Hidden Gem of Market Strategy: The 5-Indicator Technical Fusion

Ever felt like you've hit a gold mine when you discovered an ingenious, yet underrated, financial strategy? Buckle up, because today, we're diving deep into the world of technical indicators to unveil a mind-blowing market strategy that will leave you speechless. This strategy, called the 5-Indicator Technical Fusion, harnesses the power of five complex indicators, but we're going to focus on the one that sits at the perfect average. Get ready to unlock a whole new level of market mastery.

The 5-Indicator Technical Fusion:

The 5-Indicator Technical Fusion combines five advanced technical indicators that, when used together, create an unparalleled trading strategy. The five indicators are:

1. Schmancy Fibonacci Retracement Oscillator (SFRO)

2. Quantum Volume Expansion Index (QVEI)

3. Time-Traveling SMA (TTSMA)

4. Galactic Bollinger Bands Envelope (GBBE)

5. Psychedelic Relative Strength Index (PRSI)

6. Each of these indicators brings a unique perspective to market analysis, but the real magic happens when they're combined. However, we're here to talk about the one that hits the sweet spot right in the middle: the Time-Traveling 7. Moving Average (TTSMA).

Time-Traveling Moving Average (TTSMA) – The Hidden Gem:

The TTSMA is a revolutionary indicator that goes beyond the limitations of traditional moving averages. It uses quantum algorithms to simulate market behavior, projecting future price trends based on historical data. By analyzing the past, the TTSMA can predict future price movements with an astonishing degree of accuracy.

Why the TTSMA Rocks:

1. Predictive Power: The TTSMA's ability to foresee market trends before they happen gives traders a significant advantage in making informed decisions.

2. Time Efficiency: The TTSMA saves traders precious time, as it quickly identifies potential entry and exit points without the need for tedious manual analysis.

3. Risk Management: The TTSMA helps traders mitigate risk by providing insights into potential price fluctuations, allowing them to adjust their strategies accordingly.

The Secret Sauce: Averaging the 5-Indicator Fusion:

Although each of the five indicators in the Technical Fusion is powerful on its own, the true strength of this strategy lies in their combined power. To unlock the full potential of the 5-Indicator Technical Fusion, traders should use the TTSMA as the central pivot point while incorporating the insights provided by the other four indicators.

The 5-Indicator Technical Fusion, with the Time-Traveling Moving Average as its core, is a groundbreaking and largely undiscovered market strategy that offers traders unparalleled predictive power, time efficiency, and risk management. So, next time you're looking for an edge in the financial markets, don't forget to explore the hidden gem that is the TTSMA. You won't be disappointed.

Managing Psychological Resistance in Bitcoin TradingBitcoin has been gaining popularity in recent years as a digital currency, and its price has been subject to fluctuations. As traders look for ways to profit from Bitcoin, understanding psychological resistance becomes an important factor in trading decisions.

What is Psychological Resistance?

Psychological resistance is a level at which traders become hesitant to buy an asset, such as Bitcoin, due to a perceived high price. This level is not based on any technical analysis or fundamental data but is a result of human behavior and emotions.

For example, if the price of Bitcoin reaches HKEX:50 ,000, some traders may hesitate to buy it as they perceive the price to be high, which creates a psychological resistance level.

How can Psychological Resistance Affect the Price of Bitcoin?

When the price of Bitcoin reaches a psychological resistance level, traders tend to take profits or sell their positions, causing the price to drop. This can result in a short-term correction in the price of Bitcoin.

However, if the price is able to break through the psychological resistance level, it can result in a significant price increase. This is because traders who were previously hesitant to buy may now jump in, driving the price up.

Strategies for Trading Psychological Resistance:

1. Use Fibonacci Retracement: Fibonacci retracement levels can be used to identify psychological resistance levels. Traders can use the retracement levels to enter or exit their positions.

Fibonacci retracement is a popular technical analysis tool used to identify potential levels of support and resistance. The tool uses horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the price continues in the original direction.

2. Use Moving Averages: Moving averages can be used to identify trends and potential resistance levels. Traders can use the moving averages to identify potential entry or exit points.

Moving averages are a popular technical analysis tool used to identify the trend of an asset's price. Traders can use the moving average to identify potential entry or exit points.

3. Use Bollinger Bands: Bollinger Bands can be used to identify potential support and resistance levels. Traders can use the bands to identify potential entry or exit points.

Bollinger Bands are a popular technical analysis tool that uses a moving average and two standard deviations to identify potential levels of support and resistance. Traders can use the bands to identify potential entry or exit points.

4. Use Relative Strength Index (RSI): The RSI can be used to identify potential overbought or oversold conditions. Traders can use the RSI to identify potential entry or exit points.

The Relative Strength Index is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Traders can use the RSI to identify potential entry or exit points.

5. Use Volume: High volume at a psychological resistance level can indicate that traders are hesitant to buy at that price, which can result in a price correction. Traders can use volume to identify potential entry or exit points.

Volume is a measure of the number of shares or contracts traded in a specific asset. High volume at a psychological resistance level can indicate that traders are hesitant to buy at that price, which can result in a price correction. Traders can use volume to identify potential entry or exit points.

Psychological resistance is an important concept that traders need to understand when trading Bitcoin. By using technical indicators such as Fibonacci retracement, moving averages, Bollinger Bands, RSI, and volume, traders can identify potential entry or exit points at psychological resistance levels. However, traders should also be aware that psychological resistance is not an exact science, and the price of Bitcoin can be influenced by a variety of other factors such as market news, economic events, and investor sentiment. Therefore, it is important for traders to use a combination of technical analysis and fundamental analysis to make informed trading decisions.

In addition, traders should also be aware of potential psychological support levels, which are levels where traders may become more confident in buying an asset due to a perceived low price. These levels can also affect the price of Bitcoin and should be considered in trading decisions.

Overall, psychological resistance is an important concept that traders need to understand when trading Bitcoin. By using technical indicators and analyzing market sentiment, traders can identify potential entry or exit points at psychological resistance levels. However, it is important to remember that no trading strategy is foolproof and traders should always practice risk management and conduct thorough analysis before making any trades.

An Equation of the Financial Markets in form of an Endless Loop.Elliot Wave Theory claims that Markets form similar patterns of formations on smaller time frames that are visible on higher time frames, (higher/lesser degree). Crowd behaviour which the theorist defined for traders or market participants is predictable in a manner that it ought to cause a definite result after each sequential or circumventing interval. First half of idealised Elliot Wave is Motive Wave, which consists of 5 kinds of movements but majority are in the direction of higher degree trend (3) and 2 the even movements are retracements or corrections from that higher degree trend. For example on a Monthly chart there is an Upward Trend in the markets then at weekly time frame motive wave would have 1,3,5 actionary movements in upward direction and two corrective movements in downward direction. Motive Wave is further categorised with Impulse Sub-Wave and Diagonal Sub-Wave. Impulse Wave is the normal Motive wave whereas the Diagonal Wave forms consolidation in a channel at 3rd level. The Cycle that I have marked on the chart is Elliot Wave Bearish Cycle which consists of 5 Motive Waves( 15 levels of downward trend and 10 corrective retracements in upward trend) plus 3 corrective Waves as in form of 2nd phase or 2nd overall wave of the Cycle. In my calculative assumption the Corrective Waves are ending ending 18200 levels for nifty and began at 16850. I hope I could make this loopic concept a bit clearer.

Trading channelsHello,

Channels are great setups to catch reversals. When price trends upward or downward and fits between two parallel trendlines, the chart pattern is called a channel.

Channel trading is a popular strategy in financial markets that involves identifying and trading within a channel formation on a price chart. A channel is formed when a financial instrument's price movement oscillates between two parallel trendlines, one acting as a resistance level and the other as a support level.

Traders can use channel trading to identify potential buying and selling opportunities. The strategy involves buying when the price reaches the lower trendline (support) and selling when the price reaches the upper trendline (resistance). Traders can also use other technical indicators, such as momentum indicators and moving averages, to confirm their trades.

When trading channels, it is important to consider the strength of the channel and the overall trend of the market. A strong channel is one that has been tested multiple times and has a consistent slope. If the channel is weak, it may be more susceptible to breakouts and false signals.

Channel trading can be used in a variety of financial markets, including stocks, currencies, and commodities. However, as with any trading strategy, there are risks involved, and traders should carefully consider their risk tolerance and develop a solid trading plan before using this approach in the markets.

Good luck

BTCUSD : Technical Indicators and Step-by-Step StrategyHere's a step-by-step strategy for using the 15-minute BTCUSD chart:

Step 1: Set up your chart with the chosen indicators

1. Add the 50-period (blue) and 200-period (red) Exponential Moving Averages (EMA) to the Bitcoin price chart.

2. Add Bollinger Bands with a 20-period moving average (green) and 2 standard deviations.

3. Add a volume chart below the price chart.

4. Add the 14-period Relative Strength Index (RSI) in a separate panel below the volume chart.

5. Add the Moving Average Convergence Divergence (MACD) with periods of 12, 26, and 9 in another separate panel.

Step 2: Analyze the trend and identify support and resistance levels

1. Suppose the Bitcoin price is above the 50 and 200 EMA, indicating an overall uptrend. If it's below both, it signals a downtrend.

2. For example, if the price bounces off the 50 EMA multiple times, this level acts as a support in an uptrend. In a downtrend, it acts as resistance.

Step 3: Use Bollinger Bands to identify buying and selling opportunities

1. On February 10th, 12:45 PM, the Bitcoin price touches the lower Bollinger Band and then moves upwards, representing a potential buying opportunity.

Similarly, on February 11th, 4:15 PM, the price touches the upper Bollinger Band and then reverses, signaling a selling opportunity.

Step 4: Analyze volume

1. On February 10th, 1:00 PM, a significant increase in volume corresponds to a strong upward price movement, suggesting bullish activity.

Step 5: Analyze momentum and trend indicators

1. On February 11th, 9:30 AM to 10:45 AM, the Bitcoin price makes higher lows while the RSI shows lower lows, indicating a bullish divergence, suggesting a potential trend reversal.

2. On February 11th, 11:30 AM, the MACD line (blue) crosses above the signal line (orange), indicating a potential shift to an uptrend.

Step 6: Synthesize the information and make a decision

1. Using the previous examples, a possible trading strategy could be to buy when the price touches the lower Bollinger Band and the RSI shows bullish divergence during an overall uptrend, and sell when the price touches the upper Bollinger Band during an uptrend.

2. Entry points: February 10th, 12:45 PM (buy) and February 11th, 4:15 PM (sell). Set stop-loss and take-profit levels based on your risk tolerance and trading plan.

Please note that these examples are for illustrative purposes and past performance does not guarantee future results. It is essential to adapt your analysis and trading strategy to changing market conditions and develop a comprehensive understanding of these indicators to make informed decisions.

Trade talk with A.IQ1. Your Advise to the experienced traders.

As an AI language model, I cannot provide personalized advice to specific individuals. However, here are some general tips that experienced traders may find useful:

1.1 Stick to your trading plan: Experienced traders know the importance of having a solid trading plan and sticking to it. Your trading plan should include your risk management strategy, entry and exit points, and profit targets. Avoid deviating from your plan based on emotions or market noise.

1.2 Continue learning: The markets are constantly evolving, so it's important for experienced traders to continue learning and adapting to changes. Stay updated with market news and events, learn new trading strategies, and be open to new ideas and perspectives.

1.3 Practice good risk management: Experienced traders understand the importance of managing risk. Make sure you understand risk management principles and use tools like stop-loss orders and position sizing to limit your risk.

1.4 Stay disciplined: Trading can be a stressful and emotional experience, but experienced traders know the importance of staying disciplined and keeping their emotions in check. Stick to your trading plan, avoid impulsive decisions, and don't let fear or greed drive your trading decisions.

1.5 Review and analyze your trades: Successful traders are always looking for ways to improve their performance. Take the time to review and analyze your trades, identify areas for improvement, and make adjustments to your trading plan as necessary.

Q2. How to trade Head and shoulder patterns?

2.1 The head and shoulders pattern is a technical analysis pattern that is commonly used by traders to identify potential trend reversals. Here are the basic steps for trading a head and shoulders pattern:

2.2 Identify the pattern: The head and shoulders pattern consists of three peaks, with the middle peak (the "head") being higher than the other two (the "shoulders"). The neckline is a line that connects the lows between the shoulders.

2.3 Wait for confirmation: Once you have identified the pattern, wait for a confirmed breakout below the neckline. This confirms that the pattern is valid and increases the probability of a trend reversal.

2.4 Set a stop-loss: Place a stop-loss order above the right shoulder of the pattern to limit your risk if the market moves against you.

2.5 Set a profit target: Calculate the distance between the head and the neckline, and use this to set a profit target for your trade.

2.6 Monitor the trade: Monitor the trade closely and adjust your stop-loss and profit target as necessary.

Q3. Do people get rich day trading?

While it is true that some traders have become wealthy from trading, it is important to understand that trading is not a guaranteed path to riches. Trading involves risk, and losses are a natural part of the process. In fact, the majority of traders lose money, and only a small percentage are consistently profitable over the long term.

Furthermore, becoming a successful trader requires a significant amount of time, effort, and dedication. It's not something that can be achieved overnight, and there are no shortcuts or easy solutions.

In addition, it's important to have realistic expectations about trading. While it is possible to make money from trading, it is not a get-rich-quick scheme. Successful traders typically have a long-term perspective, and they focus on building consistent profits over time.

In summary, while trading can potentially lead to wealth, it is not a guaranteed path to riches. Trading involves risk, requires a significant amount of time and effort, and success is not guaranteed. As with any other profession, success in trading requires hard work, dedication, and a commitment to ongoing learning and improvement.

Q.4 Can you help someone to become a profitable trader?

As an AI language model, I can provide educational information and guidance to help someone become a profitable trader. However, becoming a profitable trader requires more than just information and guidance - it requires a combination of knowledge, experience, discipline, and a commitment to ongoing learning and improvement.

Some of the ways in which I can help someone become a profitable trader include:

4.1 Providing educational resources on trading fundamentals, technical analysis, risk management, and other key trading concepts.

4.2Assisting with the development of a personalized trading plan based on an individual's unique goals, risk tolerance, and trading style.

4.3 Offering insights into market conditions and potential trading opportunities across a range of asset classes.

4.4 Providing support and guidance on managing emotions and maintaining discipline in the face of market volatility and uncertainty.

4.5 Offering feedback and analysis on trading strategies and performance, with a focus on identifying areas for improvement and optimization.

4.6 It's important to note that becoming a profitable trader is a long-term process that requires patience, discipline, and a willingness to learn from both successes and failures. With the right guidance and approach, however, it is possible to achieve consistent profitability and success in the markets.

Q5. Do prayers help in trading?

As an AI language model, I do not have a religious belief, but I can provide a general response to your question.

Prayer is a personal spiritual practice that may bring comfort and guidance to an individual. However, it is not a guaranteed method for achieving success in trading or any other activity. Trading success depends on a combination of factors, including knowledge, experience, discipline, and a sound trading strategy.

It's important to approach trading with a rational and analytical mindset, rather than relying on external factors such as prayer or luck. While prayer may provide emotional support and help manage stress, it is not a substitute for a well-developed trading plan and disciplined approach to the markets.

In summary, while prayer may have personal and emotional benefits, it is not a reliable or effective means for achieving success in trading. A disciplined and rational approach to trading, based on sound principles and a well-developed trading plan, is key to long-term success.

Q6. How to trade triangle pattern?

The triangle pattern is a common chart pattern that occurs when the price of an asset consolidates between two converging trendlines. Trading the triangle pattern involves identifying the breakout direction and taking a position in that direction. Here are some general steps to trade the triangle pattern:

6.1 Identify the triangle pattern: Look for a period of consolidation where the price moves between two converging trendlines, forming a triangle shape on the chart.

6.2 Determine the direction of the breakout: As the price nears the apex of the triangle, it will typically break out in one direction or the other. Look for a breakout that is accompanied by high volume and follow-through price action.

6.3 Enter a position: Once you have determined the direction of the breakout, enter a position in that direction. This can be done through buying or selling, depending on whether the breakout is to the upside or downside.

6.4 Set stop-loss and take-profit levels: It's important to manage your risk by setting stop-loss levels to limit potential losses and take-profit levels to lock in profits. These levels should be based on your risk tolerance and trading strategy.

6.5 Monitor the trade: Keep an eye on the price action after the breakout to ensure that it continues to move in your favor. If the price fails to continue in the breakout direction, it may be wise to exit the trade with a small loss.

6.6 Consider other factors: It's important to consider other factors, such as market conditions and economic events, that may affect the price of the asset. This can help you make more informed trading decisions.

In summary, trading the triangle pattern involves identifying the breakout direction and taking a position in that direction while managing risk through stop-loss and take-profit levels. However, it's important to consider other factors that may affect the price of the asset and to monitor the trade closely to ensure that it continues to move in your favor.

LOOKING FOR TRADESHello,

Looking for trades using structured patterns is very helpful in trading the markets. The above/below shows how you can identify this moves for you to be aware of what to expect.

An impulse is a strong move in one direction mostly referred to as the trend. From this its clear that we are in a downward trend for this stock. Tradingview also allows you to check and review Financial statements of cos by just clicking on any earnings date. This tells you where a company is at and where it is going.

Good luck

🌊 Elliot Wave Cheatsheet📍 What Is Elliott Wave Theory?

In technical analysis, the Elliott Wave theory is the analysis of long-term trends in price patterns and how they correspond with investor psychology. These price patterns, referred to as ‘waves’, are built on specific rules that were developed by Ralph Nelson Elliott in the 1930s. Specifically, they were designed to identify and predict wave patterns within stock markets. Importantly these patterns are not intended to be certain, but instead provide probable outcomes for future price movements.

📍 How Do Elliott Waves Work?

Within Elliott Wave theory, there are different forms of waves, or price formations, from which investors can glean insight. Impulse waves, for example, include both an upward or downward trend that carries five sub-waves that may last hours or even decades. They possess three rules: the second wave cannot retrace more than 100% of the first wave; the third wave cannot be shorter than wave one, three, and five; wave four cannot surpass the third wave ever. Along with impulse waves, there are corrective waves, which fall in patterns of three.

📍 Impulse Wave

The impulse wave in Elliott Wave Theory is the wave that pushes the prices in the same direction as the trend at one larger degree. It’s the action wave.

While the corrective wave is the reaction to the first wave. Therefore, the corrective wave moves in the opposite direction of the main trend.

The impulse wave is composed of 5 waves according to certain conditions & rules. Impulse waves are always composed of five waves, labeled 1,2,3,4,5. Waves 1,3 & 5 are in the direction of the main trend. Whereas, waves 2 & 4 are in the opposite direction

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

Objective Logic for Swing Highs and Swing Lows█ OVERVIEW

This is an introduction to my idea of objective swing highs and swing lows. The objective logic for swing highs and swing lows I hope will form somewhat of a foundational building block for traders, researchers and developers alike. Not only does it facilitate the objective study of swing highs and swing lows it also facilitates that of ranges, trends, double trends, multi-part trends and patterns. The logic can also be used for objective anchor points. Concepts I will introduce and develop further in future publications.

█ CONCEPTS

Green and Red Candles

• A green candle is one that closes with a high price equal to or above the price it opened.

• A red candle is one that closes with a low price that is lower than the price it opened.

Swing Highs and Swing Lows

• A swing high is a green candle or series of green candles followed by a single red candle to complete the swing.

• A swing high is a green candle or series of consecutive green candles followed by a single red candle to complete the swing and form the peak.

• A swing low is a red candle or series of consecutive red candles followed by a single green candle to complete the swing and form the trough.

Peak and Trough Prices (Basic)

• The peak price of a complete swing high is the high price of either the red candle that completes the swing high or the high price of the preceding green candle, depending on which is higher.

• The trough price of a complete swing low is the low price of either the green candle that completes the swing low or the low price of the preceding red candle, depending on which is lower.

Peak and Trough Prices (Advanced)

• The advanced peak price of a complete swing high is the high price of either the red candle that completes the swing high or the high price of the highest preceding green candle high price, depending on which is higher.

• The advanced trough price of a complete swing low is the low price of either the green candle that completes the swing low or the low price of the lowest preceding red candle low price, depending on which is lower.

Green and Red Peaks

• A green peak is one that derives its price from the green candle/s that constitute the swing high.

• A red peak is one that derives its price from the red candle that completes the swing high.

• A green trough is one that derives its price from the green candle that completes the swing low.

• A red trough is one that derives its price from the red candle/s that constitute the swing low.

Historic Peaks and Troughs

The current, or most recent, peak and trough occurrences are referred to as occurrence zero. Previous peak and trough occurrences are referred to as historic and ordered numerically from right to left, with the most recent historic peak and trough occurrences being occurrence one.

Upper Trends

• A return line uptrend is formed when the current peak price is higher than the preceding peak price.

• A downtrend is formed when the current peak price is lower than the preceding peak price.

• A double-top is formed when the current peak price is equal to the preceding peak price.

Lower Trends

• An uptrend is formed when the current trough price is higher than the preceding trough price.

• A return line downtrend is formed when the current trough price is lower than the preceding trough price.

• A double-bottom is formed when the current trough price is equal to the preceding trough price.

█ SWING COUNTER INDICATOR

Alongside this publication I have also released an open-source indicator that counts the number of swing high and swing low scenarios on any given candlestick chart and displays the statistics in a table. As can be seen in the example picture above.

I have added plots as a visual aid to the swing scenarios listed in the table. Green up-arrows with ‘HP’ denote higher peaks, while green up-arrows with ‘HT’ denote higher troughs. Red down-arrows with ‘LP’ denote higher peaks, while red down-arrows with ‘LT’ denote lower troughs. Similarly, blue diamonds with ‘DT’ denote double-top peaks and blue diamonds with ‘DB’ denote double-bottom troughs. These plots can be hidden via indicator settings.

I have also added green and red trendlines as a further visual aid to the swing scenarios listed in the table. Green lines denote return line uptrends (higher peaks) and uptrends (higher troughs), while red lines denote downtrends (lower peaks) and return line downtrends (lower troughs). These lines can be hidden via indicator settings.

What I find most fascinating about this logic, is that the number of swing highs and swing lows will always find equilibrium on each new complete wave cycle. If for example the chart begins with a swing high and ends with a swing low there will be an equal number of swing highs to swing lows. If the chart starts with a swing high and ends with a swing high there will be a difference of one between the two total values until another swing low is formed to complete the wave cycle sequence that began at start of the chart. Almost as if it was a fundamental truth of price action, although quite common sensical in many respects. As they say, what goes up must come down.

Don't just take my word for it. You can find my indicator on my profile page under scripts, or by searching for Swing Counter in community scripts!

█ LIMITATIONS

Some higher timeframe candles on tickers with larger lookbacks such as the DXY , do not actually contain all the open, high, low and close (OHLC) data at the beginning of the chart. Instead, they use the close price for open, high and low prices. So, while we can determine whether the close price is higher or lower than the preceding close price, there is no way of knowing what actually happened intra-bar for these candles. And by default candles that close at the same price as the open price, will be counted as green. You can avoid this problem by utilising the sample period filter.

The green and red candle calculations are based solely on differences between open and close prices, as such I have made no attempt to account for green candles that gap lower and close below the close price of the preceding candle, or red candles that gap higher and close above the close price of the preceding candle. I can only recommend using 24-hour markets, if and where possible, as there are far fewer gaps and, generally, more data to work with.

█ NOTES

I feel it important to address the mention of advanced peak and trough price logic. While I have introduced the concept, I have not included the logic in my scripts for a number of reasons. The most pertinent of which being the amount of extra work I would have to do to include it in a public release versus the actual difference it would make to the statistics or outcomes. Based on my experience, there are actually only a small number of cases where the advanced peak and trough prices are different from the basic peak and trough prices. And with adequate multi-timeframe analysis any high or low prices that are not captured using basic peak and trough price logic on any given time frame, will no doubt be captured on a higher timeframe. See the example below on the 1H FOREXCOM:USDJPY chart (Figure 1), where the basic peak price logic denoted by the indicator plot does not capture what would be the advanced peak price, but on the 2H FOREXCOM:USDJPY chart (Figure 2), the basic peak logic does capture the advanced peak price from the 1H timeframe.

Figure 1.

Figure 2.

█ RAMBLINGS

“Never was there an age that placed economic interests higher than does our own. Never was the need of a scientific foundation for economic affairs felt more generally or more acutely. And never was the ability of practical men to utilize the achievements of science, in all fields of human activity, greater than in our day. If practical men, therefore, rely wholly on their own experience, and disregard our science in its present state of development, it cannot be due to a lack of serious interest or ability on their part. Nor can their disregard be the result of a haughty rejection of the deeper insight a true science would give into the circumstances and relationships determining the outcome of their activity. The cause of such remarkable indifference must not be sought elsewhere than in the present state of our science itself, in the sterility of all past endeavours to find its empirical foundations.” (Menger, 1871, p.45).

█ BIBLIOGRAPHY

Menger, C. (1871) Principles of Economics. Reprint, Auburn, Alabama: Ludwig Von Mises Institute: 2007.

📚 Elliott Wave Pattern: Flat 🌊●● Flat

❗❗ 𝙂𝙚𝙣𝙚𝙧𝙖𝙡 𝙧𝙪𝙡𝙚𝙨

● A flat always subdivides into three waves.

● Wave A is always a zigzag , flat or combination.

● Wave B is always a zigzag .

● Wave C is always an impulse or a ending diagonal .

❗ 𝙂𝙚𝙣𝙚𝙧𝙖𝙡 𝙜𝙪𝙞𝙙𝙚𝙡𝙞𝙣𝙚𝙨

● Wave A is usually a zigzag .

●● 𝙀𝙭𝙥𝙖𝙣𝙙𝙚𝙙 𝙁𝙡𝙖𝙩 ( Exp . FL )

❗❗ 𝙍𝙪𝙡𝙚𝙨

● Wave B always ends after the start of wave A .

● Wave C always ends past the end of wave A .

❗ 𝙂𝙪𝙞𝙙𝙚𝙡𝙞𝙣𝙚𝙨

● Wave B usually retraces 123.6 or 138.2% of wave A , less often — 161.8% .

● Wave C is often equal to 161.8% of wave A , less often — 261.8% .

● The most common type of flat.

●● 𝙍𝙪𝙣𝙣𝙞𝙣𝙜 𝙛𝙡𝙖𝙩 (Runn. FL )

❗❗ 𝙍𝙪𝙡𝙚𝙨

● Wave B always ends after the start of wave A .

● Wave C never goes beyond the end of wave A .

❗ 𝙂𝙪𝙞𝙙𝙚𝙡𝙞𝙣𝙚𝙨

● Within such a flat wave B should end well above the origin of wave A and that means wave C might reflect a 61.8% or even a 100% relationship to wave A .

● A running flat indicates that the forces in the direction of the larger trend at next higher degree are powerful.

● Wave B is usually no more than twice the length of wave A .

● Keep in mind that a running flat is rare.

●● 𝙍𝙚𝙜𝙪𝙡𝙖𝙧 𝙛𝙡𝙖𝙩 (Reg. FL )

❗❗ 𝙍𝙪𝙡𝙚𝙨

● Wave B never goes beyond beyond the start of wave A .

● Wave B always retraces at least 90 percent of wave A .

● Wave C always ends past the end of wave A .

❗ 𝙂𝙪𝙞𝙙𝙚𝙡𝙞𝙣𝙚𝙨

● The rarest type of flat.

__________________________

🔗 References:

Elliott Wave Principal 2005

Trade Waves / Elliott Waves Analysis (TWEWA)

📚 Elliott Wave Guide & Ellott Wave Archive ⬇️⬇️

Elliot wave counting in the WMT stockHello,

Elliot Wave theory is a technical analysis method that is commonly used in trading to analyze price movements in financial markets. It is based on the idea that prices move in repetitive patterns, and that these patterns can be used to predict future price movements. When applied to Walmart stock, Elliot Wave analysis can provide traders with insights into the stock's price movements and potential future trends.

According to Elliot Wave theory, price movements in financial markets follow a repetitive pattern that can be divided into five waves. These waves can be used to identify the direction of the current trend and predict potential future price movements. Applying this theory to Walmart stock, a trader may look for the five waves in the stock's price movement and identify potential buying or selling opportunities based on the direction of the trend. By analyzing the patterns and trends in the Walmart stock price, traders can use Elliot Wave theory to make informed decisions about when to enter or exit the market, as well as when to place stop-loss orders to minimize potential losses.

As per this chart we are in the corrective phase for more upside.

Good luck!

Elliot Wave Chapter 1: The Overall CycleRule is rule

• Impulse wave subdivide into 5 waves. In the chart, the impulse move is subdivided as (1), (2), (3), (4), (5) in minor degree

Wave 1, 3, and 5 subdivision are impulse. The subdivision in this case is 1, 2, 3, 4, and 5 in minute degree.

• Wave 2 can’t retrace more than the beginning of wave 1

• Wave 3 can not be the shortest wave of the three impulse waves, namely wave 1, 3, and 5

• Wave 4 does not overlap with the price territory of wave 1

• Wave 5 needs to end with momentum divergence