Basic Elliott Wave CycleBefore beginning about patterns in concept, we must remember that there are 3 commandments, stated by R.N Elliott that are imperative to theory: (See attached 4 hour GBPCAD chart for example).

Impulse Wave 3 can never be the shortest wave

Wave 2 can never retrace beyond the start of Wave 1

Wave 4 can never cross into the same price area as Wave 1

These rules, just like all rules in general, are bent sometimes, so don’t be afraid to think outside the box and question everything. What I would suggest is that when one of these 3 rules are broken, then a review needs to be done for the wave count.

Wave Sequence:

In a Dominant Trend, progress ultimately takes the form of 5 Waves, which are labeled with

numbers; 1,2,3,4,5.

Three of these swings, which are 1, 3 and 5, affect the overall direction in favor of the Dominant Trend. These Swings are known as Motive Waves or Impulses.

Within the 5 Wave Sequence, the 3 Waves that unfold in favor of the Dominant Trend are separated by 2 counter-trend interruptions, which are labeled as 2 and 4. These Swings represent a temporary interruption of the Impulse Waves, hence why they are called

Corrective Waves.

Wave Principle states that; a Full Cycle is made up of 8 Swings. The Market moves with 5 Waves in the direction of the Main Trend with 3 Waves against it.

Once the Impulsive Phase is complete, then the Trend Corrective Legs unfold and act as a pull-back. Labeled A, B & C.

Wave Analysis

Dow Theory simple introduction For those of you not familiar with Dow Theory. Here's a simple introduction. Nothing technical just a "welcome to" type of educational post.

Short History

Dow Has 6 Rules - these are known as the 6 Tenets

Dow is mostly known (most obvious - the Dow Jones Industrial Average)

Other tools and techniques can fit into the Dow Theory, such as Elliott and Wyckoff.

Wyckoff "Buy me now" moves.

As for Wyckoff - volume is and was a factor for the Dow Theory; Volume should increase in the direction of the trend in order to give confirmation. It is only a secondary indication but Dow realized that if volume didn't increase in the direction of the trend, this is a red flag. This means that the trend may not be valid.

As basic wave principles apply - Dow simplified the inner workings of the market with the 6 tenets.

He also came out with some brilliant quotes such as "Money is made by conservative trading rather than by the effort to get large profits by taking large risks."

And

“A person watching the tide coming in and who wishes to know the exact spot which marks the high tide, sets a stick in the sand at the points reached by the incoming waves until the stick reaches a position where the waves do not come up to it, and finally recede enough to show that the tide has turned. This method holds good in watching and determining the flood tide of the stock market.”

======================================================================================================================================

Dow theory trading strategy

Most trading strategies used today hinge on one key concept, the "trend". This was a novel idea when Charles H. Dow published his writings at the end of the 19th century. Dow theory says that the market is in an upward trend if one of its averages goes above a previous important high and is accompanied or followed by a similar movement in the other average. Therefore, a Dow theory trading strategy is based on a trend-following strategy, and can either be bullish or bearish.

So although the times have changed, human nature and the basic principles have not. Some of the theory can easily be applied to instruments such as commodities, Forex and crypto.

As I said, this is not a lesson on the trading with, it was more an intro to. Worth some additional research, there are some very interesting books on the subject.

Wyckoff basics part 2 )click the image link)

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

ELLIOTT WAVES BASICS - TUTORIALHow to understand ELLIOTT WAVES IN 4 STEPS?

For my followers to understand my analysis:

The topic is only described very roughly and is intended to give you a first overview of one of my analysis methods.

1. An impulse always moves in five sub-waves.

Waves 1, 3 and 5 of these are motive waves that move in the same direction as the overall trend.

Waves 2 and 4 are corrective waves, i.e. they correct the previous movement.

The following rules apply to an impulse:

-Wave 4 must not overlap with wave 1, except in a diagonal.

-Wave 3 is never the shortest wave.

-Wave 2 must not fall below the starting point of wave 1.

If one of these rules is broken, the chart analysis must be revised.

2. A correction wave moves in the opposite direction to the overall trend.

Corrective waves are three-part and basically consist of waves A, B and C.

Waves A and C are primarily impulse patterns of the corrective movement and drive the market in the opposite direction to the overall trend.

Wave B corrects the previous wave A and even has the potential to surpass the starting point of wave A.

3. The standard pattern consists of an impulse wave and a corrective wave.

These standard patterns repeat on a short-term basis as well as on a multi-year basis. In other words, every single wave consists of several sub-waves and in turn belongs to the larger picture. For example, wave 1 (an impulse) itself consists of five sub-waves.

This standard pattern continues and accordingly always merges into a higher level.

4. Relation Between Fibonacci and Elliott Wave Theory

Fibonacci Ratio is useful to measure the target of a wave’s move within an Elliott Wave structure. Different waves in an Elliott Wave structure relates to one another with Fibonacci Ratio. For example, in impulse wave:

Wave 2 is typically 38,2 %, 50% or 61.8% of wave 1

• Wave 3 is typically 161.8% of wave 1

• Wave 4 is typically 23.6%, or 38.2% of wave 3

• Wave 5 is typically inverse 1.236 – 1.618% of wave 4, equal to wave 1 or 61.8% of wave 1+3

You can use the information above to determine the point of entry and profit target when entering into a trade.

Wyckoff Anatomy of a Trading RangeRichard Demille Wyckoff (1873–1934) was an early 20th-century pioneer in the technical approach to studying the stock market. He is considered one of the five “titans” of technical analysis, along with Dow, Gann, Elliott and Merrill.

Analyses of Trading Ranges

One objective of the Wyckoff method is to improve market timing when establishing a position in anticipation of a coming move where a favorable reward/risk ratio exists.

Trading ranges (TRs) are places where the previous trend (up or down) has been halted and there is relative equilibrium between supply and demand. Institutions and other large professional interests prepare for their next bull (or bear) campaign as they accumulate (or distribute) shares within the TR. In both accumulation and distribution TRs, the Composite Man is actively buying and selling - the difference being that, in accumulation, the shares purchased outnumber those sold while, in distribution, the opposite is true. The extent of accumulation or distribution determines the cause that unfolds in the subsequent move out of the TR.

PS—preliminary support , where substantial buying begins to provide pronounced support after a prolonged down-move. Volume increases and price spread widens, signaling that the down-move may be approaching its end.

SC—selling climax , the point at which widening spread and selling pressure usually climaxes and heavy or panicky selling by the public is being absorbed by larger professional interests at or near a bottom. Often price will close well off the low in a SC, reflecting the buying by these large interests.

AR—automatic rally , which occurs because intense selling pressure has greatly diminished. A wave of buying easily pushes prices up; this is further fueled by short covering. The high of this rally will help define the upper boundary of an accumulation TR.

ST—secondary test , in which price revisits the area of the SC to test the supply/demand balance at these levels. If a bottom is to be confirmed, volume and price spread should be significantly diminished as the market approaches support in the area of the SC. It is common to have multiple STs after a SC.

Note: Springs or shakeouts usually occur late within a TR and allow the coin or stock’s dominant players to make a definitive test of available supply before a markup campaign unfolds. A “spring” takes price below the low of the TR and then reverses to close within the TR; this action allows large interests to mislead the public about the future trend direction and to acquire additional shares at bargain prices. A terminal shakeout at the end of an accumulation TR is like a spring on steroids. Shakeouts may also occur once a price advance has started, with rapid downward movement intended to induce retail traders and investors in long positions to sell their shares to large operators. However, springs and terminal shakeouts are not required elements.

Test —Large operators always test the market for supply throughout a TR (e.g., STs and springs) and at key points during a price advance. If considerable supply emerges on a test, the market is often not ready to be marked up. A spring is often followed by one or more tests; a successful test (indicating that further price increases will follow) typically makes a higher low on lesser volume.

SOS—sign of strength , a price advance on increasing spread and relatively higher volume. Often a SOS takes place after a spring, validating the analyst’s interpretation of that prior action.

LPS—last point of support , the low point of a reaction or pullback after a SOS. Backing up to an LPS means a pullback to support that was formerly resistance, on diminished spread and volume. On some charts, there may be more than one LPS, despite the ostensibly singular precision of this term.

BU—“back-up” . This term is short-hand for a colorful metaphor coined by Robert Evans, one of the leading teachers of the Wyckoff method from the 1930s to the 1960s. Evans analogized the SOS to a “jump across the creek” of price resistance, and the “ back up to the creek ” represented both short-term profit-taking and a test for additional supply around the area of resistance. A back-up is a common structural element preceding a more substantial price mark-up, and can take on a variety of forms, including a simple pullback or a new TR at a higher level.

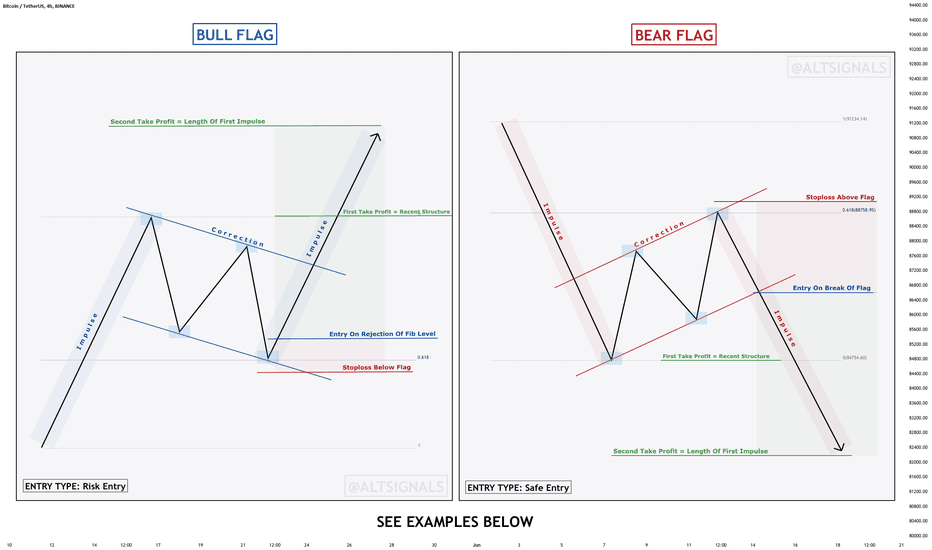

EDUCATION - Identifying & Trading Flag PatternsIn this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

EDUCATION - Identifying & Trading Flag Patterns In this post, we will be explaining what a flag patterns is and how to identify and trade them.

What is a Flag?

The flag pattern is the most common continuation patterns in technical analysis. It often occurs after a big impulsive move. The impulse move is followed by short bodied candles countertrend to the impulse move, which is called the flag. It is named because of the way it reminds the viewer of a flag on a flagpole.

Often, the breakout of the flag is the same size as the impulse leading to the flag. We can use this to create our take profit levels.

There are 2 types of ways we can trade flag patterns; Risky Entry & Safe Entry. See below for the pros and cons for both and how to enter them

_______________________________________________________________________________

Risk Entry:

The reason why it is called a risk entry is because we haven't got many confirmations apart from the bounce off the fibonacci level. Price may have the potential to go lower for a deeper correction before moving up. Whereas for the safe entry, the confirmation that it is a valid flag would be the break of the flag pattern.

How to trade using Risk Entry:

Wait for price to bounce off the fibonacci levels (0.5 or 0.618) and then enter with stops below/above the correction.

One of the advantages of doing a risk entry is that we can have small stop loss and have a great risk:reward ratio. Also, we can gain an entry at the start of the move and HODL!

Safe Entry:

Safe entry requires more than one confluence and requires confirmation. We have the rejection of the fibonacci level as well as a breakout of the flag, confirming that it is a valid flag pattern.

How to trade using Safe Entry:

For a safe entry, enter upon the break of the flag pattern with stops above/below the flag depending on whether its a bull or a bear flag. First TP would be the recent structure level and second TP would be the length of the impulse which led up to the correction.

The disadvantage to using a safe entry is that we require a bigger stop loss which makes the risk:reward ratio not as great as the risk entry. However, the probability of the trade succeeding is higher.

_______________________________________________________________________________

EXAMPLES OF RISK ENTRY

EXAMPLES OF SAFE ENTRY

BITCOIN in different time zonesHi guys, I split the chart in different time zones of the countries, but I did not find it useful.

I shared it with you, so it might be useful for you. if you got any point, let me know pls. thanks.

purple: Tokyo ,Sydney

pink : Hongkong

yellow: London ,Berlin

blue : New York

Setting Up Indicators in Multi-Chart Window for Multiple GroupsHi Everyone! This setup video is a little more informative than previous setup videos.

Available markets

We provide real-time data for free whenever we're allowed. However, some data is delayed due to specific exchange regulations. Because of this, real-time data must be purchased separately using the page below. US stock market data is real-time and provided by CBOE BZX.

Worldwide

EXCHANGE

DELAYED FREE DATA

REAL-TIME DATA

Worldwide

Currencies & CFDs

FOREX.com, FXCM, OANDA, ICE Data Services, Global Prime

N/A

Free

Worldwide

Cryptocurrency

Binance, Binance US, Bingbon, BitBay, BitCoke, Bitget, Bitfinex, bitFlyer, Bithumb, BITKUB, BitMax, BitMEX, Bitpanda Pro, BTSE, Bitso, Bitstamp, Bittrex, BTCYou, Bybit, CEX.IO, Coinbase, Coinfloor, Currencycom, Deribit, FTX, Gemini, Honeyswap, Huobi, KORBIT, Kraken, KuCoin, Mercado, OKCoin, OKEx, Phemex, Poloniex, SushiSwap, The Rock Trading, TimeX, TradeStation, UNISWAP

N/A

Free

North America

EXCHANGE

DELAYED FREE DATA

REAL-TIME DATA

USA

ARCA

STOCKS

NYSE ARCA & MKT

N/A

$2 US/mo

USA

NYSE

STOCKS

New York Stock Exchange

N/A

$2 US/mo

USA

NYSE

INDICES

New York Stock Exchange

End-of-day

N/A

USA

NASDAQ

STOCKS

NASDAQ Stock Market

N/A

$2 US/mo

USA

NASDAQ

INDICES

NASDAQ GIDS

15 min

$5 US/mo

USA

Cboe BZX

STOCKS

Cboe Global Markets (ARCA, NYSE, NASDAQ)

N/A

Free

USA

OTC

STOCKS

OTC Markets

15 min

$2 US/mo

USA

CME Group (E-mini included)

CME, CBOT, COMEX, NYMEX

10 min

$4 US/mo

USA

ICE Futures U.S.

FUTURES

INDICES

ICE Futures U.S. Financial & Commodities

10 min

$120 US/mo

USA

ICE Futures U.S.

FUTURES

ICE Futures U.S. Digital Asset Futures

N/A

Free

USA

CBOE

FUTURES

Chicago Board Options Exchange

End-of-day

N/A

USA

CBOE

INDICES

Chicago Board Options Exchange

15 min

N/A

Canada

CSE

STOCKS

Canadian Securities Exchange

N/A

Free

Canada

NEO

STOCKS

NEO Exchange

N/A

Free

Canada

TSX, TSXV

STOCKS

INDICES

Toronto Stock Exchange, TSX Venture Exchange (for non-residents)

15 min

$12 US/mo

Canada

TSX, TSXV

STOCKS

INDICES

Toronto Stock Exchange, TSX Venture Exchange (for residents)

15 min

$11 US/mo

How To Trade Triangle CorrectionTriangle Correction:

In addition to the 3-wave correction patterns, there is another pattern that appears time and time again. It is called the Triangle pattern. The Elliott Wave Triangle approach is quite different from other triangle studies. The Elliott Triangle is a 5- wave pattern where all the waves cross each other. The five sub-waves of a triangle are designated A, B, C, D, and E in sequence.

Triangles are by far most common as fourth waves. One can sometimes see a triangle as the Wave B of a 3-wave correction. Triangles are very tricky and

confusing. One must study the pattern very carefully prior to taking action. Prices tend to shoot out of the triangle formation in a swift “thrust.”

When triangles occur in Wave 4, the market thrusts out of the triangle in the same direction as Wave 3. When triangles occur in Wave B, the market thrusts

out of the triangle in the same directions as the Wave A.

How do you trade triangle correction?:

You need to place two trend lines- one from b to d sub waves (above PA) and one from a to c to e sub waves (below PA)- In a bullish example (see chart)- once d to e sub wave is completed ( see noted long legged doji on chart)- this would have been your low risk high reward time to initiate a buy trade via daily chart.

Within 20 days (do you have the P A T I E N C E ?)- you would have made a 1:6 risk and reward on your investment- which is great.

How To Trade Elliott Waves & ABC Correction WavesElliott wave analysts hold that each individual wave has its own signature or characteristic, which typically reflects psychology of moment . Understanding those personalities is a key to the application of the Wave Principle; they are defined as follows:

Five wave pattern - dominant trend (Bullish):

Wave 1: Wave one is rarely obvious at its inception. When the first wave of a new bull market begins, the fundamental news is almost universally negative.

Wave 2: Wave two corrects wave one, but can never extend beyond the starting point of wave one.

Wave 3: Wave three is usually the largest and most powerful wave in a trend.

Wave 4: Wave four is typically clearly corrective.

Wave 5: Wave five is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average retail traders finally buy in, right before the top.

Three wave pattern - corrective trend (Bearish):

Wave A: Corrections are typically harder to identify than impulse moves. In wave A of a bear market, the fundamental news is usually still positive.

Wave B: Prices reverse higher, which many see as a resumption of the now long-gone bull market. Those familiar with classical technical analysis may see the peak as the right shoulder of a head and shoulders reversal pattern.

Wave C: Prices move impulsively lower in five waves. Volume picks up, and by the third leg of wave C, almost everyone realizes that a bear market is firmly entrenched. Wave C is typically at least as large as wave A and often extends to 1.618 times wave A or beyond.

Note: Where is PA on EurCad pair going next week? look at weekly and monthly charts (all time lows)? Making doji or undecided candles? Head & Shoulder pattern? Continue bearish...Are you using Fib retracement tool? golden zone 61.8%. ... or Friday daily doiji- why not trade price action in which ever way breaks this? Good luck.

MY MORNING TRADING ROUTINE - Steps I take before I tradeComplete Routine:

06:30: Wake up – My Morning Routine Starts

I just get right up and start my day. Don’t hit the snooze button!

06:40: What’s My Daily Report Card Goal?

Each day my trading journal includes a specific goal that particular trading session, concrete actions that I’ll take to achieve that goal, and self-evaluation at the end of trading to gauge my success in reaching that goal.

The idea is to never trade without consciously working on some aspect of my trading.

06:50: Risk Control Process

I define the risk for the day :

Position sizing guidelines

Per-trade loss limits

Per-trade price targets

Daily loss limits

07:00: Frame The Context

I do a quick scan of my markets, and I frame the context by doing my analysis and establishing potential directional biases. This doesn’t take me a long time since I build upon yesterday’s analysis.

07:20: Define Market Conditions

Here I start by asking myself two questions:

Should I or shouldn’t I trade?

If I do trade, whether to do so cautiously or aggressively?

And then, I go through some variables to understand the market environment

07:30: Identify/Look For Setups

Now I understand what I want to improve on, my risk profile, market context, and how the market moves (the environment; fast, slow, etc.?)

I have specific setups and plays that I love to trade; I wait patiently for these setups to develop. Usually, they develop during London Open, but if there’s a setup at this very moment, I take it and immediately go into my breathing and meditation.

07:50: Deep Breathing + Meditation (Mental rehearsals)

This is where I get my mindset right. Breathing and meditation help me be and sustain a state of calmness and staying focused.

08:40: Cold Shower

Cold showers are amazing; they fill me with energy and the concentration to stay fully immersed in the present moment while I trade the markets.

09:00: Trade The London Open

I’m fully ready and confident to start my trading day. I’m focused, calm, and immersed in front of the screen.

Why We Need Routines:

As traders having routines in our life that encompasses all our desired best practices and habits is key to sustain consistent performance day in and day out in the markets. Trading is hard, and having to maneuver the world of trading without any routines or systems in place, is really doing yourself a disservice. Routines make your life easier. They reduce stress because you don’t have to think about what to do; your brain and body already know what to do because of the patterns you’ve set in place! This is quite amazing and really powerful; therefore, seek to build a routine to facilitate your trading performance.

💨𝙀𝙡𝙡𝙞𝙤𝙩𝙩 𝙒𝙖𝙫𝙚 𝙋𝙖𝙩𝙩𝙚𝙧𝙣: 𝙄𝙢𝙥𝙪𝙡𝙨𝙚🌊●● 𝙄𝙢𝙥𝙪𝙡𝙨𝙚 (IM)

❗❗ Rules

● An impulse always subdivides into five waves.

● Wave 1 always subdivides into an impulse or a diagonal.

● Wave 2 always subdivides into a zigzag, flat or combination .

● Wave 2 never moves beyond the start of wave 1 .

● Wave 2 always ends in the territory of wave 1 , and wave 4 in the territory of wave 3 .

● Wave 3 always subdivides into an impulse.

● Wave 3 always moves beyond the end of wave 1 .

● Wave 3 is never the shortest wave.

● Wave 4 always subdivides into a zigzag, flat, triangle or combination .

● Wave 4 never moves beyond the start of wave 2 .

● The termination point of wave 4 never moves beyond the end of wave 1 .

● Wave 5 always subdivides into an impulse or a diagonal.

● Never are waves 1 , 3 and 5 all extended.

❗ Guidelines

● Wave 4 will almost always be a different corrective pattern than wave 2 . If the second wave is a sharp correction, then the fourth wave will usually be a sideways correction, and vice versa (alternation).

● Wave 2 is usually a sharp correction in the form of a single or multiple zigzag.

● Wave 4 is usually a sideways correction in the form of a flat, triangle, or combination .

● In rare cases, a triangle (one that does not include a new price extreme) in the fourth wave position will take the place of a sharp correction and alternate with another type of sideways pattern in the second wave position.

● Wave 4 typically ends when it is within the price range of subwave four of 3 .

● In an impulse wave, wave 4 should significantly break the trend channel formed by the subwaves of wave 3 .

● Wave 4 often subdivides the entire impulse into Fibonacci proportion in time and/or price.

● On rare occasions, wave 4 subwaves can enter the territory of wave 1 . As a strong guideline, no portion of wave 4 of an impulse wave can enter the price territory of wave 1 or wave 2 .

● Second waves of impulse waves would tend to go beyond the previous fourth wave at one lesser degree.

● Sometimes wave 5 does not move beyond the end of wave 3 (in which case it is called a truncation).

● Wave 5 often ends when meeting or slightly exceeding a line drawn from the end of wave 3 that is parallel to the line connecting the ends of waves 2 and 4 , on either arithmetic or semilog scale.

● The center of wave 3 almost always has the steepest slope of any equal period within the parent impulse except that sometimes an early portion of wave 1 (the "kickoff") will be steeper.

● Wave 1 , 3 or 5 is usually extended. (An extension appears "stretched" because its corrective waves are small compared to its impulse waves. It is substantially longer, and contains larger subdivisions, than the non-extended waves).

● Often, the extended subwave is the same number ( 1 , 3 or 5 ) as the parent wave.

● Rarely do two subwaves extend, although it is typical for waves 3 and 5 both to extend when they are of Cycle or Supercycle degree and within a fifth wave of one degree higher.

● Wave 1 is the least commonly extended wave.

● If wave 1 of the impulse is the leading diagonal, then one should not expect wave 5 in the form of the ending diagonal.

● When wave 3 is extended, waves 1 and 5 tend to have gains related by equality or the Fibonacci ratio.

● When wave 5 is extended, it is often in Fibonacci proportion to the net travel of waves 1 through 3 .

● When wave 1 is extended, it is often in Fibonacci proportion to the net travel of waves 3 through 5 . In addition, wave 2 can subdivides the entire impulse into Fibonacci proportion in time and/or price.

Elliott Wave Principal 2005 & QA EWI.

NEOWAVE DIAMETRIC CORRECTION IN NIFTYplease study NEO WAVE'S diametric correction (Glen neely) ,I tried in NIFTY weekly clossing which is perfectly matching.

BUT he says intraday price levels are important, however I tried in daily, weekly clossing values which are predominant for more than a day.

'g' wave ending this week as per time cycle of 'a' wave , if it crosses 15687 (daily clossing), then 'g' wave will exend, otherwise pattern completed

CONFLUENCE TRADING | YOUR KEY TO ACCURATE ENTRIES 🥇

If you are struggling with the identification of accurate trading entries,

you definitely should try confluence zones .

Note: there are hundreds of variations of confluence elements.

In this example, we will discuss trend lines and fibonnachi.

❗️To identify a confluence zone, the price must follow a trend line

(it should match higher lows if the market is bullish;

it should match lower highs if the market is bearish).

Once the trend line is confirmed by at least two touches and consequent reactions ,

you can look for a confluence zone.

1️⃣Project a trend line and identify the next POTENTIAL touchpoint of the market with a trend line.

2️⃣Take the last impulse in the direction of the trend.

Draw a fib retracement based on it

(swing low to swing high in case if the market is bullish,

swing high to swing low in case if the market is bearish).

3️⃣Take the previous impulse (it must be in the same direction as the initial one).

Draw a fib retracement based on it.

4️⃣Look for a match of retracement levels of the last two impulses and a projected trend line.

In case if two retracement fib.levels & trend line match, you found a confluence point.

5️⃣ Apply it as a safe entry point.

You will get a perfect trend following opportunity.

❤️ Please, support this idea with a like and comment! ❤️

⬇️ Subscribe to my social networks! ⬇️

Taking advantage of day gamblers and bagholdersDay Gambling & Bagholding makes up most of the activity in stocks I reckon.

Not as big with Forex but still here. They allow people to optimise their returns.

If markets were always fairly valued you couldn't really make more than 5% a year.

And I say 5%, but to get there you'd have to not make any mistake. Perfection ==> 5%. No thanks!

Day & swing gamblers, and bagholders, are here to transfer wealth. I describe how in this idea.

I cut to the chase, I try keeping it as short as I can, but the subject does take a bit of explaining and I try to not skip important things.

What do day gamblers do?

- Exacerbate short term moves, move the price away from its natural longer term trend for example.

- Hope to make money while paying to their brokers 25% of the money they risk as spread or commission. Roulette wheel takes 2.5%.

What do bagholders do?

- Sell out of their winners very quickly. The behavior of holding losers goes in pair with getting rid of winners.

- And of course hold their losers. Bagholders that bought near the top do not add sell pressure to the pullback.

- Bagholders also love to "buy the dip", when the price of something goes down, they buy.

- Finally they sell at breakeven both when they hold a loser recovering, or when they are in the green and it pulls back.

Can't really say for a fact this is what happened, but that's how I see it in a concrete example:

FXCM says its traders average risk-to-reward is 1-to-0.57, on EURUSD in the period 2014-2015. That takes into account all those that have a high RR.

FXCM typical gambler risk to rewards is probably closer to what I see on myfxbook, something ridiculous like 1-to-0.25.

Even on Bitcoin that goes down 80% and up 8000% I can bet the typical gambler risk to reward is poor.

People also "average down", sometimes they call it just that, sometimes they call it "dollar cost averaging".

When they average down they increase their risk, all they care about is getting their money back.

This is what we call a Martingale strategy. And yes, it is very stupid. And wipes out life savings once in a while.

Academics polled people and found that in the general population - or maybe it was in a population of students - about 85% of people would rather take a small guaranteed win than a chance to get a much larger win (with of course odds multiplied by the amount were bigger than the flat win), and the exact same percentage would rather risk an enormous loss than simply take a loss. Prey ruminant mentality. They go for leaves (small wins), and they want to avoid losing at any cost because that means likely death. Compare this to a tiger that has a win ratio of 5 to 10% but gets huge meals providing several orders of magnitude the amount of calories he spent to hunt it, and they don't take silly risk, you'll never see a tiger jump in the violent river to go after prey.

And this is why you have the famous:

Wave A: A pullback with the majority still bullish (Mainstream media in the case of a bubble...).

Bagholders that got in late are in complete denial. Bagholders that got in early enough often breakeven.

Not an exact science, they do all kinds of things. I don't know many things that are 100% true in trading.

Wave B: Bagholders are quite stressed out. You hear them scream things such as "DIAMOND HANDS", "LAST TIME THEY SAID", "THE BULL MARKET IS BACK".

Price does not simply continue up in the presence of bagholders. It tops usually at 78.6% to 100% fibonacci retracement.

Wave C: Most bagholders admit we are in a bear market. By the bottom of C, nearly everyone realizes (even the slow ones) that WE ARE IN A BEAR MARKET.

Typical extensions are of 1, 1.618, 2, 2.618 (commodities).

Wipes out the bagholders, in mainstream markets this is very often "the little guy" and they whine about manipulation

(natural selection => great traders end up rich)

It has always been like this and data shows they are the ones selling. But they still cry "manipulation" and whine and never learn.

This is very typical. Not that entries matters that much, but avoiding getting sucked in "back to normal", and expecting lower prices, can help.

I can point out plenty of other examples:

Wave C has many names. Capitulation, "AAAAAAAAAAAH", make it stop god oh make it stop, this is BS, as well as when will it stop?

When it stops is when it finds the majority of bagholders breaking point.

Take a slow trend that went parabolic, the breaking point of the baggamblers will often be spread between the top and the start of the vertical move.

This is not precise at all but to get an idea:

In theory if 71% of the market is made up of bagholders and 71% of those "take their profit" we can estimate a retrace of 50% (71% of 71%).

90% of people are bagholders I think, but survival selection means the number will be lower in the markets.

Day gamblers also have their trends and ABCS. No need to repeat what I already said about bagholders, much of the same applies to day day gamblers.

So with much research, knowledge, practice, in theory one should be able to take advantage of day gamblers to get really good precise (enough) entries and exits. Thank you day gambler! Not only do they feed brokers ridiculous amounts (10 times the roulette wheel amount) allowing MY costs to go down, they also improve MY bottom in another way which is with better entries and exits.

Thank you day gamblers! You truly are altruists.

In this case...

We can note that the price after bouncing between 1 and 1.618 dropped and bounced again on the "1" level. Bagholders breaking even?

Rather than just buy at a vague price, it is in theory possible to use swing bagholders and day gamblers to have a very good entry.

Does not always work. And no point being greedy here, it's already tight enough. Enter at a likely reversal price = better entry = better RR.

Stop can be put way way far, further than the day gamblers capitulation, and even the swing bagholders, giving it many chances, and on a high timeframe it will still be a high payout for a small risk.

The goal is not to look for perfection, but to progressively improve risk rewards thanks to others mediocrity and gambling mentality.

On top, I repeat, of already all being at an advantage compared to decades ago, thanks to daygamblers taking the volatility in the teeth and cratering spread costs.

Warren and me, deep down we do the same thing:

In a concrete example, a trade I posted recently:

EW FIBONACCI Ratios, FIB Retracement and Extension application !In this post, I'm going to focus on Fib Retracement and Fib Extension Ratios by Elliott Wave, and show you how to best use these tools.

Fibonacci ratios are mathematical ratios derived from the Fibonacci sequence.The Fibonacci sequence is the work of Leonardo Fibonacci.

Fibonacci sequence is used in many applications, movies and photography, space studies, stock market actions, and many other fields.

Fibonacci is a proven approach for measure price movement relationships. For Elliott heads, it means Fibonacci numbers are tools to help guide us in our interpretation where we think price movements will go.

The most common Fibonacci ratios used in the stock markets are:

1 - 1,272 - 1,618 - 2,618 -3,618- 4.23 (extension)

0.236 - 0.382 - 0.5 - 0.618 - 0.786 (retracement)

Let's start with Elliott Impulsive Wave rules !

Wave 1: the beginning of each wave and retracet with

Wave 2: may never retrace deeper than the beginning of wave 1

Wave 3: often the longest, but never the shortest

Wave 4: may never retrace below the top of wave 1

Wave 5: x

Fibonacci ratios :

Wave 2

The most common retracements we look for in a Wave 2 pullback are either a 0.5 or 0.618 retracement of Wave 1

We expect only 12% of Wave 2 to hold 0,382 retracements of Wave 1

We anticipate 73% of Wave 2 retracements between 0,5 to 0,618

We anticipate 15% of Wave 2 to retrace below the 62%

Wave 3

Wave 3 is related to Wave 1

Fibonacci relationships:

Wave 3 is either

1,618 length of Wave 1

or 2,618 the length of Wave 1

or 4,236 the length of Wave 1

The most common multiples of Wave 1 to Wave 3 are the 1,618 and 2,618

If Wave 3 is extending, we typically look for 4,236 or higher

Only approximately 2% will a Wave 3 be less than Wave 1

We anticipate 15% of Wave 3 trade between 1 and 1,618 of Wave 1

We can anticipate 45% of the time Wave 3 will push to between 1,618 and 1,75

We can anticipate 8% of Wave 3 will extend beyond 2,618 or higher

Wave 4

Wave 4 is related to Wave 3

0,236 of Wave 3 or

0,382 of Wave 3 or

0,50 of Wave 3 or

0,618 of Wave 3

We can anticipate only 15% of the time Wave 4 to retrace between 0,236 to 0,382

We can anticipate 60% of the time Wave 4 to retrace between 0,382 and 0,5

We can anticipate 15% of the time Wave 4 to retrace between 0,5 and 0,618

We can anticipate 10% of the time Wave 4 retrace 0,618 or greater

Wave 5

Wave 5 has two relationships. Wave 5 has a direct correlation to the Fibonacci relationship of Wave 3

1. If Wave 3 is greater than 1.62, or extended

Wave 5 is a 1 to 1

or 1.618 of Wave 1

or 2,618 of Wave 1

I don't know any statistics, but in my experience a 1.618 or 1 to 1 is the most likely

2. If Wave 3 is less than 1,618. Wave 5 will often overextend.The ratio of Wave 5 will be based on the length from the beginning of Wave 1 to the top of Wave 3

Extended Wave 5 is either 0,618 from the beginning of Wave 1 to top of Wave 3

or 1,618

Unfortunately, my english is not so good and I work with google translate, but if you have any questions I will be happy to answer them .

➡️If you like my posts smash the like👍👍 button, comment or follow me. It helps me to publish more free education, also on request ⬅️

Fib retracement and Extension application follow 📚

PLG 63% increase.PLG 63% increase. The analysis is based on an important ATR rule. It is the relationship between the ATR value and the resulting wave sequence. It is now accepted that the value of the ATR can give a predictive signal for subsequent movements. If the ATR is high, we expect high market volatility. What is less well known is the impact of ATR on the size of the wave sequence that will form later. The theory here is simple. The basic principle is : the percentage change in the ATR of the previous wave sequence gives the percentage size of the next wave sequence. In our case, this means that the size of the ATR change of the previous wave sequence is 23.71%. The size of the next corrective wave sequence will be 23.71% exactly according to the rule. Now we see this. We have reason to believe that the second wave section of 23.71% is the last corrective wave we saw. We therefore expect a rise from the local bottom of this. Even though the current fair value of PLG shares is 4.6 usd but the ATR based calculations give a primary target price of :7.6usd with a secondary target price of : 11.28 usd we are buying the stock considering the good return risk.

Wyckoff Basics part 2After my last educational wyckoff post - I had a lot of comments, questions and so on.

The idea was to post the basics and show the concept - there has been a lot of the overlay, breakdown and other people jumping on this. It was a move we called on the 18th of March (see the "they blew up the rocket" post).

In terms of some simple education, Wyckoff is deep and possibly too deep for newer traders. What I was trying to highlight was the existence of such techniques. In part one;

I only covered the point of how the distribution phase was playing out in Bitcoin.

In this post, I will share some additional depth - for those of you already familiar with Wyckoff techniques you already have this. So we are not covering here (volume, how to identify or any of the more advanced stuff or terms like creeks or mark-ups and downs) Just another simple intro to the basics & a step up from post one.

So if you have not seen the first post; check it out here by clicking the image.

4 Major types of schematics

The Accumulation and Distribution Schematics are a major part of Wyckoff’s work, These schematics are broken down into 2 patterns for accumulation and 2 for distribution. These sections are then divided into five Phases (A to E), along with multiple Wyckoff Events - we will cover this later.

Distribution schematics

So in the previous post & it was fortuitous that Bitcoin was a near textbook example of the distribution schematic #1.

The second type of distribution schematic looks like this;

As you can see, there are a lot of similarities & it can be confusing, but this is where it's best to dig deeper into the concept, why volume plays a big part in Wyckoff techniques and gain an understanding of the naming convention for each of the events inside.

** We have a naming convention key below **

Accumulation

As well as distribution you also have accumulation and this also has 2 (major) schematics;

#1

And #2

======================================================================================================================================

Key;

The first phase or ways to identify a schematic forming is with what is called a PS (Accumulation) or PSY (distribution) - this is basically the change of character as the trend moves towards a schematic; Preliminary Support (PS) and Preliminary Supply (PSY). The first significant reaction that occurs after a prolonged rally that

indicates budding supply showing up.

You then have a BC or SC - buyer climax / sellers Climax; the obvious BC in an uptrend suggesting institutional operators cashing out. and the inverse with the SC.

The next major event is the AR - Automatic reaction (rally) - The reaction that occurs after a Buying Climax. It occurs without previous preparation, hence the word “automatic.” and in layman terms it's the exit of large positions after a climax (SC and BC) event.

ST next - this is a second test (ST) A name given by Wyckoff to the reaction following Automatic Rally, (or rally following the Automatic reaction.) If that test is associated

with small range and light volume — it increases the likelihood that the previous trend is over.

Next a move down if it is accumulation would be a SOW - this is "Sign of Weakness" and inverse we have SOS "Sign of strength"

In distribution - you then have two major differences over the accumulation schematic; UT = Up Thrust and a UTAD = UP Thrust after Distribution.

For distribution you have a spring, think of this like the last drop before moving up rapidly out of a schematic on the Bullish side.

You then have "Test" phases usually of the support and resistance levels (zones) created by the schematic as shown in the images above.

And finally you have LPSY for distribution Last Point of Supply - A point at the end of the process of distribution where the Composite Man (Large operators) recognizes that demand forces have exhausted themselves and it is safe to start marking down prices.

Last Point of Support (LPS) which is the accumulation equivalent - A point at the end of the process of accumulation where the large operators recognizes that supply forces have exhausted themselves and it is safe to start marking up prices.

This is still only the basics, not looking at phases or volume or anything else yet. It's worth going away and studying this in a little more detail to get familiar with the concepts and terminology and in the next post I will cover the phases.

=======================================================================================================================================

I know a lot of you readers are here purely for the crypto/BTC calls made - and another logical reason we are still liking a slow move down at this level, comes in the current DXY situation. See this post below as to the current situation there. (the relevance might be small - But understanding the forces at work, with DXY to BTC. Is actually useful).

Shorter term strength = will aid BTC slow moves.

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principle trader has over 20 years’ experience in stocks, ETF’s, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

BTCUSD: 2 simplest strategies to buy & sell in any time frame1. Buy:

1.1. In any time frame we buy when price is seemingly plunging & RSI is gaining strength. Here we "MUST" watch only.

1.2. Then, a consolidation starts during which we can be almost sure that there will be no more descending move.

1.3. Being familiar with Harmonic Patterns during growth, consolidation & downturn cycles would of utmost help.

1.4. Next is a rhyming of HHs & HLs and RSI (14) is implicating the end of a previous cycle & the new coming one.

1.5. With RSI (2) you can see at least 2 very low figures less than 10 rising and falling followed by the 3rd HL which can be a trigger.

1.6. The latter is true in daily & weekly time frames when Elliot wave counting has been done. 2nd & 4th Elliot's Corrective waves out of 5 impulsive waves reacting to the most important corrective fib levels while price is so close to the "dynamic logarithmic support" of weekly time frame price channel.

2. Sell:

2.1. In any time frame, we sell when price is seemingly going higher while RSI (14) is getting weaker.

2.2. In weekly time frame price can touch or cannot touch the "dynamic logarithmic resistance" in the first nearest distance or a complete touch with price channel.

2.3. While in daily it is showing weakness specially in the second touch with channel.

2.4. This is most true when the latter is accompanied by price getting closer or touching "dynamic logarithmic resistance" of weekly price channel while in Elliots wave counting either 1st impulsive wave, or the 3rd & the 5th ones are formed.

2.5. This (RSI Weakness coinciding with the 1st, 3rd & 5th Elliots) can be rechecked by setting fib projection levels.

Volume & the total market index for weekly and daily time frames need to be checked as well. What has been said is very easy & obvious in a way while very complicated in another way. One needs to find its own trading/investing style which best suits his personal needs & capabilities.

Any strategy has to be addressed only if there is a plan in advance. A plan has a natural deviance from reality all the time & might not yield best returns on investment, but it guarantees survival & resiliency of the business.

This is for learning purposes only and is not a financial advice.

Trading Basics Part 1:How Candlesticks Work!

Hello,Traders!

Japanese Candlesticks are thought to have been invented by the Japanese rice traders

And then made their way into the West where they were used for stocks, forex and commodity trading.

Reading candlesticks is quite easy: the body represents an area that indicates the price distance between the open and close of the candle, while wick’s ends indicate the full magnitude of the movement in-between open and close. Thus, when picking the timeframe for your chart, you are deciding on how much time will be contained between open and close of each candle.

If open is below the close, the candle is bullish , and if open is above the close, the candle is bearish , which is usually represented by different colors of the bodies and wicks on the chart, typically, green and red.

Some of you might ask me, why am I explaining things that seems to be obvious and self evident, yet my experience of Coaching, paints a different picture, with thecandlesticks being undervalued and misunderstood by many, despite them being the staple of technical analysis .

In my trading strategy, which is based on multi timeframe top-down technical analysis ,

we examine multiple timeframes, from 1 week to 1 hour, going from higher to the lower timeframes. Looking for strong levels on weekly and daily and for patterns and confirmations on 4 hour and 1 hour charts. Which means that we are opening 1 week/1 day candle like a Russian doll, finding multiple candles inside the other. We enter the trade only if we are getting the same bias on all timeframes that were of our interest!

If you found my post helpful and interesting, please, like comment and subscribe!

Thank you!

How to Build up a Position Like a Pro!Hello Traders!

Green dashed lines represents Limit orders.

White Dashed line Is the original signal, a sell stop order below the last low.

Take profit levels are the green lines.

Stop loss is also could be a stop and reverse for an inverse head and shoulders pattern.

This helps you to eliminate FOMO.

Have a great day!

Regards,

Vitez