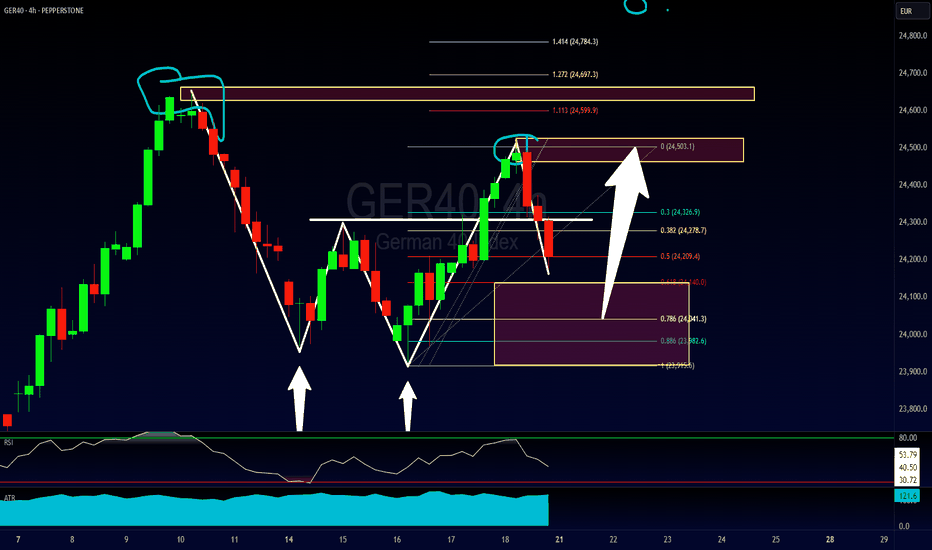

How To Trade A Bullish 2618 Setup on the GER40A walkthrough of the 2618 Trading Strategy which is a secondary or more conservative way to enter a double top/bottom. In this case, due to the overall directional analysis of the Dax, this also might be a good opportunity to hop on a pullback for a larger bullish trend continuation trade.

2618 RULES

Step 1 - Look for double top or double bottom.

Step 2 - Wait for violation of peak.

Step 3 - Look for pullback into a minimum 61.8 Fibonacci retracement.

Hope you guys have a great week of trading and remember to let me know which profit target method you think you would go with.

Akil

Community ideas

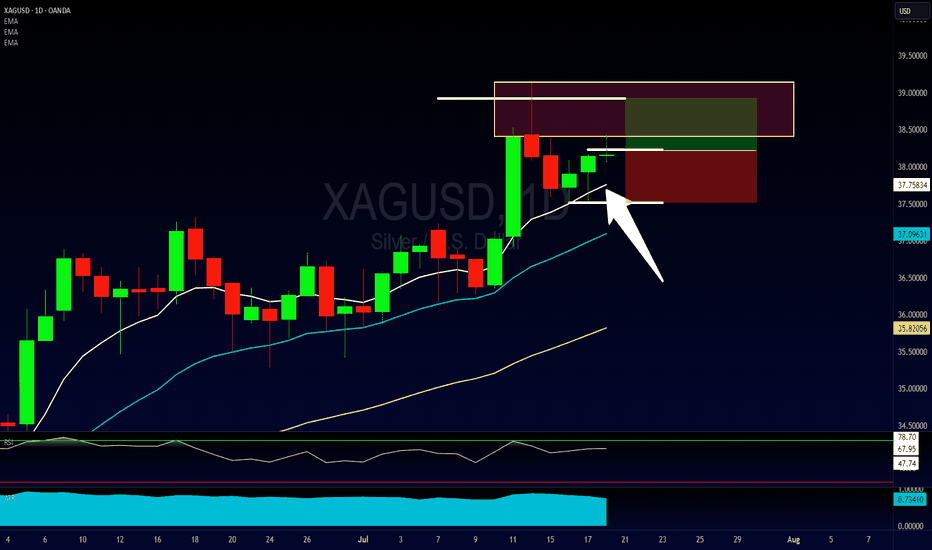

Bullish Daily Chore Strategy Entry on SilverFirst time I've spoken about this strategy here (as I don't personally trade it myself), but the "Daily Chore" is a very popular one amongst the traders I work with.

Essentially what we're looking for is for price action to be on the correct side of our 3 EMA's (8, 20 & 50), and for those EMA's to be running in the correct order.

If so, we are then looking for a pullback into the EMA's and for a pin bar rejection candles to give us a sign for entry.

This is a very difficult strategy to figure out as it requires a lot of testing and tweaks to optimize, but it also allows for a lot for freedom as it only requires a few minutes a day to check up on.

Please leave any questions or comments below and make sure to give me a follow so you don't miss my next shared trading idea.

Akil

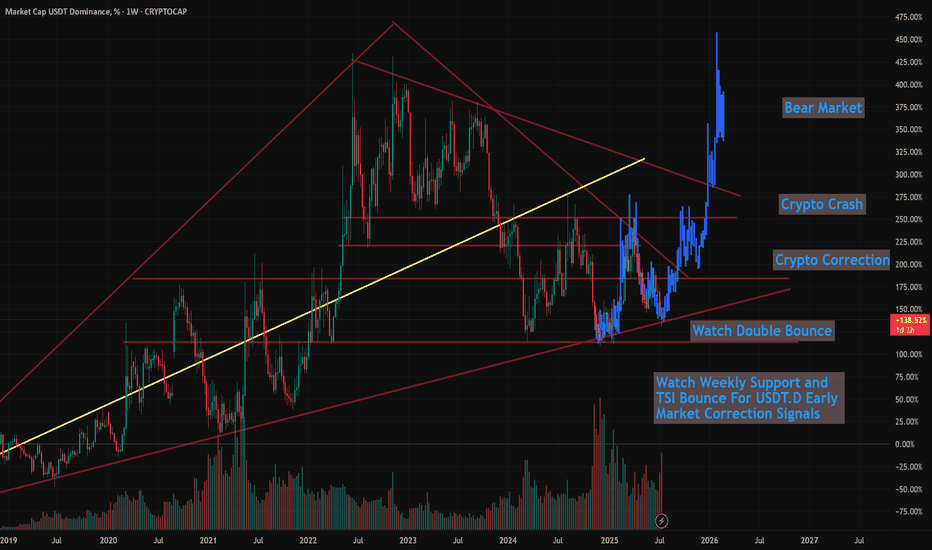

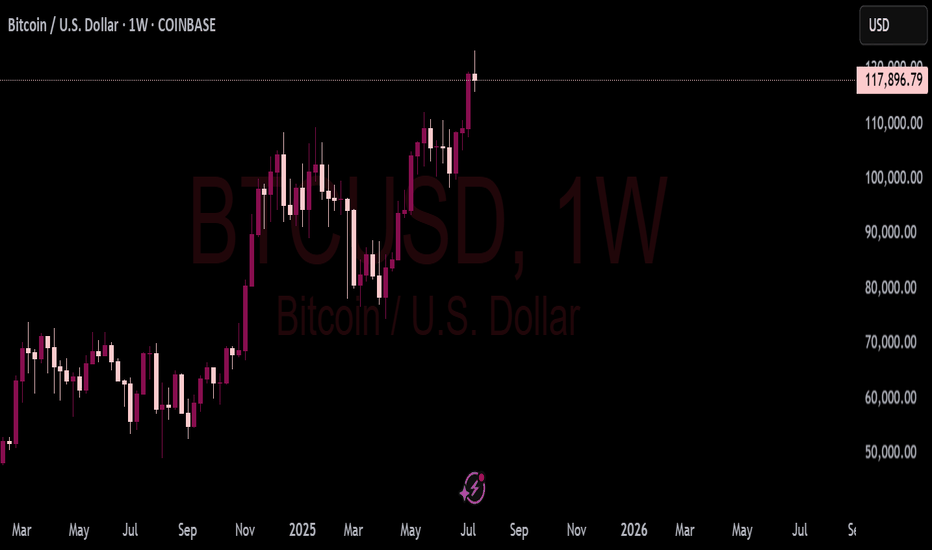

USDT.D Showing Troubling Signs of a Market Top SoonIn this video, I revist the USDT.D study I've talked about a few times before showing that when Tether Dominance comes down to this multi-year trendline support (since 2018), that's typically the beginning of a correction.

It's inversely related for obvious reasons. Money flowing out of Bitcoin and crypto flows into stablecoins (Like Tether), so when one is up and peaking, the other is down and correcting.

This video shows the relationship between both, and how we are likely setting up for a near term correction in the coming weeks.

My best guess is we continue to rally hard into early to mid-August, potentially getting close to $150k, followed by a 20-25% correction into September.

The BIG question is...

Will that mark the top, or will get a 2nd (and maybe 3rd) pump to $200k - $245k as my other models have been showing.

Let me know what you think!

3 Trading Scenarios To Choose From - Which Do You Prefer? The setup that we're looking at in this video is going to be a potential bearish bat pattern on GOLD.

However, what's more important is the lesson that I wanted to cover on different tactics for adjusting your stop/loss & dig into the pro's and con's of each.

I'd love to hear which way you guys would choose in this particular situation (or in general) so please share your opinion in the comments section below.

Wishing a great weekend and a great upcoming week in the markets.

Akil

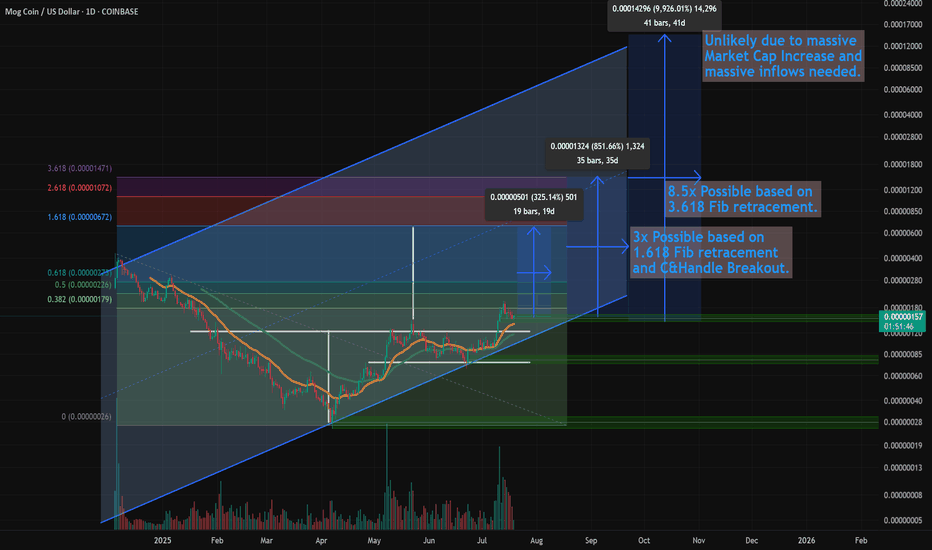

$MOG Setting Up For Cup & Handle Breakout - 10x - 100x TargetsAs I stated in the video, I don't normally cover Meme coins, but this is a great looking chart for MOG and thought I'd do a quick study on this with some potential price targets...

And how I'm using AI to get a better handle on the likelihood of my TA targets.

In short -- 10X here is possible this bull run (8.5x more likely based on the Fib)

But 100X is very unlikely, even though the top of the parallel trend channel shows it's potential.

No surprise there, but watch how using AI can give clarity on this and these decisions.

Let me know what you think...

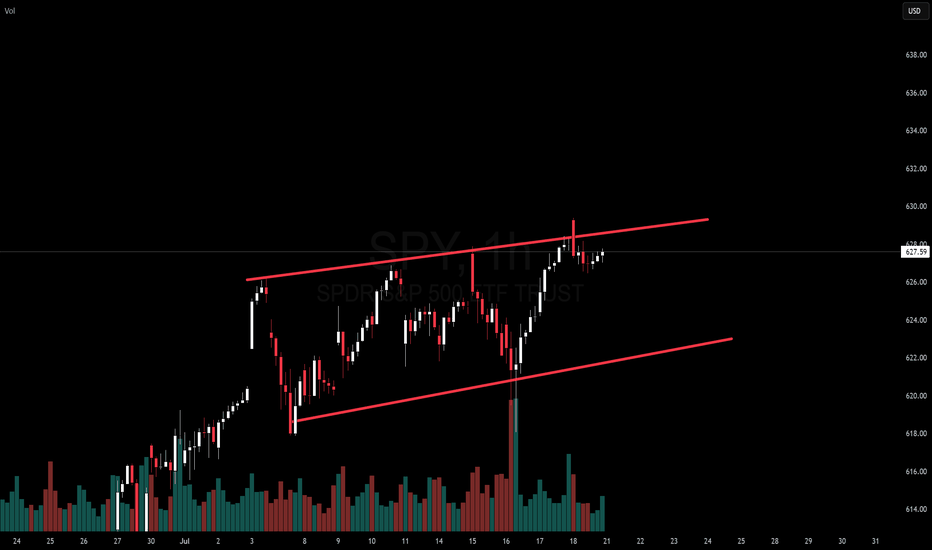

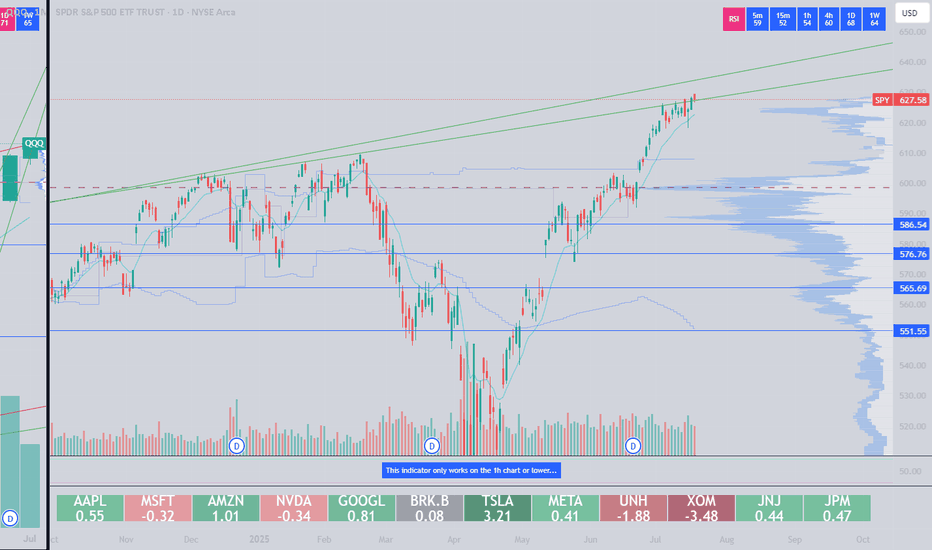

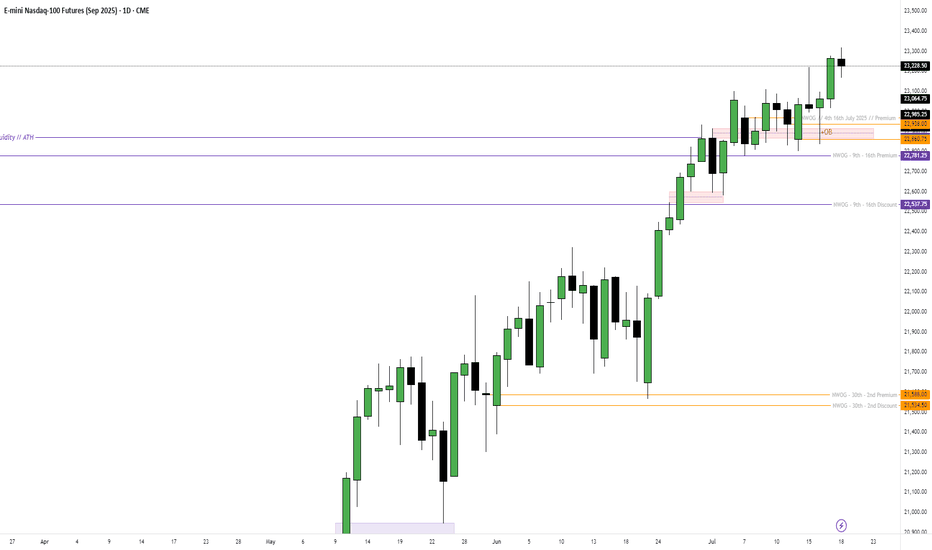

S&P 500: Buyers Are Still In Control! Continue To Look For LongsWelcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

S&P 500 (ES1!)

The Stock Indices are strong, and showing no signs of selling off. Buy it until there is a bearish BOS.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

AUDUSD: Sell The Rip!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

AUDUSD

AUDUSD has been difficult to trade, as it chops its slow grind upwards. Last week it gave a bearish close. With the USD expected to continue to gain strength, look for sells directed to the liquidity lows in AUDUSD.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

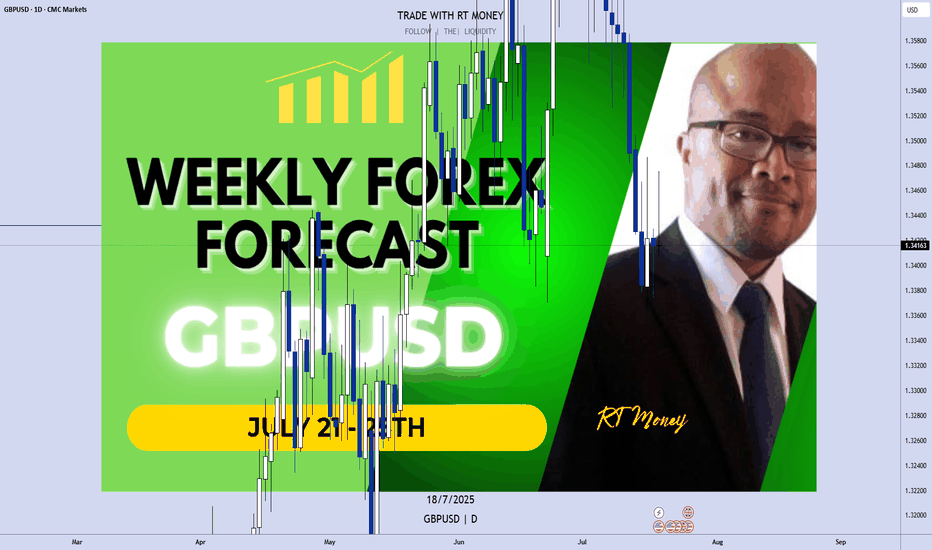

GBPUSD is Bearish! Look for Sells!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

GBPUSD

Expecting the USD to continue to push higher, which would further drag the EURO down. Look to take advantage of this dynamic and wait for sell setups!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

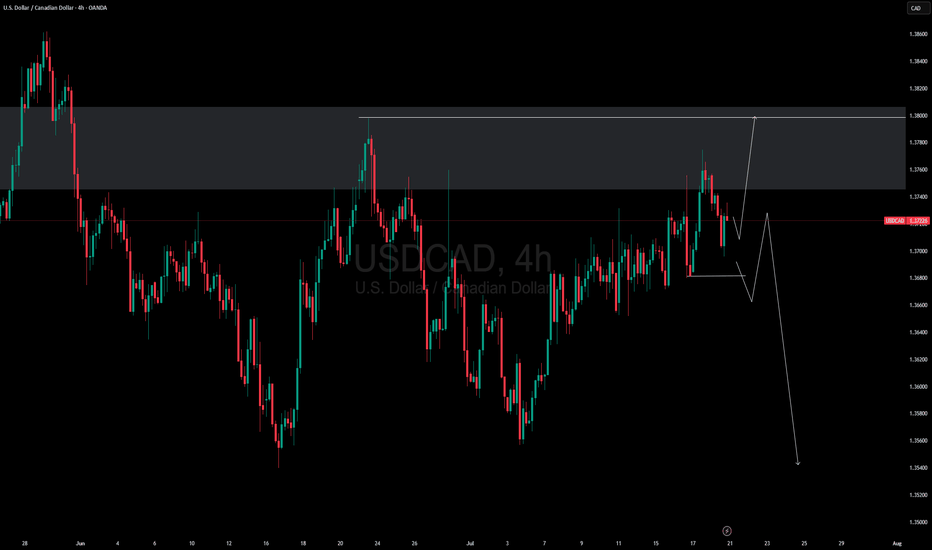

Tricky USDCAD . let the market decide - we follow Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

EURUSD Is Weaker vs USD. Look For Sells!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

EURUSD

Expecting the USD to continue to push higher, which would further drag the EURO down. Look to take advantage of this dynamic and wait for sell setups!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

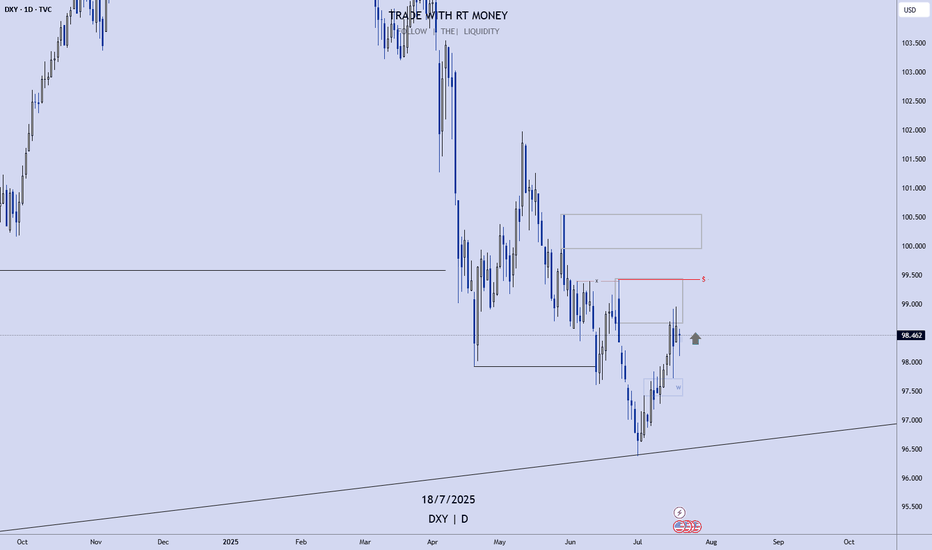

USD Is Still Bullish! Wait For Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

USD

The DXY has run bullish last week, up into an area of Supply, where the momentum hesitates now. Next week may pull back a bit... before continuing higher to the buy side liquidity.

Look out for the short term pullback to the W +FVG for a high probability move higher!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

CRYPTO-BTCUSD-SHORT TERM- SELL-SCALP PREDICTIONThe market made an impulsive move to the downside Friday 7/18/25 starting at 2am, leaving a FVG on the hourly, Price has retraced back to the hourly FVG around 118,511, expecting the market to temporarily sell off before move back to the upside. First TP is 116,914.

Ripple Update: Is XRP Ready for Another 500% Growth?Hey friends, it’s Skeptic 🩵 . In this video, I’m giving an update on Ripple’s conditions , reviewing past triggers, and what to do with your long positions in futures if you’re still holding. For spot, what’s the move? I dove into XRP/BTC analysis and, at the end, broke down BTC.D , which just had a major event you need to pay close attention to. Don’t forget money management, and stay clear of FOMO. Drop your thoughts on XRP in the comments so we can chat about it!

XAUUSD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

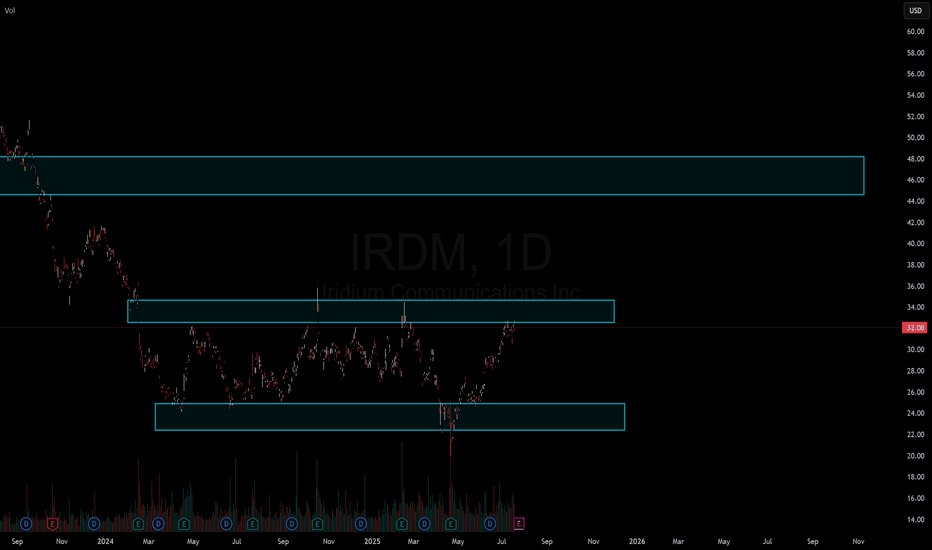

IRDM: Make or Break It Hey everyone,

This is more of a fundamental idea on one of my favourite companies, IRDM, though there is math and analysis involved.

Here are key points that I didn't want to elaborate on in the idea, but just for background info.

Summary of Earnings Transcript from Q1:

Iridium Communications reported solid performance with 6% growth in operational EBITDA and continued service revenue growth across key areas, including IoT, PNT, and engineering. CEO Matt Desch addressed uncertainties stemming from new U.S. tariffs, which could add up to $7 million in annual costs if fully implemented, though Iridium has mitigation strategies in place. Despite global trade volatility and increased competition from entrants like Starlink, Iridium remains confident in its differentiated offerings—particularly its L-band network, global coverage, and mission-critical capabilities. The company highlighted momentum in its next-gen IoT and Direct-to-Device (NTN Direct) services, GPS-alternative PNT solutions (boosted by its Satelles acquisition), and government partnerships. CFO Vince O’Neill confirmed full-year guidance for 5–7% service revenue growth and $490–500 million in operational EBITDA, citing robust free cash flow generation, healthy liquidity, and strong shareholder returns via dividends and buybacks. Management reiterated long-term confidence in Iridium’s growth strategy through 2030, supported by its technological edge and diverse partner ecosystem.

History of Irdium

1987: The concept for Iridium was born at Motorola’s Strategic Electronics Division in Arizona.

1990: Motorola publicly announced the Iridium project at simultaneous press conferences in New York, Beijing, London, and Melbourne

1991: Iridium Inc. was incorporated to develop and deploy the satellite network.

1997: The first Iridium satellites were launched from Vandenberg Air Force Base, beginning the build-out of the constellation.

November 1, 1998: Iridium officially launched its commercial satellite communications service. The first call was made by U.S. Vice President Al Gore to Gilbert Grosvenor, great-grandson of Alexander Graham Bell.

Iridium has had a slew of hardship, having filed for bankruptcy in 1999 and being revised in 2001.

IRDM's major competitors are Inmarsat, Globalstar ( BOATS:GSAT ) to a lesser extend as their network is not as broad, Telesat and Visat.

Starlink is not a direct competitor for Iridium as they server different purposes, but Iridium already faces strong competition with the above mentioned companies, in addition to the evolving companies such as NASDAQ:ASTS and NASDAQ:RKLB which have the ability to completely derail Irdium if they advance faster than Iridium can keep up.

These are my thoughts, hope you enjoyed!

Safe trades!

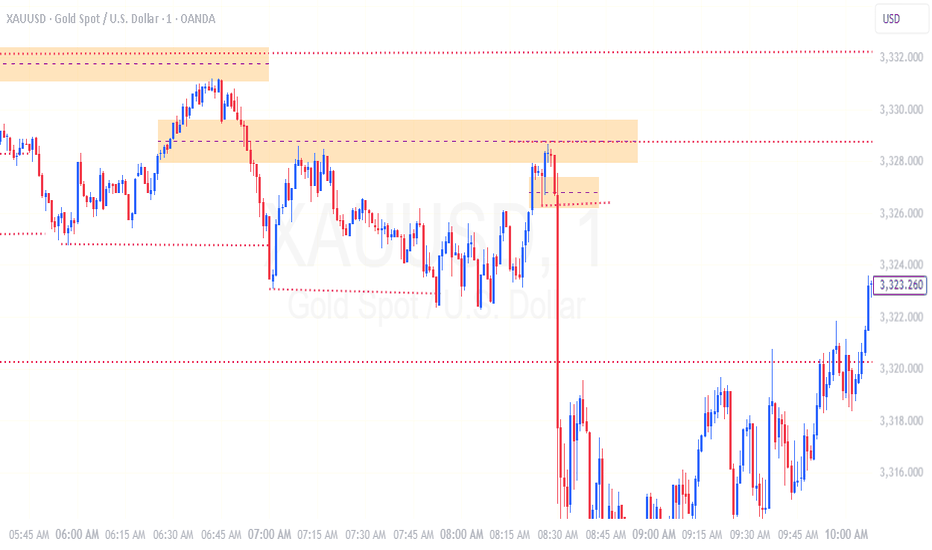

Trading Game of the Day 16-JULY-2025Trading Plan :-

1-PDA targen from IRL to the ERL

2-iFVG and FVG together with MSS and CISD

3-release PPI at 08:30 am NYT

4-double bottom and LOD is the target like a magnet for the price

these are the confirmation tools for the direction of the price for the target

Thank You

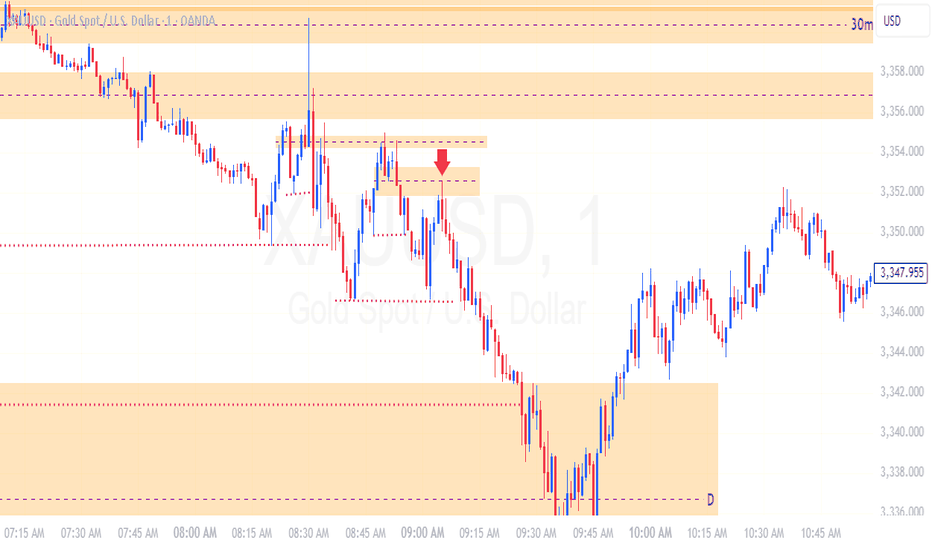

Trading Game of the Day 15-JULY-2025Trading Plan :-

1-the price from one PDA to another PDA

PDA is either swing point ,weekly high and low ,daily high and low and FVG

DOUBLE BOTTOM /TOP and TRIPLE BOTTOM /TOP are a very beautiful areas to be target by the price specially when there is FVG beyond it

these are areas of accumulation of Liquidity

2-release of CPI at 08:30

3-iFVG and FVG together with MSS and CISD

All these make my trading profitable

Thank You