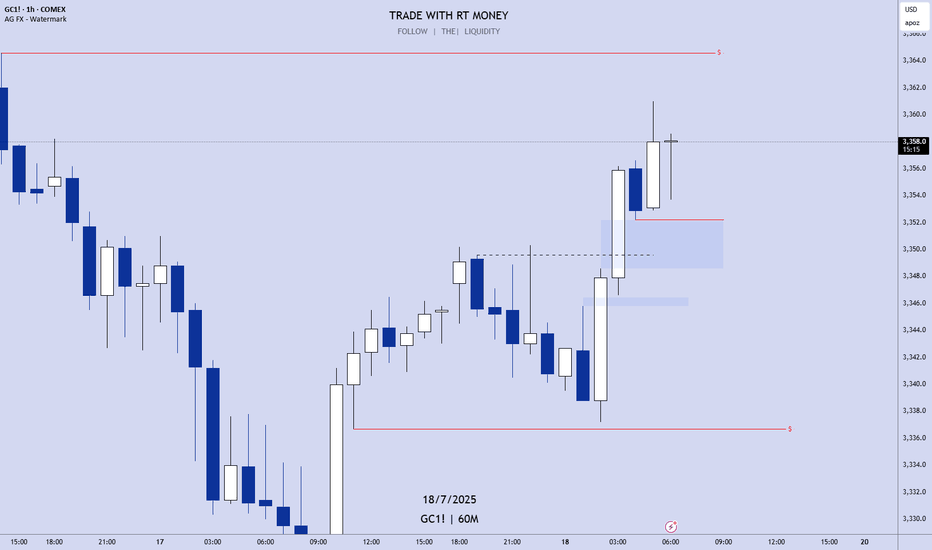

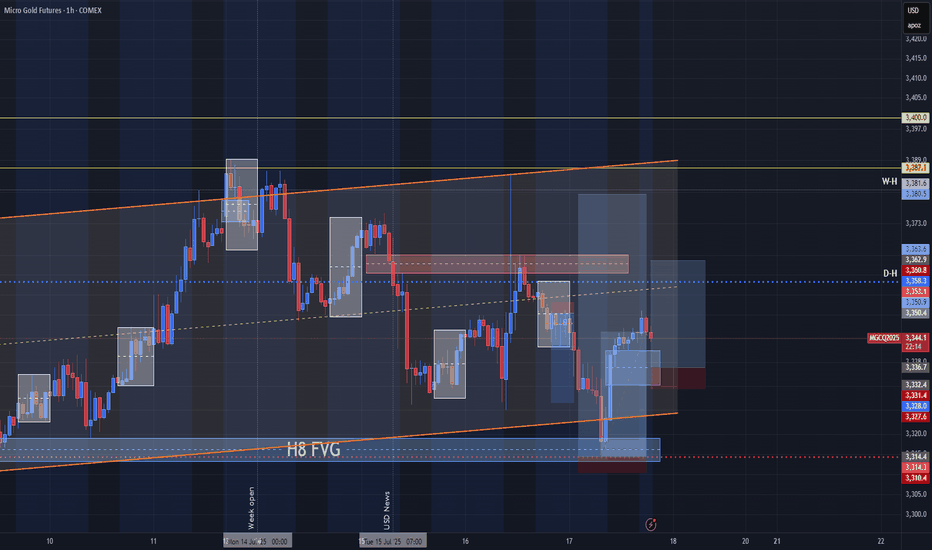

GOLD! Pre-Market Analysis For Friday July 18th!In this video, we'll present pre-market analysis and best setups for Friday July 18th.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Community ideas

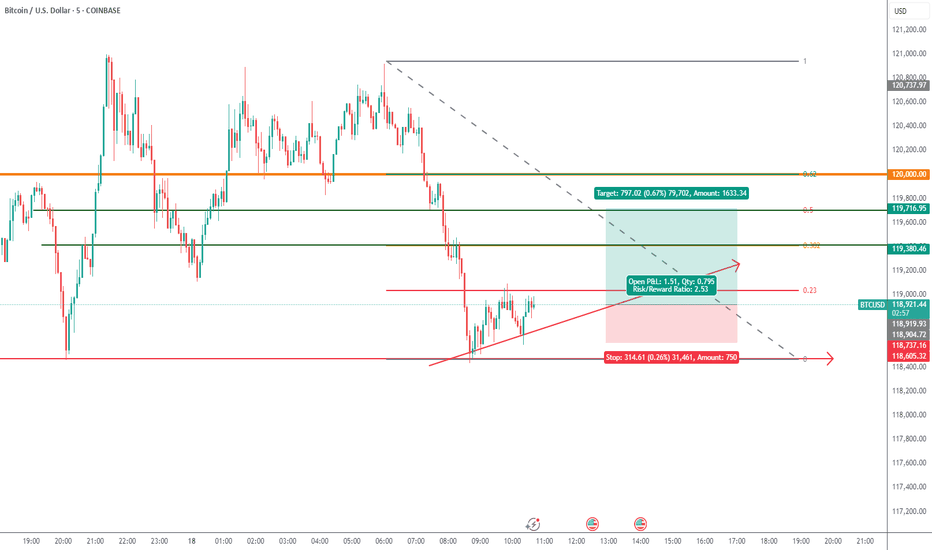

BTCUSDA Mini buy for btcusd targeting a R:R OF 1:2, although the overall trend is a sideways market favoring the downside over the upside. this buy opportunity is worth taking based on shift in market structure and we have a double bottom and order block retest. we will need a major retracement before we have our continuation sell.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

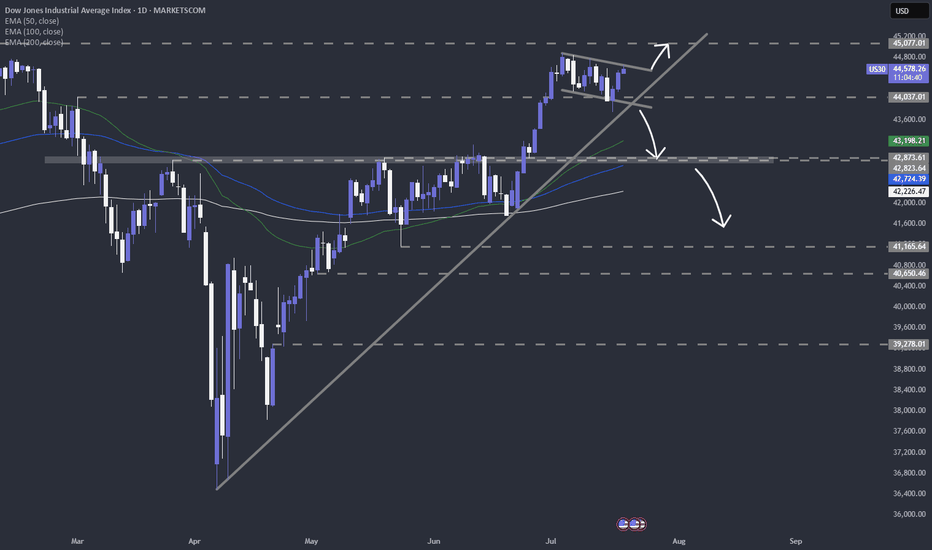

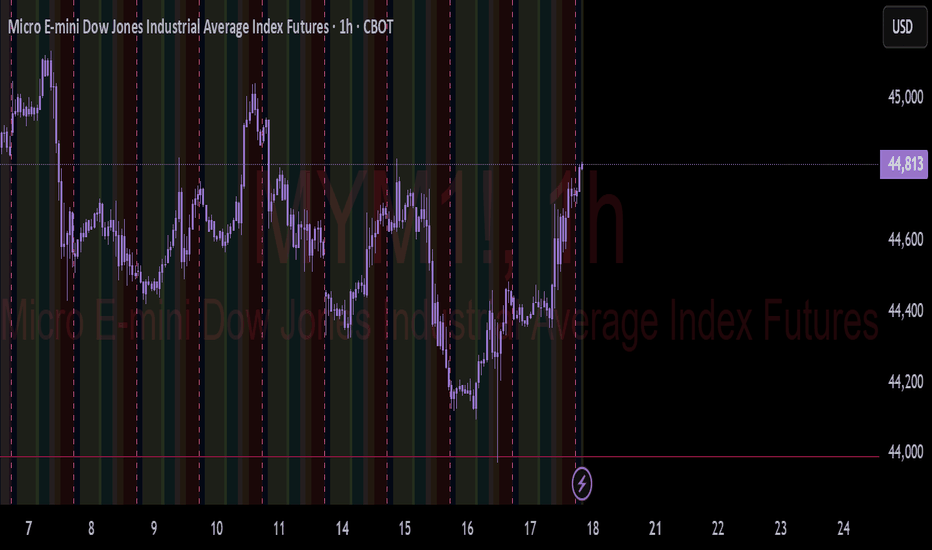

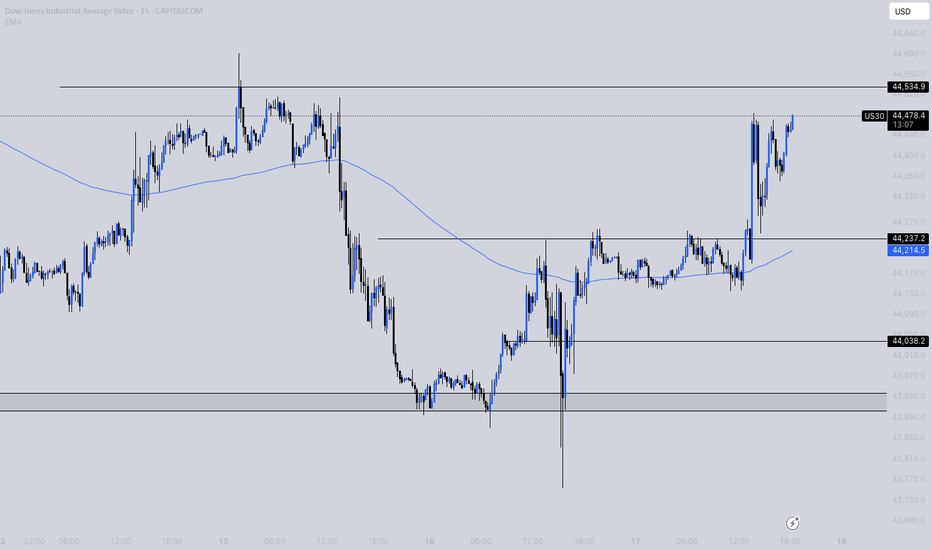

Quick take on DJIACurrently, the Dow Jones Industrial Average TVC:DJI is trading within a short-term downside channel. However, could it just be part of a correction, before another possible leg of buying? Let's dig in.

MARKETSCOM:US30

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

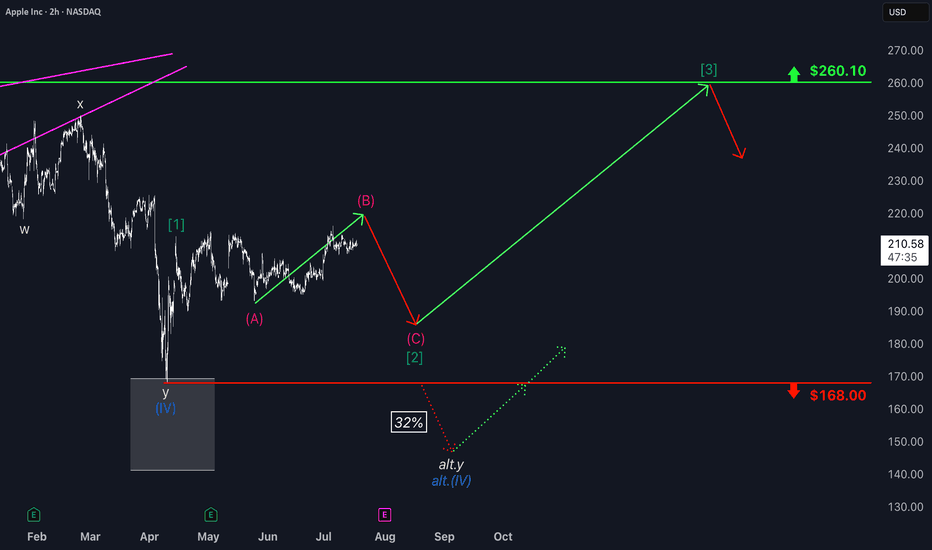

Apple: Consolidation Before Potential Breakout Toward $260Apple shares have recently pulled back into a consolidation phase. We see further upside potential in magenta wave (B) before a pullback occurs as part of the same-colored wave (C), which is expected to target the low of green wave . After that, we anticipate a new upward move: Green wave should take over—remaining above support at $168—and drive the stock toward the next major resistance at $260.10. However, if the price drops back below the $168 support level, our alternative scenario comes into play: in that case, we would expect a lower low for blue wave alt.(IV), with a probability of 32%.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

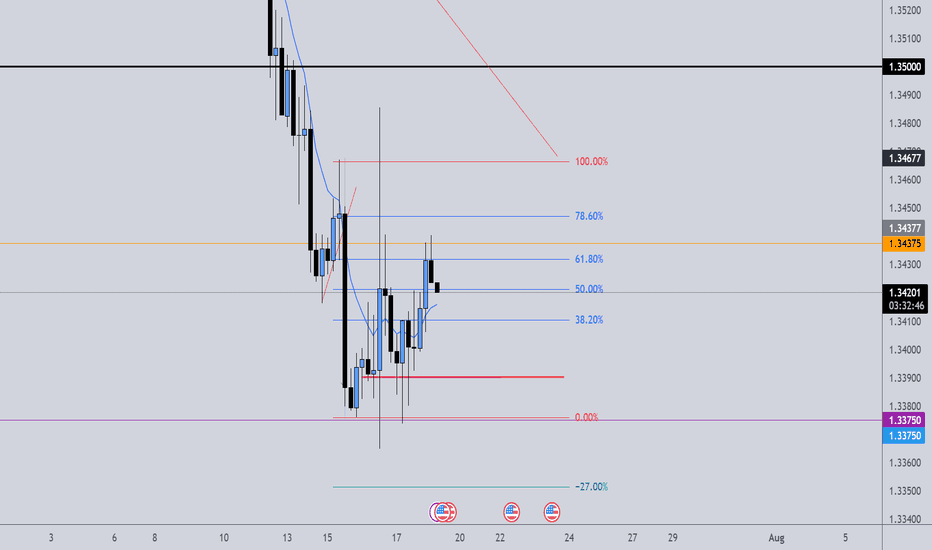

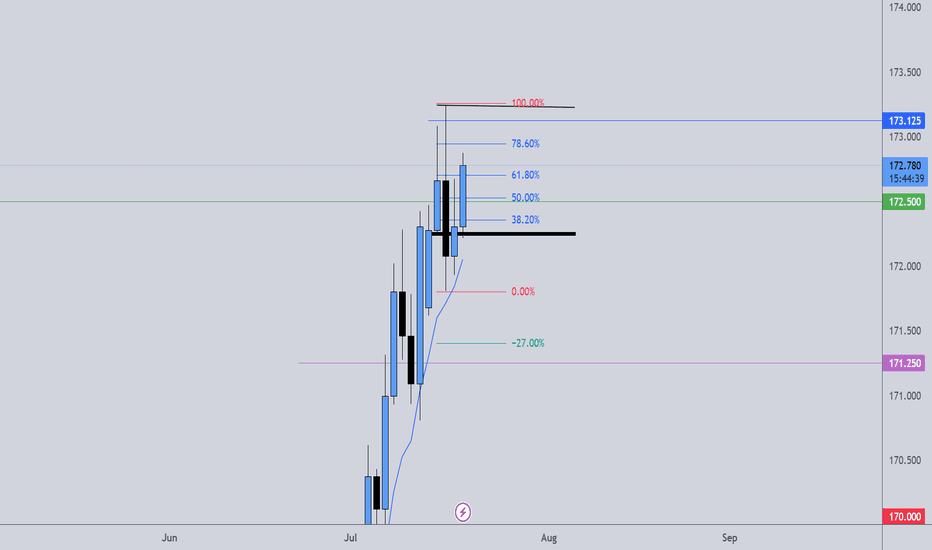

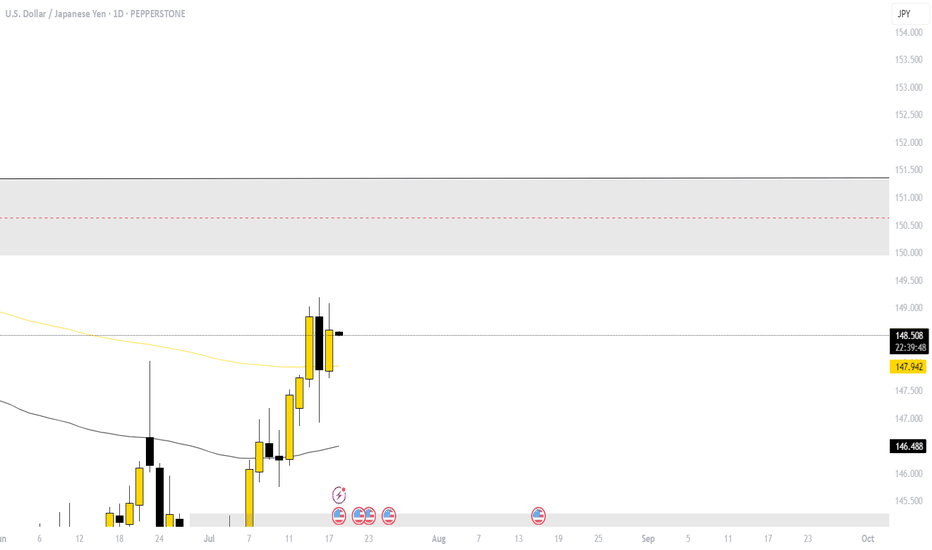

USDJPY INTRADY OPPORTUNITY Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

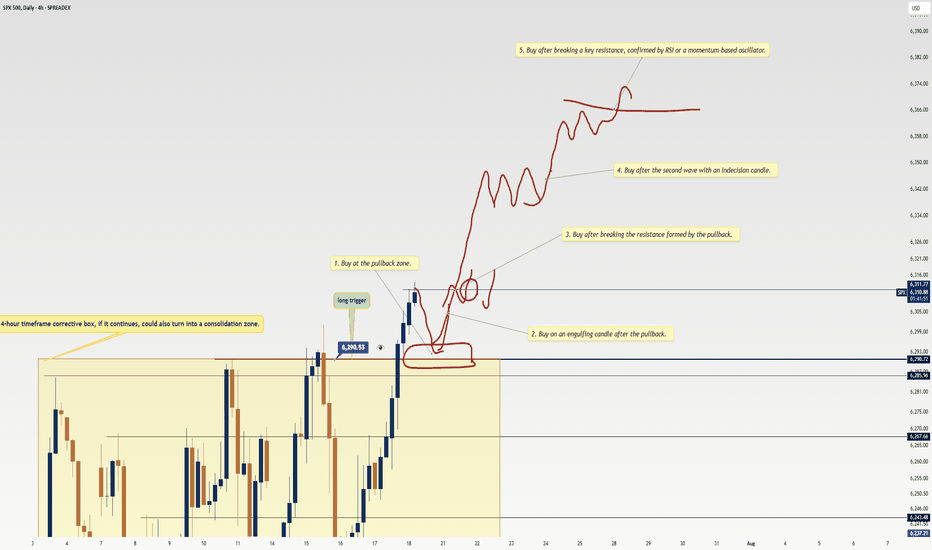

5 Proven Tricks to Trade Without FOMO After Missing Your TriggerYo traders! In this video, I’m breaking down what to do if you miss a trading trigger , so you can stay calm , avoid FOMO , and still catch the next move. We’re diving into five solid strategies to re-enter the market without losing your cool:

Buy on the pullback zone.

Buy with an engulfing candle after a pullback.

Buy after breaking the resistance formed by the pullback.

Buy after the second wave with an indecision candle.

Buy after breaking a major resistance post-second wave, confirmed by RSI or momentum oscillators.

These tips are all about keeping your trades smart and your head in the game. For more on indecision candles, check out this lesson . Wanna master breakout trading? Here’s the breakout trading guide . Drop your thoughts in the comments, boost if you vibe with it, and let’s grow together! 😎

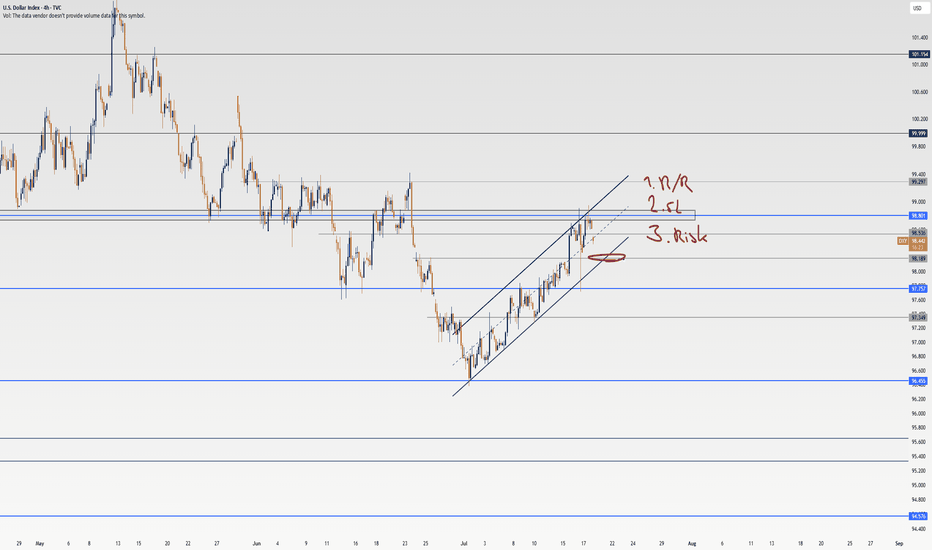

Has the DXY got you confused? Well, check out this analysis.Welcome back, traders, it’s Skeptic from Skeptic Lab! 😎 , the DXY has entered a corrective phase over the past weeks. In this analysis, I’ve broken down the technicals and chart with a skeptical eye, outlined long and short triggers on the 4h timeframe , and tried to give you a solid multi-timeframe view of the setup. At the end, I’ve shared a key educational tip that can seriously boost your win rate and R/R , so make sure you check out the full analysis.

💬If you’ve got a specific symbol in mind for analysis, drop it in the comments. Have a profitable Friday, fam <3

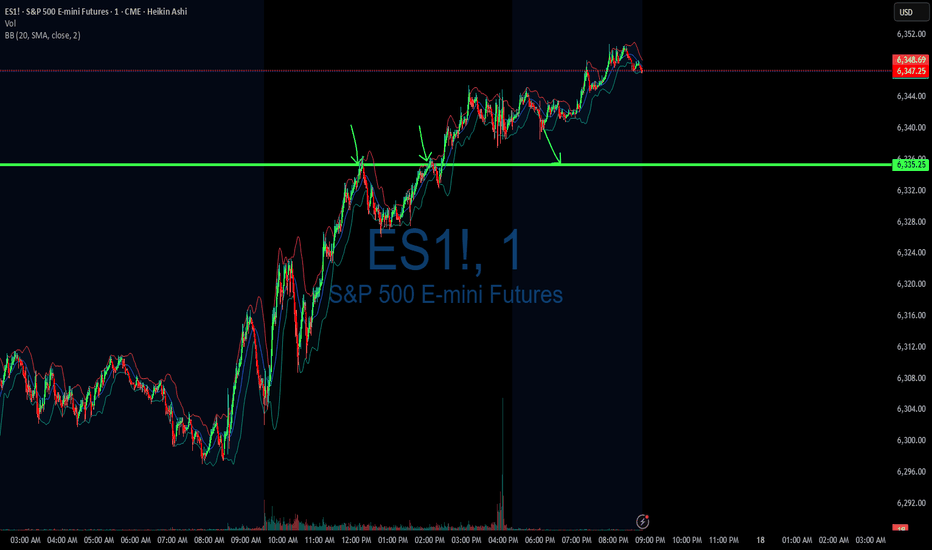

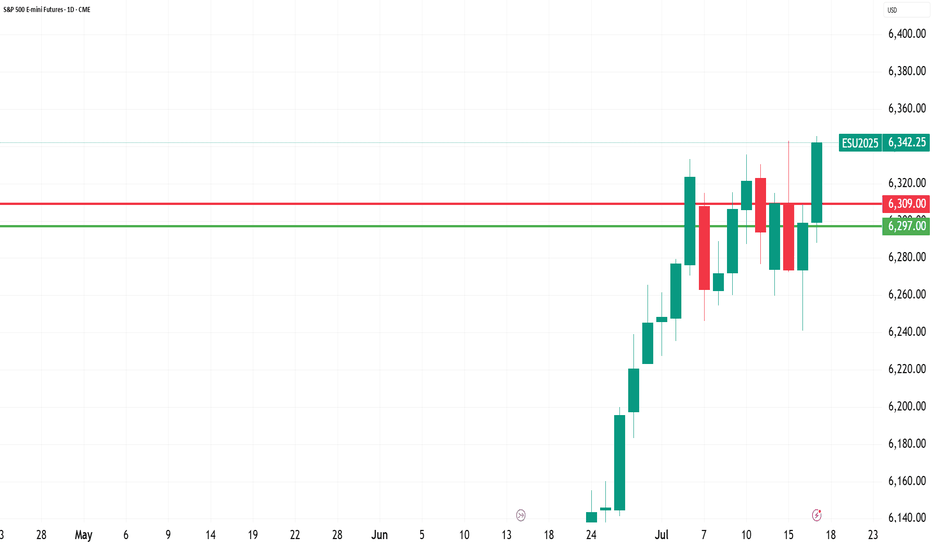

Trade Journal: Missed Morning Move & Trading Into New Highs07/17/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +447.50

Sleep: 5 hours

Overall health: My health ring is signaling that my body isn't well the last few days.

VX Algo System Signals from (9:30am to 2pm)

— 8:53 AM Market Structure flipped bullish on VX Algo X3!

— 12:17 PM VXAlgo ES X1 Sell Signal (triple sell signal)

— 1:12 PM VXAlgo ES X3 Sell Signal

— 1:40 PM VXAlgo NQ X1DD Buy Signal

What’s are some news or takeaway from today? and What major news or event impacted the market today?

Today was a bit of a rough trading day, I missed the morning move and was a bit hesitant to make trades.

Saw a lot of MM positioning high up around 6340s and wasn't sure where to get a good entry. Wanted to go in at the MOB but they never went down there.

Sell signals were not as effective today because MM wanted to make ATH but i couldn't figure out the reasoning.

News

S&P 500 ENDS AT A NEW RECORD HIGH, VIX FALLS AS STOCKS RALLY ON SOLID EARNINGS, STRONG ECONOMIC DATA

What are the critical support levels to watch?

--> Above 6300= Bullish, Under 6290= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

Sweep On levels and Confirmation of Bullish pressure! Now that we have a sweep on levels we are looking for bullish pressure to continue. They have closed the 4Hr bullish. Being that it is Friday keeping expectation low cause price can break out and push hard or it can end up being Rotational. I feel there is a move here. We just have to wait for it to line up inside of the killzone. NOFOMO Mayn!

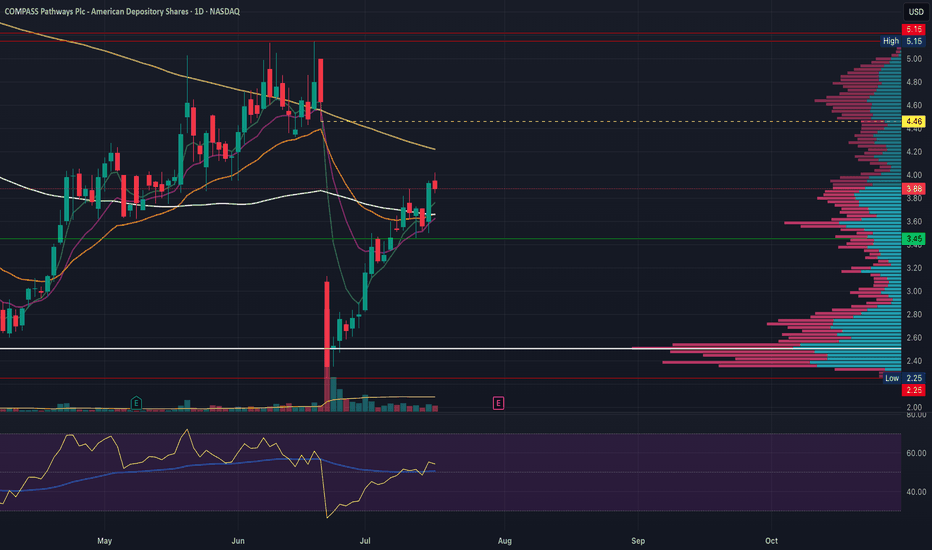

CMPS bulls are very pleased with todayCMPS had a very modest 1% pullback today after a huge 10% bull move yesterday to confirm the daily uptrend. Bulls are very happy to have seen most of those gains kept and not taken as profit.

Resistance: Daily 200 SMA, 5.15, 5.22 -> numerous weekly tops in the 5.20s

Supports: 3.50, 3.45, 3.24, 2.25

CYBN finally breaks out of its base of supportCYBN finally breaks out of 2-weeks of basing support on a very high volume bull move, close at the high of the day. I would normally anticipate a lower high below 9.83 but if this massive volume (4.5x yesterday volume!) keeps up, bulls may be able to take that level out. We will learn more in the coming days!

Resistance: Daily 200 SMA, 9.16, 9.83

Supports: 7.28, 7.11 (big red flags if lost)

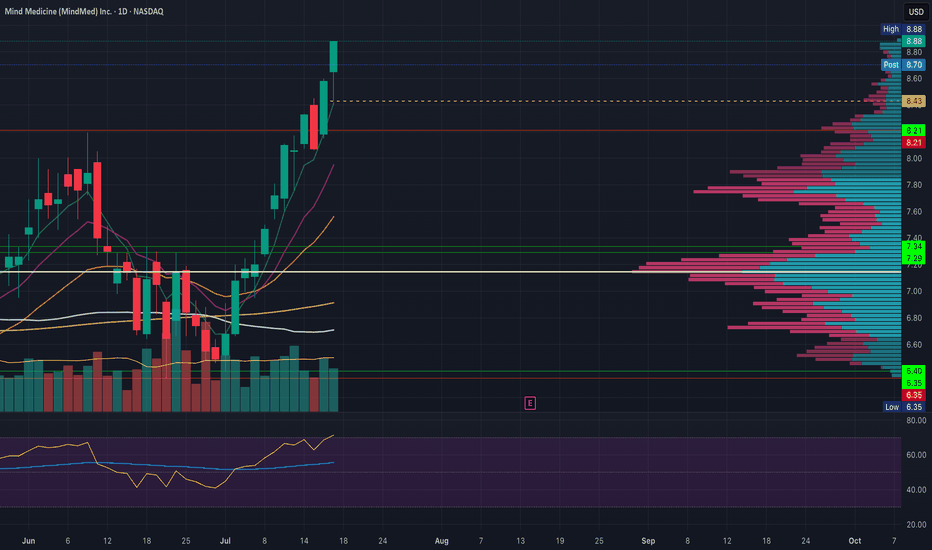

MNMD bulls continue very impressive upwardss marchBulls close at high of day, continuing a very strong two week bull move to confirm the weekly uptrend and continue to march towards key Monthly resistance at 10.44. We won't be surprised for daily consolidation when it comes but for now the hourly uptrend is our guide and the daily chart is riding a very fast moving EMA5.

Resistances Weekly 200ma, 10.44

Supports 8.43 (short term), 6.40 on daily

ATAI bulls look primed for another leg upATAI gave us the highest close we've seen in nearly 3 years today as bulls closed at high of the day approaching resistances from the gap up on July 1st. Today saw 2x the volume traded yesterday which is a great sign when looking for daily continuation.

Anticipate resistance at 2.81. 3.00, 3.01, and weekly 200 SMA

Red flag from here would be to fail at 3.00 and reverse to break below 2.53.

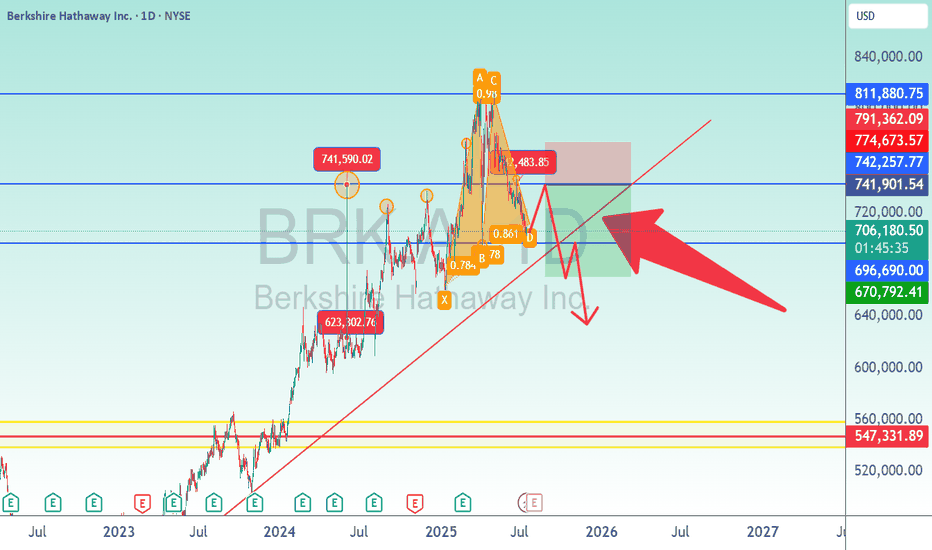

Bershire Hathaway Stock Analysis/BRK.AI looked at this particular stock because of insane activity from $623,302 to $741,590 in one day. That rejection told me to pay attention Money was coming to the door. So if the market is approaching this area again, rejection is the likely response. Looking at a short is temporary. This market is bullish in nature.