Earnings HFT gapsThe gaps that form during earnings season on or the next day after the CEO reports the revenues and income for that past quarter are always HFT driven. The concern over the past 2 previous quarters was the fact that the High Frequency Trading Firms were incorporating Artificial Intelligence into their Algos to make automated trading decisions on the millisecond scale. These small lot orders fill the ques milliseconds ahead of the market open in the US and any huge quantity of ORDERS (not lot size) causes the computers of the public exchanges and market to gap up or gap down, often a huge gap.

This can be problematic for those of you who use Pre Earnings Runs to enter a stock in anticipation of a positive to excellent earnings report for this upcoming quarter.

The HFT algos had several major flaws in the programming that did the opposite: The AI triggered sell orders rather than buy order causing the stock price to gap down hugely on good earnings news.

Be mindful that normal gaps due to a corporate event are far more reliable and consistent.

When you trade during earnings season, be aware that there is still added risk of an AI making a mistake and causing the stock to gap and run down on good news.

It is important to calculate the risk factors until it is evident by the end of this earnings season that the errors within the AI programming have been corrected and that the AI will gap appropriately to the actual facts rather than misinterpreted information.

Community ideas

"Ethereum Is The New Bitcoin" - Tom Lee ETH / Stablecoins Are the ChatGPT of Crypto

Stablecoins are exploding in adoption — just like ChatGPT took over AI and Ethereum is the engine driving that revolution. In this post, we break down 10 reasons why Tom Lee is extremely bullish on Ethereum and why it could be the single most important digital asset in the future of finance . If you're sleeping on ETH, this might be your wake-up call.

Top 10 Bullish Points from Tom Lee on Ethereum:

• Ethereum is the backbone of stablecoins , which Tom Lee compares to the “ChatGPT of crypto” due to their viral adoption and massive utility.

• Over 51% of all stablecoins operate on Ethereum , contributing to around 30% of the network’s total fees.

• Ethereum network fees could 10x as stablecoin usage grows from $250 billion to $2 trillion.

• Ethereum is positioned to lead the tokenization of real-world assets , including stocks and real estate.

• ETH could reach $10,000 if asset tokenization becomes a mainstream financial practice.

• Ethereum has a regulatory edge in the U.S. , making it the preferred platform for compliant financial innovation.

• A $250 million ETH treasury strategy is underway , aiming to use Ethereum as a long-term reserve asset.

• Institutions will buy and stake ETH to secure stablecoin networks, making ETH the “next Bitcoin.”

• Ethereum dominates the crypto ecosystem , with nearly 60% of activity including DeFi, NFTs, and dApps built on its chain.

• HODL ETH for long-term growth , as its utility, demand, and institutional support continue to rise.

Conclusion:

Ethereum isn’t just a Layer 1 blockchain — it’s becoming the core financial infrastructure for the digital age . As stablecoins expand and institutions enter, ETH could be the most asymmetric opportunity in crypto right now.

📢 Drop a like, leave your thoughts in the comments, and don’t forget to follow for more powerful macro + crypto insights. 👍👍

Weekly trading plan for SolanaLast week, BINANCE:SOLUSDT price followed our bullish scenario after breaking out from the ABCDE triangle. We’ve now hit all projected targets, with current trading around $165. However, the 4-hour RSI is showing divergence, suggesting potential near-term correction or consolidation. Full analysis in the video idea

Trade safe and stay adaptive

Micron Technology - Another +50% rally will follow!Micron Technology - NASDAQ:MU - will rally another +50%:

(click chart above to see the in depth analysis👆🏻)

About two months ago Micron Technology perfectly retested a confluence of support. This retest was followed by bullish confirmation, nicely indicating a reversal. So far we saw a rally of +100%, but looking at the channel pattern and previous cycles, another +50% will follow.

Levels to watch: $200

Philip (BasicTrading)

#LONGTERMVISION

Weekly trading plan for EthereumBINANCE:ETHUSDT Price has broken through the psychologically significant $3,000 level, but we're now seeing a clear 4-hour RSI divergence. Historical patterns suggest this divergence has a high probability of playing out. Expect potential correction initiation within the next 48 hours

Should the rally continue toward final targets:

The existing divergence may strengthen

A daily timeframe divergence could form

I'll await confirmation before considering short positions

As always, manage your risk wisely

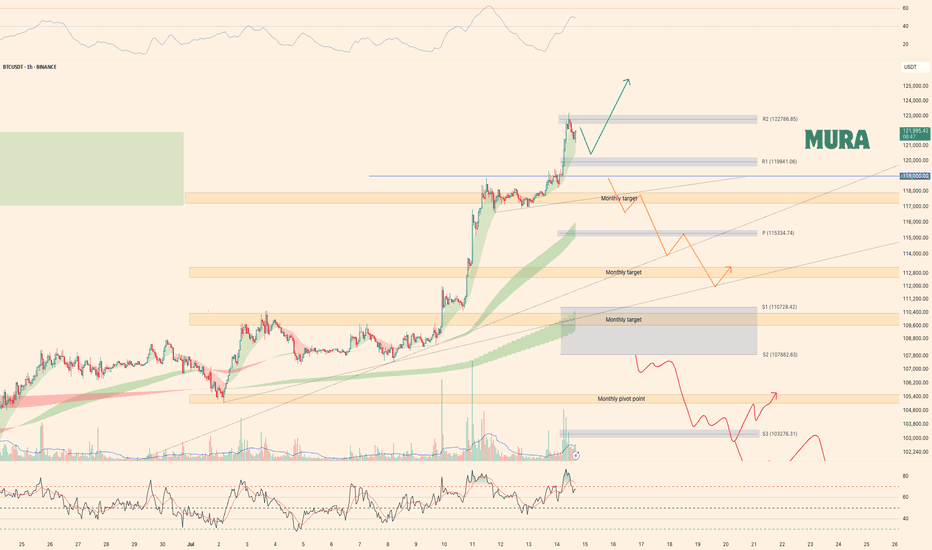

Weekly trading plan for BitcoinBINANCE:BTCUSDT has currently set a new ATH, trading in the 121k-122k range. While no clear reversal signals are present yet, we're seeing early signs of a 4h RSI divergence. Without solid confirmation, short positions remain risky - price could liquidate shorts multiple times before any meaningful reversal. Key local level to watch is 119k

Trade safe and stay adaptive

This is a good video7.14 . 25 this is a great video because there are so many examples of patterns to look at and there weren't that many markets that I was following and about 3 or 4 of the markets actually had dramatic movement in the direction you would expect and this is an example of setting up your pattern and letting the pattern take care of you as it gives you the probable Direction the market would take and there would have been no significant drawdowns or retest associated with stops... As was seeing in the coffee Market.

$BTC - Bitcoin Elliot Wave Analysis UpdateHello fellow gamblers,

Bitcoin hit my target zone and we could now see a retracement for Wave 4 or a bullish continuation into ATH.

I am also bringing a new update on Bitcoin and showing you all an alternative count that could take us way above our current targets.

- If we do have a Wave 4 retracement, I'm expecting price to find support at that 116.7k level.

- Levels to watch: 116.7k, 112k-110.4k

Market Insights with Gary Thomson: 14 - 18 JulyMarket Insights with Gary Thomson: Inflation Rate in Canada, US, and UK, US PPI, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— Inflation Rate in Canada

— US Inflation Rate

— UK Inflation Rate

— US Producer Price Index

— Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

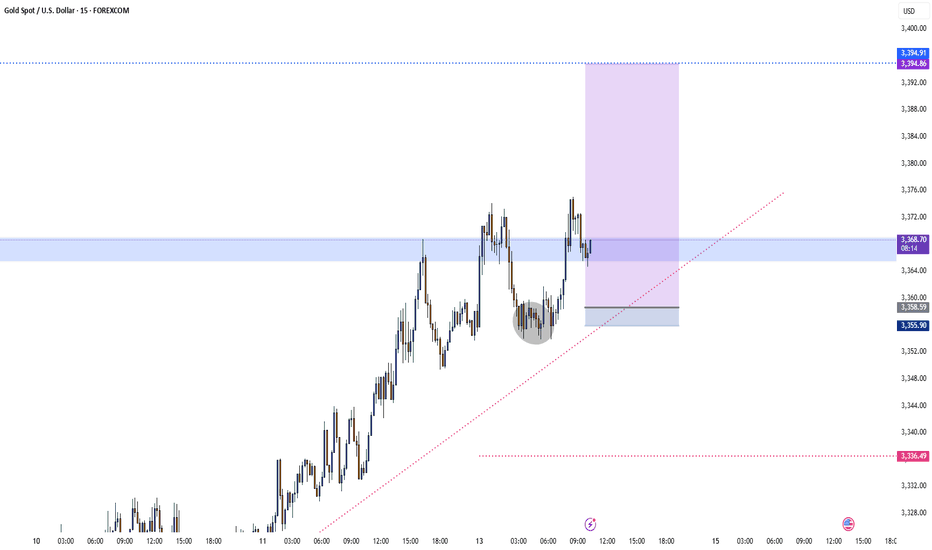

$GC / Gold - Weekend Update - 7/14Hello fellow gamblers,

We got both scenarios still active on gold, and I am bringing an update on both of them. It is a longer video, but hopefully the information can help you out on your trades.

- I want price to stay above 3363 for a bullish continuation.

- A strong rejection or loss of 3342.8 could initiate a bearish move that will validate our bearish scenario.

- Level to watch: 3418, 3363, 3283

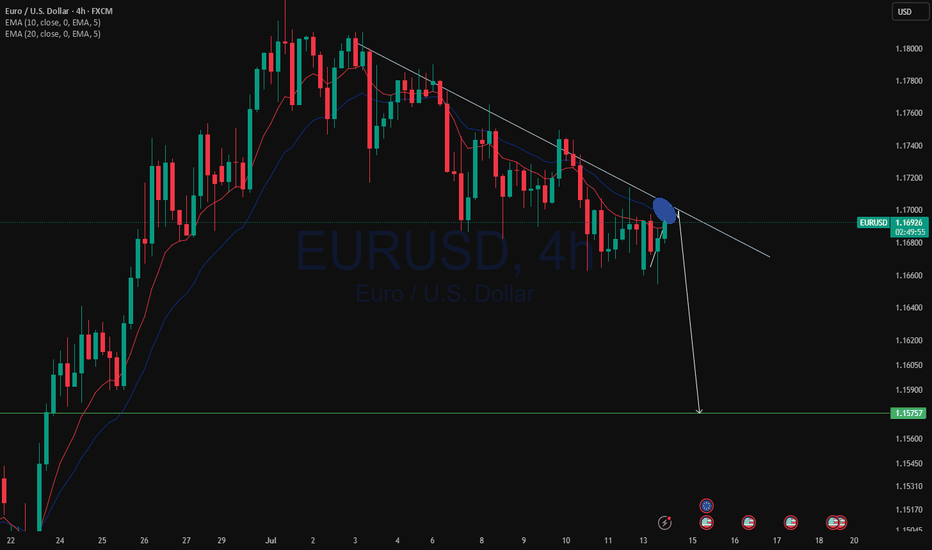

EURUSD and GBPUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

NAS100 Nasdaq Range-Bound: What Traders Should Watch Next US100I'm currently keeping a close eye on the Nasdaq 🧠📊, which is trading within a range-bound structure 📉📈. While we’re seeing some bullish momentum on the NAS100 4-hour chart today ⏱️📈, it’s nothing particularly strong or decisive just yet. I’m waiting for a clear break 🔓 either above or below this current range before considering any trading opportunities 🎯.

In this US100 chart 🖼️, I’ve highlighted key components such as price action, market structure, the prevailing trend, and other important elements of technical analysis 🧩📐.

⚠️ Please remember: this is a market analysis and reflects my personal opinion — not a trade recommendation. Always do your own due diligence 🕵️♂️ before making any trading decisions. This is not financial advice.

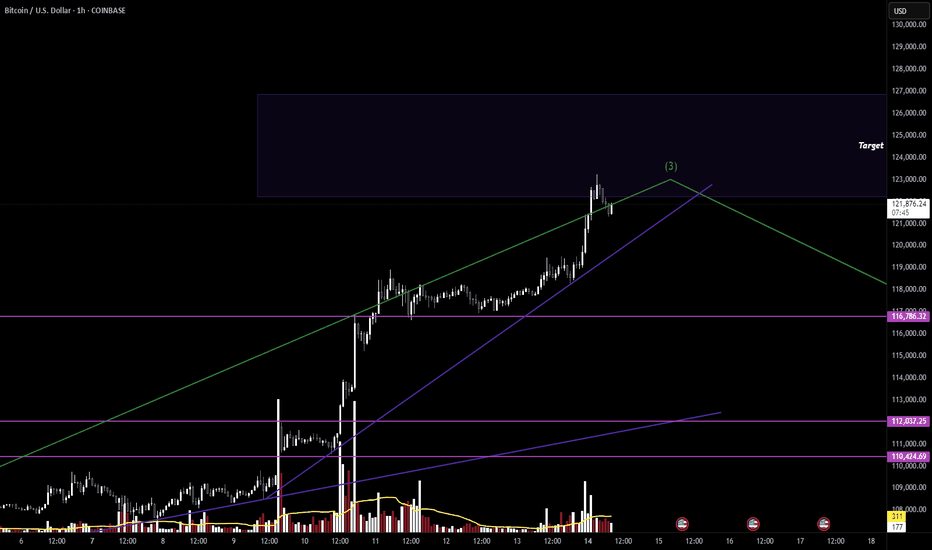

BTC PRICE PROJECTION ANALYSIS. HOW MUCH FURTHER UPSIDE???In this video, I'm just excited to see the cup and handle analysis done on October 19th, 2024 reach it's target. It's amazing!

I decided to do some predictive analysis using Elliott wave concept and Fibonacci extensions to see how far Bitcoin will go.

I am convinced that on the timeframe analyzed, this is onto a wave 5 and so pullbacks are going to be a great opportunity to grab some while a lot people will think this is madness.

My cup and handle analysis and targets getting hit has taught me a great lesson to always look at the bigger picture while taking advantage of the micro view.

Cheer to all the longs and Bitcoin believers. With only 1.11 Million Bitcoin available for grabs and Institutional confidence behind the asset, I am confident the projected price targets are highly likely and in sight soon.

Bitcoin Breakout: Charting the Next TargetsWe’re taking another look at #Bitcoin, which has surged higher and broken above its long-term channel — a move that’s caught the attention of many market watchers.

🔍 Key technical insights:

✅ The recent consolidation appears to be a midway pause in the uptrend. By measuring the preceding flagpole and projecting from the breakout, we derive an overall target near $145,000.

✅ Using Fibonacci extensions:

• From the September 2023 low to the March 2024 peak, projected off the July 2024 low, we see an interim resistance around $127,000.

• A secondary extension from the July 2024 low to the January 2025 high, projected off the March 2025 low, points to approximately $134,500.

📊 The broader bull trend remains intact while Bitcoin holds above its 55-day moving average. For those seeking tighter risk parameters, the 4-hour chart with cloud analysis suggests initial support around $119,500.

⚠️ As always, it comes down to your individual risk tolerance. (This is not investment advice.)

💬 I’d love to hear your perspectives:

• Are these targets on your radar?

• Where do you see Bitcoin heading next?

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Bitcoin Hits First Target: What I Traded and What Comes NextBitcoin just hit my first target. I went long on BTC, XRP, Chainlink, and more. Booked profits and jumped into two new breakouts with better risk-reward. In this video, I break down my trades, the setup, and why I’m still bullish between 116K and 120K. I also explain how crypto deregulation and the Genius Act could fuel the next move.

Let me know in the comments how you traded this breakout.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Overlaying AI forecast directly onto chart. Judge for yourself On the 27th of June I put through a prediction into my AI forecasting machine and this is what it said (image on screen)

I am SO impressed with the forecast so far, so I've overlayed the image onto the price action and will check in on it daily

This will give You the dominant trend direction for Bitcoin, and perhaps some extra capital in your accounts #you'reWelcome

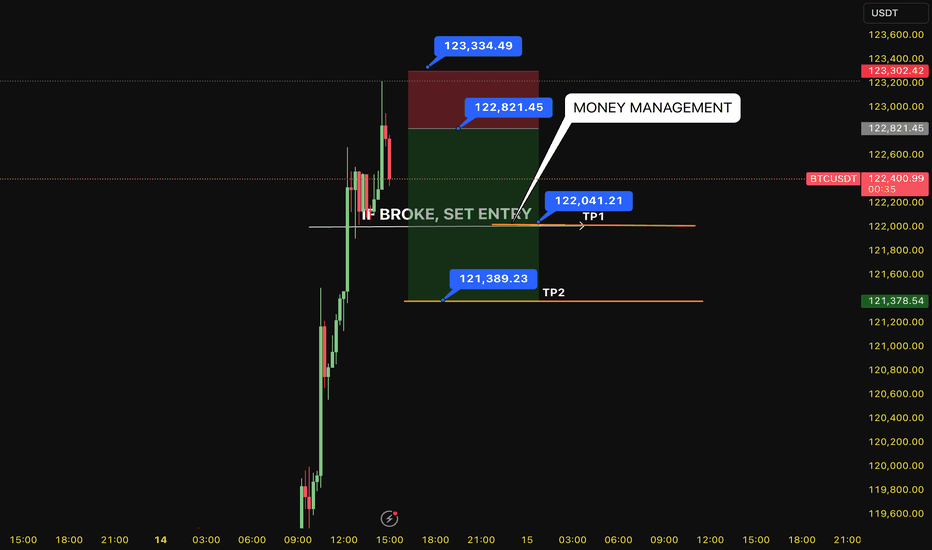

SELL BTC 13.7.2025 (scalping M15)Counter-trend trade order: SELL at THE TOP

Type of entry: Limit order

Condition:

- If the price break down at 122,041 confirming the down trend.

Note:

- Management of money carefully at the price of bottom (122,041)

Set up entry:

- Entry sell at 122,821

- SL at 123,334

- TP1: 123,041

- TP2: 121,389

Trading Method: Price action (No indicator, only trend and candles)

Gold Weekly Analysis | Will $3,360 Break or Hold? [July 14–18]In this video, I break down the recent gold price action and what to expect in the coming week. We’ll review how gold responded to last week’s FOMC minutes, why $3,360 remains a key decision zone, and what upcoming U.S. economic data (CPI, PPI, Retail Sales) could mean for price movement.

👉 If you find this content valuable, don’t forget to Vote, Comment, and Subscribe for weekly market breakdowns.

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

#GoldAnalysis, #XAUUSD, #ForexTrading, #GoldForecast, #MarketOutlook, #TechnicalAnalysis, #FundamentalAnalysis, #GoldPrice, #FOMC, #CPIData, #PPIdata, #DollarIndex, #TradingStrategy, #WeeklyOutlook, #GoldTechnicalAnalysis, #TradeSmart, #Darcsherry