Community ideas

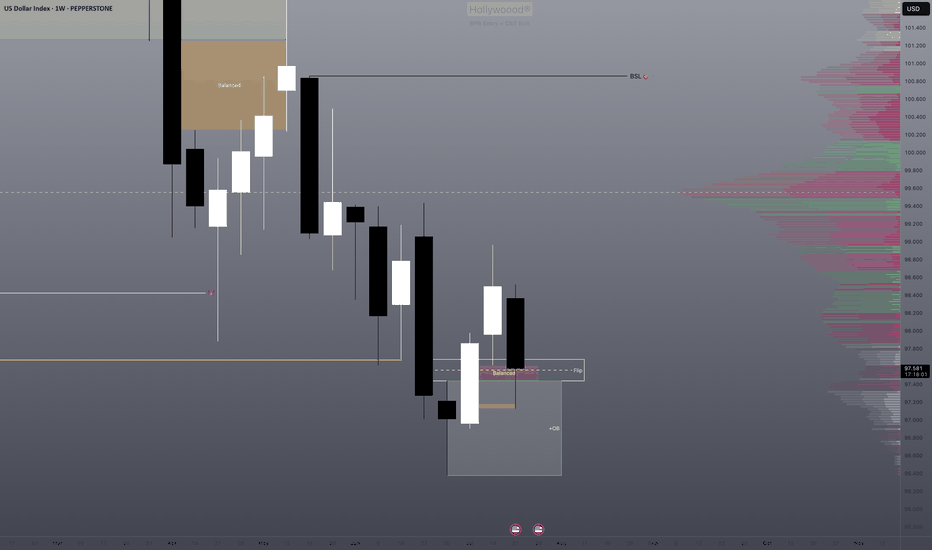

Real Sellers Vs Passive Sellers AMZNHello I am the Cafe Trader.

I was fortunate enough to get an editors pick, and I wanted to expound on how I came to those conclusions.

In this video we talk about passive sellers vs aggressive sellers and how we identify them. Also why it's important to identify these players in the market. This will help give you depth and help you get really good pricing in the markets.

Hope you enjoy the voiceover, Feel free to take a look at the previous article that this was pulled from on my profile.

Please share a boost if you enojoyed, and consider following for more.

Until next time! Happy Trading!!

@thecafetrader

XRPThe primary regulatory catalyst boosting XRP's bullish outlook in 2025 is the resolution of Ripple Labs' long-standing lawsuit with the U.S. Securities and Exchange Commission (SEC). In March 2025, Ripple settled the case by agreeing to pay a $50 million fine, and crucially, it was clarified that XRP is not considered a security in the context of secondary market sales. This settlement removed years of significant regulatory uncertainty that had suppressed XRP's price and led exchanges to delist XRP. Following this resolution, major U.S. exchanges reinstated XRP trading, and institutional confidence in XRP surged, unlocking large-scale adoption and market participation by regulated investors.

Another key regulatory development providing bullish momentum is the passage of the GENIUS Act in the U.S. House of Representatives, approved around mid-July 2025. This legislation establishes a clearer federal framework for stablecoins and digital assets like Ripple's RLUSD stablecoin, further reducing regulatory risks and positioning XRP for broader mainstream utility and adoption.

In summary, the decisive legal settlement with the SEC and U.S. legislative progress (notably the GENIUS Act) have greatly clarified XRP's regulatory status, providing a green light for institutional entry through regulated channels such as exchange-traded funds (ETFs). The proliferation of XRP ETFs—including the approved ProShares XRP Futures ETF—amplifies this effect, enabling easier institutional and retail investment and fueling bullish price momentum

XRP Real-Life Use Cases in Finance

XRP REAL LIFE APPLICATION IN THE ECOSYSTEM.

1. Cross-Border Payments

XRP’s core financial use case is to act as a bridge for cross-border payments.

Traditional international money transfers often take days and involve high fees due to intermediary banks (the SWIFT system).

With XRP, financial institutions can instantly convert and transfer value across borders. Typical settlement times are 3–5 seconds, with transaction costs usually less than a cent.

Numerous global banks and remittance providers have adopted XRP and the RippleNet system to cut costs and provide real-time international payment services.

2. On-Demand Liquidity (ODL) & Liquidity Bridging

Banks and payment providers use XRP to manage liquidity.

With XRP as a bridge currency, financial institutions do not need to pre-fund nostro accounts in multiple countries. Instead, they can source liquidity ‘on demand’ using XRP, freeing capital and reducing operational costs.

On-demand liquidity flow improves cash efficiency and speeds settlements between a wide variety of global fiat currencies.

3. Micropayments

Due to low fees and fast settlement, XRP is suitable for micropayments.

This enables new use cases in digital content (e.g., pay-per-article, tipping creators) and gaming, where sending tiny amounts is otherwise unfeasible.

Such micropayment abilities open the door to innovative business models in finance and online services.

4. Tokenization and DeFi

The XRP Ledger supports tokenization of financial assets and decentralized finance (DeFi) use cases.

Financial firms can issue stablecoins or tokenized assets (including stocks, bonds, or other real-world assets) on-chain, fostering new kinds of investment products, automated trading, and settlement.

XRP’s ledger powers “sector-based index funds,” asset baskets, and other financial instruments, expanding real-world utility within decentralized finance.

5. Remittances

Remittance companies use XRP to offer faster and cheaper international transfers.

This is particularly valuable for migrant workers sending money home, reducing transaction times from days to seconds and cutting fees, thereby increasing the amount recipients receive.

6. Banking and Trade Finance

Some banks and trade finance platforms use XRP to improve operational efficiency.

By digitizing trade documentation and facilitating instant payments, XRP is helping modernize the traditionally slow and paperwork-heavy trade finance sector.

7. Collateral & Trading

XRP can be used as collateral in digital asset trading and arbitrage.

Traders and financial institutions leverage XRP for high-speed transfers between exchanges, using its liquidity to seize arbitrage opportunities and service margin calls rapidly.

Countries adopting XRP for real-life payments, especially cross-border transactions, include several key nations across Asia, the Middle East, and beyond. Here are some notable examples of countries actively integrating XRP into their financial systems and payment infrastructures as of 2025:

Japan: A pioneer in cryptocurrency adoption, Japan has multiple banks partnered with Ripple using XRP to streamline cross-border payments. The Bank of Japan and major institutions like SBI Holdings support XRP integration to provide faster, lower-cost international transactions across Asian markets.

United Arab Emirates (UAE): The UAE is proactively integrating blockchain technology, including XRP, with banks such as Zand Bank and fintech firms using Ripple’s platform for faster cross-border payments. Dubai’s financial initiatives leverage XRP to boost transaction efficiency within and beyond the region.

South Korea: Known for its vibrant tech ecosystem and supportive crypto regulations, South Korea has seen local banks experimenting with XRP to reduce international payment costs and increase speed, making it part of the broader fintech innovation landscape.

Mexico: Financial institutions in Mexico use XRP to improve remittances, especially those coming from the U.S., reducing processing time and fees significantly.

India: Given its large remittance market and fintech growth, India is exploring the use of XRP to address the need for low-cost, quick international payments.

Singapore: XRP adoption is growing here, with increasing numbers of users and integration of Ripple’s stablecoin RLUSD into payments.

United States: Some American banks and financial institutions are starting to integrate XRP for international payments, signaling growing institutional interest.

Canada: Banks like Canadian Imperial Bank of Commerce (CIBC) and remittance services use Ripple technology, including XRP, to enable faster cross-border money transfers.

Brazil: Various financial players collaborate with Ripple to modernize the country’s payment infrastructure using XRP.

United Kingdom: Institutions and fintech firms in the UK leverage Ripple’s technology for faster, cheaper international transactions.

Thailand and Sweden: Banks in these countries are partnering with Ripple to enhance their cross-border payment capabilities by leveraging XRP.

Egypt: Major banks are collaborating with Ripple to improve payment efficiency, including through XRP-based solutions.

In essence:

XRP directly addresses major friction points in global finance by cutting costs, increasing speed, and providing new ways for banks, companies, and individuals to move and manage money—all with increasing real-world adoption in cross-border payments, liquidity management, and digital asset innovation.

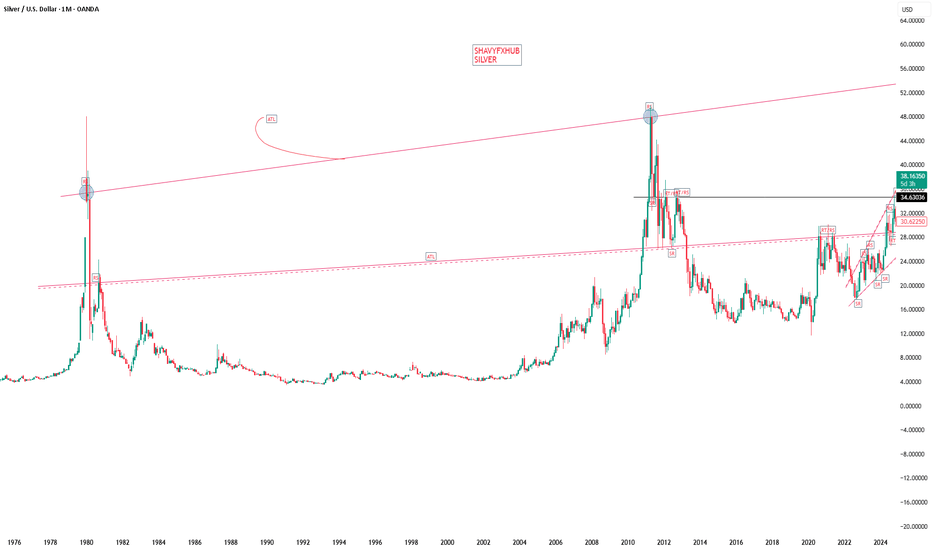

SILVER XAGUSD ON 3OTH we are expecting a strong fundamental data .

ADP Non-Farm Employment Change forecast 82K previous -33K

Advance GDP q/q forecast 2.4% previous -0.5% Advance GDP Price Index q/q forecast 2.3% previous 3.8%

Pending Home Sales m/m0.3% 1.8%

7:00pm

USD

Federal Funds Rate

4.50% 4.50%

USD

FOMC Statement

7:30pm

USD

FOMC Press Conference.

we will be watching the data outlook for clear directional bias.

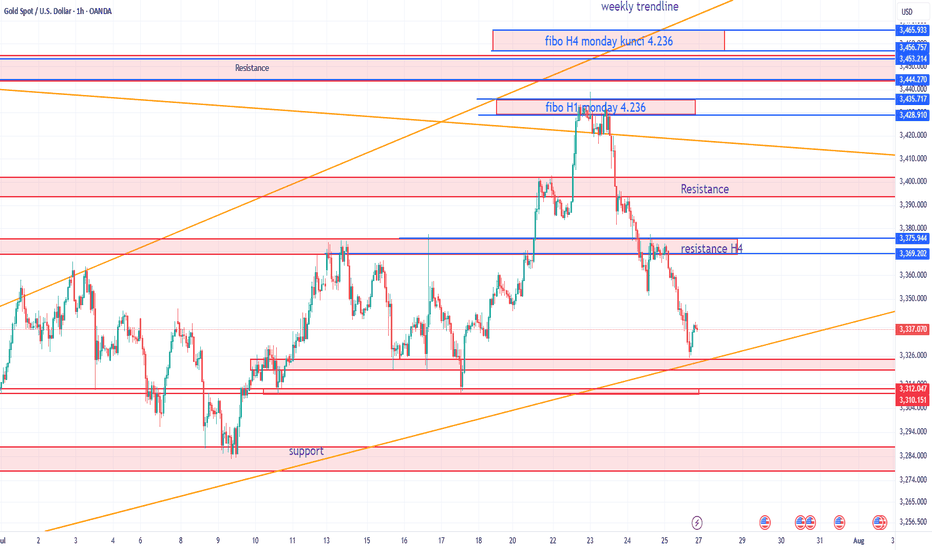

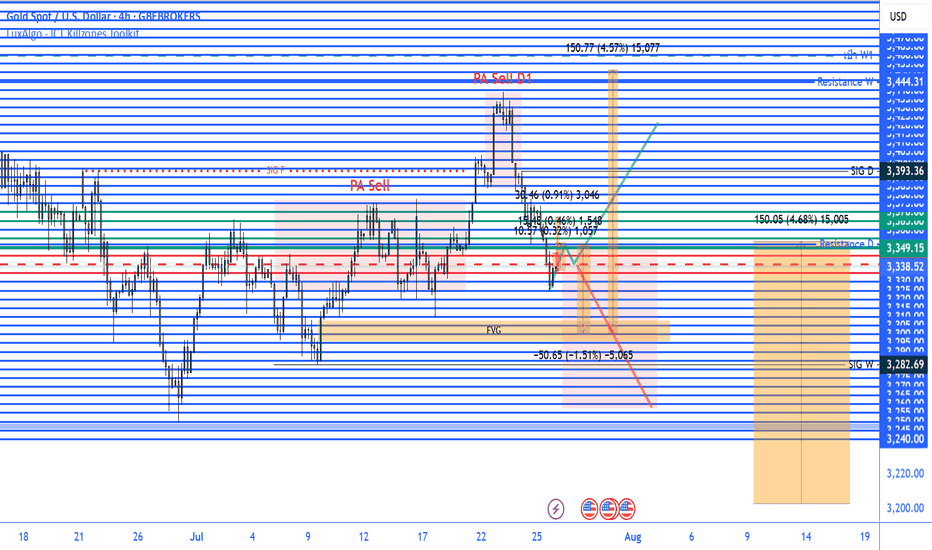

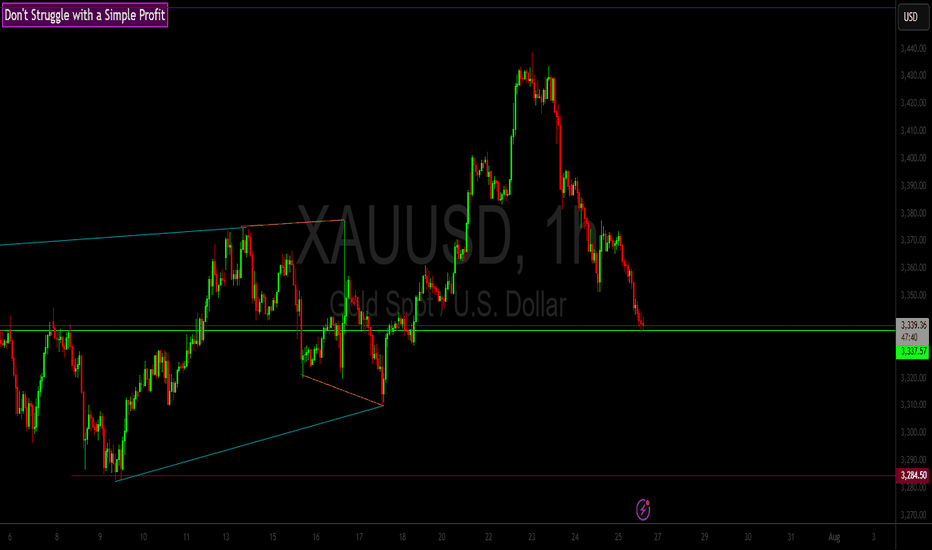

Will gold continue its downtrend further?Its hard to say if the sells is over for now.

as we are still in the range of pennant there are still possibility that gold to make its way up further.

however in every movement the best opportunity for the moment is to ride on second entries for us as traders. it safeguard our accts. all the best traders.

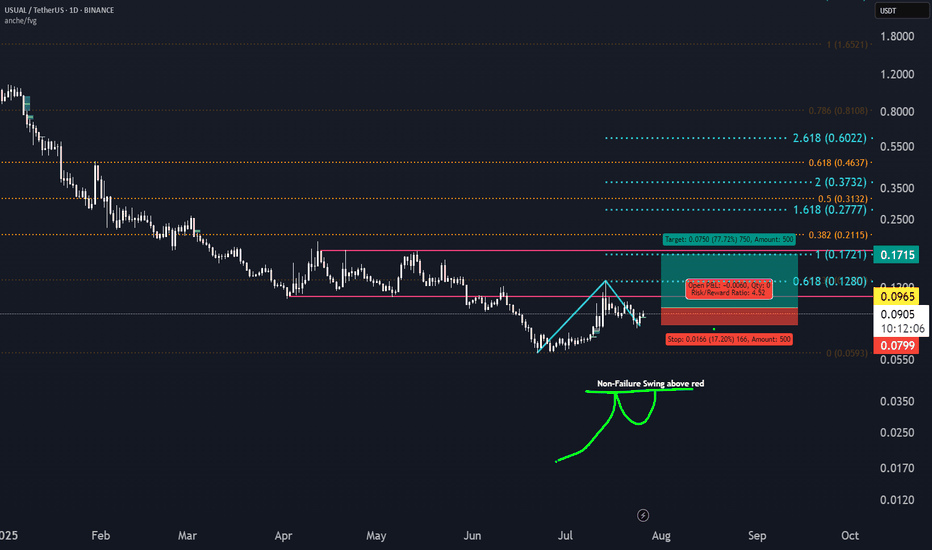

USUALUSDT-26072025Below writing is a dummy text. Ignore that and see the video only.

===============================

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

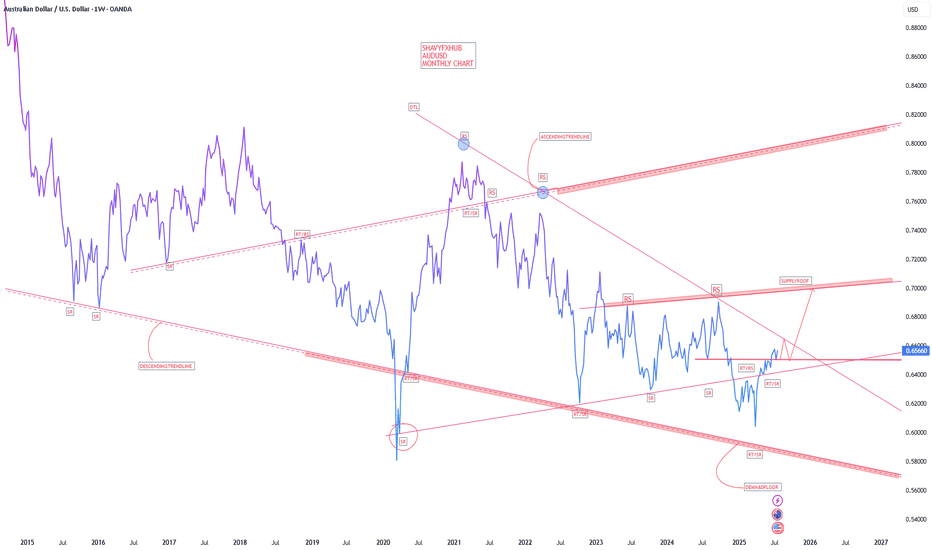

AUDUSD.JULY 29TH

Bureau of Labor Statistics will publish will JOLTS which measures the Number of job openings during the reported month, excluding the farming industry;

JOLTS Job Openings CB Consumer Confidence forecast 95.9 previous 93.0 .market will watch for data report for clear directional bias .

wednesday 30th

Australian Bureau of Statistics will publish the Consumer price index which Measures Change in the price of goods and services purchased by consumers

'Actual' greater than 'Forecast or below will be watched for clear directional bias .

this data are Frequency Released quarterly, about 25 days after the quarter ends;

and the next report will be on Oct 30, 2025

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate of 2%

Aud CPI q/q forecast 0.8% previous 0.9%

AUD CPI y/y forecast 2.1% previous 2.1%

AUD Trimmed Mean CPI q/q forecast 0.7% previous 0.7%

USD 1:15pm

1:15pm USD ADP Non-Farm Employment Change forecast 82K previous -33K

Advance GDP q/q forecast 2.4% previous -0.5%

Advance GDP Price Index q/q forecst 2.3% previous 3.8%

Pending Home Sales m/m forecast 0.3% previous 1.8%

USD Crude Oil Inventories-3.2M

by 7pm USD Federal Funds Rate previous 4.50% 4.50%

FOMC Statement

7:30pm FOMC Press Conference.

watchout for federal fund rate data report and FOMC (federal open market committee)

NOTE;TRADING ANAY INSTRUMENT IS 100% PROBABILTY ,ANY KEY LEVEL CAN FAIL YOU,DONT EVER TRADE WITH ALL YOUR CAPITAL BECAUSE YOU MENTOR SAY BUY OR SELL.

TRADING IS 100% PROBABILTY AND NO STRATEGY IS PERFECT.

TRADE WITH CAUTION.

WISH A HAPPY NEW WEEK.

BYE.

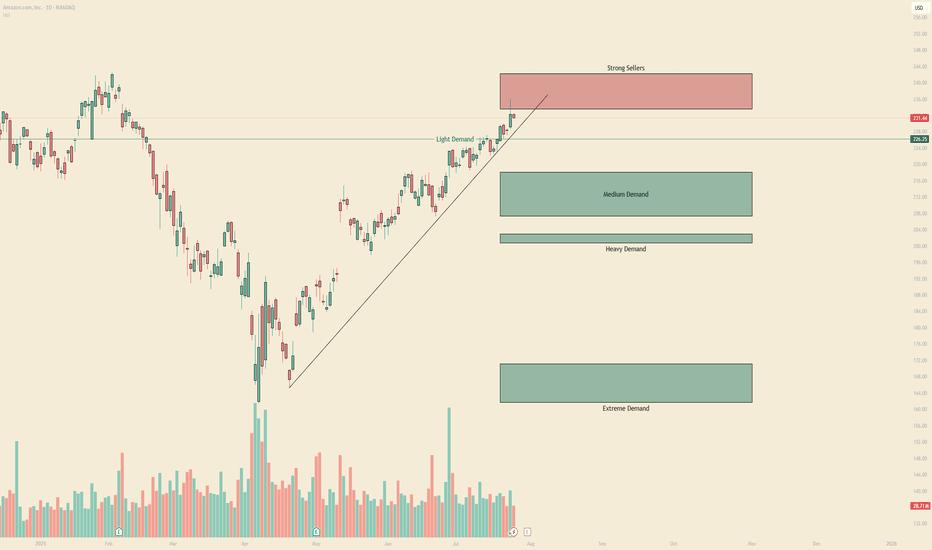

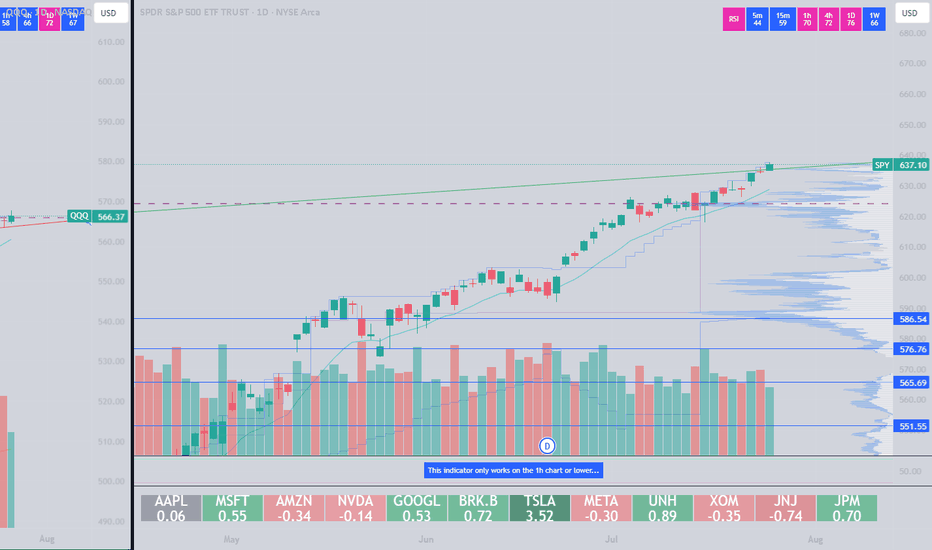

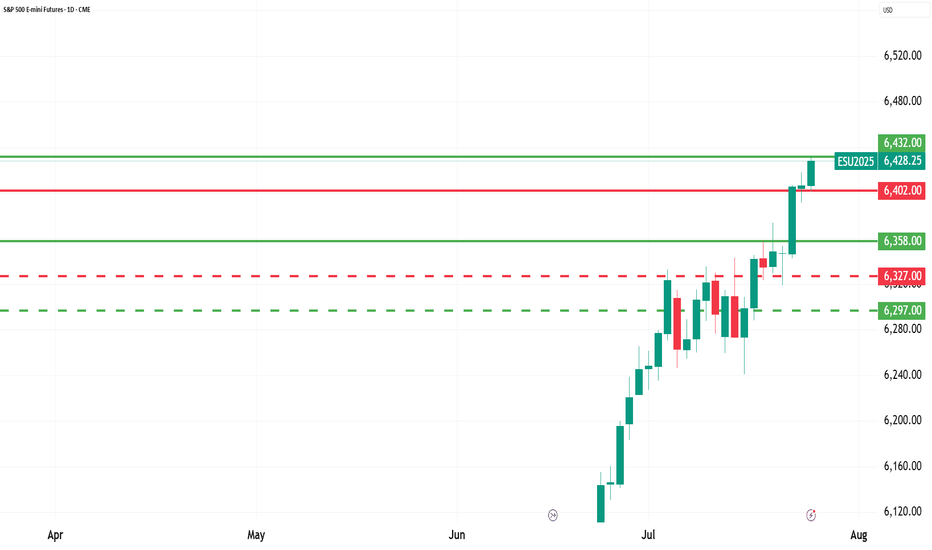

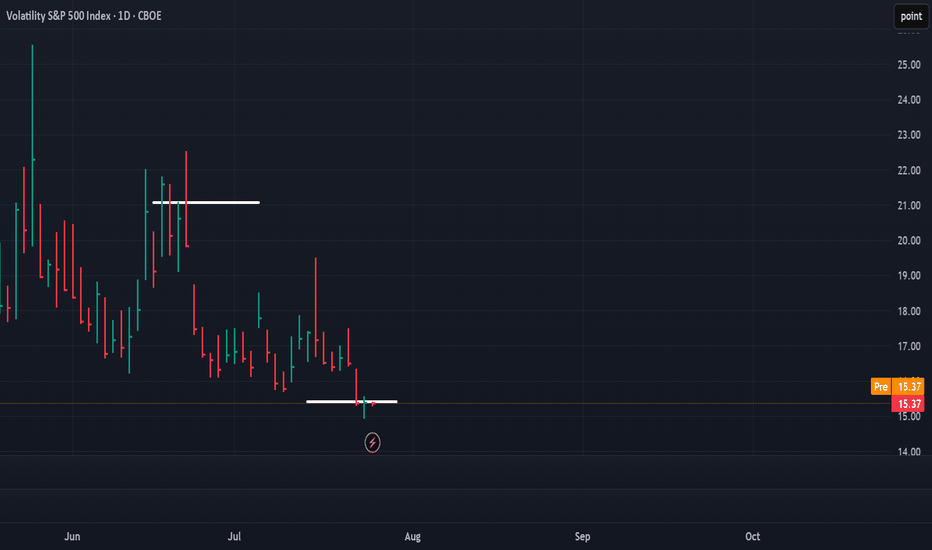

Confident closeThe close on the daily chart in the S&P 500 implies confidence from buyers going into the weekend. This implies follow-through to the upside. What will be important is how this market opens again at 5:00 PM Chicago time Sunday night. That opening can set the tone for trading on Monday.

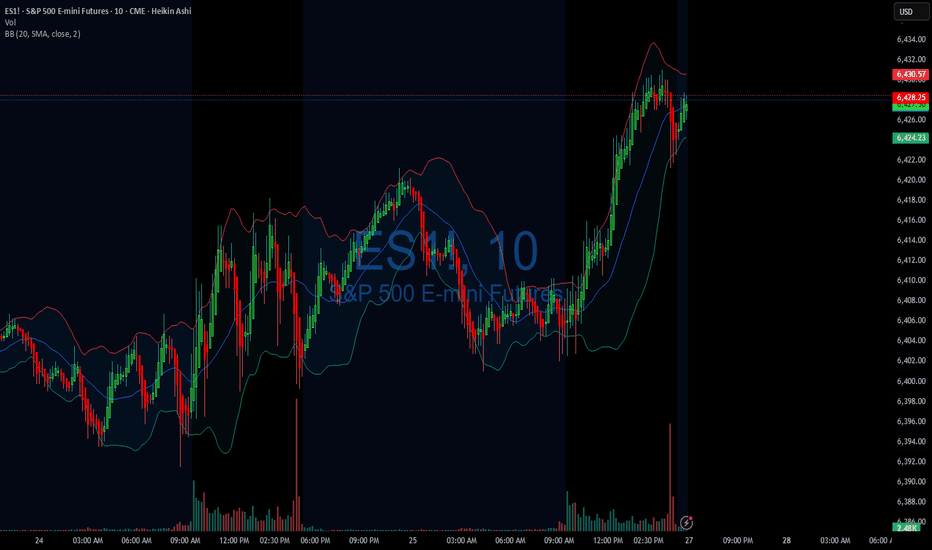

07/25/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +228

Sleep: 5 hours

Overall health: Still struggling to catch up on sleep. gonna take gg sleeping pills today

** VX Algo System Signals from (9:30am to 2pm) **

— 9:07 AMMarket Structure flipped bearish on VX Algo X3! :white_check_mark:

— 9:53 AM Market Structure flipped bullish on VX Algo X3! :white_check_mark:

— 10:30 AM Market Structure flipped bullish on VX Algo X3! :white_check_mark:

— 11:00 AM VXAlgo ES X1 Sell Signal :x:

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

Market structure algo was flipping a lot today, even in premarket, which tells me that MM was changing position a lot and things could be unreliable so i decided to end the trading day early at $200 and closed up shop on my main acccount.

**News**

*S&P 500 ENDS AT A NEW RECORD HIGH

**What are the critical support levels to watch?**

--> Above 6395= Bullish, Under 6372= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

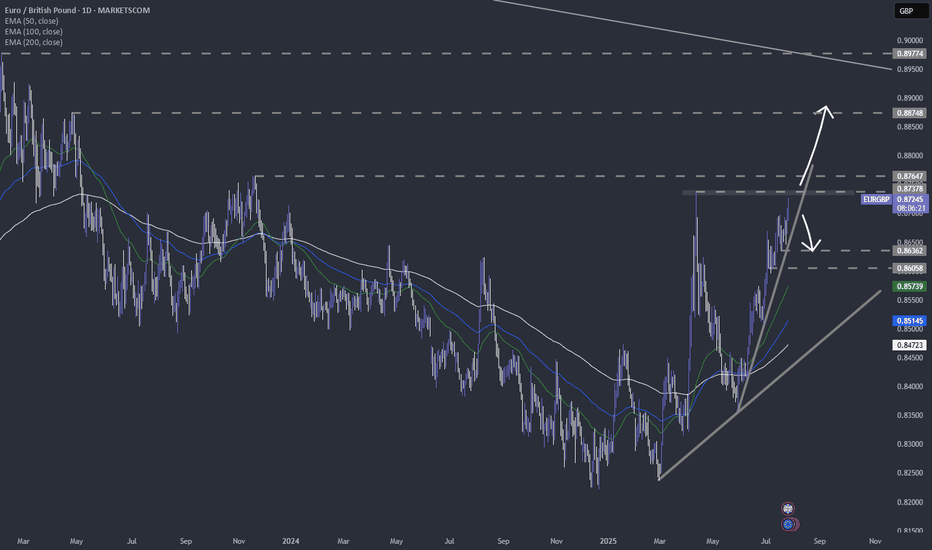

EURGBP near the current highest point of 2025.FX_IDC:EURGBP is slowly approaching a strong area of resistance, which is the current highest point of 2025. Let's dig in...

MARKETSCOM:EURGBP

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.