Community ideas

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Review and plan for 14th July 2025 Nifty future and banknifty future analysis and intraday plan.

Results - analysed.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Bitcoin Long: Expects New High; Target 124,632Over in this video, I update on the Elliott Wave counts for Bitcoin and explain why I think that Bitcoin is going higher for a wave 5 of 3 of 5.

The stop loss will be below the wave 4 and given some leeway, will be around 115,900. There are 2 Take profit targets:

1. 119,251, and

2. 124,632

I made it known that my personal preference is $124,632 but note that once a new high is made, this wave counts will already be validated even if it then drops to our stop.

I talk about the possibility of trailing the stop once a new high is reached but commented that every trader must trade based on their own style and risk preference.

Finally, Good luck in your trading!

[UPD] Trend analysis: BTC / ETH / SOL / XRP and other Just recorded a new video overview of the crypto market and the current trend developments in major coins: CRYPTOCAP:BTC , CRYPTOCAP:ETH , CRYPTOCAP:SOL , CRYPTOCAP:XRP , CRYPTOCAP:LINK , GETTEX:HYPE , BSE:SUPER , $FLOKI.

Among the new assets on my radar I shared my view on the trend structure of $RENDER.

In my personal investment planning, I continue to treat any potential corrections into key support zones as opportunities to add or open new positions.

Thank you for your attention and I wish you successful trading decisions!

If you’d like to hear my take on any other coin you’re tracking — feel free to ask in the comments (just don’t forget to boost the idea first 😉).

Are we on Super Bullish Express Highway ? Elliott Waves RoadmapHello friends,

Welcome to RK_Chaarts

Today we're attempting to analyze Bitcoin's chart, specifically the BTCUSD chart, from an Elliott Wave perspective. Looking at the monthly timeframe chart, which spans the entire lifetime of Bitcoin's data since 2011, we can see the overall structure. According to Elliott Wave theory, it appears that a large Super Cycle degree Wave (I) has completed, followed by a correction in the form of Super Cycle degree Wave (II), marked in blue.

Now, friends, it's possible that we're unfolding Super Cycle degree Wave (III), which should have five sub-divisions - in red I, II, III, IV, & V. We can see that we've completed red I & II, and red III has just started. If the low we marked in red II doesn't get breached on the lower side, it can be considered our invalidation level.

Next, within red III, we should see five primary degree sub-divisions in black - ((1)), ((2)), ((3)), ((4)) & ((5)). We can see that we've completed black ((1)) & ((2)) and black ((3)) has just started. Within black ((3)), we should see five intermediate degree sub-divisions in blue - (1) to (5). Blue (1) has just started, and within blue one, we've already seen red 1 & 2 completed, and red 3 is in progress.

So, we're currently in a super bullish scenario, a third of a third of a third. Yes, the chart looks extremely bullish. We won't commit to any targets here as this is for educational purposes only. The analysis suggests potential targets could be very high, above $150,000 or $200,000, if the invalidation level of $98,240 isn't breached. But again, friends, this video is shared for educational purposes only.

Many people think that the market doesn't move according to Elliott Waves. But friends, here we've tried to analyze from the monthly time frame to the overly time frame. We've definitely aligned the multi-time frame and also aligned it with the principal rules of Elliott Waves, without violating any of its rules.

I agree that the Elliott Wave theory can be a bit difficult, and for those who don't practice it deeply, it can be challenging. But yes, the market moves according to this methodology, following this pattern. This is a significant achievement.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Chaarts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Chaarts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

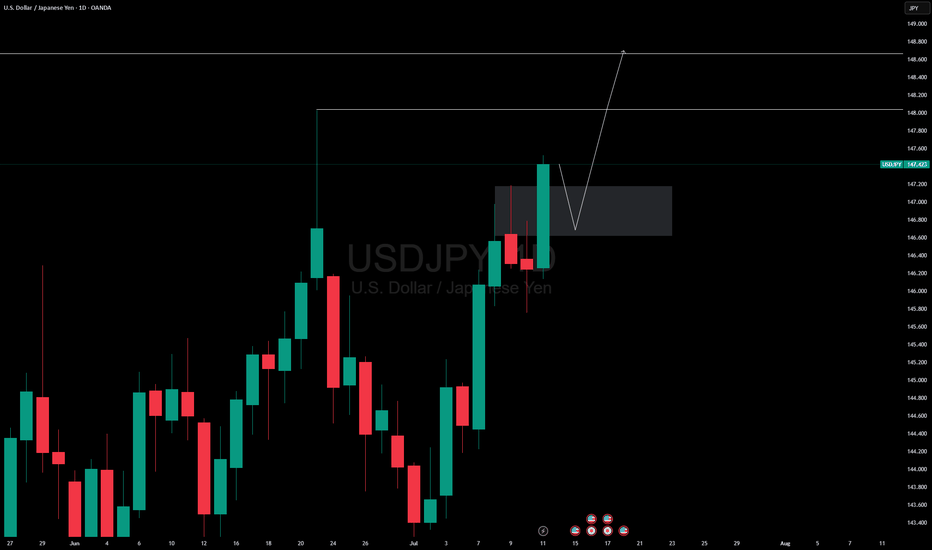

USDJPY MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

LINK: Critical Chainlink Update!! | Stablecoin Supercycle Part 4🚨 New Video Just Dropped! 🚨

Today, I cover the latest Genius Stablecoin Act update, Shanghai’s surprising interest in stablecoins, and go deep into Chainlink’s technical setup — including Wyckoff, Elliott Wave, short-term outlook, and Fibonacci time analysis.

Video Timestamps:

0:00 Genius Stablecoin Act Update

1:25 Shanghai considers stablecoins!

2:53 Chainlink Risk/Regression Analysis

5:55 Chainlink Wyckoff Accumulation Analysis

8:12 Chainlink Primary Wave Count Elliott Wave Analysis

10:14 Chainlink Short Term Analysis

11:27 Chainlink Fibbonaci Time Analysis

WTI USOIL WTI oil ,watch oil inventory and opec data report for clear directional bias . if the monthly candle closes above the supply roof,it will be a long confirmation if demand holds .the probability of rejection is high, because the current candle is coming as a retest candle to broken demand floor that served as bench mark oil price level 65$-68$ zone for long time .

#oil #opec #usoil #wti

WTI US OIL US Oil (WTI Crude) Price Context

Price: WTI crude oil futures settled at approximately $68.66 per barrel close of friday.

Prices rebounded after a prior decline, supported by strong summer travel demand, high refinery utilization, and supply management efforts by major producers like Russia and Saudi Arabia.

Outlook: Despite near-term supply tightness, the International Energy Agency (IEA) and OPEC forecast a potential surplus later in 2025 and slower demand growth through 2026–2029, especially due to slower Chinese economic growth.

The DXY measures the USD strength against a basket of major currencies and often moves inversely to commodities priced in USD like oil.

When the DXY strengthens, oil prices can face downward pressure due to higher USD value making oil more expensive in other currencies.

Conversely, a weaker DXY tends to support higher oil prices.

Current Dynamics:

If geopolitical risks or supply constraints push oil prices up, the USD may weaken as markets price in inflationary pressures.

Conversely, if the USD strengthens due to safe-haven demand or monetary policy, oil prices may soften.

#usoil

IS THE STOCK MARKET HEADING INTO DOT COM BUBBLE 2.0?In this video we look at the 3 month chart of SP:SPX using the traders dynamic index & Fibonacci retracement levels to put together a bullish case for the overall stock market to go on a monster rally over the next 7 years

We also theorize about how over the next 2 years the SP:SPX can indeed hit 7200+ by Q3 2026 and have pullbacks to 5800-6100, but how that could just be the "consolidation move in price" of the overall stock market before we get what could end up being the largest stock market rally we have ever seen in the 21st century

MSTR MICROSTRATEGY As of July 11, 2025, MicroStrategy Incorporated (MSTR) is trading at approximately $434.58 per share on the NASDAQ, showing a strong daily gain of about 3.04% (+$12.84). The stock has experienced significant growth recently, with a 3-month return of around 45% and a 1-year return exceeding 220%.

Key Highlights about MicroStrategy (MSTR):

Industry: Software - Application

Market Cap: Approximately $118.8 billion

Shares Outstanding: About 273 million

Trading Range (Year): Low near $102.40 and high around $543.00

Volume: Active trading with daily volumes around 18 million shares

CEO: Phong Q. Le

Headquarters: Tysons Corner, Virginia, USA

Business: MicroStrategy provides enterprise analytics software and services, including a platform for data visualization, reporting, and analytics. It serves a broad range of industries including finance, retail, technology, and healthcare.

Recent Price Trend

The stock has steadily appreciated from about $255 in February 2025 to over $430 in July 2025.

Recent trading range for July 11 was between $423.70 and $438.70.

After-hours trading shows a slight dip to around $433.25.

Outlook

The next earnings announcement is scheduled for July 31, 2025.

Analysts forecast the stock price could range between $434.58 and $798.13 in 2025, reflecting optimism about the company’s growth prospects and market position.

MicroStrategy’s strong correlation with Bitcoin price movements (due to its large BTC holdings) often influences its stock volatility and performance.

In summary: MicroStrategy is a major player in enterprise analytics software with a highly volatile stock influenced by its Bitcoin exposure and market sentiment. Its stock price has surged strongly in 2025, reflecting both business fundamentals and crypto market dynamics.

GB10Y UK GOVERNMENT 10 YEAR BOND YIELD

The current Governor of the Bank of England is Andrew Bailey.

Appointment: Andrew Bailey has served as Governor since March 16, 2020, and his term runs until March 15, 2028.

Role: As Governor, he chairs the Monetary Policy Committee, Financial Policy Committee, and Prudential Regulation Committee.

Background: Prior to his appointment as Governor, Bailey was Chief Executive Officer of the Financial Conduct Authority (FCA) and has held several senior roles within the Bank of England, including Deputy Governor for Prudential Regulation.

Recent Activity: He remains active in shaping UK monetary policy and financial stability, and was recently nominated as the next Chair of the Financial Stability Board, beginning July 2025.

Andrew Bailey continues to lead the Bank of England through significant economic and financial developments.

Upcoming UK Economic Reports (July 13–17, 2025)

Below is a schedule of major UK economic releases and events for the coming week, with local times (BST):

Date Time (BST) Event

July 13, Sun 06:00 AM Core Inflation Rate MoM

July 13, Sun 06:00 AM Retail Price Index MoM

July 13, Sun 06:00 AM Retail Price Index YoY

July 14, Mon 12:00 PM NIESR Monthly GDP Tracker

July 14, Mon 11:01 PM BRC Retail Sales Monitor YoY

July 15, Tue 09:00 AM Treasury Stock 2032 Auction

July 15, Tue 08:00 PM BoE Governor Andrew Bailey Speech

July 16, Wed 06:00 AM Inflation Rate YoY

July 16, Wed 06:00 AM Core Inflation Rate YoY

July 16, Wed 06:00 AM Inflation Rate MoM

July 16, Wed 06:00 AM Core Inflation Rate MoM

July 16, Wed 06:00 AM Retail Price Index MoM

July 16, Wed 06:00 AM Retail Price Index YoY

July 16, Wed 09:00 AM Treasury Gilt 2034 Auction

July 17, Thu 06:00 AM Unemployment Rate

July 17, Thu 06:00 AM Average Earnings incl. Bonus (3Mo/Yr)

July 17, Thu 06:00 AM Employment Change

July 17, Thu 06:00 AM Average Earnings excl. Bonus (3Mo/Yr)

July 17, Thu 06:00 AM HMRC Payrolls Change

July 17, Thu 06:00 AM Claimant Count Change

July 17, Thu 09:00 AM Treasury Gilt 2030 Auction

Note: All times are in British Summer Time (BST). These events are subject to change based on official updates.

Key releases include inflation data, labor market statistics, retail sales, and several government bond auctions. The Bank of England Governor's speech is also a major event for markets with price volatility .

the UK 10-year gilt yield (UK10Y) is approximately 4.63%, having edged up 0.03 percentage points from the previous session. Over the past month, it has risen about 0.15 points and is 0.52 points higher than a year ago, reflecting persistent inflation concerns and expectations about Bank of England (BoE) monetary policy.

Correlation Between UK10Y, UK10, and GBP Strength

UK10Y Yield and GBP:

The 10-year gilt yield is a key indicator of UK long-term borrowing costs and investor sentiment. Higher yields typically attract foreign capital seeking better returns, which tends to strengthen the British pound (GBP). Conversely, expectations of BoE rate cuts or economic weakness can pressure yields lower and weaken GBP.

Recent Dynamics:

Despite inflation remaining above 3%, the UK economy has shown signs of contraction (GDP shrinking 0.1% in May), prompting markets to price in an 80% chance of a BoE rate cut in August. This has led to some volatility in yields and GBP strength.

The BoE’s policy rate has already been reduced from 5.25% to 4.25% over the past year, and further easing is anticipated, which can weigh on the GBP.

UK10 (Shorter-Term Yields) vs. UK10Y:

Shorter-term gilt yields (e.g., 2-year or 5-year) tend to be more sensitive to immediate BoE policy moves, while the 10-year yield reflects longer-term inflation and growth expectations. A steepening yield curve (rising long-term yields relative to short-term) can indicate confidence in economic recovery and support GBP. A flattening or inverted curve may signal caution and pressure GBP.

GBP Strength Mixed; supported by higher yields but pressured by economic slowdown and easing expectations

Yield Curve Moderately steep, reflecting growth/inflation expectations

In essence: The UK 10-year gilt yield at 4.63% supports GBP strength by attracting yield-seeking capital, but the expected BoE rate cut and economic weakness introduce downside risks. The interplay between short- and long-term yields and BoE policy guidance will continue to influence GBP’s trade directional bias .

UK GOVERNMENT 10 YEAR BOND PRICE GB10Relationship Between GB10 Price and GBP Strength

Inverse Relationship:

Bond prices and yields move inversely. When gilt yields rise (due to inflation concerns or expectations of tighter monetary policy), gilt prices fall. Conversely, if yields fall, prices rise.

Impact on GBP:

Higher UK gilt yields, reflecting higher interest rates or inflation expectations, tend to attract foreign capital seeking better returns. This supports demand for the British pound (GBP), strengthening the currency.

However, if yields rise due to inflation fears without confidence in economic growth, or if rate cuts are expected, GBP strength may be limited.

Current Market Context:

The UK economy has shown signs of contraction, and markets are pricing in an 80% chance of a Bank of England rate cut in August 2025. This dynamic creates some volatility:

Yields remain elevated (4.63%), supporting GBP.

Expectations of easing may cap GBP gains and pressure gilt prices higher (yields lower).

GBP Strength Supported by higher yields but tempered by expected BoE easing

Market Drivers Inflation, economic contraction, BoE rate expectations

Conclusion

The current UK 10-year gilt price near 99.0 and yield around 4.63% reflect a market balancing inflation risks and economic slowdown. Elevated yields help support GBP strength by attracting yield-seeking investors, but the prospect of Bank of England rate cuts and economic weakness limit upside for the pound.

#GBP #GB10 #GB10Y

ETHEREUM ETHEREUM DAILY CONFIRMATION FOR LONG IS NOT APPROVED YET.BE PATIENT

Ethereum Approximately $2,930.55-2,925$ per ETH, watch for 30754 ascending trendline breakout or pull back into 2680 zone ,if we keep buying then 4100 zone will be on the look out as immediate supply roof break and close will expose 4900.my goal in this context is to see ETHUDT buy into my purple supply roof,it will happen .

Market Capitalization: Around $358 billion, making Ethereum the second-largest cryptocurrency by market cap.

Circulating Supply: About 120.7 million ETH.

Recent Performance: Ethereum has gained roughly 17.3% over the past week and about 7% over the last month, though it is down about 4% compared to one year ago.

Market and Technical Overview

Ethereum remains a key player in the blockchain ecosystem, supporting decentralized finance (DeFi), NFTs, and smart contract applications.

The price is consolidating near the $3,000 level, with technical indicators suggesting moderate bullish momentum but some short-term volatility.

Trading volume in the last 24 hours is around $29 billion, indicating strong liquidity and active market participation.

Ethereum continues to be a foundational blockchain platform with strong institutional interest and ongoing development, maintaining its position as a major digital asset in 2025.

#ethusdt #btc #bitcoin

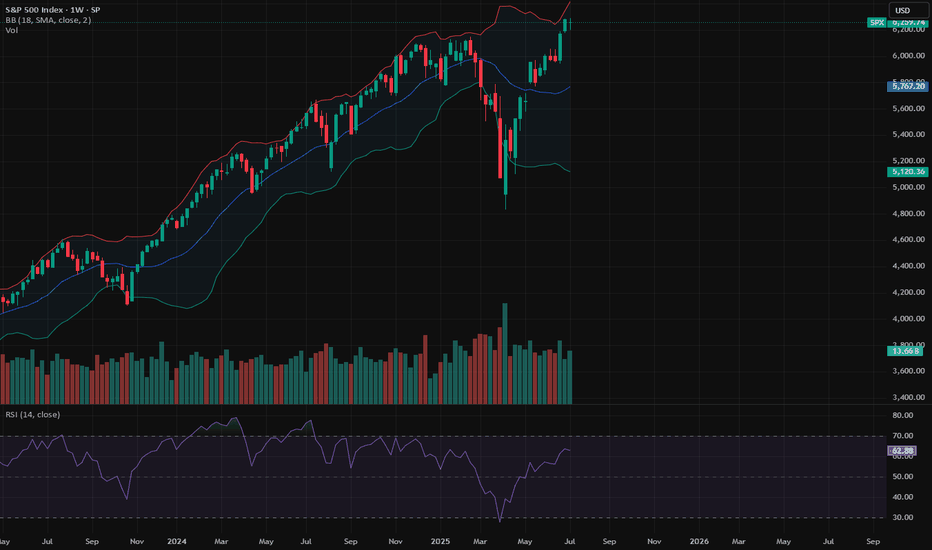

SPX Breakdown or Another Push Higher?Hi y'all thanks for tuning in! Here are a few written notes to sum up the video.

Indecision at New Highs

After breaking out to new all-time highs, SPX printed a doji on the weekly chart, signaling indecision. This hesitation could mark the start of digestion.

Still Structurally Bullish, but Extended

The weekly chart shows SPX is still holding trend structure, but price is notably extended from the 10EMA. Historically, when price moves too far from key short-term EMAs, it tends to reset either via time (sideways chop) or price (pullback).

Daily Chart Shows a Shelf Forming

On the daily chart, price has been consolidating just under the prior high with small-bodied candles. This is forming a “shelf” around the 6,260–6,280 zone. It’s acting like a pause, not a breakdown. Holding above this zone keeps the trend intact.

Pullback Risk Increases Below 6,232

If price loses 6,232 (last week's breakout area and short-term shelf), it increases the likelihood of a pullback toward the 6160 or even deeper toward the 5970. That lower zone also marks the bottom of the prior consolidation box from earlier this year.

Seasonality Reminder

Historically, July is strong in the first half, with weakness (if it shows up) arriving mid-to-late month. So far, price has tracked that seasonal strength. Any weakness from here would align with that typical timing.

ETHEREUM DAILYETHEREUM DAILY CONFIRMATION FOR LONG IS NOT APPROVED YET.BE PATIENT

Ethereum Approximately $2,930.55 per ETH, watch for 30754 ascending trendline breakout or pull back into 2680 zone ,if we keep buying then 4100 zone will be on the look out as immediate supply roof break and close will expose 4900.my goal in this context is to see ETHUDT buy into my purple supply roof,it will happen .

Market Capitalization: Around $358 billion, making Ethereum the second-largest cryptocurrency by market cap.

Circulating Supply: About 120.7 million ETH.

Recent Performance: Ethereum has gained roughly 17.3% over the past week and about 7% over the last month, though it is down about 4% compared to one year ago.

Market and Technical Overview

Ethereum remains a key player in the blockchain ecosystem, supporting decentralized finance (DeFi), NFTs, and smart contract applications.

The price is consolidating near the $3,000 level, with technical indicators suggesting moderate bullish momentum but some short-term volatility.

Trading volume in the last 24 hours is around $29 billion, indicating strong liquidity and active market participation.

Ethereum continues to be a foundational blockchain platform with strong institutional interest and ongoing development, maintaining its position as a major digital asset in 2025.

#ethusdt #btc #bitcoin