The only plays you need this week! 🚀 Join us as we dive into the highs and lows of Bitcoin this week! 🔥

Opportunities like this don’t show up every day — and we’ve got a strong feeling there’s a 10X trade hiding somewhere in this video! 👀💰

We’re locked in on the charts like eagles 🦅, watching closely to see if any of our setups come to life. You won’t want to miss what’s coming next! 📈📊

✨ Stay tuned for daily updates, smart setups, and sharp moves! ✨

📅 Weekly Schedule:

🛠️ Daily Setups: Monday to Friday

🎓 Class: Every Tuesday (if stars align 🌟 – subject to confirmation)

Let’s make it a big week! 💪🚀

Community ideas

Review and plan for 1st July 2025Nifty future and banknifty future analysis and intraday plan.

swing idea - trent

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Xrp - The expected rally of +50%!Xrp - CRYPTO:XRPUSD - is still clearly bullish:

(click chart above to see the in depth analysis👆🏻)

Ever since Xrp rallied more than +550% in the end of 2024, we have been witnessing a quite expected consolidation. However Xrp still remains rather bullish and can easily retest the previous all time highs again. Maybe, we will even see another parabolic triangle breakout.

Levels to watch: $3.0, $10.0

Keep your long term vision!

Philip (BasicTrading)

Tron (TRX): Buyers Are Getting Ready For Breakout | +40% ComingTron coin is seeing a decent volume of buys recently, and we are still expecting to see a volatile breakout, which would give us an opening and potential of 40% movement from here, so we wait for BREAK OF STRUCTURE.

More in-depth info is in the video—enjoy!

Swallow Team

Velocity Market Conditions Explained.There are 6 primary upside Market Conditions. Currently the stock market is in a Velocity Market Condition where price and runs are controlled by retail investors, retail swing traders, retail day traders and the huge group of Small Funds Managers using VWAP ORDERS to buy shares of stock with an automated systematic buy order trigger when the volume in that stock starts to rise. The more volume in a stock the faster the VWAP order will trigger.

You task is to study Dark Pool hidden and quiet accumulation bottoming formations to be ready for the Velocity Market Condition that always follows.

Price is a primary indicator.

Volume is a primary Indicator.

These are the most important indicators in your trading charting software tools.

The next most important indicator is Large lot versus Small lot indicators which are NOT based on volume but more complex formulations.

HFTs use algorithms, AI, social media discussions etc.

To ride the Velocity wave upward, you must enter the stock before the run upward.

Learning to read charts as easily takes practice and experience.

The benefit is the ability to forecast with a very high degree of accuracy what that stock will due in terms of rising profits, over the next few days or longer.

Candlesticks have many new candle patterns that have just developed in the past couple of years. The stock market is evolving at a fast pace and the internal market structure that you can't see is only visible in the candlesticks, large lot vs small lot indicators, and other semi professional to professional level tools for analyzing stocks.

The stock market is changing and becoming far more tiered with more off exchange transactions. Learn to read charts so that you can trade with higher confidence and higher revenues.

Litecoin (LTC): Break of Resistance | Buyers DominatingLitecoin is showing signs of a possible bounce that we might be taking very soon. While we had a successful breakout here, we also see with the current retest price showing signs of recovery, where buyers are not giving the current zone away easily.

More in-depth info is in the video—enjoy!

Swallow Academy

Weekly trading plan for XRPLast week's BINANCE:XRPUSDT price action followed our projected path but ultimately failed to reach the first target. The price now appears to be consolidating in a triangular pattern, so I've outlined two detailed scenarios. While further downside remains the primary expectation, a sharp breakout above the local high would delay the anticipated correction

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

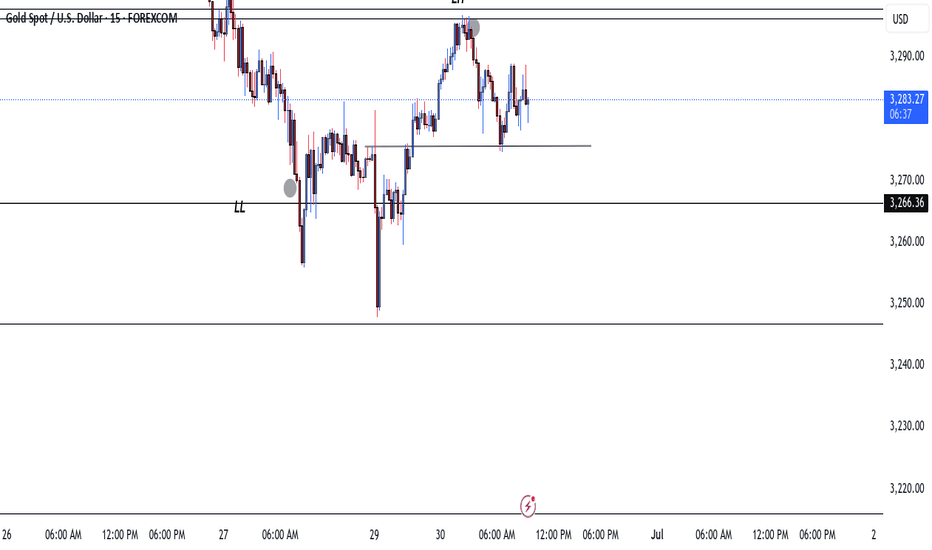

XAUUSD I Trade Update Welcome back! Let me know your thoughts in the comments!

** XAUUSD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

Weekly trading plan for Solana Last week, BINANCE:SOLUSDT price followed our bullish (green) scenario perfectly and hit the first target. At this point, the upward corrective phase may be complete, so we could reasonably expect a pullback to either the weekly pivot point or support zone

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

AUDUSDAUD/USD Exchange Rate

Current Level: 0.6530–0.6550

Slightly bearish near-term bias amid RBA rate cut expectations

Australia 10-Year Government Bond Yield

Current Yield: 4.15% (as of June 30, 2025)

Rose 0.01 percentage points from the previous session.

Reflects market reaction to RBA policy and global trade uncertainty.

Reserve Bank of Australia (RBA) Rate

Current Cash Rate: 3.85% (lowest in two years)

Cut by 25 bps in May 2025 to combat slowing growth and align with 2–3% inflation targets.

Markets price a 90% probability of another 25 bps cut in July 2025.

US Federal Reserve (Fed) Rate

Current Federal Funds Rate: 4.25–4.50%

Unchanged since December 2024; held steady at the June 18, 2025, meeting.

Fed signaled potential for two 25 bps cuts in late 2025 (September/December), contingent on inflation cooling.

Key Implications

Rate Differential:

RBA-Fed spread: –0.40% to –0.65% (AUD negative), pressuring AUD/USD.

Australia’s 10Y yield premium over US 10Y (~4.26%) is –0.11%, reducing AUD carry appeal.

AUD/USD Drivers:

RBA Easing: Expected July cut may weaken AUD further.

Fed Patience: Delayed cuts sustain USD strength.

Yield Sensitivity: Narrowing yield spreads limit AUD upside.

In summary:

AUD/USD trades near 0.6530–0.6550, pressured by RBA-Fed policy divergence and narrowing yield spreads. The RBA’s dovish path (3.85% rate, July cut expected) contrasts with the Fed’s hold at 4.25–4.50%, sustaining USD strength. Australia’s 10Y yield at 4.15% offers minimal premium over US Treasuries, limiting AUD support.

#AUDUSD

Weekly trading plan for EthereumBINANCE:ETHUSDT Last week, price mostly traded in a range. For this week, I've updated key levels, marked them on the chart, and modeled several scenarios. We can expect a pullback—possibly a deeper correction—before another push toward resistance levels. If price breaks the local low but then reclaims the weekly pivot point, I'll consider opening long positions without waiting for a deeper pullback.

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

ETHUSDT WEEKLY UPDATE — PART 1

When Conviction Fails: Apex Rejection, Hidden Redistribution, and the Illusion of Demand

Good morning, good afternoon, good evening, wherever you're tapping in from. Now, as always, I’m not here to waste your time with unnecessary waffle. Let’s get straight into it and unpack this mess step-by-step.

THE APEX REJECTION | MORE THAN JUST A WICK

So picking up from last week's update, we find ourselves right at the crossroads, and not the romantic kind either. What we’re looking at right now so far, is a clean yet 100% conclusive rejection from the apex of a key macro structure.

This isn’t just any level. This is the intersection of vertical momentum and horizontal memory, the apex of a triangle that’s been forming for months. This is where bullish intent was supposed to hold, supposed to assert dominance, but instead, what did we get? A strong push into resistance, a failure to fix above it, followed by exhaustion and signs of institutional unloading.

Now, to the untrained eye, this may look like a pullback, or even a healthy correction. But we’re not here to look at charts with retail goggles. We’re here to track the true intent behind the price action, and if you know your schematics, this is screaming redistribution. And not just any redistribution, the kind that happens right before the market changes its personality.

WHERE ARE WE IN THE SCHEMATIC?

If we overlay Wyckoff logic on top of this structure, it's very clear:

We’ve had our PSY (preliminary support).

Followed by a spring, a shakeout, and a fake rally.

Now we’re dancing around what appears to be the UTAD (upthrust after distribution) — but weaker.

This isn’t classic distribution, it’s redistribution masked in macro confusion.

Here’s the thing this range isn’t just price consolidation, it’s behavioural conditioning. This long, choppy sideways movement is designed to wear out both bulls and bears, making them question their bias, mismanage their risk, and either overstay or exit too early.

The market is methodical, not random. These candles aren’t accidents, they are footprints of algorithmic trap setting, and right now, it looks like the net is about to close.

VOLUME TELLS THE TRUTH

Let’s not forget volume. Look at the weekly volume through this recent push:

Decreasing volume on the rallies,

Higher volume on the red closes,

And multiple spikes that failed to carry price past resistance.

That’s your dead giveaway. You don’t need to be a wizard, just follow the clues. Price is being pushed, not lifted. Demand isn’t stepping in, liquidity is being removed. This isn’t smart money accumulation, if confirmed by the endd of this week, this most recent move up cout be doing of smart money unloading, Quietly and Efficiently.

THE MARKDOWN IS PRIMED

Let’s now address the elephant in the room, the range low and point C of the triangle on the 4H.

T hat’s where liquidity is sitting.

That’s where the market’s next objective lies.

We’ve now failed to reclaim the apex, the wick was slapped down, and unless something significant shifts, the next logical move is to sweep that C point, take out the emotional support, and either:

Tap into true demand (if it exists), or

Begin the cascade toward the final green demand zones between 2,150–2,070, which we marked weeks ago.

And don’t forget, this sweep may not be clean. We could get a fakeout bounce mid-range — enough to bait in more longs, only to roll over again.

PSYCHOLOGICAL LAYER

What’s happening here isn’t just technical, it’s emotional warfare. This entire range has been one long gaslight for the average trader. Between the failed breakouts, failed breakdowns, and chaotic intraday behaviour, retail has been turned into liquidity.

And if you’re still trying to long blindly at the top of this, hoping for 3k ETH without a confirmed structure reclaim, then respectfully, you’re the product right now.

Coming next in Part 2:

A full breakdown of the 4H macro setup

Analysis of the internal range mechanics

Recalculated fib zones

Where the liquidity pockets are

What the most probable path is short, medium, and long-term

Stay tuned — I’ll keep the flow coherent, structured, and aggressive. No fluff. No hopium. Just structure, psychology, and execution.

Weekly trading plan for BitcoinLast week price action showed a local correction before reaching the first target. This week, we may see a deeper pullback before the next targets are hit and ATH is revisited. In this idea I marked the important levels for this week

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades ! mura

SPY/QQQ Plan Your Trade For 6-30-25 : Gap Potential PatternToday's pattern suggests the SPY will attempt to create a GAP at the open. It looks like the markets may attempt to move higher as the SPY is already nearly 0.35% higher as I type.

Last week was very exciting as we watched the QQQ and the SPY break into new All-Time Highs.

I suspect the markets will continue a bit of a rally into the early Q2 earnings season where retail traders attempt to prepare for the strong technology/innovation/AI earnings data (like last quarter).

I do believe this rally is due for a pullback. I've highlighted this many times in the past. Typically, price does not go straight up or straight down. There are usually multiple pullbacks in a trend.

So, at this point, the markets are BULLISH, but I still want to warn you to stay somewhat cautious of a pullback in the near future (maybe something news-related).

Gold and Silver should start to move higher over the next 5-10+ days, with gold trying to rally back above $3450. I see Gold in a solid FLAGGING formation that is moving closer to the APEX pattern.

Bitcoin is nearing a make-or-break volatility point. I see BTCUSD breaking downward, but it could break into a very volatile phase where it attempts to rally (with the QQQ through earnings), then collapse later in July. We'll see how things play out.

Remember, tomorrow morning I have a doctor's appointment. So I may or may not get a morning video done. FYI.

Get some today.

Market Insights with Gary Thomson: 30 June - 4 JulyMarket Insights with Gary Thomson: Eurozone Inflation, US Jobs, ISM PMIs, ECB Forum Updates

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

— Euro Area Inflation Rate YoY Flash

— US Nonfarm Payrolls and Unemployment Rate

— US ISM Manufacturing and Services PMI

— ECB Forum on Central Banking

Note: U.S. markets may see thin trading ahead of the 4 July holiday, raising volatility risks.

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Update - 6/29/2025- Strong close on Friday especially in consumer related names

- Most excited about retail/consumer/DTC names, especialy NASDAQ:ODD , NASDAQ:NAGE , $YSG.

- AI names are back on the radar, and quantum computing has been for a while -> speculation money is back

- Breadth and market in general looks very constructive, so we will likely continue going higher

- Been very protective with my account, keeping losses below 0.1% as the market has been choppy since May 12

- However, if we start another leg higher, I'll go much more aggressive, maybe 0.5-1% of my account in strong names