Community ideas

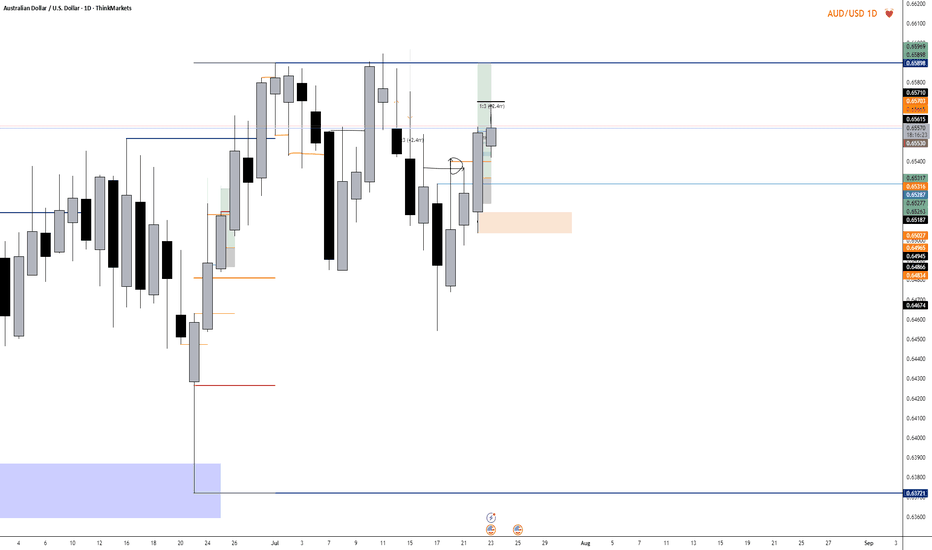

AUDUSD Long - A BreakdownAfter a thorough breakdown, I decided to enter longs on AUD/USD. I expect for price to reach highs of around .65898 Which is the daily structure high Currently in profit On a long position and We entered on the 5 minute using a one hour stop loss Hopefully this trade continues to play out, and we'll see you on the other side of profit.

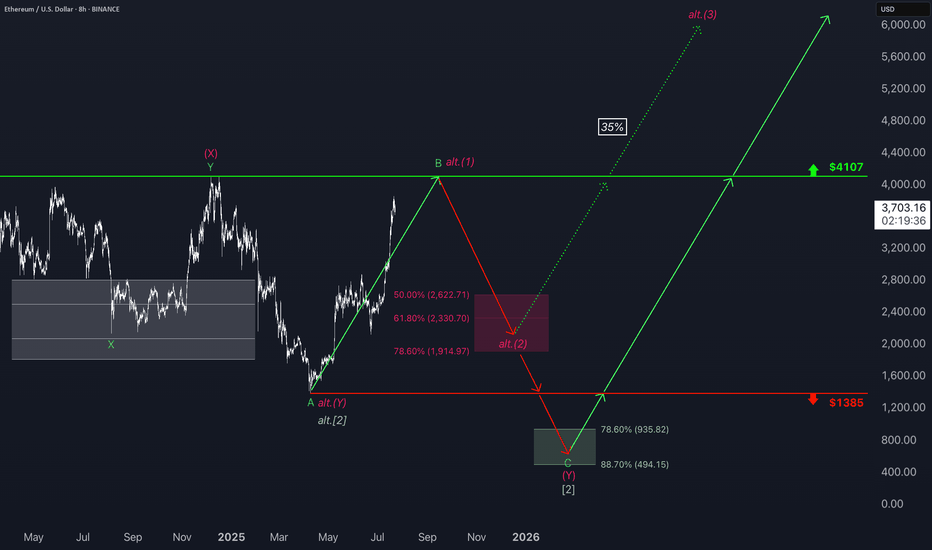

ETH: Eyes Resistance, But Correction Still LoomsEthereum has also seen a modest pullback since yesterday morning, but here too, it’s too soon to confirm a high for turquoise wave B. Accordingly, we anticipate further gains in this corrective rally—potentially up to resistance at $4,107—before the subsequent turquoise wave C takes over and drives the price down into the green long Target Zone ($935.82–$494.15). Within this range, we primarily expect the low of the wave- correction, which has now lasted more than four years, setting the stage for a long-term trend reversal to the upside. According to to our alternative scneario, magenta wave alt.(1) would complete with the next high. The following pullback, attributed to wave alt.(2), would then only extend into the slightly adjusted magenta Target Zone ($2,622–$1,914) before a move to new all-time highs (probability: 35%).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

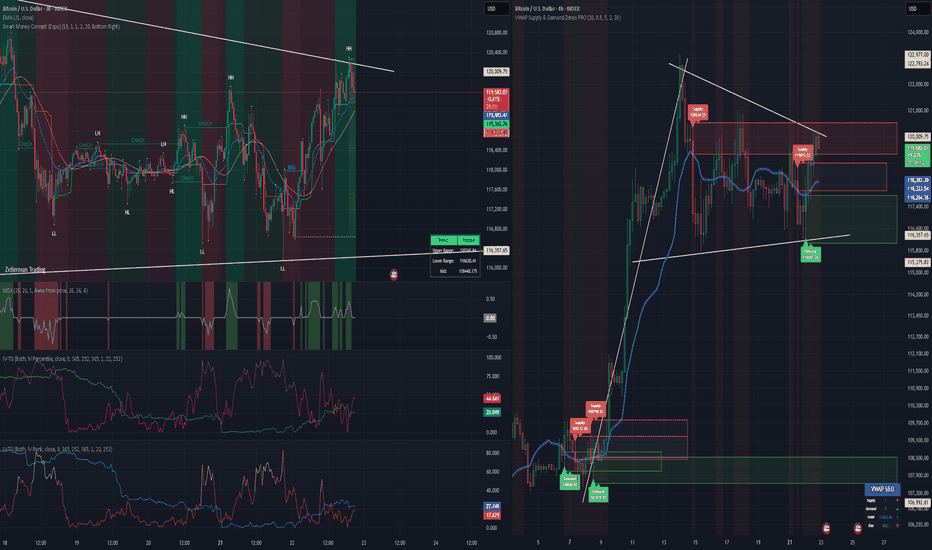

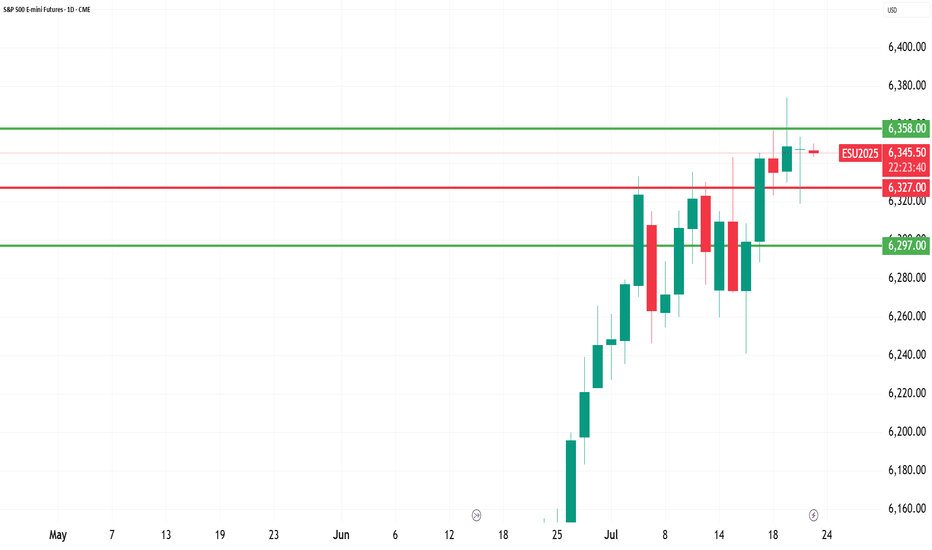

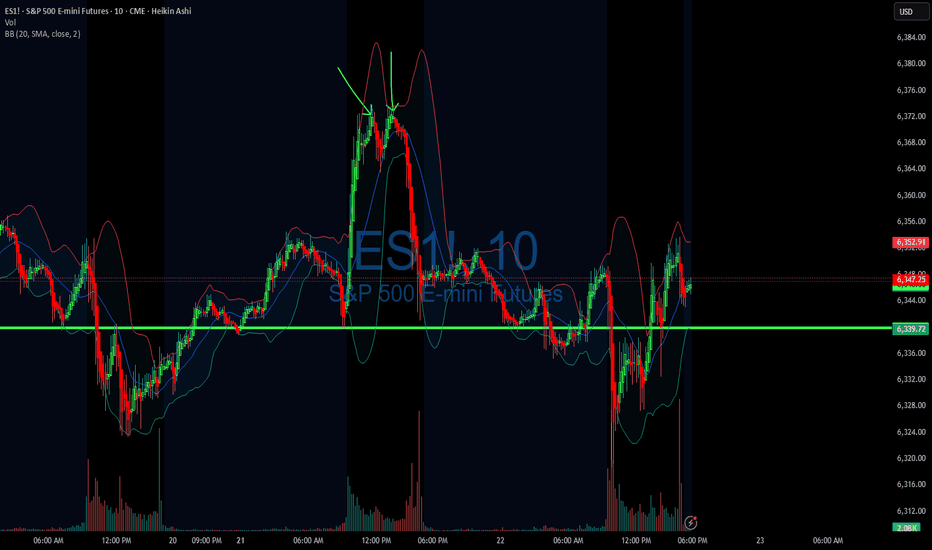

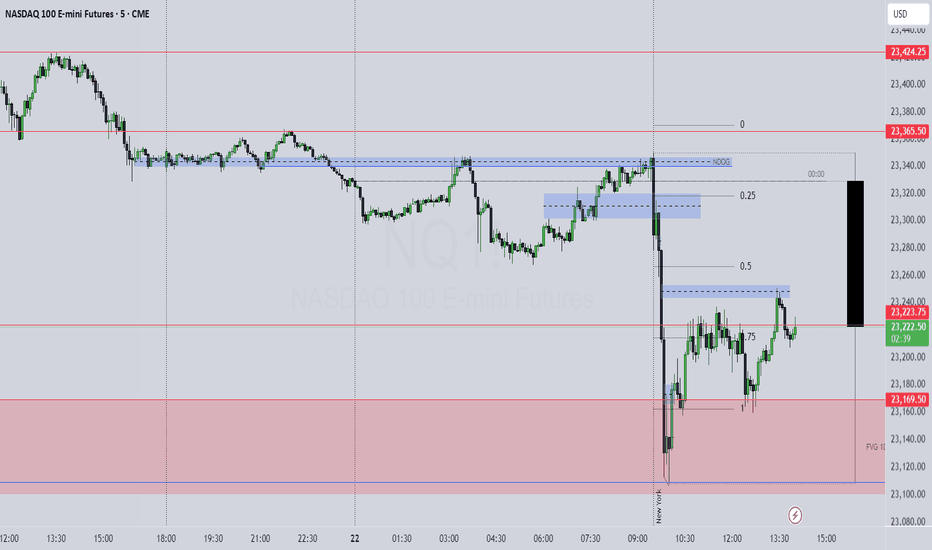

07/22/25 Trade Journal, and ES_F Stock Market analysis

EOD accountability report: +

Sleep: 6 hours

Overall health: Good

** VX Algo System Signals from (9:30am to 2pm) **

— 9:40 AM Market Structure flipped bearish on VX Algo X3!

— 10:20 AM VXAlgo ES X1 Buy signal

— 11:30 AM VXAlgo NQ X1DD Sell Signal

— 2:00 PM Market Structure flipped bullish on VX Algo X3!

**What’s are some news or takeaway from today? and What major news or event impacted the market today? **

Very clean trading day for me, signals worked out really well and everything played out accordingly

**News**

S&P 500 CLOSES AT A NEW ALL-TIME HIGH ABOVE 6,000

**What are the critical support levels to watch?**

--> Above 6339= Bullish, Under 6320= Bearish

Video Recaps -->https://www.tradingview.com/u/WallSt007/#published-charts

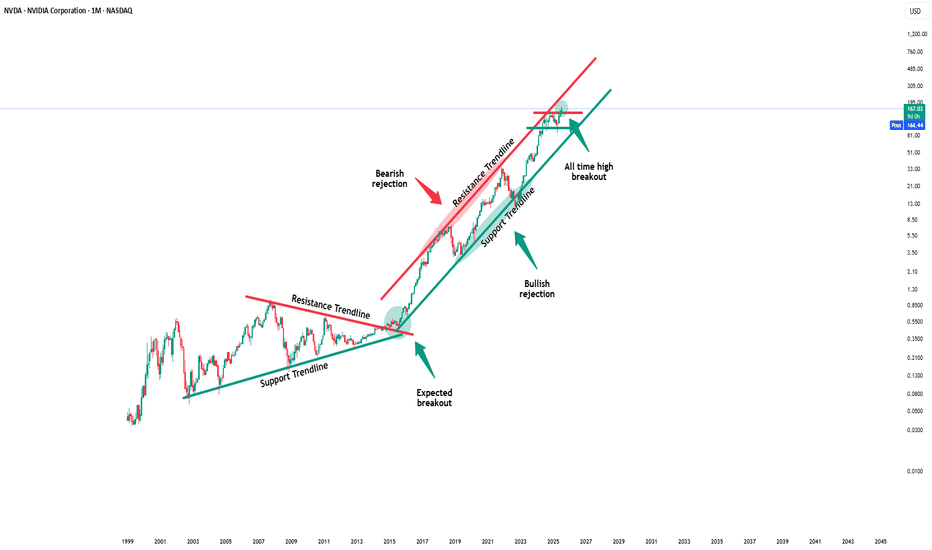

Nvidia - This is clearly not the end!📐Nvidia ( NASDAQ:NVDA ) will confirm the breakout:

🔎Analysis summary:

Over the past couple of months, Nvidia managed to rally about +100%, reaching top 1 of total market cap. Most of the time such bullish momentum just continues and new all time highs will follow. But in order for that to happen, Nvidia has to confirm the all time high breakout now.

📝Levels to watch:

$150

🙏🏻#LONGTERMVISION

SwingTraderPhil

Adobe - A gigantic triangle breakout! 🔋Adobe ( NASDAQ:ADBE ) will break the triangle:

🔎Analysis summary:

Yes, for the past five years Adobe has been overall consolidating. But this consolidation was governed by a strong symmetrical triangle pattern. Thus following the underlying uptrend, there is already a higher chance that we will see a bullish breakout, followed by a strong rally.

📝Levels to watch:

$400, $700

🙏🏻#LONGTERMVISION

Philip - Swing Trader

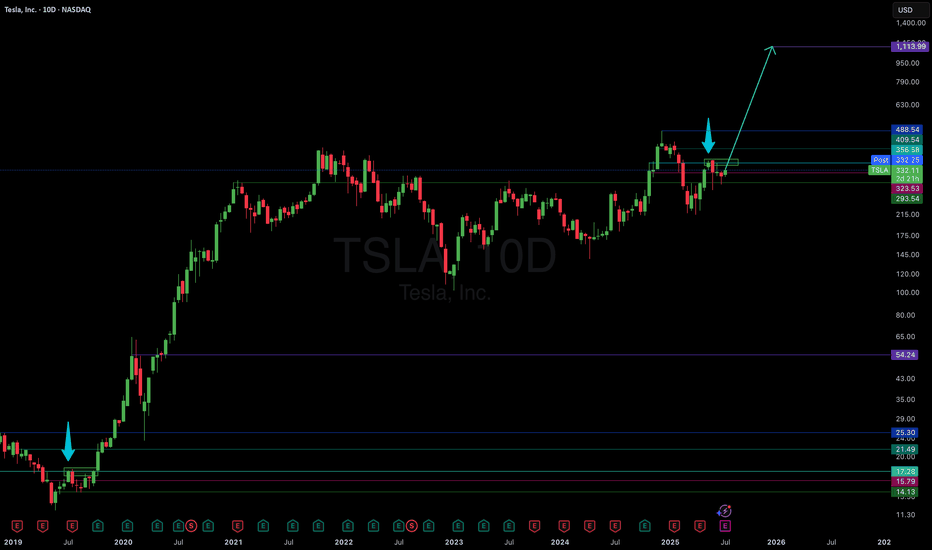

Bitcoin - The cycle is just starting!⚔️Bitcoin ( CRYPTO:BTCUSD ) just created new highs:

🔎Analysis summary:

Bitcoin is currently - especially with the new all time high breakout - just perfectly following previous cycle behavior. Since there is no real resistance above current price, apart from psychological levels, I do expect a substantial rally back to the upper channel resistance trendline.

📝Levels to watch:

$300.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

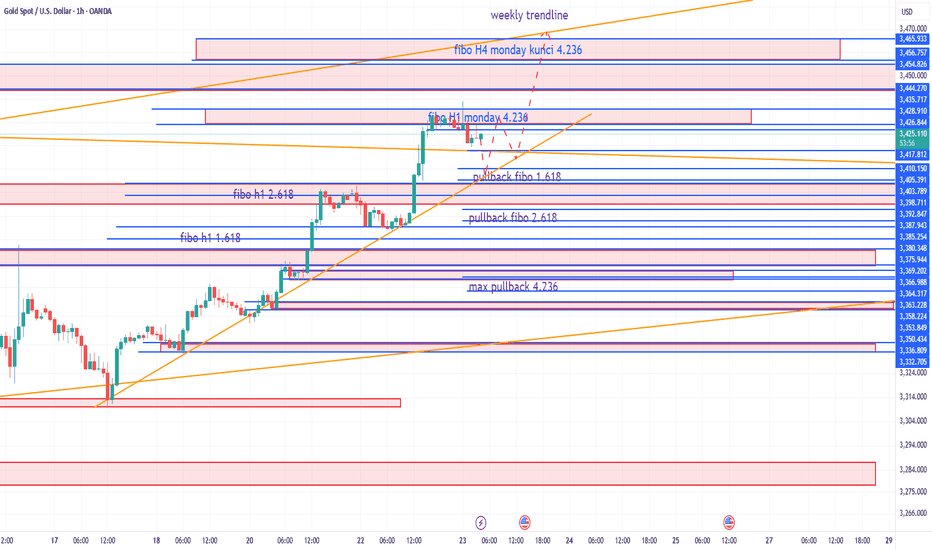

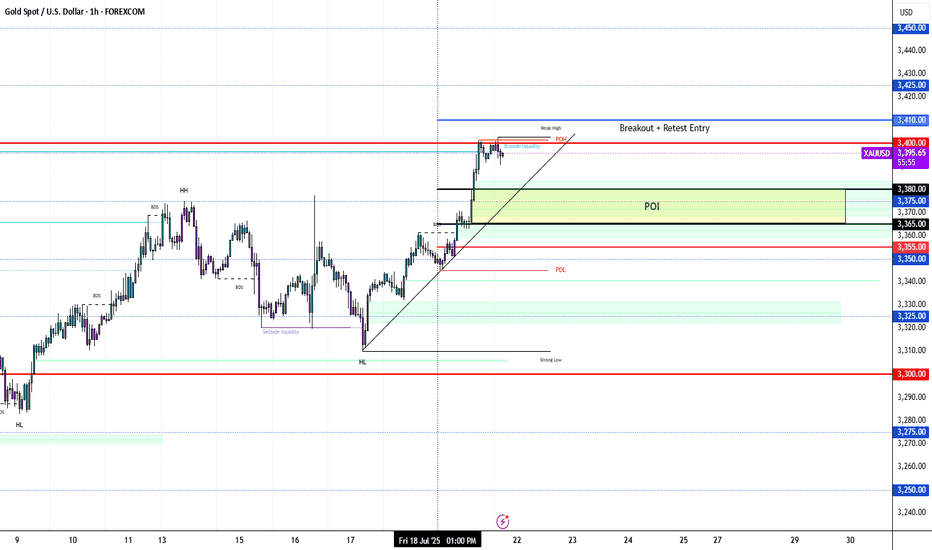

GOLD: Price Made A New HHLooking to buy gold, market structure is bullish on the H1 and H4. I went over 2 different scenarios in the video...

1. Pullback Entry (Preferred)

🟢Entry Zone: 3365–3380

TP1: 3432

TP2: 3450

TP3: 3475–3500 (extended target if momentum holds)

2. Breakout Buy (Aggressive)

Trigger: M15 breaks and closes above 3405–3410 with strong displacement.

Entry: Retest of breakout zone at 3402–3405

Same Targets

Don't forget to set those price alerts!

Review and plan for 23rd July 2025Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

TradingView Show: Trade Ideas You Can't Miss with TradeStationJoin us for a timely TradingView live stream with David Russell, Head of Global Market Strategy at TradeStation, as we break down the latest rebound in the markets and what it could mean for traders and investors. In this session, we’ll dive into:

- New sectors to watch, like homebuilders

- Prior insights on companies like Coinbase and Micron

- What trades are setting up, why, and educational concepts to plan for them

- Upcoming economic news and more to have on your calendar

- Key charts, indicators, and technical patterns to watch for signs of sustained momentum

- Essential strategies for navigating market recoveries, corrections, and upcoming Federal Reserve decisions

Bonus: Discover our latest broker integration update with TradeStation—now supporting equity options trading directly on TradingView. This upgrade brings advanced tools like the strategy builder, options chain sheet, and volatility analysis to your fingertips, making it easier to trade through uncertain market conditions.

This session is sponsored by TradeStation, whose vision is to provide the ultimate online trading platform for self-directed traders and investors across equities, equity index options, futures, and futures options markets. Equities, equity options, and commodity futures services are offered by TradeStation Securities Inc., member NYSE, FINRA, CME, and SIPC.

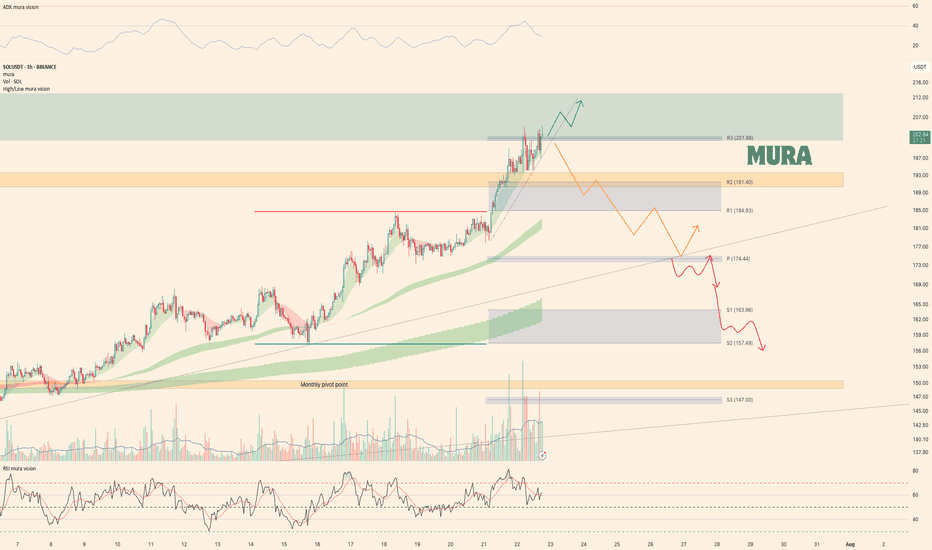

Weekly trading plan for Solana Price Action Summary

SOL perfectly followed our bullish scenario, achieving all projected targets.

Price has now entered our predefined zone.

Avoid shorting in discovery mode—momentum remains unpredictable.

Key Technical Observations

Caution Signals:

Overbought RSI on higher timeframes

Bearish divergence on the hourly chart

Elevated volume + weak upward momentum → Potential institutional distribution

Critical Levels to Watch

1 Local Trendline (5-min chart):

Break below → Likely correction toward weekly pivot

Hold → Extended discovery possible

2 Weekly Pivot:

Primary downside target if trendline fails

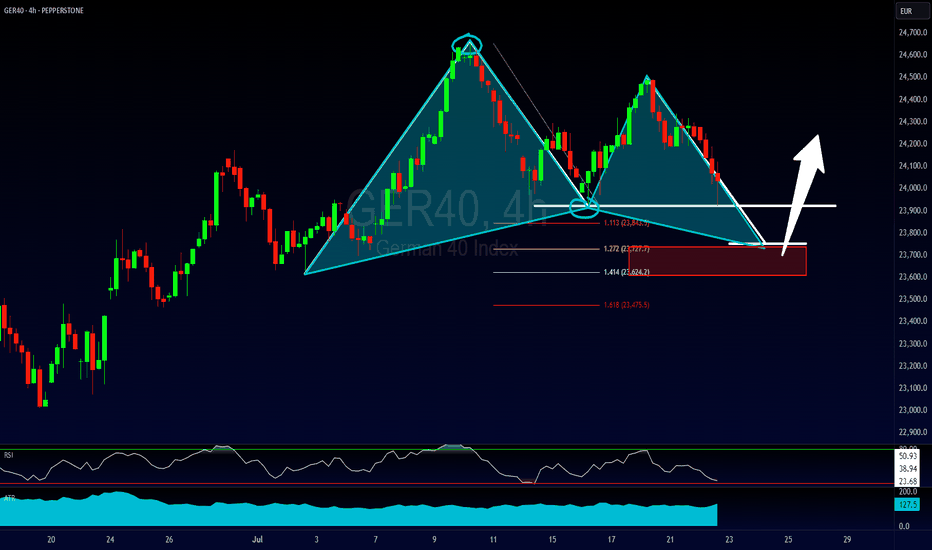

The Kiss of Death Trade & Other Reasons for EntryFollowing up on the 2618 opportunity that we looked at on the FOREXCOM:GER40 this past weekend the market has now created more potential trading opportunities to get involved.

1) A bullish bat pattern that has completed due to a result of a complex pullback into the original double bottom.

2) A potential Kiss of Death trading opportunity

3) A bigger potential bullish gartley pattern IF the current 2618 opportunity is violated.

Please leave any questions or comments below & feel free to share your opinion on the setup.

Akil

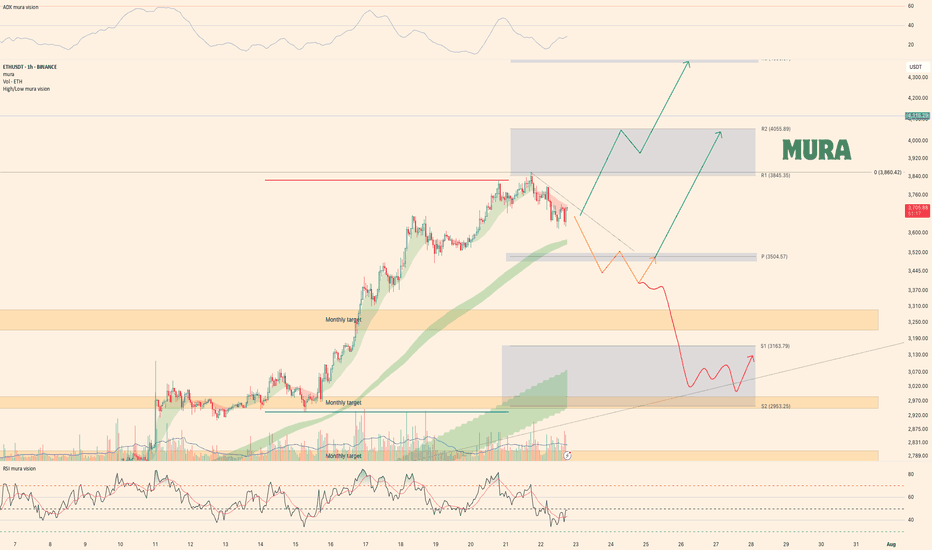

Weekly plan for EthereumLast week, ETH followed our green scenario, breaking through resistance to reach $3,860. Currently, a critical level at $4,116 (higher timeframe) will determine the next major move.

Key Scenarios

If $4,116 holds as resistance:

Expect a Wave E correction within the long-term ABCDE triangle pattern.

Initial downside target: $3,500

Breakdown below $3,500 opens the door to $3,100–$2,900

If $4,116 breaks:

The ABCDE triangle scenario is invalidated

Next major resistance levels open for a potential continuation rally

Current Market Structure

Price remains above the weekly pivot point

However, early signs suggest a correction may have begun

Confirmation of a deeper pullback requires a close below $3,500

As always, manage risk according to key level breaks

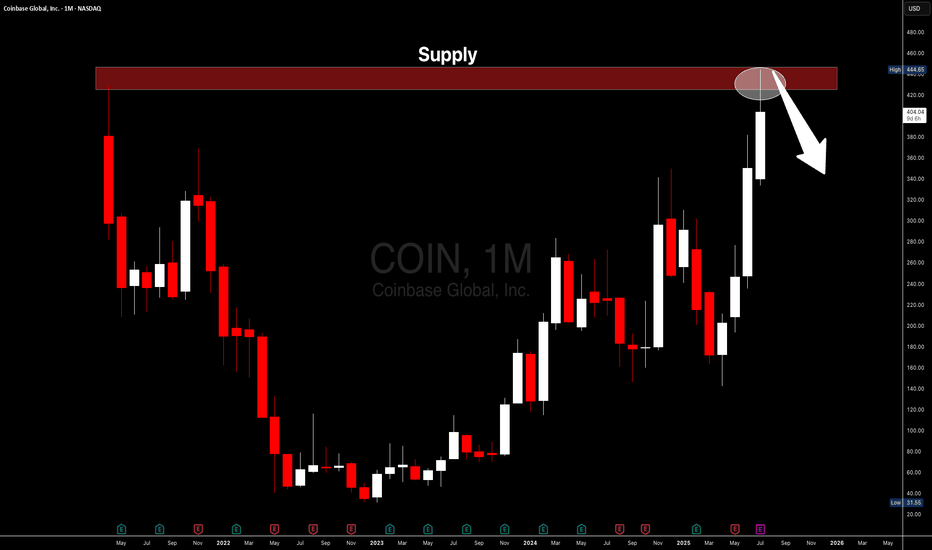

COINBASE I Strong Bearish Outlook (Take Action Now)Welcome back! Let me know your thoughts in the comments!

** COINBASE Analysis - Listen to video!

We recommend that you keep this stock on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!